What will the "ultimate form" of the stablecoin chain be?

- 核心观点:稳定币发行方布局Layer1以掌控金融通道。

- 关键要素:

- 稳定币规模超2800亿美元。

- 头部发行方盈利强劲,Circle季度营收6.58亿美元。

- 推出自研Layer1实现垂直整合与合规。

- 市场影响:重塑支付与外汇结算,挑战传统金融巨头。

- 时效性标注:中期影响。

Original author: Terry Lee

Original translation: Saoirse, Foresight News

In less than 12 years, stablecoins have evolved from a niche cryptocurrency experiment into an asset class exceeding $280 billion. As of September 2025, their growth momentum is still accelerating. Notably, the rise of stablecoins is driven not only by demand but also by a clearer regulatory environment—with the recent passage of the GENIUS Act in the United States and the introduction of the Markets in Crypto-Assets Directive (MiCA) in the European Union. Major Western countries have now officially recognized stablecoins as a legitimate cornerstone of the future financial system. Interestingly, stablecoin issuers are not only "stable" but also highly profitable. Driven by high interest rates in the United States, USDC issuer Circle announced revenue of $658 million in the second quarter of 2025, primarily from interest earned on its reserves. As early as 2023, Circle was profitable, with net profits reaching $271 million.

Source: tokenterminal.com, current stablecoin circulating supply data

This profitability has naturally sparked competition. From Ethena's launch of the algorithmic stablecoin USDe to Sky's issuance of USDS, numerous challengers have emerged, attempting to disrupt the dominance of Circle and Tether. As the focus of competition shifts, leading issuers like Circle and Tether have begun adjusting their strategies, building their own Layer 1 blockchains with the goal of controlling the future of financial channels. These financial channels not only deepen their competitive advantage and generate additional fees, but also have the potential to reshape how programmable money circulates on the internet.

A trillion-dollar question arises: Can industry giants like Circle and Tether withstand the impact of disruptors like Tempo (a non-stablecoin native entrant)?

Why choose Layer 1 blockchain? Background analysis and differentiating features

Essentially, the Layer 1 blockchain is the foundational protocol that underpins the entire ecosystem, responsible for processing transactions, completing settlements, achieving consensus, and ensuring security. For those in the technical field, think of it as the "operating system" of the cryptocurrency world (e.g., Ethereum, Solana), upon which all other applications are built.

For stablecoin issuers, the core logic of deploying Layer 1 blockchains is to achieve vertical integration. They no longer rely on third-party blockchains like Ethereum, Solana, and Tron, nor on Layer 2 networks. Instead, they proactively build their own channels to capture more value, strengthen control, and better comply with regulatory requirements.

To understand this "battle for control," we can look at the Layer 1 blockchains of Circle, Tether, and Stripe: they share common characteristics while also following different development paths.

Common characteristics

- Using its own stablecoin as its native currency eliminates the need to hold ETH or SOL to pay gas fees. For example, on Circle’s Arc blockchain, transaction fees must be paid in USDC; however, in some scenarios (such as Tether’s Plasma chain), transaction fees are completely waived.

- High throughput and fast settlement: These Layer 1 blockchains all promise to achieve "sub-second finality" (transactions are irreversible very quickly after completion) and can process thousands of transactions per second (TPS) - ranging from 1,000+ TPS on Plasma chains to 100,000+ TPS on Tempo, a subsidiary of Stripe.

- Optional privacy protection and compliance environment: These blockchains create a "selective encryption ecosystem" with stronger privacy protection and higher compliance, but this advantage comes at the cost of a certain degree of centralization.

- Compatible with the Ethereum Virtual Machine (EVM): This ensures that developers can build applications based on familiar development standards, lowering the technical threshold.

Core Differences

- Circle's Arc is designed for both retail and institutional users. Its proprietary foreign exchange engine is highly attractive for capital market transactions and payments, and is poised to become the "preferred gateway to Wall Street" in the crypto space.

- Tether's Stable chain and Plasma chain: With "accessibility" as the core, it launched a zero-gas fee design to make the transaction process between retail users and peer-to-peer (P2P) users smoother and frictionless.

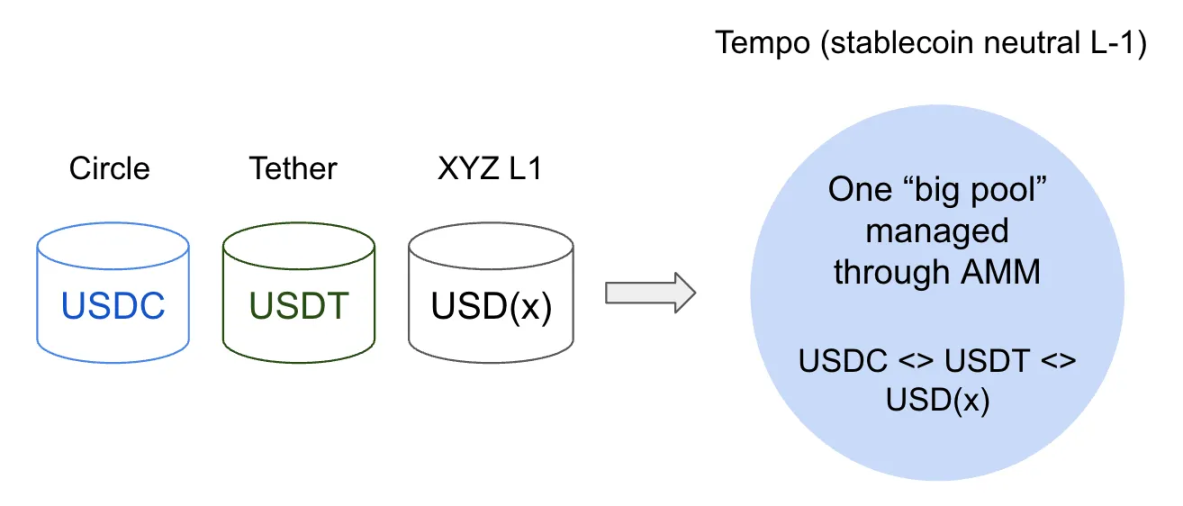

- Stripe's Tempo takes a different approach, maintaining stablecoin neutrality. Rather than being tied to a single stablecoin, it supports multiple USD stablecoins through a built-in automated market maker (AMM). This may be more appealing to developers seeking flexibility and users who aren't limited to a single USD token.

Layer 1 blockchain application trends

According to my analysis, there are three main trends at present:

Trend 1: Traditional Financial Integration – Building Trust and Adapting to Compliance

For stablecoin issuers, building their own Layer 1 blockchain is crucial to building trust. By controlling the channel or ecosystem, rather than relying solely on third-party networks like Ethereum and Solana, Circle and Tether can more easily provide compliance-ready infrastructure, ensuring compliance with regulatory frameworks like the US GENIUS Act and the EU MiCA.

Circle has positioned USDC as a "compliant product": institutions responsible for USDC and US dollar redemptions must adhere to Know Your Customer (KYC) and Anti-Money Laundering (AML) compliance frameworks. Its newly launched Layer 1 blockchain, Arc, goes a step further, combining auditable transparency with privacy protections, making it a potentially reliable option for institutional users. Tether is also pursuing a similar strategy with its Stable Chain and Plasma Chain, aiming to become the "infrastructure backbone" for banks, brokerages, and asset managers.

Given this trend, the ideal application scenario could be foreign exchange trading. Leveraging Circle's Arc Blockchain—with its sub-second finality, 1,000+ TPS throughput, and foreign exchange processing capabilities—market makers and banks can achieve instant settlement of foreign exchange transactions. This creates an opportunity for them to tap into the foreign exchange market, which boasts a daily turnover exceeding $7 trillion, thereby fostering a powerful network effect. Stablecoins like USDC and EURC are poised to become "native settlement assets," locking developers into their ecosystems. This could also open the door to DeFi applications: supporting institutional-grade "inquiry systems," mitigating counterparty risk through smart contracts, and enabling rapid settlement.

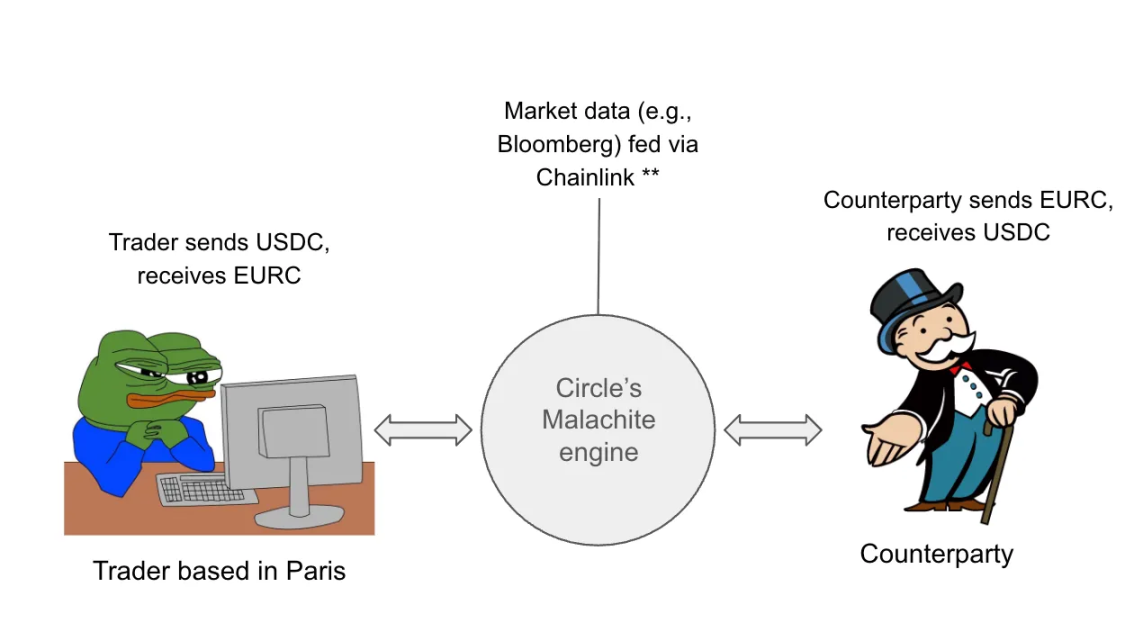

(Note: This scenario is an example, assuming Chainlink Oracles are used to obtain data)

(Image: The process by which traders complete transactions on the Circle Layer 1 blockchain)

For example, a Paris-based forex trader could use the USDC/EURC trading pair on the Arc blockchain, leveraging the Malachite FX engine, to exchange $10 million USD for Euros. Assuming a real-time exchange rate (e.g., $1 = €0.85) obtained through a Chainlink oracle, the entire transaction could be completed in under a second—reducing the traditional forex settlement cycle from "T+2" (two days after the trade) to "T+0" (real-time settlement). This is the revolution enabled by technology.

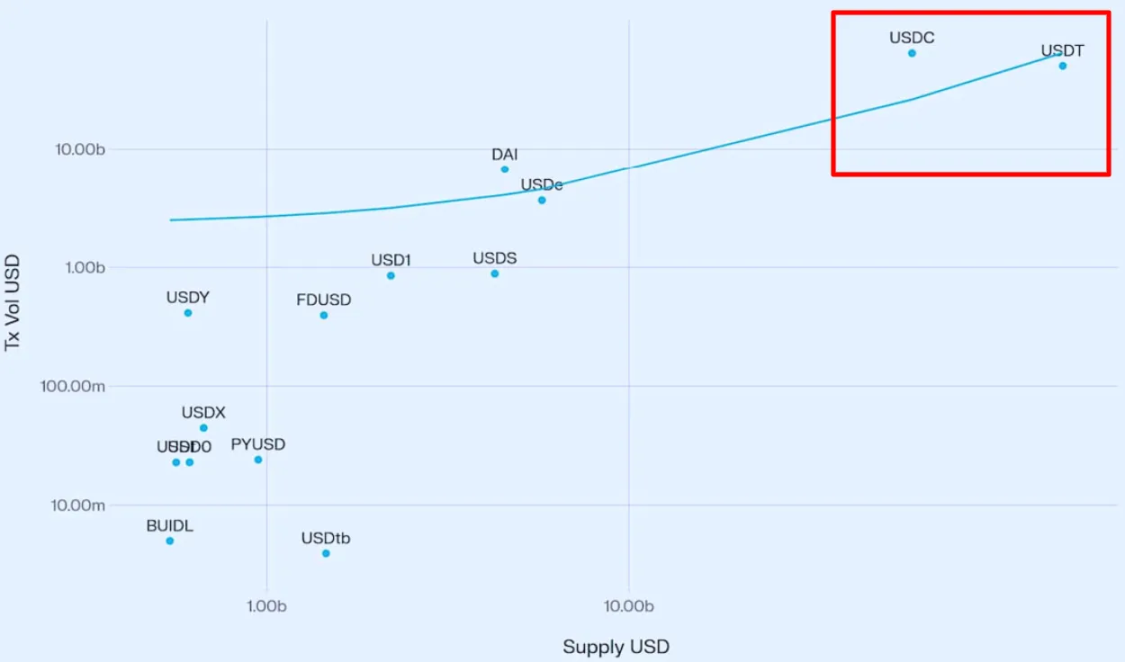

Source: Vedang Ratan Vatsa, “Stablecoin Growth and Market Dynamics”

Research data supports this trend. Vedang Ratan Vatsa's research shows a significant positive correlation between stablecoin supply and trading volume: the larger the supply, the deeper the liquidity and the greater the degree of adoption. As the two leading issuers, Tether and Circle undoubtedly have the advantage of capturing this institutional capital flow.

However, the integration of traditional finance and blockchain channels still faces significant challenges: coordinating with regulators, central banks, and regional laws requires navigating a complex environment (for example, achieving compliance with multiple central banks can take years); issuing stablecoins for emerging market currencies is even more challenging—if the product doesn't match market demand, adoption could be slow or even unpopular; even if these obstacles are overcome, banks and market makers may be wary of migrating "critical infrastructure" to new channels—a migration that could increase costs (not all currencies are already on-chain, requiring institutions to maintain both traditional and encrypted systems) and introduce uncertainty. Furthermore, with Circle, Tether, Stripe, and even banks launching their own blockchains, the risk of "liquidity fragmentation" is exacerbated: if no single channel achieves sufficient scale and liquidity, it may not be able to dominate the $7 trillion daily foreign exchange market.

Trend 2: Can stablecoin chains pose a threat to established institutions in traditional payment channels?

As Layer 1 blockchains attract traditional financial institutions with their programmability, their rise could also pose a threat to traditional payment giants like Mastercard, Visa, and PayPal. This is because Layer 1 blockchains can provide "instant, low-cost" settlement services through various decentralized applications. Unlike the "closed, single platforms" of traditional payment giants, these blockchain channels are "open and programmable": they provide a flexible foundation for developers and fintech companies, similar to "renting AWS cloud services" rather than "building their own payment infrastructure." This shift enables developers to quickly launch applications such as cross-border remittances, AI-driven payments, and tokenized assets, while achieving "near-zero fees" and "sub-second settlement."

For example, developers can build an instant settlement payment DApp on a stablecoin chain, allowing merchants and consumers to enjoy fast, low-cost transactions, while Layer 1 issuers like Circle, Tether, and Tempo capture value as core infrastructure. The key difference is that this model eliminates intermediaries like Visa and Mastercard, allowing developers and users to directly benefit.

However, risks remain: as more issuers and payment companies launch their own Layer 1 blockchains, the ecosystem could become fragmented. Merchants may face challenges with USDC tokens from different chains, with interoperability issues. Circle's Cross-Chain Transfer Protocol (CCTP) attempts to address this issue by maintaining a single, liquid version of USDC across multiple chains. However, the protocol only applies to Circle-owned tokens, limiting its reach. In this oligopolistic market, cross-chain interoperability could become a critical bottleneck.

Stripe recently announced the launch of Tempo, a stablecoin-neutral Layer 1 blockchain incubated by Paradigm, further shifting the market landscape. Unlike Circle and Tether, Stripe has not yet launched its own stablecoin. Instead, it supports multiple stablecoins for payments and gas fees through a built-in AMM. This neutrality is likely to be highly attractive to developers and merchants—not being tied to a single stablecoin offers greater flexibility, potentially opening up new opportunities for Stripe in a market dominated by crypto-native companies.

Trend 3: Duopoly — Competition between Circle and Tether

As Layer 1 blockchains challenge traditional players, they are also reshaping the stablecoin market. As of September 2025, Circle and Tether dominated the stablecoin market, controlling nearly 89% of total issuance—62.8% for Tether and 25.8% for Circle. By launching Layer 1 blockchains like Arc and Stable/Plasma, these two companies have further consolidated their dominance and set high barriers to entry. (For example, Tether's Plasma chain capped treasury deposits at $1 billion for token sales, significantly increasing the barrier to entry for new entrants.) Using the Herfindahl-Hirschman Index (HHI), a measure of market concentration, the current stablecoin market HHI stands at 4600 (62.8² + 25.8² = 4466), far exceeding the traditional market's antitrust review threshold of 2500.

However, a potential threat is emerging: a "stablecoin-neutral Layer 1 blockchain." Stripe's Tempo lowers the barrier to entry for merchants and alleviates regulators' concerns about market concentration. If this "neutral model" becomes the industry standard, Circle and Tether's closed competitive advantage will become a disadvantage: they could lose network effects and market attention. At that point, the current "duopoly" could shift to a "multi-polar oligopoly," with different channels occupying their own niche markets.

in conclusion

In summary, stablecoins have become a significant sector with a scale exceeding $280 billion, and issuers are reaping huge profits. The rise of Layer 1 blockchains based on stablecoins is demonstrating three key trends: (1) promoting the integration of traditional finance into crypto-native channels and tapping into the growing foreign exchange market; (2) reshaping the payment sector by removing intermediaries such as Mastercard and Visa; and (3) driving the market from a "duopoly" (HHI 4600) to an "oligopoly." These shifts collectively point to a broader direction: stablecoin issuers such as Circle and Tether, as well as new entrants such as Stripe's Tempo, are no longer simply "bridges between cryptocurrencies and fiat currencies" but are gradually becoming the "core of future financial infrastructure."

Ultimately, this raises a question: How will these blockchain channels achieve product-market fit? Whether it's Circle's Arc, Tether's Stable/Plasma, or Stripe's Tempo, which neutral stablecoin challengers will lead in terms of transaction volume or institutional adoption? While opportunities abound, challenges like liquidity fragmentation remain.

References

[1] https://www.sciencedirect.com/science/article/pii/S 0165176524004233#:~:text=The%20 first%20 stablecoin%20 went%20 live, blockchain%20 and%20 was%20 crypto%2 Dbacked.

[2] https://www.circle.com/blog/introducing-arc-an-open-layer-1-blockchain-purpose-built-for-stablecoin-finance

[3] https://tokenterminal.com/explorer/markets/stablecoin-issuers/metrics/outstanding-supply

[4] https://www.coindesk.com/policy/2025/07/18/tether-ceo-says-he-ll-comply-with-genius-to-come-to-us-circle-says-it-s-set-now

[5] Stablecoin Growth and Market Dynamics by Vedang Ratan Vatsa

[6] https://tempo.xyz/

[7] https://uk.finance.yahoo.com/quote/CRCL/financials/