Crypto industry moment of truth: Income is the only PMF validator

Original author | Castle Labs ( @castle_labs )

Compiled by | Odaily Planet Daily ( @OdailyChina )

Translator | Dingdang ( @XiaMiPP )

In the business world, it is often said that "business is business", but when we try to apply the business model of traditional enterprises to the crypto industry, the problem is not that simple.

The core purpose of this article is to think about: Should the crypto industry also return to its commercial essence and reshape its product logic to create products that truly meet user needs and can continuously generate revenue?

The crypto industry is at a turning point: The failure of the hype model

The crypto industry is currently facing a critical moment: the project model that relies on "hype-driven" is being constantly "slapped in the face" by the real market.

Unlike Web2 startups that always build long-term value around "revenue", Web3 projects follow another "unbalanced script": financing, issuing coins, creating momentum, incentivizing new users, and then leaving it to the market to decide their fate.

This path instills a wrong perception in users: the product exists for "speculation" rather than providing real value. Users often stay for a few months, receive airdrops, and then leave. The project bears the sunk cost instead of gaining long-term users.

As a result, the core focus of the project is not PMF (product-market fit) and revenue, but financing and launch. As for whether the product is actually used, it is irrelevant.

Worse, the model appears to be successful because it is built on a series of unhealthy and unsustainable premises.

The crypto industry is inherently cyclical, with sharp ups and downs and fleeting popularity. Most projects lose their motivation to innovate after the popularity fades, and they are unable to provide users with a reason to stay.

Considering the extremely low cost of on-chain migration and the lack of an account system or KYC threshold for users, users will just turn around and leave. Projects without user stickiness and income support have a very low probability of surviving in a turbulent cycle.

If you want to survive the cycle, "income" must become the long-term core

If we want this industry to truly mature and develop, Web3 projects must fundamentally transform and make "revenue" their core goal rather than relying on luck or popularity.

In this way, the project can judge the real needs and stickiness of users, form a stable cash flow, and have the ability to cross cycles.

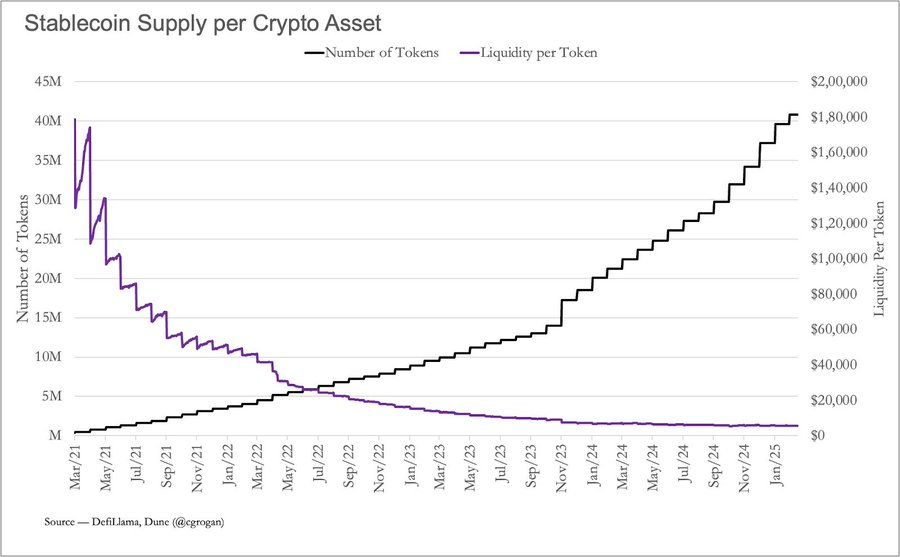

Data from decentralised.co shows that the liquidity of newly launched tokens is continuing to decline, and the speed of token issuance far exceeds the speed of new funds injected into the market.

This means that the space for extracting value from old users is shrinking rapidly, the competition faced by projects is becoming increasingly fierce, and the funds available are becoming less and less.

Revenue is the “reality check” for crypto projects

As mentioned earlier, the fundamental problem is that there is something wrong with the product design logic: we are not making tools that can truly solve problems, but rather making hype products that are "only valuable in a hot environment."

This is why I believe that revenue is the ultimate criterion for testing whether a crypto project is healthy.

Teams that are willing to transition from a hype-driven valuation model to a fundamental logic will have a better chance of surviving and growing. However, projects that continue to rely on storytelling will find it more difficult to survive in the future when liquidity becomes increasingly scarce.

Four key points to building a revenue model

1. Fee-oriented business logic : Projects should charge users based on product practicality rather than relying solely on token appreciation. The industry needs to abandon the misconception that “users should not pay”.

2. Strong user retention mechanism : The portability of cryptocurrencies is so high that the cost of user transfer is almost zero. Therefore, projects must try to create "long-term relationships" so that users come back for practicality instead of airdrops.

3. Track real business indicators : Compared with token market value, TVL or incentive indicators, the team should pay more attention to "operational data" such as revenue brought by each user, customer acquisition cost, user lifetime value, etc.

4. Repurchase mechanism driven by real income : Borrowing the logic of the traditional stock market, the token repurchase is driven by real income. For example, Hyperliquid uses more than 50% of the protocol income for token repurchase, with significant results.

Who is executing? Who is delivering?

Crypto Fees data shows that old projects such as Uniswap and Aave are still the most stable "cash flow machines". This also explains why they can continue to attract attention. Users are willing to pay for value, which is the most essential positive feedback.

Note: cryptofees does not get Solana data

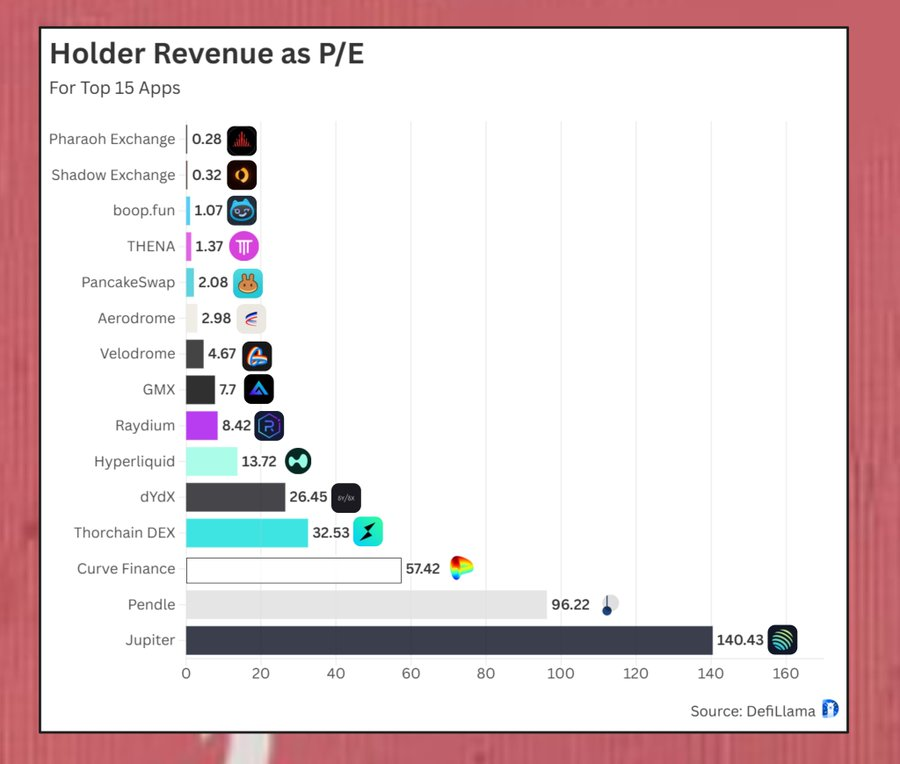

The DeFi community is also paying more attention to profitability. @0x Breadguy analyzed the P/E (price-to-earnings ratio) of multiple protocols, which is an important indicator to measure the relationship between the value and return of tokens. DefiLlama data also shows that since May 2025, the TVL of mainstream protocols has increased by more than 15%.

Above is the price-to-earnings ratio (P/E) of the top 15 applications calculated based on the annualized data of the past 30 days, and compared with the current market capitalization (MC):

1) Shadow and Pharoah have very strong returns , with annualized returns even exceeding their overall market cap. However, it should be noted that their circulation rates (the proportion of circulating tokens to total supply) are only about 11% and 13%, so be cautious when interpreting the data.

2) PancakeSwap may be the most balanced project between fees, valuation and liquidity at present.

3) Hyperliquid has performed extremely well - even with a market cap of $11 billion, it still achieves revenue ratios far exceeding many small and medium-sized DeFi protocols, which is crazy.

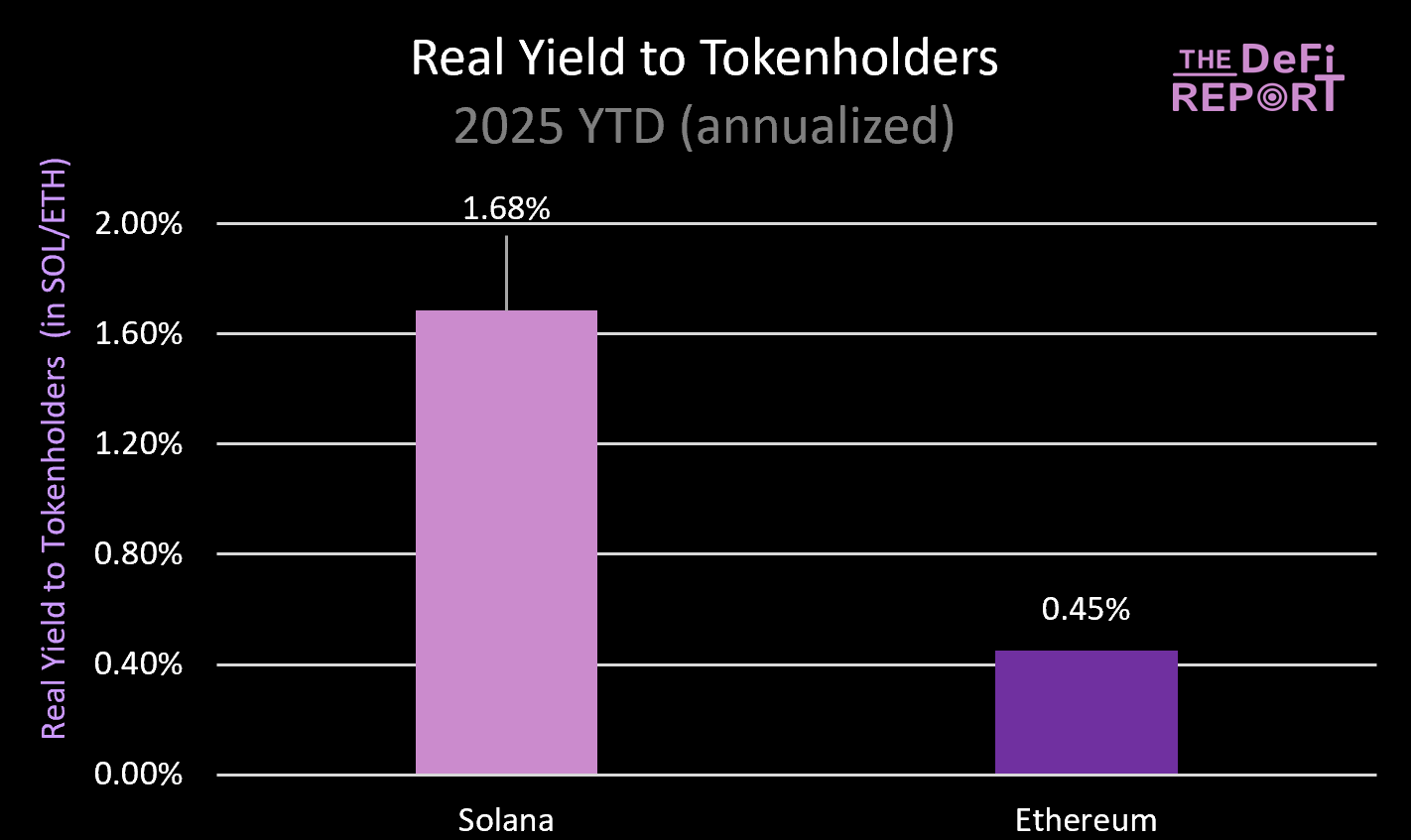

Another researcher @JustDeauIt proposed the "Real Yield" indicator, which refers to the portion of fees paid by users on the chain (including MEV income) that is directly allocated to stakers. It mainly answers the question that investors are most concerned about: How much value from real economic activities can I get by buying and staking the tokens of this chain?

The key dimensions of measurement include on-chain transaction fees and MEV income paid by users, the economic vitality of the L1 chain ecosystem, the total asset size (TVL) protected by the network, the total amount of staked assets in the network, the liquidity rate of assets in DeFi, the supply and circulation efficiency of stablecoins, the new issuance scale of RWA, the liquidity of cross-chain bridge assets, the economic linkage between L1 and L2 and their upper-layer applications, infrastructure, and the operating income paid to staking service providers.

It can truly reflect the intrinsic economic health of a public chain, rather than just "telling stories" based on superficial indicators such as inflation, destruction, narrative or TVL.

New trend: Revenue-oriented DeFi applications are on the rise

Recently we’ve seen a rapid growth in a new category of apps that were designed from the ground up with revenue in mind.

Aggregate trading interface based on DeFi

DeFi trading applications have achieved impressive results in terms of revenue performance. Through clear value propositions and high-quality execution capabilities, these products provide users with an efficient and smooth on-chain trading experience, enabling them to seamlessly connect to trading platforms on multiple blockchains.

The target users of this type of application are professional traders, who value execution efficiency, system stability and ease of use. As long as the experience is good enough and the efficiency is high enough, users are willing to pay for it - because an excellent tool can directly improve their profitability.

For example, @AxiomTrading precisely met this demand and achieved commercialization in a very short time. Its platform axiom.trade has exceeded $100 million in revenue in just 4 months since its launch, becoming one of the fastest growing startups in the crypto space.

Mobile DeFi apps powered by Hyperliquid

Another direction worth paying attention to is DeFi-driven mobile applications. DeFi is one of the most transformative innovations in cryptocurrency, but its complexity makes it difficult for the general public to accept it. But now this situation is changing.

A range of mobile-first experiences built on Hyperliquid infrastructure are now beginning to emerge, delivering user experiences far superior to anything previously available.

Applications such as @dexaridotcom and @LootbaseX provide a convenient experience comparable to centralized exchanges, while retaining users’ full control over their assets and the decentralized nature of transactions. Such products not only lower the threshold for using DeFi, but also release users’ potential needs in mobile scenarios.

I believe that this kind of mobile, lightweight, and highly secure DeFi application will further promote the exploration of diversified business models and more easily arouse users' willingness to pay. Because for ordinary users, "usable, easy to use, and worth paying for" products are the real DeFi growth engine.

These products with more mature designs and clearer goals can not only attract new users, but also have clear monetization paths. They are expected to lead a new trend of "revenue-centric" and will also encourage more builders to move towards pragmatic innovation.

Conclusion

It is foreseeable that the next wave of mass adoption in the crypto industry will be led by revenue-driven products , which are more sticky, more likely to attract real money investment, and more likely to establish long-term user relationships and real market demand.