Original | Odaily Planet Daily ( @OdailyChina )

Author: jk

As the Bitcoin ecosystem returns to the main stage and modular blockchain architecture accelerates its evolution, Hemi is connecting the two core worlds of crypto assets - Bitcoin and Ethereum - in an unprecedented way. As a future-oriented modular Layer 2 network, Hemi not only attempts to inherit the security of Bitcoin, but also embraces the flexibility of Ethereum's smart contracts. Through the innovative hVM architecture and Proof-of-Proof consensus mechanism, it opens up a new path for inter-chain collaboration.

Since its launch, Hemi has attracted the attention of top institutions such as YZi Labs (formerly Binance Labs) and Breyer Capital, and has accumulated over 100 million TVL in a short period of time, becoming one of the most watched emerging L2. This article will comprehensively sort out Hemi's technical path, core team, ecological layout and token progress, revealing its unique value proposition in the wave of modular blockchain.

Public Chain Overview

Hemi is a modular Layer 2 network that focuses on high scalability, security, and inter-chain interoperability. According to the official introduction, Bitcoin and Ethereum are regarded as the core components of the same "super network", and the advantages of the two major public chains are integrated in parallel through a dual-drive architecture. Under the premise of full compatibility with EVM, developers can build applications that connect BTC and ETH in one stop.

One of Hemi's core technologies is the Hemi Virtual Machine (hVM), which embeds a complete Bitcoin full node inside the Ethereum Virtual Machine (EVM) to enable smart contracts to directly access the Bitcoin state. This architecture allows developers to use familiar EVM tools to build "Bitcoin-aware" dApps, improving Bitcoin's DeFi, lending and MEV ecosystem support capabilities.

At the same time, the Proof‑of‑Proof (PoP) consensus created by Hemi anchors the L2 block status to the Bitcoin chain, and special PoP miners package and publish the status to the Bitcoin network to achieve "Bitcoin-level" security. Users running lightweight PoP miners can publish L2 block headers and obtain token rewards. This process does not require the participation of Bitcoin miners, and the network can reach Superfinality in about 90 minutes, which is beyond the final confirmation capability of Bitcoin.

Hemi's "Tunnels" mechanism constitutes its trustless cross-chain bridge, which can safely migrate assets between Bitcoin and Ethereum, break through the trust bottleneck of traditional bridging , and provide infrastructure support for cross-chain assets and liquidity aggregation. At the same time, through hVM and Hemi Bitcoin Kit, developers can call Bitcoin native assets for on-chain deployment. Through the above architecture, Hemi hopes to break through the barriers between Bitcoin's huge value reserves and Ethereum's flexible smart contract ecosystem, and build a high-performance bridge between the two.

Team Background

Hemi was created by a team with rich experience in the crypto field, and its core members have heavyweight backgrounds. Co-founder Jeff Garzik is an early legendary Bitcoin developer who worked with Satoshi Nakamoto and served as Bitcoin core developer for 5 years. He is also the co-founder and CEO of blockchain infrastructure company Bloq. Another co-founder Maxwell Sanchez is a pioneer in the field of blockchain security. He first co-founded the PoP consensus mechanism and led the optimization design of the protocol.

In addition to the two founders, the Hemi team currently has nearly 30 people, including many members who have participated in the technical development of well-known projects (such as former Decred CTO Marco Peereboom, etc.).

Investment

Since its inception, the Hemi project has been favored by many well-known institutions. In September 2024, Hemi Labs announced the completion of a $15 million seed round of financing, led by YZi Labs (formerly known as Binance Labs) under Binance. The financing was also jointly led by traditional Silicon Valley venture capital Breyer Capital (whose founder had invested in Facebook, Circle, etc. in the early stage) and crypto fund Big Brain Holdings.

In addition, the participating investors are strong, including institutions such as Crypto.com Capital, HyperChain Capital, Alchemy Ventures, SNZ Holding, and industry celebrities such as Bitmain founder Jihan Wu. The investors' backgrounds cover crypto exchanges, traditional VCs, and industrial capital, reflecting the market's recognition of Hemi's modular blockchain vision. It is reported that the funds from this round of financing will be mainly used to promote the development of the Hemi network based on Bitcoin and Ethereum and the launch of the mainnet. After Binance's investment department completed the brand reorganization, Hemi became one of its key supported infrastructure projects.

On-chain data performance

As an important indicator to measure the popularity of the on-chain ecosystem, the total locked value (TVL) of Hemi has grown rapidly since the launch of the mainnet. When the mainnet was officially opened on March 12 this year, Hemi attracted about $440 million in asset injections, of which about $270 million flowed in through Hemi's staking platform in the first three days of the mainnet launch to obtain BTC, ETH and other staking rewards. With the gradual deployment of ecological projects and the growth of users, TVL has continued to rise since then.

Currently, according to DeFiIlama data, the locked-in scale on the Hemi chain remains at approximately US$300 million, and this is without taking into account liquid pledged assets.

On-chain ecology

While Hemi attracted large-scale liquidity in a short period of time, its on-chain ecosystem also expanded rapidly. Currently, dozens of decentralized applications (dApps) have been deployed or announced to support Hemi, covering DeFi, NFT, cross-chain communication and other fields. When the Hemi mainnet was launched, 50+ protocols were included as the first launch partners.

Among them, there are many well-known cross-chain and DeFi protocols in the industry. For example, Ethereum's mainstream decentralized exchanges Uniswap and Sushi have launched Hemi to provide users with token trading and market-making services; DODO Exchange and elastic centralized liquidity protocol iZUMi are also on the first list of supported platforms. In terms of lending and income, emerging LayerBank and ZeroLend provide on-chain lending markets, and protocols such as Nucleus and Concrete have launched multi-strategy income vaults.

Currently, Pell Network’s TVL has reached 177 million, iZUMI’s TVL has reached 61.44 million, and Uniswap follows closely with approximately 21.46 million US dollars.

Liquidity staking tokens (LST) and liquidity re-staking tokens (LRT) derived from Bitcoin and Ethereum have also become a major feature of the Hemi ecosystem. For example, pumpBTC provides Bitcoin staking derivatives, and StakeStone supports Ethereum staking derivative assets. In terms of on-chain oracles, Hemi has integrated high-performance oracle networks such as RedStone and Pyth to provide on-chain price and data feed services for DeFi protocols. The cross-chain communication protocol LayerZero has also joined Hemi as a key infrastructure, which helps to achieve message and asset interoperability between Hemi and other chains.

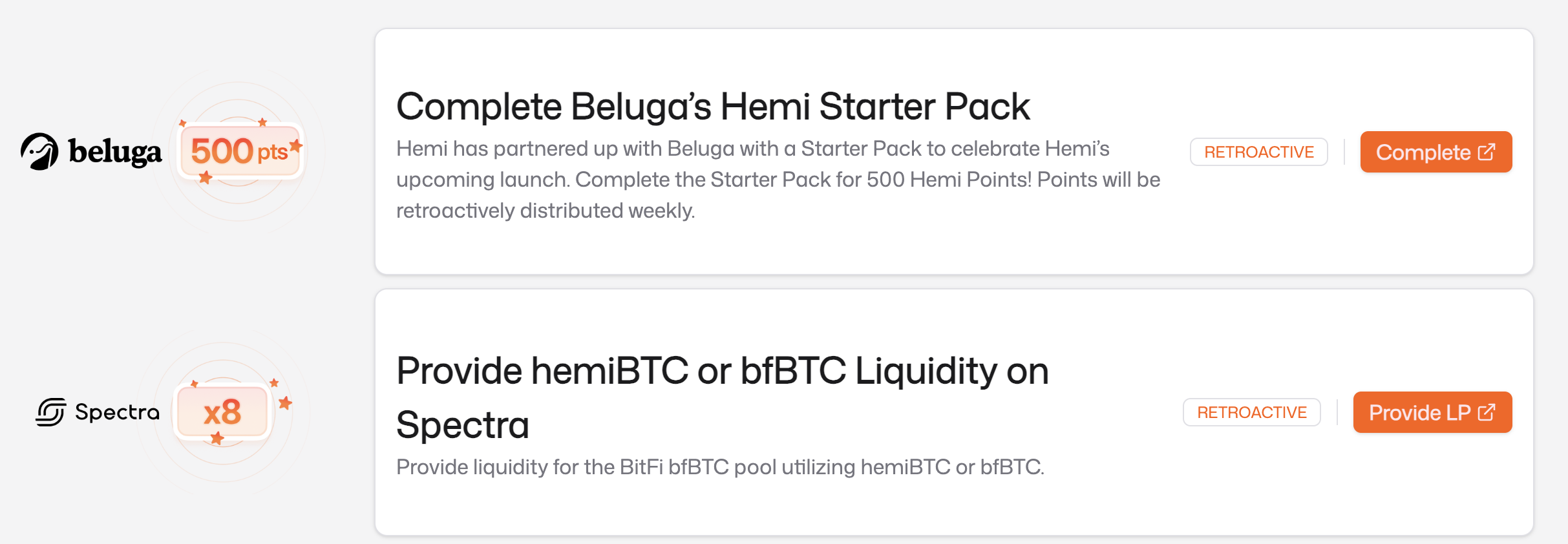

Currently, Hemi's mainnet activities are still in progress, and users can accumulate points by completing tasks and co-branded tasks.

Overall, the initial ecological projects of the Hemi mainnet include both the expansion deployment of mature platforms in the industry and a number of emerging protocols focusing on Bitcoin DeFi scenarios, initially forming a prosperous ecological prototype centered on "Bitcoin + Ethereum DeFi".

Token Generation Offering (TGE) Progress

Regarding the issuance plan of Hemi's native token (TGE, Token Generation Event), this is a topic of great concern to the community and investors. As of now, the team has not officially announced the exact TGE date. However, according to earlier official information disclosure, Hemi's token issuance will most likely be carried out within a few weeks after the mainnet is launched. Hemi co-founder Max mentioned in a community sharing in February that TGE is expected to be around 4 to 6 weeks after the mainnet is launched. Based on the mainnet launch in mid-March, the original token generation event may be launched as early as the end of April to May. However, due to factors such as the project development rhythm and market environment, the official has been cautious about the timing of issuance. Another possibility is that Hemi has entered the TGE rhythm, but it has not entered the public eye.

The community generally looks forward to the market performance of the tokens after they are launched. Since Hemi has hundreds of millions of dollars in on-chain assets and an active cross-chain ecosystem, many industry insiders predict that once its tokens are issued, their market value and liquidity are expected to gain attention in the secondary market. In addition, the background of YZi Labs, one of the leading investors under Binance, also aroused speculation - the community expects that Hemi tokens may be listed on mainstream trading platforms in the future, thereby further expanding their influence.

In general, the Hemi team has taken a prudent attitude towards token issuance: on the one hand, it prioritizes consolidating technology and ecology after the mainnet is launched, and on the other hand, it ensures that real contributors benefit when the token economy is launched through a points mechanism. As the mainnet gradually stabilizes and the ecology improves, it is expected that the launch of Hemi tokens has entered the countdown stage. Odaily is keeping a close eye on this and will continue to report on it.