Original title: "LINK Research Report Interpretation: The Hidden Big Winner in Dollar Tokenization, Where Does the 30-fold Upside Potential Come From?"

Comparative Dimensions Chainlink (LINK) Ripple (XRP) Actual Utility Provides critical infrastructure for 500+ protocols Almost no actual use Institutional adoption Deep integration with SWIFT, JPMorgan Chase, DTCC, etc. Very few institutions actually use Market share 90%+ TVS (Total Oracle Value Spent) Not applicable Market value approximately US$22 billion Approximately US$330 billion If you have been paying attention to the crypto market recently, you must have noticed the strong performance of LINK.

Public data shows that LINK has risen by nearly 30% in the past month; for an old coin with a lukewarm narrative, this performance is quite impressive, and there has been more and more discussion about LINK on social media recently.

However, while most people are still debating whether LINK is just an "oracle token", the world's largest financial institutions, such as JPMorgan Chase, SWIFT, Mastercard and DTCC, have quietly deployed Chainlink at the core of their blockchain strategy.

Recently, the crypto investment institution M31 Capital released a 90-page in-depth research report, making a bold prediction: LINK still has the potential to increase by 20-30 times .

The report believes that the tokenization wave of global financial assets will bring $30 trillion in opportunities, and Chainlink is not one of the participants, but the only infrastructure monopoly in the blockchain middleware field.

TechFlow interpreted and organized the report, selecting key viewpoints and data for easier reading.

(Note: This report and interpretation do not constitute any investment advice. The crypto market is volatile, so please conduct your own research and judgment.)

Core investment logic: Relatively undervalued, "buy" narrative emerges

The report generally believes that LINK represents one of the best risk/reward investment opportunities in the current crypto market. Several core arguments are as follows:

- The main beneficiary of the $30 trillion trend - the global financial system is transforming towards tokenization

- Complete monopoly of on-chain financial middleware - no competitor can provide the same technical reliability and institutional trust

- Misunderstood Asset - Despite unparalleled integration and dominant market share, the market capitalization is far below its strategic value

- Realistic 20-30x upside potential - In comparison, the objectively inferior benchmark asset XRP trades 15x higher than LINK

Specifically, the report explains why LINK is currently undervalued from three aspects.

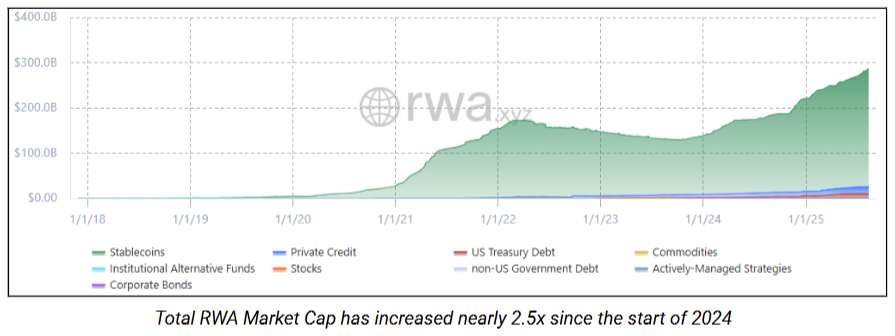

Hidden beneficiaries of the RWA wave

Since 2024, the tokenized real asset (RWA) market has grown 2.5 times . BlackRock's BUIDL tokenized money market fund has reached $2 billion in size; traditional financial giants such as JPMorgan Chase, Goldman Sachs, and Charles Schwab are no longer piloting but actually deploying it.

But how do tokenized U.S. Treasury bonds know the current interest rate? How can on-chain gold tokens verify physical reserves? How can cross-chain asset transfers ensure security and compliance?

They all need Chainlink. The premise of everything is to have a trusted data and interoperability layer.

Business monopoly, but undervalued

Chainlink is a true monopoly in its field:

- $24 trillion+ in on-chain transaction value has been realized through Chainlink

- $85 billion in Total Value Protection (TVS)

- 18 billion+ verification messages

- 50+ blockchain integrations, 500+ application integrations

No competitor offers Chainlink’s combination of technical reliability, product breadth, regulatory compliance capabilities, and institutional trust. Once integrated, it becomes mission-critical infrastructure with high switching costs and self-reinforcing network effects.

In comparison, XRP’s market capitalization is 15 times that of LINK, but its actual value is not even one-tenth of LINK’s.

Narrative reversal

For years, LINK was burdened with a negative narrative of “team dumping.” However, the launch of the LINK reserve mechanism in August 2024 brought about changes.

Previously : Chainlink Labs funded operations by selling tokens, causing continued selling pressure

Now : Hundreds of millions of dollars in corporate revenue are automatically converted into LINK purchases, creating sustained buying pressure.

Coupled with the expectation of more collaborations and more institutional pilots going into production in the next 12-18 months, verifiable on-chain revenue will surge.

The market is still viewing LINK with old eyes, while the fundamentals have fundamentally changed. This cognitive gap is the source of huge investment opportunities.

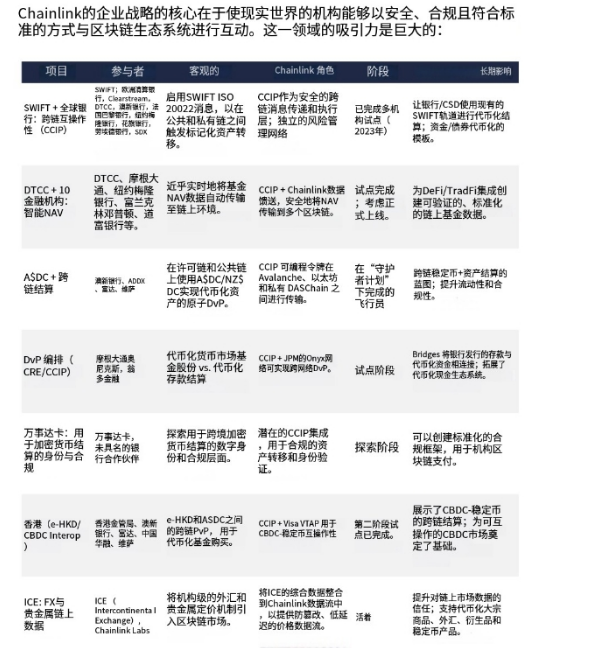

Chainlink Deployment Map of Global Financial Giants

The report also lists some key collaboration use cases, especially among traditional financial giants.

- SWIFT: November 2024, using Chainlink CCIP to enable traditional SWIFT messages to trigger on-chain token operations

- Participating institutions include: ANZ, BNP Paribas, Bank of New York Mellon, Citi, Clearstream, Euroclear, Lloyds Bank, etc.; Successfully simulated the transfer of tokenized assets between public and private chains

- JPMorgan Kinexys: In June 2025, JPMorgan's blockchain division Kinexys and Ondo Finance completed the first cross-chain delivery-versus-payment (DvP) settlement

- Chainlink's role: CRE (Enterprise Runtime Environment) coordinates workflows, and CCIP ensures cross-chain messaging security.

- White House endorsement, technical and policy endorsement:

- Founder Sergey Nazarov was invited to attend the White House Crypto Summit and had direct dialogue with the president and cabinet officials.

- White House Digital Asset Report - Chainlink Officially Recognized as Core Infrastructure for the Digital Asset Ecosystem

- Chainlink Releases Detailed Plans for 10+ Federal Blockchain Use Cases

Crucially, these aren’t isolated experiments; each successful pilot represents a use case. ChainLink is present in all of these use cases, though it may not be front and center.

(Chainlink typical enterprise cooperation case, AI translation)

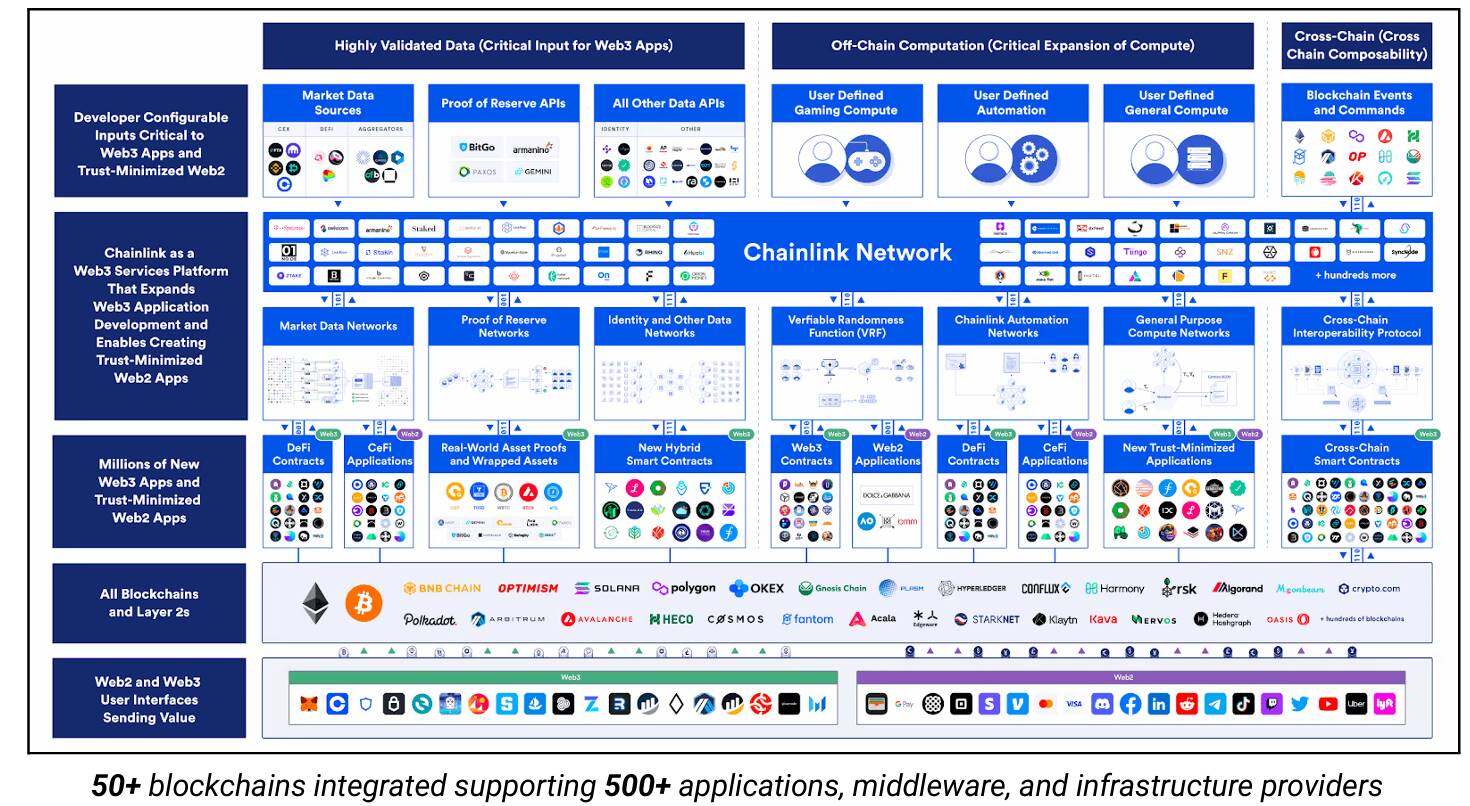

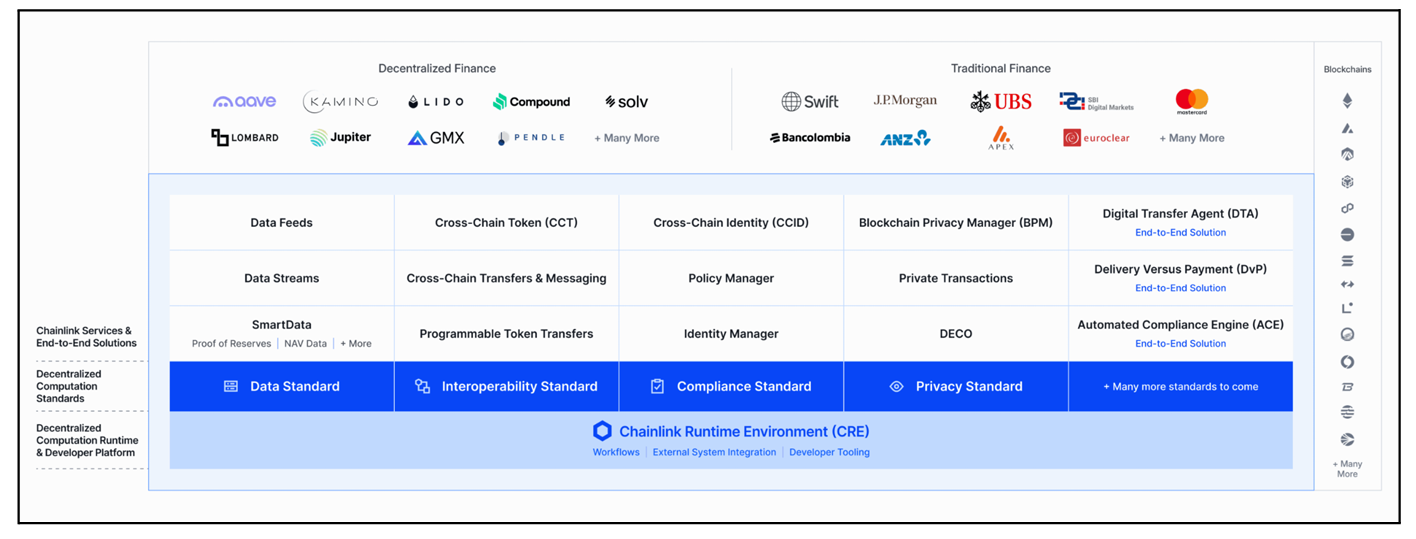

Not just oracles, but also the monopoly of middleware

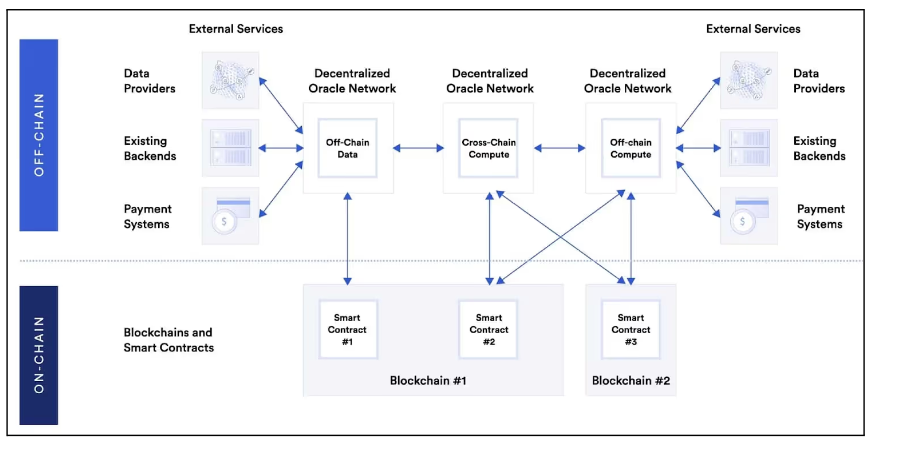

Many people still think of Chainlink as a price oracle. In reality, Chainlink has built a complete blockchain middleware ecosystem, becoming an indispensable bridge between blockchain and the real world.

Its products cover five key areas:

- Data

- Providing market data streams (such as price feeds), Proof-of-Reserve, Verifiable Randomness, and ultra-low latency data streaming.

- These features ensure that blockchain applications can reliably access off-chain data and support a variety of scenarios such as financial applications, games, and insurance.

- Compute

- Provides off-chain computing capabilities (such as complex calculations implemented through Functions) and event-driven automation capabilities.

- This enables the blockchain to process complex logic and calculations without excessively consuming on-chain resources.

- Cross-Chain Interoperability

- Provide CCIP (Cross-Chain Interoperability Protocol) and support multi-network risk management.

- CCIP enables the secure transmission of assets and data between different blockchains, solving the problem of cross-chain communication.

- Compliance

- Provides an Automated Compliance Engine (ACE) for programmatically enforcing compliance requirements based on jurisdictional rules.

- This is particularly important for institutional users to help them meet regulatory requirements.

- Enterprise Integration Layer

- Provides the Chainlink Runtime Environment (CRE) for coordinating workflows between private and public chains.

- CRE helps enterprises achieve seamless integration of blockchain and traditional systems, reducing friction and risk.

These are not standalone products, but a system that works together. When SWIFT uses Chainlink, they are not just using an oracle, but tapping into an entire infrastructure.

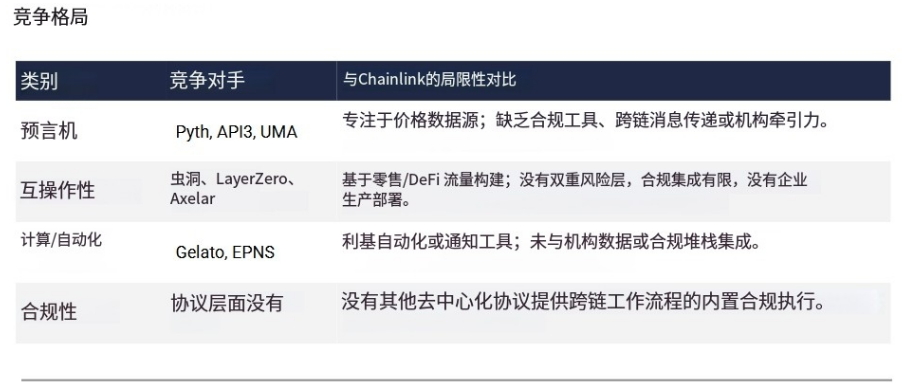

The competitive advantage here is that other market players typically only cover one or two areas, while Chainlink is the only solution that covers all key areas.

The benefit of using ChainLink for institutions is that they can use it as the only integration point, significantly reducing integration friction and risk.

This full-stack capability, combined with years of accumulated security records and institutional trust, creates a technological moat that is almost impossible to replicate.

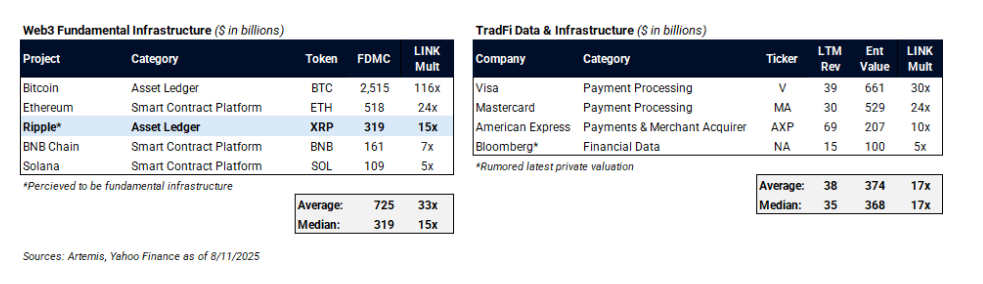

What is the reasonable valuation of LINK?

Now we come to the most critical question: How much is LINK worth?

The report uses several independent valuation methodologies, all of which point to similar conclusions.

Method 1: Comparison with XRP, relative valuation method

Take XRP as an example. This "bankcoin" created in 2012 has yet to realize its promised use case and has almost no real institutional adoption, yet it has a fully diluted market capitalization of $330 billion.

In contrast, Chainlink has been adopted by the world's top financial institutions, but its market capitalization is only 1/15 of XRP.

Assuming LINK is at least as valuable as XRP, XRP’s current market capitalization is 15 times that of LINK, presenting an attractive risk/reward opportunity for investors.

If Chainlink’s significantly superior fundamentals are considered, LINK’s valuation is more appropriately compared to traditional financial companies like Visa and Mastercard, which have similar positioning in the payment processing and data infrastructure sectors.

Comparing with the market capitalization of these companies, LINK has a 20-30 times growth potential .

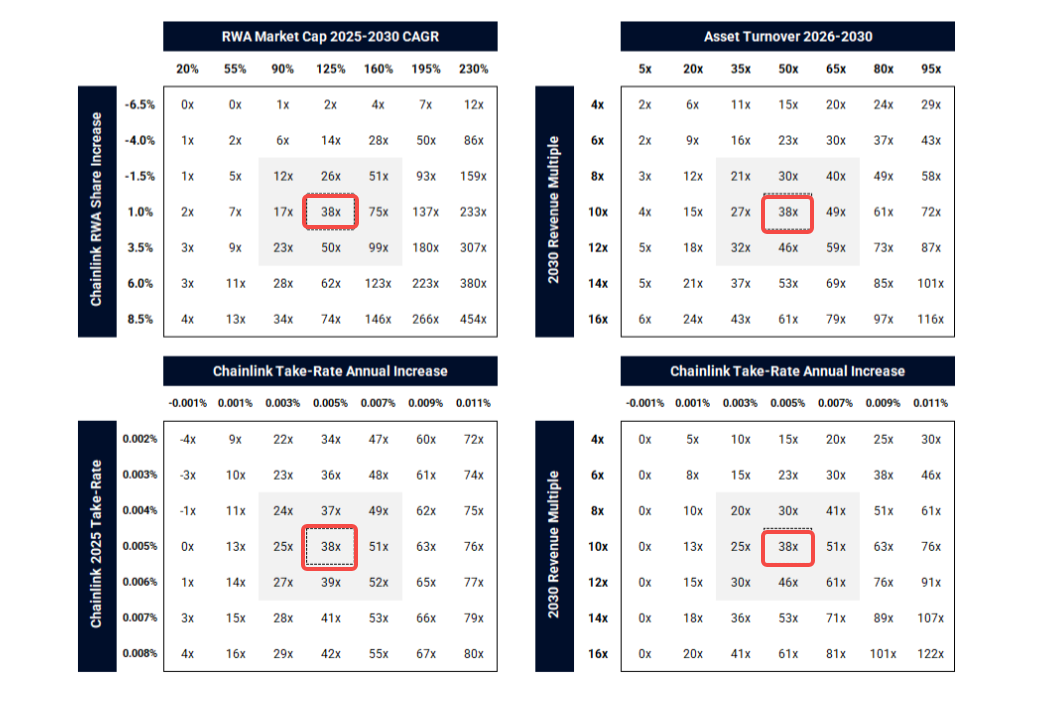

Method 2: Traditional company logic, market share method

By 2030, approximately $19 trillion in real-world assets will be tokenized globally.

As the "data pipeline" and "cross-chain bridge" for these assets, Chainlink is expected to obtain 40% of the market share, serving approximately US$7.6 trillion in tokenized assets.

These assets will enable Chainlink to process approximately $380 trillion in transaction volume annually. Based on gradually increasing fees (currently 0.005% per transaction), Chainlink’s annual revenue could reach $82.4 billion by 2030.

With annual revenue of $82.4 billion, Chainlink's enterprise value is approximately $824 billion, calculated at a price-to-sales ratio (PS) of 10.

Assuming the total supply of LINK remains at around 1 billion, the network value of $824 billion means the theoretical value of each LINK is approximately $824. The current price is only around $22, which means there is still about 38 times of room for growth.

Of course, this 38 times is a theoretical valuation in the translator's view, and any change in assumptions will have significant consequences.

Near-term catalysts (Q3/Q4)

LINK Reserve Mechanism

For years, Chainlink has driven industry growth by heavily subsidizing its services, but this has also obscured its profit potential, forcing Chainlink Labs to maintain operations through token sales. The newly introduced LINK Reserve mechanism will completely change this situation:

- The flow of funds is reversed, and hundreds of millions of dollars of off-chain corporate income each year will be automatically used to repurchase LINK in the market

- Market pressure shifts from sustained selling pressure to net buying pressure

- Let everyone confirm ChainLink's enterprise-level profit potential

Data service extension

- Data Streams covers traditional financial assets : On August 4, it officially supports real-time pricing of US stocks and ETFs, providing data support for tokenized funds, synthetic assets, and on-chain structured products.

- ICE Partnership : Announced on August 11, the integration of Intercontinental Exchange’s comprehensive foreign exchange and precious metals data streams provides key support for institutional-grade on-chain pricing

- CCIP landed on Solana : CCIP was launched on the Solana mainnet in May, enabling cross-ecosystem settlement and messaging between EVM and SVM environments.

Product function upgrade: Privacy and staking returns require special attention

Privacy and permissioning features, including CCIP private transactions, meeting the confidentiality requirements of cross-chain bank transactions, and Chainlink Privacy Manager, ensuring that sensitive data is not leaked to the public chain.

Privacy and security are also prerequisites for banks to use ChainLink and move from pilot projects to production.

Staking v 0.2 and fee distribution are now live, supporting staking for more service types.

After future upgrades, user fees will be directly rewarded to stakers; as data flow and CCIP transaction volume grow, staking returns will increase significantly.

This is somewhat similar to Ethereum's merged staking returns, but based on real enterprise-level revenue.

in conclusion

Chainlink offers one of the most asymmetric risk-reward profiles in all of financial markets.

No competitor can match Chainlink's breadth of integrations, technical reliability, regulatory compliance, and institutional trust. High-profile pilot projects will expand into production over the next 12 to 18 months. Each integration deepens its moat through high switching costs, network effects, and entrenched compliance processes.

Financially, Chainlink offers diversified, recurring, and scalable revenue streams, including CCIP transaction fees, institutional data subscriptions, Proof of Reserves certification, and automation services, creating a durable growth engine directly tied to the adoption of tokenized assets. With global tokenization projected to reach tens of trillions of dollars, the addressable market is enormous and underpenetrated.

Despite these fundamental strengths, LINK remains a mispriced asset, valued more like a speculative project than a monopolistic financial infrastructure provider.

As the tokenized economy matures and Chainlink integrations move into production, the market will be forced to significantly revalue LINK to reflect its systemic importance, revenue potential, and irreplaceable role in the global financial system.

- 核心观点:LINK是美元代币化浪潮核心受益者。

- 关键要素:

- 垄断预言机市场,TVS达850亿美元。

- 获摩根大通、SWIFT等顶级机构深度集成。

- 储备机制逆转,创造持续买盘压力。

- 市场影响:或推动LINK价值重估,提振市场信心。

- 时效性标注:中期影响。