Western Union’s Stablecoin Bet: Can the 172-Year-Old Bank Make a Successful Turnaround?

- 核心观点:西联汇款需转型为现金与数字资产桥梁。

- 关键要素:

- 传统业务衰退,收入持续缩减。

- 数字化落后,增长远逊竞争对手。

- 实体代理网络可转化为战略优势。

- 市场影响:推动传统金融与加密生态融合。

- 时效性标注:中期影响。

Original author: Stablecoin Blueprint

Original translation: TechFlow

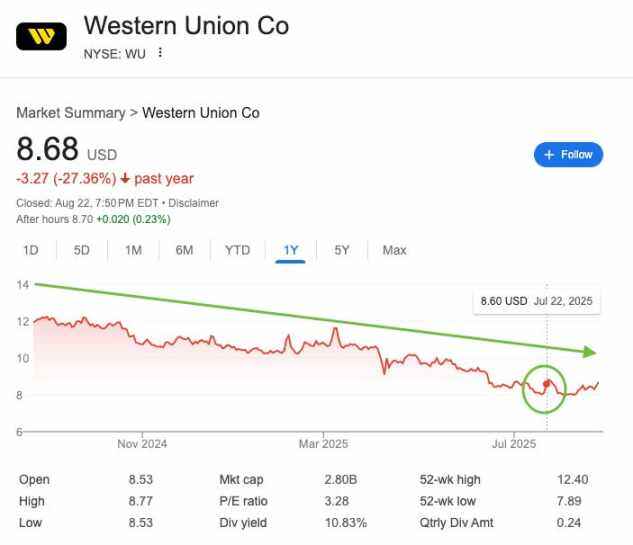

On July 22nd, Western Union seemed to have seen a long-awaited ray of hope. After its CEO mentioned in a Bloomberg interview that the company would delve deeper into the stablecoin space, the traditional payments giant's stock price soared, closing up nearly 10% that day, attracting a wave of investors buying the dip that hadn't been seen in years. However, this hope was short-lived. A week later, Western Union's financial report again fell short of analyst expectations, sending its stock price plummeting to its lowest point, completely erasing its earlier gains.

This brief market euphoria wasn't just about Western Union; it also reflected Wall Street's newfound affinity for stablecoins. Following the passage of the landmark "Genius" bill and the astonishing fivefold increase in the stock price of stablecoin issuer Circle, investors have become almost reflexive: flocking to the term "stablecoin." However, this enthusiasm for "stablecoins" is more about a misunderstood buzzword than a genuine business strategy. Stablecoins won't save Western Union's core business, but if the company takes the right steps, they might just usher in a new era.

The decline of giants

Founded in 1851, Western Union was once a giant in the global remittance industry, but its financial performance tells the story of a giant struggling in a new era. In recent years, Wall Street has viewed the world's largest remittance company as a melting "ice cube," and the data confirms this view: since 2021, the company's revenue has shrunk from over $5 billion to a projected $4.1 billion in 2025, while its market share has been steadily eroded by digital-first competitors. This decline is also reflected in its stock price, which has fallen from a high of $26 in 2021 to currently hovering between $8 and $9.

The foundational strength of this 172-year-old giant—its global network of nearly 400,000 physical agent locations—has now become its greatest structural weakness. This reliance on agents is costly, accounting for approximately 60% of Western Union's service costs. This network primarily serves a key customer segment: migrant workers who rely on cash and often lack access to banking services. For decades, this model served as Western Union's defensive defense.

However, as global digitization accelerates, this cash-dependent customer base is in long-term structural decline. And in the digital arena—the future battleground—Western Union is significantly underperforming its competitors. Last quarter, Western Union's digital revenue grew by only 6%, while competitors like Wise and Remitly saw growth rates of 20%-30% or even higher. Once the undisputed king of remittances, Western Union is now losing ground to its competitors in the digital arena.

A charming but flawed solution

On the surface, Western Union’s proposed stablecoin initiative appears quite comprehensive. In its recent earnings call, the company outlined four key strategies:

- Improve your own financial management;

- Enable global payments through stablecoins;

- Provide buying, selling and holding functions in digital wallets;

- Most importantly, use its global network as an entry and exit point to the crypto ecosystem.

However, the company’s current focus is clearly on the first strategy. As CEO Devin McGranahan put it, “this is where we’re spending most of our time and energy,” namely solving back-office operational efficiency problems through stablecoins.

The appeal of this strategy is undeniable. McGranahan emphasized that stablecoins can "significantly improve settlement speeds and reduce the amount of upfront funding required by partners." He cited a recent weekend liquidity crunch in India that resulted in payment delays. Stablecoins could enable real-time replenishment of liquidity and 24/7 service availability, significantly improving the customer experience.

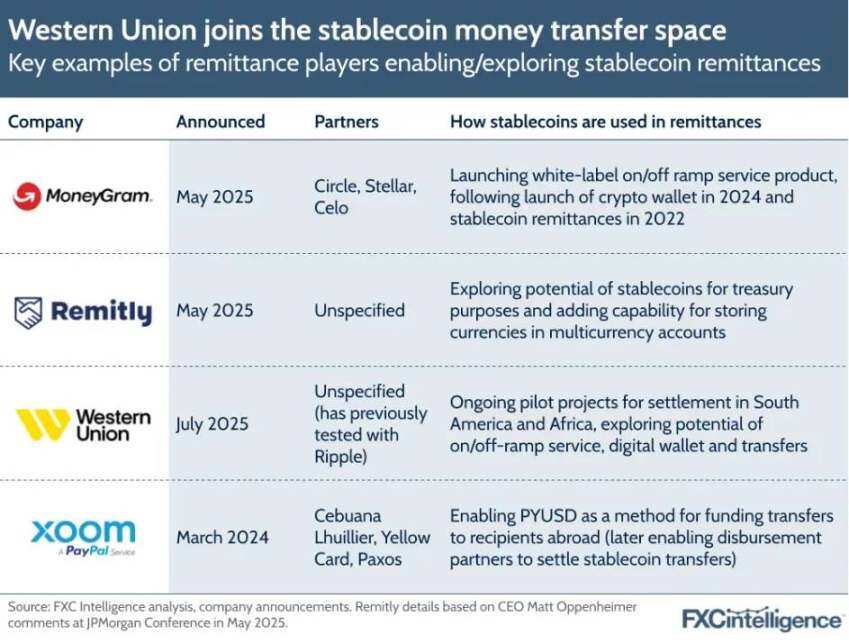

However, while optimizing financial management through stablecoins is a sensible goal, it doesn't offer a long-term competitive advantage. Western Union's major competitors, such as MoneyGram and Remitly, are already implementing similar stablecoin-based settlement strategies. Any cost savings are likely to be eroded by competitive pressure, especially from digital businesses with inherently lower operating costs. This reduces this potential innovation to a mere "cost of doing business," unable to reverse the company's current structural decline.

Source: FXC Intelligence

The Real Opportunity: The Cash Bridge to the Digital Economy

Western Union's future lies not in trying to catch up digitally with its competitors, but in becoming the role they can't replace: the world's primary cash-to-stablecoin access layer. The company should leverage its 400,000 physical agent locations as its most important strategic asset. By strengthening this network and leveraging its trusted brand, Western Union has the potential to solve a critical financial infrastructure problem: providing a seamless connection between physical cash and the global digital economy, a service desperately needed in many emerging markets.

This strategic transformation can be achieved in two ways. First, owning traffic.

Western Union can integrate cash-to-stablecoin conversion functionality directly into its highly acclaimed mobile app. Users can walk into a trusted Western Union agent location, hand over their volatile local currency, and receive USD stablecoins in their digital wallet within minutes. This is an attractive solution for users who want to protect their wealth with USD stablecoins, especially those living in regions with high currency volatility.

The second, more powerful method is through platform traffic.

A more promising approach is opening its agent network to third-party wallets and fintech companies via APIs. These partners can embed "Pay with Western Union" or "Withdraw with Western Union" buttons directly in their apps. Market demand for this is already evident. McGranahan revealed on the company's earnings call that they were pleasantly surprised by the "unexpectedly high demand" for deposits and withdrawals. This approach transforms Western Union from a closed remittance service into open infrastructure, serving as a critical "last mile" connection between the rapidly growing digital ecosystem and the physical world.

Western Union can achieve significant financial returns simply through its deposit and withdrawal services. Based on current fee rates and its agent economic model (which accounts for its pricing power in cash transactions), just $1 billion in deposit and withdrawal volume could generate approximately $80 million in operating profit, a significant increase to the company's current total profit of approximately $800 million. By comparison, digital competitor Remitly saw its transaction volume increase by $5 billion in the most recent quarter compared to the previous year.

Beyond transaction fees, Western Union's digital wallet allows it to offer a wider range of financial services, such as debit cards for online spending, credit products, and savings and investment services. Western Union is even considering issuing its own stablecoin. Its digital wallet, combined with its extensive cash in/out network, creates a compelling service package and convenient distribution channel. More importantly, unlike Western consumers, the target audience for these services is less sensitive to interest rates, potentially allowing Western Union to retain more of the profits.

These new features will fundamentally redefine the role of Western Union Agents. Agent locations will no longer simply be places to collect a one-time money transfer, but will become efficient banking branches for the digital age. For millions of unbanked and underbanked people, Western Union's local Agents will serve as a physical gateway to global digital wallets, ultimately fulfilling the promise of "banking the unbanked."

Necessary transformation, fraught with risks

This strategic shift is fraught with challenges, ranging from the significant execution risks faced by a 172-year-old company to the secular decline in cash usage and the threat posed by informal peer-to-peer networks. However, it is the structural decline of its core business that makes this transformation necessary.

While defending its traditional business, Western Union urgently needs to inject new growth drivers into the company through its deposit/withdrawal strategy. This strategy not only allows the company to participate more deeply in the rapidly expanding digital asset economy, but also, through its global physical network, a powerful differentiator, buys it valuable time to become the indispensable cash bridge of the future—assuming it can be successfully executed.

Western Union's recent $500 million acquisition of Intermex, a cash remittance business focused on Latin America, suggests a preference for synergies in integrating declining businesses and converting low-cost users to digital. While acquisitions can be time-consuming and labor-intensive, presenting another significant risk hindering Western Union's transformation, the additional retail locations could also become strategic assets, aligning with its potential future role as a cash bridge.

in conclusion

Western Union's future cannot be secured by tweaking its old business model with new technologies. The strategic choice is now clear: either continue playing defense and playing by the rules set by digital-first competitors, or decisively transform and become the indispensable cash bridge between the physical world and the rapidly evolving digital asset economy. Stablecoins cannot save the traditional remittance economy, but they hold the key to unlocking the platform economy of the future. One path leads to a graceful demise; the other to a new meaning of existence.