Trend Research: “Buying in” becomes a consensus, and ETH market capitalization will surpass BTC in the long term

- 核心观点:ETH机构需求远超解质押供给,市值将超越BTC。

- 关键要素:

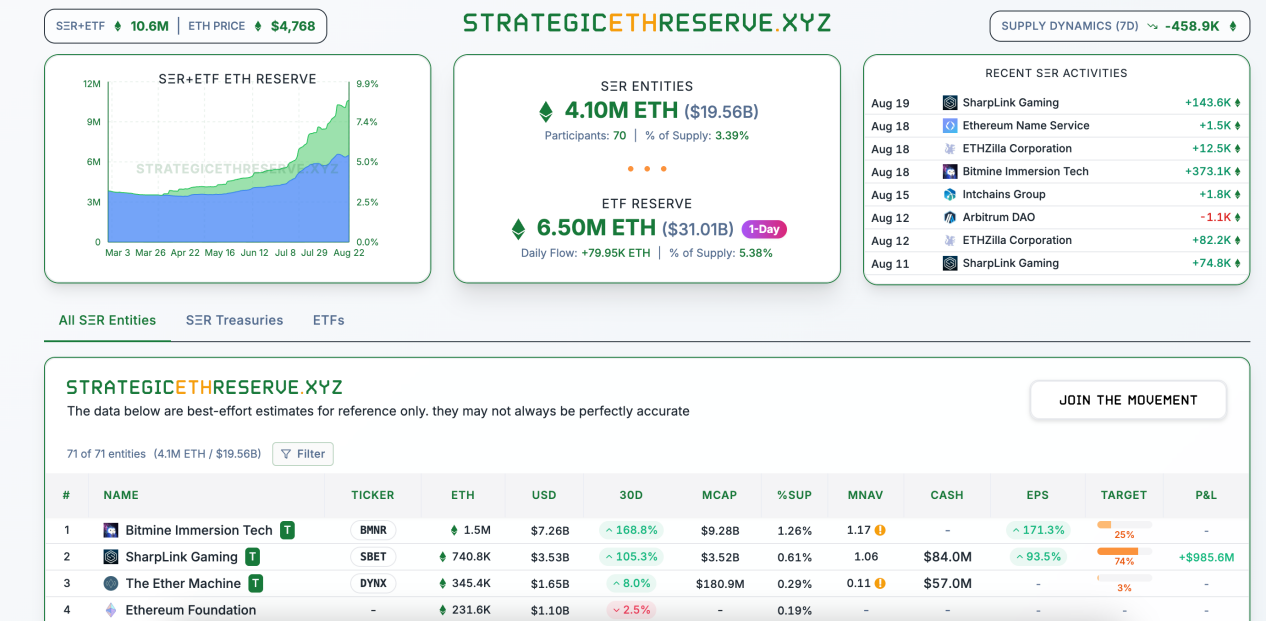

- 美股公司已持200亿美元ETH,占供应3.39%。

- ETH自带质押和流动性收益,年化约5%。

- ETF连续14周净流入,机构买量持续。

- 市场影响:推动ETH长期上涨,重塑加密市场格局。

- 时效性标注:长期影响。

Original author: Trend Research

Since ETH entered its current uptrend, the market has been circulating data on ETH unstacking with each short-term correction. However, from a supply-demand perspective, the demand generated by institutional consensus currently far outstrips the supply of unstacking, and we believe that a long-term, fully loaded unstacking situation is unsustainable. Since treasury companies like SharpLink began buying, US-listed ETH holdings have totaled nearly $20 billion, representing 3.39% of the total supply. Bitmine is 75% of the way to its target of 5% of total ETH. With the further implementation of crypto-friendly policies and Wall Street's consensus on ETH's long-term value, the rush to buy ETH has only just begun. With the impending interest rate cuts, we are raising our long-term ETH target price, believing that ETH's market capitalization will surpass BTC within one to two bull-bear cycles.

1. Unstaking Data

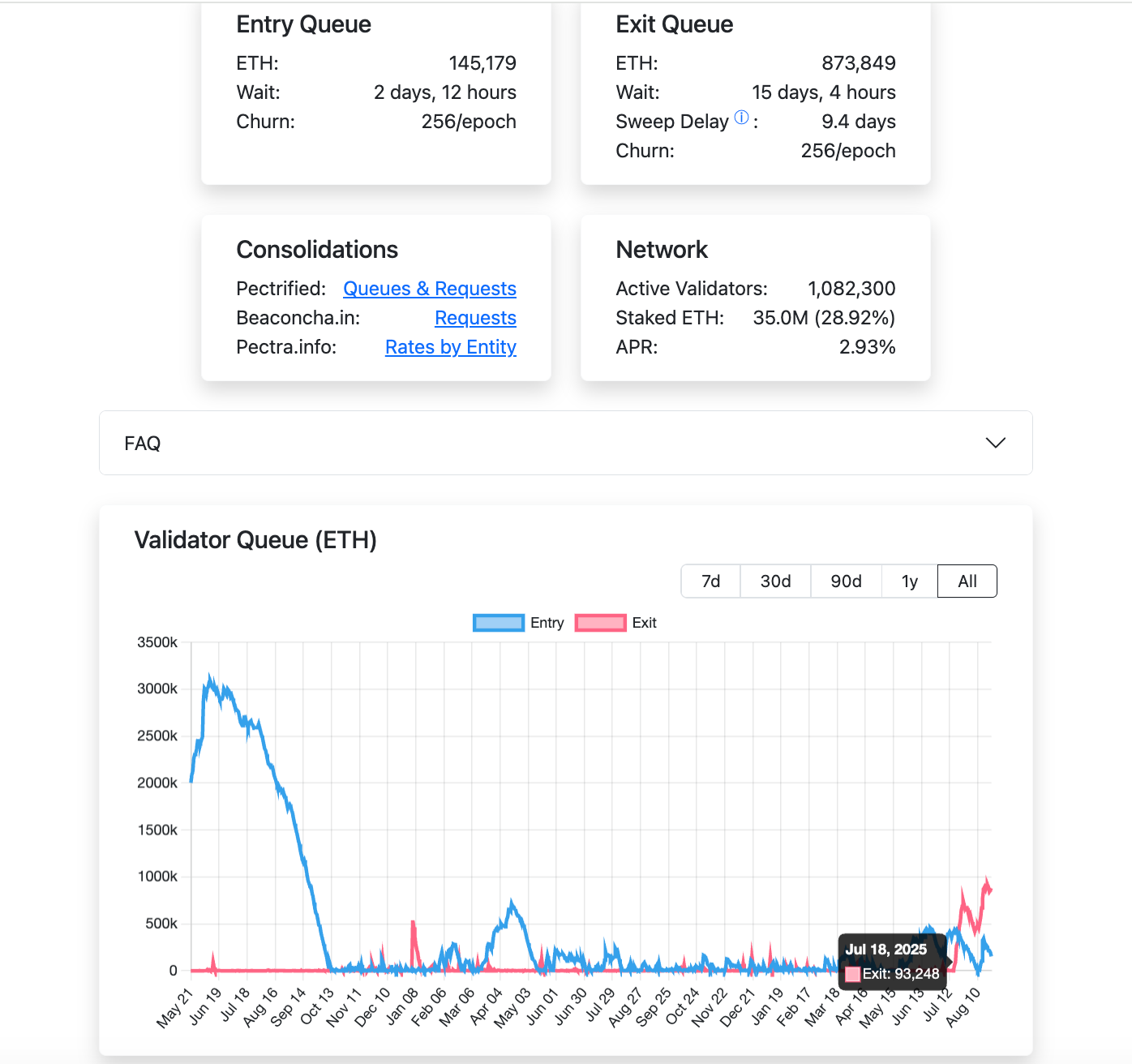

Starting with the Pectra (Prague + Electra) Ethereum mainnet upgrade in May 2025, the theoretical withdrawal rate for staked tokens will be denominated in ETH and hard-capped at 256 ETH/epoch (1 epoch ≈ 6.4 minutes). Converted to daily values, this means the theoretical upper limit is 256 × (1440 ÷ 6.4) = 256 × 225 = 57,600 ETH/day.

Since July 18, the ETH mainnet has been in a full queue for unstaking. Currently (August 24), there are 873,849 ETH waiting for unstaking, which will take 15 days and 4 hours to digest.

The amount of ETH that can be unstaked in a week is capped at 57,600 * 7 = 403,200 ETH. Last week, the ETH Treasury purchased 531,400 ETH. As long as the Treasury continues to buy, even if 100% of the unstaked ETH enters circulation, it can be fully absorbed. We believe that ETH's network value is not yet fully recognized by the market, and that unstaked ETH is not fully entering circulation. As consensus builds, the full unstaked ETH situation will improve.

Simply put, unstaking does not represent the complete market supply situation. Although the total amount of unstaking shows a certain negative correlation with the rise in ETH price, we believe that this part of the supply will not lead ETH to enter a market that turns from rising to falling.

II. Demand Analysis of Treasury Companies and ETFs

Since June 2025, ETH treasury companies, such as SharpLink, have entered the market, confirming our previous speculation that the US would prioritize ETH as a new platform for financial blockchain infrastructure (for details, see our articles "On the Eve of the Surge: Why We Are Bullish on ETH" and "A Storm is Coming: Market Convergence Will Drive Value Discovery in ETH," published on June 11 and July 3). The entry of institutional purchasing power, represented by treasury companies, has fundamentally changed the dominant force behind ETH's price fluctuations.

1. Caiku Company's operating logic - hoarding coins means premium

The market-to-market premium (MNAV) of cryptocurrency treasury companies stems from investors' recognition of the growth potential of the assets they acquire. DAT companies increase their holdings of crypto assets through financing (either through equity offerings or debt), creating a flywheel effect: more crypto assets → expanded balance sheets → rising stock prices → increased financing → further increases in holdings. This cycle amplifies market optimism about treasury stocks, driving up the MNAV premium. This flywheel effect is exemplified by the success of MicroStrategy, and ETH possesses several characteristics that make it more suitable as a treasury asset compared to BTC.

2. What is the difference between ETH Treasury companies? Assets bring their own income

Unlike BTC, a limited asset with limited purchase scarcity, ETH, as the largest DeFi network in the crypto world, will naturally generate returns if held on a large scale.

(1) Staking income: Ethereum has switched to a PoS mechanism since its "merger" in 2022, giving ETH the attributes of an interest-bearing asset. At the same time, its ecosystem supports high-yield activities such as DeFi and RWA. These characteristics provide DAT with a stable source of cash flow, forming the basis of a "cash flow premium." As of August 2025, the total amount of Ethereum staked reached 36 million ETH, accounting for 30% of the total supply, with an average annualized yield of approximately 2.95% (the actual yield is approximately 1.5%-2.15%). A risk-free return of 1.5% is similar to the cash flow of traditional bonds.

(2) Liquidity income: Obtain additional income by providing liquidity to DeFi protocols in the Ethereum ecosystem. In 2025, the TVL of Ethereum DeFi protocols was approximately US$120 billion, and the annualized yield of liquidity mining was generally between 2% and 10%. Assuming that HODL provides liquidity through DeFi protocols, a conservative estimate is that it can obtain an annualized return of 3.5%. Combining staking income (1.5%) and liquidity income (3.5%), HODL can achieve an annualized cash flow return of approximately 5%. Using a discounted cash flow (DCF) model, assuming a discount rate of 5%, a cash flow premium of 1x MNAV, and a total MNAV multiple of 2x.

(3) Other premiums: Ethereum's EIP-1559 mechanism makes ETH potentially deflationary by destroying basic transaction fees. In 2025, Ethereum is expected to issue 730,000 ETH (annual inflation rate of approximately 0.6%), but with the destruction of the network. If ETH achieves net deflation in the future, the ETH price may only rise and amplify the cash flow benefits of hoarding stocks, indirectly increasing the MNAV premium.

3. Caiku’s purchase of volume has just begun

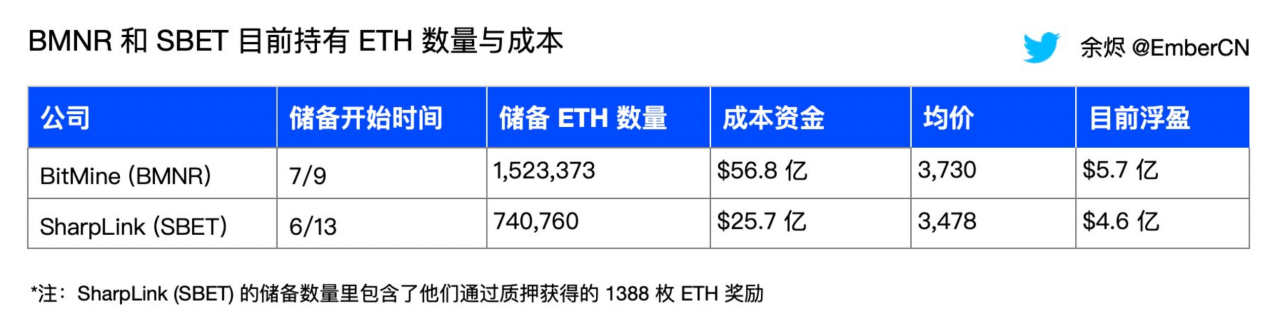

ETH treasuries like BMNR and SBET have high purchase costs and ample reserves, while overall traditional finance purchases are still in their infancy. According to data compiled by Ember, BitMine (BMNR) has held 1,523,373 ETH since July 9th, at a cost of $5.68 billion and an average price of 3,730 ETH. SharpLink (SBET) has held 740,760 ETH since June 13th, at a cost of $2.57 billion and an average price of 3,478 ETH, including 1,388 ETH earned through staking rewards. As the price of Ethereum continues to rise, the holding costs of both companies will increase accordingly.

From the perspective of future financing capabilities:

BMNR: According to the Prospectus Supplement published on August 12, 2025, BMNR has increased its ATM funds to $24.5 billion. It estimates that it has raised approximately $4.45 billion through its ATM mechanism and holds approximately 1.52 million ETH, leaving it with a theoretical remaining available balance of approximately $18-20 billion. If the ETH price remains at $4,700 per coin, BMNR could increase its holdings by approximately 4.26 million ETH, bringing its potential total holdings to approximately 5.78 million ETH, approaching its target of holding 5% of the total.

Since launching its ETH treasury strategy in June 2025, SharpLink has rapidly accumulated approximately 740,760 ETH through ATM financing (approximately $1.2 billion cumulatively) and registered direct sales. Its ATM limit has been adjusted to a maximum of $6 billion from its initial limit. Additionally, it expects to raise approximately $600 million through private placements and other methods. Assuming all funds raised are used to purchase ETH, based on the cost of ETH, the remaining ATM balance is expected to purchase 851,000 ETH.

Currently, corporate entities holding ETH in the U.S. stock market already hold nearly $20 billion worth of ETH, accounting for 3.39% of the total supply. Bitmine is still 75% away from achieving its goal of holding 5% of the total ETH supply.

Daily ATM Funds Available:

MicroStrategy is a representative of Bitcoin treasury strategy, and its trading volume varies significantly in bull and bear markets.

MicroStrategy implemented a Bitcoin treasury strategy in 2020. During the 2020–2021 bull market, its stock price rose from $13 to a high of $540, and daily trading volume increased significantly, though this was significantly influenced by market activity and the price of Bitcoin. Based on recent stock prices and average trading volumes, daily trading volume is estimated to be approximately $3.5 billion to $7 billion.

During the bear market in 2022, the price of Bitcoin plummeted from $69,000 to $16,000.

MicroStrategy's stock price was halved and trading volume shrank significantly, with average daily trading volume falling to between $200 million and $500 million.

Comparing with ETH DAT company, a similar situation may occur:

BitMine's current daily trading volume has reached $2 billion, peaking at $6 billion, approaching or exceeding MicroStrategy's peak during the previous bull market, garnering significant market attention. Meanwhile, SBET's daily trading volume fluctuates significantly, averaging 50 million shares and approximately $1 billion per day. If the market enters a bear market, DAT companies' trading volume could shrink to $100 million to $500 million per day, similar to MicroStrategy's performance in 2022. Assuming 10%-20% of daily trading volume can be converted into ATMs, maintaining current trading volumes could raise $2 billion to $4 billion per week for ETH purchases. Based on the ATM cap, this could last for three months.

4. ETFs’ long-term performance remains strong

ETFs, as passive funds that have achieved success through large-scale, low-cost investment, have become the preferred choice for traditional large-scale capital allocation. From May 16th to August 15th, the ETH ETF recorded 14 consecutive weeks of net inflows, with a peak single-week net inflow of $2.85 billion. The net asset value accounted for 5.38% of the total supply. Of this, 19.2 billion (68%) of the ETH was accumulated during these 14 weeks, with an estimated purchase cost of approximately $3,600.

BlackRock's ETHA is the largest ETF, holding approximately 2.93% of all tokens and currently has a market capitalization of $17.2 billion. Since April 2025, ETHA has experienced weekly net inflows of approximately $8 billion, with the largest single-week net inflow reaching $2.32 billion.

Currently, the size of global gold ETFs (plus ETFs/ETPs from all over the world) is US$386 billion, Bitcoin is US$179.5 billion, and Ethereum is only US$32.6 billion. If the Ethereum narrative is sustainable, it will require US$140 billion in growth buying volume to catch up with the current size of Bitcoin ETFs.

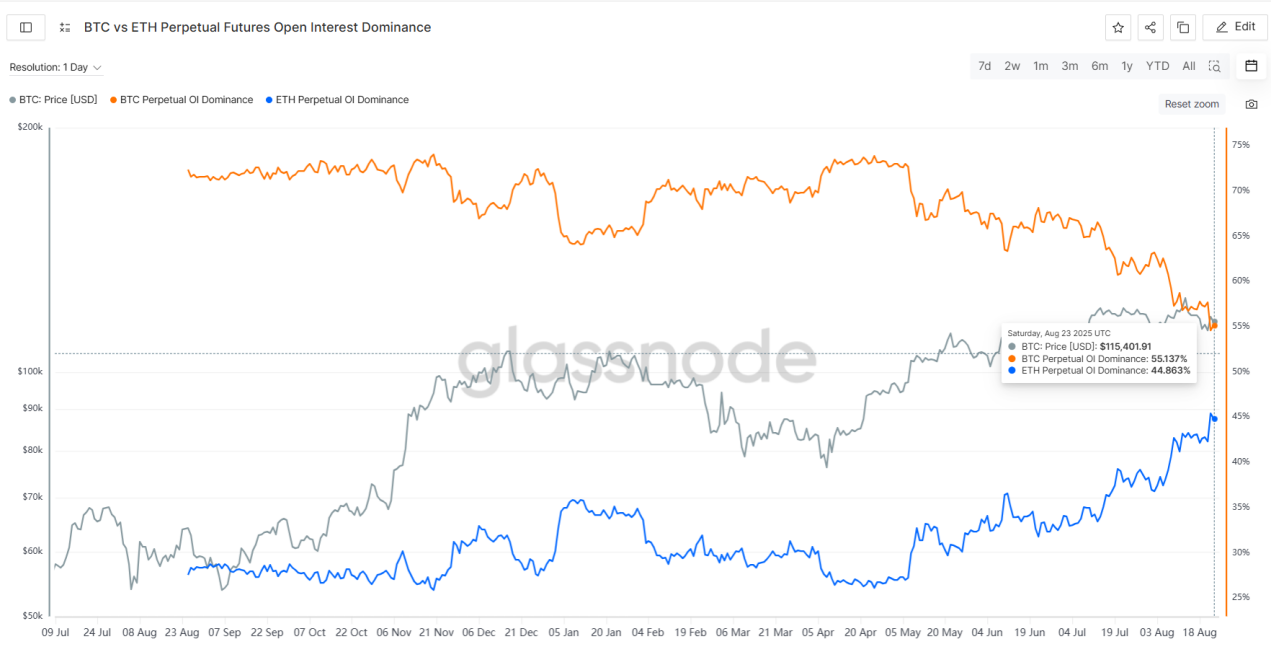

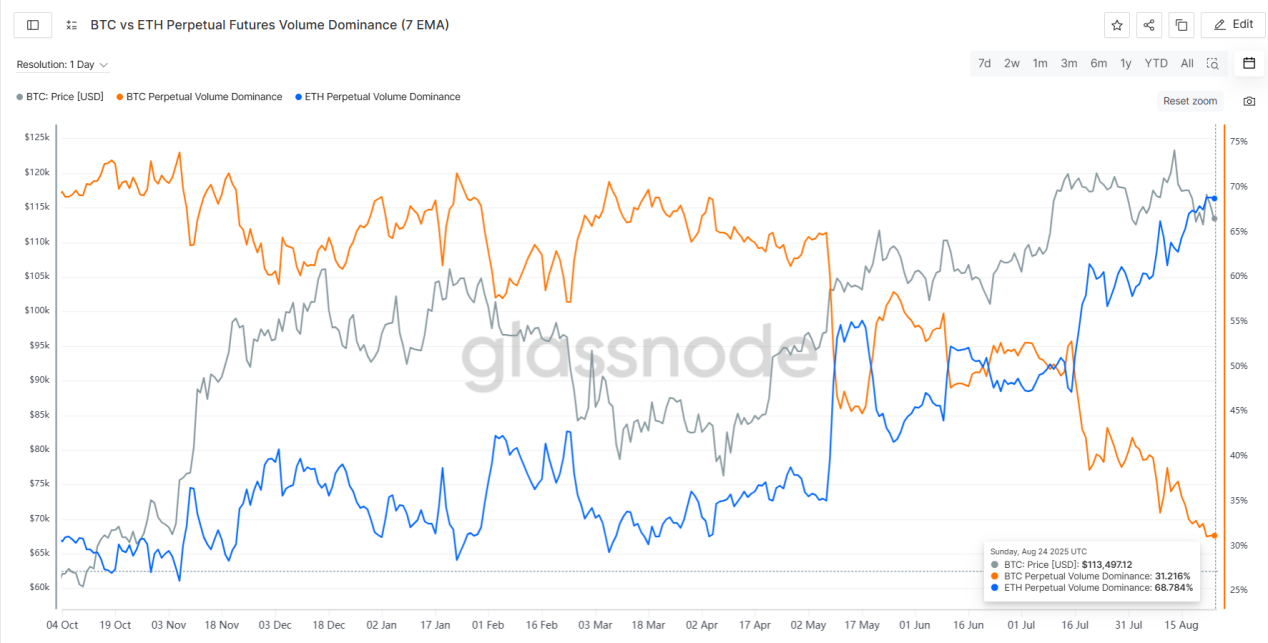

5. Market bias shifts from BTC to ETH trading

Judging from the open interest and trading volume of futures contracts, BTC has clearly cooled, with funds concentrated in ETH. At the beginning of May, BTC futures accounted for 73% of the open interest, but now it is only 55%. ETH's open interest has increased from 27% to 45%.

In terms of contract trading volume, BTC's trading volume share has dropped from 61% at the beginning of May to the current 31%; ETH's trading volume share has risen from 35% at the beginning of May to the current 68%, and its share continues to increase.

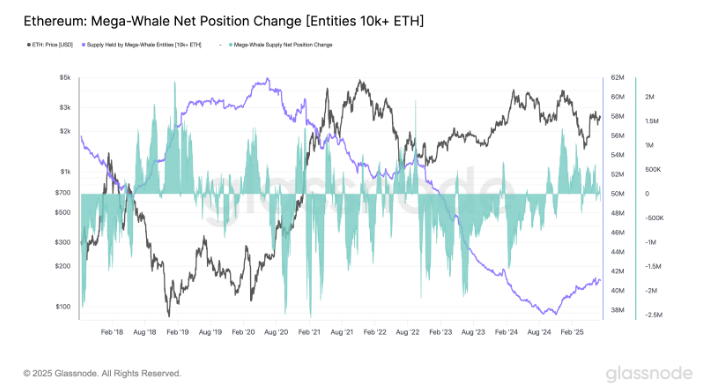

Recent on-chain whale activity suggests a shift in sentiment, with investors selling BTC and buying ETH. According to xtpa data from @ai_9684, starting on August 20th, a 7-year-old BTC whale, dormant for seven years, sold some of its BTC, swapping 71,108 ETH (worth approximately $304 million) for ETH on the spot market at an average cost of approximately $4,284 per ETH. This whale subsequently increased its holdings to 105,599 ETH (worth approximately $495 million). The whale also established a long position in ETH on Hyperliquid and, on August 25th, staked 269,485 ETH (worth $1.25 billion) to the ETH beacon chain, surpassing the Ethereum Foundation's holdings of 231,000 ETH.

On-chain Ethereum whales (wallets holding 10,000 to 100,000 ETH) increased their holdings by 200,000 ETH ($515 million) during Q2 2025, while the total amount of ETH held by super whales (holding more than 100,000 ETH) has rebounded from the historical low of 37.56 million ETH in October 2024 to more than 41.06 million ETH, an increase of 9.31% since October 2024.

3. BTC holdings remain relatively stable

As the market shifts from BTC to ETH, BTC has recently been relatively weak. ETFs have seen significant net outflows, while on-chain whales have seen a significant number of them exchanging BTC for ETH. Based on the cryptocurrency market's four-year cycle, this bull market will reach a similar length in just two to three months. Consequently, there are market concerns about whether BTC is about to enter a bear market. If so, how can ETH maintain its independence and maintain an independent upward trend?

We believe that the current U.S. fiscal cycle is longer than the cycles in the previous two crypto bull markets. At the same time, the chip structure of BTC remains relatively stable and is currently in a state of volatility.

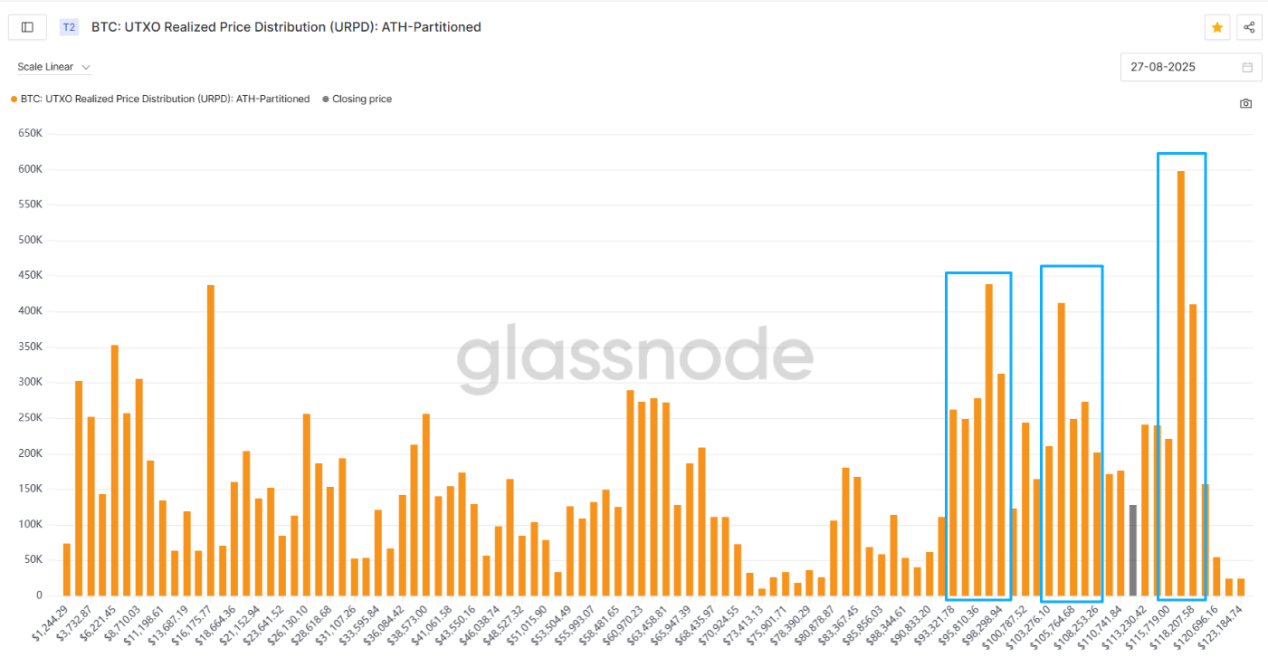

The figure below shows the distribution of BTC chip costs. The gray bars represent the current price, and the blue boxes indicate the main areas of chip concentration: 93K-98K, 103K-108K, and 116K-118K. These three areas have a significant amount of accumulated chips, and a large number of low-cost chips are traded within these ranges, forming relatively strong support.

Currently, chips between 116K and 118K are experiencing slight losses, while chips between 93K and 98K and 103K and 108K are in profit. While BTC prices are currently relatively weak, they have found support near 11K. There are still two larger support areas below, and the overall price is in a state of volatility.

Furthermore, the current cost of holding short-term holders is approximately 108,800. When BTC trades above this level, short-term holders remain profitable overall, preventing panic selling. Historically, BTC has rebounded twice near the cost of holding short-term holders in early 2024, and also dipped below this cost line after its initial touch in February 2025. If BTC falls below this cost line, it will enter a mid-term correction, impacting the overall trend of the crypto industry.

Currently, BTC is at a critical position. It rebounded after touching the cost line yesterday. This week, we should pay close attention to whether BTC can stabilize at this position.

4. Continuously Improving Macroeconomic Environment

1. Fundamental Reshaping of Valuation Logic under US Regulations

In July 2025, the US GENIUS Stablecoin Act was officially enacted. Compared to Bitcoin, stablecoins are pegged 1:1 to the US dollar, and their higher capital efficiency makes them more suitable as a debt-repaying tool. Furthermore, stablecoins can promote the efficient flow of global capital into the US dollar system, support the purchase of US Treasury bonds and the injection of liquidity into on-chain financial assets, and promote the digital expansion of US dollar hegemony. Currently, the total market capitalization of stablecoins is $275 billion, while Bitcoin's market capitalization is $2.2 trillion. The global value of Bitcoin mining equipment is estimated to be between $15 billion and $20 billion, while Ethereum's market capitalization is $550 billion, with a staked value of approximately $165 billion. Whether replacing Bitcoin's role in debt repayment, promoting the inclusion of on-chain assets, or accommodating new payment systems, the scale of stablecoins will accelerate in the long term, rapidly growing to a trillion-dollar market size.

As the primary infrastructure for stablecoins and DeFi, ETH's price benefits both from ETH purchases driven by the security of on-chain financial networks and from the inherent DeFi model: stablecoins inject foundational liquidity, the DeFi ecosystem leverages stablecoins to create leverage and derivatives to purchase more ETH, and a surge in trading activity drives up gas fees and promotes ETH burn. Using ETH network transaction fees (gas fees) and Proof of Stake (PoS) as cash flow revenue, a rough valuation using a discounted cash flow (DCF) model reveals that, under optimistic conditions (7% growth rate, 9% discount rate, and leverage factor 3), ETH's market capitalization has the potential to exceed $3 trillion, surpassing the current BTC market cap.

2. An interest rate cut cycle is coming

On August 22, Powell delivered a speech at the Jackson Hole conference, stating that inflation remains high, but downside risks to employment are increasing; with policy still in a "restrictive" range, the committee will "proceed cautiously" and adjust its policy stance as necessary. Analysts generally believe that a September rate cut is almost "a foregone conclusion" and represents a turning point for dovish sentiment. After the speech was released,

Crypto-related stocks and ETH-related targets rose sharply in response, with ETH recovering all of its losses at the beginning of the week and rushing towards a historical high of 4887.

In the past interest rate cut cycles, ETH generally outperformed BTC. With lawmakers returning to Congress after their vacation in September, the promotion of crypto policies will advance rapidly. The expectations of ETH's financial chain and DeFi prosperity have not yet been realized, providing a positive macro environment for ETH market.

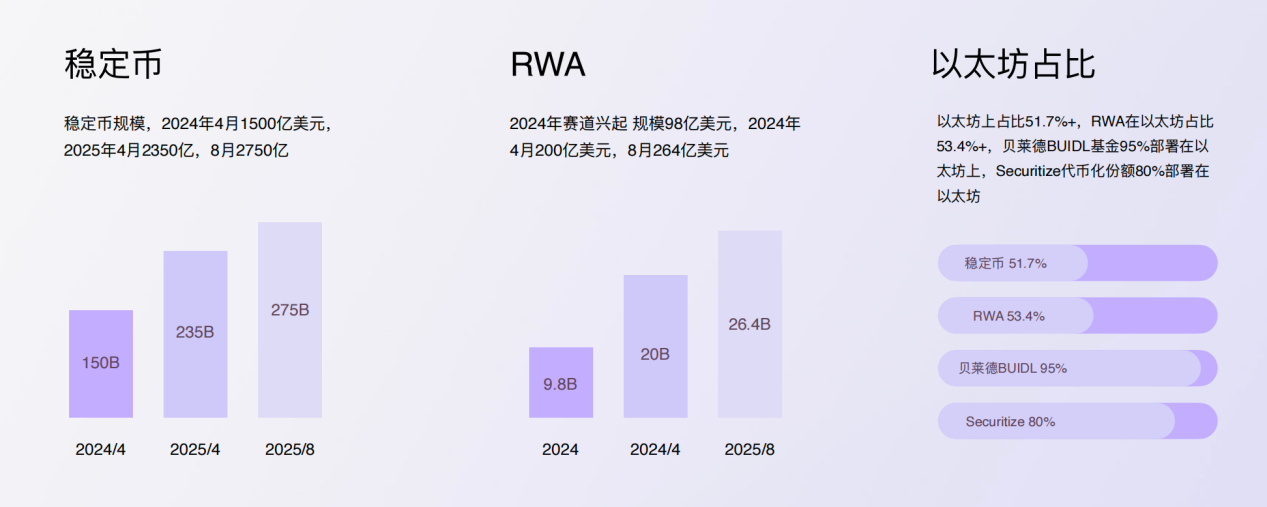

3. Stablecoins and RWA are the first choice for development

The US government and financial institutions are steadily pushing financial blockchains. Currently, the total value of stablecoins has reached $275 billion, and the value of RWAs is $26.4 billion. Over 50% of these stablecoins run on the Ethereum network, while RWAs account for 53.4% of Ethereum. DeFi's total TVL is 1,611 billion, with over 60% deployed on Ethereum. 95% of Belaid's BUIDL funds are deployed on Ethereum, and 80% of Securitize's tokenized shares are deployed on Ethereum.

In this article, we analyze selected quantitatively clear and significant data. Overall, recent supply-side unstaking data will not alter ETH's upward trend. On the demand side, the foreseeable upper limit of new purchases by both treasury companies and ETFs remains far from being reached, and the cost of establishing a position is high. With the fundamental shift in financial logic under US regulations, ETH possesses the potential for both internal and external growth to drive its price. With an improving macroeconomic environment and further policy development, ETH's market capitalization is expected to surpass BTC in the long term.