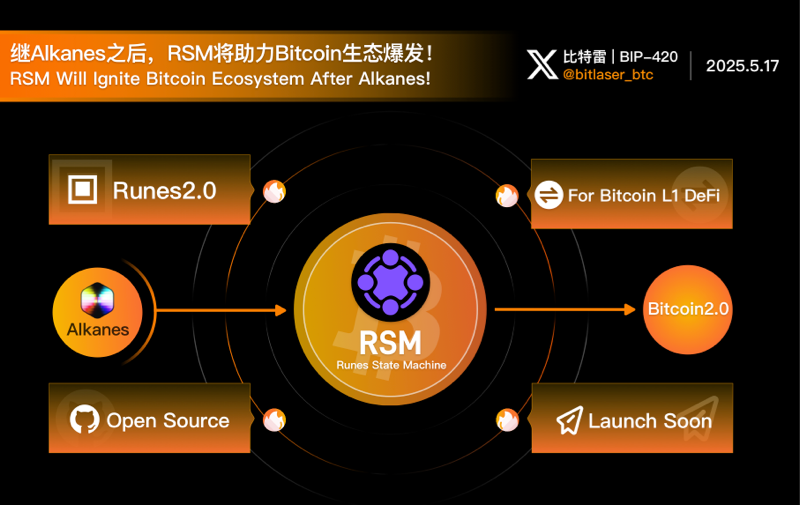

Following Alkanes, RSM will help the Bitcoin ecosystem explode!

As $BTC once again broke through $100,000, the Bitcoin ecosystem ushered in a new round of prosperity, and the market enthusiasm was thoroughly ignited. $ORDI, $SATS, and $DOG have successively pulled up, showing that investors are strongly pursuing Bitcoin native assets. As the leading token of the #Alkanes @oylwallet protocol of Runes 2.0, the market value of #METHANE broke through a new high to $16 million, laying a solid market foundation for a new round of "protocol wars".

So what kind of protocol will explode in the Bitcoin ecosystem and help the Bitcoin ecosystem explode?

There should be four points:

1. Bitcoin Layer 1: The protocol must be based on Bitcoin Layer 1 and support Bitcoin native assets.

2. Bitcoin DeFi: Provides native DeFi functions such as AMM and lending, unleashes the potential of $BTC, and supports decentralized trading, derivatives, and governance.

3. Open source: The code is open source and hosted on GitHub, relying on Layer 1 security to ensure no vulnerabilities and enhance community trust.

4. Bitcoin Mainnet: The Bitcoin Mainnet is launched, with tokens, which stimulates community enthusiasm and has been practiced, recognized and trusted by the community and the market.

Alkanes' outbreak also verified these four points.

Bitcoin 2.0 Ecosystem Three Major Narratives: Runes 2.0, BRC 2.0, OP_CAT Except for the mainnet launch, all other outbreak conditions are met, so which one will be the next to break out? This will be a game of time competition.

BRC 2.0 : The official @bestinslotxyz has made it clear that it will be launched on the Bitcoin mainnet in the fourth quarter of 2025, introducing EVM and supporting DeFi, RWA, DAO and other scenarios. The market expectations are strong.

#OP_CAT : The activation time has not yet been determined, but all parties predict that it may be activated next year.

Runes 2.0 : #Alkanes has been launched on the Bitcoin mainnet, and #RSM (Runes State Machine) @RSM_Runes, which is known as the "Runes 2.0 Gemini" with Alkanes, has frequently updated its code recently. Combined with tweets, it indicates that it is very likely to be launched in the second or third quarter of 2025.

In the new round of Bitcoin ecosystem "protocol war" time competition, #RSM's various performances indicate that it will be launched on the Bitcoin mainnet earlier and will become the next outbreak point after #Alkanes.

RSM: Programmable Runes Solution

Advantages

1. Runes 2.0 Concept

Runes 2.0 Twin Stars 1: RSM is based on Runes, increases the programmability of Runes, and expands the application scenarios. Its route is:

RSM proposes a Turing-complete state machine mechanism that supports complex smart contracts, decentralized computing, and DAO governance.

RSM drives Runes 2.0 to evolve from a simple “token issuance + transaction” to a broader decentralized finance and application ecosystem, injecting new vitality into the Bitcoin ecosystem.

2. Born for Bitcoin DeFi

RSM is designed to provide infrastructure for Bitcoin's DeFi ecosystem and unleash the potential of BTC as a native asset. Currently, Ethereum and Solana's DeFi ecosystems rely on smart contracts and Layer 2 solutions, while Bitcoin's DeFi ecosystem is limited by the lack of programmability of Layer 1. RSM fills this gap by supporting complex on-chain logic, such as AMM, on-chain derivatives, and DAO governance, through a Turing-complete state machine.

RSM is committed to building a Bitcoin-native DeFi ecosystem, which is extremely groundbreaking in the versatility of smart contracts.

3. Open source code, build an open source ord client based on Casey

The diversity of Runes 2.0 ecosystem is reflected in the technical foundation

RSM is built on ORD based on the Runes protocol and can provide on-chain metadata support for Runes. By introducing a Turing-complete state machine, developers can write complex on-chain programs. The code is completely open source and hosted on GitHub for community review and reference.

If Casey @rodarmor wants to officially upgrade Runes, RSM's open source nature and technological foresight make it an ideal choice for official upgrades, because RSM directly expands the existing infrastructure of Ordinals and Runes, has strong compatibility, and is more convenient for implementing smart contract functions.

4. Support from many bigwigs

The rise of a project is inseparable from the support of the community and key leaders, which provides strong market momentum for it to become the next hot spot.

Both RSM and Alkanes have a close relationship with Casey @rodarmor (founder of Ordinals) and domo @domodata (founder of BRC-20).

RSM has also received support from a number of overseas bigwigs, including ODIN.FUN founder Bob @BobBodily, ᴛʜᴇ ʙʟᴏᴄᴋ ʀᴜɴɴᴇʀ Podcast @TheBlockRunner, OnChain podcast host Shizzy @ShizzyOnChain, businessman @businessmanet, Francis Dhun @TheCryptoLif 7 and so on.

5. Bitcoin Mainnet will be launched soon

RSM is launched on the Bitcoin mainnet and the token is launched fairly, so that the community can participate in it, stimulate enthusiasm, and truly gain market verification, which is also the last link in completing the conditions for an outbreak.

challenge

1. High technical complexity

RSM's Turing-complete mechanism is powerful, but it is difficult to develop, and its tools and documentation are immature, which may slow down developer adoption. Basic development tools need to be improved as soon as possible after going online.

2. Bitcoin takes a long time to generate blocks

The slow block confirmation speed of the Bitcoin mainnet is a common difficulty faced by all Layer 1s, and RSM is no exception. It needs to achieve a breakthrough in technology, either by collaborating with Layer 2 or by increasing the speed through a sequencer like BRC 2.0.

3. Community and Market Verification

The explosive growth of a project requires community support. The open source and decentralized nature of RSM requires active community participation. Currently, RSM has not yet formed a strong community of sufficient scale. Of course, this is related to the fact that the project has not yet been launched on the Bitcoin mainnet. However, with Alkanes as a pioneer in opening up the Runes 2.0 market, RSM will be extremely explosive when it goes online.

Outlook

1. High possibility of short-term outbreak

RSM is expected to be launched in Q2 or Q3 of 2025, earlier than BRC 2.0 and OP_CAT. With the help of the Runes 2.0 craze and #METHANE verification, it may detonate the market.

2. Become a Runes Official 2.0 Upgrade

The open source and compatibility of RSM make it possible for it to become the official upgrade basis of Runes, similar to Ethereum EVM, attracting many developers.

3. Helping Bitcoin DApp Ecosystem Explode

RSM supports complex DApps, builds Bitcoin native DeFi, challenges Ethereum's position, helps Bitcoin transform from a store of value to a decentralized application platform, and realizes the "Ethereum moment" together with the three major narratives of the Bitcoin ecosystem.

Summarize

The "protocol war" in the Bitcoin ecosystem is entering a white-hot stage. Runes 2.0 has gained market popularity thanks to the technological breakthrough of Alkanes, and RSM is expected to set off a new wave of enthusiasm in Q2 and Q3 of 2025. In the future, with the gradual implementation of BRC 2.0 and OP_CAT, the Bitcoin 2.0 ecosystem will usher in greater prosperity.