Bankless co-founder Ryan's letter to his son: Don't put your money in the bank, put it in cryptocurrency

- 核心观点:银行是三重骗局,应避免存款。

- 关键要素:

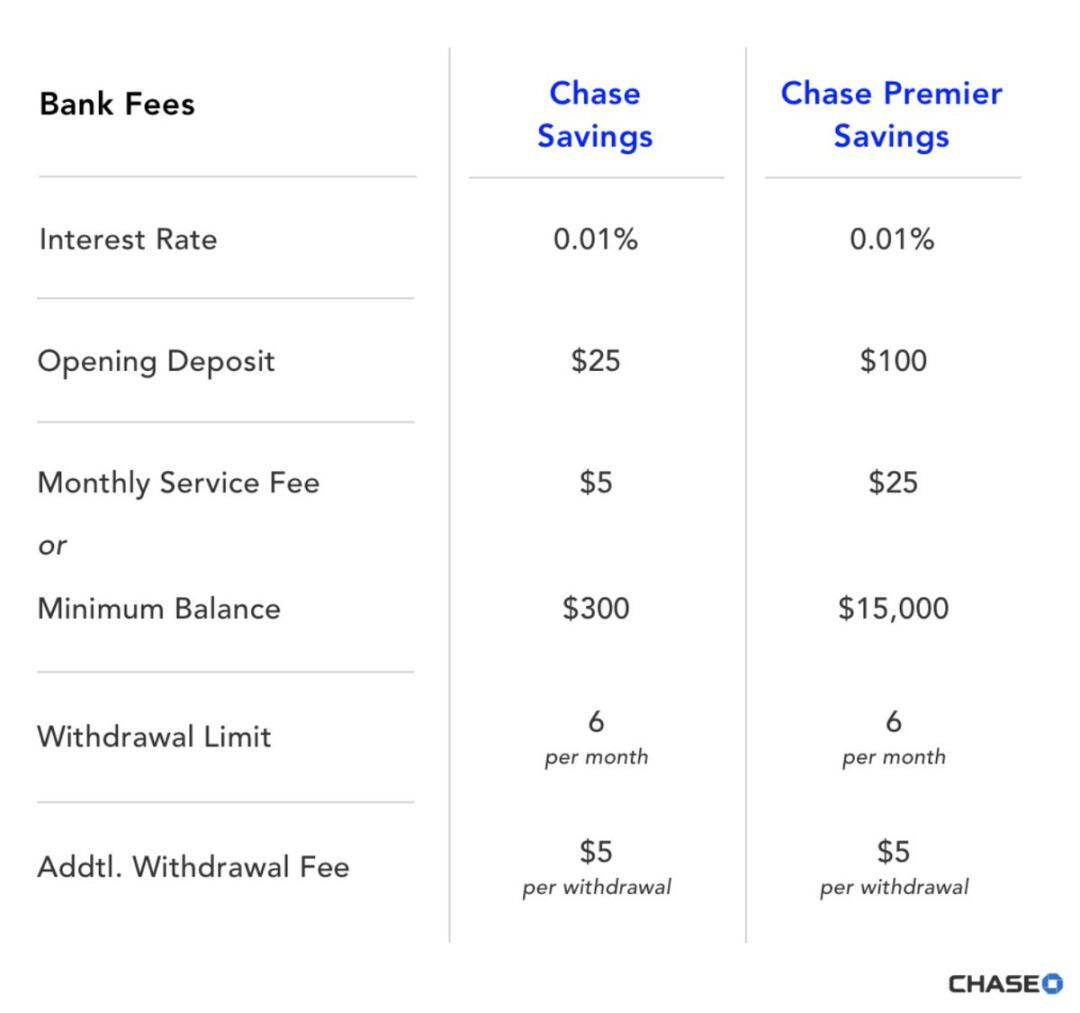

- 银行私吞国债收益,仅分储户0.01%。

- 名义收益被通胀和征税侵蚀,实际为负。

- 美元无稀缺性,长期贬值,非价值储存工具。

- 市场影响:推动资金流向比特币、黄金等资产。

- 时效性标注:长期影响。

Original article by Ryan Adams, Co-founder of Bankless

Original translation: Luffy, Foresight News

Editor's Note: This article is a letter from Bankless co-founder Ryan Adams to his son. In it, Ryan offers some wealth management advice, the core message being, "Don't keep your money in the bank," claiming banks are a triple scam. Ryan ultimately offers an alternative: keep some US dollars for daily expenses and invest your wealth in a portfolio of assets that can store value over time, such as Bitcoin, gold, and stocks. The following is a translation of the full letter:

Dear Son,

Don't keep your money in the bank. Banks may seem safe, but they are actually a triple "scam."

Scam 1: They stole your profits

At any given time, there's actually a risk-free return on the US dollar: Treasury bonds. Treasury bonds, in simple terms, are "US dollars wrapped in short-term government bonds," offering a fixed return of 4.2%.

There is no additional risk, it is equivalent to free money, and it is tailor-made for you.

However, the bank will not give you this money in your savings account, but will pocket it. They will not tell you about this income, will not help you exchange the US dollars for treasury bonds, and will even actively lobby the US government to prevent depositors from receiving this income.

The bank takes 4.19% of the profit and only gives you 0.01%

Rich people don't keep their money in banks at all; they put their cash into government bonds instead of savings accounts. But the middle class and the financially illiterate have their profits stolen every day by the "friendly" bank next door, without them even realizing it.

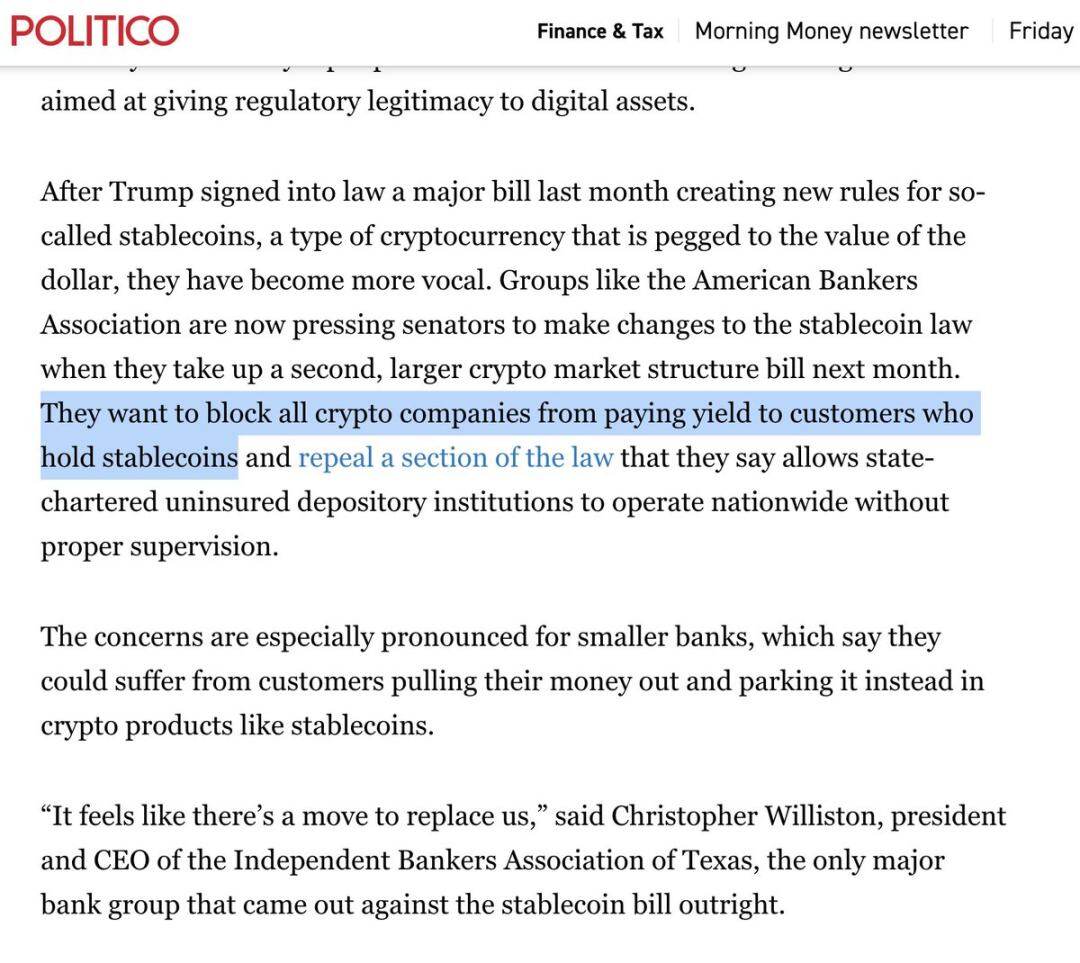

Bank lobbyists are still eyeing the tiny returns of cryptocurrency stablecoins, trying to keep them out of reach. They're spreading panic, saying that without the "blood-sucking" savings account business, the entire financial market will collapse!

Yields will change, so you have to watch what the Fed Chairman says, but as long as yields remain positive, put your dollars in short-term Treasury bonds and money markets, not in bank accounts.

Scam 2: The so-called income is not real income

Now you know the next secret: the yield is fake.

Do you think the 4.2% yield you're getting now can offset the loss in purchasing power? Actually, that's just the "nominal rate of return." The purchasing power of the dollar shrinks every year. This is known as inflation. Even in good times, inflation is to be expected, and it's even more severe in bad times.

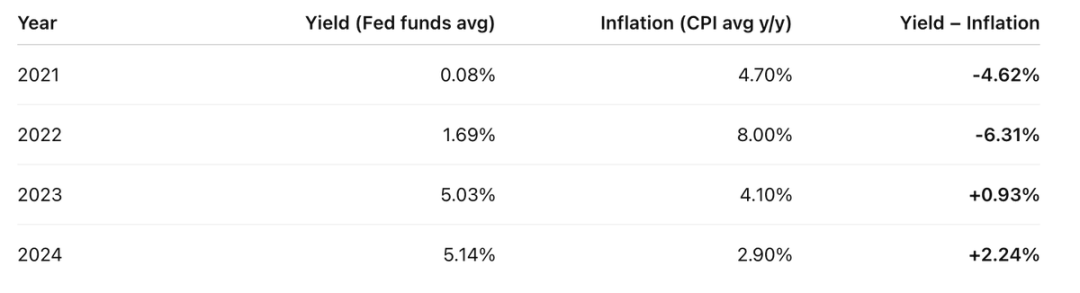

Over the past four years, your actual earnings have been roughly as follows:

The account's rate of return minus the annual CPI is not very good.

So in two of the last four years you lost a lot more than you made.

But the reality is even worse: the "fake returns" you receive will be taxed as income.

Assuming your income tax rate is 20%, you have to pay 20% tax on those "fake gains" first. So the actual gains are actually like this:

Before the inflation "tax", you paid income tax first, and the US dollar is equivalent to double taxation.

Real rate of return = nominal rate of return - inflation.

They want you to think that inflation is a natural force like gravity or the laws of physics. It is not at all; it is a deliberate design of the modern system of government and central banks.

Inflation is a tax, just like any other tax, except that they hide it.

I know you don't mind paying your fair share of taxes. Public services are important, and you recognize the common good. But what about this hidden tax? Is it fair to target middle-class savers who are trying to save for the future?

Learn from the rich: they avoid the "savings tax" by holding a lot of assets instead of US dollars. This brings us to the third and most insidious layer of nested "scam".

Scam #3: The money itself isn’t real

Okay, I'm exaggerating a bit. The US dollar is real, but it's a temporary thing. It's good for short-term payments, not for storing wealth across time or for the future. It's a medium of exchange, not a store of value.

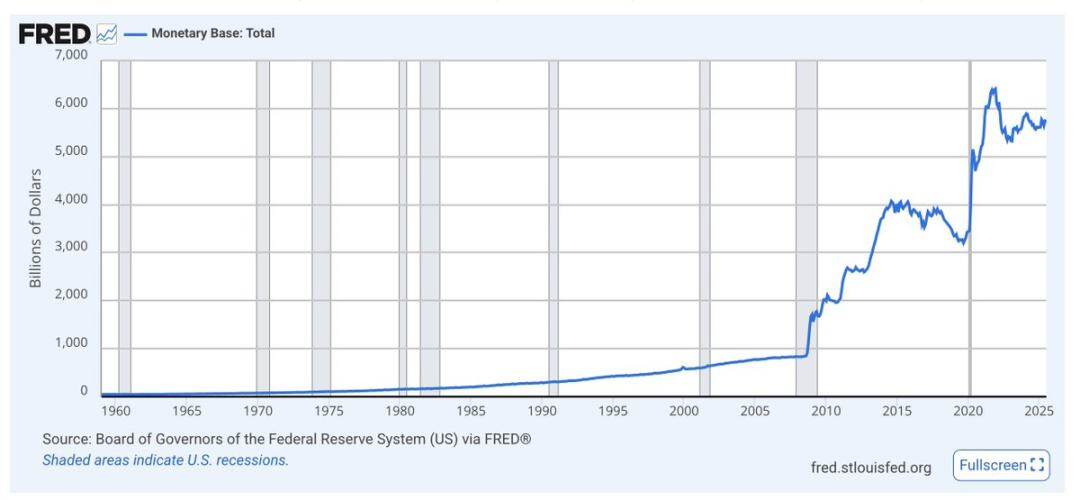

The base money supply is called M0, which is cash and bank reserves. You can see how much it rises during a crisis. The overall trend is upward.

The dollar has no long-term scarcity constraint, and its supply is always increasing. Your percentage of the total supply is shrinking much faster than the returns can make up for it, because they keep printing money.

The amount of dollars printed is almost never mentioned. Economists focus solely on inflation and purchasing power, but in the long run, an increase in the money supply devalues the dollar relative to assets. The more dollars are printed, the less valuable your money is.

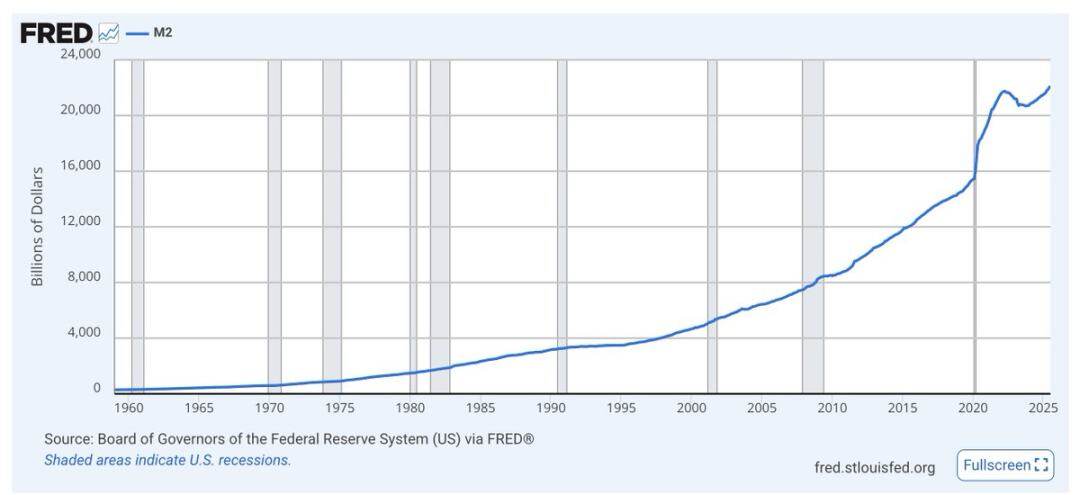

The same is true for M2 (M1 plus short-term savings). It surges during crises and tends to soar.

Don't get bogged down in the economists' debates; just look at the charts. Regardless of who's in power, the government will use printing dollars as a lubricant for economic and political stagnation. That's what the dollar was designed for, not savings.

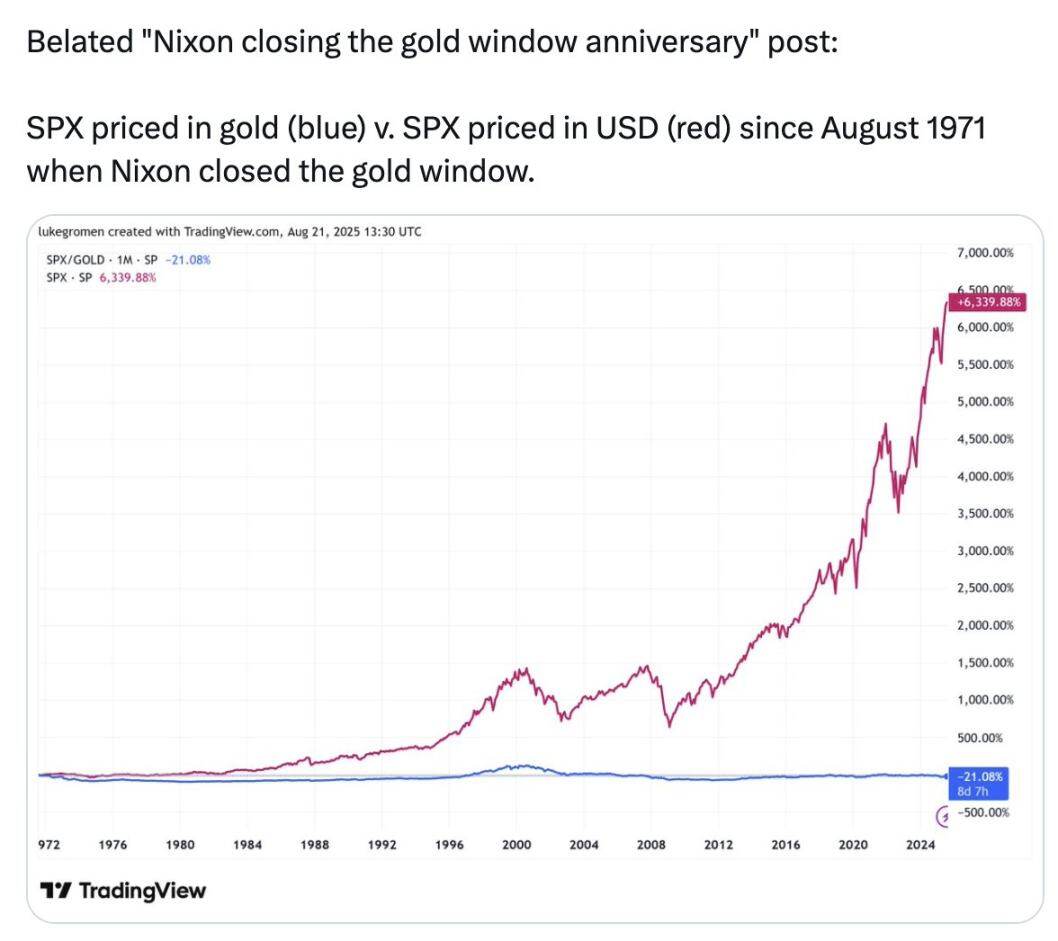

Look at the blue line in this picture:

The S&P 500 has risen 6,339% in US dollar terms since 1971, but has fallen 21% in gold terms.

Over the past 54 years, wealth has been better stored in gold than in the 500 largest and best-performing companies in the United States.

This chart isn't meant to tell you to buy gold. It's meant to tell you this: what they call "money," what we use to measure everything, the dollars in your bank account, isn't really "money" at all. It doesn't store value, never has, and never will.

The "money" they talk about is not a store of value. So this is a three-layered "scam":

- Scam 1: Steal your profits;

- Scam 2: The so-called profits are not real profits;

- "Scam" three: The money itself is not "real".

What should I do then?

Keep some dollars for short-term needs, such as daily expenses, taxes, and emergency funds. Earn income in the form of government bonds.

Put all your long-term wealth into a portfolio of assets that store value over time: Stocks and real estate are good options, but so are Bitcoin, Ethereum, and gold. The latter three are scarce and protected from inflation. These assets appear risky because they are volatile, but volatility does not equal risk.

You can also place some medium-term wealth in government bonds, waiting for long-term value-store assets to decline in value before investing your cash. This is the key to investing, as Warren Buffett put it: Be greedy when others are fearful, and be fearful when others are greedy. Don't rush to sell; wait for a major drop and think in terms of years, or even decades.

Try to use cryptocurrency tools and exchanges to operate these. Avoid cutting-edge risks. This way you can stay at the forefront while avoiding the pitfalls of cryptocurrency disrupting traditional finance.

School won't teach you this, but you have to learn it, keep studying, and protect your future.

Don't keep your money in the bank. Put it into assets and put it into cryptocurrencies.