BitMart Launches New Contract Function, Bringing Zero-Slippage Trading Experience

- 核心观点:BitMart推出创新合约功能解决滑点问题。

- 关键要素:

- 保证止盈止损功能实现0滑点交易。

- 市价单滑点限制功能控制价格波动风险。

- 日均合约交易量超3000亿美元,滑点损失显著。

- 市场影响:提升交易安全性和用户体验。

- 时效性标注:中期影响。

In the current cryptocurrency market, contract trading has become a crucial way for users to earn high returns. With the increasing volatility of major cryptocurrencies like Bitcoin and Ethereum, opportunities for contract trading have become more frequent. However, while high leverage offers lucrative profit potential, it also carries significant risks. Slippage, especially in highly volatile markets, has become a major pain point for traders.

The latest data from Coinglass shows that global average daily contract trading volume has stabilized at $300 billion, peaking at nearly $500 billion, with the total value of open interest exceeding $100 billion. It is estimated that even an average slippage rate of 0.001% would consume $3 million in user assets daily.

“When prices fluctuate rapidly, what users need most is not ex post compensation, but ex ante defense mechanisms.”

To address this pain point, BitMart, a leading global cryptocurrency trading platform, recently launched two innovative contract features: guaranteed stop-loss and take-profit, and market order slippage limits. These features aim to provide users with a more stable and accurate trading experience. These features not only effectively address the issue of slippage but also further enhance users' risk management capabilities.

The iron law of price guarantees the absolute defense line of stop-profit and stop-loss

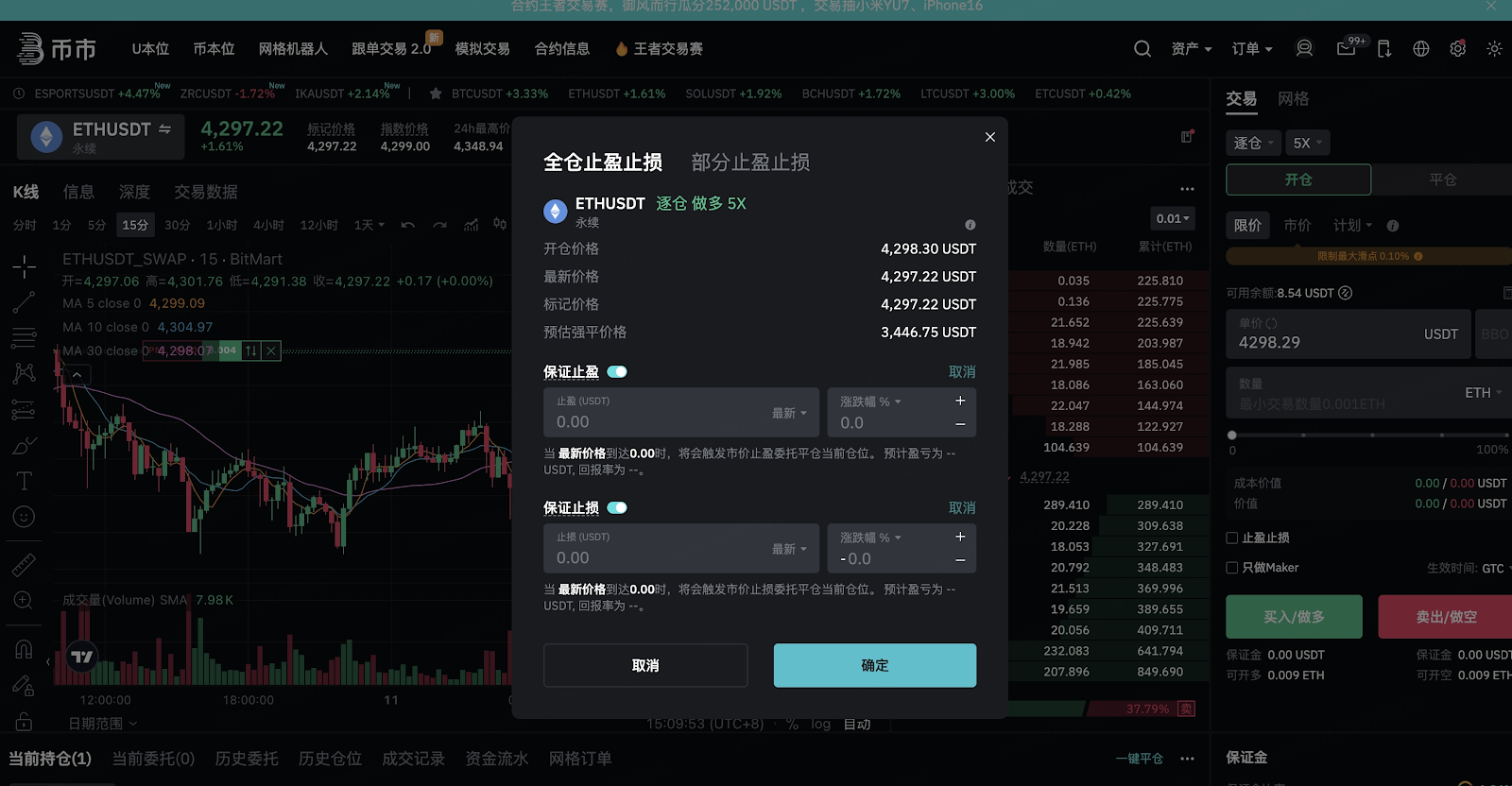

In traditional contract trading, stop-loss and take-profit orders often cannot be accurately executed due to excessive market volatility or insufficient liquidity, which can lead to unnecessary risks for users. BitMart's guaranteed stop-loss and take-profit functions are designed to meet the needs of users in extreme market conditions, ensuring that users' trading plans are executed as expected.

Key advantages:

1. Accurate execution, zero slippage experience: The system will strictly execute closing according to the price set by the user, avoiding slippage problems caused by fluctuations and achieving a precise trading experience with zero slippage;

2. Guaranteed take-profit, guaranteed returns, guaranteed stop-loss, and risk control: For take-profit orders, the platform promises to execute at a price equal to or better than the set trigger price, ensuring that users can take profits at the desired price and avoiding slippage that could impact their returns, all completely free of charge. For stop-loss orders, the platform will also strictly execute them at the set stop-loss trigger price to prevent additional losses from slippage.

3. Flexible Settings and Convenient Operation: Users can easily enable the guaranteed stop-loss and take-profit function in the "Take Profit and Stop Loss" pop-up window on the position page, allowing for customized settings for all or part of a position. Once configured, the system will execute at the set trigger price. Currently, this feature supports BTC/USDT and ETH/USDT trading pairs.

Accurate price control to comprehensively improve transaction execution accuracy

In addition to guaranteed stop-loss and take-profit functionality, BitMart has also introduced a slippage limit feature for market orders. This innovative feature allows users to intelligently control the execution price range of their market orders by presetting a maximum slippage threshold (e.g., 0.1%).

Key highlights:

1. Limit slippage to ensure price control: Based on the maximum slippage threshold set by the user, the system strictly controls the upper and lower limits of the execution price of buy/sell orders, ensuring that the order price is as close as possible to market expectations and avoiding adverse effects caused by price fluctuations;

2. Risk pre-management and automatic avoidance of abnormal slippage: Through settings, abnormal slippage caused by insufficient liquidity or sudden market fluctuations can be automatically avoided;

3. Widely applicable, supporting multi-scenario trading: This function is applicable to all contract market orders and market orders after conditional orders are triggered. It is particularly suitable for large traders and programmatic trading strategies, providing controllable execution prices for high-frequency trading.

From prevention and control to assurance, BitMart enters a new era of contract risk control

From the three major contract plans to the second phase of the Slippage Protection Plan, the compensation threshold has been reduced to 0.02%. These measures, together with the newly launched guaranteed stop-loss and guaranteed profit take-profit functions and the market order slippage limit function, constitute a complete risk management framework - a three-level protection system of "pre-emptive prevention and control, in-process monitoring, and post-event compensation."

Clearly, through precise stop-loss and take-profit execution and strict slippage control, BitMart has achieved technically accurate and stable trading, strengthening users' risk management capabilities. In a volatile market, these innovative features not only improve trading efficiency but also provide users with strong psychological protection, ensuring the security and predictability of their transactions.

Going forward, BitMart will continue to innovate, optimizing existing features and launching more advanced trading tools to adapt to ever-changing market demands and technological advancements. Whether for novice traders or experienced high-frequency traders, BitMart aims to provide a stable, secure, and efficient trading platform, helping users maximize profits in the complex crypto market.

About BitMart

BitMart is a leading global digital asset trading platform with over 12 million users worldwide. Consistently ranked among the top exchanges on Coingecko, BitMart offers over 1,700 trading currencies with competitive fees. BitMart is committed to continuous innovation and financial inclusion, providing a seamless trading experience for users worldwide. To learn more about BitMart, visit the website , follow X on Twitter , or join our Telegram channel for updates, news, and promotions. Download the BitMart app to trade anytime, anywhere.

Risk Warning:

The following information is for informational purposes only and should not be considered a recommendation to buy, sell, or hold any financial asset. All information is provided in good faith. However, we make no representations or warranties, express or implied, as to the accuracy, adequacy, validity, reliability, availability, or completeness of such information.

All cryptocurrency investments (including returns) are inherently highly speculative and carry a significant risk of loss. Past performance, hypothetical results, or simulated data are not necessarily indicative of future results. The value of digital currencies may rise or fall, and buying, selling, holding, or trading digital currencies may involve significant risks. Before trading or holding digital currencies, you should carefully evaluate whether such investments are suitable based on your investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice.