Ethereum's revenue plummeted 75%: a sign of recession or the pain of transformation?

- 核心观点:以太坊收入锐减引发健康争议。

- 关键要素:

- 月收入同比降75%,历史第四低。

- L2转移主网负载致费用降低。

- 反对者视收入下降为生态成功。

- 市场影响:引发以太坊估值逻辑辩论。

- 时效性标注:中期影响。

Original author: David, TechFlow

In the past two days, the hottest debate on English-language crypto Twitter has been the discussion about Ethereum revenue.

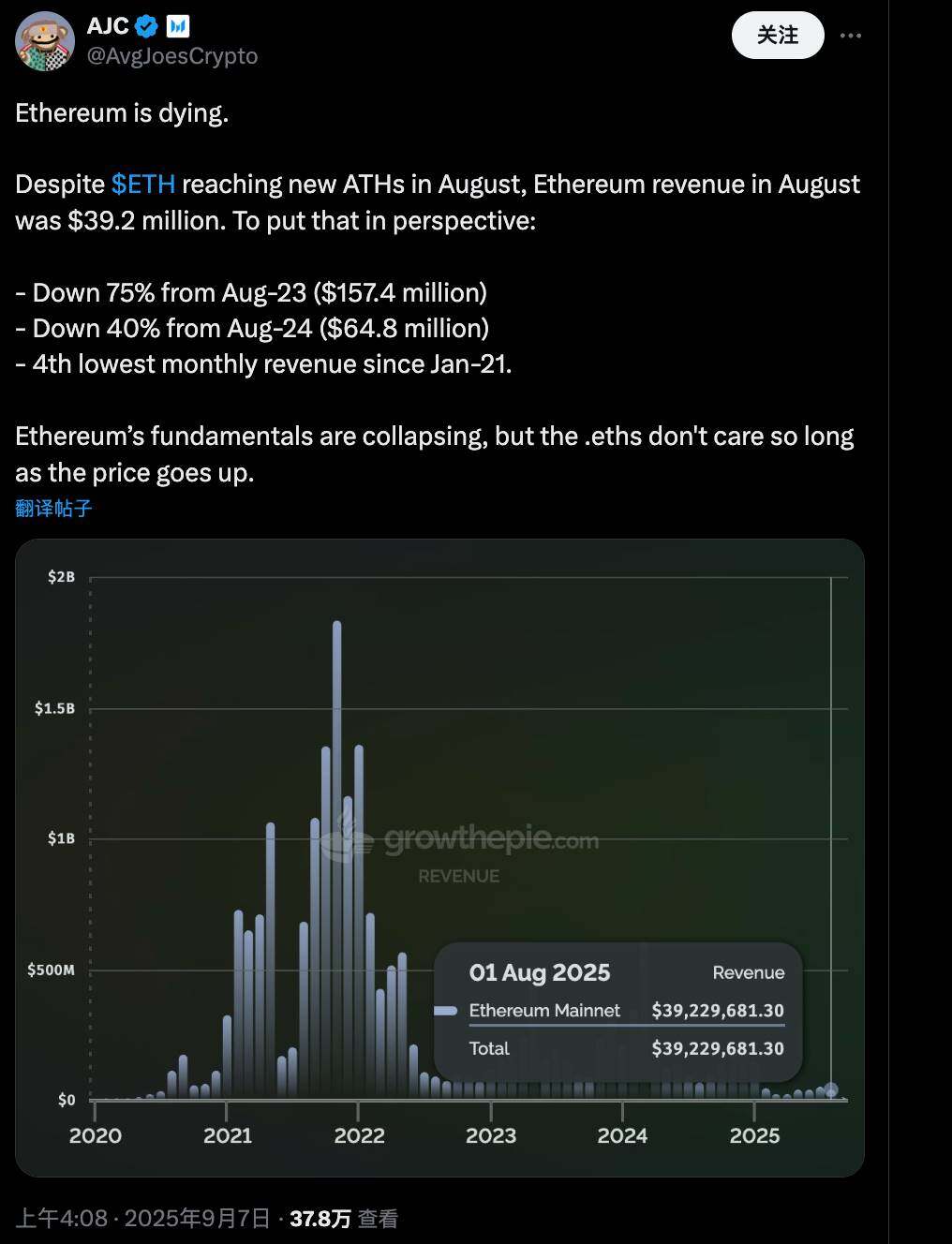

On September 7, Messari Enterprise Research Manager AJC posted a post directly pointing out that the Ethereum network is in a state of "death." He said that although the price of ETH hit a new high in August, Ethereum's revenue that month was only $39.2 million.

This figure represents a 75% decrease from $157.4 million in August 2023 and a 40% decrease from $64.8 million in August 2024. It is also the fourth-lowest monthly revenue level in Ethereum’s history since January 2021.

AJC lamented that Ethereum's fundamentals are collapsing, but everyone seems only concerned with rising ETH prices, regardless of the network's health. Two days after posting this, it has already received nearly 380,000 views and nearly 300 replies.

Why is discussing Ethereum’s fundamentals so popular now?

The timing is indeed tricky. ETH is currently at the peak of its bull run, with prices hitting new highs, but the underlying network activity and Ethereum’s own positioning are quietly shifting.

After the Dencun upgrade in 2024, L2 such as Base and Arbitrum became popular, and the main chain transaction fees were greatly reduced, resulting in the transfer of revenue to these extension layers; after the popularity of coin-stock gameplay this year, SBET and BMNR competed to reserve ETH, and mainstream finance and Wall Street began to turn ETH into a tool for increasing financial leverage.

And now, Ethereum itself looks more like a Lei Feng-style altruistic flag, flying in response to market trends and pointing others in the right direction, but it itself is full of holes?

The decline in revenue is an indisputable fact, but the community has different opinions on whether this is a signal of the decline of the Ethereum network itself.

Supporters: Income is lifeline, alarm bells have been sounded

The core point of the ACJ and others who support it is actually very simple: income is the right measure to judge L 1 .

Specifically, a chain's income mainly comes from transaction fees and block space usage fees, which are the core manifestations of users' actual demand for your chain.

As the largest platform in the crypto world, Ethereum's core competitiveness lies in its "block space demand": it enables the network to efficiently process smart contracts and decentralized applications, which is more advantageous than Bitcoin's simple value storage and is also a major narrative point that distinguishes it from Bitcoin.

But now the income is approaching zero, which means that users' demand for the main chain is shrinking. Even if L2 flourishes, AJC believes that the entire ecosystem lacks new users to support so much L2 usage.

You might ask, why is revenue tied to Ethereum’s fundamentals?

The original author and supporters of the post argue that revenue is collected and destroyed in the form of ETH, which directly drives ETH's deflationary mechanism. If revenue collapses, the amount of destruction decreases, and the pressure on ETH supply increases, the long-term value of ETH will be difficult to maintain.

More importantly, during the last bull market, the Ethereum community boasted about the high on-chain revenues and the "block space premium," demonstrating strong demand for the network. The reversal of circumstances is no coincidence, but a genuine collapse in demand drivers.

While somewhat pessimistic, a more neutral view is that the network is the asset itself. Prices can be driven up in the short term by speculation, but if they deviate from fundamentals, they will eventually return to reality. This principle has been proven countless times in other crypto infrastructure projects.

From an observer's perspective, AJC's revenue logic does make sense, at least highlighting the hidden dangers of the ETH bull market bubble. However, if we ignore other ecosystem indicators, such as on-chain activity, this view may be somewhat biased.

The opposition is firing on all cylinders: Is declining income a good thing?

As soon as the AJC's opinion came out, the comment section instantly turned into a battlefield, with opponents firing on all cylinders, expressing their disagreement with this theory of decline.

Unlike the typical Ethereum defenders, the opponents are looking at Ethereum from a larger narrative. Their core counterattack is:

It is a complete categorization error to think of Ethereum as a tech company focused on maximizing revenue. Ethereum is now more like a cryptocurrency, a commodity with an inelastic supply, or an emerging economy.

From this qualitative perspective, declining revenue is not a problem, but rather a positive sign of design success, as it fosters broader user adoption and ecosystem growth.

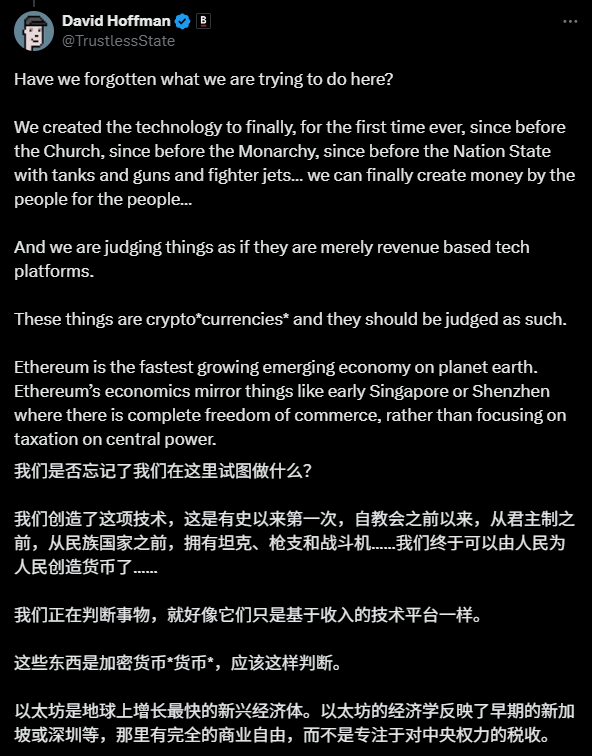

For example, Bankless co-founder David Hoffman likens Ethereum to early Singapore or Shenzhen, a paradise conducive to free business. In such an environment, the focus shouldn't be on how much tax a city can collect, but rather on whether it drives infrastructure and economic growth.

Vivek Raman, a former Wall Street trader and founder of Etherealize, said that Bitcoin has almost no revenue and is not in recession, so why should Ethereum be judged by revenue?

Their logic stems from Ethereum founder Vitalik Buterin's early vision of Ethereum as a commodity with an inelastic supply, whose valuation relies on supply and demand dynamics, not quarterly financial statements. Excessively high revenue can easily create a negative network effect, and excessive gas charges can drive away users.

In fact, the origins of these opposing views can be traced back to Vitalik’s early vision.

In the white paper, Vitalik describes ETH as the "crypto fuel" of the network, and the community often compares it to digital oil, whose value depends on supply and demand dynamics rather than quarterly financial reports like a company.

High fees (a source of revenue) have been shown to hinder user adoption, creating a negative cycle that the community views as an anti-network effect.

Therefore, the decline in Ethereum mainnet revenue is actually a good thing in their eyes to some extent.

After the Dencun upgrade in 2024, L2 will shift the load from the main chain, resulting in a reduction in revenue. However, this will result in a low fee threshold, attracting mass users to explore DeFi, NFT, and even institutional applications.

In the comments section, Tom Dunleavy, head of venture capital at Varys Capital, bluntly stated that L1’s revenue is a stumbling block to ecosystem growth;

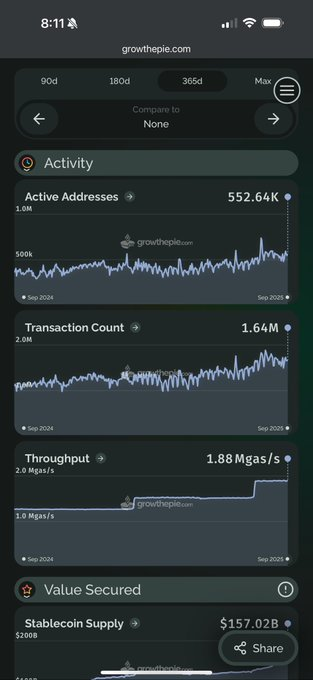

Ryan Berckmans, a cyclical trader in the Ethereum community, threw out some data: When 60% of the stablecoin market capitalization is on Ethereum, it has been singled out for attention by the US Treasury Secretary, and all activity indicators on the chain have improved, what kind of recession is this?

Ethereum’s Next Crossroads

While this debate was lively, it actually touched upon an underlying question: How should we value Ethereum?

Judging from the comments, most opponents believe that Ethereum is shifting from a busy execution layer to a stable global settlement layer. If you use the logic of technology stocks and use revenue to value it, it is a bit too rigid.

From the logic of technology stocks, revenue is obviously the most important. If the collapse of revenue is indeed a signal of weak demand, then the risk of the short-term bull market bubble bursting is not small.

The various counterattacks in the comment section are actually a multi-indicator narrative that emphasizes the ecological health and long-term transformation of Ethereum. Revenue itself is not very important. Its valuation comes from the recognition of all parties and the dependence of the entire crypto ecosystem on Ethereum.

The debate may be over, but Ethereum’s story is far from over.

The transition from a crypto-tech platform to a global economy will certainly involve pain, such as declining revenue and L2 eroding market share.

But this transformation may be the only way for Ethereum to mature.

Just like the Internet evolved from the early paid dial-up era to the popularization of free broadband, on the surface the operators' per-user revenue has declined, but the scale of the entire digital economy has grown exponentially.

Ethereum is currently at a similar inflection point: the decline in mainnet revenue may be making room for a larger ecosystem boom. The rise of L2 isn't "stealing" Ethereum's value, but rather amplifying its strategic value as a settlement layer.

More importantly, the debate itself illustrates Ethereum’s unique position in the crypto world – no one is arguing fiercely about Bitcoin’s “revenue decline” because everyone has long accepted its position as digital gold.

The reason why Ethereum has sparked such heated discussions is that it carries a more complex and grander vision.

Everyone benefits when Ethereum is healthy. Who knows if the next bull market will start from here?