Real World Bitcoin (RWB) in Action: From Passive Reserves to an Institutional-Grade Asset Class

- Core idea: Bitcoin is shifting from a passive reserve to a productive financial asset.

- Key elements:

- Bitcoin liquidity can be produced, with TVL reaching billions of dollars.

- Become the security layer and verification asset of decentralized infrastructure.

- The rise of native financial products supports institutional-level packaging and compliance.

- Market impact: Promote the institutionalization of Bitcoin and connect DeFi and TradFi.

- Timeliness annotation: medium-term impact.

With a market capitalization exceeding $2.2 trillion, Bitcoin remains the leading digital currency. The core driving force behind this trend is its narrative as "digital gold"—a secure, scarce, and highly liquid reserve asset. However, this positioning has also long kept Bitcoin dormant.

The "Real-World Bitcoin (RWB)" movement is emerging, aiming to mobilize this massive capital stock and transform Bitcoin from a passive reserve into an asset class that can generate income, can be circulated legally, and can be used by institutions.

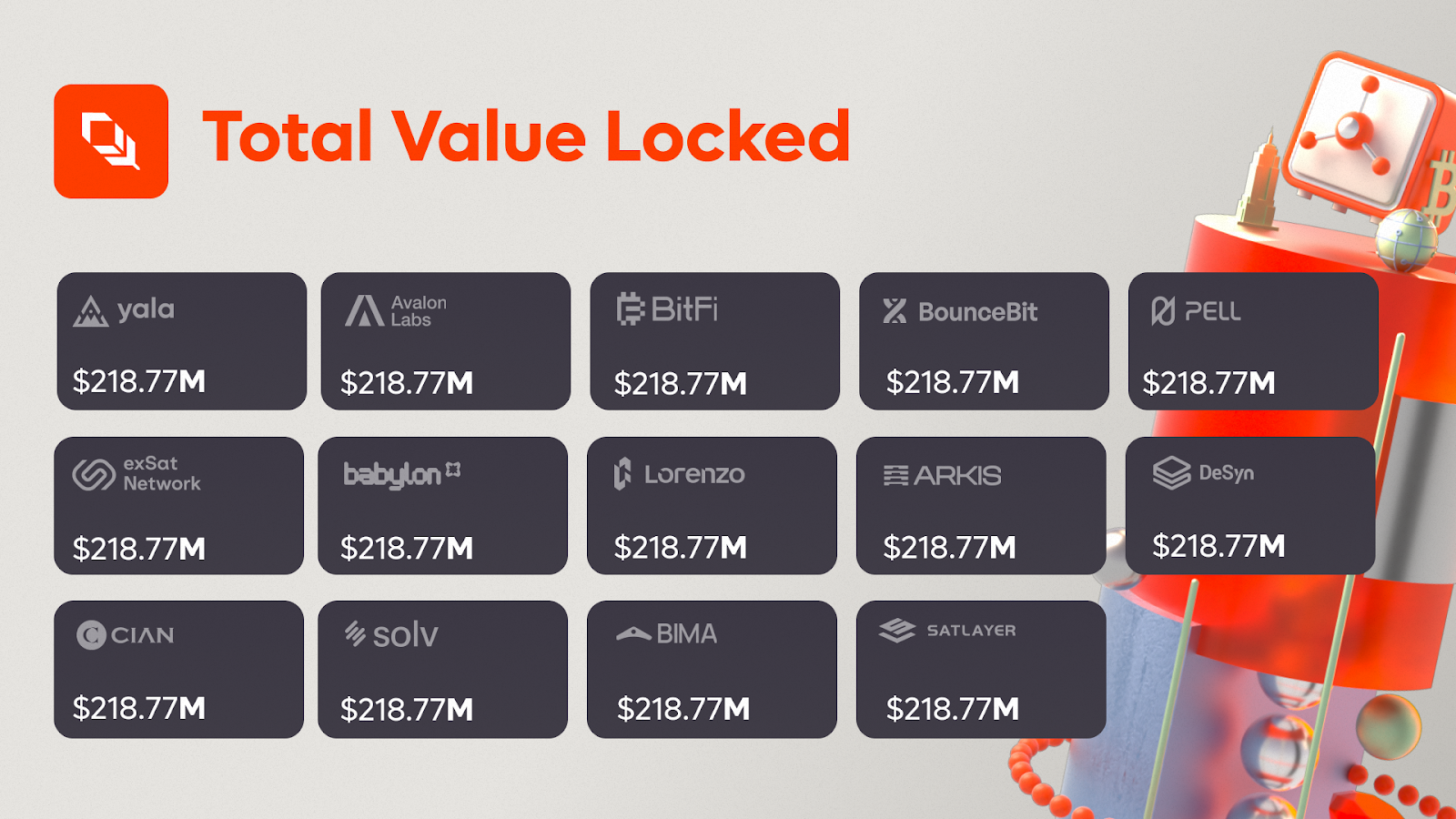

To gain a deeper understanding of how “Real World Bitcoin” is transforming the ecosystem, Plume surveyed 15 leading protocols building BTC-enabled products on their networks. These partners revealed why they chose to integrate Bitcoin and how they are creating value for institutional users.

The results show that Bitcoin is gradually evolving from a simple store of value to a global financial foundation with income attributes, compliance and institutional applicability.

Here are the core trends we’ve identified.

1. Bitcoin liquidity becomes “producible”

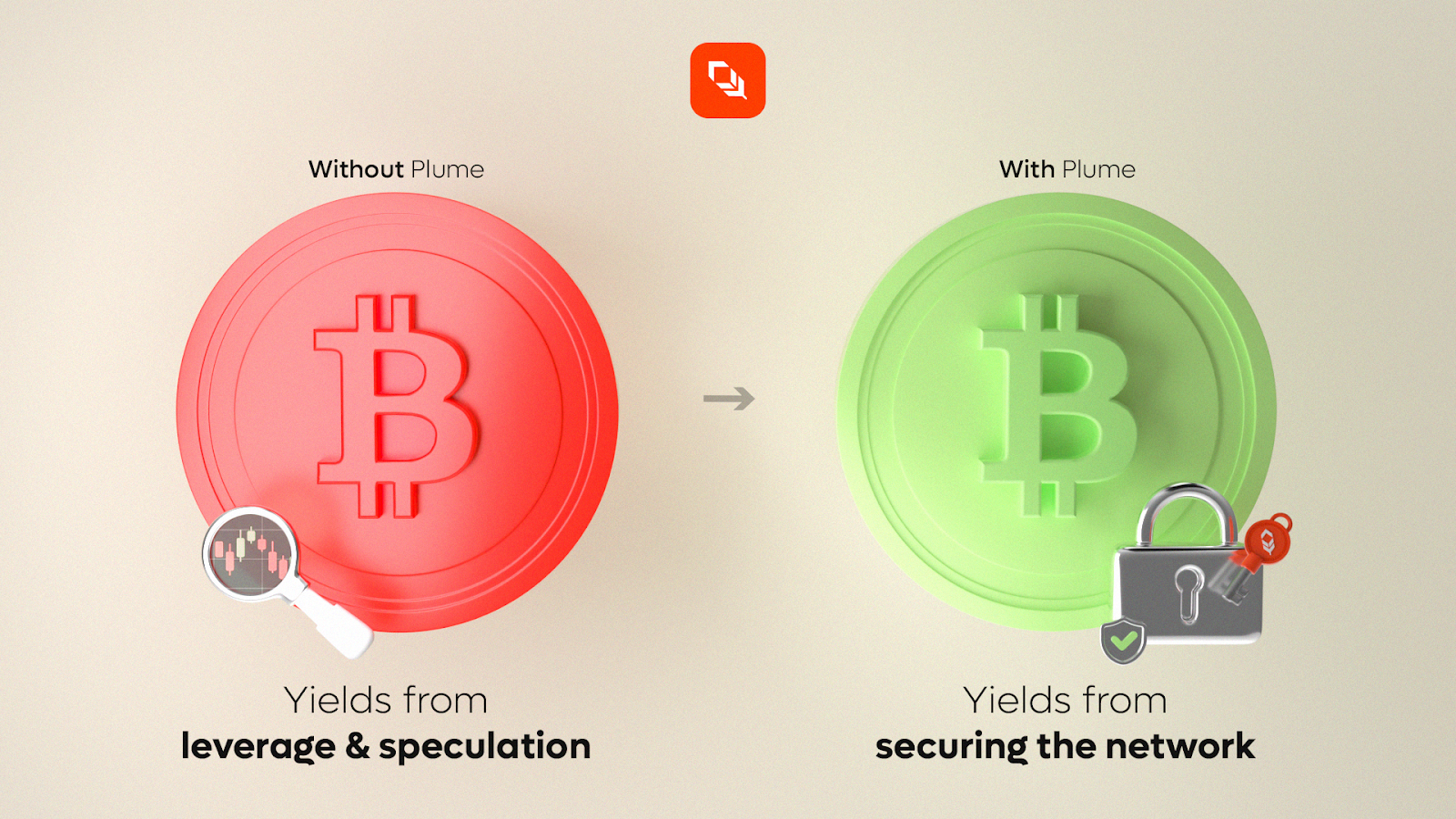

One point that builders generally emphasize is that Bitcoin is moving away from traditional high-risk custodial lending models (such as Celsius and BlockFi) to a self-custodial, transparent and compliant framework.

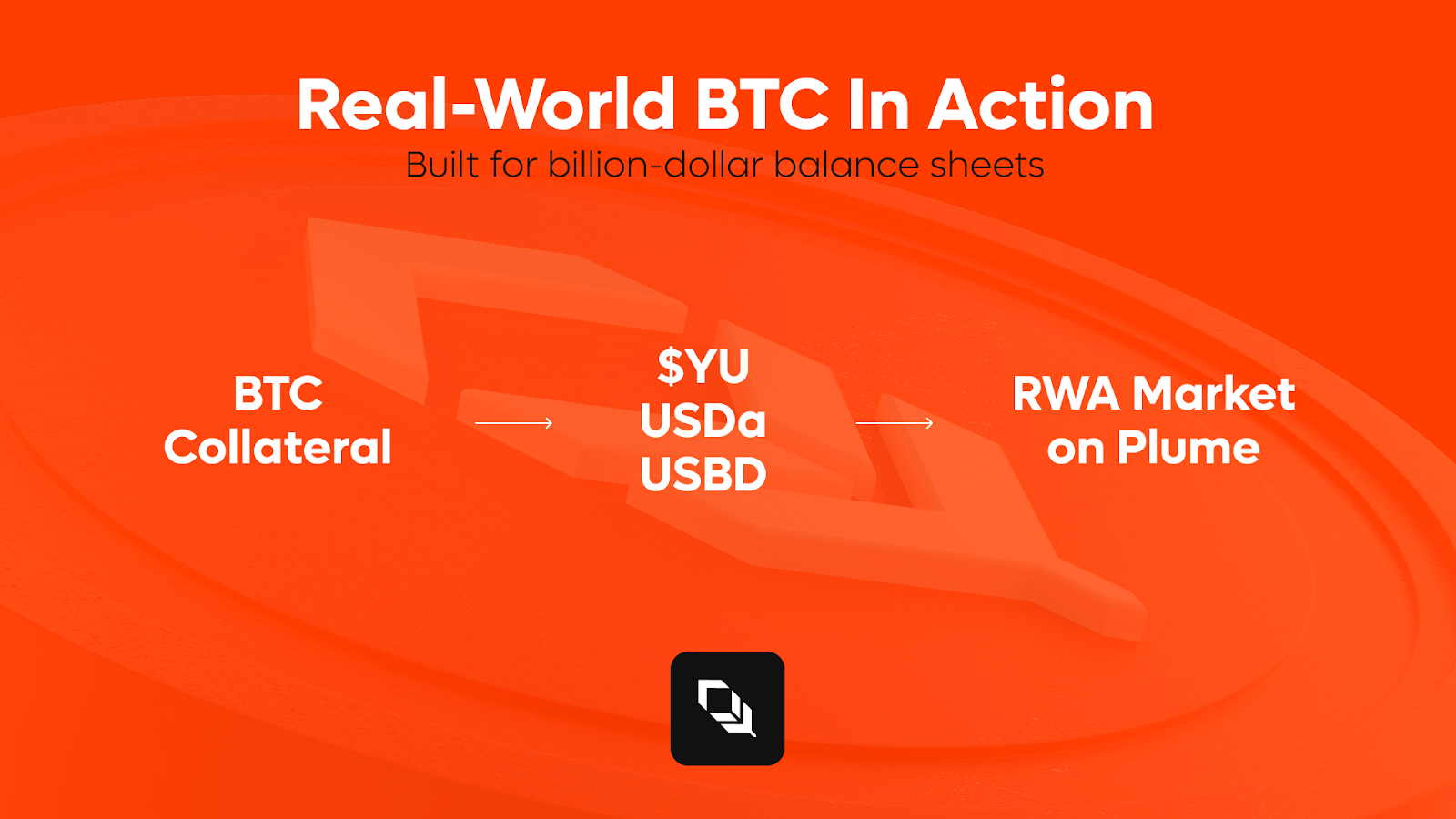

- Projects such as Yala, @avalonfinance_, and @BimaBTC support stablecoins (such as $YU, USDa, and USBD) through Bitcoin collateral, allowing users to obtain liquidity while maintaining their BTC holdings.

- These stablecoins are not only active in DeFi, but have also begun to enter the RWA market, linking BTC liquidity with real financial instruments such as credit and commodities.

The scale of liquidity is also growing rapidly: Yala's TVL reached US$230 million in August 2025; Avalon Labs' TVL exceeded US$2 billion in January 2025, and USDa's market value reached US$260 million.

At the same time, @Bitfi_Org and @bounce_bit connected CeFi and DeFi, launched a structured and neutral income strategy, and combined on-chain transparency with institutional-level guarantee mechanisms (such as off-chain settlement) to win the trust of institutions and funds.

2. BTC becomes the security layer of decentralized infrastructure

Bitcoin's role is not limited to collateral, it is also evolving into an "infrastructure asset."

- Pell Network uses Bitcoin heavy staking to secure applications on Plume.

- Babylon directly integrates BTC into the decentralized staking layer to provide security for applications and RWA protocols.

@satlayer uses heavily staked BTC as programmable collateral, ensuring correctness through a penalty mechanism. This allows Bitcoin to become the validating asset for cross-chain networks, using the most liquid crypto asset as the cornerstone of security.

For institutions, this represents a new revenue model: one that doesn't rely on speculative leverage, but rather on contributions to network security. Combined with Plume's compliance module, this model is providing an auditable and scalable path for institutional BTC staking.

3. The rise of Bitcoin-native financial products

Protocols @exSatNetwork and @LorenzoProtocol are building a full-stack asset management system for Bitcoin.

- exSAT positions BTC as the underlying layer of on-chain banking, combining revenue, compliance, and RWA integration to create a diversified financial platform.

- Lorenzo focuses on institutional-grade packaging products such as enzoBTC and on-chain traded funds (OTFs), allowing BTC to be integrated into traditional investment portfolios.

SolvBTC, launched by @SolvProtocol, provides a cross-border and efficient way to circulate Bitcoin. Users can participate in liquid staking, lending and income strategies based on SolvBTC, further expanding the role of BTC in TradFi, CeFi and DeFi.

Together, these projects demonstrate how Bitcoin has evolved from a speculative reserve asset to an investment vehicle with standardized products, credit lines, and transparent performance metrics.

4. BTC as Institutional Collateral

The credit market is the final link in the expansion of "real world Bitcoin".

- @ArkisXYZ and @DesynLab offer institutional BTC collateralized credit pathways. Arkis leverages the traditional prime broker model to provide compliant lending and leverage management for institutions, while Desyn packages BTC liquidity into risk management pools, which have demonstrated strong market demand.

- @CIAN_Protocol simplifies the path for institutions to enter BTC structured products through a multi-source heavy-collateralization income layer, and even provides a white label solution to facilitate quick access for funds and custodians.

5. Institutionalization of Real-World Bitcoin

All protocols share a common goal: to target the institutional market. Compliance, transparency, and predictable performance are key words repeatedly emphasized by their builders.

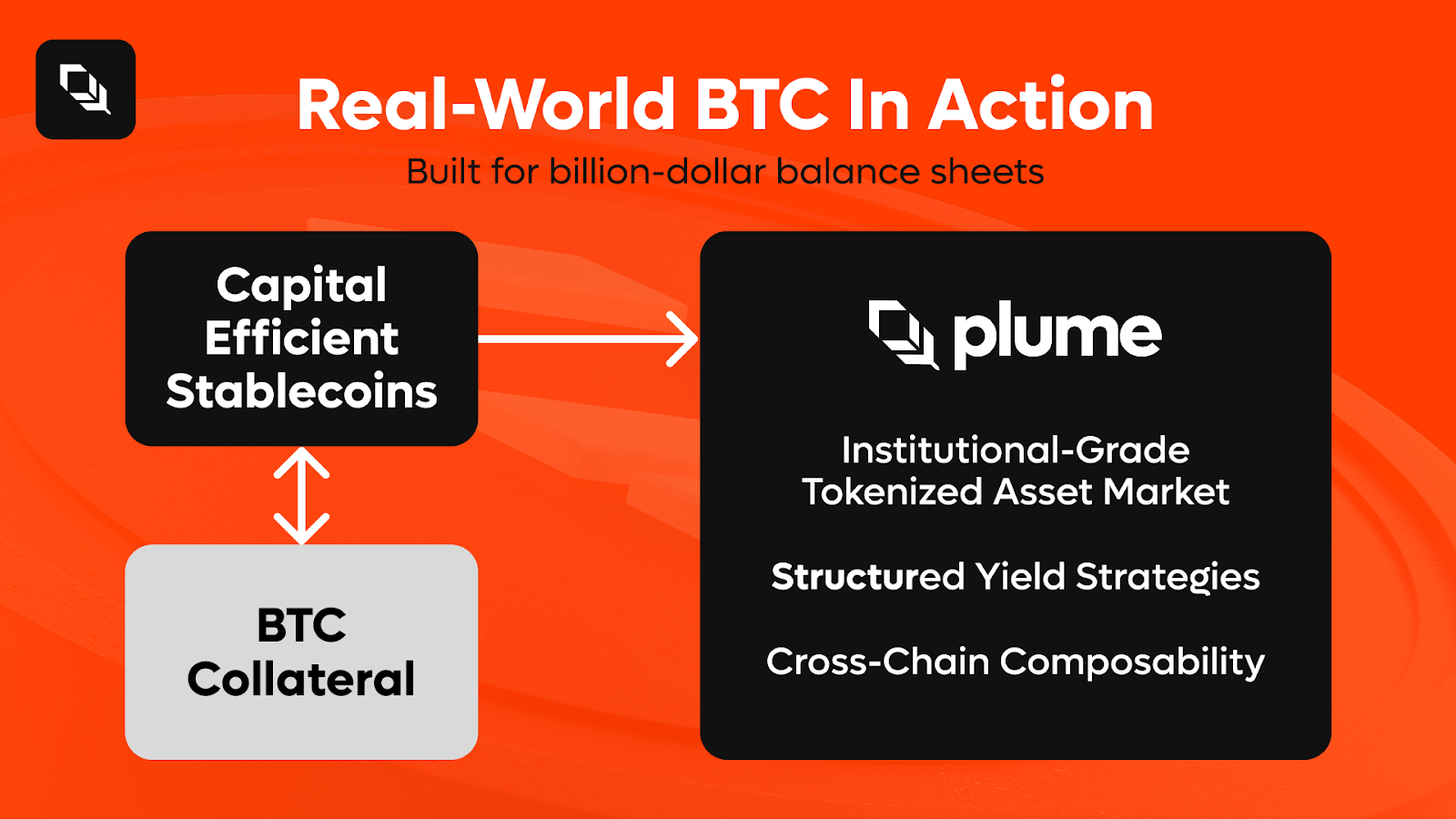

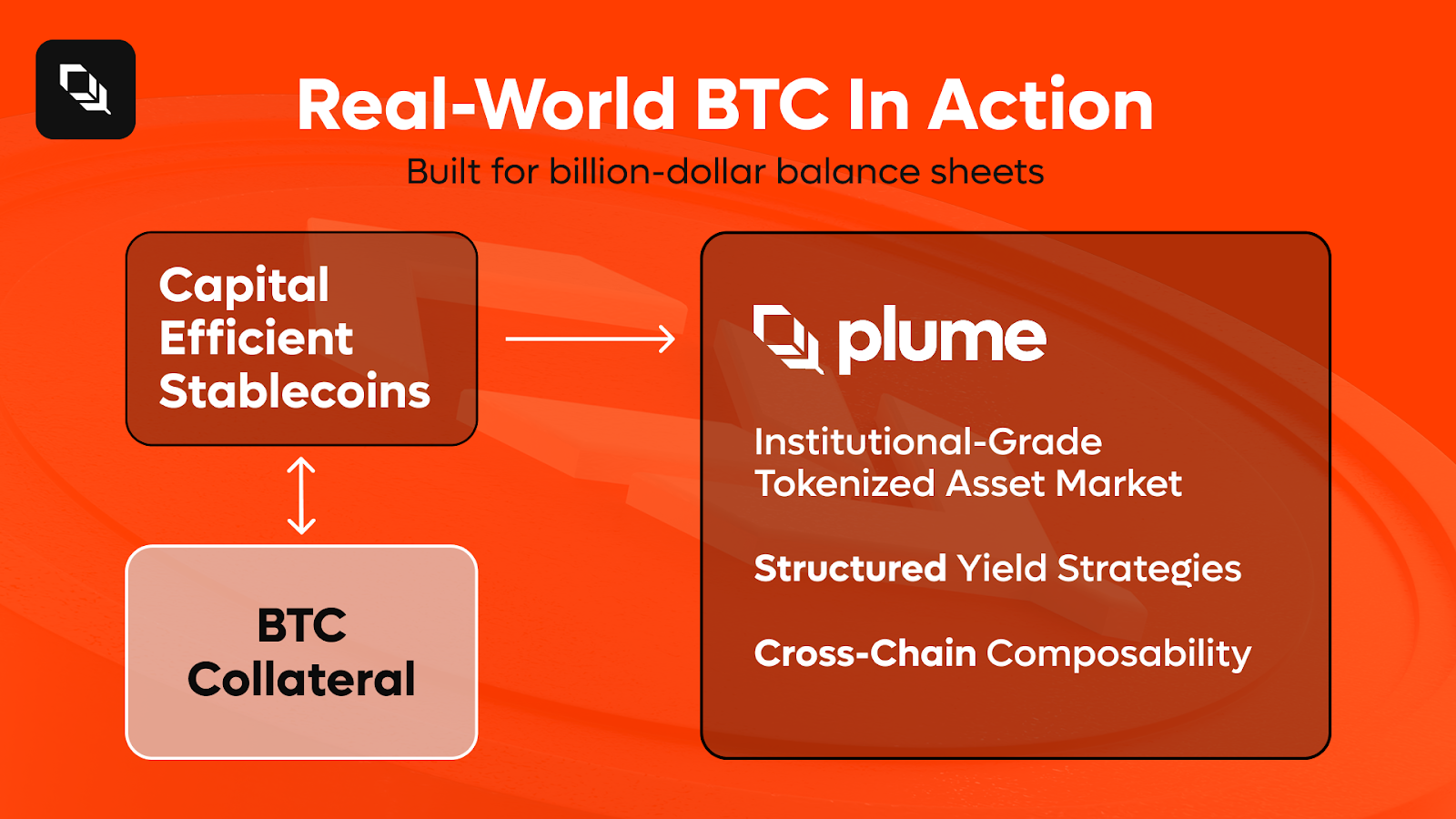

Plume’s infrastructure (built-in compliance, RWA channels, and EVM compatibility) is the key to transforming BTC into an institutional-grade asset.

The result is a multi-layered economy for real-world Bitcoin: encompassing liquidity, security, asset management, credit, and collateral. Bitcoin has evolved from a passive asset to the productive financial cornerstone supporting DeFi and TradFi.

Plume: A real-world Bitcoin accelerator

Every layer of evolution of real-world Bitcoin relies on compliance, transparency, and scalability infrastructure.

- Institutional capital will only participate in BTC stablecoin and liquidity strategies if they are securely deployed. Plume's compliance module and RWA-first architecture ensure that both funding providers and trading institutions earn returns within compliant standards.

- Heavy staking and security layers require cross-chain interoperability and auditable settlement. Plume provides this underlying layer, enabling protocols like @Pell_Network and @babylonlabs_io to integrate BTC into their security layer while ensuring transparency in pricing, penalties, and liquidations.

- Asset management and investment tools must be embedded within institutional workflows. Plume's EVM compatibility allows product design to align more closely with traditional financial logic, facilitating institutional adoption.

- Credit markets rely on strong risk management. Plume provides on-chain margin accounts, managed pools, and repayment logic, allowing institutions to safely use BTC as collateral.

Ultimately, the core market for real-world Bitcoin is institutions. Plume bridges the gap between DeFi innovation and institutional adoption, making Bitcoin a compliant, auditable, and standardized financial asset.

Bitcoin's next chapter

"Real World Bitcoin" is not intended to replace Bitcoin's "digital gold" positioning, but to expand its boundaries.

With self-custody, compliance and RWA integration as core principles, Bitcoin is becoming the underlying asset of global finance: with liquidity, security and profitability.

Just as gold was once a central bank reserve asset, Bitcoin may become the universal reserve of decentralized finance and institutional finance - but this time, it will be a productive asset that can operate efficiently in digital and physical markets.

Plume and its partners are pioneering this future: unleashing the compliant, connected, and productive value of Bitcoin.

The full survey results have been published in Plume’s Bitcoin At Work series.