Multi-army retreat VS air force carnival: Has $100,000 become the "Maginot Line" of BTC?

Original | Odaily Planet Daily ( @OdailyChina )

Author: Wenser ( @wenser 2010 )

In the early hours of this morning Beijing time, BTC briefly surged to $107,000 before pulling back, ETH once fell below $2,400, and mainstream currencies also generally started to pull back. Regarding the future market trend, whales have begun to "speak with positions". Some people have spent tens of millions of dollars to start their short-selling journey, and some people's long positions have made a floating profit of nearly $30 million. Odaily Planet Daily will summarize the recent positions of whales in this article for readers' reference.

Big whale Jams Wynn: Long floating profit once reached nearly 30 million US dollars, and now retreated to around 18 million US dollars

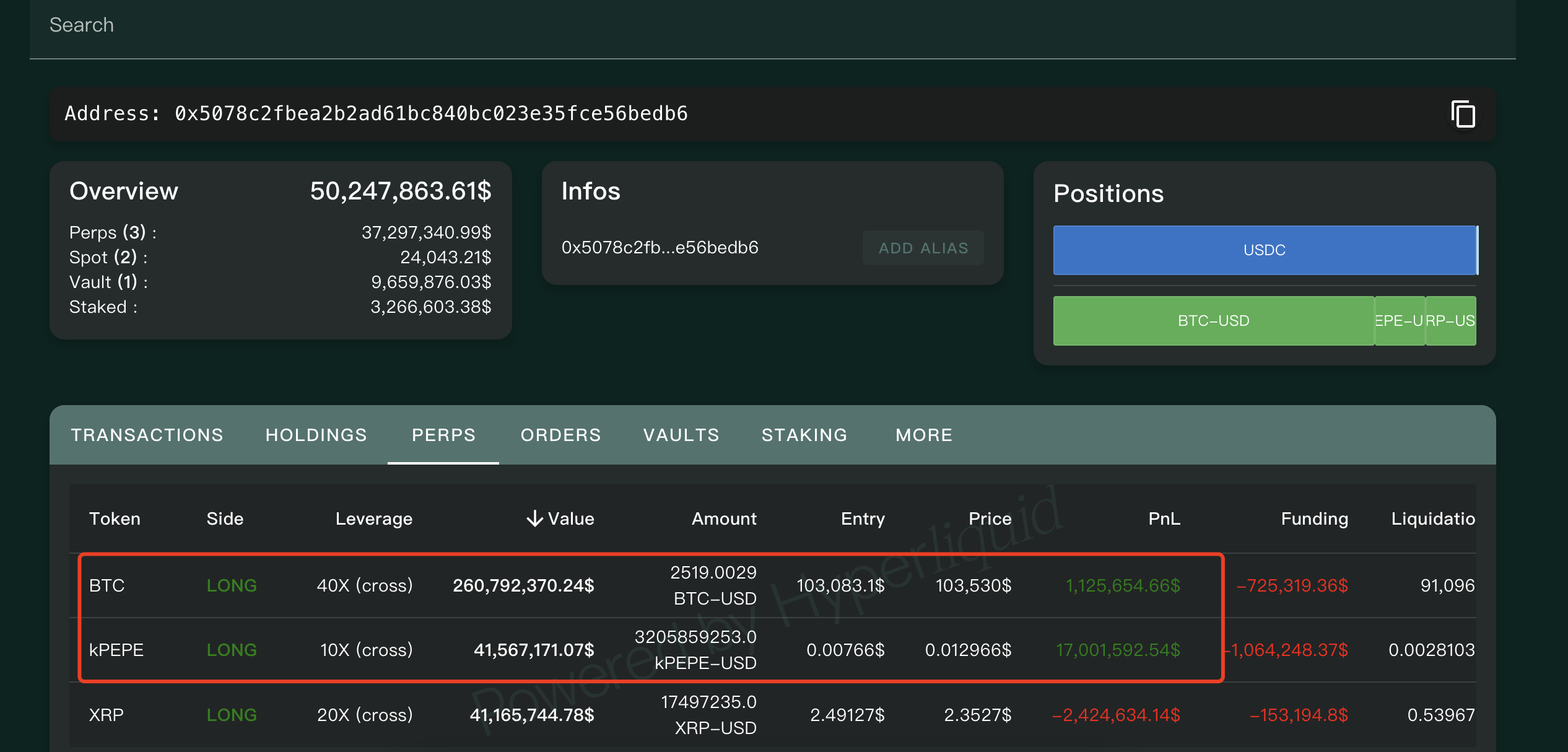

On May 18, according to the monitoring of on-chain analyst @EmberCN, the whale @JamesWynnReal used 40x leverage to buy 3788.7 BTC on Hyperliquid, with a position value of $391 million, an opening price of $103,083, and a liquidation price of $96,474. As BTC briefly broke through $105,000, James Wynn's long position profit exceeded $27.7 million, including $8.38 million in BTC 40x long position profit and $20.26 million in kPEPE 40x long position profit.

The latest data shows that the long-order floating profit of the giant whale @JamesWynnReal BTC has retreated to $1.12 million; the long-order floating profit of kPEPE has retreated to around $17 million; in addition, its long-order floating loss of XRP is around $2.42 million. On-chain data: https://hypurrscan.io/address/0x5078c2fbea2b2ad61bc840bc023e35fce56bedb6

Long Representative

ETH short sellers: 25x short position, value of position once exceeded $100 million

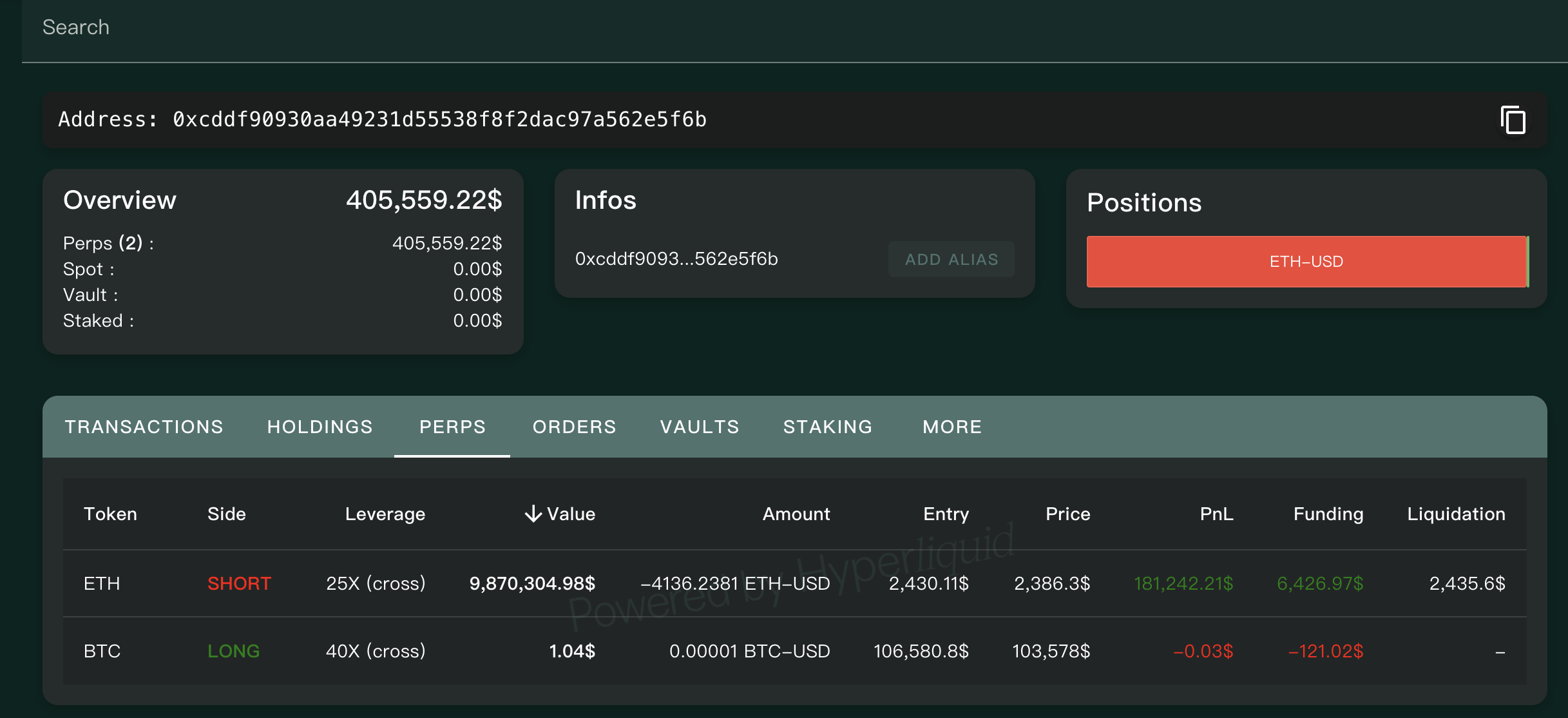

Yesterday, the address 0xcddf, which had been silent for four years, shorted 41,851 ETH with 25x leverage, with a position value of $103 million, an opening price of $2,514, and a liquidation price of $2,525. Subsequently, due to the rise of ETH, it eventually closed its position at a loss of 2.46 million. After closing its ETH short position, it turned around and used the remaining funds to chase BTC: it opened 166 BTC at a price of $106,580, 40x long, with a position value of $17.6 million, and finally lost $175,000 in just 45 minutes. However, it later shorted ETH again at 25x leverage, and rolled over again after floating profits . The current position has gradually increased to 4,136 ETH. The latest data shows that the address's 25x leveraged short position has dropped to around $9.8 million, and the current floating profit is about $180,000.

On-chain data: https://hypurrscan.io/address/0xcddf90930aa49231d55538f8f2dac97a562e5f6b

Being beaten on both sides represents

ETH short sellers: 20x short position, once reaching $70 million

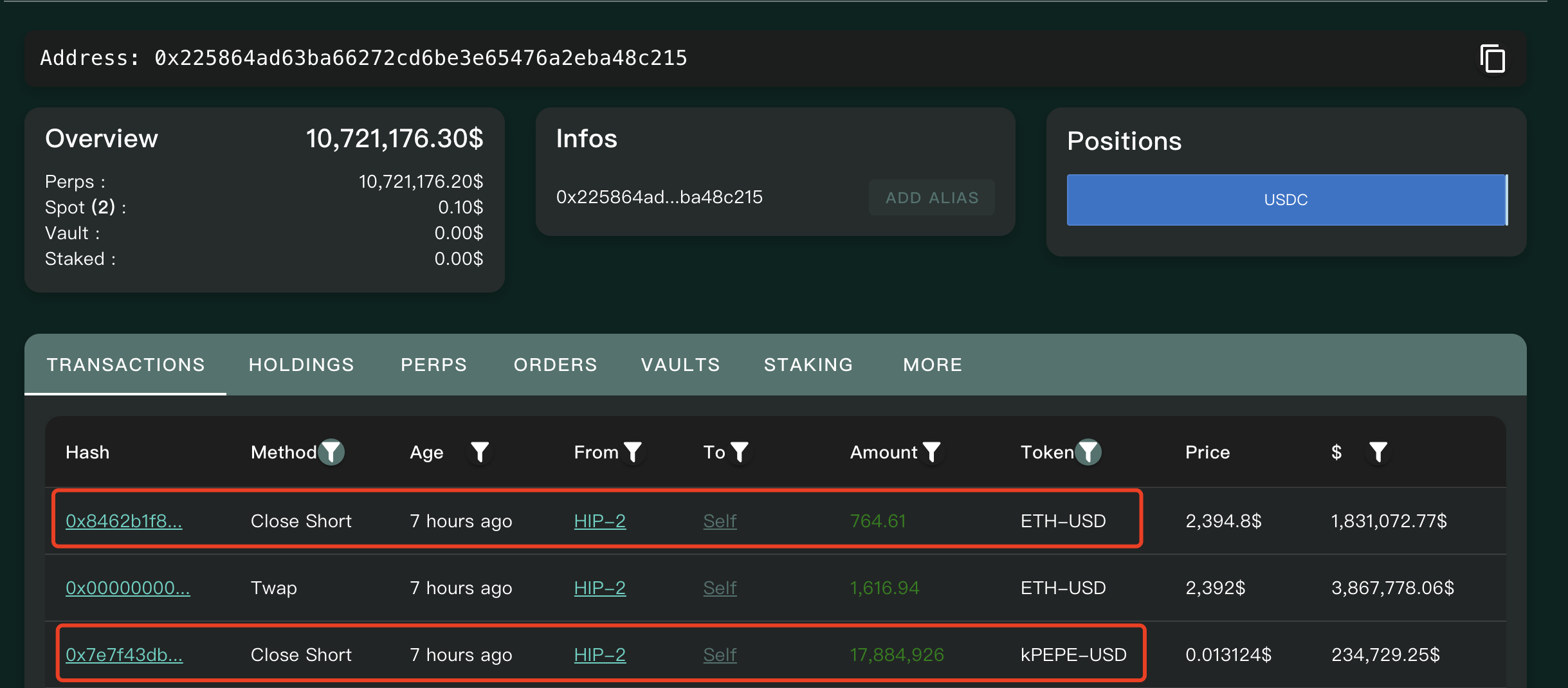

The address 0x2258 previously shorted 28,248 ETH with 20x leverage, with a position value of 70 million US dollars, an opening price of 2,561 US dollars, and a liquidation price of 2,694 US dollars. 7 hours ago, it closed all short positions, and the address has now been cleared.

Chain information: https://hypurrscan.io/address/0x225864ad63ba66272cd6be3e65476a2eba48c215

Position closed

SOL short sellers: 20x short selling, holdings exceeding 20,000 SOL

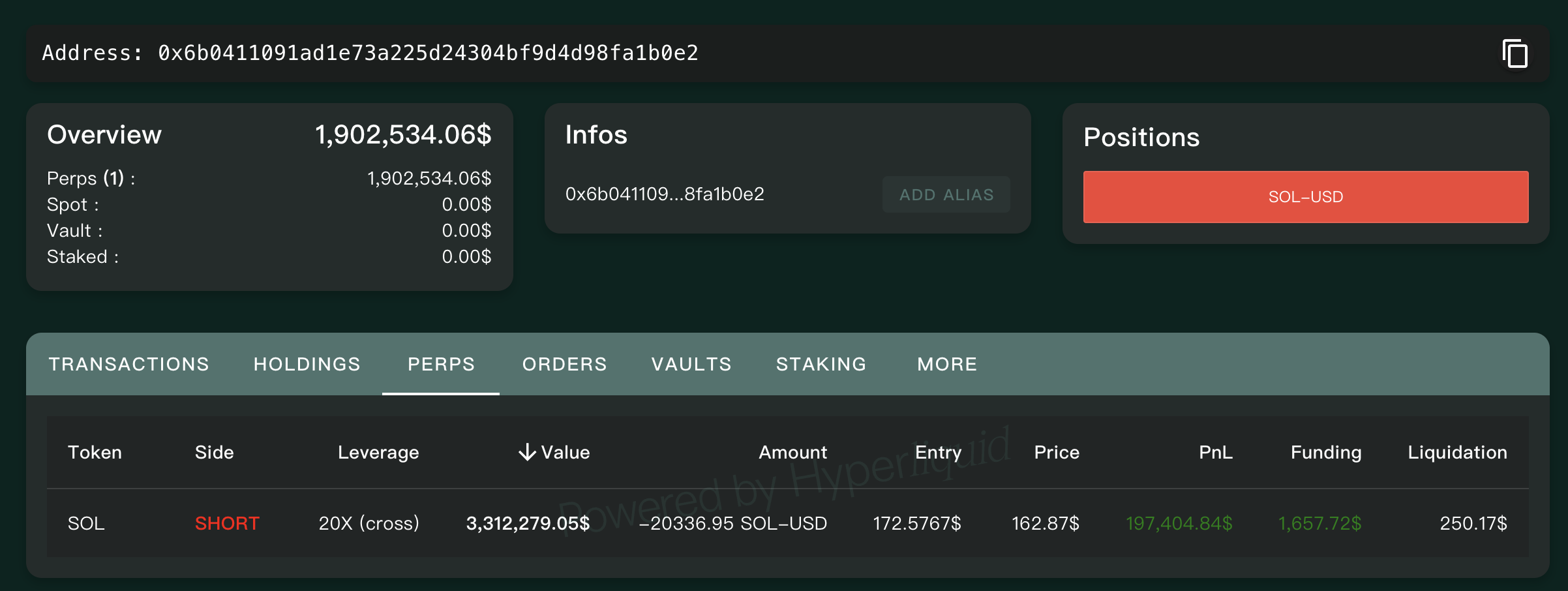

On May 16, according to OnChain Lens, a whale deposited 1.7 million USDC into Hyperliquid and opened a SOL short position with a 20x leverage. The latest data shows that the address currently holds approximately 20,336 SOLs, with a cumulative floating profit of approximately $197,400.

Chain information: https://hypurrscan.io/address/0x6b0411091ad1e73a225d24304bf9d4d98fa1b0e2

Short selling continues

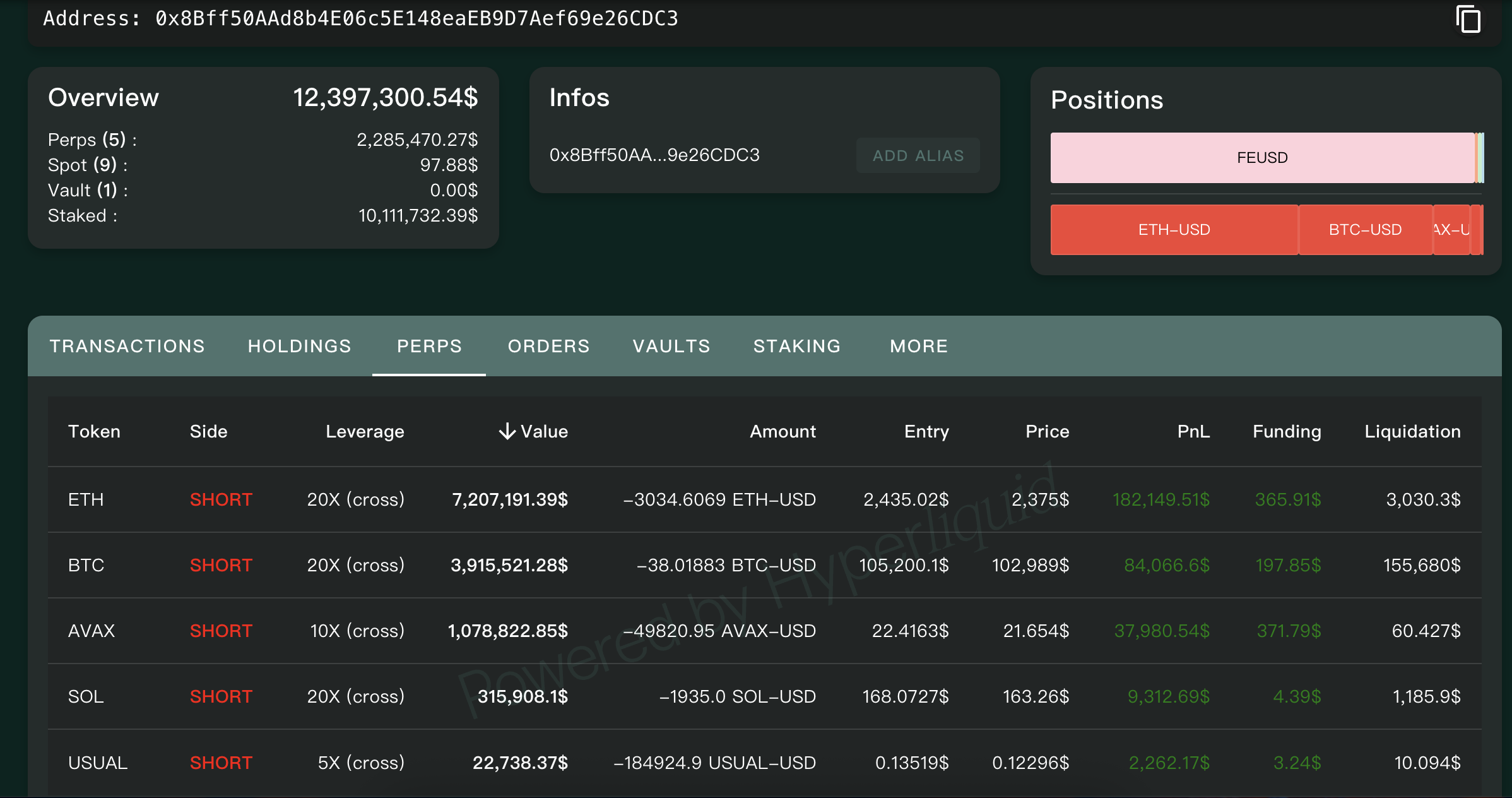

Mainstream coin short sellers: Hyperliquid previously made over $15 million in profit and shorted 5 tokens

According to Lookonchain monitoring, a whale who made more than $15 million in profit on the Hyperliquid platform began to short ETH, BTC, AVAX, SOL and USUAL. The trader also set 100 limit orders in the $2460-2480 range, preparing to continue shorting ETH.

The latest data shows that all short orders of this address have made profits. Among them, the ETH 20x short position holdings are 3034 ETH, with a floating profit of approximately US$182,000; the BTC 20x short position holdings are 38 BTC, with a floating profit of approximately US$84,000; the AVAX 20x short position holdings are approximately 50,000 AVAX, with a floating profit of approximately US$38,000; the SOL 20x short position holdings are approximately 1935 SOL, with a floating profit of approximately US$9,000; the USUAL 5x short position holdings are approximately 185,000 USUAL, with a floating profit of approximately US$2,000.

Chain information: https://hypurrscan.io/address/0x8Bff50AAd8b4E06c5E148eaEB9D7Aef69e26CDC3

20x short on ETH, BTC, AVAX, SOL, 5x short on USUAL

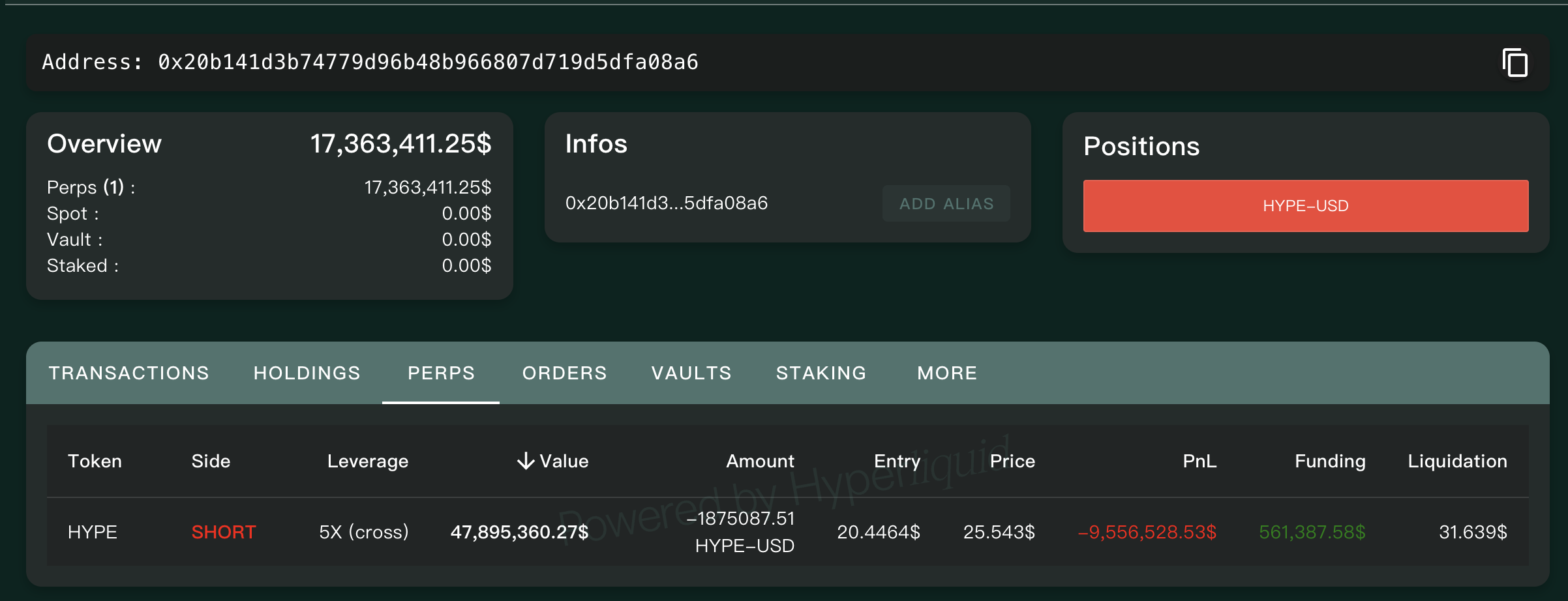

HYPE short sellers: 5 times short, holdings exceeding 1.87 million HYPE

Previously, according to on-chain analyst Yu Jin’s monitoring, a whale opened a 5-fold short position on Hyperliquid and sold 1.875 million HYPE coins; on the 17th, its floating loss amounted to $12.06 million. Subsequently, it withdrew another 3 million USDC from Binance as margin, with a liquidation price of $31.6. The latest data shows that the address has currently suffered a floating loss of about $9.55 million.

On-chain information: https://hypurrscan.io/address/0x20b141d3b74779d96b48b966807d719d5dfa08a6

Firmly bearish

In addition to the whales who are long or short in the above contracts, there are also whales who bought the bottom of the spot during the previous ETH oversell and eventually realized millions of profits.

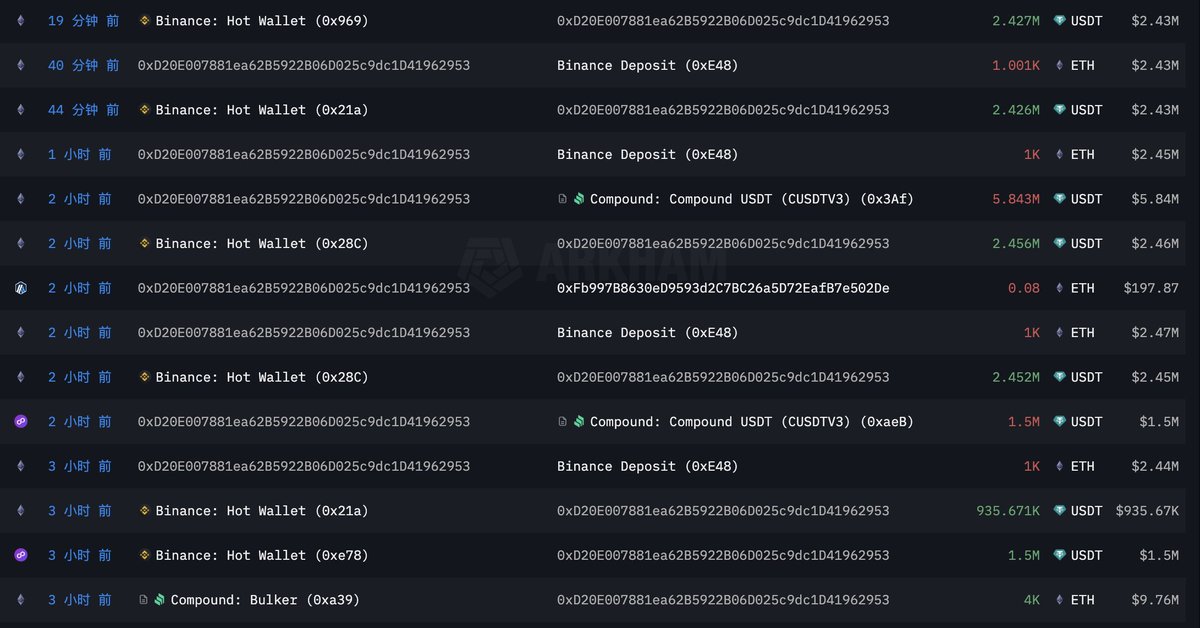

ETH bottom-fishing whale: bottom-fishing and buying more than 6,700 ETH, making a profit of more than 4.26 million US dollars

According to on-chain analyst Ember, a whale transferred 6,384.5 ETH to Binance in the past 4 hours, earning 15.549 million USDT, with an average selling price of about $2,435. The whale withdrew 6,710 ETH from Binance about a month ago, when the price was $1,768. Roughly estimated, it made a profit of more than $4.26 million in this round of operations.

Chain information: https://intel.arkm.com/explorer/address/0xD20E007881ea62B5922B06D025c9dc1D41962953

Profit taken

Summary: The Air Force is temporarily ahead, but the multi-army will never give up

After a short period of weekly highs, BTC and ETH have experienced different degrees of corrections, and the shorts are currently in a leading position. In addition, the whales who previously bought the bottom of BTC and ETH have also chosen to take profits. However, industry insiders and analysts including James Wynn and Arthur Hayes generally believe that it is difficult for the price of BTC to fall below 100,000, and the longs are still full of expectations. In the short term, the shorts may have the upper hand, but the longs will never give up.