Circle IPO: The “ChatGPT” Moment for Stablecoins and On-Chain Finance

This article comes from: Paolo@Victory Securities Partner, Andy@VDX Senior Researcher ; Odaily Planet Daily is reprinted with permission.

TL;DR

Market space: The stablecoin market relies on the two core rigid demand scenarios of transaction and payment, and there may be room for dozens of times of growth in the future. Stablecoin is the first track to be included in the compliance and supervision of various crypto tracks. Compliance, institutionalization and mainstreaming are long-term trends. In the future, stablecoin users may even exceed BTC holding users and become the largest killer app in crypto.

Circle's advantages and barriers: 1) Compliance first-mover and orthodoxy: Benefiting from compliance dividends, it is expected to serve as an "in-system stablecoin" to carry the on-chain US dollar expansion strategy; 2) Open infrastructure and ecological network: USDC has multi-chain support, cross-chain protocols, and is deeply integrated with various exchanges and DeFi, and cooperates with payment institutions to become the hub for cross-border payments and on-chain settlements; 3) Institutional-level trust and mainstream capital access: Assets are safe and transparent, audit reports are published regularly, and it is currently the only product that is widely accepted as an "institutional-level stablecoin."

Circle's risks and challenges: 1) The revenue structure is highly dependent on the interest of US Treasury bonds, which is interest-sensitive and highly cyclical. The revenue growth is under pressure during the US dollar interest rate cut cycle; 2) It is highly dependent on channels, and about 60% of its current revenue is distributed to channels such as Coinbase and Binance. Whether it can expand other sources of income (such as transaction commissions, etc.) and improve channel bargaining power in the future is the key to its growth.

Competitive comparison: The competition between USDT and USDC is essentially the competition between black and white dollars in different markets and scenarios. Tether is a "money printing machine" and Circle is a "narrow bank". USDT relies on the liquidity pillar of exchanges, OTC exchange, and gray payments, while USDC focuses on compliant cross-border payments, corporate liquidation, DeFi, and RWA asset underlying currencies. The two form a parallel symbiotic relationship in different scenarios.

Investment analysis: As the first compliant stablecoin leader to go public after the introduction of the Stablecoin Act, Circle's IPO benefited from high market sentiment. However, compared with its revenue of US$1.7 billion and net profit of US$160 million in 2024, the current market PE valuation of nearly 50 times has been priced more optimistically, and we need to be wary of concentrated profit-taking under high valuations. In the long run, the stablecoin track has huge potential for growth. Circle is expected to further consolidate its leading position with its advantages of compliance first-mover, ecological network construction, and mainstream institutional capital access. It is recommended to pay attention to its long-term development.

Introduction | From gray arbitrage to institutional takeover: Stablecoins usher in a watershed

Circle's listing marks the first time that stablecoins have entered the main stage of the global capital market. From USDT, which was regarded as "casino chips", to USDC, which represents the "compliant digital dollar", landing on the US stock market today, this is not only a turning point in business, but also a frontier battle for the reconstruction of the financial order. Compliant stablecoins are no longer a circulation tool on the chain, but a strategic agent for the US dollar to expand globally in a "de-banking and de-geographical" way.

In 2025, the regulation of stablecoins in the United States, Hong Kong and other countries will be implemented one after another, and the "gray dollar" represented by Tether and Circle and the "white list dollar" will be formally differentiated. The listing of Circle is not only a capitalization event for the crypto industry, but also another structural upgrade of the globalization of the US dollar. It is the starting point for the compliant US dollar to complete the on-chain export of financial sovereignty.

Market size | Stablecoins as a new anchor for global liquidity

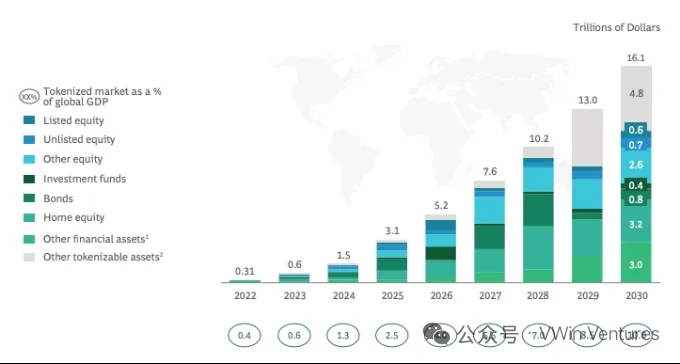

According to forecasts by Citigroup and other institutions, the total market value of global stablecoins will be between US$1.6 trillion and US$3.7 trillion in 2030, with the increase mainly concentrated in the three major areas of cross-border payments, on-chain finance and RWA.

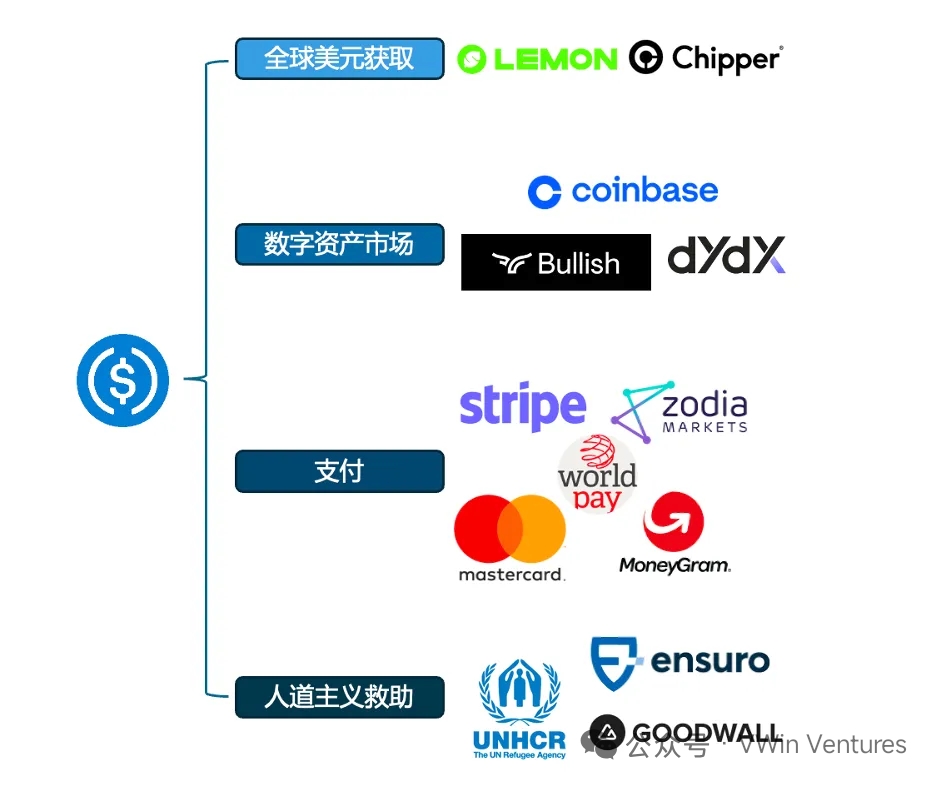

Cross-border payments will become the core driving scenario. The average settlement cost of stablecoins is more than 90% lower than the traditional SWIFT path, and the T+0 settlement efficiency is particularly attractive to high-friction areas such as the Middle East, Latin America, and Southeast Asia.

RWA connects on-chain and real assets. Stablecoins are the on-chain funding side, and RWA is the asset side. The twin relationship between the two constitutes a growth flywheel. The USDC Treasury Fund launched by Circle and BlackRock is a typical pilot: stablecoins are used as liquidation and participation tokens, while providing income access and asset packaging.

The native scenario of virtual assets serves as a continuous basic liquidity carrier. On-chain lending, derivatives, and structured income agreements continue to absorb stablecoins as collateral, forming the underlying "US dollar liquidity pool".

Stablecoins will no longer be just a transit channel for cryptocurrency funds, but will gradually become the "dollar flow kernel" in the Web3 native operating system.

Competition landscape | Circle is experiencing a dual race between native scenarios on the chain and new players in the circle of compliance

Circle is currently facing a dual race: on the one hand, it is competing with native players on the chain such as Tether in terms of liquidity coverage and usage flexibility; on the other hand, it is competing with traditional financial giants such as PayPal and JPMorgan in the right to output the stablecoin system.

Circle's core competitive advantages:

Compliance first mover and orthodoxy: Benefiting from the compliance dividend, it is expected to serve as an "in-system stablecoin" to carry the on-chain US dollar expansion strategy.

Open infrastructure and ecological network: USDC has multi-chain support, cross-chain protocols, and is deeply integrated with various exchanges and DeFi. It also cooperates with payment institutions to become the hub for cross-border payments and on-chain settlements.

Institutional, trust, and mainstream capital access: Assets are safe and transparent, audit reports are published regularly, and it is currently the only product that is widely accepted as an "institutional-grade stablecoin."

The implementation of the policy raises the market entry threshold and will accelerate the elimination of non-compliant players

In the on-chain native usage scenarios, as global regulatory policies are implemented at an accelerated pace, the operating thresholds and costs of non-compliant issuers continue to rise. Circle's institutional compliance and auditability are gradually transformed into competitive dividends, enabling its ecological nesting capabilities in DeFi, wallets, payment protocols and other scenarios to continue to increase.

Although it is difficult for Circle to beat USDT in terms of liquidity scale in the gray market, it is building irreplaceability from an institutional level and taking over USDT’s compliant market share:

If the US and Europe accelerate regulation, USDT's market share in compliance scenarios is expected to drop from 25% to 10%, releasing approximately $21.6 billion in market space;

Circle is expected to take over about 60% of this, corresponding to an increase of US$13 billion.

The possibility of USDT becoming "compliant" is extremely low. In the future, it may maintain its role as a gray channel, reach an "informal agreement" with the United States, and continue to serve as a black tentacle for the global spillover of the US dollar.

After clarifying the market access rules, banks and payment institutions will accelerate their entry, challenging USDC’s compliance leading window period

Circle’s lead in compliance license barriers is relatively limited, and many players have accelerated to catch up (Paypal, etc.).

The leading advantage in the compliant transition from compliant issuance to application remains, and the self-minted stablecoins of JPM, Fidelity and others are currently still in an internal closed system.

The capital market's traffic dividend will also be diluted with the listing of compliant crypto companies, and there is a risk of dilution of early ecological dominance.

Can Circle maintain its compliant payment scenarios?

The core advantages of the three existing stablecoin giants are: USDT is deeply involved in gray and black scenarios and has a bottom-up multi-level acceptance distribution network; USDC has compliant bank and institutional channels; DAI is censorship-resistant and cannot be frozen.

Among them, USDC's compliance channel barriers are the most vulnerable. Bank-issued stablecoins use traditional bank account systems and compliance channels to deploy large-scale scenarios. Circle (eg USDC is a derivative of USDT in specific scenarios. Users actually use USDT in cross-border trade, but the terminal on/off ramp will switch from USDT to USDC through its compliance fiat currency channel)

It remains to be seen whether Circle’s current cooperative channels can have a strong binding relationship or whether it needs to continue to burn money for subsidies.

Circle’s competition with traditional financial institutions

In the short term, Circle has an overwhelming advantage in the "open global on-chain clearing network" by virtue of its compliance first mover, on-chain native ecology, and open protocol capabilities.

In the medium and long term, if traditional financial players enter the market, their traffic, user accounts, and deposit and withdrawal systems will become the biggest threat, especially in retail payments and closed system settlements (such as their own wallets), which may constitute a partial replacement.

The key to success or failure lies in who can build a “compliant + composable + accessible” on-chain payment infrastructure faster and win the trust of institutions. Circle is already ahead, but it cannot be taken lightly.

The core lies in the network effect, which is widely accessed by both sides.

Bank stablecoins may form liquidity mutual recognition in B2B trade scenarios, but they lack "neutrality" in the on-chain ecosystem and are difficult to be widely used; access to the neutral layer USDC is more feasible

Circle’s long-term advantages:

1) Compliance + Open Ecosystem: Circle has become a leader in the field of compliant stablecoins through early deployment, and has broken through the technical barriers of traditional financial giants with the help of multi-chain and cross-chain payment platforms.

2) DeFi and RWA Integration: Circle’s leading position in DeFi and RWA (asset tokenization) enables it to expand into high-growth areas that traditional finance has not covered.

Competitive advantages of traditional finance:

1) Traditional payment network and merchant base: Traditional financial giants can quickly promote stablecoin payments, especially in the retail and B2B payment fields, leveraging their vast payment infrastructure, merchant network, and customer trust.

2) Fiat currency deposits and withdrawals and bank integration: Traditional financial stablecoins have obvious competition in fiat currency exchange and banking system integration.

In the RWA incremental scenario, USDC must complete the upgrade from "license stablecoin" to "on-chain system coin"

BCG predicts that by 2030, the global RWA market will exceed $16 trillion. Stablecoins need "asset anchoring" to build trust and expand scenarios, and RWA needs "on-chain funds" to obtain liquidity. Together, the two form a closed loop of value connecting the real world and the on-chain world.

Compliance and reserve transparency alone are no longer a moat. Circle needs to gain dominance in on-chain payment and transaction settlement and bind RWA to new incremental asset categories. Otherwise, its application layer will continue to be eroded and its valuation ceiling will be suppressed.

Business model | Interest rate sensitivity and channel dependence, Circle needs to move towards a diversified growth curve

Circle’s current profit structure is single and highly sensitive to interest rates

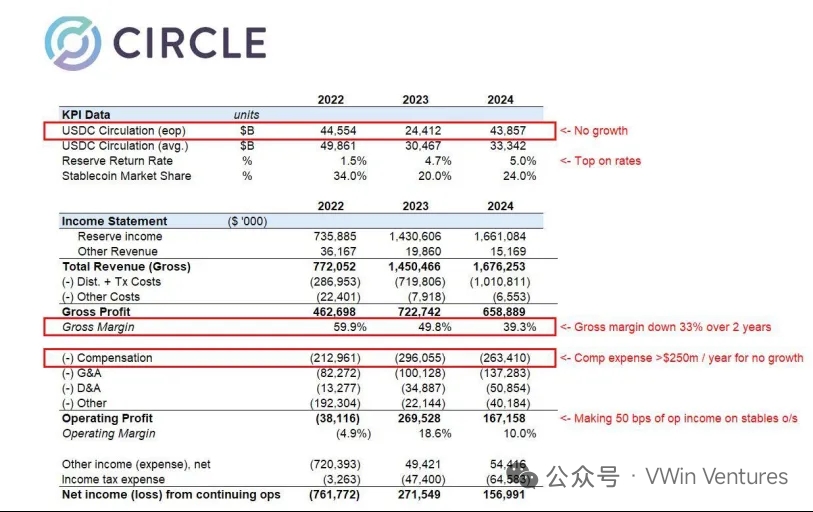

Revenue in 2024 is about $1.7 billion, with net profit of $160 million, 99% of which comes from interest on reserves;

Assuming the Fed cuts interest rates by 1% annually, based on the AUM size in 2024, revenue may decrease by about 20%, which will have a huge impact on its profits;

High degree of channel dependence, Coinbase monopolizes monetization efficiency

Coinbase has exclusive rights to the USDC platform, and Circle relies heavily on Coinbase to promote its network;

After 2023, Coinbase will become the only issuing partner of USDC, and the interest income generated by its platform will belong to Coinbase;

Circle, a non-Coinbase channel, can only split the profits 50-50. In 2024, the approximately $1 billion in distribution expenses will almost all go to Coinbase, and Circle’s interest rate monetization efficiency is extremely low.

Core transformation direction: Combinable monetization of stablecoin infrastructure and expansion of non-interest income

Interest alone cannot maintain long-term valuation expectations. In the future, it is necessary to expand revenue scenarios through on-chain payment APIs, stablecoin cross-chain channels, wallet accounts and other modules to increase To B profitability.

CCTP (Cross-Chain Transfer Protocol) builds a bridge between different chains for USDC, giving it the foundation to become an “on-chain payment layer”.

Circle Mint and its API products have been connected to dozens of platforms. If an SDK-level calling closed loop can be formed, a To B business closed loop will be formed.

On-chain clearing and settlement and RWA linkage (such as cooperation with BlackRock and Securitize) are core scenarios for long-term valuation reconstruction.

Finance and Valuation | The hedging structure of black and white dollars, the road to compliance is difficult to compare with profit margins

Financial Status

Circle's IPO valuation is approximately US$8.1 billion, with a PE of approximately 50 times and a PS of approximately 5 times (calculated based on the 2024 financial report data). Judging from the profit margin and cash flow structure alone, the valuation has achieved a relatively optimistic pricing.

AUM rebounded to $60 billion, surpassing SVB’s pre-crisis level of around $40 billion.

Current interest rates support profitability, with gross profit of approximately $660 million, and operating expenses on the high side, with employee costs of $260 million.

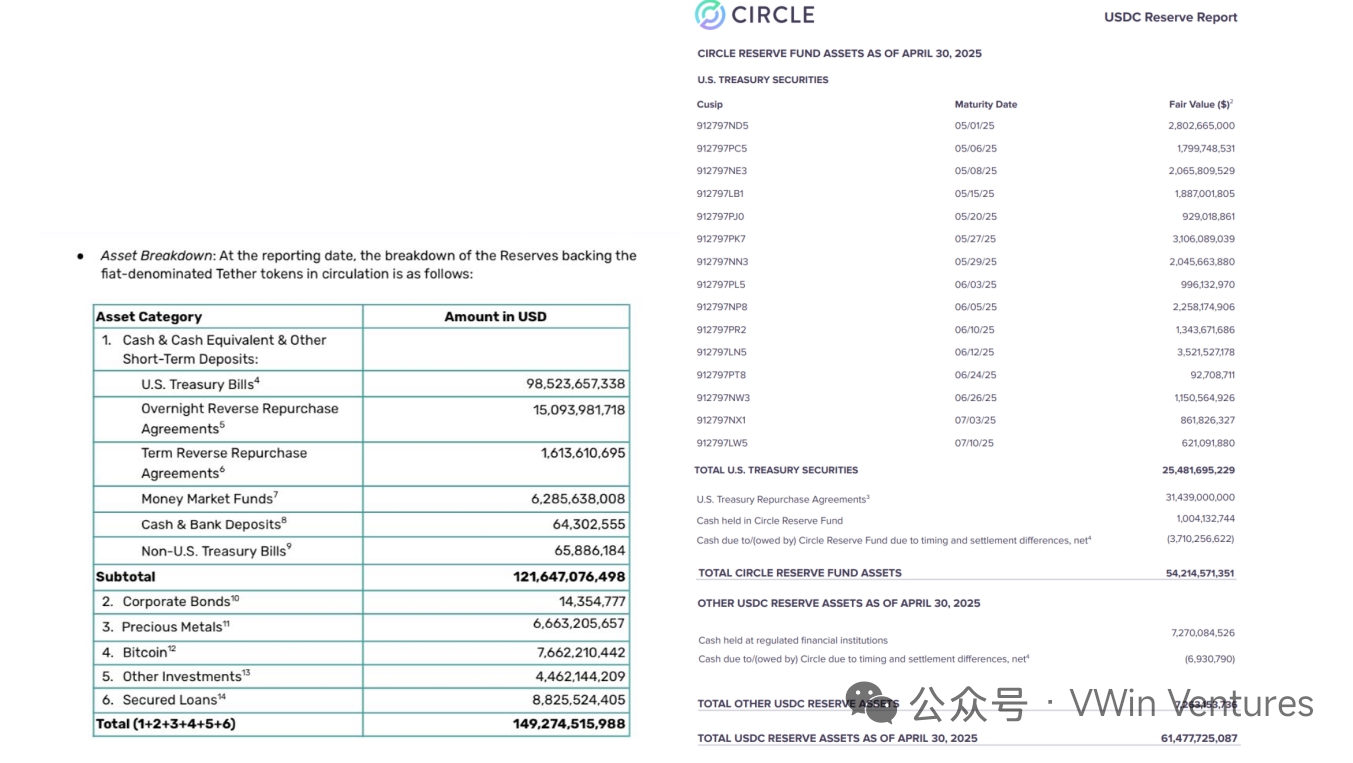

It is compared with Tether as follows:

Tether's net profit exceeds $13 billion, 80 times that of Circle, and its AuM is only 2.5 times that of Circle

Very high net profit margin: all directly operated, no channel costs; only a few hundred employees, low compliance costs, the company with the highest per capita net profit in the world

USDT reserve asset structure is more aggressive (85% US Treasury bonds, 5% gold, 7% BTC), high risk also brings high returns

Differences in profit structure: Tether is a money printing machine, Circle is a narrow bank

Tether has extremely low operating costs. It does not need to bear compliance costs or pay channel commissions, and directly collects all interest spreads. USDC is deducted at every stage.

Different application scenarios: gray industry vs. compliance

Tether has gone further in the gray area (bypassing KYC, contacting sanctioned countries, etc.) and achieved super profitability

Circle is highly compliant and financially transparent

USDC must implement blacklist, KYC, AML and other systems

Deny access to some high-risk/non-compliant markets

Profitability is suppressed by compliance costs (such as audit and compliance expenses)

Compliance profit margins are difficult to compete with non-compliance

But compliance can attract mainstream and institutional funds

Under the compliance trend of mainstream markets, the space for non-compliant businesses is getting smaller and smaller. However, under the background of global fragmentation, the bottom-up real/non-regulatory demand is growing rapidly.

Compliance can create capital market value and capital premium

Investment Strategy | Valuations driven by short-term sentiment have achieved relatively optimistic pricing, and there are trading opportunities with sentiment premiums; long-term efforts should be made to achieve systematic valuation reconstruction

During the IPO phase, market sentiment is high and funds are crowded. Short-term market enthusiasm and recognition of the narrative of "leading compliant stablecoins" may bring about periodic trading opportunities.

However, we need to pay attention to the potential fluctuations in valuation regression. The main risks come from the spread compression caused by the decline in interest rates and the income sensitivity that may be exposed when the bargaining power of channels has not yet been fully established.

The key in the medium and long term is to see whether new business development, channel dependence is reduced, and the ability to embed into the global payment network.

What investors are buying now is the compliance license + the future pricing power of the on-chain payment network, not the current profit.

Whether Coinbase's "high point listing" will be repeated remains to be seen. The key point is whether it can deliver on-chain payment landing progress and non-interest income incremental data in the next two quarters.

Conclusion | The Stablecoin Act ushers in the era of compliance, is IPO just the prologue to the future?

The stablecoin market is on the eve of an unprecedented explosion: the rigid demand for payments and transactions provides the fuel for its continued growth, and the trend of compliance, institutionalization and mainstreaming is shaping it into the most core infrastructure of on-chain finance.

Circle is at the core intersection of this trend.

The compliance and legitimacy bring institutional advantages, making it a representative option for "stable currency within the system";

The open infrastructure capability gives it a multi-chain, composable, and nestable technical architecture, which can be neutrally integrated into payment, DeFi, cross-chain, RWA and other scenarios;

The institutional-level trust structure makes it the preferred clearing and settlement asset for traditional institutions to access the crypto world in compliance with regulations.

But at the same time, Circle still faces structural challenges such as the sensitivity of its revenue structure to interest rates and high dependence on channels. Whether it can break free from cyclical constraints and build a second growth curve in the expansion of new businesses will determine its valuation reconstruction path.

The competition between USDC and USDT is no longer a single-dimensional "market value battle", but a full-stack competition representing the black and white dollar system, different clearing and settlement paths, and regulatory compatibility.

Circle’s IPO is not an end, but the starting point for the global stablecoin to officially enter the institutional track.

What the capital market is really betting on is not today's revenue, but whether it can play a key role in the protocol layer in the global on-chain dollar consensus system. When USDC becomes the universal circulation base of "on-chain dollars", the story of Circle will really begin.