In the era of narrative collisions, is volatility the real asset?

- 核心观点:市场处于多重矛盾叙事碰撞期。

- 关键要素:

- 比特币9月季节性回调与减半后看涨矛盾。

- 美联储被迫在滞胀环境中降息。

- 企业加密货币财库或从需求支柱转为抛压。

- 市场影响:加剧资产波动,稀缺资产受青睐。

- 时效性标注:中期影响

Original author: arndxt

Original translation: Luffy, Foresight News

Every cycle has its own unique narrative, and right now, the market is struggling with conflicting chapters: Bitcoin’s seasonal patterns and post-halving dynamics, the Fed’s dovish rhetoric and inflation, and a bond market steepening that could signal a reprieve or a recession.

We are in a very volatile market:

- In the short term: September could see a surge in Bitcoin that hasn’t been seen this year. For those willing to downplay seasonality in post-halving years, a pullback could be a buying opportunity.

- In the medium term, the Fed's policy faces the risk of undermining its credibility. Interest rate cuts due to rising inflation will change the investment landscape.

- Long-term perspective: The key to the cryptocurrency cycle may not only lie in the flow of retail or institutional funds, but also in the structural health of corporate cryptocurrency coffers. This is a fragile pillar, and if it breaks, demand will turn into supply.

The core logic for investors is simple: we are entering an environment of volatile narratives, with seasonality, policy and structural mechanisms pointing in different directions.

In the eyes of investors, the signal is not in a single data point, but in the collision of these narratives.

Bitcoin’s “September Ghost” and the Post-Halving Reality

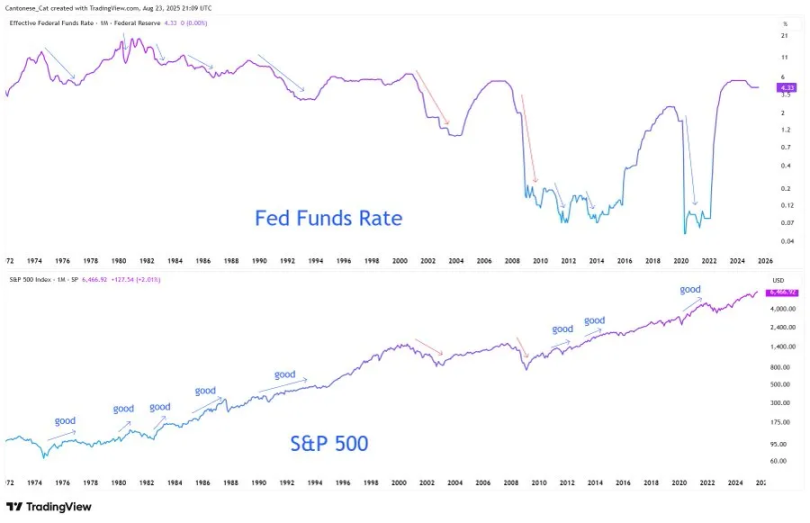

Historically, September is Bitcoin's worst month. Charts show recurring declines driven by the liquidation of long positions. However, this cycle is different: we are in a post-halving year, and the third quarter of such years historically tends to be bullish.

Since 2025, there has been no single-month gain exceeding 30% (or even 15%), indicating that volatility has been compressed. In every bull market, sharp rallies occur in clusters. With four months left in the year, the question is not whether volatility will return, but when. Investors are concluding that a September pullback could become the last significant entry window before the inevitable fourth-quarter rally.

The Fed's Split Narrative

Powell's speech at Jackson Hole was widely misinterpreted as a green light for aggressive easing. In fact, his stance was more nuanced: he left the door open for a September rate cut, but stressed that this would not mark the beginning of an easing cycle.

Regarding the labor market, Powell acknowledged a "strange balance": both labor supply and demand are slowing, leaving the market in a fragile state. The risks are asymmetric, and if this balance is disrupted, it could explode quickly in the form of layoffs.

Regarding inflation, he was blunt: tariffs have clearly pushed up prices, and the impact will continue to accumulate. Although Powell called it a "one-time change in the price level," he stressed that the Fed cannot allow inflation expectations to get out of control.

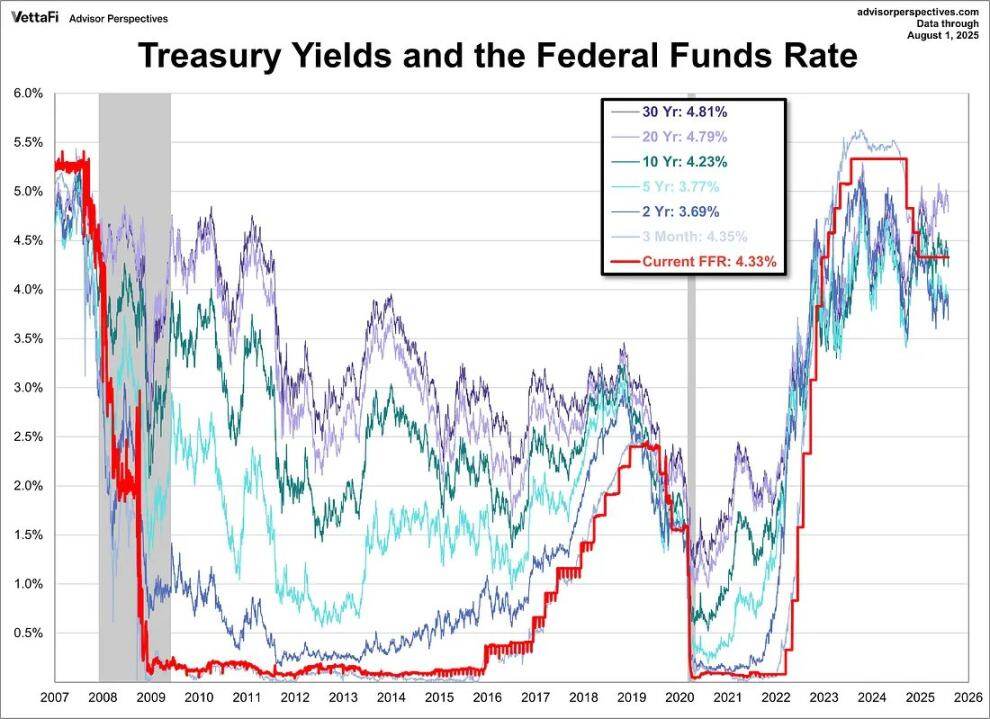

The shift in framework is even more revealing. The Federal Reserve officially abandoned its "average inflation targeting" approach in 2020, returning to its 2012 "balanced path" model: no longer tolerating inflation above 2% and no longer focusing solely on unemployment. In other words, even as the market has priced in a near-certain rate cut, the Fed is signaling a stricter interpretation of its 2% inflation target.

The paradox is this: the Fed is poised to cut rates in a stagflationary environment, easing even as core inflation accelerates and the labor market weakens. Why? Because structurally, the US debt burden makes "maintaining higher interest rates for longer" politically and fiscally unsustainable. Powell can talk about credibility, but the system is stuck in a vicious cycle: spending, borrowing, printing money, and so on.

The key takeaway for investors is that credibility risk has now become an asset pricing risk. If the 2% target devolves from an "anchor" to an "aspiration," it will reset the valuations of bonds, stocks, and hard assets. In this environment, scarce assets (Bitcoin, Ethereum, gold) become a logical hedge against dilution risk.

Bond market steepening signals

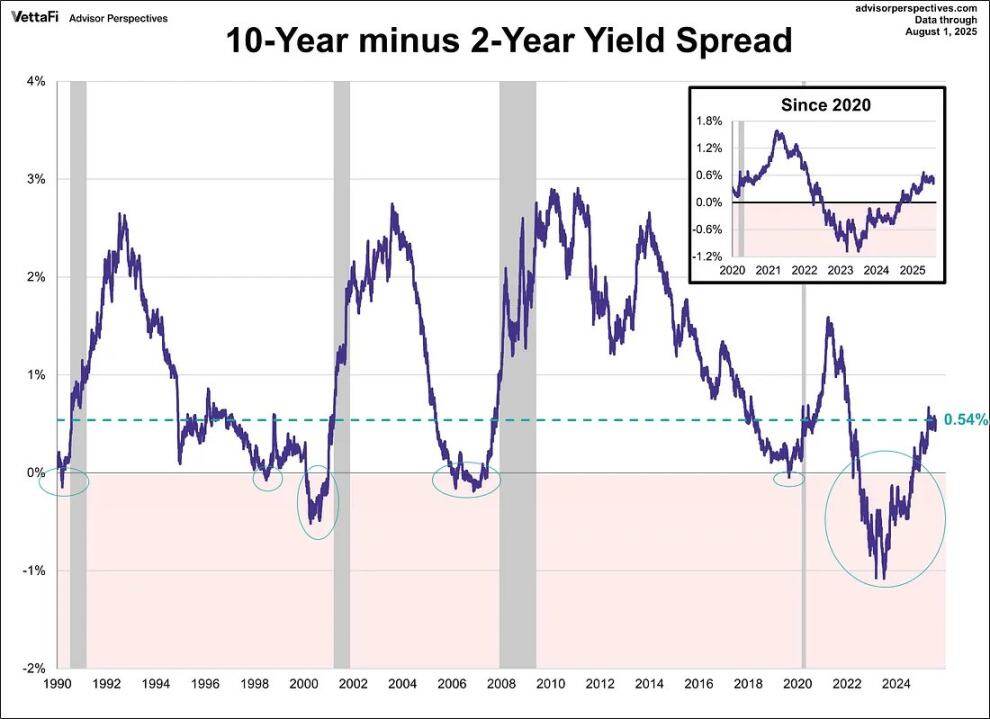

The yield curve has quietly un-inverted: the 10-year to 2-year Treasury yield spread has rebounded from one of the deepest inversions in history to +54 basis points. On the surface, this looks like normalization, a healthier curve.

But history offers a different warning. In 2007, the steepening of the curve after an inversion wasn't a "safety signal" but a precursor to a collapse. The key lies in the reason for the steepening: if it stems from improving growth expectations, it's bullish; if it stems from short-term interest rates falling faster than long-term inflation expectations, it signals an impending recession.

Right now, the curve is steepening for the wrong reasons: the market is converting expectations of rate cuts into sticky inflation. This is a fragile setup.

Structural problems with cryptocurrencies

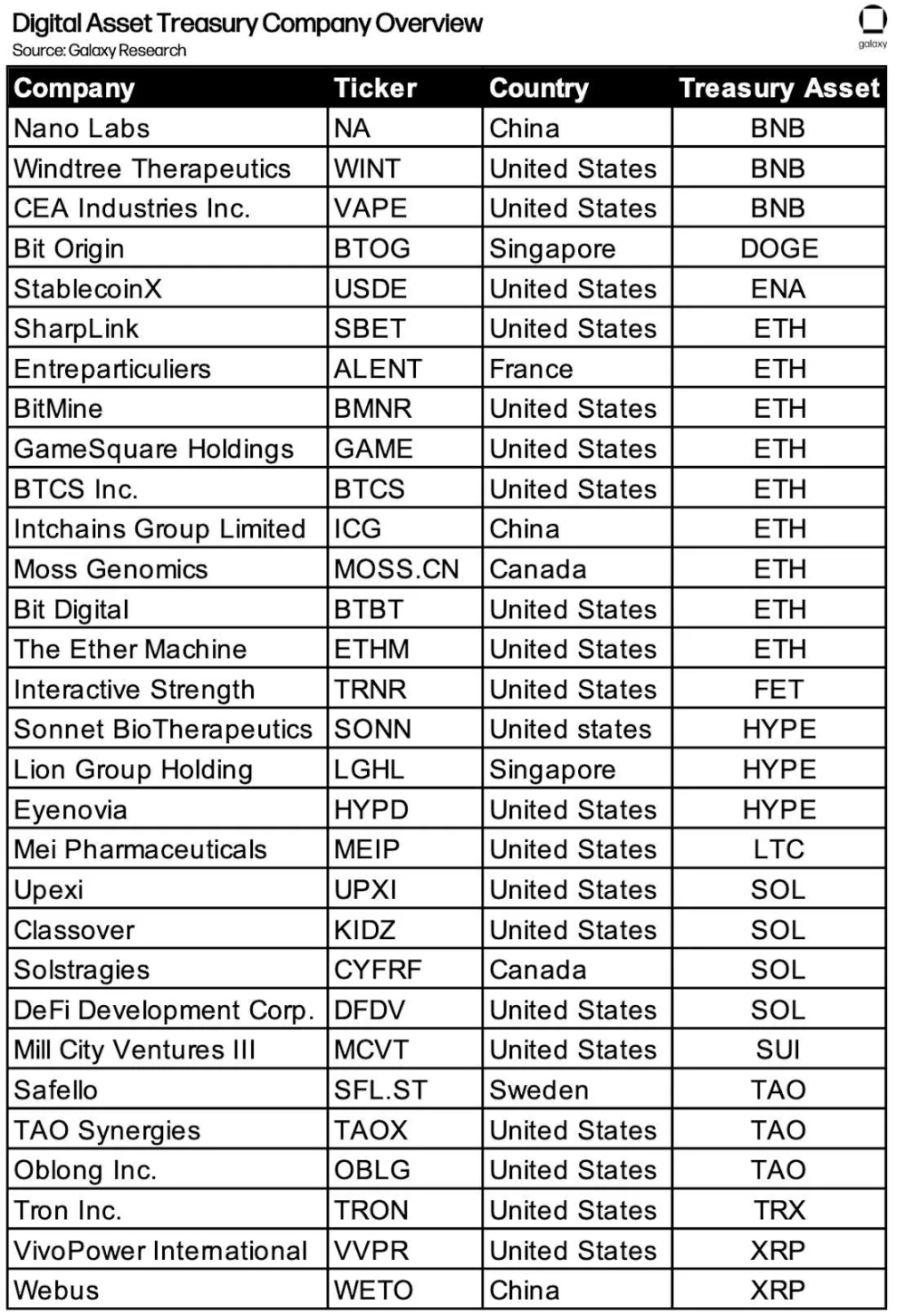

Against this macro backdrop, cryptocurrencies face their own existential challenge. "Corporate treasury hoarding" (MSTR, Metaplanet, companies holding ETH, etc.) has been a core pillar of demand. However, as net asset value premiums compress, the danger is that these entities could shift to discounts, transforming from buyers into forced sellers.

Cycles don’t end with the death of narratives, but with a reversal of the mechanisms driving demand. In 2017, it was ICOs, in 2021 it was DeFi/NFT leverage, and in 2025 it could be crypto treasuries hitting the limits of balance sheet arbitrage.

Overall, the core narrative of this cycle is "disharmony": the market is pulled in opposite directions by seasonal, policy and structural mechanisms.

- Bitcoin’s September pullback collides with the inevitable rise after the halving;

- The Federal Reserve made cautious remarks, but was forced to cut interest rates amid stagflation;

- The steepening of the bond market appears to be easing, but it reveals fragility;

- Treasury hoarding, the fuel of cryptocurrency itself, is at risk of turning into liquidation.

For investors, the logic is simple: We are in an era of narrative collision, and the premium goes to those who can anticipate breakouts, hedge against dilution, and embrace volatility as the only true constant.

The opportunity lies not in choosing a narrative, but in recognizing that volatility itself is an asset.