Hyperliquid Stablecoin is about to be hammered: Why did the new team Native Markets acquire USDH?

- 核心观点:Hyperliquid稳定币发行权争夺重塑行业格局。

- 关键要素:

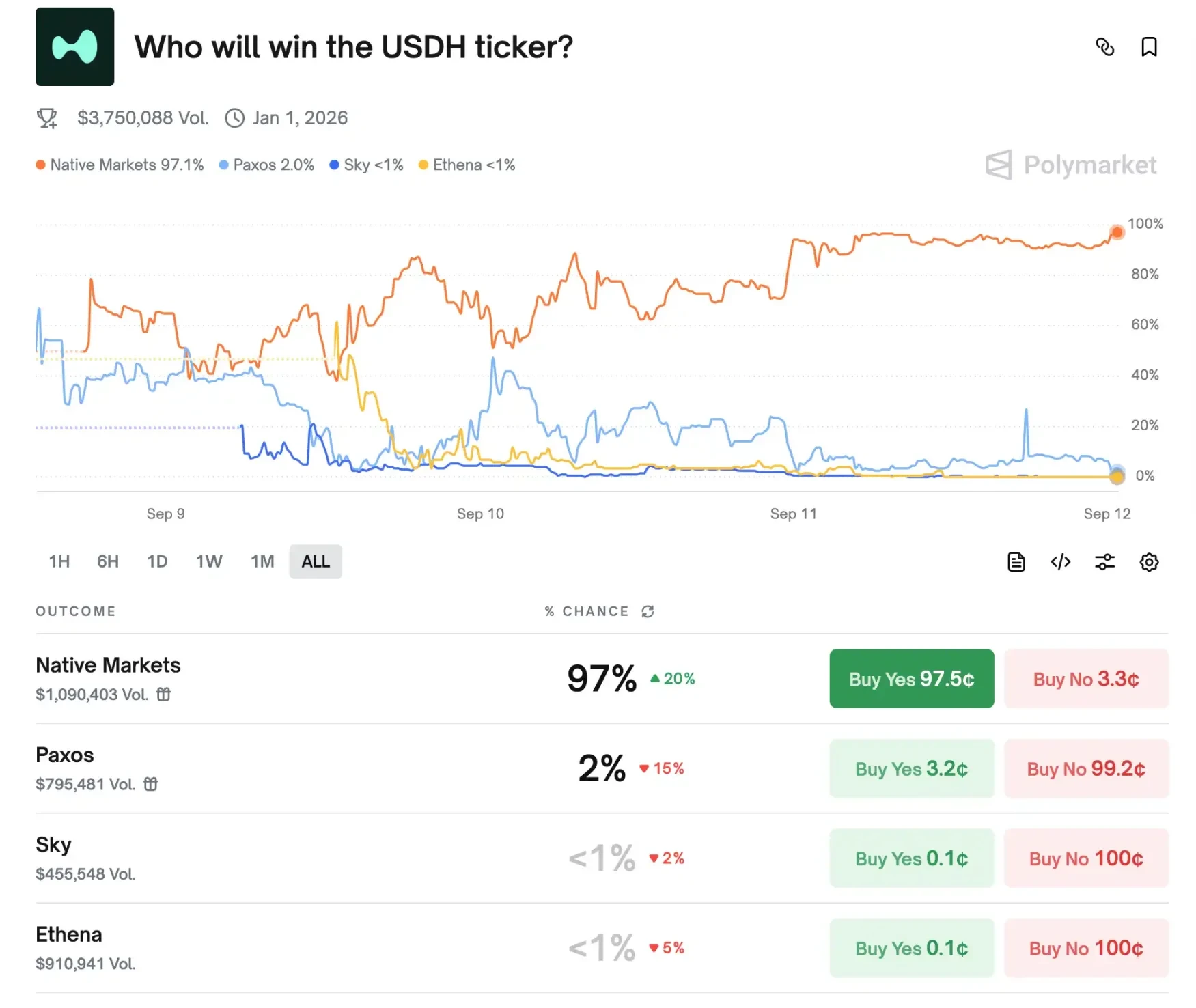

- Native Markets以97%优势几乎锁定胜局。

- 其方案将利息收益返还社区与生态。

- 团队背景深厚,含前Uniswap总裁等。

- 市场影响:或引发行业稳定币战略重大变革。

- 时效性标注:中期影响。

Original author: kkk, rhythm

Recently, Hyperliquid, a decentralized derivatives trading platform, has been the scene of a highly anticipated stablecoin battle. On September 5th, the official announcement of the upcoming ticker auction for its native stablecoin, USDH, instantly ignited the market. Numerous institutions, including Paxos, Ethena, Frax, Agora, and Native Markets, submitted proposals to compete for the right to issue USDH. As a leading player in the popular perp DEX market, Hyperliquid has become a strategic opportunity that institutions must enter, even if it "doesn't make money." Currently, Native Markets leads with a 97% lead, virtually securing victory.

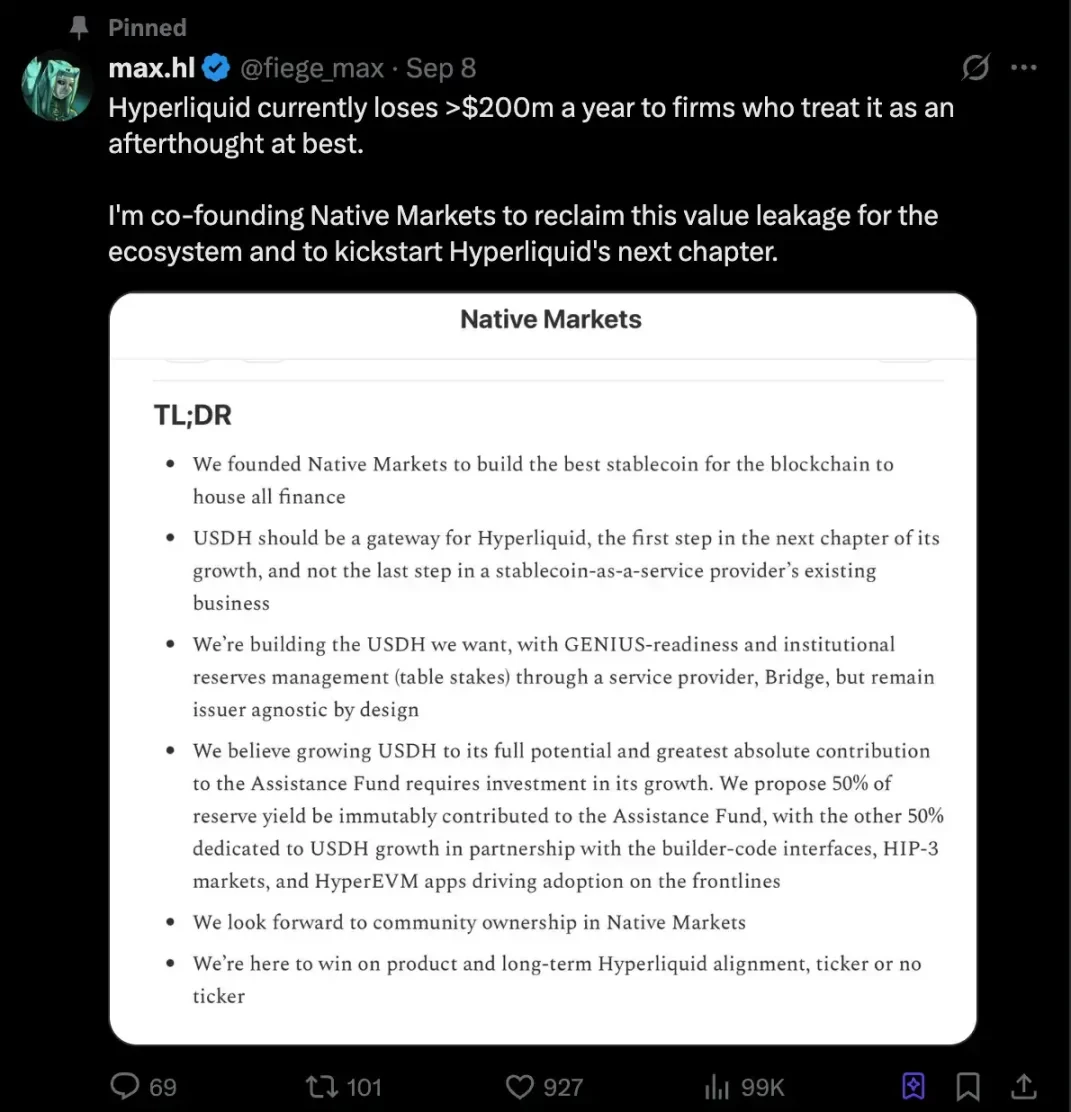

Native Markets’ Strategy

Native Markets' concept is for USDH reserves to be jointly managed by BlackRock (off-chain) and Superstate (on-chain), ensuring both regulatory compliance and issuer neutrality. Its mechanism is unique: interest earned on the reserves is split 50-50: half goes to the Assistance Fund for HYPE buybacks, and the other half is invested in ecosystem development, including the development of the HIP-3 market and HyperEVM applications.

Users can mint and redeem USDH through Bridge, with more fiat onboarding channels planned for the future. The protocol's core component, CoreRouter, has been audited and open-sourced, encouraging direct community participation. Native Markets also promises that USDH will comply with US GENIUS regulatory standards and inherit the global compliance credentials and fiat access capabilities of Bridge, the issuer. Notably, Bridge was acquired by payments giant Stripe last year, and Native plans to leverage its network to further integrate stablecoins with fiat currencies.

Although Native Markets is the least well-known of the current major bidders, it has become the most popular player at present thanks to its team's long-term deep cultivation in the Hyperliquid chain and the invitation of many industry heavyweights (from Paradigm, Uniswap, etc.) to join.

Founding Team

@fiege_max

Over the past year, Max has been deeply involved in the Hyperliquid ecosystem. As an investor and advisor, he has driven nearly $2.5 billion in HyperEVM locked-up volume and $15 billion in HyperCore trading volume. He previously led product and strategy at Liquity and Barnbridge, focusing on stablecoins and fixed-rate instruments. As a community leader at Hyperion, he also spearheaded the launch of Hyperliquid's DAT public company.

@Mclader

Mary-Catherine Lader, former President and COO of Uniswap Labs (2021–2025), pushed BlackRock to invest in digital assets as early as 2015 and invested in fintech business at Goldman Sachs as a Managing Director. She is now ready to chart the course for the development of USDH and Hyperliquid in the post-GENIUS era.

@_anishagnihotri

Anish is a blockchain researcher and software engineer with over a decade of experience. He was the first employee at Ritual, briefly served as Paradigm's youngest researcher, and worked as a dedicated DeFi trader at Polychain. He has also made significant contributions and impact in the open source development of MEV and DeFi tools.

Community controversy

Of course, there are also many questions about this community vote. Haseeb Qureshi, managing partner of the well-known VC Dragonfly, wrote on Tuesday that he was "starting to think the USDH RFP is a bit ridiculous," and claimed that validators seemed unwilling to seriously consider any team other than Native Markets.

He added that Native Markets’ bid came almost immediately after the RFP was issued, “which means they had advance notice,” while other bidders were busy preparing their bid documents. He said that while more established players like Paxos, Ethena, and Agora had put forward stronger proposals, the process seemed “tailor-made for Native Markets.”

However, Nansen CEO @ASvanevik denied this speculation in a statement, stating that as one of Hyperliquid's largest validator node operators, they and the @hypurr_co team invested significant effort in reviewing proposals and communicating with bidders, with the goal of finding the optimal stablecoin solution. Ultimately, they chose to support Native Markets.

Seeing that the situation was hopeless, Ethena Labs announced its withdrawal from the USDH bidding, stating that although some had questioned Native Markets' credibility, they believed their success perfectly reflected the qualities of Hyperliquid and its community: it is a fair playing field where emerging participants can win the support of the community and have a fair chance of success.

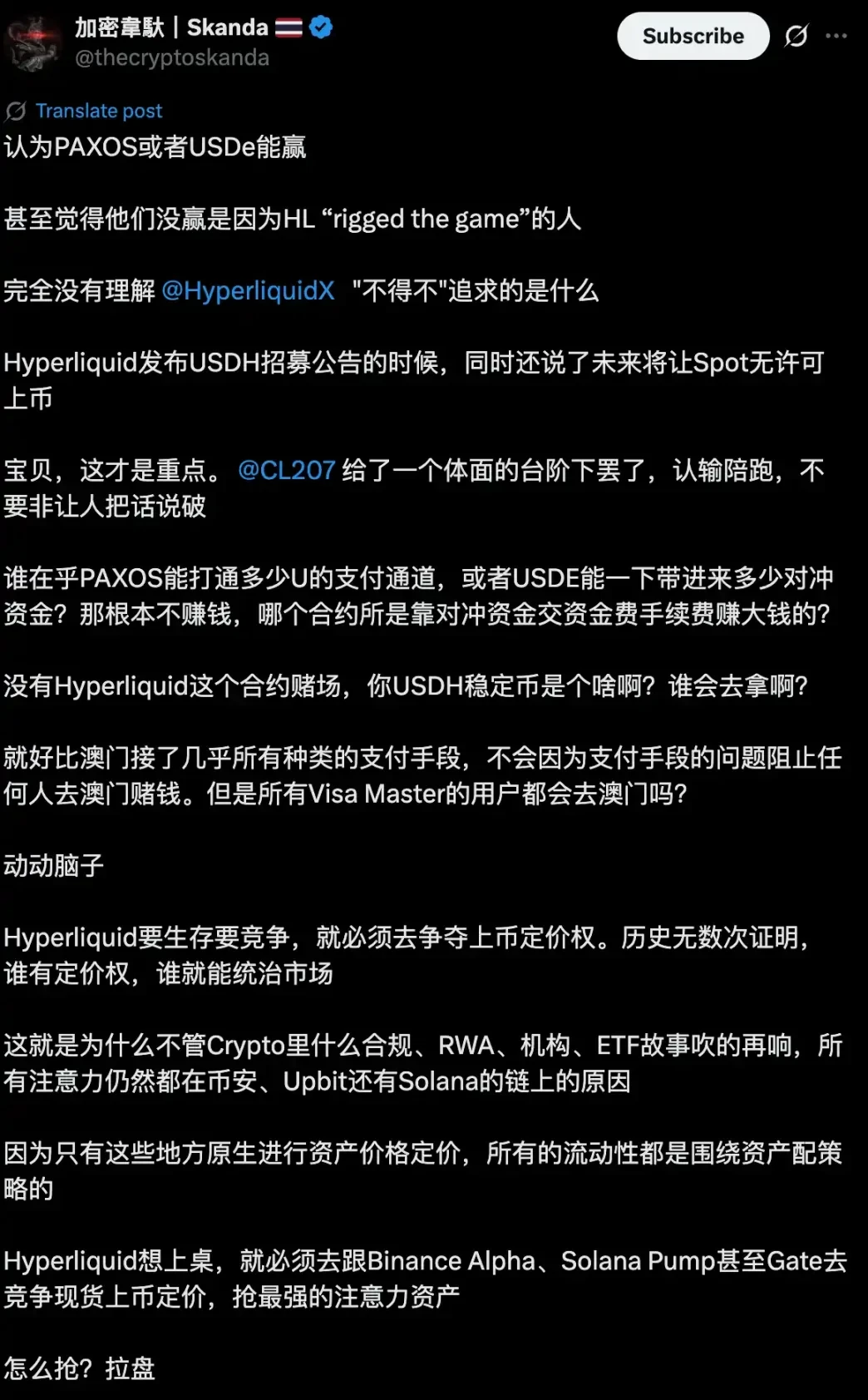

KOL Crypto Skanda @thecryptoskanda Native Market was chosen as it was inevitable. Other teams could not meet Hyperliquid's most obvious need for listing pricing, which is the core of the trading platform.

On the Hyperliquid chain, the accumulation of US dollar liquidity has long relied on external stablecoins such as USDC, with the circulating volume reaching approximately $5.7 billion at one point, representing 7.8% of the total USDC supply. The Hyperliquid team's decision effectively cedes hundreds of millions of dollars in annual interest income to the community.

For this reason, the right to issue USDH is not only about a massive market share, but also about who controls the vast potential profits. In the case of Hyperliquid, we've witnessed a stablecoin issuer willing to give up nearly all of its profits simply for the opportunity to distribute it within a specific scenario—a scenario that was previously unimaginable. It's foreseeable that once USDH successfully launches and establishes a positive cycle of "returning profits to the community and reinforcing value to the ecosystem," other exchanges and public chains will inevitably follow suit, triggering a major shift in the industry's stablecoin strategies. Then, perhaps, the "Stablecoin 2.0 Era" will truly begin.