Original | Odaily Planet Daily ( @OdailyChina )

Author: Golem ( @web3_golem )

First of all, congratulations to Tron blockchain for reaching a new level. On June 16, Tron announced that it would go public through a reverse merger with SRM Entertainment (stock code: SRM), which is already listed on Nasdaq. SRM Entertainment will be renamed Tron Inc. The company will also launch the TRX treasury strategy. (For details, see: Tron merges SRM and aims at Nasdaq, Sun Yuchens move is in the atmosphere )

With Tron listed on the US stock market, combined with the news that Tron completed the minting of the first USD1 stablecoin on June 12, it indicates that Tron is transforming into a compliant US chain supported by the Trump Organization. With its advantages in stablecoin transfers, the future network demand of Tron blockchain will definitely be more vigorous, and it is foreseeable that network transfers will prosper and the cost will rise.

In order to reduce the cost of transfer, most users will choose to lease energy. Using energy leasing on Tron can help users save 70% to 80% of the cost of a single transfer. Although the advantages are obvious, Trons energy leasing industry is still in the Warring States Period. The industry is in chaos, platform fraud is rampant, and users rights and interests are greatly threatened. As the user base and network demand of the Tron blockchain expand, the chaotic elements in the Tron energy leasing industry are bound to be cleaned up.

In this article, Odaily Planet Daily will introduce in detail what Tron Energy is and the leasing empire behind it. At the same time, it will interview CatFee, a self-service energy leasing platform recommended by the official Tron wallet, to reveal the chaos in the Tron energy leasing industry and promote the entire industry to become more transparent and user-friendly.

1. Introduction to TRON Energy and Leasing

There are two types of resources in the TRON network, namely bandwidth and energy. Bandwidth is used to measure the storage and network resources occupied by transactions on the chain, and energy is used to measure the computing resources required for smart contracts to execute instructions (such as storage reading and writing, logical calculations, etc.). Ordinary TRX transfers only consume bandwidth, not energy; but calling TRC-20 or TRC-721 contracts (such as transferring USDT or creating NFTs) requires both bandwidth and energy.

In simple terms, TRON energy can be understood as “Gas” similar to Ethereum. Users can obtain energy in three main ways:

Stake TRX

Users who stake a certain amount of TRX can obtain energy for free in proportion during the staking period (daily energy = staked TRX amount / total staked TRX amount in the entire network * 180,000,000,000). The staked TRX still belongs to the user. After unstaking and waiting for 14 days, TRX can be used normally, but no energy will be generated. Users can stake TRX through the tronscan linked wallet. Currently, staking 1 TRX can obtain about 10.39915 energy (daily floating).

Direct Combustion TRX

For users who do not often use the Tron network, the word energy may be unfamiliar, because some users do not seem to feel the use of energy when using Tron to transfer USDT. In fact, this is because when there is not enough energy in the users address to pay, the wallet will automatically burn the TRX in the address to exchange for the required energy. According to tronscan data, burning 1 TRX can obtain 4,761.90476 energy.

It should be noted that the burned TRX is destroyed directly on the chain and is not paid to the node or leasing platform.

Renting energy through the energy rental platform

The third way is that users can rent energy in advance on TRONs third-party energy rental platform to cover the cost of the transfer. Users can pay a certain amount of rent for the address that needs energy. Taking the energy rental platform CatFee as an example, it supports multiple rental options such as DApp purchases, API access, and energy sublease. Ordinary users can get 65,000 energy by paying 3 TRX, which is enough to support one USDT transfer and save about 10 TRX (burning TRX to pay requires about 13.5 TRX).

What problems does TRON energy leasing solve?

There is no doubt that obtaining Tron energy through energy leasing is the best solution for occasional users of the Tron network, peak demanders, project owners, and developers.

Energy leasing makes transfers cheaper

First, the cost of leasing is generally lower than the cost of staking and directly burning TRX to obtain energy. Taking USDT transfer as an example, if the target address already has USDT, a transfer requires about 65,000 energy + 350 bandwidth, and direct burning requires about 13.5 TRX. If the target address does not have USDT, it requires about 13,000 energy (27.7 TRX).

However, using energy leasing can reduce the transfer cost by more than 50%. Based on the current official rental price of 72 sun/Day from JustlendDAO, users can spend 7.3 TRX to rent 100,000 energy, which can complete 2 USDT transfers. If you want to obtain 100,000 energy through staking, you need to stake at least 9617 TRX.

If you use the third-party energy rental platform CatFee , you only need to spend 3 TRX to rent 65,000 energy, which is much lower in cost.

Optimize capital efficiency

In addition to lower costs, energy leasing can also optimize capital efficiency and not occupy too much of the users TRX. For users who occasionally use Tron to transfer money, it is obviously not cost-effective to pledge 6250 TRX to get 65,000 energy for free. It seems free, but TRX needs to be locked for 14 days before it can be used normally. If there is a big drop during this period, there will also be a risk of a substantial shrinkage of assets.

Even for users who frequently use Tron transfers, using a safe and professional third-party energy leasing platform to obtain energy is not only cheaper, but also increases the flexibility of their own funds.

2. The energy leasing industry is still in chaos

At present, the TRON energy leasing market is showing a rapid growth trend and has formed a multi-level ecological structure. In the primary market, users obtain energy by staking TRX, with an annualized rate of return of about 2.8% -4.1%; in the secondary market, energy leasing platforms match supply and demand and rent out idle energy, with an annualized rate of return of more than 20%; and in the tertiary market, professional institutions even conduct energy futures contract transactions, cross-platform arbitrage of USDD, TRX, stUSDT, and other operations, with an annualized rate of return peak of 30% -50%.

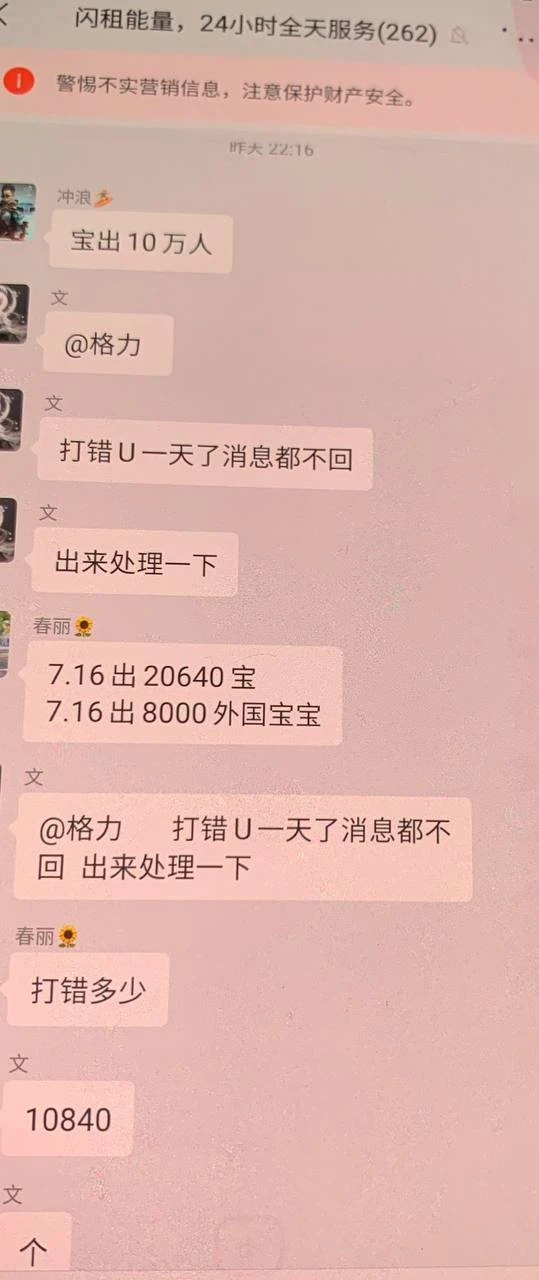

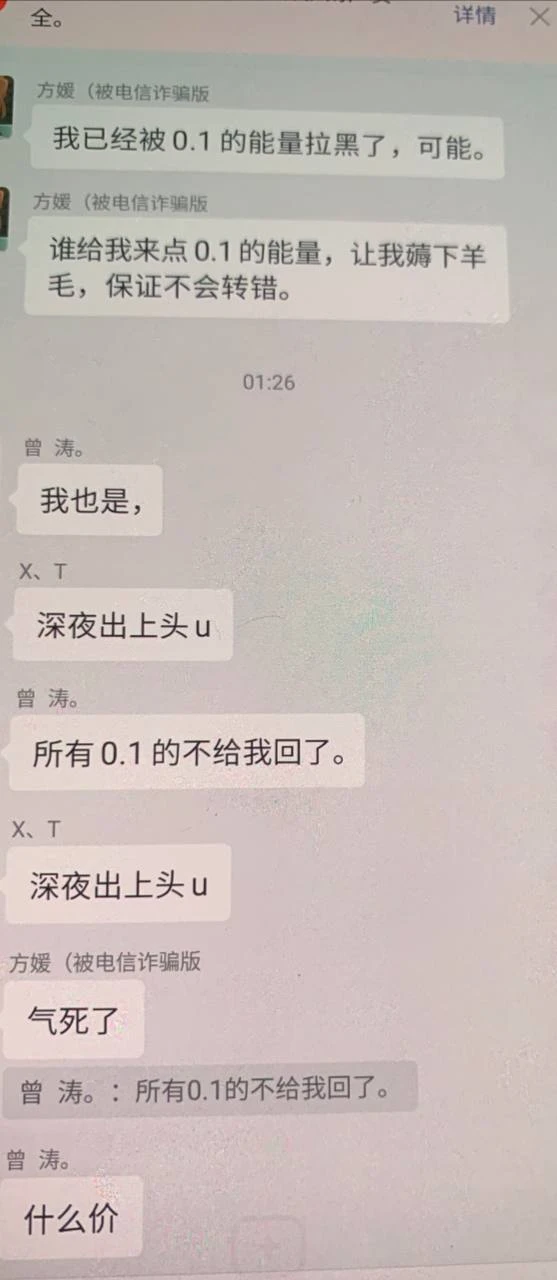

However, even though the market size is growing, the Tron energy leasing industry is still in a chaotic period, especially in the secondary market. We understand that many newbies to Tron or users who dont understand energy leasing have encountered phishing attacks, Ponzi schemes, and virus implants to steal assets, and when these fraud cases occur, it is extremely difficult to recover assets.

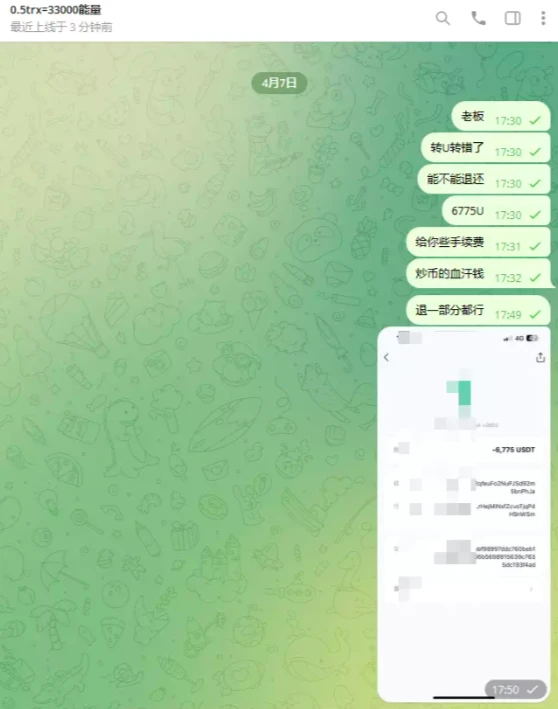

Low-price energy leasing casts a wide net, misleading users to make the wrong transfer

The most typical energy rental scam model is to attract users with low rental prices, and then induce users to transfer addresses. Specifically, the scammers deliberately lower the energy price, using the gimmick of paying 2.5 TRX or even less to make a USDT transfer (regular rental requires at least 3 TRX), and when users pay the scammers addresses, they can indeed receive about 65,000 energy, but they generally remind users to save the address book in their wallets or pin their addresses, and remind users to rent from this address when they need Tron transfers.

The scam begins at this point, because the scammers address is pinned to the top of the saved address book. The scammer is betting that the user will mistake their address for the target transfer address and transfer USDT and other tokens to their address by mistake. However, when the user finds that the transfer is wrong, the scammer will block them and complete the harvest.

The scammers complete the harvest when the user transfers to the wrong address

In fact, compared with Ponzi schemes and Trojan viruses, this type of scam is not very clever, but it is indeed the most common. It takes advantage of users desire to get a small advantage, and increases the winning rate of users wrong transfers by casting a wide net. You can get a dozen or twenty advantages, but the scammers only need you to make a mistake once.

User begs scammer to return USDT that was transferred incorrectly

Don’t think that this “simple” method can’t attract much money. We learned from CatFee that its leasing business has returned more than $600,000 in funds that users transferred by mistake since its opening two years ago. The profits of those leasing platforms that deliberately lure users to transfer funds by mistake and don’t return the funds can be imagined.

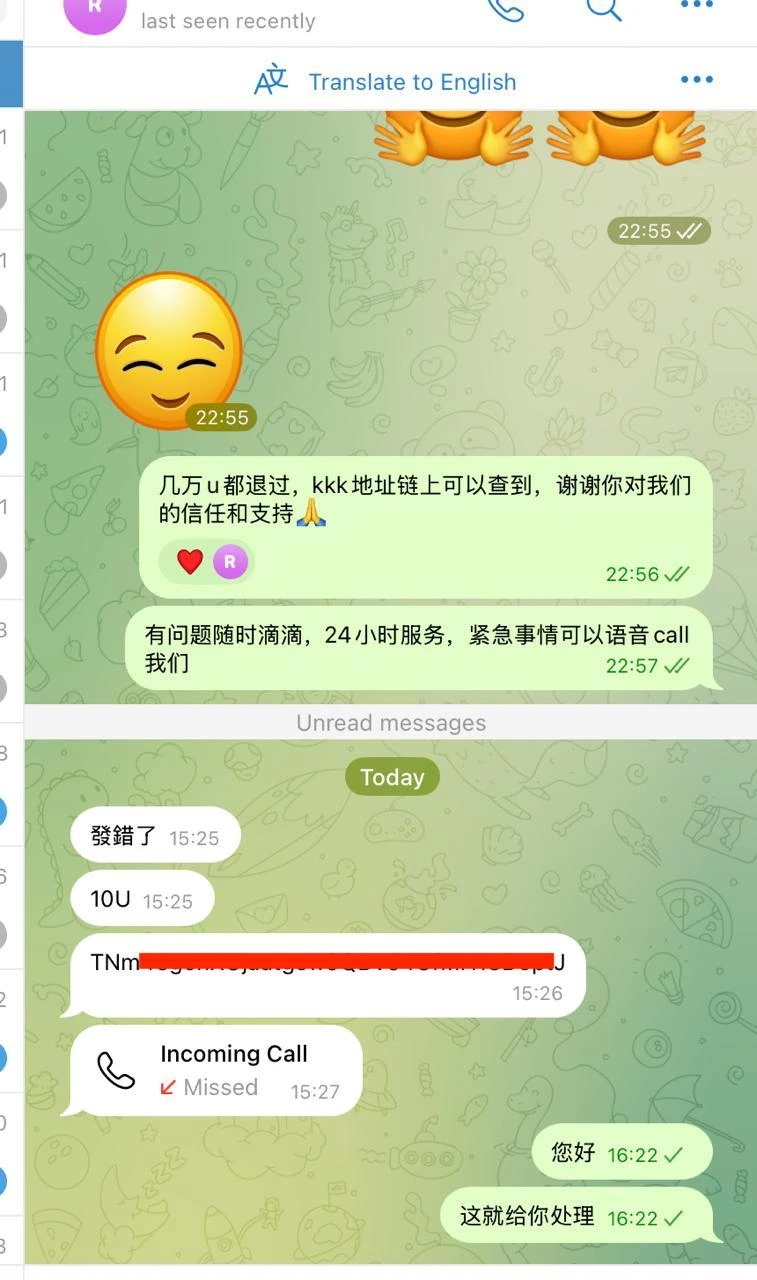

Formal energy leasing platforms will refund users’ mis-transferred funds

At the same time, CatFee revealed to Odaily reporters that the rental fishing platform does not care about the rental cost. They mainly let users develop a habit. You may not make mistakes in 1-10 days, but 10% of people will be careless in 1 month. This is called raising fish fry. There are even people who are teaching fishing and recruiting agents to streamline this fishing method.

After the user transferred to the wrong address, the scammer lost contact

So how can we tell whether an energy leasing platform is legitimate? CatFee said that the most important thing is to see whether its business address has a record of returning the wrongly transferred funds. At the same time, users can also observe whether its platform website is professional, domain name registration time, whether the development documents are formal and complete, business address activation time and transaction record activity. If there is not even a business website and only a simple telegram robot, then it may run away at any time.

The magical thing is that there are also users who think they will never make a wrong transfer and are dedicated to taking advantage of scammers.

3. Inventory of mainstream energy leasing platforms

From the above phishing cases, it can be seen that for ordinary users, it is extremely important to choose a low-priced, safe and reliable TRON energy leasing platform. Currently, there are four mainstream energy leasing platforms on the market for users to choose from, namely Trons official JustLend energy leasing platform, CatFee energy leasing self-service platform, Baimao C2C energy trading platform and Mefree energy leasing platform, which will be introduced below.

JustLend

JustLend is the first official lending platform on Tron, where users can also view energy prices and rent energy. JustLend energy prices are calculated on a daily basis, fluctuating between 70 and 75 sun/day (1 TRX = 1,000,000 sun). For example, a user can rent 100,000 sun with 7.365 TRX (equivalent to the energy obtained by staking 9,617 TRX), which is enough to satisfy two transactions.

CatFee

CatFee is a third-party energy leasing platform officially recommended by TRON Wallet. The company was established in Los Angeles, USA at the end of 2023. With the rapid development of its business, it established branches in Melbourne, Australia and Malaysia in 2024. In terms of TRON energy leasing business, CatFee is committed to helping downstream TRC 20 transfer users save gas fees, while providing energy leasing services to upstream whale users who hold a large amount of TRX to obtain additional income.

At present, the daily energy leasing scale of CatFee platform is stable between 4 billion and 5 billion, providing TRC 20 transfer support to 30,000 to 40,000 users per day, and the platforms daily average energy delivery service orders exceed 30,000 orders, saving users more than 300,000 TRX gas fees per day. Lower handling fees not only lower the users usage threshold, but also encourage more people to choose to transfer TRC 20 through the TRON network, thereby promoting the development of the TRON ecosystem while also bringing practical convenience and cost advantages to end users.

Compared with other energy leasing platforms, CatFee has the following advantages:

Large energy pool with high concurrency capability

CatFee has a large wave field energy pool of more than 4 billion, which can meet the energy supply during peak hours and has a stable supply. At the same time, CatFee has redundant computer rooms in Los Angeles, Melbourne, and Singapore. The strong hardware investment enables it to have high concurrency capabilities, and can process up to 300 orders concurrently within 1 second, providing energy for 500,000 TRC 20 transfers per day.

The rental cost is lower than the official rental price

It takes about 65,000 energy (13.5 TRX) to transfer USDT in TRON. Compared with the energy rental cost of JustLend, it only costs 3 TRX to rent 65,000 energy using CatFee, which is cheaper than the official one. CatFee said that if the rental platform does not have its own funds and energy pool, the energy operation cost is as high as 4.6 TRX. Only with these two energy rental platforms can the sales cost be reduced. Even so, the platform only has a 5% profit, and it was even in a state of slight loss last year. It was not until March to May 2025 that the business gradually entered the stage of slight profit , CatFee told Odaily reporters.

This also indirectly proves that 99% of the energy leasing services on the market with prices below 2 TRX, especially those in the 0.1 – 2 TRX range, are operating at a loss or are phishing platforms.

The team is reliable and full refund will be given if the transfer is wrong

CatFee team is composed of blockchain engineers from various countries, forming a strong and professional development team, and its products and services are updated and iterated rapidly. At the same time, in the energy leasing industry, CatFee is one of the few platforms operated as a professional company, supporting 7*24 hours global multilingual customer service online to answer user questions.

And CatFee promises that if you use transfer to purchase energy, even if you transfer the wrong assets to the platform, CatFee will not deduct any fees and will return 100% of the assets to the original source.

100CAT C2C Energy Trading Platform

100CAT is a C2C energy trading platform officially recommended by TRON. Users can sell idle energy on the platform (suitable for staking users), and users who need energy can also buy it on the platform. The energy on the 100CAT platform is also cheaper than the official price. As shown in the figure below, if you buy 65,000 energy and rent it for 3 days, the unit price can be as low as 45 sun/day. At the same time, energy sellers can also manually take orders and sell energy to buyers. If you don’t want to sell manually, just register as a 100CAT VIP and the platform will help customers sell energy automatically to obtain the highest profit.

Mefree

Mefree is also an energy rental platform officially recommended by TRON, with an energy pool of about 1.2 billion. However, due to the increase in USDT transfer fees on the Tron blockchain, the Mefree energy rental price has also been raised, and 5 TRX (if the target address has USDT, otherwise 10 TRX is required) is required to purchase 65,000 energy. At the same time, it stated that if the user mistakenly transferred 3 TRX and did not receive energy, a full refund will be given.

4. Write to the end

There is no doubt that with the prosperity of the Tron blockchain itself, the Tron energy leasing industry will benefit more in the future, and the user energy leasing demand will also increase. However, the entire industry is still in the stage of great waves washing away the sand, chaos and order coexist, and middlemen compete with regular operating companies.

The formal energy leasing industry is a highly competitive industry with high technology and high capital barriers. Once it is unable to maintain basic profits, whether the energy leasing team will turn to illegal methods such as fishing at the critical moment of survival is also a test of the humanity of the energy leasing team in the industry, said CatFee when asked about the current situation of the energy leasing industry.

It is true that in this situation, many teams will turn to phishing, fraud, or evolve into a Ponzi scheme that relies on customer deposits to operate, but we believe that Trons energy leasing industry will also move from wilderness to civilization and order like Tron. In the future, only platforms that truly provide users with high-quality services can survive.

Related Reading

Why can’t I buy energy using a wallet on a centralized exchange?

I have already leased the energy, why does the transfer still fail?