The Risk Dilemma Behind Ethereum’s Treasury

- 核心观点:以太坊财库需平衡流动性风险与收益优化。

- 关键要素:

- 质押ETH流动性受限,解锁需排队数日。

- 再质押等策略面临智能合约安全风险。

- 企业以太坊持仓激增,BMNR目标质押5%供应量。

- 市场影响:推动ETH需求增长,价格或创新高。

- 时效性标注:中期影响。

Original author: James Rubin

Original translation: Saoirse, Foresight News

Wall Street investment bank Bernstein pointed out in a report on Monday that there are significant differences between Ethereum Treasury and Bitcoin Treasury in asset management: Ethereum Treasury obtains income through staking, but this process is accompanied by risks such as limited liquidity and smart contract security. Companies need to find a balance within the limitations of capital deployment.

Analysts believe that these factors are key considerations for companies when balancing the liquidity of Ethereum assets with "revenue optimization."

Analysts noted, "If Ethereum treasuries stake ETH for yield, while the staking contracts are generally liquid, unlocking them can sometimes require waiting days. Therefore, Ethereum treasury companies must strike a balance between ETH liquidity and yield optimization. Furthermore, more complex yield optimization strategies, such as re-staking (such as the Eigenlayer re-staking model) and DeFi-based yield generation, must also address smart contract security risk management."

Bernstein added: “The advantage of the Ethereum treasury model is that staking income can bring actual cash flow to operations, but liquidity risks and security issues still need to be paid attention to.”

Staking is the process of pledging tokens to a network to support its operations. Proof-of-Stake networks like Ethereum and Solana differ from Proof-of-Work systems like Bitcoin, which rely on resource-intensive mining operations.

Currently, more and more companies are starting to build Ethereum treasuries. Bernstein mentioned that Ethereum-related companies including SharpLink Gaming (SBET), Bit Digital (BTBT), and BitMine Immersion (BMNR) had accumulated 876,000 ETH in July.

Last week, BMNR’s Ethereum holdings surpassed $2 billion, and the company stated its goal to hold and stake 5% of the total Ethereum supply. SharpLink holds over $1.3 billion worth of ETH.

"Driven by the digital dollar and tokenized assets, the growth of the internet finance economy will drive the expansion of transactions and users within the Ethereum ecosystem (including the Layer 2 chains operated by platforms like Coinbase and Robinhood). As the underlying native asset, Ethereum is expected to realize increased value from this growth through staking income generated by transaction fees and its token buyback and burn mechanism."

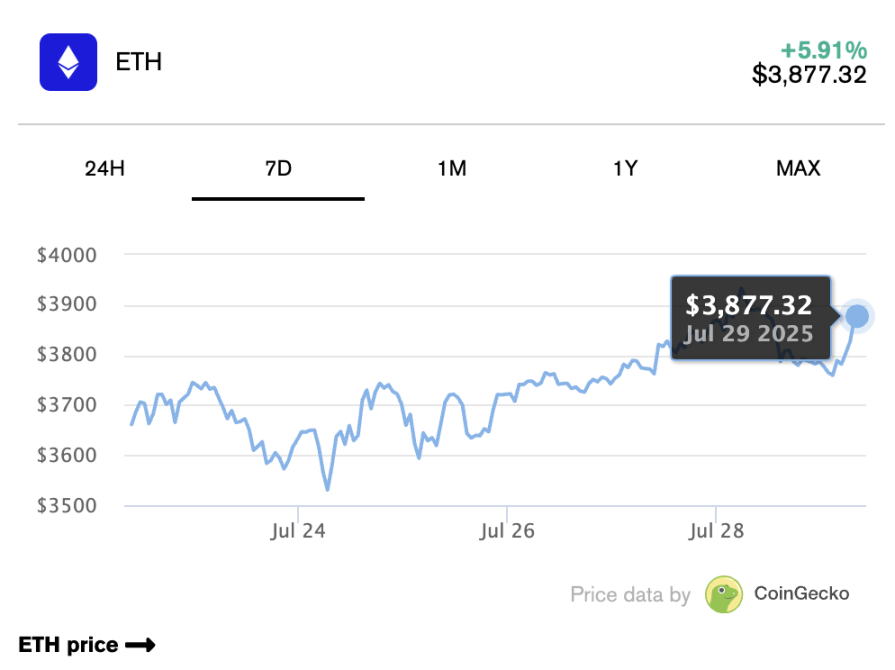

Ethereum briefly surpassed $3,900 during trading on Monday, reaching its highest level since early December, before retreating. Over the past month, the asset has surged over 50%, a rise closely tied to the rise of the Ethereum Treasury, the improved Ethereum ecosystem following the passage of the GENIUS Act, and market recognition of its potential.

Many analysts predict that ETH may break through its previous historical high of $4,800 this year. BitMEX founder Arthur Hayes even recently predicted that ETH will reach $10,000 this year.

Tom Lee, chairman of BitMine Immersion, stated in a report on social media platform X that based on the replacement value provided by research analysts, ETH could reach 18 times its current price, or approximately $60,000. Of course, as a company holding shares, BitMine's predictions are inevitably biased.

The Ethereum Treasury model draws on the experience of Strategy (formerly MicroStrategy). After years of poor performance and a depressed stock price, the company transitioned from software development to Bitcoin purchases in 2020. At current prices, its Bitcoin holdings are worth nearly $72 billion. However, analysts point out that " risk management for the Ethereum Treasury is more complex than that of the Strategy model. "

Analysts said: "Michael Saylor insists on keeping Bitcoin on the balance sheet in the form of liquidity, rather than obtaining passive income through lending. Strategy places great emphasis on asset-liability management (ALM) and liquidity management."

"Strategy often adjusts between debt financing and equity financing based on market sentiment to maintain a conservative debt level."