Europe's First Web3 Stock Lists on Nasdaq: CoinShares' Valuation Puzzle and Expansion Ambition

- 核心观点:CoinShares借壳赴美上市,寻求业务扩张。

- 关键要素:

- 欧洲最大加密资管,规模超80亿美元。

- 资管业务稳步增长,但利润持续下滑。

- 收购Valkyrie ETF,布局美国市场。

- 市场影响:加剧美欧加密资管市场竞争。

- 时效性标注:中期影响。

Original author: Eric, Foresight News

Following Coinbase, Galaxy Digital, Circle, Bullish and Gemini, the U.S. stock market is about to welcome another company from the Web 3 industry.

On September 8th, European crypto asset management company CoinShares will merge with Vine Hill Capital Investment Corp., a Nasdaq-listed special purpose acquisition company, and Odysseus Holdings Limited, a newly established Jersey company. Following the merger, CoinShares will be listed on Nasdaq (or another US exchange) and delisted from Nasdaq Stockholm. Following the successive IPOs of several US-based Web 3 companies, this marks the first European Web 3 enterprise to enter the US capital market.

CoinShares' predecessor was Global Advisors, a commodities investment firm founded in 1998 by Russell Newton and Danny Masters. Russell Newton spent eight years trading crude oil for companies including Shell starting in 1986 before joining JPMorgan Chase as a commodities strategist in July 1994. Co-founder Danny Masters, current Chairman of CoinShares, served as Global Head of Energy Trading at JPMorgan Chase before co-founding Global Advisors with Russell Newton.

Economist JM Mognetti, current CEO of CoinShares, joined Global Advisors in 2012. Just a year later, global macro investors began to pull out of commodities in favor of equities and fixed income. The three urgently needed new investment opportunities, and Bitcoin, then priced at just a few hundred dollars, caught their eye.

With almost no hesitation, Global Advisors completely turned to the digital asset field in 2014, and later changed its name to CoinShares in 2016. It has gradually developed into today's crypto asset management company integrating asset management, capital market business and independent investment.

In 2014, Global Advisors launched the first regulated Bitcoin investment fund in Europe. After rebranding, CoinShares acquired XBT Provider, which launched the first Bitcoin-based security on a regulated exchange, and its Bitcoin Tracker One ETP was listed in Sweden in 2015.

In early 2021, CoinShares began launching ETPs (exchange-traded products) with physical assets as the underlying assets. Currently, these products cover not only Bitcoin and Ethereum, but also tokens such as Litecoin (LTC), XRP, Link, and UNI. In March of the same year, CoinShares went public in Sweden, becoming the world's second publicly listed Web 3 company after Galaxy Digital (which was then listed on the Toronto Stock Exchange in Canada). According to data provided by CoinShares, as of February 19, 2021, CoinShares' assets under management amounted to US$4.56 billion, including 70,185 Bitcoins and 655,211 Ethereums, making it the largest crypto asset management company in Europe at the time and the second largest globally (after Grayscale).

In comparison, as of February 24, 2021, Grayscale's total assets under management were US$39.3 billion, Bitwise's assets under management just exceeded US$1 billion, and Galaxy Digital's assets under management were US$834.7 million as of January 31, 2021.

In early 2024, after the SEC approved several Bitcoin spot ETFs filed by institutions, CoinShares acquired Valkyrie, one of the issuers of a Bitcoin spot ETF. As of this writing, Valkyrie's Bitcoin spot ETF assets under management exceeded $650 million.

In addition to asset management, investment is also a key business for CoinShares. At its 2021 IPO, CoinShares disclosed its late-2020 investments in Canadian crypto asset management company 3IQ Corp and the parent company of Kingdom Trust, a US qualified trust institution. In 2021 and 2022, CoinShares invested in Swiss online bank FlowBank twice, reaching a maximum stake of nearly 30%. However, FlowBank went bankrupt and liquidated in 2022 due to insolvency.

After talking about the development history of CoinShares, let’s talk about its financial situation.

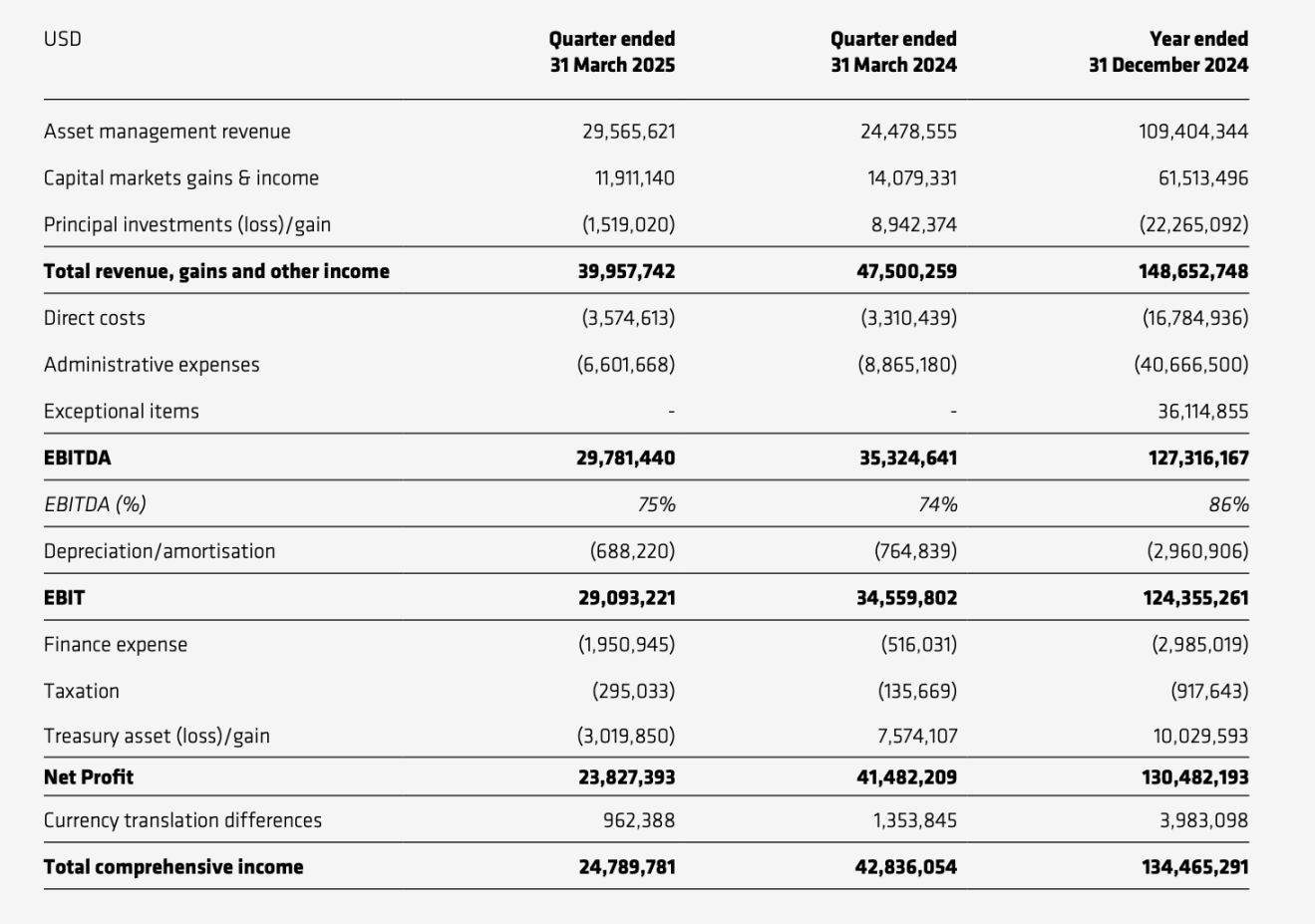

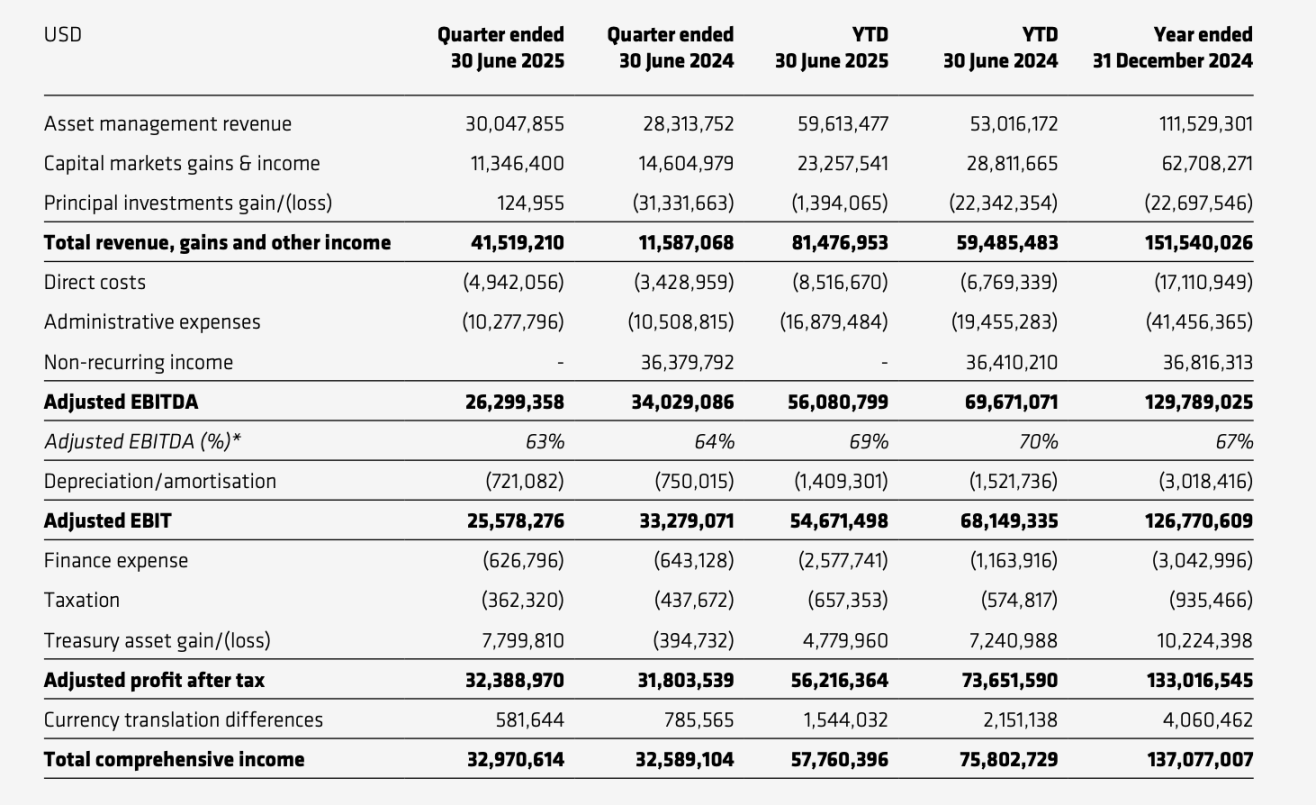

Comparing CoinShares' first and second quarter financial reports this year, Q1 revenue was $39.958 million, a year-on-year decrease of approximately 15.88%. EBITDA (earnings before interest, taxes, depreciation, and amortization) was $29.781 million, a year-on-year decrease of approximately 15.7%. However, the profit margin reached 75%, a slight year-on-year increase. Taking into account fluctuations in the price of the company's own crypto assets, taxes, and other factors, CoinShares' comprehensive income for the first quarter was approximately $24.79 million, a year-on-year decrease of 42.1%.

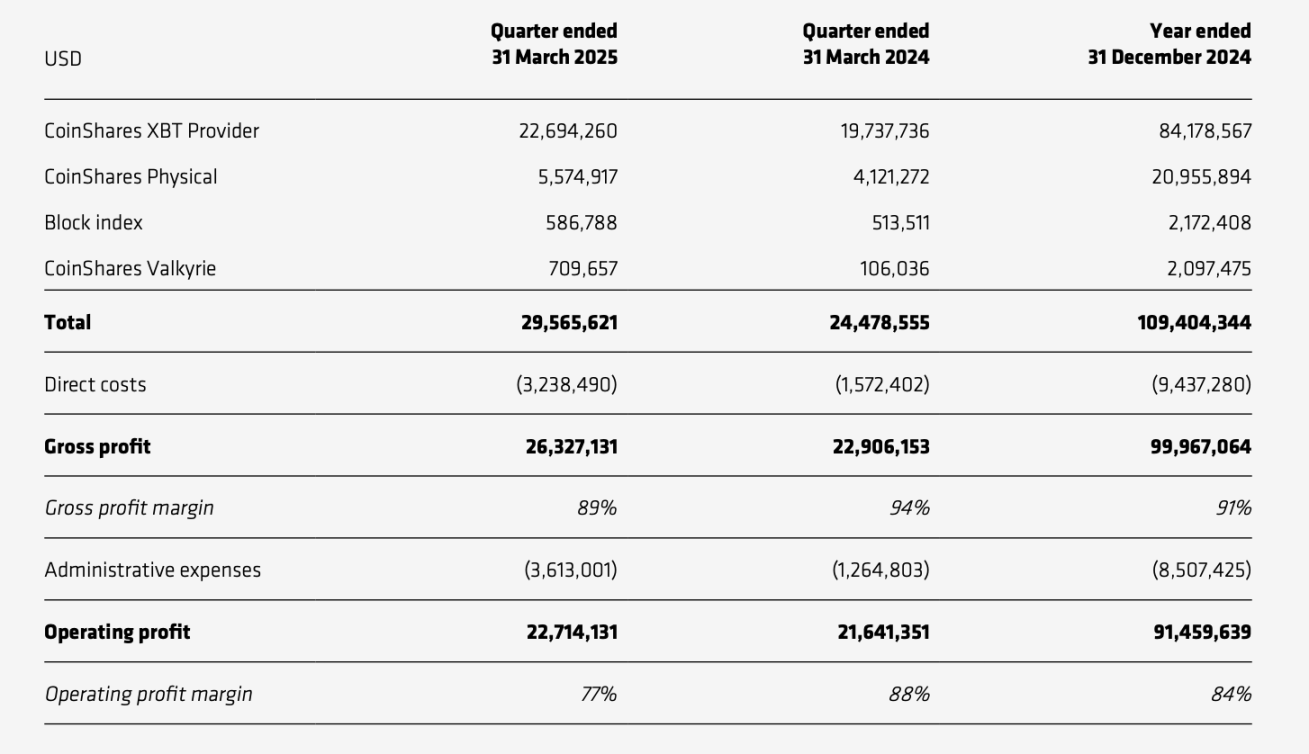

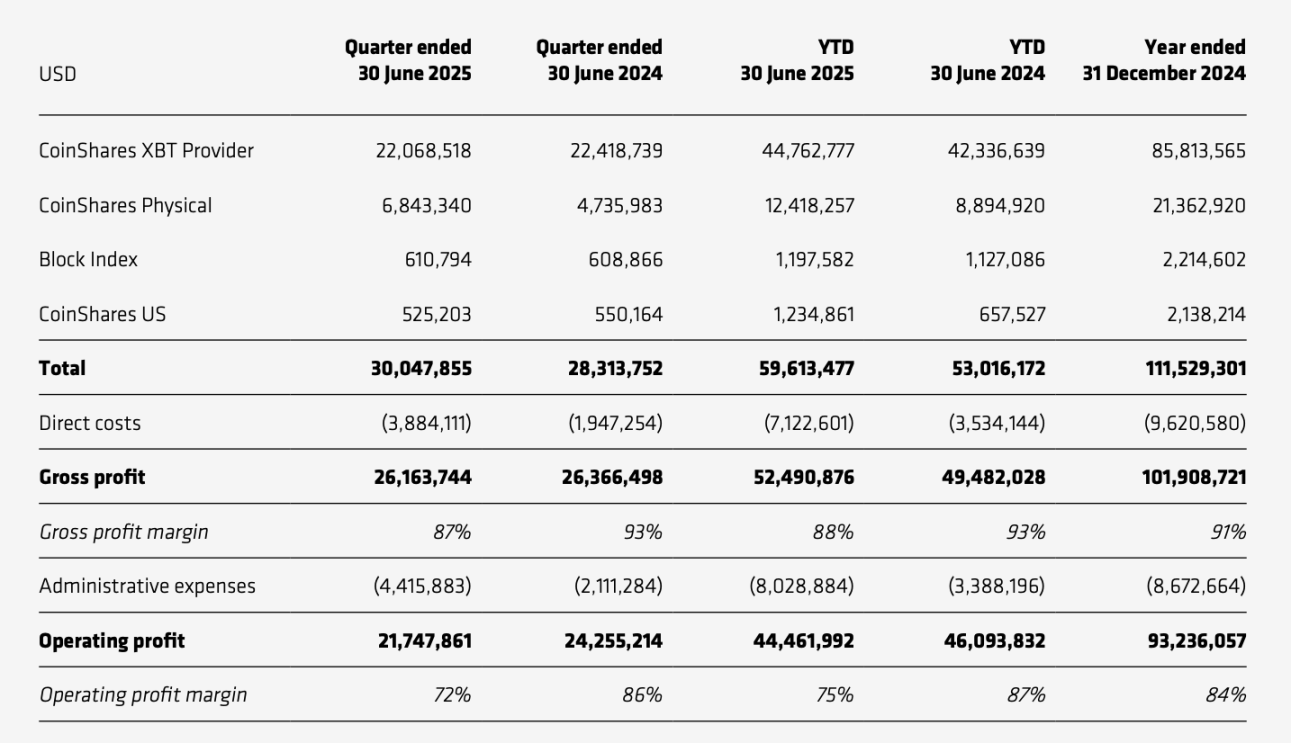

CoinShares' asset management business, which accounts for the largest portion of its revenue, generated $29.566 million in revenue in the first quarter, representing approximately 74% of total revenue and a year-on-year increase of approximately 20.8%. Profit after deducting direct costs and administrative expenses was approximately $22.714 million, a slight year-on-year increase of approximately 5%.

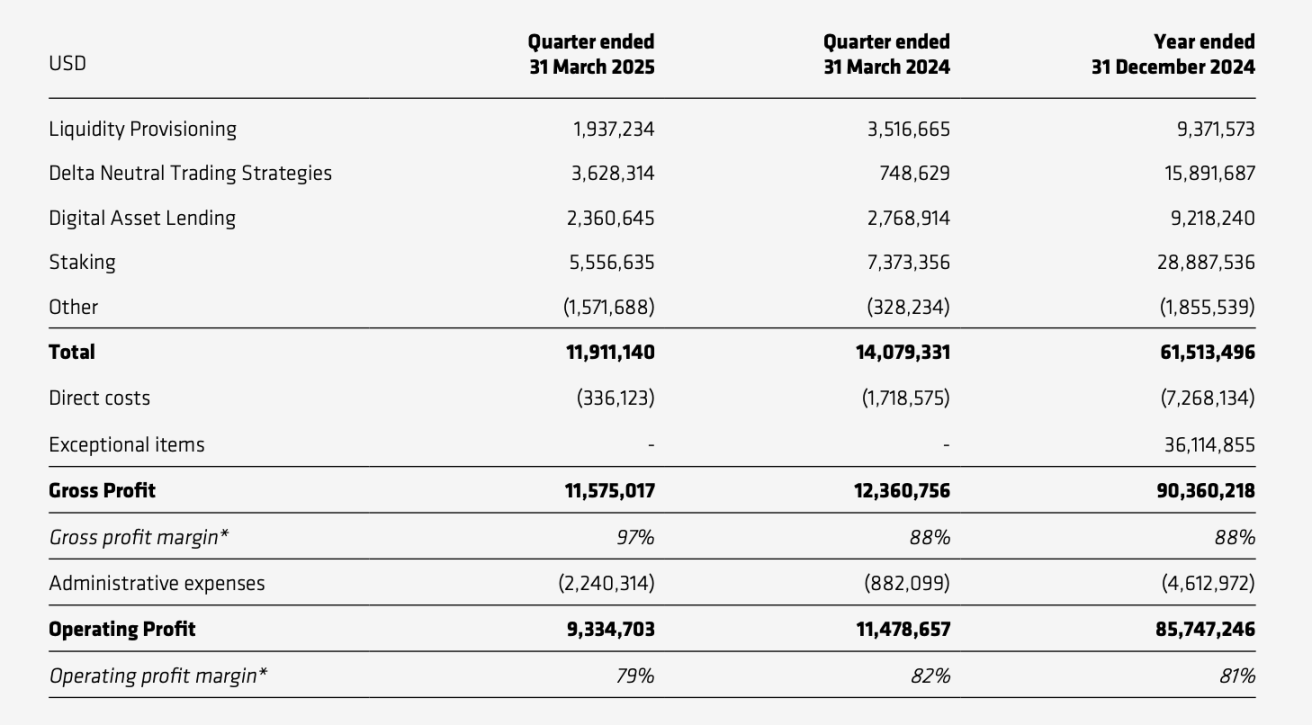

CoinShares' capital markets infrastructure business generated approximately $11.911 million in revenue in the first quarter, a year-on-year decrease of approximately 15.4%. CoinShares' so-called capital markets infrastructure business includes income from providing liquidity, delta-neutral trading strategies, digital asset lending, and staking. After deducting direct costs and administrative expenses, profit was approximately $9.335 million, a year-on-year decrease of approximately 18.7%.

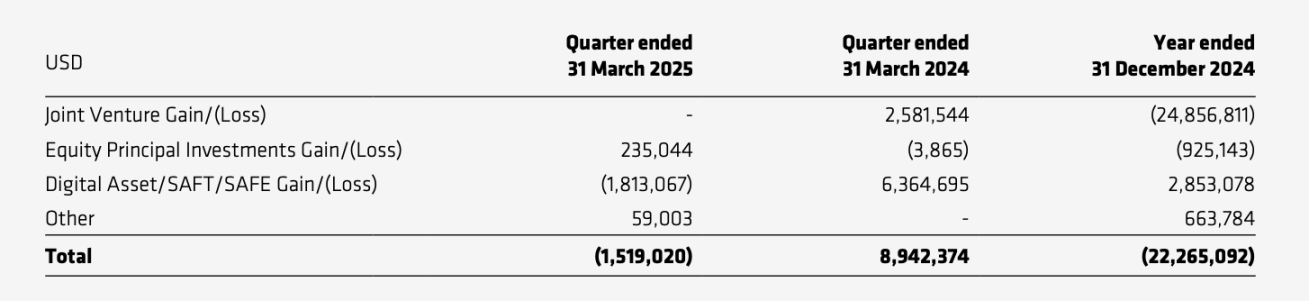

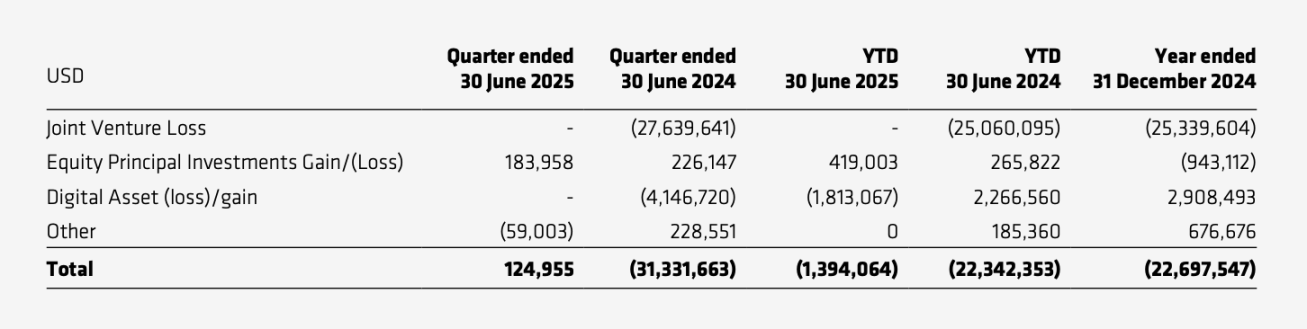

In its proprietary investment business, CoinShares lost approximately $1.519 million in the first quarter, compared with a profit of approximately $8.942 million in the same period last year, a year-on-year plunge of approximately 117%.

Due to the overall decline in cryptocurrency prices in the first quarter, all other business segments experienced declines, with the exception of asset management, which is not significantly affected by price fluctuations. A closer look at the financial report reveals that within the capital markets infrastructure business, revenue from providing liquidity, lending, and staking was significantly impacted by falling prices and sluggish trading. However, Delta-neutral trading offset some of these losses, while the investment business was primarily impacted by the overall market price decline. Overall, CoinShares has not seen a decline in its core business and is actively adjusting its investment strategy.

In the second quarter, cryptocurrency prices rose overall, but CoinShares' business did not see significant growth.

CoinShares recorded revenue of $41.519 million in the second quarter, up approximately 3.8% quarter-over-quarter and a significant 258.3% year-over-year. Earnings before interest, taxes, depreciation, and amortization (EBITDA) were $26.299 million, down 11.7% quarter-over-quarter and approximately 22.7% year-over-year, with a profit margin falling to 63%. CoinShares' comprehensive income for the second quarter was approximately $25.578 million, up slightly by approximately 3.2% quarter-over-quarter and 1.1% year-over-year.

For the entire first half of the year, the data is somewhat distorted due to the inclusion of losses from FlowBank's bankruptcy and revenue from the sale of FTX bonds in 2024 (the significant year-on-year increase in revenue is also abnormal). Excluding this part of the data, CoinShares' performance in the first half of this year has not changed much compared with the same period last year.

In its asset management business, CoinShares' second-quarter revenue exceeded $30 million, a slight increase of 1.6% quarter-over-quarter and a 6.1% year-over-year increase. Operating profit was $21.748 million, a decrease of approximately 4.3% quarter-over-quarter and 10.3% year-over-year. For the first half of the year, CoinShares' asset management business generated approximately $59.613 million in revenue, a year-over-year increase of 12.4%, while operating profit was $44.462 million, a year-over-year decrease of 3.5%.

CoinShares said that its XBT products saw a net outflow of $126 million in the second quarter. In addition, the company allocated more expenses and fees to its asset management department, resulting in an increase in asset management income but a continuous decline in profits.

In its capital markets infrastructure business, CoinShares generated approximately $11.346 million in revenue in the second quarter, a 2% decrease from the previous quarter and a 22.3% decrease from the previous year. Excluding the additional revenue from the sale of FTX bonds, both the profit amount and profit margin declined.

CoinShares's proprietary investments generated only a profit of approximately $125,000 in the second quarter. While this represents a slight increase compared to the approximately $1.519 million loss in the first quarter, investment losses and gains are somewhat random and therefore not very reliable. It is worth noting that CoinShares has been in the red throughout 2024 and 2025 to date, despite achieving a profit of nearly $3.7 million in 2023.

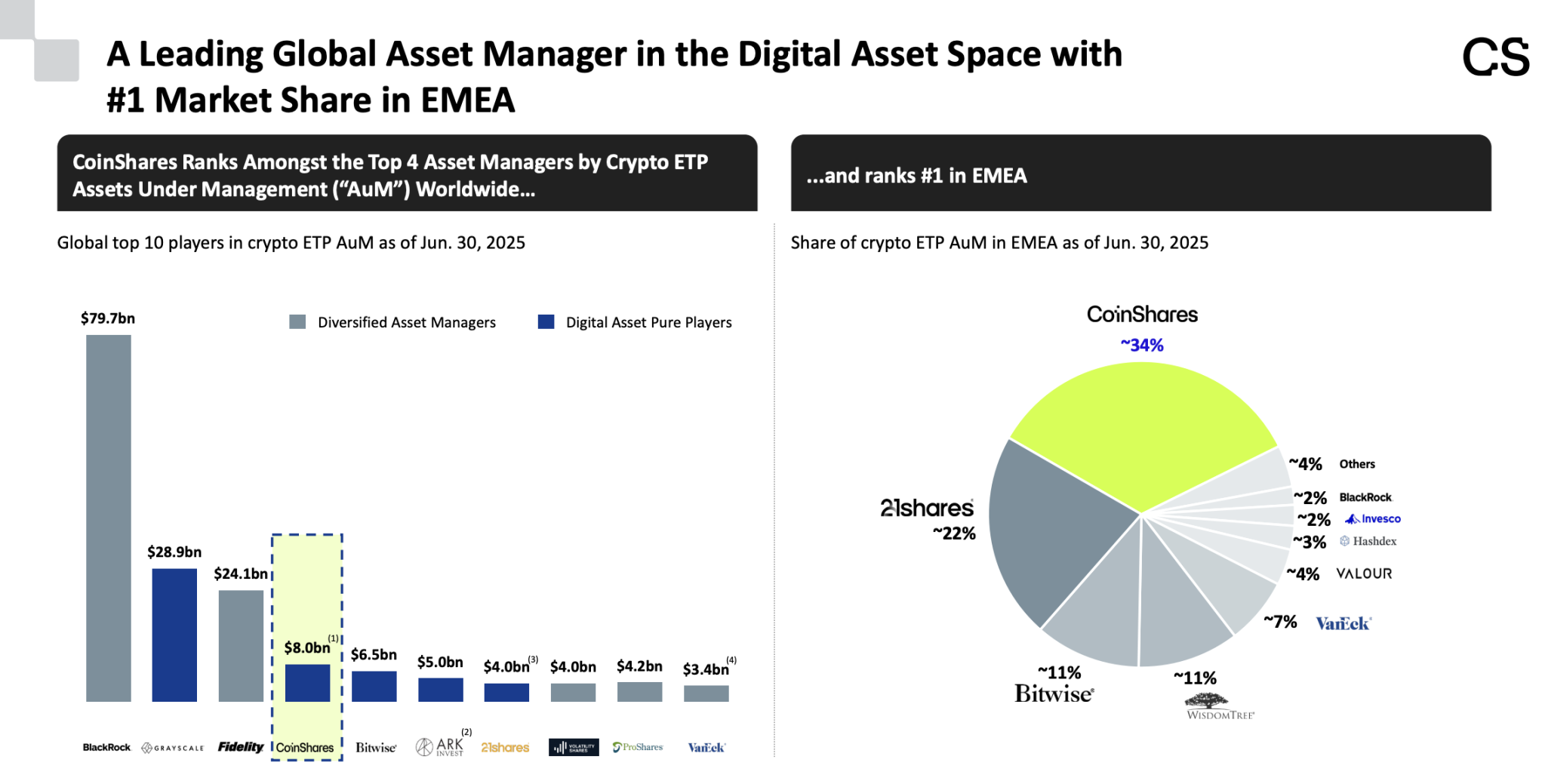

Although CoinShares stated in its roadshow materials that its total assets under management (AUM) have exceeded $8 billion, making it the fourth-largest crypto asset manager globally after BlackRock, Grayscale, and Fidelity, and the largest in EMEA (Europe, Middle East, and Africa), with approximately 34% market share, the aforementioned data suggests that CoinShares' growth has been slow. Aside from steady, modest growth in its asset management business, the performance of its other businesses has been highly volatile. CoinShares' acquisition of Valkyrie and its US IPO are essentially aimed at expanding its US presence, but its home base does not appear to offer any unique moat.

According to ISS Market Intelligence data, as of the end of May this year, the assets managed by US fund companies in Europe had increased from US$2.2 trillion a decade ago to US$4.9 trillion. If US asset management giants intend to expand their crypto asset management business to Europe, CoinShares will have to face strong competition.

Assuming the SEC approves more cryptocurrency ETFs in the future, CoinShares' current advantage could be gradually eroded. Based on yesterday's closing price of European stocks, CoinShares' market capitalization is approximately 8.228 billion Swedish kronor, or approximately $877 million, with a price-to-earnings ratio of approximately 7.97. However, its valuation after a backdoor listing reached $1.2 billion, representing a premium of nearly 37%.

Compared to BlackRock, the world's largest asset management company, which managed $12.5 trillion in assets as of the end of the second quarter, CoinShares significantly surpasses BlackRock in terms of asset management to market capitalization ratio, yet its price-to-earnings ratio is significantly lower than BlackRock's, which is nearly 27. This creates a rather contradictory valuation for CoinShares. While crypto asset management will remain a hot commodity for a considerable period of time, whether CoinShares' market capitalization can achieve significant growth, from a rational perspective, likely depends on whether its asset management business can achieve unexpected growth, whether it can establish a competitive advantage in non-US markets, and whether it can capture a share of the domestic market.