Lao Mo, I want to eat fish: Use Bitget Launchpool to kill two birds with one stone and earn thousands of U a month

- 核心观点:Bitget Launchpool 提供稳定长期收益。

- 关键要素:

- PUMP 项目 APR 高达 1,273.32%。

- 滚仓策略实现资金无缝复利。

- 平台优质项目持续入驻。

- 市场影响:吸引更多投资者参与平台活动。

- 时效性标注:中期影响。

Original author: OneshotBug

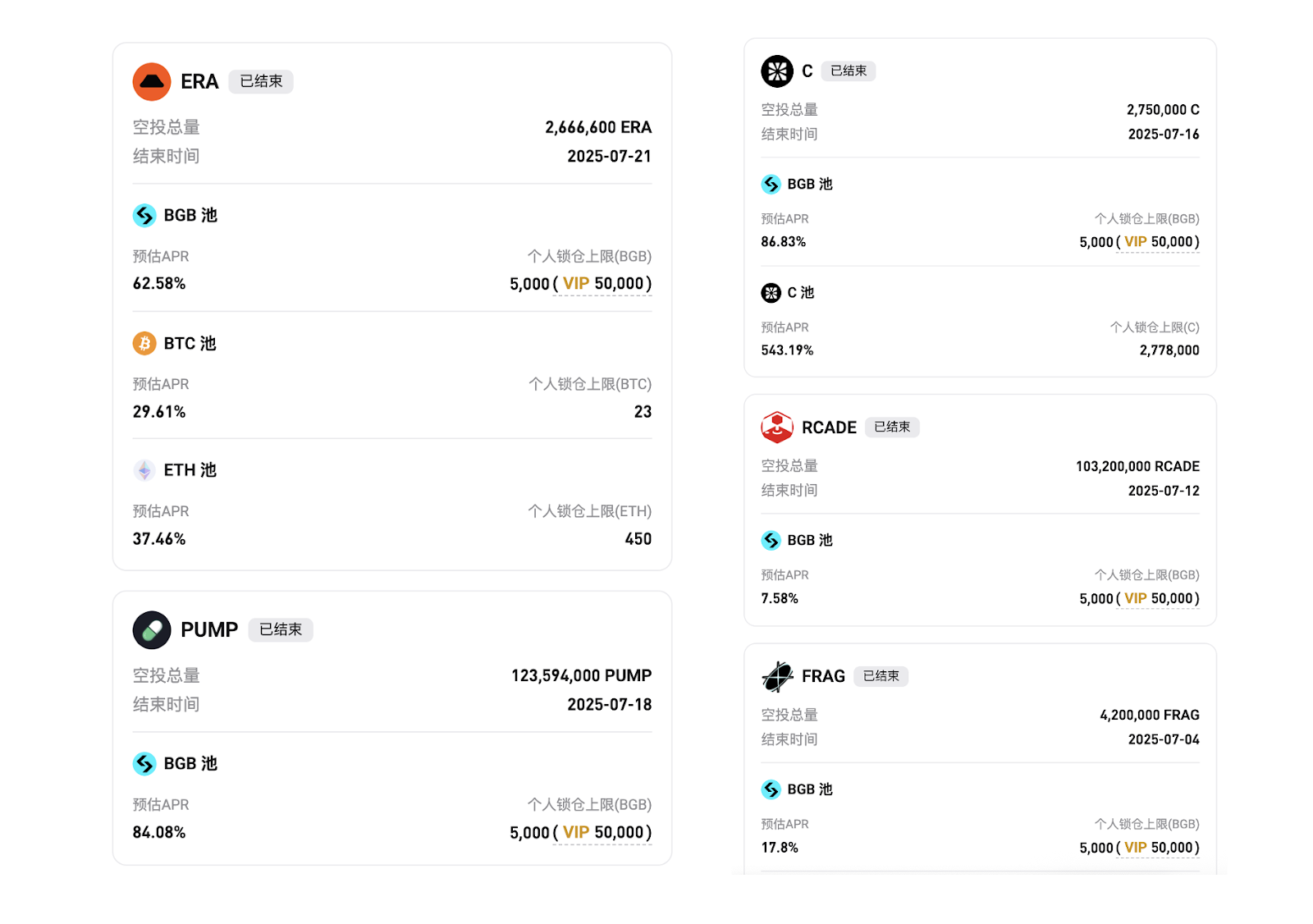

In the crypto market, although opportunities that can bring high returns in the short term are full of temptations, for rational investors, stable returns and long-term appreciation are more worthy of attention. Bitget Launchpool previously launched major projects such as ENA, SONIC and ELX, and the rate of return increased significantly, which aroused my interest. In July, star projects such as C, PUMP, and ERA were launched in succession, among which PUMP (Pump.fun) brought its own topic heat, and C (Chainbase) was listed on Binance.

After experiencing all these recent activities, I no longer regard Bitget Launchpool as a short-term speculative tool, but as a long-term value-added investment channel, which can achieve "killing two birds with one stone" with continuous capital rollover. If you are looking for a simple, stable and effective investment method, Bitget Launchpool is a good choice. The latest GAIA project is about to open for investment, and it is confirmed that it will be listed on Binance Alpha. It is likely to get a good return, so you can try it.

Next in this article, I will share how to make the same funds obtain stable returns in continuous Launchpool activities and effectively avoid the high volatility risks of the market.

Bitget Launchpool Activity Review: From Participation to Profits

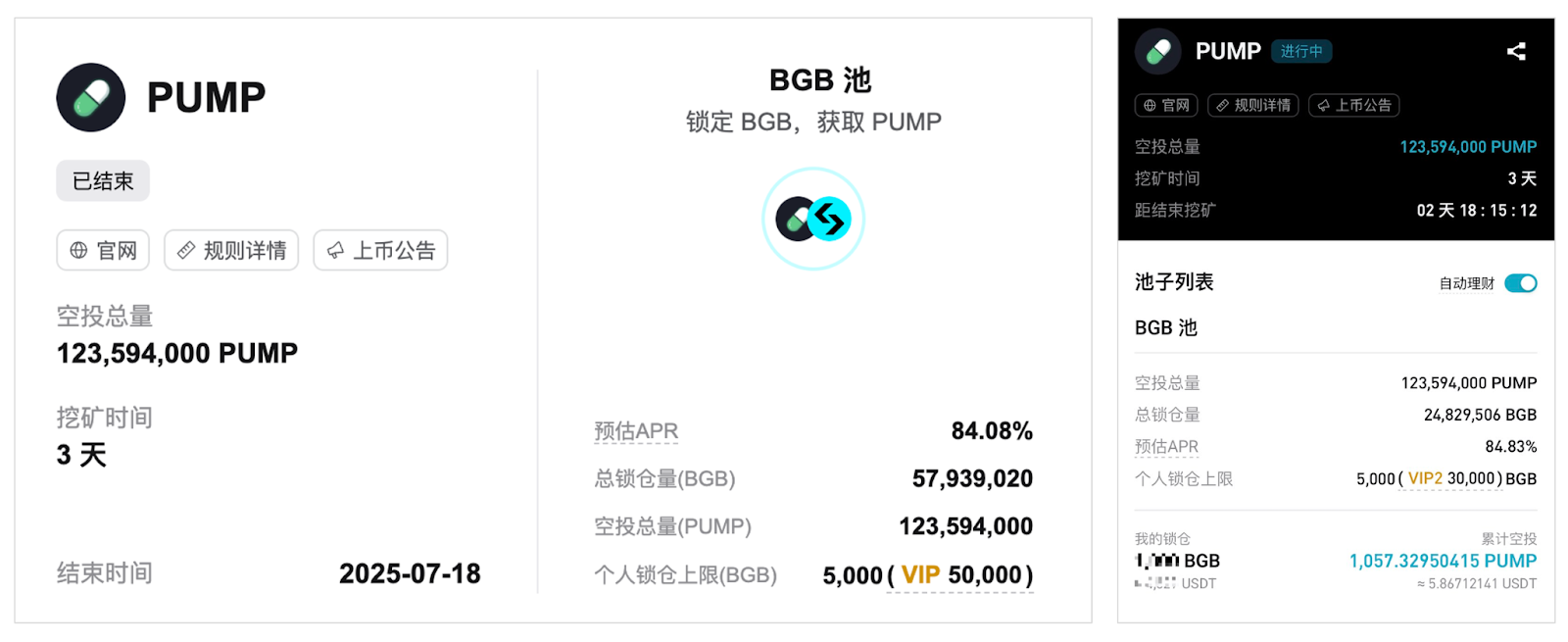

In order to better evaluate the potential of Bitget Launchpool, I participated in all recent activities, including C, PUMP and ERA. The returns of each project were in line with expectations, gradually verifying the actual effect of the platform in providing stable returns.

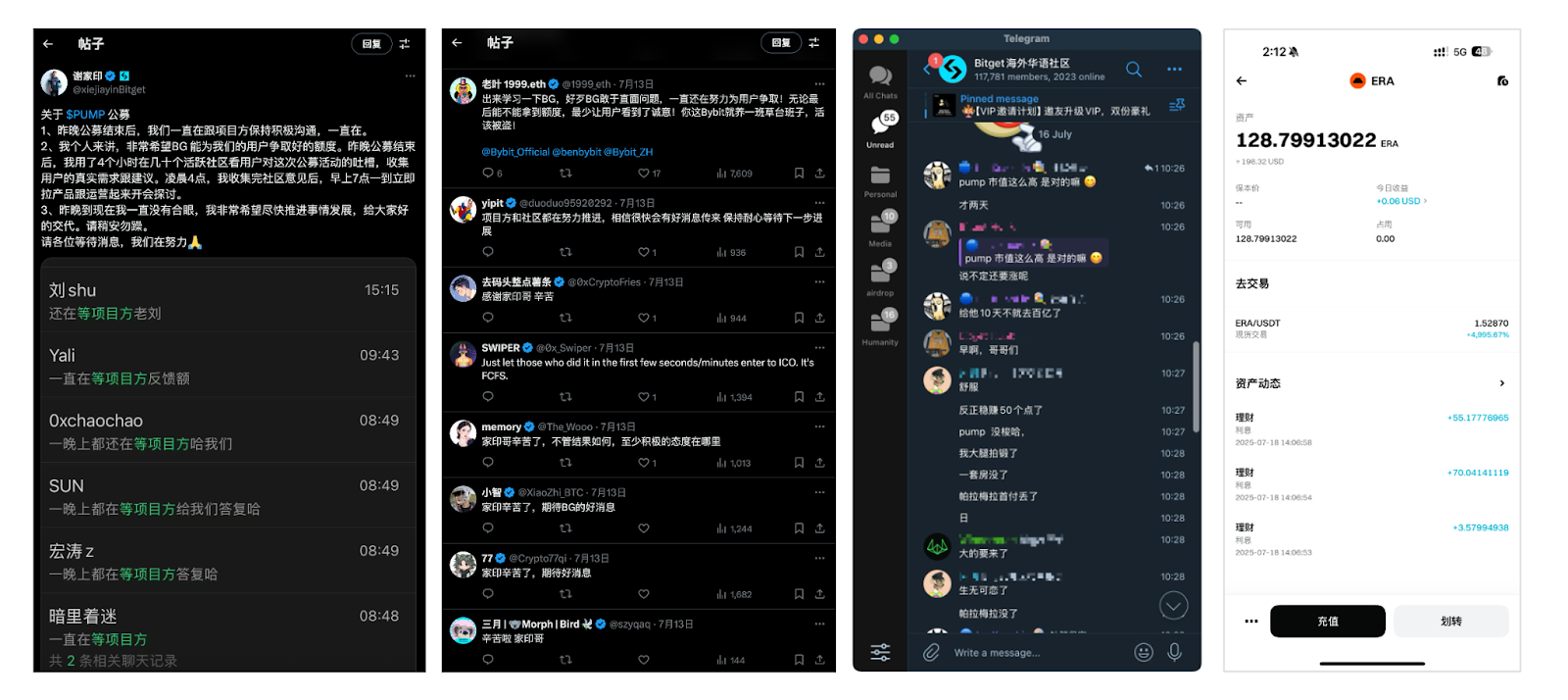

In terms of project returns, the short-term APR of the PUMP project once reached 1,273.32%, and the short-term APR of ERA once reached 4,958.73%. Judging from the sharing of other users on Twitter and in the TG group, they generally have satisfactory gains. For example, one investor received 128 ERA (equivalent to about 200 U) in one hour in the ERA event, and the final return exceeded 5,000 U. For a time, the community was full of positive comments, and it was a huge word-of-mouth explosion.

Profit estimation: Assuming you invest 10,000 U in early July and exchange it for BGB to continue participating in all activities, the final profit can reach about 1,460 U, and the annualized profit exceeds 175%. The composition of the profit includes:

- Directional gains from BGB's own growth 1220 U

- The hedging income of Launchpool staking mining is 240 U, and the hedging strategy is equivalent to a risk-free income source.

These examples fully demonstrate that Bitget Launchpool provides participants with sustained and stable returns through good market performance and event arrangements. These returns not only meet expectations, but also demonstrate the strong resource allocation and robust income structure behind the platform.

What is unique about the Bitget Launchpool model?

Based on BG's current Launchpool projects, gameplay, return rate and public information, we can summarize its current attractiveness:

1. Distribution method: As fair and diverse as possible

Many platforms often implement a "first come, first served" model. Although it is fair in logic, it is actually difficult for a large number of retail investors to obtain shares. Bitget Launchpool adopts a variety of allocation methods, mainly allocating shares based on the amount of pledge, so that more users can grab shares, and the community has very positive comments on this.

2. Excellent return rate: satisfactory income and intensive activity arrangement

Bitget Launchpool has recently received good returns from many projects, which is also an important reason for attracting investors. During market fluctuations, these related activities can provide participants with stable and substantial returns, which is of great positive significance to the majority of retail investors.

3. The platform’s voice: high-quality projects entering the platform and a larger share of the project

Judging from the quality of recent cooperation projects and the share of projects allocated to BG, BG's position as the fourth largest and fastest growing exchange has been recognized by the project parties. For example, in addition to C, PUMP and ERA launched in July, there were also a number of projects with strong backgrounds such as ENA, SONIC, ELX, etc.; BG also successfully won the highest quota in the PUMP project. A positive cycle is generated here. The platform is attractive to the project parties, and the project parties can cooperate with the platform to provide users with more profit opportunities. By participating in these high-quality projects, users can enjoy higher returns and trust the platform more. This is good for the project parties, BG and users.

The combination of these advantages not only makes Bitget Launchpool stand out in the market, but also provides investors with a stable and efficient investment channel. It is an opportunity worthy of attention for both novice and veteran investors.

Rollover strategy: seamlessly transition between activities and earn stable returns

Bitget Launchpool is now operating on the logic of rolling positions in my investment portfolio planning. Simply put, it converts the proceeds of each round of activities into BGB, and then continues to invest it in the next round of activities, thereby ensuring the continuous flow of funds and maximizing profits.

Core idea

After each participation in the Bitget Launchpool event, the token rewards I received were not withdrawn but converted into BGB, and then I continued to participate in the next round of activities. The advantage of doing this is that it can avoid the window period of funds, ensure the continuous operation of funds, and achieve compound growth. This strategy has kept the income from each activity of mine and continuously converted it into more income.

Specific operation process

The operation of rolling positions is very simple, and is not much different from the fixed investment operation. After each activity, I will quickly liquidate the profits and convert them into BGB. Then, I will decide how much BGB to invest in the next round of activities based on the content and price trend of BGB. This process is efficient and continuous, and there is no information to monitor. Just check the activity page in advance. After each operation, I will make a summary, analyze the performance of the income, and adjust the strategy according to market changes to better optimize the next round of investment.

Strategic Advantages

The most significant advantage of the rolling strategy is that it avoids the window period of funds. After many platform activities end, funds will face a long wait, which is a loss for investors. Rolling enhances the continuity of investment. After each activity ends, the proceeds will be quickly reinvested, which not only maximizes the returns, but also effectively disperses the risks of market fluctuations. Even if the price of some project tokens fluctuates, the funds are always in a state of steady growth.

In theory, this strategy is also applicable to other similar staking mining or income investment projects. However, at present, the Launchpool activities of many platforms are infrequent and lack continuity, so BG seems to be the only option at present.

My change in positioning of BGB: from passive holding to active operation

In my current investment strategy, BGB has gradually transformed from the initial "hold-and-hold bullish" to an active tool in my asset allocation.

Initially, my strategy for BGB was quite simple: hold the coin and wait for it to rise. Especially after the market rally at the end of 24, I was confident in the appreciation of BGB, and continued to increase my holdings and regarded it as a "passive asset". However, with the gradual development of Bitget Launchpool activities, and BGB often being used as the main pool currency, BGB has become the core asset of my Launchpool rolling strategy.

In the revenue structure of Launchpool, the increase in the price of BGB itself is an important component of revenue, so the price expectation of BGB is very important. Combined with last year's market conditions, high V/MC, continuous planned destruction, and the community evaluation of Launchpool, I am still optimistic about its price.

Risk control and sustainability: rational thinking behind high returns

Although Bitget Launchpool offers quite attractive high returns, as investors, we need to be aware of the potential risks. No investment tool is risk-free. Understanding and managing these risks can ensure the sustainability of returns and avoid unnecessary losses.

1. Potential risks

First of all, market volatility is one of the biggest risks. Volatility in the crypto market is inevitable. Even projects with considerable returns may experience price fluctuations due to market sentiment or macroeconomic changes. For LP pool tokens like BGB, the growth of the coin price is actually an important part of the income structure, but the coin price will be affected by the overall market trend, which cannot be ignored. Therefore, as I said before, it is still necessary to keep an eye on the coin price. Being prepared for sudden fluctuations is a must for every investor.

In addition, the risks of the project itself cannot be ignored. Although Bitget is cautious in screening projects, there is still a certain degree of uncertainty in the market. Some emerging projects may face challenges such as technical difficulties, unstable operations or low market acceptance, which may lead to the failure to achieve the expected returns. Therefore, investors still need to remain vigilant and assess the actual risks of the project at any time.

2. Response strategy: diversification and flexible adjustment

In order to effectively manage these risks, diversification is one of the most commonly used and effective strategies. Although I advocate investing all the project income into the next project, I will not invest all the principal every time, but will make certain diversification arrangements, such as temporarily exchanging part of BGB for USDT. I think this can reduce the risk of a single project and obtain a more balanced return.

In addition, it is equally important to flexibly adjust the investment portfolio. In case of large market fluctuations, I will adjust my investment according to the actual market conditions and the latest activities of the platform. For example, if the return rate of a certain project decreases, I will quickly transfer funds and choose projects with greater return potential. By responding to market changes in this way, I strive to keep my investment in the best state.

Epilogue: Continuously Optimizing Investment Strategies

In this article, we share how to achieve stable long-term returns through Bitget Launchpool. Whether it is participating in high-return projects or using rolling strategies to continuously invest funds in new activities, Bitget Launchpool demonstrates its unique advantages as a low-risk, high-return investment tool.

There are two key factors that we will continue to focus on: First, the stability of the APR in Bitget Launchpool. Although the current rate of return is satisfactory, it is still worth paying attention to whether the platform can maintain the current high return as the number of participating users increases. Secondly, the continued introduction of high-quality projects. If Bitget can continue to introduce high-yield projects such as ENA, C, and PUMP, and continue to maintain excellent performance in subsequent projects such as GAIA, its attractiveness and market position will be further enhanced.

By sharing my investment strategy above, I hope to provide readers with some ideas to help you find your own stable income path in a complex market.