Original author: momo, ChainCatcher

Recently, with Binance announcing that it will list Ethena USDe (USDe), ENA has seen a sharp rise, and once again allowed the market to see the huge potential of innovative products such as CeDeFi Vault.

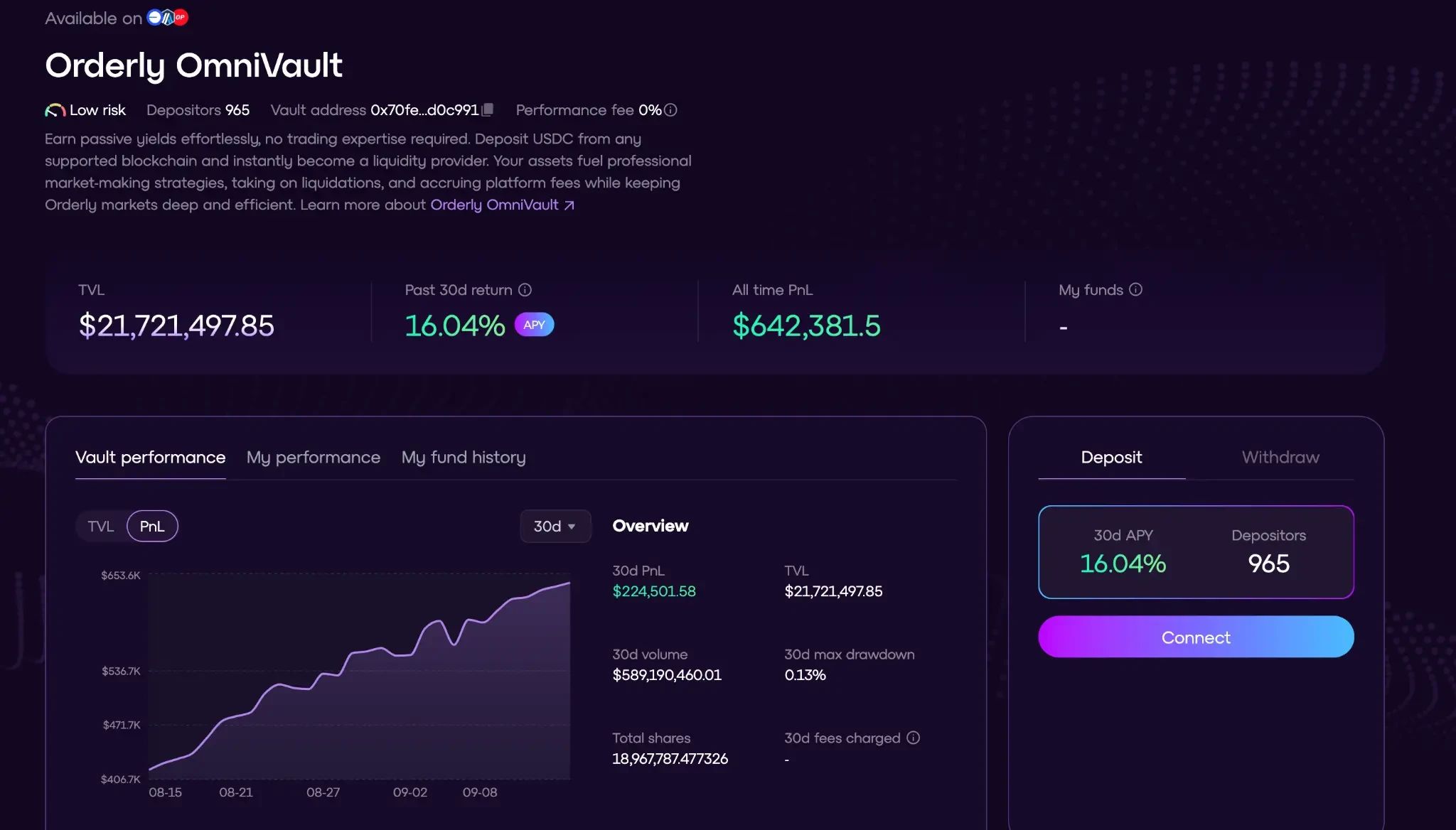

Following Ethena, OmniVault, Orderly's cross-chain liquidity vault, is also beginning to gain traction. Since integrating Binance liquidity through Ceffu, OmniVault has seen strong performance: its TVL has quickly surpassed $21 million, with nearly $600 million in trading volume in the past 30 days. This impressive performance also helped Orderly secure a spot in the BNB Chain 2025 Awards.

The rapid rise of OmniVault not only marks its evolution of the Ethena model, but also reveals its ambition to build a core entrance to future on-chain asset management and become the liquidity hub of the CeDeFi ecosystem.

Why is OmniVault considered an evolution of Ethena Vault?

High returns and low drawdown performance

Orderly is a modular trading infrastructure, providing developers with a composable and pluggable trading system. In April of this year, Orderly launched OmniVault, a full-chain liquidity vault. Later, through integration with Ceffu, it became a representative vault product for the CeDeFi model. OmniVault aims to provide users with a more stable on-chain financial management channel while pursuing higher returns.

OmniVault is simple to use. After users deposit USDC, their funds automatically participate in market making on the Orderly network, running Kronos Research strategies across multiple chains like Arbitrum, Optimism, and Base, resulting in real, verifiable LP returns. Notably, OmniVault supports flexible deposits and withdrawals every three hours, a rare feature in the DeFi space.

The yield performance is also quite attractive. Initially launched, the APY (Annualized Percentage Yield) exceeded 50%, and the APY over the past 30 days has remained around 20%, higher than most traditional DeFi vaults. Furthermore, its risk management capabilities are very solid, with the maximum drawdown during the period being kept within 0.13%.

Three major evolutions compared to traditional DeFi Vault

The ability to achieve such high returns and low drawdowns is due to OmniVault’s three key evolutions compared to traditional DeFi Vaults:

1) Support for multi-strategy trading. Unlike traditional DeFi vaults, which generally rely on a single strategy, "simulated matching," or "inner-circulation trading" as their revenue source, OmniVault combines the dual advantages of CeFi and DeFi to achieve diversified trading strategies and revenue sources. Revenue is derived from real on-chain order matching transactions, which has stronger sustainability and volatility resistance.

For example, OmniVault, through collaboration with professional institutions like Kronos Research, employs a high-frequency, multi-exchange trading strategy, hedging across multiple exchanges to generate stable returns. This strategy, previously reserved for specialized trading institutions, is now accessible to the general public by transparently recording all transactions and profit distributions on-chain. This allows users to enjoy the high execution efficiency and stable returns of CeFi without sacrificing the low barrier to entry, openness, and transparency of DeFi.

2) Integrates CeFi liquidity. OmniVault integrates with Binance's institutional custody platform, Ceffu, to access Binance liquidity and retain a portion of funds in on-chain smart contracts. This design preserves the liquidity and trading opportunities of centralized exchanges while also ensuring the transparency and security of on-chain operations. Furthermore, the Orderly protocol allocates up to 40% of net revenue and a portion of insurance fund fees to the vault, further enhancing return stability and volatility resistance.

3) Multi-chain support. Traditional DeFi vaults are often limited to a single chain. OmniVault, leveraging Orderly's full-chain liquidity layer, enables seamless deposits and withdrawals across multiple chains. For example, users can deposit USDC on Optimism and withdraw it on Base, reducing operational costs caused by liquidity fragmentation and improving capital efficiency.

Beyond Ethena's full-chain expansion and diversified strategies

Overall, OmniVault can be considered an evolution of the Ethena model. Ethena is primarily based on the Ethereum ecosystem, generating income through staking ETH derivatives and hedging strategies. Its strategy is relatively simple, and its cross-chain scalability is limited.

OmniVault natively supports multiple chains and, through its integration with Ceffu, has successfully accessed the liquidity of the mainstream exchange Binance, establishing a more efficient connection between CeFi and DeFi. More importantly, it plans to introduce multiple managers and diversified strategies. In the future, users will be able to flexibly allocate assets based on their risk appetite, enjoying a transparent and convenient trading environment while having a wider range of profit paths.

Behind the high growth: On-chain financial management shifts from speculation to real returns

If innovative product design laid the foundation for OmniVault's explosion, then its actual performance after going online confirmed the market demand for this model.

Data shows that OmniVault's transaction volume in the past 30 days was nearly US$600 million. Its TVL exceeded US$21.7 million in a short period of time, attracting nearly a thousand deposit users and generating a cumulative income of more than US$640,000 for deposit users.

"The performance has definitely exceeded our initial expectations," Ran, co-founder of Orderly, admitted in a recent interview. OmniVault addresses users' urgent need for stable on-chain financial management. OmniVault hasn't engaged in large-scale marketing, relying solely on the natural inflow of funds based on its performance.

The short-term explosion from Hyperliquid to Orderly OmniVault also shows that after the benefits of DeFi airdrop subsidies have faded, the current on-chain funds are shifting from "speculative assets" to "investment structures", and funds are accelerating to new infrastructure that can generate real returns and improve transaction efficiency.

Hyperliquid has become a dark horse in the DEX market by creating a system that is more in line with the needs of professional traders through "centralized experience + on-chain asset settlement". Orderly OmniVault, with its CeDeFi structure of "CeFi-level asset management strategy + transparent on-chain profit distribution", is creating a new paradigm for on-chain financial management with higher returns and greater stability, becoming a new financial management option for more on-chain users.

Currently, the synergy between OmniVault and the Orderly ecosystem is becoming apparent. OmniVault not only leverages Orderly's deep liquidity to optimize strategy execution, but also benefits the ecosystem, attracting more traders and capital. Since OmniVault's launch, Orderly's overall TVL has exceeded $51 million, and its user base is approaching 900,000.

Ambition to become the “core entrance to on-chain asset management”

OmniVault's ambitions extend far beyond a single hit product. According to Ran, co-founder of Orderly, its long-term goal is to create a truly on-chain asset management portal, building a closed-loop ecosystem of "on-chain financing and off-chain revenue generation."

He emphasized in the interview that on-chain asset management is poised for explosive growth, and crypto users' financial management needs will gradually shift from centralized exchanges to on-chain platforms. "In the future, centralized exchanges will serve as gateways for fiat currency deposits and withdrawals, as well as for KYC services, guiding users and funds into on-chain liquidity and financial management. Following Aave and Pendle, more complex and higher-yielding on-chain financial products will emerge."

Under this vision, OmniVault's business scope is expected to continue expanding. In the short term, the team will support more asset types, expanding from the current USDC to mainstream currencies such as USDT and Ethereum, to meet users' diverse asset allocation needs. Furthermore, the platform plans to introduce multi-strategy management and a multi-manager system, breaking the reliance on a single strategy and providing users with a variety of risk products, ranging from conservative to high-yield.

In the long run, as TVL continues to grow and integration with infrastructure such as Ceffu deepens, OmniVault is likely to evolve along the "Ethena reverse path" in the future: from the existing DEX+Vault model, gradually moving towards issuing native stablecoins, exploring more forms of income rights tokenization, enhancing capital liquidity and composability, and forming a more complete asset closed loop and value cycle.

OmniVault is moving step by step towards its goal of becoming the core entrance to on-chain asset management, and hopes to redefine the future form of CeDeFi asset management.

How can ordinary players participate in OmniVault?

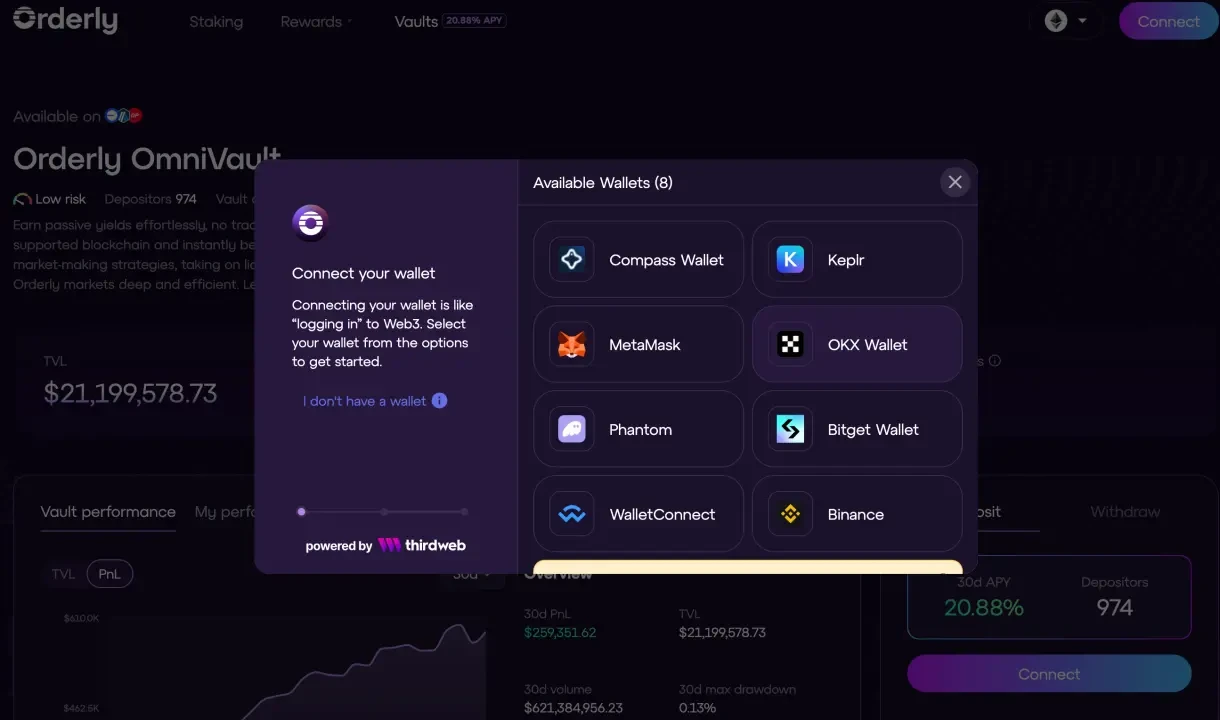

For ordinary users, the process of participating in OmniVault is very simple and does not require complex on-chain operations or strategy knowledge.

Users simply need to visit Orderly's official OmniVault page and connect a supported wallet. For example, users can deposit USDC directly into the OmniVault vault through Binance Wallet to automatically receive real passive income generated by strategies managed by professional market makers like Kronos Research. After depositing, users can monitor their assets and accumulated returns at any time, and have flexible redemption rights every three hours.

It is worth mentioning that, relying on Binance Wallet, OmniVault has access to hundreds of millions of users and the potential for billions of US dollars in liquidity.

Regarding asset security and transparency, which are of paramount concern to users, OmniVault maintains all user funds in audited smart contracts, with key operations overseen by a decentralized governance mechanism. Furthermore, asset security is further assured through institutional-grade custody and multi-signature risk management in partnership with Ceffu. Users can verify all position status, transaction records, and profit distributions in real time on-chain, minimizing information asymmetry.

The Orderly protocol’s own insurance fund mechanism and the design of feeding back part of the protocol’s revenue also provide an additional buffer layer to deal with extreme market conditions.

Conclusion: Can it become the liquidity hub of the CeDeFi ecosystem?

The rapid rise of OmniVault is far more than the success of a single product; it also signals that on-chain asset management is moving from “short-term speculation” to a new stage of “infrastructure reconstruction.”

With its innovative CeDeFi architecture, OmniVault not only achieves a risk-return ratio far superior to traditional models, but more importantly, it verifies a sustainable and scalable way to organize on-chain liquidity.

Currently, OmniVault is still in its early stages of development, but its performance clearly points to a more ambitious future: it is no longer just the growth engine of the Orderly ecosystem, but is gradually becoming the underlying hub connecting CeFi and DeFi liquidity, multi-chain assets, and user income needs.

Its continued evolution not only provides growth momentum for the Orderly ecosystem, but also provides a practical example for the industry to explore the next generation of on-chain asset management models.

- 核心观点:OmniVault引领CeDeFi金库创新进化。

- 关键要素:

- TVL超2100万美元,30天交易量6亿美元。

- APY达20%,最大回撤仅0.13%。

- 集成Ceffu接入币安流动性,支持多链。

- 市场影响:推动链上理财向真实收益转型。

- 时效性标注:中期影响。