Original author: danny (X: @aginter )

As derivatives exchanges following Binance, how do Bybit and Bitget stand out in the highly competitive and volatile perpetual contract battlefield?

Bybit has chosen an architectural route of extreme capital efficiency, striving to build a financial engine that serves institutional-level strategies; while Bitget embraces high volatility sensitivity and competes for the minds of subjective traders and arbitrage quantitative teams with a more open, transparent and responsive mechanism.

Seemingly similar top-level algorithms can actually evolve completely different K-line behaviors - the real difference lies in every detail.

Under the algorithmic order of Binance, the industry leader, Bybit and Bitget did not blindly imitate it. Instead, they used their own unique trading philosophies and financial mechanisms to explore different survival paths and strategic spaces in the structural institutional gray areas such as funding rates, mark prices, and forced liquidation processes.

1. Index price algorithm: Whose price is more real?

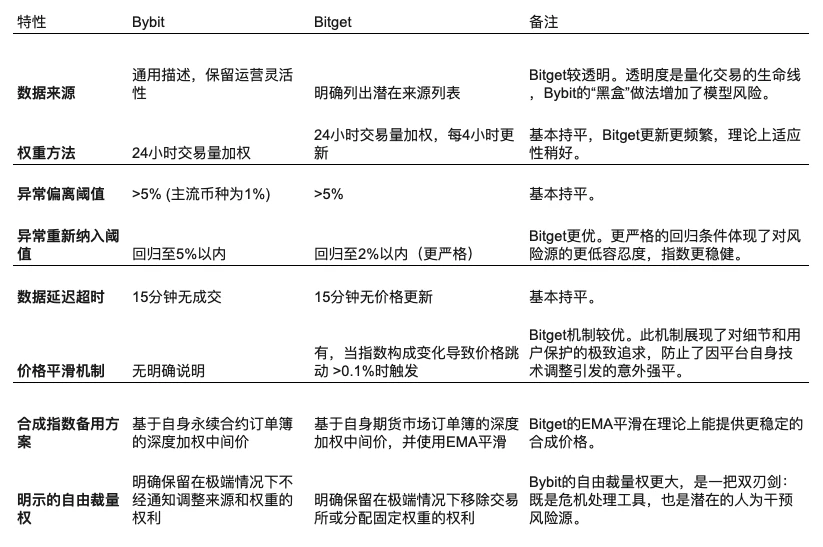

Both Bybit and Bitget follow industry best practices, using quotes from multiple mainstream spot exchanges and calculating index prices through the volume-weighted average method (VWAP), aiming to build a fair price that reflects the broad market value of assets, thereby effectively resisting price anomalies caused by insufficient liquidity or malicious manipulation of a single exchange.

Bybit Mechanism

Bybit obtains spot prices from multiple mainstream exchanges and calculates the index weighted by trading volume. However, its specific data sources are not fully disclosed, and the platform reserves the right to adjust the data source and its weight without prior notice in extreme market conditions. While this mechanism provides operational flexibility, it also constitutes a certain information black box for traders.

Bitget Mechanism

Bitget also uses the VWAP method, but its significant advantage is that it fully discloses all index component exchanges (such as Binance, Coinbase, OKX, etc.), providing traders, especially quantitative teams, with a highly transparent data source, facilitating model verification and risk assessment.

Core Differences

Transparency: Bitget provides full data sources publicly, reducing black box risks and making it easier for traders to conduct modeling and backtesting; Bybit sacrifices a certain degree of transparency while maintaining platform flexibility, bringing about a trust cost.

Abnormal data processing mechanism: Bitget is more strict in handling abnormal data sources. Only when the price of a data source returns to the median ± 2% range can it be re-included in the index calculation; in contrast, Bybit sets a tolerance of ± 5%, which is more relaxed.

Price smoothing mechanism (Bitget-specific): When the adjustment of index components may cause the price to fluctuate by more than 0.1%, Bitget will start the smooth transition mechanism to gradually replace the components to avoid sudden price jumps caused by technical changes, thereby reducing the risk of forced liquidation caused by non-market factors. (However, this is a problem when the altcoin fluctuates violently)

2. Mark Price Algorithm: How to Resist Market Manipulation?

Both Bybit and Bitget use the industry-wide recognized Median-of-Three method to calculate the contract mark price. This method effectively resists the distortion of a single data source by taking the median of three independent price sources, fundamentally reducing the risk of manipulation behavior such as pulling the market/smashing the market to trigger forced liquidation.

Bybit Mechanism

Bybit selects three prices:

Price 1 and Price 2: derived from index price, funding rate and short-term basis;

Price 3: The latest transaction price on the platform.

The system uses the median of the three as the mark price, effectively filtering out extreme price fluctuations.

Bitget Mechanism

Similar to Bybit, Bitget also adopts the three-price median method and introduces three prices with basically the same structure. Although the naming and arrangement are slightly different, the essential logic is the same.

The real difference lies not in the algorithm, but in the quality of the underlying data

Although the two are highly consistent in formula structure, the key to the final mark price performance is not the top-level algorithm design itself, but the way the input parameters are generated, especially including: whether the source of the index price is transparent, the calculation frequency and logic of the funding rate, and whether the basic data update mechanism is lagging behind.

These underlying factors are the core in determining whether the platform is easy to manipulate or whether the rationality of forced liquidation is sound.

One more thing: The “Phantom PL” phenomenon that follows the deviation of the exchange’s marked price

In a turbulent market, especially for small-cap altcoins, traders often encounter a confusing phenomenon:

As soon as a position is opened at the market price, the system immediately displays unrealized loss or close to liquidation.

This is not a systemic loophole, but rather a result of the structural characteristics of the dual-price system :

The opening price is calculated based on the latest transaction price ;

Unrealized profit and loss is calculated based on the mark price .

If the mark price is lower than the latest transaction price when opening a position, the long position will instantly show a loss; vice versa, a short position may also immediately enter a false profit state.

This type of phantom profit and loss is particularly obvious when the market fluctuates violently, the exchange order book is shallow, and there is a short-term deviation between the index and the spot price, causing novice traders who are not familiar with the mechanism to mistakenly believe that there is a malicious liquidation in the system.

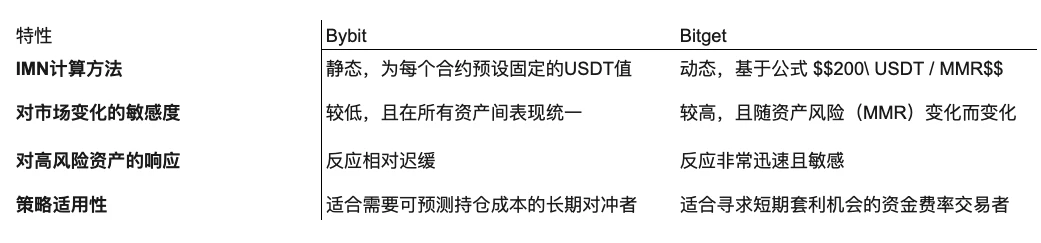

III. Funding Rate Algorithm: Static Stability vs Dynamic Feedback

Funding rate is the core mechanism that anchors the perpetual contract price to the spot price. Although Bybit and Bitget use the same top-level funding rate calculation formula, the definition of one of the key parameters is completely different, which reveals their fundamental philosophical differences in market regulation mechanisms.

Bybit Mechanism:

Bybit uses the standard premium index + interest rate formula. Among them, the key parameter Impact Margin Number (IMN) used to measure market depth is a fixed USDT value statically configured for each contract. This value remains unchanged in any market environment.

Bitget mechanism:

Bitget uses the same top-level formula as Bybit, but the calculation method of Impact Margin Amount (IMN) is completely different from Bybit.

Core differences:

The calculation method of the impact margin amount (IMN) is the fundamental difference between the two in the funding rate mechanism. Bitgets IMN is dynamically calculated, and its formula is directly linked to the risk parameter of the contract - the minimum maintenance margin rate (MMR). This means that the higher the risk of the currency, the smaller its IMN, and the more sensitive the funding rate is to short-term order book imbalances.

Bybit: Using static IMN settings, it provides a unified and predictable market depth measurement standard for all contracts. Regardless of market volatility, the order book depth used to calculate the premium index remains consistent. The biggest advantage of this design is the reproducibility of the model and the stability of behavior. Especially among mainstream currencies, Bybits funding rate performance is relatively smooth and easy to model, and can be regarded as a stable but slow architecture as a whole.

Bitget: It uses a dynamic IMN mechanism to explicitly incorporate market risk into the funding rate calculation logic. Its IMN value is directly linked to the minimum maintenance margin rate (MMR) of the contract. According to its formula, assets with higher risks and greater volatility will usually have higher MMRs, and higher MMRs will be reversely mapped to smaller IMNs.

For example, the MMR of mainstream coins is usually 0.5%, while the MMR of highly volatile altcoins may reach 2%. This means that on Bitget, the riskier the asset, the smaller the IMN value, and the calculation of the premium index will be based on shallower order book data, making it more sensitive to short-term liquidity imbalances.

Therefore, in high-risk altcoin transactions, Bitgets funding rate is extremely sensitive to small imbalances at the top of the order book (such as short-term buying or selling pressure). This sensitive but more responsive design makes Bitgets funding rate fluctuations on high-volatility contracts more drastic.

This also forms a powerful, adaptive risk-adjustment feedback mechanism:

When the market sentiment of a certain altcoin tilts unilaterally (such as long or short dominance), Bitgets funding rate will soar or fall faster and more dramatically than Bybit. This drastic change will quickly create a strong arbitrage incentive, leading reverse traders to enter the market, thereby more effectively pulling the contract price back to the index price level.

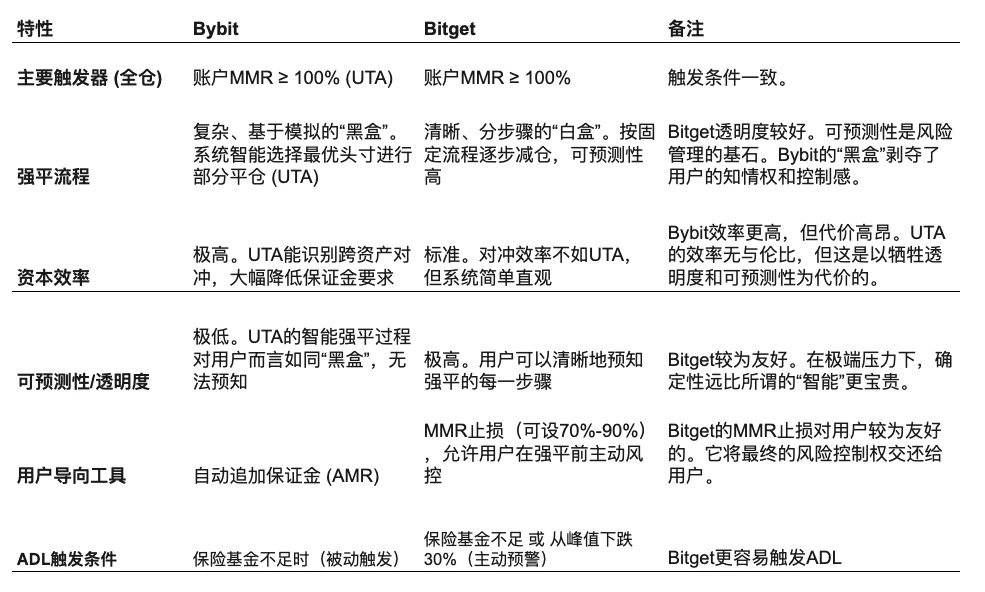

4. Forced liquidation mechanism: black box intelligence vs white box empowerment

Bybit and Bitget are similar in the underlying model of forced liquidation. Both adopt the Systemic Absorption Liquidation Model, which means that when a users position triggers forced liquidation conditions, the exchanges liquidation engine will take over and handle it. However, in terms of execution process, user control, and associated risk management tools, the two have completely different risk control philosophies.

The basic logic of this type of liquidation mechanism is as follows:

When the forced liquidation price is triggered, the users position will be taken over by the system and internally settled at the bankruptcy price (i.e., liquidation price). This means that the users maximum loss is theoretically locked in, without the need to bear the risk of subsequent slippage.

It is worth noting that the bankruptcy price is usually worse than the liquidation price: the system always triggers liquidation at the liquidation price, but the execution price is the bankruptcy price. For example, if the liquidation price is 1000 and the bankruptcy price is 980, then once the position is liquidated, it will be settled at 980.

Important reminder: Since forced liquidation is based on the bankruptcy price, you should be sure to set a reasonable stop loss point when opening a position to avoid it.

The liquidation engine will hold the internalized position and assume the obligation to actually close it in the market. If the liquidation transaction price is worse than the bankruptcy price, the difference will be made up by the insurance fund; if the transaction is better than the bankruptcy price, the surplus will be injected into the insurance fund.

Bybit Mechanism:

Bybits Unified Trading Account (UTA) system, especially in the Portfolio Margin mode, demonstrates extremely high complexity and technological advancement. The system can automatically identify and evaluate the multi-asset net risk exposure of the entire account, such as identifying the hedging structure between spot BTC longs and perpetual shorts, thereby reducing margin requirements and releasing available funds. This design greatly improves the efficiency of capital utilization, which is particularly in line with the high capital efficiency requirements of traders using multiple positions and multiple strategies.

But this complexity also means that once an account is close to forced liquidation, the system will execute the optimal solution processing strategy based on its internal algorithm model. This system logic of Bybit reflects a paternalistic risk management concept.

Bitget mechanism:

Bitgets forced liquidation mechanism is based on the core principle of predictability and controllability. The system also uses the accounts minimum maintenance margin rate (MMR) reaching 100% as the forced liquidation trigger standard. However, its forced liquidation process has clear execution steps, such as: canceling all orders first, then partially reducing positions, and finally closing positions. Users can clearly predict every operation link.

Whether it is a position-by-position or full-position mode, Bitget clearly stipulates that when MMR reaches 100%, forced liquidation is triggered. At the same time, the platform provides a complete set of fixed-order processing procedures, based on which traders can establish clear risk expectations and risk control models.

In addition, Bitget also provides a tool called MMR Stop Loss, which allows users to preset risk thresholds (such as 75%, 80%), automatically reduce positions or stop losses before forced liquidation occurs, thereby actively managing their own risks.

Core differences:

Predictability: Bitget’s forced liquidation mechanism is a “white box model” with clear processes and fixed order, which is easy to model and predict; while Bybit’s UTA forced liquidation mechanism is a “black box model”, in which users cannot know which assets the system will prioritize, sacrificing predictability in exchange for the optimal solution at the system level.

User sense of control: Bitget’s “MMR Stop Loss” tool returns risk control to users, which is an “empowering” risk management concept; Bybit’s liquidation mechanism emphasizes the dominance of system algorithms, which is a “paternalistic” design.

Capital efficiency: Bybits UTA, especially the portfolio margin system, can identify cross-asset hedging structures, thereby significantly reducing margin requirements. Its capital efficiency is higher than Bitget and is suitable for institutions and high-frequency teams.

ADL triggering conditions: Bitgets automatic deleveraging (ADL) mechanism is more sensitive - in addition to the exhaustion of insurance funds, if its insurance fund falls by more than 30% compared to its historical peak, ADL will also be triggered. Bybit only activates ADL after the insurance fund is exhausted.

Postscript: Strategy selection under different mechanisms

There is no absolute difference between the mechanism designs of Bybit and Bitget, but each is adapted to completely different trader profiles and strategy requirements:

Bybit has devoted all its efforts to building an efficient, powerful but relatively opaque system that is designed to serve complex strategies and high-frequency capital; Bitget has chosen a completely different path to create an empowering platform that is more open, predictable, volatility-sensitive, and respects users independent decision-making power.

Understanding the underlying financial philosophy and institutional logic behind each platform is the key for every trader, arbitrageur, and institution to make the best strategic choice.

Know that it is so and know why it is so.

Let us always move forward with a heart full of awe for the market.