Robinhood vs. Coinbase: A $160 Billion Battle

- 核心观点:Robinhood与Coinbase展开金融未来实验。

- 关键要素:

- Robinhood主打低费用简易交易。

- Coinbase专注加密基础设施。

- 两者市值均达800亿美元。

- 市场影响:重塑金融与加密市场格局。

- 时效性标注:长期影响。

Original author: Thejaswini MA

Original Source: thetokendispatch

Original translation: Vernacular Blockchain

There's a war going on in your pocket, and most people don't even realize it.

Two major US financial apps—Robinhood and Coinbase—are conducting diametrically opposed experiments on millions of users. Robinhood ranks 14th in the App Store's Finance category, while Coinbase ranks 20th. Both have a market capitalization of approximately $80 billion. Each is targeting young investors, but they believe the other's approach is completely flawed.

Both experiments were successful to some extent.

The Essence of Robinhood and Coinbase

The two companies are not competitors in the traditional sense, but rather conducting different experiments on the same subjects (us).

Robinhood saw the pain points of finance and asked, "What if we fixed all the annoying parts?" They offer 15 cryptocurrencies, commission-free trading, and an interface that lets you buy Tesla stock without a finance degree. The idea is: You don't need to know how sausage is made to enjoy a hot dog.

Coinbase takes the opposite approach, asking, "What if we rebuilt the entire financial system on blockchain technology?" While charging higher fees than competitors like Robinhood, Coinbase offers a platform for users who want comprehensive access to the crypto ecosystem, offering access to over 260 cryptocurrencies. They're betting that traditional finance will eventually migrate to blockchain and hope to become the infrastructure for this transformation.

Coinbase CEO Brian Armstrong said: "In the next five to 10 years, our goal is to become the world's leading financial services application because we believe that cryptocurrency is eating financial services and we are the number one crypto company. All asset classes - money market funds, real estate, securities, debt - will be on the blockchain."

The two companies went public a few months apart in 2021, each with a market capitalization of $80 billion. Both target young, mobile-first investors, but their products seem designed for different species.

This is not a war for dominance, but a race to serve a different financial future.

The race to expand crypto products

Both companies are accelerating the expansion of their encryption products, but in very different ways.

Robinhood's recent announcements suggest they're attempting to directly outmaneuver Coinbase. In June, they launched Robinhood Chain, their own Layer-2 network, supporting tokenized stocks and cryptocurrencies, with future support for assets raised by SpaceX and OpenAI. European users can now trade tokenized US stocks 24/7, not just during market hours. This represents the 24/7 trading model crypto users have come to expect, now applied to traditional assets.

They also launched crypto staking for ETH and SOL, acquired Bitstamp, Europe's oldest crypto trading platform, for $200 million, and plan to launch crypto perpetual futures for European users. Their crypto infrastructure seamlessly integrates with the existing stock trading experience, rather than simply grafting crypto functionality onto traditional brokerage services.

All of this—the chain, the tokenized shares, the low fees—is designed for the next generation of investors who will inherit trillions of dollars in wealth.

Amid the fee war, Robinhood crypto trading fees are around 40 basis points (0.4%), while equivalent trades on Coinbase can be as high as 1.4% or higher. Buying $1,000 in Bitcoin costs Robinhood around $4, while Coinbase charges over $14.

Robinhood makes money through payment for order flow, where market makers pay fees for executing retail trades, similar to its stock trading model. This established model allows them to offer “free” trades and still make money.

But Coinbase offers something Robinhood can't match: true cryptocurrency ownership. On Robinhood, you buy a cryptocurrency "IOU," which is simply a receipt that Robinhood owes you the crypto. You can't transfer your Bitcoin to your own wallet or use it elsewhere; you can only buy and sell within the Robinhood app. You can't participate in DeFi, stake most tokens, or use cryptocurrency for anything other than buying and selling.

For most people, this doesn’t matter; they just want cryptocurrency exposure, not utility. But for users who want to conduct sophisticated crypto operations, Coinbase is the only realistic option among the major US platforms.

Q2 Financial Report Analysis

This summer's financial reports revealed the effectiveness of both approaches.

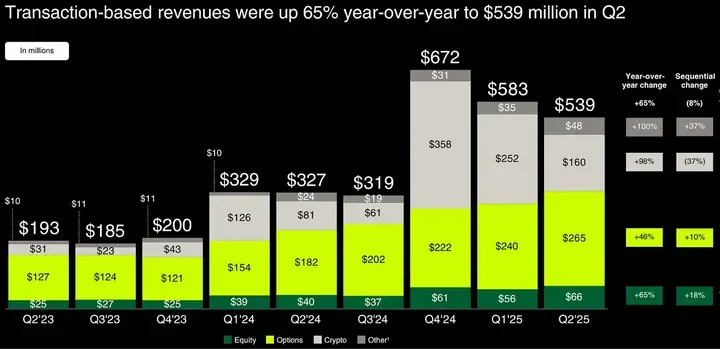

Robinhood performed exceptionally well. Total revenue increased 45% year-over-year to $989 million. Crypto revenue surged 98% to $160 million (from 10% of total revenue last year to 16% this quarter), despite a relatively flat overall crypto market. Robinhood boasts 26.5 million active accounts and $279 billion in assets under management, a 99% year-over-year increase. The acquisition of Bitstamp added approximately 520,000 crypto users, generating $7 billion in notional crypto trading volume following the June acquisition.

Platform assets reached $279 billion, a 99% year-over-year increase, with net deposits of $13.8 billion. Active accounts grew 10% to 26.5 million, and cash balances surged 56% to $32.7 billion, demonstrating a strengthening of client wallet share.

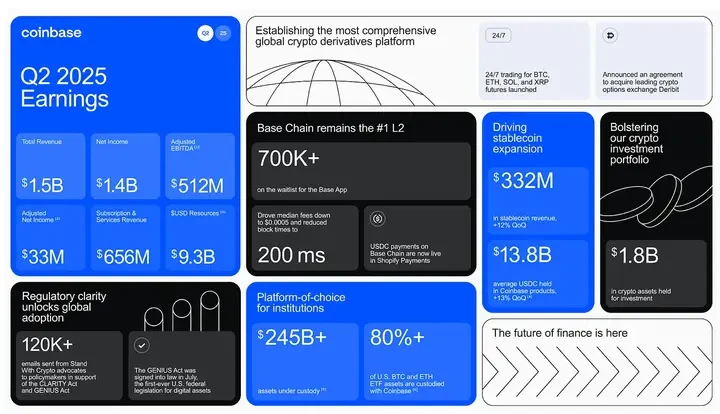

Coinbase experienced a difficult quarter. Total revenue fell 26% from Q1 to $1.5 billion, missing analyst expectations. Trading revenue fell 39% due to a decline in retail trading. The stock price fell 16% on earnings day, as investors tried to determine whether this was a temporary downturn or a sign of a high-fee model.

But calling the quarter a failure misses the full picture. Coinbase achieved $1.4 billion in net income, exceeding $512 million in adjusted EBITDA, primarily due to $1.5 billion in unrealized gains on its portfolio and strategic crypto asset holdings. Even excluding these one-time gains, adjusted net income still stood at $33 million, demonstrating actual profitability.

The increase in operating expenses was primarily due to a one-time $307 million loss from the May data breach. Core costs (technology, administration, and marketing) actually decreased, demonstrating cost control. USDC stablecoin revenue reached $332 million, with average balances increasing by 13%. Assets under custody reached a record high of $245.7 billion. Prime Financing (institutional financing), part of Coinbase Prime, also reached a new high. This offering provides custody, trading, lending, and financing services to hedge funds, family offices, and others.

Coinbase continues to launch new products: new derivatives, expansion of the Base chain, and the launch of the Coinbase One Card. Despite the decline in revenue, the foundation remains solid.

Coinbase's Infrastructure Empire

Coinbase's infrastructure strategy is more complex. They hold $245.7 billion in institutional assets under custody, representing a significant share of the institutional crypto market. When you buy a Bitcoin ETF through your 401k, it's likely using Coinbase infrastructure.

Coinbase is the primary custodian for over 80% of US Bitcoin and Ethereum ETFs, managing approximately $113.4 billion (out of the $140 billion in total crypto ETF assets). When BlackRock's IBIT or Fidelity's FBTC need to store billions of Bitcoin, they turn to Coinbase. When PayPal launches its PYUSD stablecoin or JPMorgan Chase needs crypto payment rails, they also use Coinbase's backend.

Coinbase boasts over 240 institutional clients, over 420 liquidity providers, and regulatory approvals unmatched by most competitors. Its custody business is chartered by the New York State Department of Financial Services, a multi-year regulatory approval process that is difficult for competitors to replicate.

Their "all-in-one exchange" strategy is beginning to bear fruit. They launched perpetual futures with up to 10x leverage, bringing derivatives trading, previously only available on overseas exchanges, to US retail users. They also integrated their decentralized exchange directly into their app, allowing users to trade Ethereum or any token on Coinbase without leaving the platform.

Its Base layer-2 network processed over 54,000 token issuances in a single day, surpassing Solana. Base’s real strength lies in its integration with Coinbase’s other businesses: ETF providers can use it for instant settlement, businesses can directly tokenize assets, and retail users can access institutional-grade infrastructure.

Robinhood's generational takeover

While Coinbase builds the infrastructure for institutions, Robinhood executes the smartest long-term strategy in finance: capturing young people before they get rich.

A similar strategy brought success to Disney. In the early 20th century, Disney captivated children through animation and theme parks, building an emotional bond before they had money. When those children grew up and earned money, their loyalty translated into spending on movies, merchandise, streaming services, and vacations, creating a multi-generational cash machine.

Robinhood's dominance among young investors should worry traditional brokers:

About 50% of customers are millennials, 25% are Generation Z, and 20% are Generation X.

The average Robinhood user starts investing between the ages of 19 and 22, significantly lower than the average age of millennials in their 20s and baby boomers in their 30s on other platforms.

Robinhood guides new users to complete their first sell order quickly, not to encourage frequent trading, but because locking in actual profits (even if it is only $50) creates an emotional hook that keeps users coming back.

Its "All Finance" expansion aligns with this logic. Robinhood Gold (a $5 monthly subscription) includes a 3% cash-back credit card, high-yield savings, retirement matching, and margin discounts. Gold subscribers grew 60% year-over-year to 2 million. These users use Robinhood for banking, credit cards, and retirement.

The platform currently holds $279 billion in assets under custody, targeting the $84-124 trillion "mega-transfer" of wealth from baby boomers to younger generations over the next 20 years. Robinhood is betting that by establishing user habits early on, it can avoid predicting wealth succession patterns and simply take advantage of them when they arrive.

Who is winning?

The two companies have similar market capitalizations: Robinhood at $81 billion and Coinbase at $85 billion. Year-to-date, Robinhood's stock is up 135%, while Coinbase's is up just 30%, with much of that gain coming in the past month.

Bank of America analyst Craig Siegenthaler recently raised Robinhood's target price to $119 and lowered Coinbase's from $383 to $369, citing: "Robinhood's crypto revenue has surged, while Coinbase is overly dependent on volatile altcoin trading that retail users are abandoning."

Coinbase's global market share fell from 5.65% to 4.56%, recovering slightly in July. Kraken's US market share has grown most significantly this year. Coinbase faces a dilemma: lower fees and hurt profit margins, or maintain high fees and risk losing traders. They chose profit margins by adding fees to previously free stablecoin trades, while Robinhood's fees are approximately 50% lower.

Mizuho reiterated its $120 price target after meeting with Robinhood CEO Vlad Tenev, praising the company's crypto resilience and aggressive push into tokenized equities. They stated, "The European tokenized equity opportunity, expansion into upstream and teen markets, 15% of net deposits coming from competitors, focus on NPS and execution, and crypto price inelasticity are impressive."

But Coinbase has institutional credibility. While other exchanges compete for trading fees, Coinbase has relationships with the institutions that will shape the integration of crypto and traditional finance over the next decade.

Neither company is going away. They serve different user needs, and both are growing. This isn't a winner-take-all competition, but more of a market segmentation: Robinhood for mainstream finance, Coinbase for crypto infrastructure.

This reveals two competing theories about how people will interact with money in the future:

Robinhood believes that the future of finance will be "invisible", abstract, simple, and integrated into lifestyle applications, with finance becoming part of the environment.

Coinbase is betting on earning trust through architecture.

There's no right or wrong in either approach, they just have different goals: one pursues simplicity and trust, while the other builds the underlying architecture.