Can Trump's USD1 remain stable if it is de-anchored before large-scale adoption?

- 核心观点:USD1因Launchpad活动抛压短暂脱锚。

- 关键要素:

- Gate交易所IKA活动致2亿美元USD1集中抛售。

- USD1流通量仅21.9亿,抗压能力不足。

- 特朗普家族背书未解决机制脆弱性。

- 市场影响:暴露中小稳定币流动性风险。

- 时效性标注:短期影响。

Original | Odaily Planet Daily ( @OdailyChina )

Author | Dingdang ( @XiaMiPP )

At 6:00 PM on July 29th, the USD1 stablecoin experienced a brief decoupling, falling to a low of 0.9934 USDT, deviating from its 1:1 USDT peg. Subsequently, the USD1 price gradually recovered and has now stabilized at 0.9984 USDT. This brief fluctuation has attracted market attention.

The truth behind USD1 depegging

Based on current community discussions and speculation, the direct trigger for this depegging incident may be closely related to the IKA Launchpad event launched by Gate Exchange on July 26th. The event offered a total of 200 million IKA tokens for subscription, with users able to participate using either USD1 or Gate's native token, GT. The subscription price was set at 1 IKA = 0.001424 GT = 0.025 USD1. According to official Gate data, as of July 28th, subscriptions for the USD1 pool alone had exceeded $200 million. This massive subscription volume demonstrates market enthusiasm for the IKA project, but it may also sow the seeds for selling pressure on USD1.

We note that the IKA subscription event officially ended at 1:00 PM on July 29th. Based on price trends, USD1's initial decline began shortly thereafter and continued until around 6:00 PM that same day. This timeline closely matches the depegging event, further confirming the possibility of a surge in selling pressure due to capital outflows after the event. Some participants may have quickly cashed out their USD1 after the subscription was completed, leading to a concentrated sell-off.

USD1, issued by World Liberty Financial (WLFI), is officially positioned as a "low-volatility digital asset option." Its goal is to provide users with a stable medium for cryptoasset transactions through a 1:1 USD peg. According to its white paper and audit report, USD1's reserve assets primarily consist of U.S. Treasury bonds and U.S. dollar deposits, theoretically ensuring strong redemption and price anchoring.

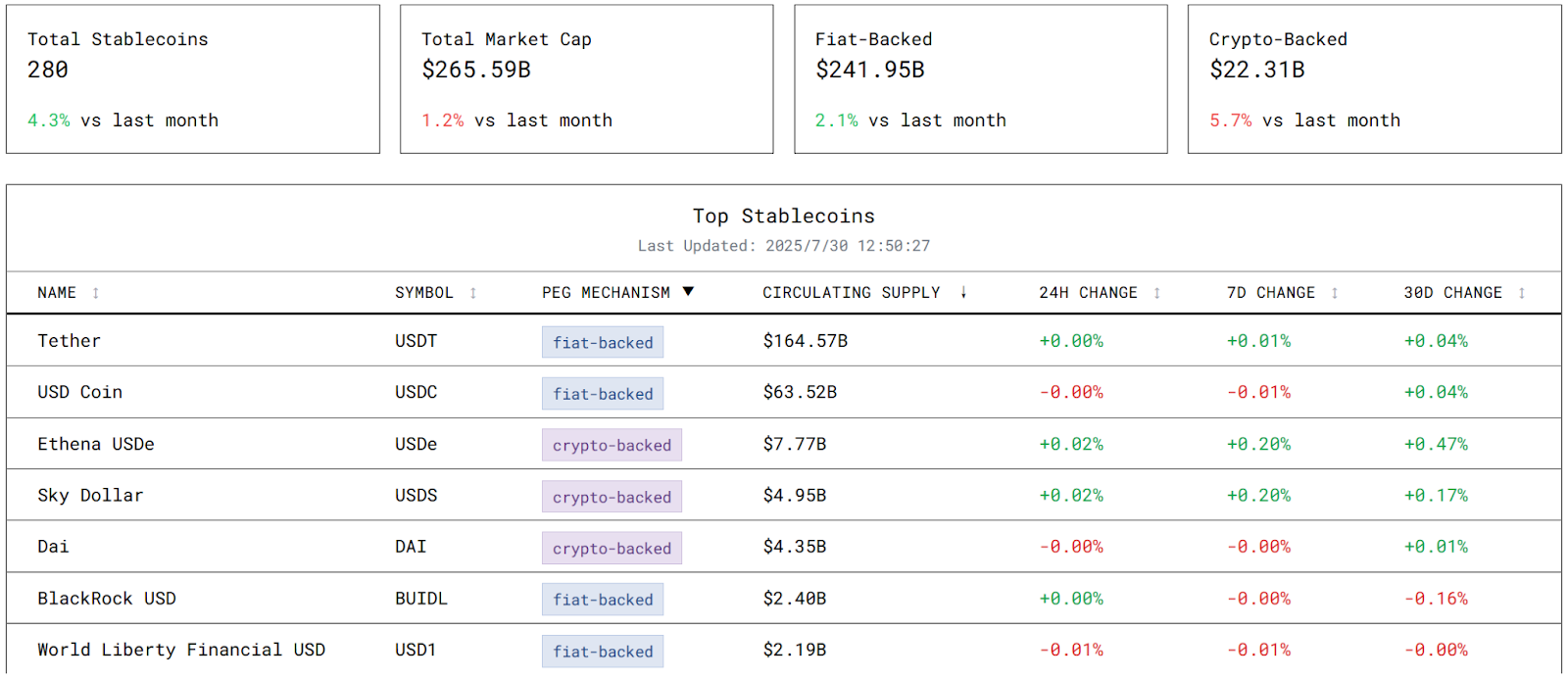

However, from a broader perspective, this unpegging exposes the vulnerability of small and medium-sized stablecoins to high-intensity capital movements . According to data from stablecoins.asxn.xyz , the current stablecoin market has reached $265.59 billion, with USDT leading the way with $164.57 billion. USD1, on the other hand, has a mere $2.19 billion in circulation, representing approximately 1.3%. In absolute terms, this market size is insufficient to sustain large-scale adoption, let alone the sudden influx and subsequent withdrawal of $200 million in subscription funds. For USD1, this is not just a real-world test, but more of a passive stress test.

Backed by Trump, resource advantages are beginning to emerge

While USD1 experienced a brief depegging during this incident, it also demonstrates its advantages in terms of market resources. Unlike traditional stablecoins, which rely on the self-sustaining growth of an on-chain ecosystem, USD1 not only has the financial resources of World Liberty Financial but also the political and financial backing of the Trump family. This has enabled USD1 to quickly enter the fundraising, transaction settlement, and launchpad processes of several crypto projects, making it a "strategic stablecoin" that more and more platforms are willing to guide their users towards.

However, having a strong backer doesn't guarantee a secure future. The lessons learned from the IKA Launchpad depegging incident clearly demonstrate that market recognition of resource background cannot replace verification of the security of the mechanism . As USD1 becomes a key entry point for crypto applications, its inherent resilience, liquidity design, and user confidence mechanisms will be the key factors determining its long-term success.

Especially when faced with a liquidity shock of hundreds of millions of dollars in a short period of time, the issues exposed by USD1 deserve WLFI's high attention. The Trump family's political aura can bring repeated attention dividends, but only by converting this attention into use cases and accumulating these use cases into ecological inertia can USD1 grow from an empowered chip to a powerful player in the stablecoin landscape.