Alpha WORLD is about to be launched: the first to support AIOT, can structured pledge reshape the value structure of the Alpha project?

According to official news, the Web3 digital financial platform Alpha WORLD is about to be launched and will be the first to support $AIOT (OKZOO native token) holders to participate.

Alpha WORLD is not a traditional IDO platform. It attempts to solve the core pain point of the current Launchpad market, which is "heavy issuance and light construction", by introducing a structured financial participation mechanism and deep community binding. Its core innovation is to shift the focus from "fundraising before the project goes online" to "value stability and community consensus growth after the project goes online."

1. Basic information of the project

Project Name: Alpha WORLD

Core Positioning: A Web3 digital financial platform for the Binance Alpha ecosystem, designed to activate early-stage project liquidity and community participation.

Project Mission: Transform the project from "passive display" to "active empowerment", and change users from bystanders to participants, contributors, and governors.

First asset to be connected: $AIOT (OKZOO native token, already listed on Binance).

First public chain: BNB Chain (BSC).

2. Market pain points and Alpha WORLD’s solutions

Current Web3 projects, especially early Alpha projects, generally face the curse of "peak at launch", even Binance Alpha is no exception. The birth of Alpha WORLD seems to be to solve this series of chain problems:

Market pain points:

- Value overdraft in advance: Most projects encounter large-scale sell-offs after they go online, causing prices to plummet, confidence to be lost, and difficulty in long-term construction.

- Fragile community consensus: User participation mostly remains at the low-quality speculative level, lacking a stable mechanism and structured interaction model for early co-construction with project parties.

- Project homogeneity: The project mechanisms on Launchpad are similar and lack differentiation, making it difficult to build a real moat.

Alpha WORLD's solution:

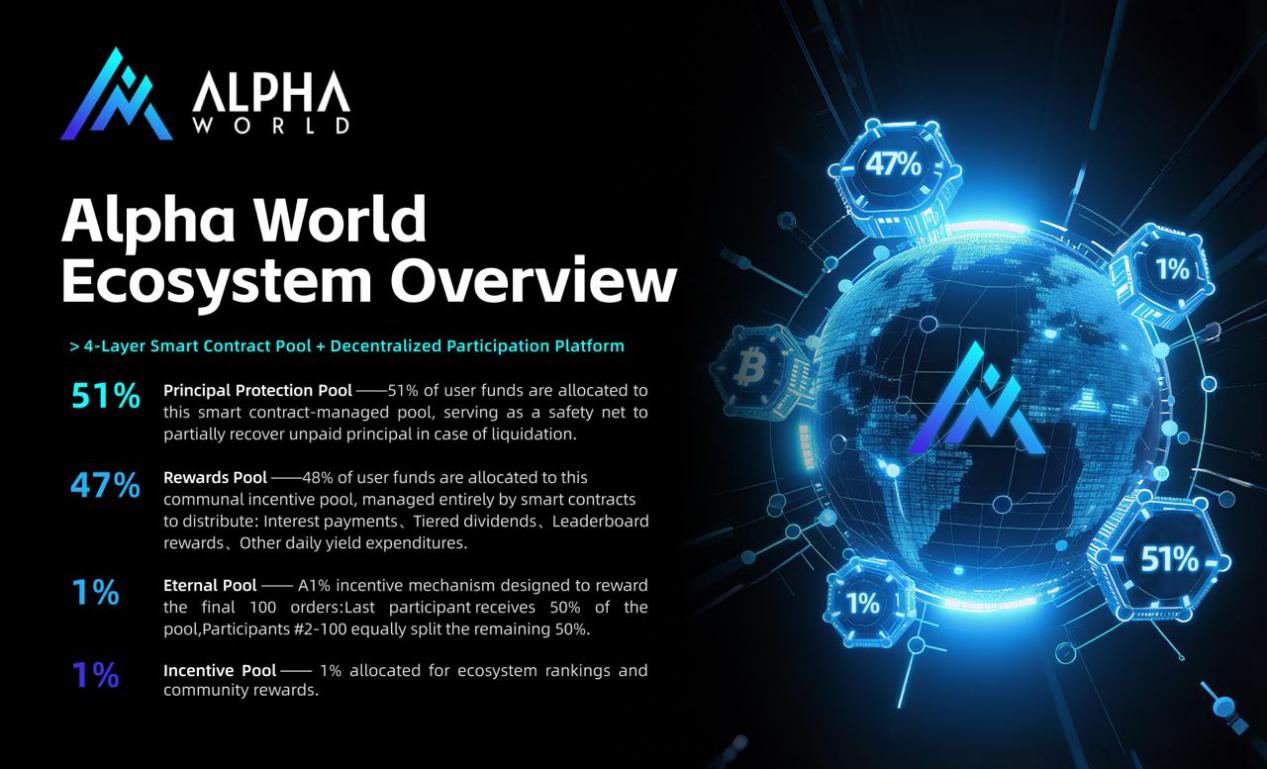

- Structured fund release: To address the issue of “dumping the market as soon as listing”, the platform has designed a pledge contract pool and lock-up mechanism with a random period (1-49 days). It manages asset liquidity through a stable and predictable rhythm, greatly alleviating short-term selling pressure.

- Deep participation incentives: In response to the "low community activity", the platform has introduced recommendation incentives, behavioral rights and platform governance consensus (DAO will be launched in the future) to deeply bind user interests with the platform and project ecology.

- Differentiated project models: In response to "project homogeneity", the platform allows each connected asset to have an independent contract pool and cycle model, providing customization possibilities for project parties.

3. Horizontal comparison analysis: Alpha WORLD vs. traditional mainstream Launchpad

In terms of core goals, the core of traditional mainstream Launchpad is fundraising (IDO/IGO). The core goal of Alpha WORLD is liquidity and value management, which aims to provide structured liquidity support and community consensus building for the Alpha projects that have been launched. This transformation from "one-time fundraising" to "continuous value empowerment" has enabled it to enter the "stock market" after the project is launched, opening up a new dimension of competition.

In terms of participation mode, traditional platforms usually adopt a pledge/ticket system. In contrast, Alpha WORLD adopts an investment-cycle-return system. Users directly invest project tokens (such as $AIOT) into the contract pool and enter a random cycle financial plan, which has a relatively lower threshold and is more flexible.

In terms of asset incentive mechanism, the traditional model generally adopts linear unlocking (Vesting). However, Alpha WORLD's mechanism provides participants with stable and considerable incentives through an innovative staking income model.

In terms of community role positioning, participants in traditional Launchpads are more like early speculators. Alpha WORLD is committed to cultivating users into participants, contributors, and governors, and encourages users to become co-builders and long-term stakeholders of the ecosystem through behavioral rights and future DAO governance.

In terms of supporting projects, the role of traditional Launchpad is usually one-time support. Alpha WORLD provides continuous support, aiming to become a "horizontal liquidity collaboration platform". In the future, it will continue to connect to high-quality projects and is expected to form a strong ecological network effect.

4. Strengths and opportunities

Model innovation advantage: The "structured participation" model is highly recognizable and innovative in the current Launchpad market.

Accurate ecological positioning: Focusing on the Binance Alpha section, this is a pool of high-quality projects that have undergone preliminary screening and come with their own traffic and attention.

High-quality initial launch project: $AIOT has multiple halos. The success of choosing $AIOT as the initial launch asset will directly affect the market reputation of Alpha WORLD.

Clear expansion path: The roadmap is clearly planned, from single-asset verification to multi-asset parallelization, to the launch of platform coins and access to cross-chain assets, demonstrating the team's long-term vision.

5. Risks and Challenges

Sustainability of the economic model: The high staking income provided by the platform is one of its core attractions, but the sustainability of its economic source needs to be closely monitored. This is the biggest challenge facing the model. If the income comes from the project reserves or platform funds, it is necessary to evaluate whether it can be sustained in the long term; if it comes from complex algorithms or market games, its stability and risk resistance need to be tested by the market.

Execution and delivery risks: The technical development and project management capabilities of the project team will be the key to whether it can be delivered on time.

Market competition risk: Although the tracks are differentiated, they are still essentially competing for users’ funds and attention. Alpha WORLD needs to quickly prove the superiority of its model to attract users.

Project attractiveness: Whether the platform can continue to attract high-quality Alpha projects like $AIOT is the core of whether its ecosystem can prosper.

6. Conclusion

Alpha WORLD is not satisfied with being a simple financing platform, but attempts to provide a new and healthier growth paradigm for early Web3 projects through the combination of financial engineering and community engineering. Its biggest highlight is to shift the focus of the game from "before launch" to "after launch", aiming to create a win-win situation between project owners, early users and the community.

However, investors should be aware of its potential risks, especially the sustainability of its profit model. It is recommended to pay close attention to the project's detailed description of its economic model and the actual operating data of the first project $AIOT after its launch before investing.