The end of transactions surrounding Taylor Swift's marriage and Trump's crypto treasury

- 核心观点:预测市场内幕交易监管模糊。

- 关键要素:

- Polymarket用户靠订婚消息获利。

- 美国体育内幕下注法律灰色。

- CFTC监管预测市场规则不明。

- 市场影响:或引发监管执法行动。

- 时效性标注:中期影响。

The original article " The Taylor Swift Wedding Trade " was translated by Odaily Planet Daily jk.

Matt Levine is a Bloomberg Opinion columnist covering finance, consistently ranking as the most read columnist on Bloomberg Finance. He was formerly the editor of Dealbreakers and has worked in investment banking at Goldman Sachs, as an M&A lawyer at Wachtell, Lipton, Rosen & Katz, and as an associate judge on the U.S. Court of Appeals for the Third Circuit.

Romantic

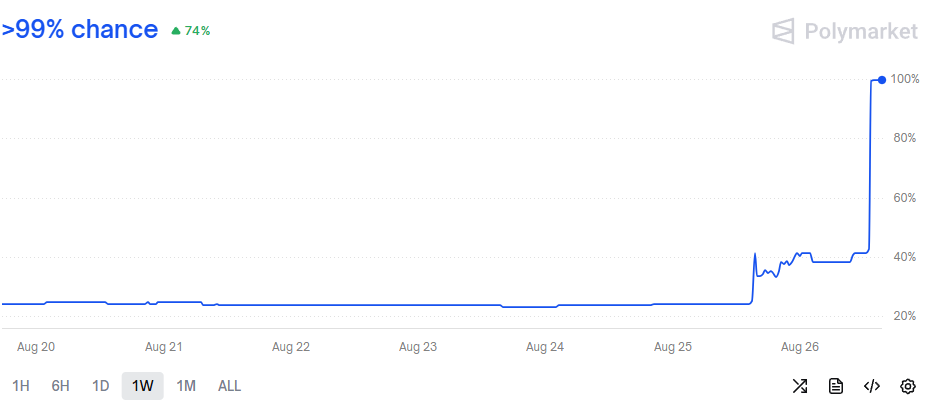

Here’s a one-week chart of “ Taylor Swift and Travis Kelce engaged in 2025? ” on the prediction market Polymarket:

Yesterday afternoon's spike, which went from around 43% to nearly 100% , was due to Taylor Swift and Travis Kelce's official engagement announcement; the market has now settled in "Yes." Monday afternoon's spike, which went from around 25% to around 40%, wasn't due to the official announcement. Someone bought a large amount of Yes contracts on Monday; Polymarket's activity log shows that the user " romanticpaul " has been buying heavily since around 25 cents on Sunday. As of yesterday, he was the largest holder of Yes contracts, holding 5,062 contracts. Each Yes contract pays $1, so he probably made around $3,500 on this trade.

RomanticPaul's timing was good. Did he have inside information, or was he just lucky? I don't know. He wasn't exactly "lucky," either; I doubt $3,500 would even cover the cheapest item on Swift and Kelce's wedding registry. Still, it raises eyebrows. Word online is that they were actually engaged two weeks ago. Someone must have known about it before yesterday. In the past, if you knew about Taylor Swift's engagement before everyone else, you could feel cool about it or sell the story to the tabloids. Now, you can use prediction markets to turn that directly into—well, a little money. You get rewarded for making the market for Taylor Swift's engagement more efficient.

The three topics we often discuss here are:

- Insider trading in the US stock market is illegal; there are numerous laws surrounding it, and enforcement is quite aggressive. But insider betting—using material, non-public information to place bets on sports—is a bit more legally ambiguous, as legal sports betting in the US is relatively new. A reasonably plausible argument can be made that insider sports betting is a form of wire fraud (just as insider trading is securities fraud), and there have indeed been some prosecutions. But a reasonably plausible counterargument can also be made that it isn't, and there haven't been many prosecutions. (This isn't legal advice.)

- For some strange and serendipitous reason, sports betting—indeed, any betting—has gained a new and attractive path in the United States: through prediction markets, which are regulated by the Commodity Futures Trading Commission ( CFTC ) and treated as commodity exchanges. Kalshi , a CFTC-regulated prediction market, now lists sports contracts, which appear to receive better regulatory and tax treatment than regular sports betting. (Kalshi also listed contracts related to Taylor Swift's wedding.) Polymarket also now has a CFTC-registered derivatives exchange.

- Insider trading in prediction markets is also a bit murky. Kalshi explicitly prohibits insider trading. Manifold Markets (a prediction market that plays with "toy coins" and is not regulated by the CFTC) loves insider trading because it makes predictions more accurate. Polymarket is even murkier; here's a 2024 Decrypt article that says, "A person familiar with Polymarket's operations, who requested anonymity so they can speak candidly, told Decrypt that insider trading is 'strictly prohibited' in the company's terms of service," but also points out that the terms of service don't actually say that. What they say is: You can't do anything that violates applicable law. So does insider trading on Polymarket violate applicable law? Maybe!

So, if you use inside information to bet on sports or weddings on a CFTC-registered futures exchange, is that… commodities fraud? The traditional answer is, "Insider trading isn't about fairness, it's about misappropriation": If you have inside information and owe the owner of that information an obligation not to use it, then trading on it is illegal. (If you took Swift and Kelce's engagement photos and signed a nondisclosure agreement, you can't trade.) If you have inside information and you own it—whatever, use it. (If romanticpaul is Travis Kelce, maybe? And that would be super cool.) Most conceivable sports insider trading would probably be illegal: sports leagues generally have strict prohibitions on betting by players and employees, especially on their own games, so players betting based on inside information would clearly violate confidentiality obligations. But this is just speculation, not legal advice.

As for many non-sports bets—sorry, predictions—the rules are even murkier. Bloomberg 's Francesca Maglione reports:

Taylor Swift's engagement to football star Travis Kelce has sparked a wave of online betting on the billionaire singer's private life.

On prediction market sites like Kalshi and Polymarket , traders are betting real money on the couple's future. … On Kalshi, punters can now place bets on the "wedding timeline," and the company reports that approximately $80,000 in bets were placed within hours of Swift's post. On Polymarket, punters are even placing bets on when they'll have a baby, with growing confidence that the singer will headline the 2026 Super Bowl halftime show.

In short, I'm looking forward to the first CFTC insider trading enforcement action related to sports betting, or betting on sports betting tips, or betting on wedding dates. Everything is sports, and everything is ultimately a commodity fraud.

Cronos

I sometimes describe crypto treasury companies as perpetual motion machines . The idea is this:

- You issue 100 shares at $1 per share, raise $100, and then buy $100 worth of Bitcoin.

- Now your net asset value (NAV) is $100 (that bit of Bitcoin), but somehow your shares are trading at $2 per share, for a total market capitalization of $200. The stock market is willing to pay $2 for $1 of Bitcoin, and you benefit from this mispricing.

- You issue another 100 shares at $2 per share, raising $200, and then buy another $200 worth of Bitcoin.

- Now you have 200 shares outstanding, net assets of $300 ($1.50 per share), a market capitalization of $600, and a share price of $3.

- You repeat this infinitely, buying more Bitcoin and simultaneously pushing the stock price higher.

Obviously, I'm kidding. There's no such thing as a perpetual motion machine. This will eventually end. But how? Well, the main point I'm making is this: you can't sell shares at 200% of net value forever: eventually, people won't be willing to pay a premium for your shares, and the deal won't work. You can't sell unlimited shares to buy unlimited Bitcoins, because they won't sell. And there are signs that the universal "stock market will buy $2 for $1 of crypto assets" trade is not what it used to be. MicroStrategy Inc., the company that invented it, still trades at a premium to the value of its Bitcoin, but it's no longer a 100% premium, and some other "crypto vault" announcements are also deviating.

But there's another reason this deal can't last forever: the ultimate global cap on Bitcoins is only 21 million. You can't issue unlimited shares to buy unlimited Bitcoins, because Bitcoin isn't infinite. As a skeptic of this kind of deal, I assume you'll run out of investors willing to buy your shares before you run out of Bitcoins. However, if you're extremely bullish on "crypto vault companies," you might conclude the opposite. A theoretically plausible "endgame" for MicroStrategy is:

- Currently, the total market value of Bitcoin is approximately US$2.2 trillion; MicroStrategy owns approximately US$70 billion (approximately 3% of the total), and its own market value is approximately US$100 billion.

- It continues to issue additional shares to raise money to buy more Bitcoin.

- It buys enough to push the price of Bitcoin up, but its stock price also rises, allowing it to continue raising money to buy more Bitcoin.

- Ultimately, Bitcoin's total market capitalization reached $10 trillion, with MicroStrategy owning $9.99999 trillion of it—only one coin left—and its stock market capitalization reaching $13 trillion.

- Then MicroStrategy buys the last Bitcoin in circulation: at this point it owns 100% of the world's Bitcoins, and the only way to get Bitcoin exposure is to buy MicroStrategy stock.

- ???

I don't know if this is desirable, why, or what would happen next. I don't think it's practically feasible, with arguments like "not everyone will sell their Bitcoin to MicroStrategy ," "there are a ton of other Bitcoin vault companies out there," and "please, no one's going to value MicroStrategy at $13 trillion, that's just silly." But I guess it's theoretically possible. If a "crypto vault company" truly is a perpetual flywheel, then the natural end point is for the vault to own all the crypto assets. If the crypto assets are "twice as valuable" inside the vault than outside it, they'll eventually flow to where they're most valuable.

Again: stupid! But here's a, uh, "thing" about Trump Media & Technology Group Corp.:

Trump Media & Technology Group Corp. and Crypto.com have reached an agreement with shell company Yorkville Acquisition Corp. to form a "crypto treasury company" focused on buying and holding CRO tokens, the native cryptocurrency of the Cronos ecosystem.

Trump Media 's shares rose as much as 10.2% on Tuesday, while Yorkville Acquisition 's shares fell as much as 3.4% in New York. Cronos token prices rose 32.3% on Tuesday, according to CoinMarketCap .

According to CoinMarketCap , Cronos has a total market capitalization of approximately $6.5 billion, ranking it as the 23rd largest cryptocurrency by size. It is the native token of the Cronos blockchain and is backed by Crypto.com .

The filing indicates that the SPAC (special purpose acquisition company) will be named Trump Media Group CRO Strategy Inc. and is expected to be funded by 6.3 billion CRO tokens (approximately 19% of the total CRO supply), $200 million in cash, $220 million in mandatory exercise warrants, and a $5 billion equity credit line from affiliates of Yorkville Acquisition's sponsors. Details of the expected funding were not disclosed.

The fact that the SPAC’s stock price is down (it trades roughly at cash value) suggests that you can’t actually expect to “sell” Cronos tokens for shares on an exchange at much of a premium, but whatever. Anyway, here’s the point: this “crypto treasury company” is looking to raise something like $6.6 billion to buy tokens with a total market capitalization of $6.5 billion. Maybe its buying will push the total market capitalization higher, but we’re talking about close to 100% coverage. Weird, right? The press release also plays it straight, stating that the company will have “what we believe is the highest digital asset treasury to market capitalization ratio in history,” which is definitely a ratio that’s going to be in the next edition of a finance textbook. Also:

Kris Marszalek , co-founder and CEO of Crypto.com , said: "The project's scale and structure will exceed the current market capitalization of CRO , with over $400 million in additional cash commitments and a further $5 billion in credit lines to acquire more CRO . This, combined with the restricted sales arrangements between the parties and the vault's validator strategy, makes this a unique and highly attractive product compared to other digital asset vaults."

Is the plan... to buy up all the tokens? No? The press release states, " The Cronos ecosystem has flourished across DeFi protocols, multi-asset markets, and more, powered by the CRO token as a utility and governance asset." If you stuffed 100% of your tokens into a treasury company, CRO 's utility would be minimal. However, I imagine that if you put nearly all your tokens into a treasury company, the price might be more stable, perhaps even more so than "utility" itself. If the "most valuable use" for crypto tokens is to store them in a publicly traded treasury company, that's where they'll all end up.

Numerai

At a somewhat abstract level, a large hedge fund operates by hiring researchers, having them find ways to predict stock prices, and then trading stocks based on their predictions. If it works, the fund makes money and the researchers get a share; if it doesn't, the fund loses money and the researchers are fired. This "general description" covers both fundamental analysts (covering a smaller pool of companies, having a deep understanding, and making high-probability bets on specific companies they believe will outperform) and quantitative researchers (covering all stocks, finding statistical relationships, and making thousands of low-probability probabilistic bets based on "which types of stocks tend to outperform"). So the key skills of researchers will be different: it could be financial analysis, it could be machine learning, and so on. But for funds, the key skills are:

- Recruiting good researchers;

- Verify their predictions before trading;

- Do a good job of risk management to ensure that if a forecast fails, the fund can stop trading based on it in a timely manner;

- Stop-loss orders (fire) those researchers whose "trading is not working".

These are the defining characteristics of large hedge funds: they excel at recruiting ( Gappy Paleologo put it on the Money Stuff podcast: " We are a massive filter of talent "), excel at capital allocation and risk management, and are quick to act on managers experiencing large drawdowns. Successful multi-manager funds are, at their core, analytical, medium-term investments in their investors.

The typical approach is through the recruitment process, human resources departments , and risk management departments. Fundamental approach, in short. But you can also imagine a quantitative, probabilistic approach. See this Bloomberg News report on Numerai :

A “crowdsourced hedge fund” backed by billionaire Paul Tudor Jones is expected to double in size with a massive inflow of capital from JPMorgan Asset Management .

San Francisco-based Numerai LLC , which currently manages about $450 million, said it has secured a one-year funding commitment of up to $500 million from the asset management arm of JPMorgan Chase & Co.

Numerai launched its first fund in 2019, buying and selling stocks based on "trading ideas" from freelance financial quantitative researchers. These researchers are paid in the company's native cryptocurrency and use it to express confidence in their predictions.

Numerai itself lost 17% in 2023. Richard Craib , founder of Numerai , said his team subsequently adjusted the fund's playbook to more quickly eliminate losing trades. A smaller but higher-quality user pool fueled the subsequent rebound.

The typical approach of large hedge funds is to interview a relatively small pool of potential investment managers, get to know them well, and then make high-conviction bets on them. (If they don’t work out, they’re quickly fired.) Numerai ’s approach is to “hire” everyone, use statistical signals to identify predictive power, make more but lower-conviction bets, and then, of course, quickly eliminate them if they don’t work out.