1. Policy: Stablecoin legislation breaks the ice, and the "GENIUS Act" releases hundreds of billions of "dollar-style liquidity"

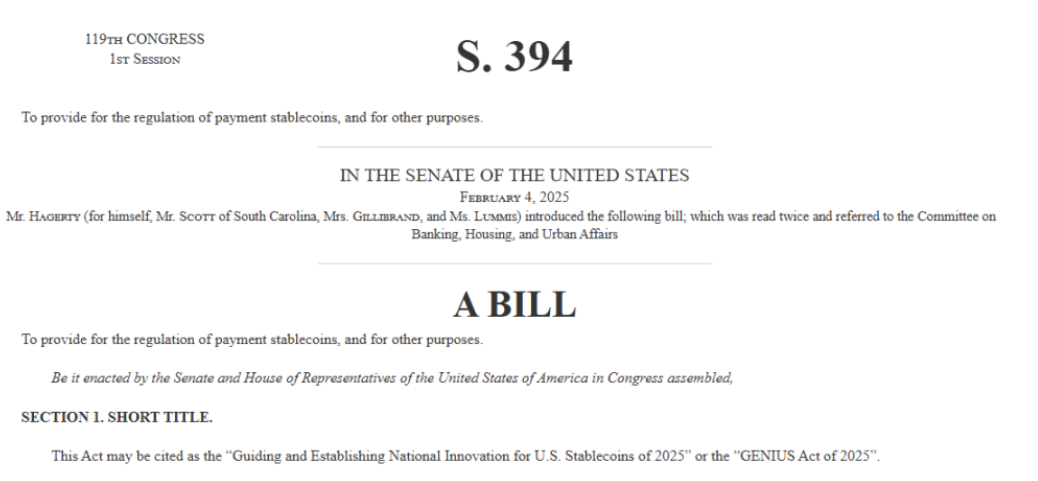

On May 14, 2025, the U.S. Senate passed the GENIUS Act, a stablecoin regulation bill, by 69 votes to 31, marking the bill's official entry into the final revision and full house voting process. This is a major breakthrough in the history of the United States to include stablecoins in the federal legislative system, and it also means that the crypto industry will usher in unprecedented incremental liquidity within the compliance framework. The essence of this bill is to provide a clear and legal operating mechanism for the current US dollar stablecoin market, which is currently about $200 billion in size and has long been in the gray area, so as to effectively introduce a large amount of off-site US dollar capital into the on-chain system and open up the main channel of "US dollar liquidity" for the entire crypto ecosystem.

The legislative background of the GENIUS Act is full of practical urgency. On the one hand, stablecoins, as the form of "on-chain dollars", have become the basic assets of crypto transactions and DeFi finance, but they have long been in a regulatory vacuum in the United States, and have even been blamed by the Treasury Department, SEC and other institutions. On the other hand, the digitalization of global legal currencies and stablecoin regulatory policies such as China's digital RMB and the EU MiCA Act are accelerating. The United States urgently needs to give its own answer in the "financial geopolitical competition", and the compliance of stablecoins has become a frontier battlefield to maintain the global dominance of the US dollar. The GENIUS Act is therefore given strategic significance. It is not only a regulatory response to financial innovation, but also a digital extension of the US dollar financial infrastructure.

From the design of the provisions, the bill requires that all stablecoins must be issued by banks or registered trust institutions at the federal or state level in the United States, and use 100% cash or short-term U.S. Treasury bonds as reserve assets, disclose the reserve situation to the public on a daily basis, and accept the supervision of the Ministry of Finance, the SEC, and the CFTC. In other words, in the future, stablecoins must not only be "compliant", but also "auditable on the chain". This high standard directly targets the credit risks and audit opacity existing in the current traditional stablecoin models such as USDT. The bill also specifically sets up a CBDC exclusion clause, which makes it clear that its goal is not to promote central bank digital currency, but to build a market-oriented "stablecoin free competition system", which is of great practical significance in the current political atmosphere and clears the way for the long-term development of market-oriented dollar stablecoins.

It is worth noting that the GENIUS Act has not only received strong support from the Republicans, but also received the tacit approval of some moderate Democrats. The Trump camp even regards it as the core of the future digital financial strategy. Trump's crypto advisor David Sacks publicly stated that once the bill is passed, it will release "trillions of dollars" of on-chain demand for short-term U.S. debt, indirectly realize the digital digestion of U.S. Treasury bonds, and ease the pressure of fiscal refinancing. At the same time, the Federal Reserve and the Treasury Department have also begun to open data interfaces and audit mechanisms for compliant stablecoins, and the SEC has begun to draft supporting regulatory rules for cryptocurrencies. These signs indicate that government agencies are actively paving the way for the implementation of the bill.

This series of systems and funding preparations mean that after the bill is passed, a legal, transparent, and deeply connected on-chain dollar ecosystem will be quickly formed. Large financial technology companies such as Circle, PayPal, Visa, and JPMorgan are likely to participate in the issuance and clearing system of the new generation of stablecoins at the first time, becoming pioneers in the global expansion of the digital dollar. The crypto market will also usher in a turning point in its full connection with the traditional capital market under this mechanism, especially short-term U.S. Treasury bonds will be injected into the chain in large quantities and become the standard collateral asset of stablecoins. Its low volatility and high credit characteristics will provide a new "risk-free interest rate anchor" for the entire on-chain financial system.

It can be foreseen that once the bill is formally legislated, the US stablecoin market will move from an unregulated state to a new paradigm of "strong regulation + high transparency". Non-compliant stablecoins such as USDT and DAI may face pressure to reconstruct their models, while US stablecoins such as USDC and PYUSD are expected to occupy a compliant dominant position. On the capital side, according to estimates by many institutions, the first phase alone is expected to introduce an additional stablecoin issuance of US$200 billion to US$400 billion to the on-chain market, which will not only reconstruct the on-chain payment and clearing mechanism, but may also directly increase the valuation anchor of Bitcoin and mainstream assets. In the past, the Bitcoin market was mainly driven by spot and futures capital, and in the future, the "on-chain US dollar deposit" mechanism carried by stablecoins will become a new cornerstone of the Bitcoin price system.

The advancement of the GENIUS Act marks a historic turning point in the transformation of stablecoins from marginal tools to core financial infrastructure. It releases not only liquidity, but also the rebalancing of the United States' dominance over the on-chain financial order. In this new architecture, stablecoins will become a strategic weapon for "on-chaining of the US dollar", and crypto finance will truly move from the gray laboratory to the institutionalized track. With the large-scale influx of compliant funds, the market may usher in a new round of "macro bull market" in the second half of 2025, and the stablecoin track will also become the "policy main line" leading this round of market conditions.

2. Macroeconomic environment: U.S. Treasury yields fell, the funding environment became marginally looser, and "invisible QE" entered a new stage

The current crypto market is ushering in a process of fund repricing driven by changes in the global macro environment. The core of this trend is the rebalancing between the structural contradictions of US debt and interest rate policies, as well as the reality of the tight to loose funding situation under the linkage of fiscal and monetary policies. Recent market changes have clearly reflected this turning signal. The yield of the US 10-year Treasury bond has fallen sharply from its high point, and has fallen to 4.46% at the latest. The market's expectations for the long-term interest rate path have loosened, reflecting that funds have begun to redefine the trade-off between US economic growth and inflation, which is a favorable premise for valuation reconstruction for all risk assets including Bitcoin. The downward trend of Treasury yields this time is not a pure market transaction result, but a product of the Treasury's active intervention. The US Treasury announced this month that it would launch a $40 billion Treasury bond repurchase operation. Although it did not operate under the name of "QE" as traditional quantitative easing, its core mechanism has converged with the essence of QE: actively buying issued Treasury bonds to recover liquidity pressure and refinance a new round of debt at a low interest rate. Wall Street generally regards it as a kind of "invisible QE" or "quasi-QE operation". More importantly, this operation does not require the cooperation of the Federal Reserve, that is, it achieves the suppression of the actual interest rate level in the market without using the expansion of the Fed's balance sheet. From the results, after the start of this round of repurchases, the bond market volatility indicator MOVE index quickly fell, reflecting the market's expectations for the future path of interest rates. This stability is exactly the "mild monetary environment" signal that crypto assets need most at the macro end.

At the same time, the inflationary pressure in the United States has eased marginally, and both CPI and PPI data have fallen month-on-month. The consensus within the Federal Reserve on maintaining high interest rates is loosening. Previously, the market was worried that "maintaining high interest rates for a longer period of time" would suppress the valuation of risky assets, but as inflation cools and fiscal burdens increase, the Federal Reserve has gradually released signals that it may adjust its policy stance in the second half of the year. Recently, some voting committee members have no longer emphasized "continued interest rate hikes" in their speeches, but are more concerned about "flexible response after observing data", which shows that the tone of the Federal Reserve in the next stage will switch from "controlling inflation" to "stabilizing growth" and "maintaining debt sustainability", and this process of policy fine-tuning essentially constitutes the driving factor for marginal easing of the funding side.

At the same time as the macro-economy began to slow down and the window for policy fine-tuning opened, the other end of the global financial system, the crypto market, was experiencing a rare structural inflection point: the on-chain funding structure was increasingly optimized, and the proportion of long-term holders reached a new high. Glassnode data shows that 97% of Bitcoin addresses are currently profitable, and the on-chain illiquidity supply has also hit a record high. This means that the price of Bitcoin is not only driven by short-term speculation, but also completed a repricing in an environment where liquidity is gradually tightened and market belief is strengthened. In this structural holding context, once the macro environment releases a signal of easing, risk appetite will quickly recover and the valuation space of mainstream currencies will be reopened.

What is more noteworthy is that the continued decline in U.S. Treasury yields is reshaping the position of the "risk-free yield anchor" in the global capital market. In the past two years, U.S. Treasury yields have had a suppressive effect on digital assets, but as the yield curve moves downward, the opportunity cost between holding crypto assets and holding cash is rapidly decreasing. Even in some time windows, the yield of on-chain stablecoins has surpassed that of U.S. Treasury bonds of the same maturity. This rebalancing of micro-interest rate spreads is driving some funds back to on-chain assets. In an environment where real interest rates are falling, stablecoin holders will be more willing to participate in DeFi to obtain excess returns, thereby driving the prices of mainstream assets represented by Bitcoin and Ethereum to continue to rise.

The continued inflow of funds into spot Bitcoin ETFs further confirms the change in the pricing logic of crypto assets due to the macro shift. Even when the U.S. stock market was volatile due to fiscal and credit rating concerns, the price of Bitcoin broke through the all-time high of more than $110,000 over the weekend, and the market showed remarkable resilience. The inflow of funds into ETF products is essentially a "vote" for the stability of macro fundamentals: that is, institutional investors believe that Bitcoin has long-term value anchor properties in the current environment and can hedge against the uncertainty of traditional financial markets. As the downward cycle of interest rates approaches and the market's expectations for "re-inflation of financial assets" strengthen, the hedging and value-added logic of Bitcoin as "digital gold" will become more attractive.

Overall, the macro environment is entering a new stage of "structural easing + policy correction + fund repricing". From the Treasury's repurchase operations to the market's expectations of the Fed's shift, to the overall decline in bond yields and the continued stability of ETF inflows, all variables are jointly pushing crypto assets out of a bull market track with endogenous resilience. In this context, Bitcoin is not only the engine of the market, but also the cornerstone of the repricing of the entire digital asset ecosystem, and key tracks such as stablecoins, DeFi, and RWA (tokenization of real-world assets) will usher in larger-scale funds and user dividends under the support of this round of macro catalysis.

3. On-chain structure: BTC non-circulating supply hits a new high, ETF continues to attract funds, and the chip structure is stable

The reason why Bitcoin can continue to strengthen and break through $110,000 to set a record high in the current environment where multiple macro and policy variables are intertwined is that its on-chain structure is undergoing deep reconstruction. On the one hand, data from on-chain analysis platforms such as Glassnode show that the non-circulating supply of BTC has climbed to a record high, which means that more and more Bitcoins are firmly held and locked in wallets by long-term investors and have not flowed to the trading market. This phenomenon is not just a change in technical indicators, but reflects the strengthening of market structural beliefs: more investors regard Bitcoin as a long-term value storage asset rather than a short-term speculative chip, and are willing to trade time for space and wait for long-term value to be released.

Behind this trend is the result of the continuous absorption of mainstream funds by spot Bitcoin ETF products in recent months. So far, the cumulative net inflow of multiple Bitcoin spot ETFs in the United States has exceeded 10 billion US dollars, especially with the participation of asset management giants such as BlackRock and Fidelity. These funds are not short-term arbitrage, but more likely represent the "formal allocation" of BTC by long-term institutional capital such as traditional pension funds, sovereign funds, and family offices. Their participation not only provides a strong buying bottom, but also has a profound impact on the market liquidity structure of Bitcoin. Compared with the previous market pattern dominated by retail investors on exchanges and drastic ups and downs, today's Bitcoin price is more "institutional style": volatility convergence, clear trend, limited retracement, and stable inflow.

More importantly, from the perspective of the chip structure, Bitcoin is gradually getting rid of the historical fate of "being locked up at high levels in every bull market". This round of rise is not driven by zero-cost money, but by institutional investors with long-term funding backgrounds and "new long-term holders" who have a deep understanding of the macro environment and the monetary system. From the on-chain data, it can be seen that although the number of active addresses remains stable, the proportion of frequent short-term chip movements has decreased, indicating that there has been no short-term investment behavior in the market that is eager to cash out, and market sentiment is still in a rational and optimistic range. At the same time, the average holding time of long-term holders (LTH) has continued to lengthen, indicating that the consensus foundation of Bitcoin is becoming further consolidated.

ETF inflows, record highs in non-circulating supply, and increasing proportion of long-term holders together constitute the "anchor" of the current Bitcoin price, and are also the fundamental reason why it can achieve independent growth and resist declines and shocks when there are still many uncertainties in the traditional market. Unlike the previous cycle, Bitcoin is gradually moving towards the recognition of the attribute of "reserve assets". It is no longer just a price barometer in the encryption industry, but has obtained the same strategic asset status as gold and bonds in the context of global capital allocation.

At the same time, a series of on-chain infrastructures around the Bitcoin ecosystem are becoming more mature. The number of products anchored to BTC by stablecoins continues to increase, and the combination of on-chain DeFi tools and Bitcoin assets has become active. Some high-net-worth users are even using Bitcoin as collateral for on-chain lending and financial management operations, which has also released Bitcoin's capital efficiency to a certain extent. Projects such as the BTC Staking project on the HTX public chain, or the Bitcoin-anchored configuration model of TUSD and USDD stablecoins promoted by the Tron network, have further strengthened Bitcoin's role in the on-chain financial system. Bitcoin is no longer just an "asset that looks at prices", but has gradually become an "asset that is used". The structural logic changes behind this will provide more solid support for the mid- and long-term market.

It can be said that Bitcoin has completed the transformation from a "trading tool" to an "institutional asset", and the significance of this structural change far exceeds short-term fluctuations. From the perspective of on-chain data, today's Bitcoin market is more mature, more stable, and has more long-term potential than any previous cycle. This not only provides a solid foundation for the market to continue to rise, but also establishes a "valuation anchor" for the entire crypto asset market, becoming the real engine of the bull market structural market.

4. Trading behavior: The long-short structure is healthy, the market has not been overheated, and the room for correction is limited

When Bitcoin broke through its all-time high under the support of macro-easing expectations and favorable policies, the most concerned question for investors is: Is the current market overheated? Will there be a sharp correction? From a trading perspective, the answer is "not yet". Although this round of rise was rapid, the trading structure and capital sentiment showed a fairly healthy rhythm control, with neither panic chasing nor obvious signals of excessive leverage accumulation. The funding rate in the futures market remained in a reasonable neutral range, with no significant positive premium, indicating that the market bullish sentiment was strong but not out of control; the spread structure between spot and contract also remained stable, further confirming that the current price trend was more driven by spot buying rather than derivative leverage.

From the perspective of the options market, the call/put option ratio in mainstream exchanges remains at a bullish level, especially in the medium-term contracts from the end of June to September, where call option positions are active, which means that investors still expect an increase in the next few quarters. In addition, the option volatility curve shows a mild upward slope and has not become drastically steep due to price increases, indicating that the market has not overpriced future volatility. In this context, any technical pullback is likely to be just short-term bullish profit-taking rather than a trend reversal. This "mild pullback and slow bull pattern" is a typical structural bull market feature.

In addition, on-chain indicators also support this view. Although the average holding profitability of Bitcoin has climbed to a high level, the "profit realization" behavior is not concentrated; the activity index and the capital inflow data have risen simultaneously, and the typical top characteristics of price increases and user activity diverging have not appeared. At the same time, although the fear and greed index has risen to "extreme greed", it is still far from the high point of the bull market in 2021. Importantly, no large-scale capital outflows or institutional reductions have been observed on mainstream trading platforms such as Binance, HTX, and Coinbase, which means that core participants in the market are still holding or even increasing their positions, rather than retreating.

It is worth noting that the health and stability of the current market trading structure also benefited from the "deep deleveraging" of the previous round of liquidation cycle. Although the FTX collapse, LUNA zeroing, Three Arrows liquidation, Genesis bankruptcy and other events in 2022 caused panic in the short term, they also cleared a large number of excessive leverage and fragile chains, allowing the market to enter a more stable upward channel. This also laid a clean foundation for the steady breakthrough of Bitcoin prices in this round.

From the perspective of retail investors, on-chain data shows that although the number of new wallets has rebounded, it is far from the level of "FOMO-style outbreak" in the bubble cycle. Although the popularity of searches, social media discussions, and crypto-related content on YouTube and TikTok are rising, they have not yet formed a nationwide frenzy. In other words, the current market is more driven by structural funds and professional investors, and is far from the level of national participation and frequent top signals. In other words, the "mass base" of this bull market has not yet been fully launched, and the market still has a lot of room to rise. The magnitude and depth of the callback will also be strongly supported by the chip structure and professional funds. It is unlikely to see an extreme correction of 40% to 50% like in 2021.

Therefore, at the level of trading behavior, whether from the perspective of futures funding rates, options position building behavior, on-chain activity, or from the perspective of funding structure and trading platform trends, the current market is not in a state of "irrational excitement", but instead shows a calm, healthy, and rhythmic upward path. In this state of the market, the room for callback is relatively limited, and it is more of a "strong consolidation" rather than a "trend reversal". Investors should also follow the rhythm of the structural slow bull market in terms of strategy selection, avoid excessive pursuit of gains and losses, and are more suitable for "covering positions at every rebound" rather than "high-level gaming".

5. Key tracks and investment logic: TRX ecosystem and stablecoin payments are the biggest beneficiaries

With the GENIUS Act stablecoin bill making significant progress, the macro funding environment becoming marginally loose, and Bitcoin breaking through its all-time high, investors are now most concerned about not only whether BTC can continue to rise, but which "tracks" and "assets" will truly receive new funds and become the winners of the next stage of structural dividends. From policy context to on-chain data, from capital flows to technological evolution, it can be clearly seen that the stablecoin payment track, especially the on-chain US dollar payment system represented by TRX (Tron), is becoming the biggest beneficiary of this round of policy dividends and capital shifts.

First of all, the policy logic is extremely clear. The GENIUS Act is precisely to provide a federal regulatory framework for the stablecoin market and open a positive channel between government bonds and crypto-dollars, which is essentially to "legally push the dollar onto the chain." It does not directly benefit high-volatility assets such as BTC and ETH, but rather benefits infrastructure-based public chains and protocols that build payment networks and dollar-denominated asset clearing and settlement networks around stablecoins. The de facto leader in this track is undoubtedly the TRON network. According to DefiLlama data, more than $42 billion of USDT is circulating on the TRON network, far higher than Ethereum. According to on-chain tracking, TRON currently carries more than 75% of the world's cross-border stablecoin transactions and is the most widely used "on-chain dollar highway" in the real world. This means that once the regulatory dividends and legalization channels are opened, TRON will be the most direct beneficiary and naturally enjoy the status of "the first chain for compliant stablecoin applications."

From the perspective of fund behavior, the market's attention has quietly shifted to the key assets of the TRX ecosystem. As the Gas Token of the TRON mainnet, TRX also bears the underlying value support of the entire TRON financial system and has been rising steadily for several weeks. Compared with other mainstream public chain tokens, although the increase in TRX is not extremely drastic, the fluctuation is very small, and the main fund holdings are stable, showing its characteristics of "continuous absorption of structural funds". Ecological tokens around TRX, such as JUST (DeFi lending protocol on TRON) and USDD (TRON native stablecoin), are also becoming the focus of high-net-worth investors and VCs in their layout. The frequency of technical updates and external cooperation in the TRON ecosystem has also significantly accelerated. Recently, during his visit to the United States to contact the Trump family, Justin Sun repeatedly emphasized that his goal is to promote the popularization of global payments of "on-chain dollars", which is highly consistent with the US policy trend. This pattern of "policy resonance + technology landing + reasonable asset pricing" is the "triple resonance" that very few crypto projects can achieve in the early stage of the bull market, and its scarcity also constitutes the core support for TRX's current valuation.

More importantly, compared with other Layer 1 ecosystems, TRON does not pursue high-frequency hype or building-in-the-air narratives, but always steadily advances around the clear main line of "stablecoin payments" and "on-chain financial efficiency". This self-consistency in narrative is the key to its ability to survive cycles in multiple bear markets. With the increasing global demand for on-chain payments, cross-border settlements, and tokenized dollars, coupled with the gradual shift of US policy towards "maintaining global financial dominance with US dollar stablecoins", the main line of stablecoin payments represented by TRON is likely to complete the "strategic repricing" from the margins to the main stage in the next 1 to 2 years.

In short, with the advancement of the GENIUS Act and the gradual shift in global policies, the entire crypto market is about to usher in the outbreak of the "on-chain dollar era". Those ecosystems that truly undertake the dollar payment function and already have the application foundation will become the biggest winners. TRON not only has realistic payment data and usage foundation, but also has a clear technical path and policy strategy matching. Its ecological tokens TRX, USDD, USDJ, TUSD, SUN, BTT and other assets will become the most noteworthy core configuration targets in this round of macro liquidity + policy dividends.

6. Conclusion: BTC’s new high is just the beginning, the on-chain dollar and structural bull market have just begun

The advancement of the GENIUS Act marks a paradigm shift in the US regulation of crypto assets - from "suppressing speculation" to "embracing the digital infrastructure of the US dollar". This is a profound reconstruction of the global capital market. As the purest "non-sovereign anti-inflation asset", Bitcoin is not only completing a technical breakthrough, but also completing a "cognitive upgrade" and "status upgrade". Its $110,000 is just a starting point, and a larger funding channel has just been opened.

For investors, the real opportunity lies in standing at the early stage of structural trends and laying out ecological infrastructure, rather than just price speculation. In the second half of 2025, we have reason to believe that the next goal of Bitcoin is $150,000 to $180,000, and the real outbreak will be the "on-chain dollar ecosystem" of the 100 billion level.