Is the bull market coming? Crypto investment under geopolitical conflict

Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

As the news of the US raid on Iran's nuclear facility base gradually spread, the crypto market once again experienced a sharp decline. BTC once fell below the $100,000 mark, and the price of ETH fell below $2,300. As a result, a bull market belonging to the air force may have begun.

In recent days, both individual traders and institutions that are shorting are almost all in a profitable state. Many traders even speak out with pride, saying that they have "made a comeback."

At present, the market is still in a state of jumping between panic decline and small rebound under geopolitical conflicts. Odaily Planet Daily will discuss the subsequent duration and key influencing factors of the "air bull market" in this article for readers' reference. Note: I only share my views and perspectives, which does not constitute investment advice.

Bull market vs. shock trap: Can you make money as long as you go short?

As the situation between Iran and Israel becomes increasingly tense, BTC, once a safe-haven asset, has now become part of the global economy. "Wallets pay for the Iran-Israel conflict" has become a helpless self-mockery among many crypto people. In such a market situation, the short-selling group is the small group that makes a lot of money.

The “Air Force Chief” showed off his power: shorting 16 tokens, with a floating profit of nearly $10 million

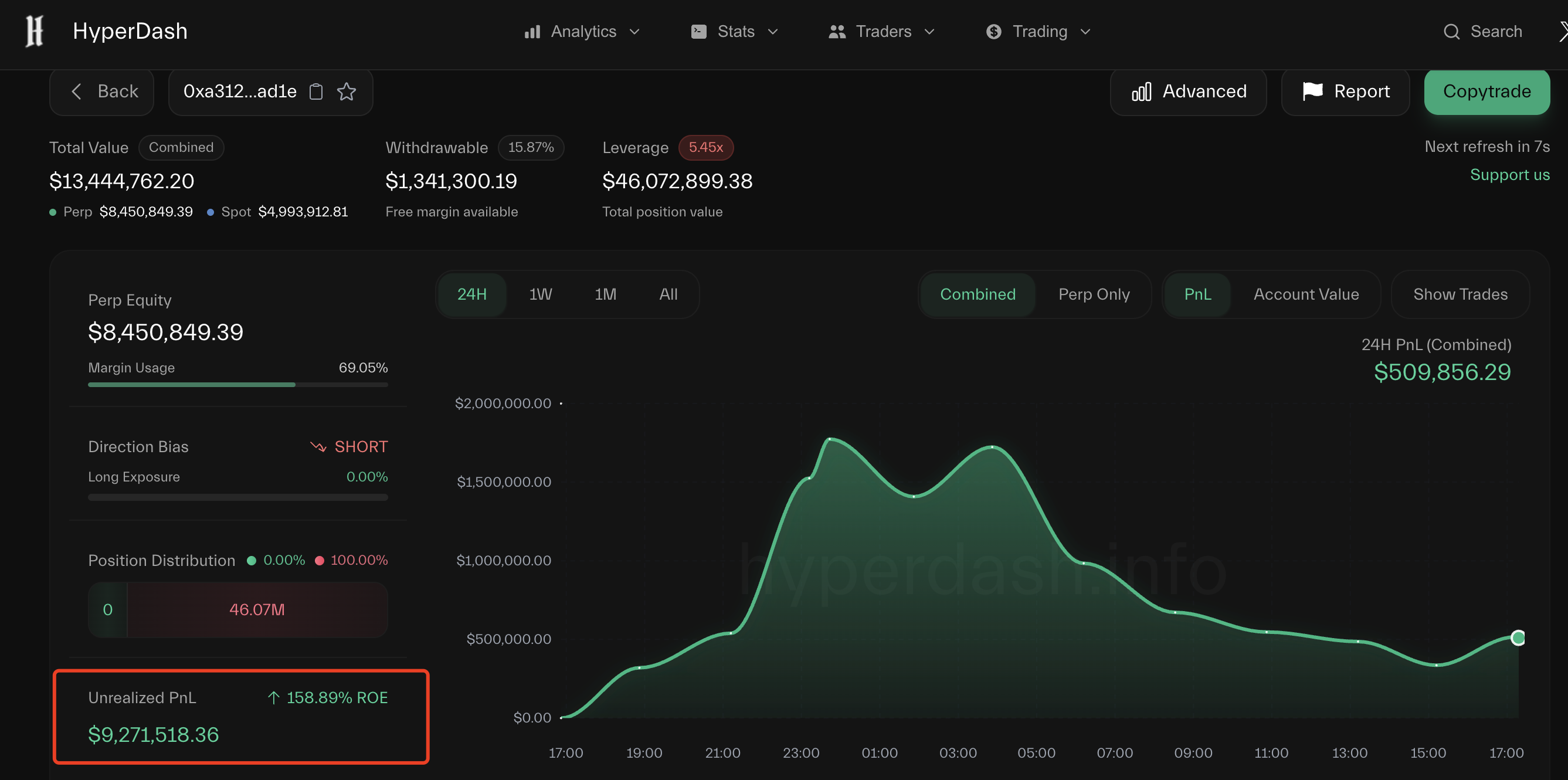

On June 20, the cumulative profit of Hyperliquid's last "air force chief" who shorted 16 altcoins was temporarily reported at US$9.68 million, much higher than last week's US$3.56 million. At that time, 15 of its 16 positions were in a floating profit state, and the only floating loss, HYPE, had narrowed its losses to US$1.92 million. The overall position value was approximately US$53.3 million.

It is worth mentioning that the whale partially closed its positions in multiple assets including ETH, PEPE, INIT, and XRP on June 17, locking in part of the profits.

https://hyperdash.info/zh-CN/trader/0xa312114b5795dff9b8db50474dd57701aa78ad1e

Currently, the address has withdrawn $1.34 million, and the floating profit under the account is still as high as $9.27 million. It is worth mentioning that the only token that caused its loss is HYPE, which currently has a floating loss of about $1.7 million.

Coincidentally, there is more than one “Air Force Chief”.

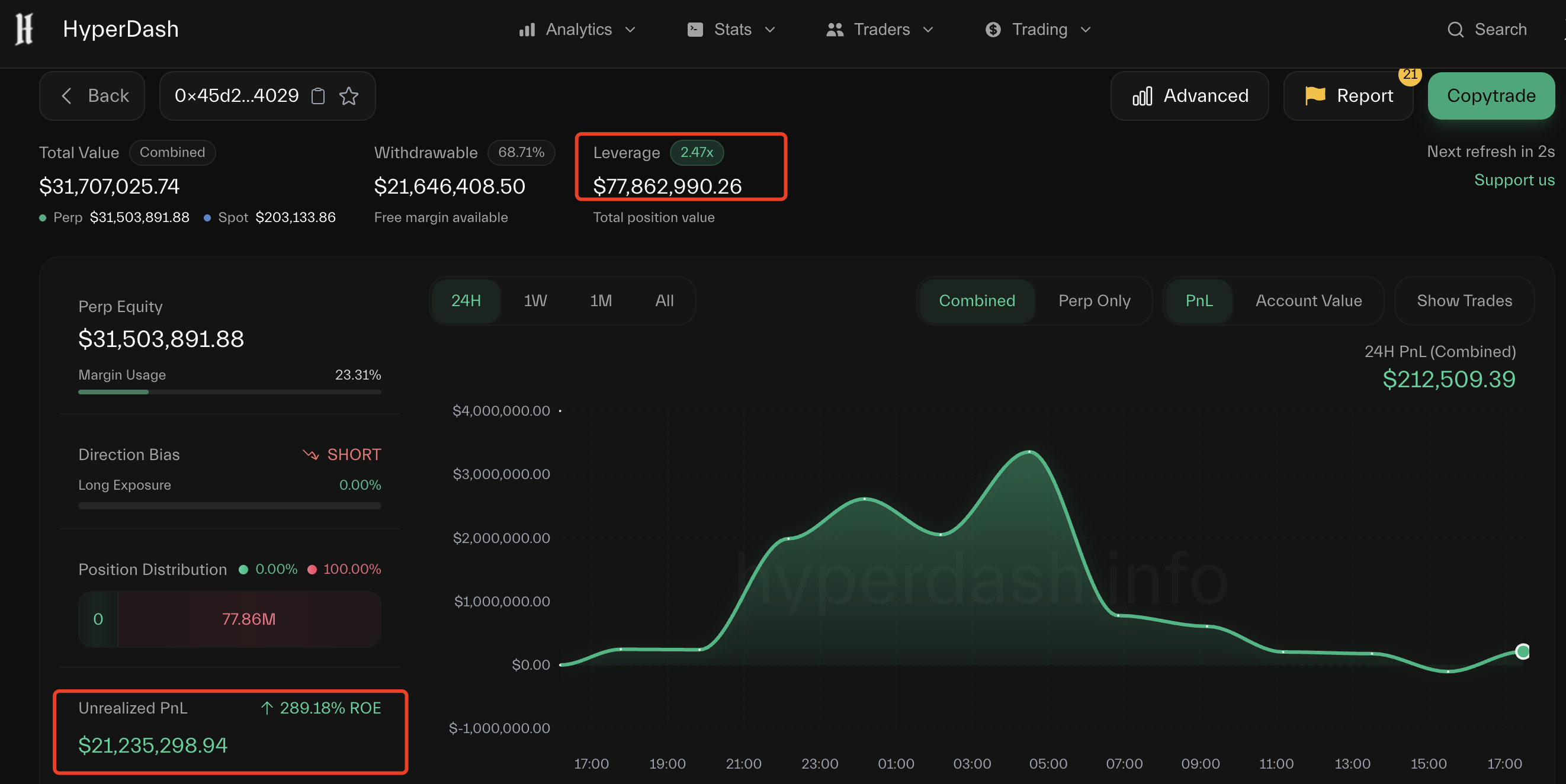

“Air Force Whale/Institution”: Shorting 58 tokens, with a floating profit of more than 20 million US dollars

Since June 16, a whale/institution has started its "air force journey" - it has opened short positions in 58 currencies on Hyperliquid, including BTC, ETH, SOL, XRP, PEPE, FARTCOIN, DOGE, AAVE, HYPE, etc. At present, the address has a floating profit of 21.34 million US dollars, and its position size has reached 77.79 million US dollars. Among the 58 short orders, only two are in a floating loss state, namely HYPE (floating loss of about 4.28 million US dollars) and AAVE (floating loss of about 16,000 US dollars); ETH has the best performance, with a floating profit of 4.438 million US dollars.

https://hyperdash.info/zh-CN/trader/0x45d26f28196d226497130c4bac709d808fed4029

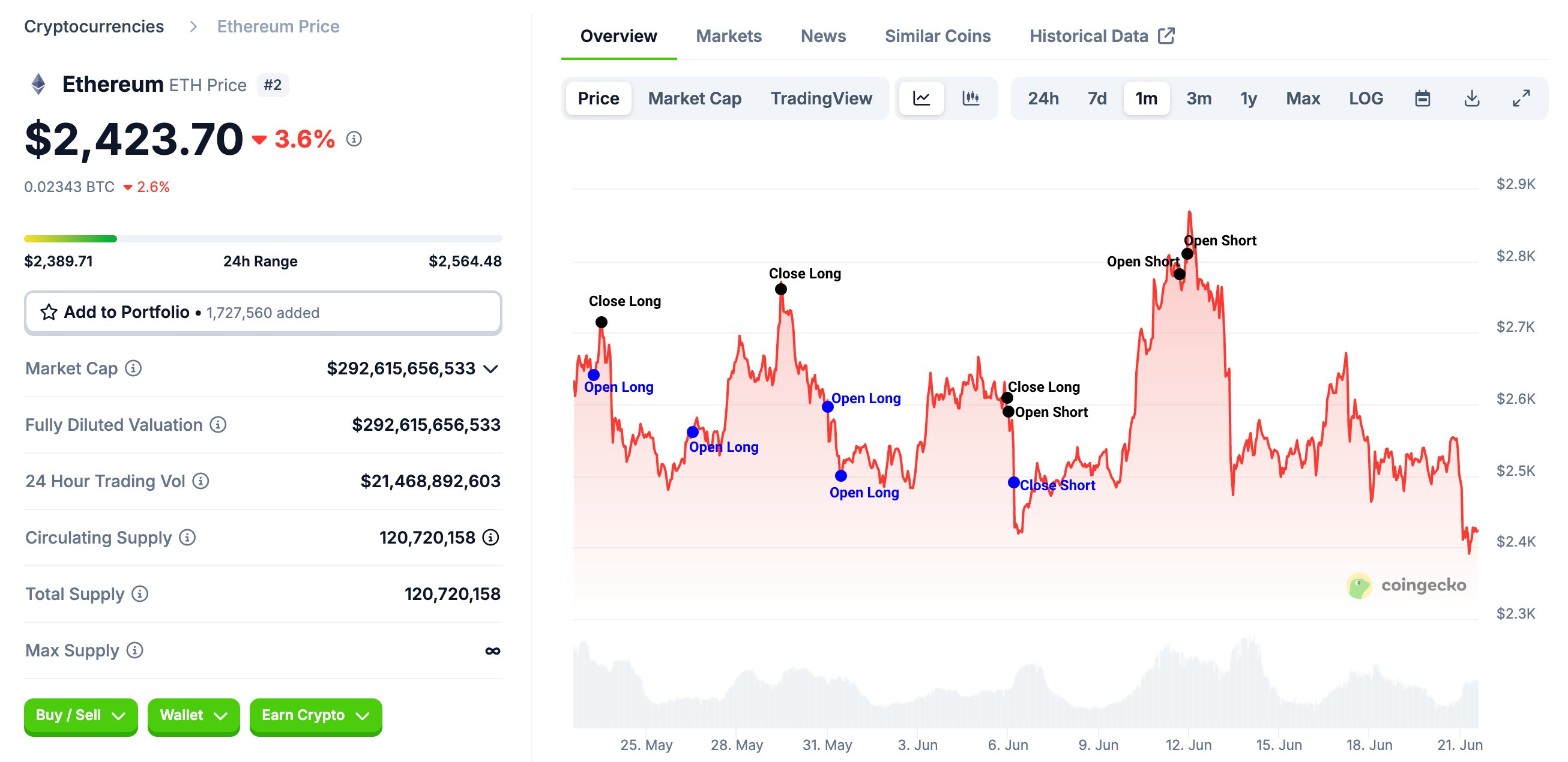

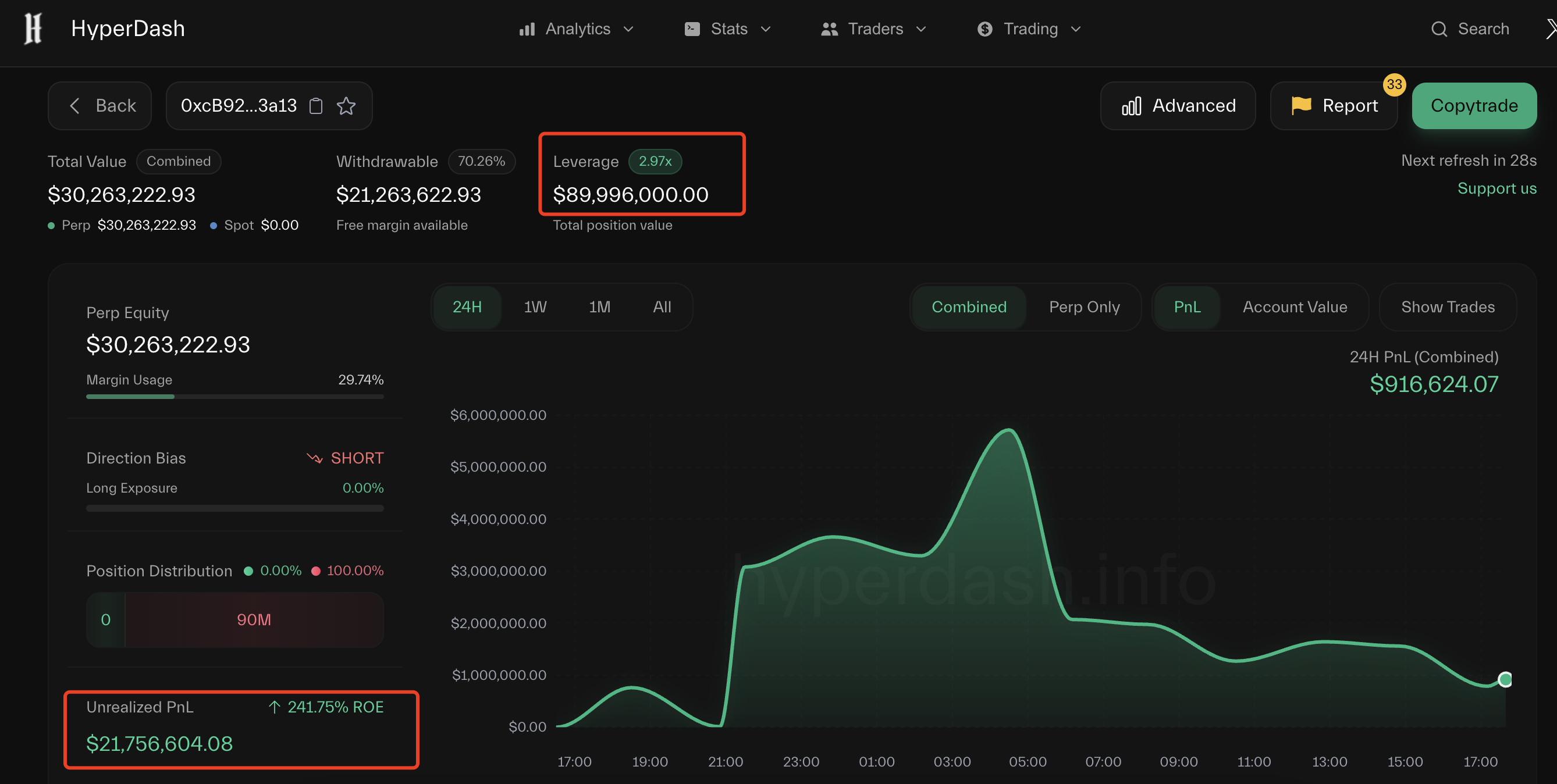

ETH smart money: shorting at the top, with a floating profit of over $20 million

In addition to the "brainless short selling" air force leaders, the short selling craze also includes "ETH smart money players."

According to LookonChain monitoring , a certain smart money that was long on ETH at the bottom had almost perfect operations in the past month. It was able to close its positions before ETH fell sharply every time and short at the top. It had made a huge profit of 20 million US dollars in the previous month. At present, the cumulative floating profit of this address exceeds 21.75 million US dollars, and the position value is as high as about 90 million US dollars.

https://hyperdash.info/trader/0xcB92C5988b1D4f145a7B481690051F03EaD23a13

Insider opinions at a glance: Data-driven statistics, traders’ opinions, U.S. stock market fake bull market, Trump and other “unstable factors”

In the current market, industry insiders have given their own views on the current downward and volatile situation. Some start from the data, some give their own views based more on macro-level risks, and some believe that the previous Circle listing and the US stock market's copycat bull market have affected the liquidity of the crypto market to a certain extent. Combined with the various operations made by US President Trump "in defiance of the world", they together constitute the "unstable factors" in the crypto market.

Statistics: The number of tokens in the past six months has reached a new low of 294

According to the statistics published by crypto KOL @zxw 018018 , among the top 1,000 trading volumes, there are only 9 tokens with a half-year high, while the number of tokens with a half-year low is as high as 294. He personally believes that this is a major manifestation of "the continuous return of the Shanzhai to zero".

Trader James Wynn: Increase short positions, BTC short-term target is $93,000 to $95,000

James Wynn, a trader who previously rose to fame for being long BTC and ultimately for opening high-frequency orders, recently wrote that he has “increased his short positions” and set a short-term target price for Bitcoin at $93,000 to $95,000.

He pointed out that the market still does not fully reflect the real risks in the context of more countries joining the war. In addition, there is no expectation of interest rate cuts in the United States . The so-called bullish logic relies only on the expansion of global liquidity, but this does not come from the US dollar system. In addition, he further proposed a conspiracy theory that the US government may hope to force Bitcoin to fall through some kind of "black swan event" to create opportunities for itself to build positions at low levels. (Of course, this is purely subjective personal conjecture.)

The US raid on Iran's nuclear facilities has indeed to some extent intensified outside speculation about the escalation of the Iran-Israel conflict and the market's "voting with its feet" downward trend.

US stock market altcoin bull market: BTC reserve camp grows, Circle leads the stablecoin sector

Another factor that has a significant impact on the crypto market is the U.S. stock market after the approval of BTC ETF and ETH ETF.

On the one hand, Strategy’s “coin hoarding strategy” has been successfully verified by listed companies such as Metaplanet, and has become a specialty of many listed companies in reserving funds and raising stock prices, which has further affected the possibility and scale of non-circle funds flowing into the crypto market. On the other hand, Circle, which landed on the U.S. stock market with the concept of “the first stablecoin stock”, and SRM, a company that reverse-merged with TRON, have become the “copycat kings” of the U.S. stock market. The stablecoin sector has thus led the recent copycat bull market in the U.S. stock market.

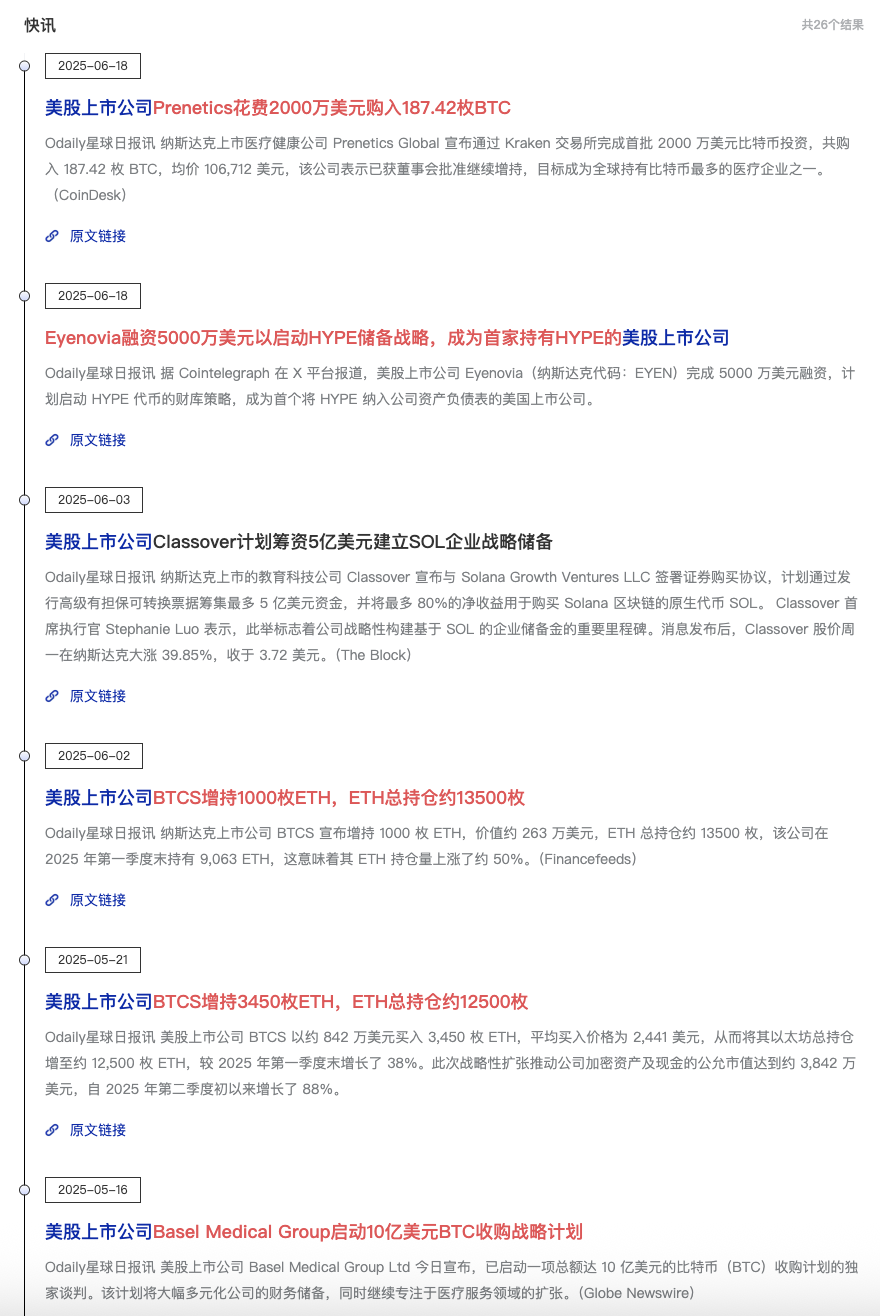

The latest situation of US listed companies hoarding coins

To the surprise of many in the crypto community, Circle’s stock price has soared all the way to nearly $260 today, which to a certain extent has had a “siphon effect” on the altcoin market, further shrinking capital liquidity.

Trump has intensified the local hot wars, and the United States is on the brink of a war quagmire

As for Trump, he is undoubtedly a complete troublemaker in the current Iran-Israel conflict.

On June 20, the White House's attitude towards the Iran issue was: US President Trump will decide within two weeks whether to take military action against Iran .

Just two days later, Trump proudly announced to the outside world that the US military had completed the strike operations on Iran's three nuclear facilities, Fordow, Natanz and Isfahan, with Fordow being the main target and full bomb drops having been carried out.

Such changing political attitudes and swift military strikes have further aggravated the tension between Iran and Israel in the Middle East. The latest news shows that Iran plans to close the Strait of Hormuz, the throat of oil transportation. This move has been approved by the Iranian parliament, but still needs to wait for the final decision of the highest security agency.

Trump even shouted the slogan "MIGA" (Make Iran Great Again), suggesting that the Iranian authorities should consider regime change.

It has to be said that Trump, who comes from a businessman background, has much less psychological pressure to start a war than politicians like Biden, and the serious consequences caused by this may require the crypto market and the world's economic system to pay for it.

Conclusion: Short-term market recovery still depends on the attitude of the United States, and the current situation is pessimistic

Overall, the crypto market has had signs of a “copycat G” for a long time, and the Iran-Israel conflict and the US’s direct withdrawal are undoubtedly the catalysts for this result. The short-term market recovery still depends mainly on the US’s subsequent statements and follow-up, especially Trump’s remarks and actions.

Trader Eugene Ng Ah Sio previously wrote that he had opened long orders for Bitcoin and some altcoins, believing that "the US bombing campaign, coupled with the closure of the Strait of Hormuz" was a continuous blow to early bulls, which was enough to clean up the market, and now is the time to "buy on dips."

However, it remains unknown whether Trump can "first launch a tariff trade war and then make positive remarks to save the market" as he did in April.

Perhaps, for most people, limited short selling is a more cost-effective option than mindless long selling.