The first year of the stablecoin public chain: the exit of giants, the next battle of stablecoins

- 核心观点:稳定币发行方自建公链重构价值链。

- 关键要素:

- 避免手续费被公链攫取。

- 解决技术限制与用户体验问题。

- 实现监管合规与竞争差异化。

- 市场影响:挑战传统金融支付中介地位。

- 时效性标注:长期影响。

In the second half of 2025, the stablecoin industry entered a new stage.

Over the past few years, companies like Tether and Circle have become core players in the stablecoin market, but their role has remained limited to issuers. The design and operation of the underlying networks have been delegated to public blockchains like Ethereum, Tron, and Solana. While stablecoin issuance has grown in scale, users still rely on other blockchains to conduct transactions.

In recent months, this landscape has begun to shift. Circle launched Arc, Tether released Plasma and Stable almost simultaneously, and Stripe and Paradigm jointly launched Tempo. The emergence of three public stablecoin chains for payments and clearing signifies that issuers are no longer content with simply distributing their coins; they want to control the networks themselves.

Such concentrated actions are difficult to explain as coincidence.

Why do we have to develop our own public chain?

Early stablecoins almost all grew on public chains such as Ethereum, Tron, and Solana, but now more and more issuers choose to build dedicated chains to keep issuance and settlement firmly in their own hands.

The most direct reason lies in the distribution of value. The transaction fees “taken away” by the underlying network are far larger than imagined.

Tether processes over $1 trillion in transactions each month, but the majority of these fees are captured by public blockchains. On the Tron network, each USDT transfer requires a fee of approximately 13 to 27 TRX, equivalent to approximately $3 to $6 at current prices. Considering the massive USDT trading volume on Tron, this represents a significant revenue stream. If the Tron network processes hundreds of millions of dollars in USDT transactions daily, the fees alone could generate hundreds of millions of dollars in annual revenue for the network.

USDT is the most active smart contract on the TRON network. Source: Cryptopolitan

While Tether's own profits are ridiculously high, they primarily come from interest rate differentials and investment returns, unrelated to USDT trading volume. With each additional USDT transaction, Tether's direct profit is zero; all fees go into the public blockchain's pockets.

Circle is in a similar situation. Every USDC transaction on Ethereum consumes ETH as gas fees. Based on Ethereum's current transaction fee levels, if USDC could reach the same transaction volume as USDT, transaction fees alone could generate billions of dollars in annual revenue for the Ethereum network. However, Circle, as the issuer of USDC, receives zero revenue from these transactions.

What’s even more frustrating for these companies is that the greater the trading volume, the more missed profits they face. USDT’s monthly trading volume has grown from a few hundred billion dollars in 2023 to over $1 trillion today, but Tether’s revenue from trading remains zero.

This situation of "being able to see but not being able to get" is the core motivation that drives them to build their own public chain.

Furthermore, the technical constraints of existing public blockchains are accumulating. Ethereum's high fees and slow speeds make small payments impractical; Tron's low costs are subject to scrutiny, but its security and decentralization are questionable; Solana's speed is not stable. For 24/7 payment services, these constraints are unbearable.

User experience is also a hurdle. Ordinary users switching between chains require different native tokens and wallets. Cross-chain transfers are even more complex, costly, and pose security risks. On a regulatory level, transaction monitoring and anti-money laundering functions on existing public chains largely rely on external solutions, with limited effectiveness. Competitive differentiation is essential. Circle aims to offer faster settlement and built-in compliance modules through Arc, while Stripe aims to achieve programmable payments and automated settlement through Tempo.

When the contradictions of value distribution, technological limitations, user experience, regulatory compliance and competition are superimposed on each other, building a chain by oneself becomes an inevitable choice.

The fate of the giants

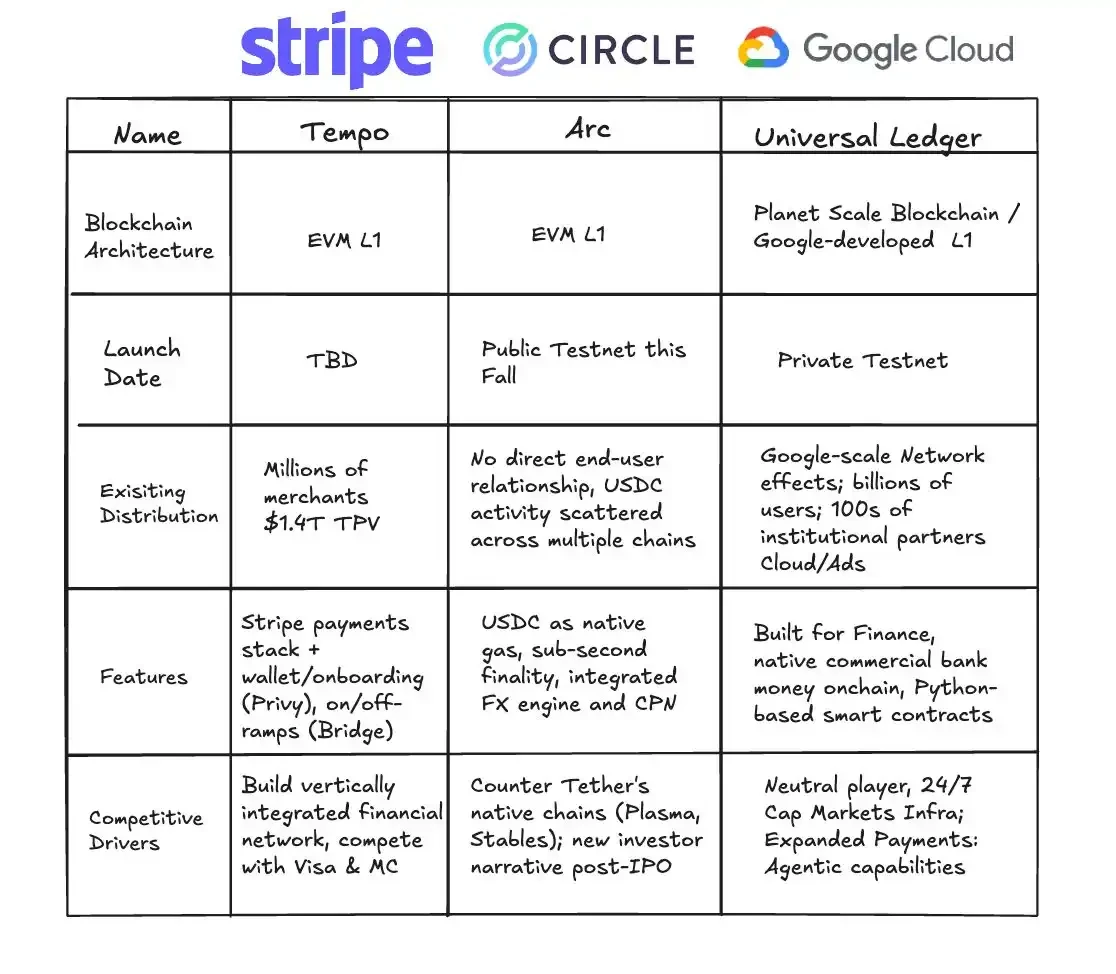

Faced with these challenges and opportunities, different companies have chosen different technological paths and business strategies.

Stripe Tempo: A neutral platform technology choice

Tempo is a dedicated payment chain jointly developed by Stripe and Paradigm. Unlike traditional public chains, Tempo does not issue its own native token, but instead directly accepts mainstream stablecoins like USDC and USDT as gas. This decision is both a gesture and an ambition.

Image source: X

This design may seem simple, but the underlying technical challenges are significant. Traditional blockchains use a single native token as a transaction fee, making the system design relatively simple. Tempo needs to support multiple stablecoins as transaction fees, which requires complex token management and exchange rate calculation mechanisms at the protocol level.

Tempo's technical architecture is also optimized for payment scenarios. Its improved consensus mechanism enables sub-second confirmations while maintaining extremely low costs. It also includes built-in payment primitives that developers can directly call to build complex applications such as conditional payments, scheduled payments, and multi-party payments.

Tempo has built a robust ecosystem. Its initial design partners span key sectors, including artificial intelligence (Anthropic, OpenAI), e-commerce (Shopify, Coupang, DoorDash), and financial services (Deutsche Bank, Standard Chartered, Visa, Revolut). This list itself signals Stripe's ambition to establish Tempo as a cross-industry infrastructure.

Circle Arc: Vertically Integrated Deep Customization

In August 2025, Circle launched Arc, a public chain designed specifically for stablecoin finance. Unlike Stripe's neutral stance, Arc represents a thorough vertical integration strategy.

Image source: Circle

Arc uses USDC as its native gas token, meaning all transactions on the Arc chain require USDC for processing fees, directly increasing USDC demand and application scenarios. This design allows Circle to benefit from every transaction on the network, achieving a closed value loop.

Arc also features a built-in, institutional-grade spot foreign exchange engine, enabling rapid exchange between stablecoins and currencies, and striving for sub-second transaction finality. These features are designed specifically for the needs of institutional clients and demonstrate Circle's deep understanding of its target market.

By owning its own public blockchain, Circle provides a more efficient and controllable environment for the operation of USDC. More importantly, it is able to build a closed-loop financial ecosystem around USDC, firmly locking value within its own system.

Tether's dual-chain strategy: a radical and comprehensive layout

As the world's largest stablecoin issuer, Tether launched both the Plasma and Stable projects in 2025, demonstrating a more aggressive vertical integration stance than its competitors.

Image source: Bankless

Plasma is a Layer 1 blockchain backed by Tether's sister company, Bitfinex, designed specifically for stablecoin transactions. Its key selling point is its zero-fee transfers for USDT. This directly challenges the Tron network, which has long dominated USDT circulation. In July 2025, Plasma raised $373 million in its token sale, demonstrating strong market interest in this public blockchain.

Compared to Plasma, Stable aims to be more radical. Tether calls it "USDT's exclusive home," employing a dual-chain parallel architecture: a main chain responsible for core settlement, and Plasma, a parallel chain, handling a massive volume of small transactions and micropayments, regularly clearing them on the main chain. Within this network, USDT serves as both a transaction medium and a fee token, eliminating the need for users to hold additional tokens to pay for gas, significantly lowering the barrier to entry.

To further enhance flexibility, Stable has launched multiple USDT variants. Standard USDT is used for daily transactions, USDT 0 is a specialized cross-chain bridge token, and gasUSDT is used to pay network fees. All three maintain a 1:1 value peg and can be exchanged between users at zero cost, maintaining a consistent user experience across multiple scenarios.

Stable utilizes a customized version of StableBFT for its consensus mechanism. This mechanism, developed based on the CometBFT engine (an improved version of Tendermint), is a delegated proof-of-stake system. StableBFT separates transaction propagation from consensus propagation, aiming to address congestion during periods of high traffic and provide a more stable network environment for large-scale payments.

Through the dual-chain combination of Plasma and Stable, Tether not only responds to the limitations of the existing network in terms of fees and stability, but also attempts to build a comprehensive closed-loop system for USDT from transactions, fees to cross-chain.

Tech giants' infrastructure ambitions

Google is also making a move, setting its sights on the underlying infrastructure of stablecoins through its Google Cloud Unified Ledger (GCUL). GCUL is an enterprise-grade blockchain platform designed to support the issuance, management, and trading of stablecoins for banks and financial institutions.

Comparison of GCUL, Tempo, and Arc. Source: Fintech America

Its core advantage lies in its deep integration with Google Cloud's existing enterprise services. Financial institutions can quickly launch stablecoin products on GCUL without having to build infrastructure from scratch. For banks accustomed to using Google Cloud services, this is a nearly seamless digital asset solution.

Google's strategy is exceptionally restrained. It doesn't directly participate in the stablecoin issuance or payment competition. Instead, it positions itself as a shovel seller, providing the underlying technology for all players. This choice means that no matter which stablecoin ultimately outperforms, Google will reap the benefits.

These specialized public chains don't simply replicate the functionality of existing blockchains; they transcend them in several key dimensions. Stablecoins already eliminated the role of banks, and now they've also broken free from reliance on public chains like Ethereum and Tron, truly controlling transaction channels themselves.

They unlock greater programmability. Stablecoins are essentially a set of contracts. Stripe CEO Patrick Collison has said that programmable payments will spawn entirely new business models, such as "proxy payments" for AI agents. On the new blockchain, developers can directly call built-in payment primitives to assemble complex applications such as conditional payments, scheduled payments, and multi-party settlements.

It also compresses settlement times to near-instantaneous levels. Public chains like Arc aim to reduce confirmation times to sub-second levels. This "what you see is what you get" speed is revolutionary for high-frequency trading, supply chain finance, and even micropayments in chat apps.

Furthermore, they are architected for interoperability. Cross-chain bridges and atomic swaps are no longer add-ons but integral to the system. Stablecoins on different chains can flow freely, creating a direct channel between the global banking system.

The first year of the stablecoin public chain

The emergence of stablecoin public chains is essentially a rewriting of the value chain. Profits that were previously divided among banks, card schemes, and clearing institutions in the payment system are now flowing to new participants.

By issuing stablecoins, Circle and Tether have gained control of a vast pool of interest-free funds. These funds, when invested in safe assets like U.S. Treasuries, generate billions of dollars in interest annually. Tether's profits reached $4.9 billion in the second quarter of 2024, almost entirely from this "seigniorage" income.

With its own public blockchain, value capture becomes more diverse. Transaction fees are just the surface; the real potential lies in value-added services. Tempo can customize payment solutions for corporate clients, and Arc offers institutional-grade features for compliance and foreign exchange settlement. The premium for these services far exceeds the transaction itself.

The application layer holds even greater potential. When payments become programmable, new business models emerge. Automated payroll, conditional payments, and supply chain finance—they both increase efficiency and create value never before possible.

But for traditional financial institutions, stablecoins are shaking their very foundations. Payment intermediation is a crucial source of revenue for banks, and the widespread adoption of stablecoins could render this business increasingly unnecessary. While the short-term impact is limited, in the long term, banks will have to redefine their role.

This reconstruction of value isn't simply a commercial competition; it also carries geopolitical implications. The global circulation of US dollar stablecoins is essentially a continuation of US dollar hegemony in the digital age. Reactions from various countries are already emerging. Future competition will not just be a battle between a single public blockchain and a single company, but a contest between different countries and monetary systems.

The rise of stablecoins is more than just a technological upgrade or a change in business model. It triggers the most profound structural restructuring of global financial infrastructure since double-entry bookkeeping and the modern banking system.

From a longer-term perspective, stablecoins may trigger the most profound reconstruction of the global financial infrastructure since double-entry bookkeeping and the modern banking system.

Throughout history, every transformation in underlying infrastructure has brought about a leap forward in the business landscape. Venetian merchants' bills of exchange made intercity trade possible, the Rothschilds' transnational banking network facilitated the global flow of capital, and the Visa and SWIFT systems accelerated payments to seconds.

These changes have reduced costs, expanded markets, and unleashed new growth momentum. Stablecoins are the latest node in this evolution.

Its long-term impact will be reflected on many levels.

First, inclusiveness will be amplified: anyone with a smartphone will be able to access the global network, even without a bank account. The efficiency of cross-border settlements will also be dramatically improved, with near-instant settlements significantly improving capital flows in supply chains and trade.

A more profound change is that it will give rise to digitally native business models. Payments are no longer simply the flow of funds; they can be programmed and combined like data, pushing the boundaries of business innovation.

In 2025, with the emergence of public stablecoin chains, stablecoins will truly step out of the crypto world and enter the mainstream financial and commercial arena. We are at this intersection, witnessing the formation of a more open and efficient global payment network.