The Offshore "Feast Is Over": From US Stock Tax Payments to On-Chain Pricing Power, Crypto Exchanges' "Route Battle"

- 核心观点:Crypto交易征税与合规化趋势不可逆转。

- 关键要素:

- CRS全球税务信息交换落地。

- 离岸CEX合规投入激增,转型加速。

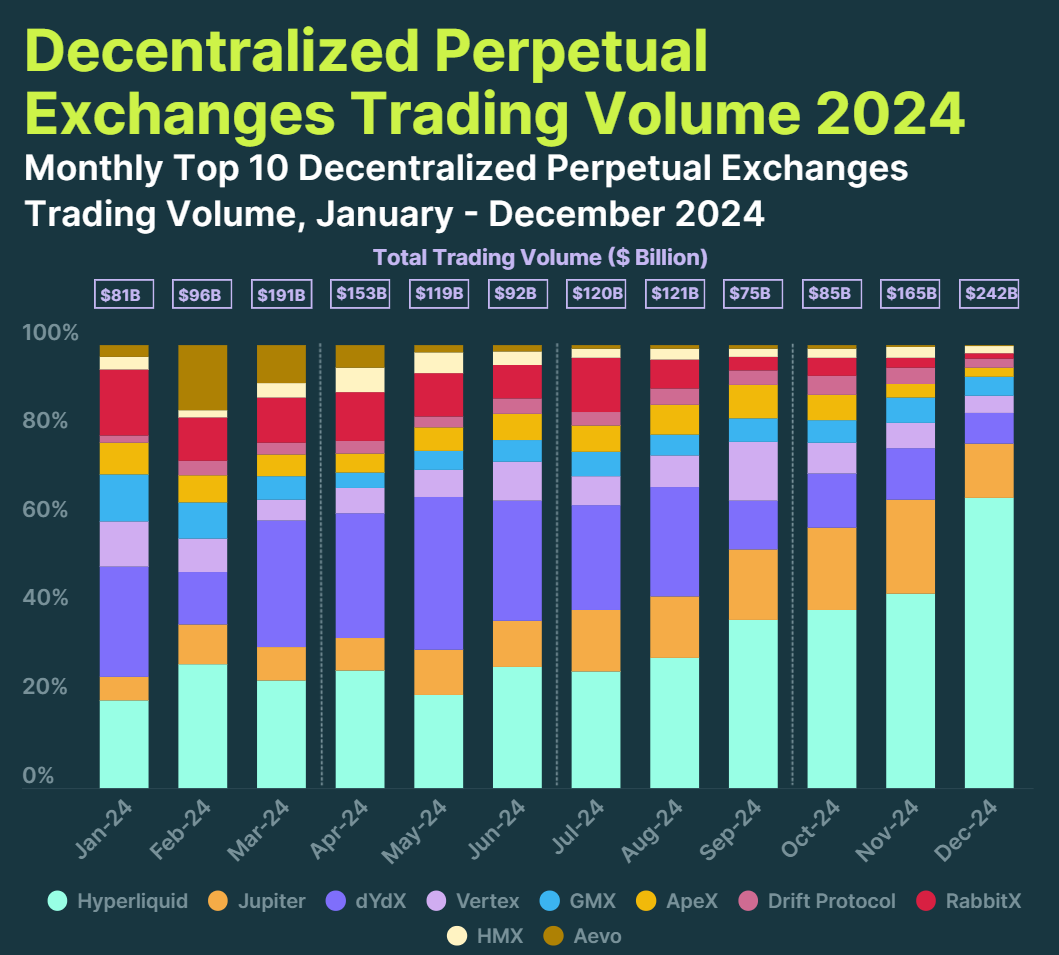

- DEX衍生品交易量年增超100%。

- 市场影响:推动行业向合规与链上分化发展。

- 时效性标注:中期影响。

Have you ever thought that Crypto transactions will be taxed in the future?

Since the spring of this year, many mainland Chinese users who use Tiger Brokers, Futu Securities, etc. to trade US stocks have received retroactive tax payment notices. This is by no means accidental. With the implementation of CRS global information exchange, overseas accounts and investments are being included in full-view monitoring, from high-net-worth individuals to ordinary middle-class people.

The principle is the same. The "sovereignty vacuum" in finance is often short-lived. Today's US stock brokerages may be a preview of tomorrow's crypto trading - once the wild era is over, Liangshanpo will eventually be incorporated into the regular army:

From the invisible freedom of opening offshore accounts for US stocks to the global interoperability of CRS information, from the wild growth of third-party payments to the strict control of central bank licenses, financial innovation outside the mainstream supervision has gone from gray to standardized, which is an irreversible one-way street.

Especially since this year, with the entry of Web 3 and the entry of power, Crypto exchanges can be said to be standing at a crossroads of fate. Compliance localization companies are sitting on the Diaoyutai, the offshore gray area is rapidly narrowing, and on-chain DEX is gaining momentum.

There is no middle ground, only clear dividing lines.

Offshore CEX: The Feast is Over

Centralized exchanges (CEX) are still the top predators in the current Crypto ecosystem.

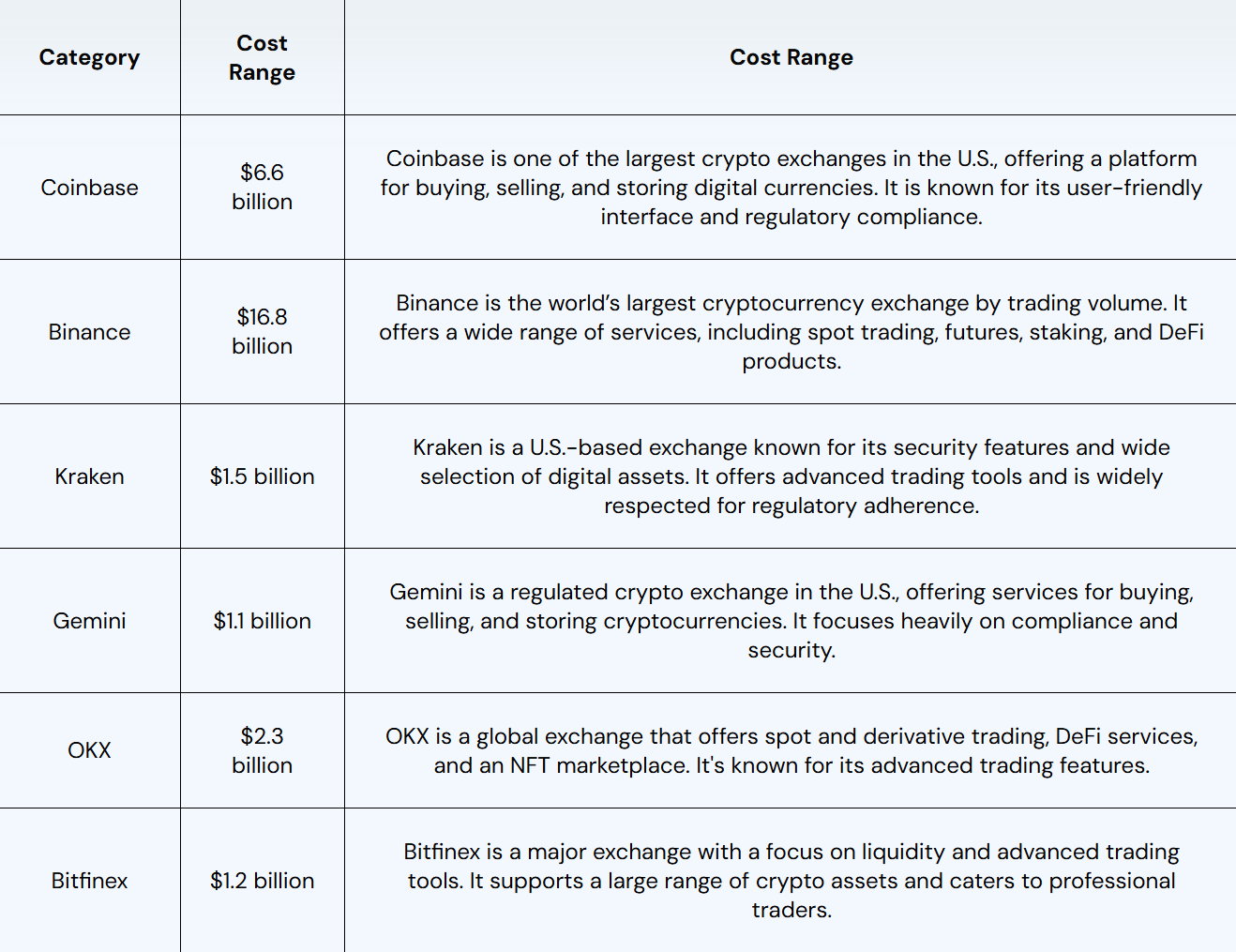

It can be said that CEX, which relies on transaction fees as its core source of income, has reaped the greatest benefits from the explosion in the size of Crypto. According to public market estimates, the annual revenue and profits of leading offshore CEXs such as Binance and OKX are currently in the billions or even tens of billions of US dollars. For example, Binance's annual revenue in 2023 was as high as US$16.8 billion, and its annual cryptocurrency trading volume exceeded US$3.4 trillion.

This means that even in a turbulent period of the global macro-environment, offshore CEX is still one of the most profitable businesses.

Source: Fourchain

However, the golden age of the offshore model is clearly coming to an end.

Compliance pressure and tax storms are extending from traditional finance to the crypto sector. Similar to the recent back taxes on US stock transactions, careful users should have noticed that offshore CEXs such as Binance and OKX have also been subject to controversy over the past year:

This includes but is not limited to restricting accounts that use cryptocurrency assets as the sole source of income, and requiring the user to provide proof of annual income and tax payments, etc.

Objectively speaking, the price paid by offshore giants such as Binance and OKX to "go ashore" is not cheap. In addition to the legal accountability faced by the founders, a considerable amount of funds have also been invested. Binance has publicly disclosed that it invested hundreds of millions of dollars in compliance and security alone in 2024, and its internal compliance team has grown to 650 experts.

Especially since 2025, all companies have been taking advantage of the "political dividend window" to accelerate compliance and potential listing.

For example, Kraken. First, the US SEC dropped the securities violation charges against Kraken, and the FBI also ended its investigation into its founder. Then it hinted at potential IPO plans. Recently, there were reports that it raised $500 million in financing at a valuation of $15 billion, making a complete turn towards compliance.

The same is true for OKX. It first reached a settlement with the U.S. Department of Justice in February this year and paid a fine of more than US$500 million. It then actively promoted its IPO in the United States. There were even reports that the compliance department in the United States was adjusted to the highest priority of all departments.

These actions send a clear signal that the survival space of the offshore model has been compressed to a historical low, and CEXs are scrambling to enter the final compliance window.

It can be said that this Crypto political honeymoon period, which was jointly catalyzed by Trump's reshaping of the policy narrative, BTC's "balance sheetization" and the stablecoin craze, is almost the last window for offshore CEX transformation.

Once you miss the opportunity to "go ashore", you may go from being a predator at the top of the ecosystem to being the target of elimination by the times.

The foreseeable pattern of "three-way division"

If we compare today's Crypto market to the Hong Kong and US stock markets that Chinese investors participated in ten years ago, then the regulation and market evolution are only a few years behind in time.

With the convergence of global tax compliance, capital controls, and the entry of financial institutions, the future landscape of exchanges is almost foreseeable to be divided into three parts:

- Localized, licensed, and compliant CEXs: Coinbase, Kraken, HashKey, OSL, and others are representative. Their core features include bank connectivity and compliant clearing capabilities. They primarily serve local users and institutional/high-net-worth individuals, building long-term brand value through regulatory compliance.

- Offshore gray CEXs: represented by Binance, Bitget, Bybit, etc., serve global retail investors and some high-risk users. Under the current global compliance trend and the approaching on-chain experience, they will inevitably be squeezed, eroded, and marginalized;

- Pure on-chain decentralized exchanges (DEX/DeFi native): No KYC required, permissionless access, native support for on-chain asset settlement and multi-chain portfolio trading, and may become a new global liquidity hub in the future;

Among them, compliant exchanges are undoubtedly the "upward curve players" that benefit from policy dividends. In markets such as the United States and Hong Kong, compliant exchanges can not only undertake cooperation with institutions and banks, but can also be included in the local tax system. The strategic goal of such platforms is very clear - to become a new generation of digital asset securities exchanges and clearing houses.

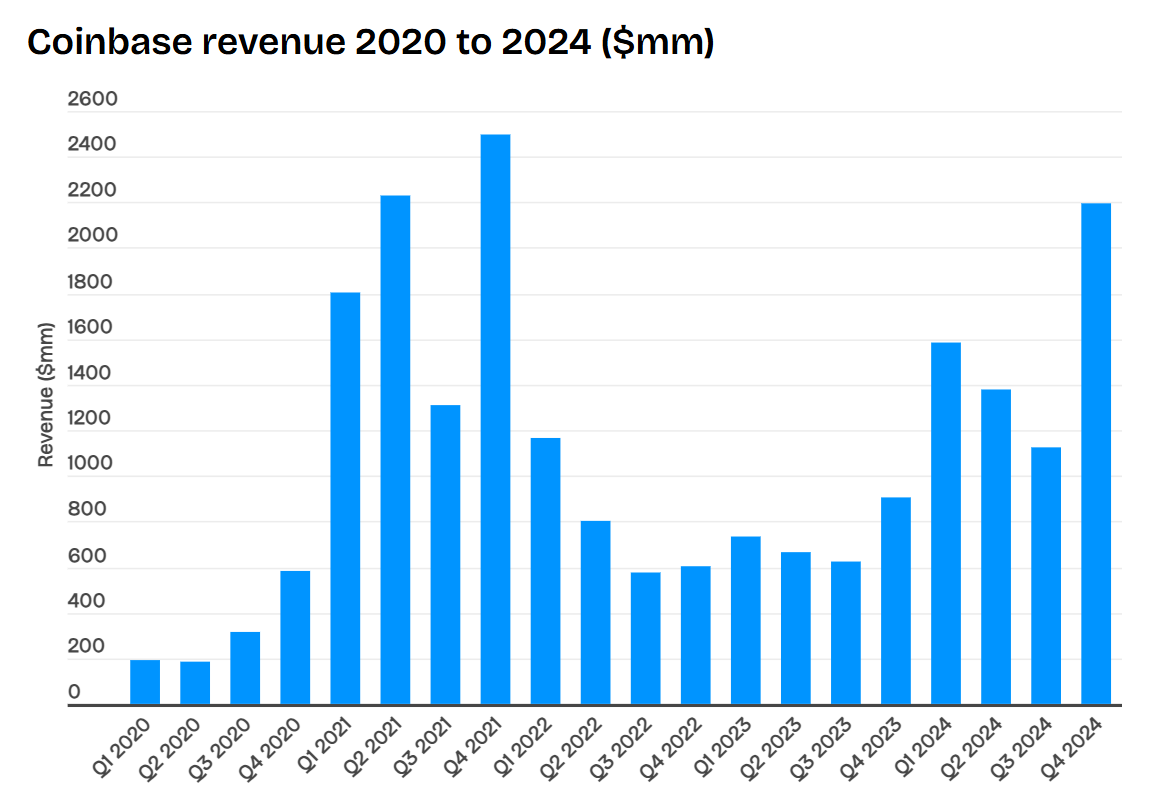

For example, a signal that is easily overlooked is that compliant exchanges represented by Coinbase are ushering in their golden moment. In 2024, Coinbase's revenue was US$6.564 billion, more than doubling year-on-year, and its net profit was as high as US$2.6 billion, almost 50% of the offshore leader Binance (according to market estimates).

More importantly, Coinbase has almost no need to worry about the risk of law enforcement pursuit or bank freezes in major jurisdictions around the world, so it naturally becomes the preferred "safe haven" for institutions and high-net-worth users.

On-chain DEXs are the "global market players" with the greatest potential and the highest ceiling. They do not need to rely on national licenses and are global liquidity hubs available 24/7. In particular, they natively support on-chain asset settlement and cross-asset portfolio strategies and are highly programmable.

Although its current market size is still less than 10% of CEX, it has great growth elasticity. Once the on-chain derivatives market matures, the market depth and strategy space of DEX will attract a large amount of high-frequency funds, arbitrageurs and institutional liquidity migration.

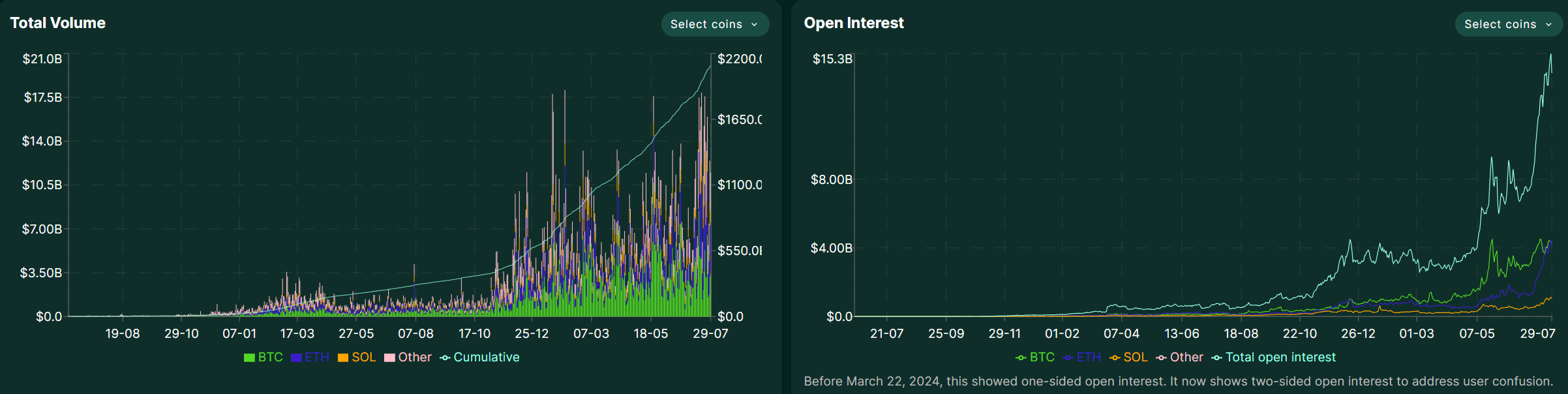

For example, Hyperliquid's capital growth soared in July, from just under $4 billion at the beginning of the month to $5.5 billion, and at one point in the middle and late July it approached $6 billion.

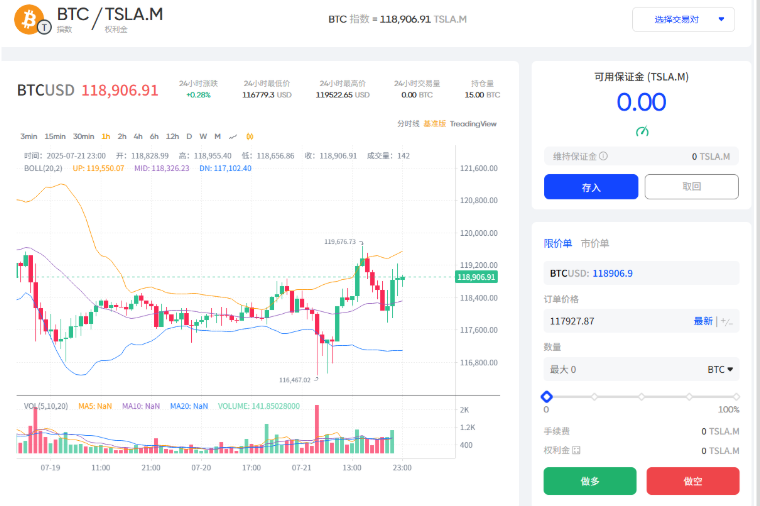

Moreover, DEX is not only an innovative vehicle for DeFi, but may also become the cornerstone of decentralized pricing for global commodities and crypto assets, just like the TSLA.M/BTC index trading pairs newly launched by Fufuture based on "coin-margined perpetual options":

Allowing users to use TSLA.M as margin to participate in BTC/ETH perpetual options trading not only explores a new liquidity path for tokenized US stocks, but can also be used to help build pricing pools for tokenized gold/crude oil products or other small-cap meme assets.

Overall, the strategic significance of Fufuture's DEX derivatives mechanism, which integrates options and perpetual contracts, lies in converting long-tail assets (such as SHIB, TSLA.M, etc.) that were originally only held in wallets into available margin, activating cross-asset liquidity, and forming a natural positive cycle of "holding a position means participating in liquidity construction." It also makes it easier for the on-chain market to approach the capital efficiency and depth of the traditional derivatives market.

In contrast, offshore CEX has already reached its peak and its living space is being sharply compressed. On the one hand, it is caught between compliance and on-chain and has no long-term living space. On the other hand, the tightening of global supervision, CRS tax interoperability, and the superposition of bank KYC systems have made it difficult for gray traffic to continue.

It can be said that the feast of the offshore model has come to an end. In the past, it served as a "gray buffer zone" to accommodate regulatory arbitrage, but in the future it may linger on the edge of policy for a long time, and be eroded by compliance and on-chain markets in both directions: either it will be incorporated into the tax and compliance system and become a local licensed institution; or it will be completely on-chain and become a borderless global market.

The middle ground is destined to be cleared.

New proposition for DEX: decentralized pricing of global assets

From a longer-term perspective, the future competition among exchanges will not only be a competition for traffic and transaction fees, but also a competition for the route after the global market rules are rewritten.

If the first phase of DEX is more of a testbed for DeFi innovation, then as licensed local exchanges in the United States, Hong Kong, and other countries take on compliance requirements, are incorporated into the tax system, and fully move closer to the banking system, the mission of DEX may be completely reshaped:

It may assume "price discovery and pricing power" in the global permissionless market.

Why does the pricing power of global assets belong to on-chain DEX?

- Unlike stocks and bonds, which have distinct regional attributes (except for US stocks and bonds), commodities such as gold, crude oil, and copper, as well as crypto assets such as BTC and ETH, are inherently global trading targets.

- At the same time, traditional commodity futures are concentrated in Chicago, London, Shanghai and other places, and are subject to time zone and trading hours restrictions, while on-chain operations run 24/7, providing time-zone-free and permissionless liquidity.

- Even better, stablecoins can serve as a universal global settlement tool . Users can open positions with stablecoins as margin, and all profits and losses are settled in stablecoins. This means that price discovery is no longer restricted by geography or the banking system.

With these three characteristics, DEX is naturally expected to become the decentralized pricing cornerstone of crypto assets and commodities.

Source: Coingecko

Of course, for DEX, what truly supports price discovery is never simple spot trading, but the trading depth and price discovery mechanism constructed by derivative systems such as futures and options.

This is also why derivatives DEX experienced explosive growth in 2024, with the total trading volume of various Perp DEXs reaching US$1.5 trillion, more than doubling the US$647.6 billion in 2023.

Among them, futures contracts are mainly based on Hyperliquid, and its annual trading volume soared from US$21 billion in 2023 to US$570 billion in 2024, achieving a 25.3-fold increase. Recently, Hyperliquid has become one of the top five derivatives platforms in terms of daily trading volume. At its peak, its daily trading volume exceeded US$10 billion, which is on par with some mid-level CEXs.

Source: Hyperliquid

At the more complex cross-asset strategy level and on-chain derivatives pricing logic, Fufuture also provides a concrete example. Its "coin-based perpetual option mechanism" has no fixed expiration date and dynamically collects premiums based on holding time, taking into account the nonlinear returns of options and the trading rhythm of perpetual contracts.

If you have truly experienced Fufuture's perpetual options product, you will be able to clearly feel its innovation compared to traditional on-chain options products. Take users holding SHIB as an example. This type of meme asset can hardly be used as any form of trading collateral in traditional on-chain derivatives protocols, but on Fufuture, you only need to deposit SHIB into the platform to participate in transactions as margin.

In practical terms, as long as SHIB is deposited as "available margin", the entire transaction process is almost the same as contract trading - no stablecoin is required as margin, and there is no need to weigh the expiration date, strike price, and trading profit and loss curve. Just like daily contract trading, you can start trading by selecting the target, direction (long/short), and opening quantity.

At the same time, it theoretically allows any on-chain asset, including the latest tokenized US stocks, to be activated as available margin - users can use TSLA.M and NVDA.M as margin to participate in perpetual options strategies for BTC and ETH (further reading: " Liquidity Thoughts on US Stock Tokenization: How to Rebuild On-Chain Trading Logic? "), forming a true cross-market speculation and hedging network. Traditional CEXs find it difficult to provide this kind of combination freedom.

From an industry perspective, on-chain derivatives DEXs such as Hyperliquid and Fufuture are not only about avoiding compliance restrictions, but also about providing a 24/7, borderless trading and settlement network for global commodities.

In particular, new trading mechanisms such as Fufuture, which do not require pre-exchange of stablecoins and can directly open positions by selecting a direction, can maximize the liquidity and strategic space of on-chain assets. Not only is the trading experience close to CEX, but objectively only on-chain derivatives DEX can achieve this. It also has the potential to become the on-chain "pricing power portal" for global assets.

Final Thoughts

The future of exchanges will not be a battle of short-term gains, but a division between those who rewrite global market rules.

One is local compliance, one is offshore gray area, and one will become the cornerstone of decentralized pricing for the next round of global commodities and crypto assets.

There is no middle ground.

At the crossroads of the future, the direction has been determined, and the only thing left is a matter of time.