Key Takeaways

• The total market value of global cryptocurrencies is $4.16 trillion, up 4.7% from $3.97 trillion last week. As of press time, the total net inflow of US Bitcoin spot ETFs is about $54.82 billion, with a net inflow of $72.06 million this week; the total net inflow of US Ethereum spot ETFs is about $9.33 billion, with a net inflow of $1.85 billion this week.

• The total market value of stablecoins is US$260.9 billion, of which USDT has a market value of US$163.3 billion, accounting for 62.59% of the total market value of stablecoins; followed by USDC with a market value of US$64.3 billion, accounting for 24.65% of the total market value of stablecoins; DAI has a market value of US$5.37 billion, accounting for 2.06% of the total market value of stablecoins.

• According to DeFiLlama data, the total TVL of DeFi this week is $143.2 billion, up about 1.18% from $141.5 billion last week. By public chain, the three public chains with the highest TVL are Ethereum, accounting for 59.95%; Solana, accounting for 7.11%; and BNB Chain, accounting for 4.99%.

• From the on-chain data, the performance of major public chains this week was obviously differentiated: TON's daily trading volume fell sharply by 713%, Solana (-4.36%) and BNB Chain (-12.98%) fell slightly; Ethereum and Sui rose by 39.37% and 43.88% respectively, and Aptos remained basically unchanged. In terms of transaction fees, Ethereum (-150%) and TON (-18.71%) fell, TON rose by 80%; Solana and Sui increased slightly, and BNB remained unchanged. In terms of daily active addresses, Sui (+23.81%), Aptos (+7.99%) and Ethereum (+3.26%) increased, while the rest of the chains declined, with Solana falling by 44%. TVL increased overall, with only Aptos falling slightly (-3.19%). Among them, TON and BNB Chain had the highest increases, at 6.25% and 5.43% respectively.

• New projects to watch: Quack AI is an AI protocol for general on-chain governance, dedicated to innovating the DAO governance process. Poseidon is a full-stack decentralized data layer project built on the Story protocol with intellectual property as its core. It is incubated by the Story team and is committed to solving the core problem of obtaining high-quality, available and legally authorized training data in the AI field. WaveX is a perpetual contract decentralized exchange (DEX) built on the Soneium network, providing high-leverage trading, zero price impact and deep liquidity.

Table of contents

Key Takeaways

Table of contents

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

2. Fear Index

3. ETF inflow and outflow data

4. ETH/BTC and ETH/USD exchange ratios

5.Decentralized Finance (DeFi)

6. On-chain data

7. Stablecoin market value and issuance

2. Hot money trends this week

1. The top five VC coins and Meme coins with the highest growth this week

2. New Project Insights

3. New trends in the industry

1. Major industry events this week

2. Big events coming up next week

3. Important investment and financing last week

4. Reference links

1. Market Overview

1. Total cryptocurrency market value/Bitcoin market value share

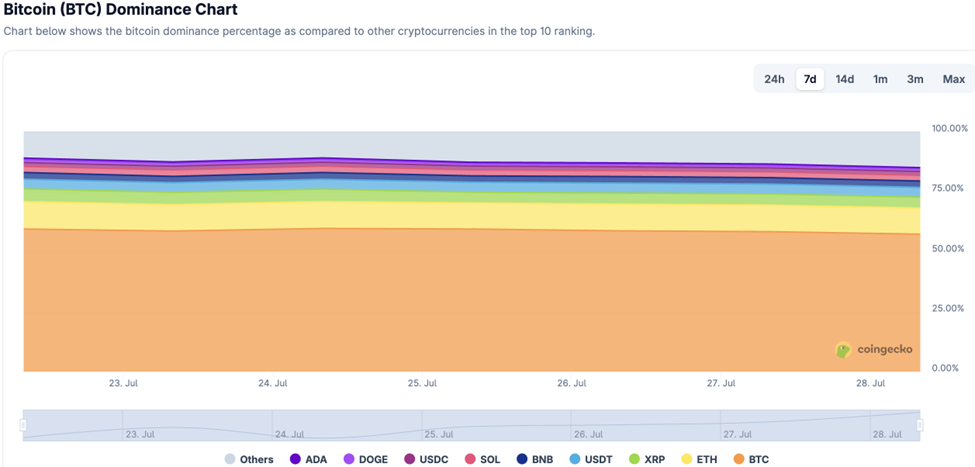

The total market value of global cryptocurrencies is US$4.16 trillion, up 4.7% from US$3.97 trillion last week.

Data source: Cryptorank

Data as of July 27, 2025

As of press time, Bitcoin’s market cap is $2.37 trillion, accounting for 56.9% of the total cryptocurrency market cap. Meanwhile, stablecoins’ market cap is $260.9 billion, accounting for 6.27% of the total cryptocurrency market cap.

Data source: coingeck

Data as of July 27, 2025

2. Fear Index

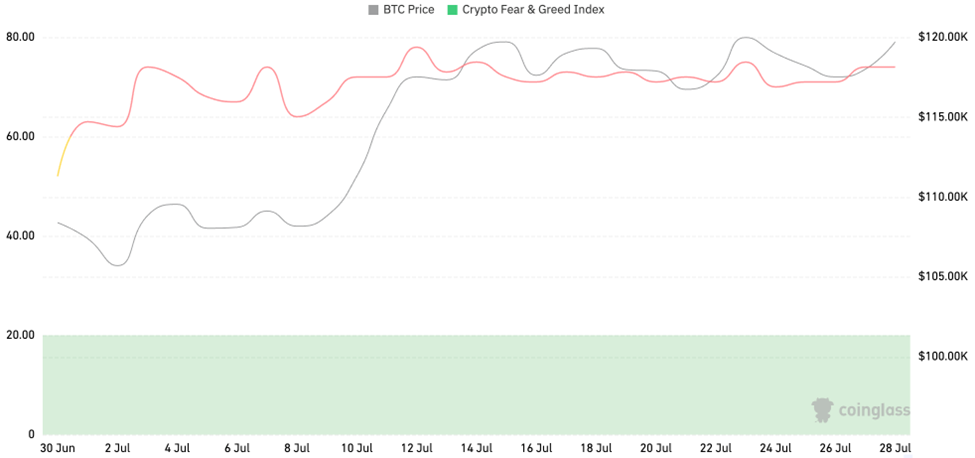

The cryptocurrency fear index is at 74, indicating greed.

Data source: coinglass

Data as of July 27, 2025

3. ETF inflow and outflow data

As of press time, the U.S. Bitcoin spot ETF has accumulated a total net inflow of approximately US$54.82 billion, with a net inflow of US$72.06 million this week; the U.S. Ethereum spot ETF has accumulated a total net inflow of approximately US$9.33 billion, with a net inflow of US$1.85 billion this week.

Data source: sosovalue

Data as of July 27, 2025

4. ETH/BTC and ETH/USD exchange ratios

ETHUSD: Current price: $3,844.53, historical highest price: $4,878.26, a drop of about 21.11% from the highest price

ETHBTC: Currently 0.032289, the highest in history is 0.1238

Data source: ratiogang

Data as of July 27, 2025

5.Decentralized Finance (DeFi)

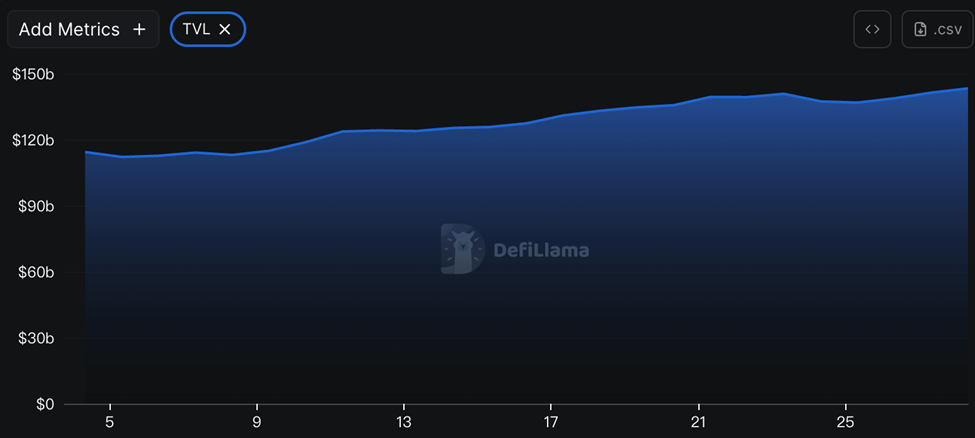

According to data from DeFiLlama, the total TVL of DeFi this week is $143.2 billion, up about 1.18% from $141.5 billion last week.

Data source: defillama

Data as of July 27, 2025

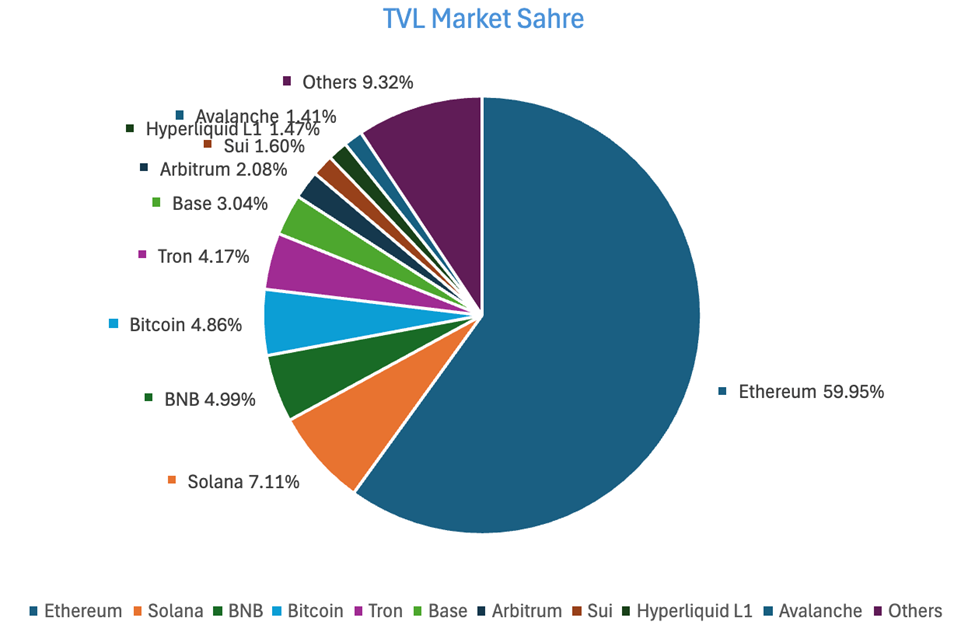

By public chain, the three public chains with the highest TVL are Ethereum Chain, accounting for 59.95%; Solana Chain, accounting for 7.11%; and BNB Chain, accounting for 4.99%.

Data source: CoinW Research Institute, defillama

Data as of July 27, 2025

6. On-chain data

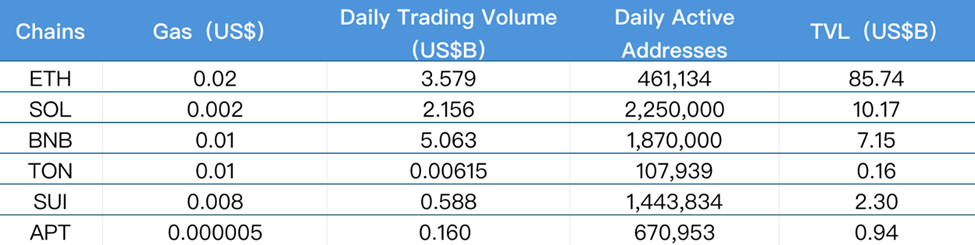

Layer 1 related data

The main data of Layer 1 including ETH, SOL, BNB, TON, SUI and APT are analyzed mainly from the perspective of daily transaction volume, daily active addresses and transaction fees.

Data source: CoinW Research Institute, defillama, Nansen

Data as of July 27, 2025

• Daily trading volume and transaction fees: Daily trading volume and transaction fees are core indicators for measuring the activity of public chains and user experience. In terms of daily trading volume, TON fell significantly this week, with a drop of 713%; Solana (-4.36%) and BNB Chain (-12.98%) fell slightly. Ethereum and Sui increased by 39.37% and 43.88% respectively; Aptos was almost the same as last week. In terms of transaction fees, only Ethereum and TON Chain fell this week, with a drop of 150% and 18.71% respectively; BNB was the same as last week; Sui (+4.24%) and Solana (+16.99%) rose slightly; TON increased significantly by 80%.

• Daily active addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of the public chain, and TVL reflects the degree of user trust in the platform. This week, the daily active addresses of Ethereum, Sui and Aptos increased by 3.26%, 23.81% and 7.99% respectively; the remaining chains all declined, namely Solana (-44%), BNB Chain (-26.2%), and TON (-19.43%). In terms of TVL, only Aptos saw a slight decline (-3.19%), while the remaining public chains all achieved an increase. Among them, TON and BNB Chain increased by 6.25% and 5.43% respectively; Ethereum, Solana and Sui increased slightly, at 2.82%, 2.44% and 2.78% respectively.

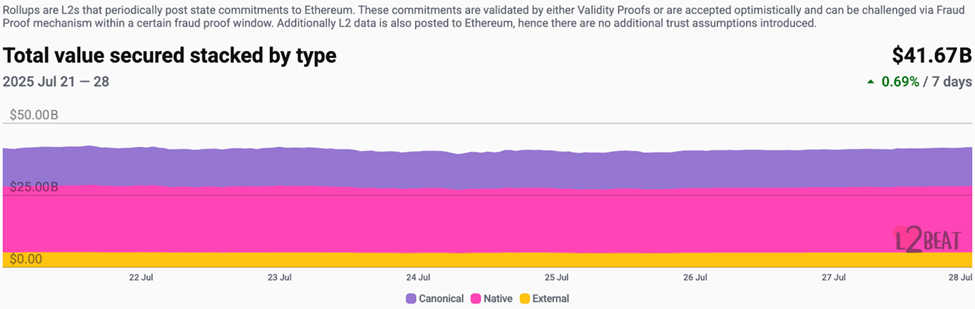

Layer 2 related data

According to L2Beat data, the total TVL of Ethereum Layer 2 is US$41.67 billion, an overall increase of 1.37% this week compared to last week ($41.1 billion).

Data source: L2Beat

Data as of July 27, 2025

Base and Arbitrum occupy the top position with 37.37% and 34.27% market shares respectively, while Base and Optimism saw a slight decline in market share over the past week.

Data source: footprint

Data as of July 27, 2025

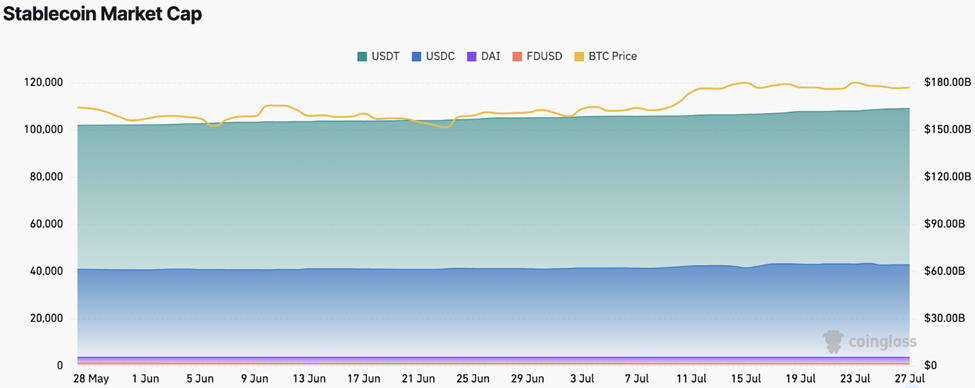

7. Stablecoin market value and issuance

According to Coinglass data, the total market value of stablecoins is US$260.9 billion, of which USDT has a market value of US$163.3 billion, accounting for 62.59% of the total market value of stablecoins; followed by USDC with a market value of US$64.3 billion, accounting for 24.65% of the total market value of stablecoins; and DAI with a market value of US$5.37 billion, accounting for 2.06% of the total market value of stablecoins.

Data source: CoinW Research Institute, Coinglass

Data as of July 27, 2025

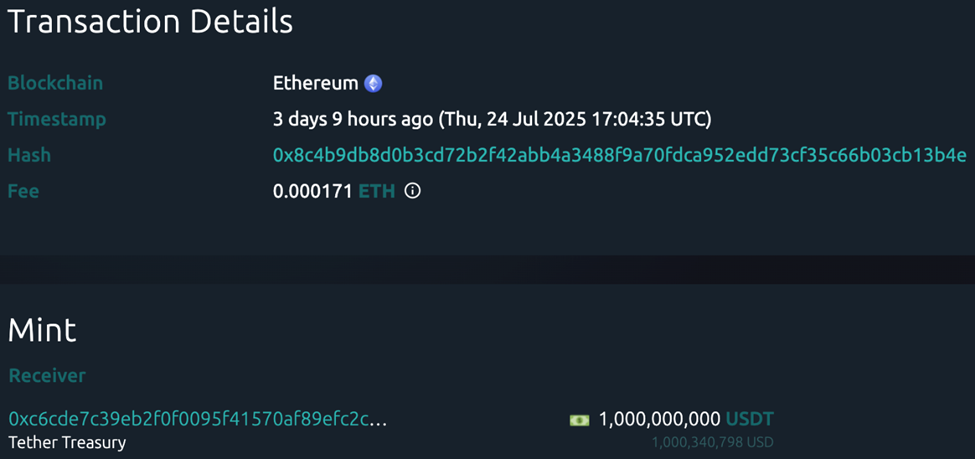

According to Whale Alert data, USDC Treasury issued a total of 1.412 billion USDC this week, and Tether Treasury issued a total of 2 billion USDT this week. The total amount of stablecoins issued this week was 3.412 billion, down 33.35% from the total amount of stablecoins issued last week (4.55 billion).

Data source: Whale Alert

Data as of July 27, 2025

2. Hot money trends this week

1. The top five VC coins and Meme coins with the highest growth this week

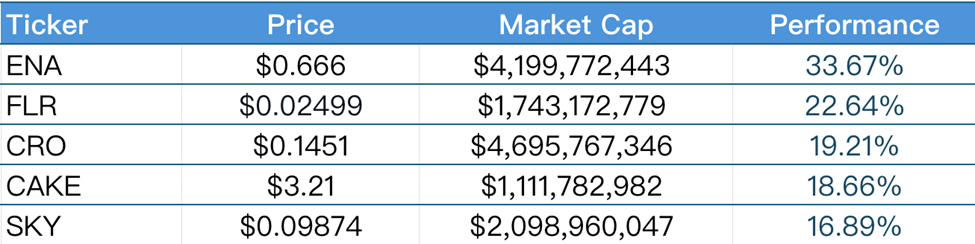

Top five VC coins with the highest growth in the past week

Data source: CoinW Research Institute, coinmarketcap

Data as of July 27, 2025

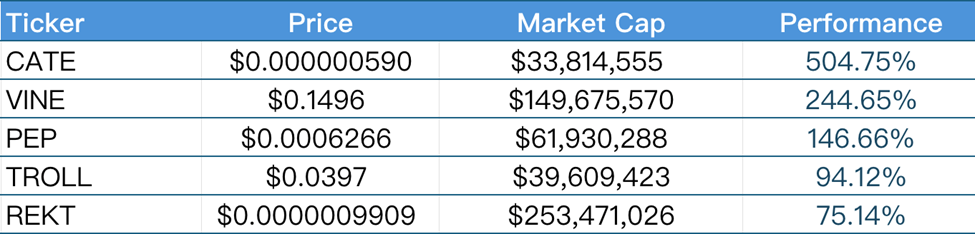

Top 5 Meme Coins with the Most Gains in the Past Week

Data source: CoinW Research Institute, coinmarketcap

Data as of July 27, 2025

2. New Project Insights

• Quack AI is an AI protocol for general on-chain governance, dedicated to innovating the DAO governance process. Through automated decision-making, real-time execution, and AI-driven risk analysis, Quack AI achieves seamless management from AI-generated proposals to multi-chain on-chain execution, improving governance efficiency and transparency.

• Poseidon is a full-stack decentralized data layer project built on the Story protocol with intellectual property as its core. It is incubated by the Story team and is committed to solving the core problem of obtaining high-quality, available and legally authorized training data in the AI field. The project completed a $15 million financing led by a16z in July 2025. Chris Dixon, founder of a16z, said that Poseidon provides AI developers with compliant and secure data access through the Story protocol's programmable intellectual property layer and immutable registry, helping to build a new Internet data economic ecosystem.

• WaveX is a perpetual contract decentralized exchange (DEX) built on the Soneium network, providing high leverage trading, zero price impact and deep liquidity. Users can not only trade efficiently, but also become liquidity providers by depositing assets and gain potential benefits.

3. New trends in the industry

1. Major industry events this week

• DePHY Network officially launched the token generation (TGE) and community airdrop activities of the native token PHY on July 26, 2025. As an important part of the decentralized IoT infrastructure, PHY tokens will play a core role in promoting network incentives, node operations and governance mechanisms. This airdrop is aimed at community members who have long supported DePHY. Qualified users will have the opportunity to receive airdrop rewards through designated channels of the platform.

• Aspecta officially launched the Token Generation Event (TGE) of its native token ASP at 18:00 (UTC+8) on July 24, 2025. The total issuance of ASP is 1 billion, of which 45% is allocated to the community and ecosystem, 20% to investors, 15% to early contributors, 3% for liquidity support, and 17% to the foundation management. The official airdrop qualification query will be opened at 15:00 (UTC+8) on July 24, and the airdrop will be opened at 18:00 TGE.

• Elympics announced the official launch of the Token Generation Event (TGE) of its native token ELP on July 24, 2025, and simultaneously launched the airdrop qualification query tool. The airdrop is open to three types of community users: the top 1,600 users with the highest Respect scores, the top 500 Cookie DAO snapshot #1 users, and users who participated in Elympics' multiple airdrop incentive activities and pledged COOKIE.

• Bitlayer launched the Ooster Program (acceleration incentive program) and Pre-TGE activities at UTC 09:00 on July 24, 2025. The former will airdrop 3% of the total BTR (30M pieces) to early community supporters who complete the task, and the latter will open subscription for 2% of BTR (20M pieces). The price is US$0.02 per piece, and the subscription limit is 3BNB. The tokens must be locked and can only be circulated after the project party announces the unlocking.

• Delphinus Lab launched the first generation (TGE) of ZKWASM tokens on July 22, 2025, marking a new stage for the project ecosystem. This TGE is open to core community members, and will further promote the construction and development of decentralized zero-knowledge application infrastructure through token distribution. ZKWASM is the native token launched by Delphinus Lab, which will be used to incentivize the developer ecosystem, node participation and protocol governance, and help build an efficient, secure and scalable ZK application execution environment.

2. Big events coming up next week

• Ulalo (ULA) will conduct TGE at 15:00 (UTC) on July 30, releasing 30% of the tokens for the first time, and the remaining part will be released linearly over 3 months after a 1-month lock-up period. Previously, the project has completed the airdrop distribution with the cooperation platform, and eligible users can receive the airdrop qualification. Recently, several IDO and Launchpool activities have been arranged to prepare for the subsequent token circulation and ecological construction.

• Refacta (REFACTA) will conduct a TGE through an IDO on July 28, 2025, issuing tokens accounting for approximately 2% of the total supply, with a fundraising target of US$250,000. Refacta is a platform that combines artificial intelligence and blockchain technology, dedicated to providing automated generation and optimization services for smart contracts, helping developers improve the efficiency and security of smart contracts.

• Treehouse (TREE)'s TGE and Phase 1 Booster event will end on July 28, when the initial token issuance and participation reward distribution will be basically completed. Users can participate and receive token rewards through staking, and the total distribution accounts for approximately 0.25% of the total supply. Prior to this, the project took a snapshot of GoNuts Season 1 participants at 00:00 (UTC) on May 29, and eligible users can claim the base token allocation and possible additional rewards at the TGE. In addition, TSC NFT holders can also claim 500 TREE incentives for each NFT within three months after the TGE.

• STEPN will launch a new round of GMT airdrops in the future. The official airdrop snapshot was completed at 07:00 UTC on July 17. This round of airdrops will issue GMT rewards to STEPN and STEPNGO community users. Users who are eligible for airdrops must meet any of the following conditions: hold a STEPN badge that meets the requirements in their consumer account; hold at least one Genesis sneaker or shoebox (holding time is included); rank in the top 5000 in the historical rankings; or have used at least 10 energy points within 30 days before the snapshot. The specific airdrop collection time and process will be announced later.

3. Important investment and financing last week

• Bitzero, a crypto mining company backed by Kevin O'Leary, has completed a $25 million financing round, with investors not disclosed. Bitzero focuses on cryptocurrency and sustainable data center construction, and plans to use part of the funds to purchase 2,900 Bitmain S21 Pro mining machines to expand its computing power. (July 24, 2025)

• British listed company Satsuma Technology (formerly known as Tao Alpha) announced the completion of more than 100 million pounds of financing. The company focuses on building infrastructure and AI Agent on the Bittensor network and actively increases its holdings of Bitcoin. The funds will be used to expand decentralized infrastructure and accelerate Bitcoin holdings. Previously, Satsuma had first established a position of 28.56 BTC on July 14. (July 24, 2025)

• South Korean blockchain infrastructure service provider DSRV announced the completion of its first round of B round financing of approximately 16 billion won (approximately 11.6 million US dollars), with investors including Intervest, NH-SK Securities, etc. DSRV provides node and infrastructure services for more than 70 blockchain networks around the world, and manages assets of more than 4 trillion won. The company plans to expand new businesses such as stablecoins and custody, and accelerate its layout in the US, Japan and African markets. (July 23, 2025)

• Gaia, a decentralized AI inference platform, announced the completion of a $20 million seed round and Series A financing round, with investors including ByteTrade, SIG, Mirana, Mantle, etc., and Outlier Ventures, NGC, Taisu Ventures, and Consensys Mesh following suit. The funds will be used to expand decentralized AI infrastructure and launch the world's first AI native phone - Gaia AI phone, which is built on Galaxy S25 Edge hardware and supports local AI inference without uploading data to protect user privacy. (July 23, 2025)

• MEI Pharma (NASDAQ: MEIP) announced the completion of a $100 million private placement financing, intending to use the funds to purchase Litecoin (LTC) as a financial reserve asset, becoming the first company listed on a national exchange and holding Litecoin. Litecoin founder Charlie Lee joined the board of directors, and GSR served as financial advisor. This round of financing issued approximately 29.24 million shares at $3.42 per share, and investors included the Litecoin Foundation and several institutions. (July 22, 2025)

4. Reference links

1. Quack AI: https://quackai.ai/

2. Poseidon: https://psdn.ai/

3. WaveX: https://wavex.fi/

4. Bitzero: https://bitzero.com/

5. Satsuma Technology: https://www.satsuma.digital/

6. DSRV: https://www.dsrvlabs.com/

7. Gaia: https://www.gaianet.ai/

8. MEI Pharma: https://meipharma.com/

- 核心观点:加密货币市场整体上涨,公链表现分化。

- 关键要素:

- 加密货币总市值上升4.7%至4.16万亿美元。

- USDT占稳定币总市值62.59%,主导地位稳固。

- DeFi TVL增长1.18%,以太坊占比59.95%。

- 市场影响:短期市场情绪偏向乐观。

- 时效性标注:短期影响。