Crypto CEX spot trading volume hits a nine-month low, and the gap between institutions and retail investors intensifies

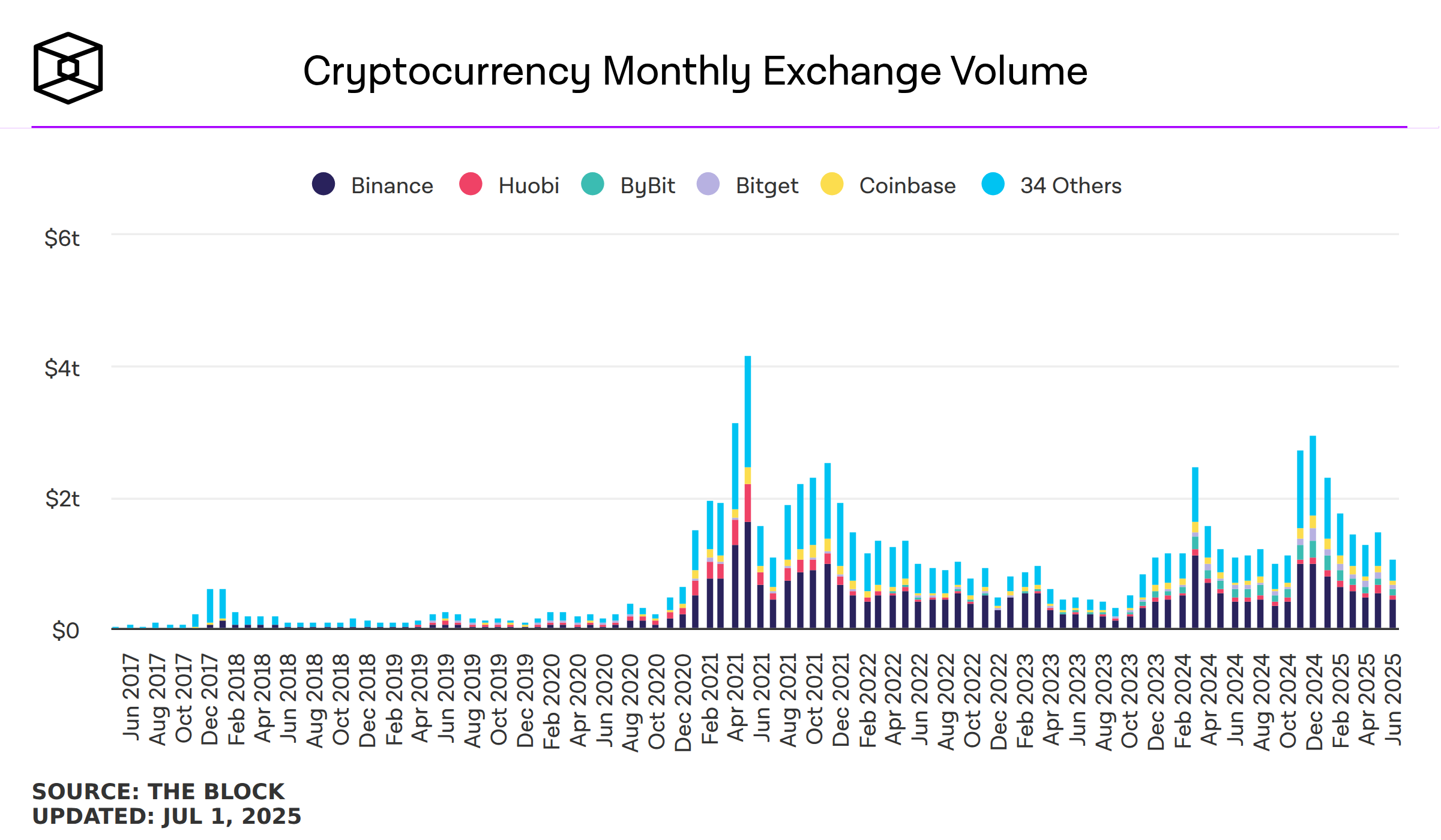

According to the latest data from The Block, in June 2025, the spot trading volume of centralized exchanges (CEX) fell to $1.07 trillion, down about 27% from $1.47 trillion in May, hitting a nine-month low. This significant decline in trading volume not only reflects the short-term volatility of the cryptocurrency market, but also reveals structural changes within the market. Min Jung, a research analyst at Presto Research, pointed out that while Bitcoin prices remain stable and close to historical highs, the altcoin market, including Ethereum (ETH), has performed poorly, with prices falling nearly 40% from their peak.

This divergence shows that market momentum is mainly driven by Bitcoin transactions driven by institutional investors, while retail investors' participation in altcoins is significantly insufficient. This article will delve into the background of the decline in trading volume, focus on analyzing the internal dynamics of the market, and look forward to future market trends.

CEX spot trading volume plummeted in June

In June 2025, CEX spot trading volume plummeted from $1.47 trillion in May to $1.07 trillion, the lowest since September 2024. As the main trading venue for the cryptocurrency market, changes in CEX trading volume are often a direct reflection of market sentiment and participation. This significant decline in trading volume indicates that market activity is weakening, which may be affected by changes in investor behavior, market structural adjustments, and asset class differentiation. In particular, the performance difference between Bitcoin and altcoins provides important clues for us to understand the dynamics within the market.

Market Internals: Bitcoin and Altcoins Divergence

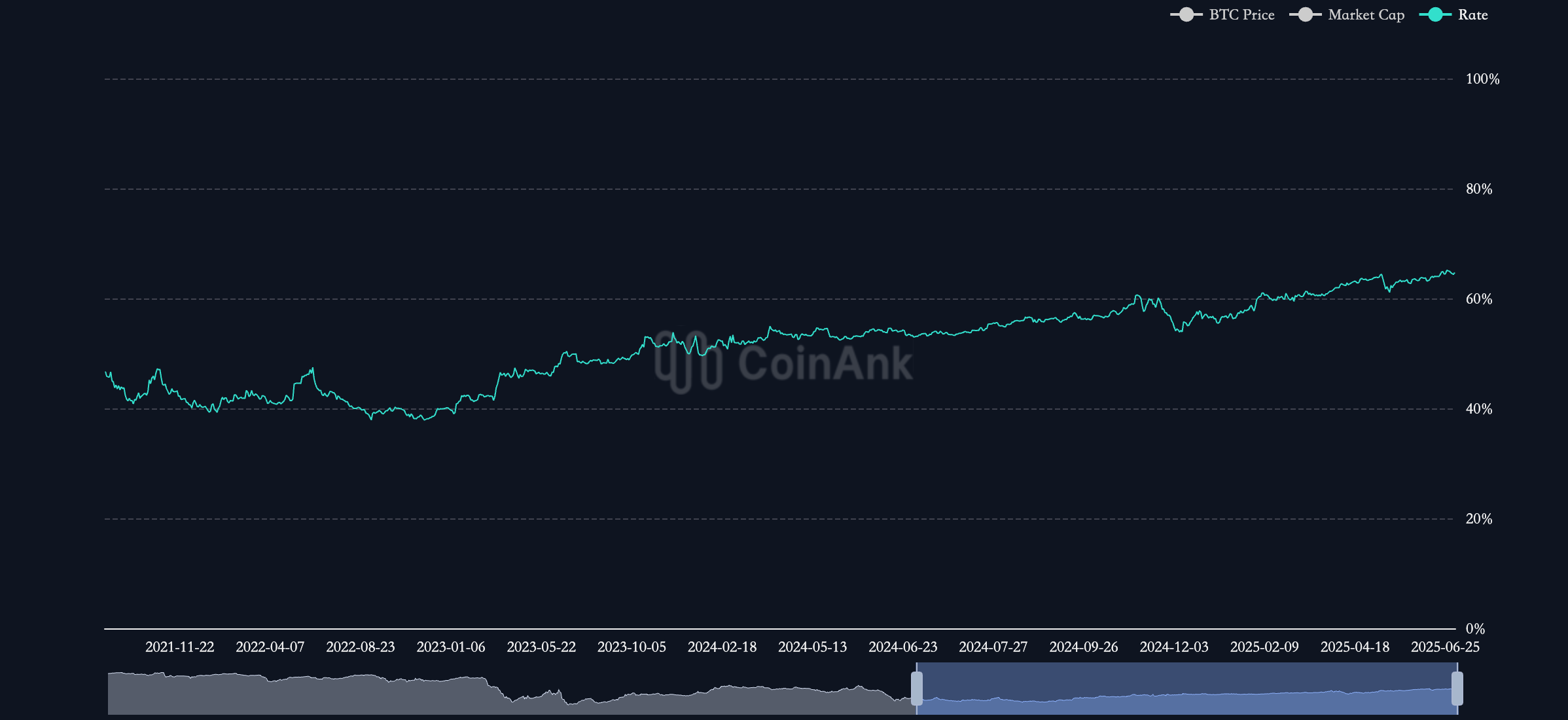

The internal structure of the cryptocurrency market has changed significantly in June 2025, with a clear polarization in the performance between Bitcoin and altcoins. As the dominant asset in the market, Bitcoin's price remains relatively stable, with a volatility range close to its historical high. This stability is due to Bitcoin's market positioning as "digital gold", and its low volatility and wide institutional acceptance make it a safe-haven option for investors. On-chain data shows that Bitcoin's trading volume dominates CEX, with a market share stable at around 55%.

Institutional investors continue to increase their holdings of Bitcoin through spot ETFs, corporate balance sheet allocations, and other means, further consolidating its market position. For example, companies such as MicroStrategy continue to increase their holdings of Bitcoin through bond financing, and net inflows from spot ETFs also provide solid support for Bitcoin prices. This institutional-driven inflow of funds not only maintains Bitcoin's price stability, but also drives its dominance in CEX trading volume.

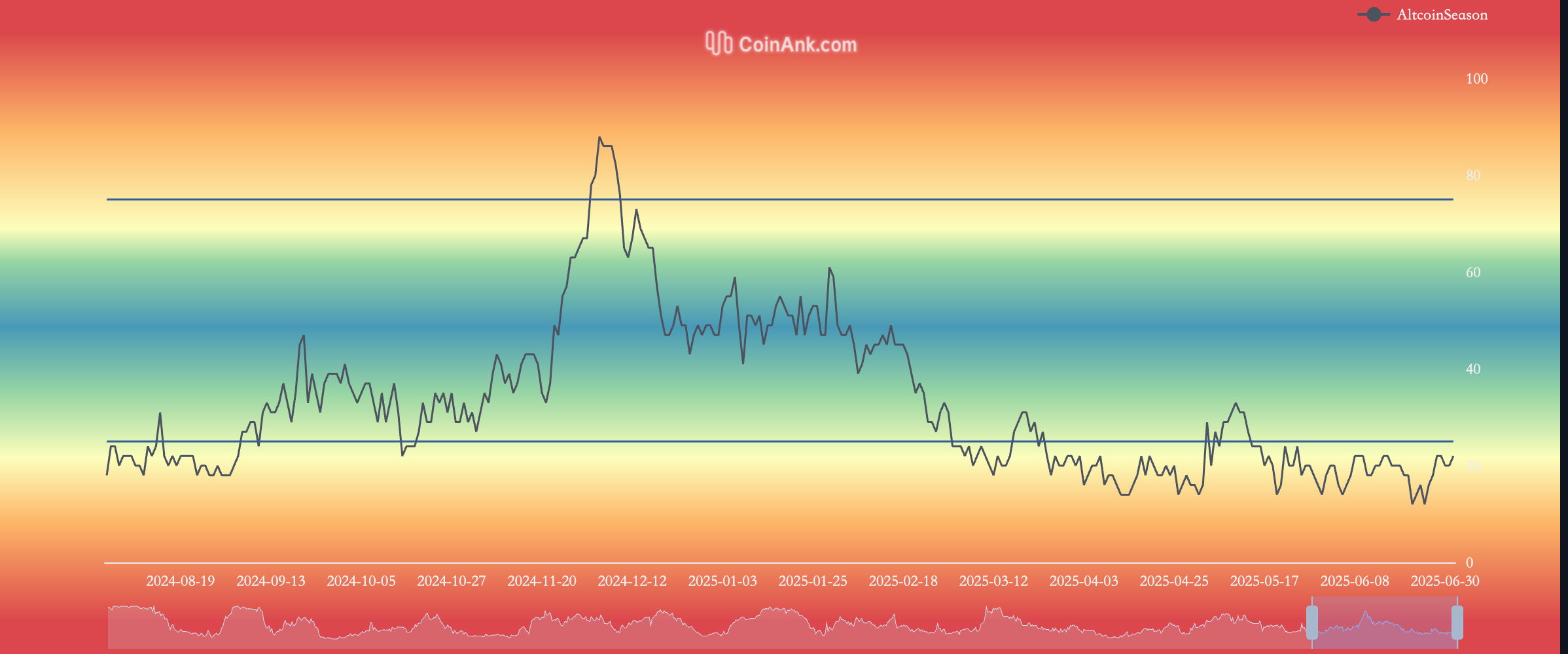

In contrast, the altcoin market has fallen into a slump. Ethereum (ETH), the second-largest cryptocurrency, has fallen nearly 40% from its all-time high, and other major altcoins such as Solana (SOL), Cardano (ADA), and Polkadot (DOT) have also failed to escape the downturn. On-chain activity further confirms this trend: the Ethereum network's transfer volume and active address count fell significantly in June, indicating low user participation and transaction demand. This downturn is partly due to the high volatility and speculative nature of altcoins.

Unlike Bitcoin, the price movement of altcoins often relies on the rotation of market hot spots and the catalysis of technological innovation. For example, the DeFi craze and NFT craze in 2021 once drove the price of Ethereum and related tokens to soar, but the market in June 2025 lacked a similar new narrative. Although Layer 2 solutions such as Optimism and Arbitrum have made progress in reducing transaction costs and improving efficiency, these technological advances have not yet been translated into widespread market enthusiasm, and the trading volume of altcoins has continued to shrink.

Low participation by retail investors is another key factor in the sluggish altcoin market. Retail investors generally prefer altcoins, pursuing high-risk, high-return opportunities. However, data from June 2025 shows that altcoin trading activity has dropped significantly, reflecting the wait-and-see attitude of retail investors. Many retail investors suffered losses in the market crash of 2021-2022, and the current low prices and lack of a clear investment theme may further undermine their confidence. In addition, the complexity of the altcoin market may also constitute a barrier to entry. For example, the complex operating procedures of DeFi protocols and the speculative risks of the NFT market may discourage ordinary investors. In contrast, Bitcoin's simplicity and widespread awareness make it more acceptable to novices, which further exacerbates the sluggish altcoin market.

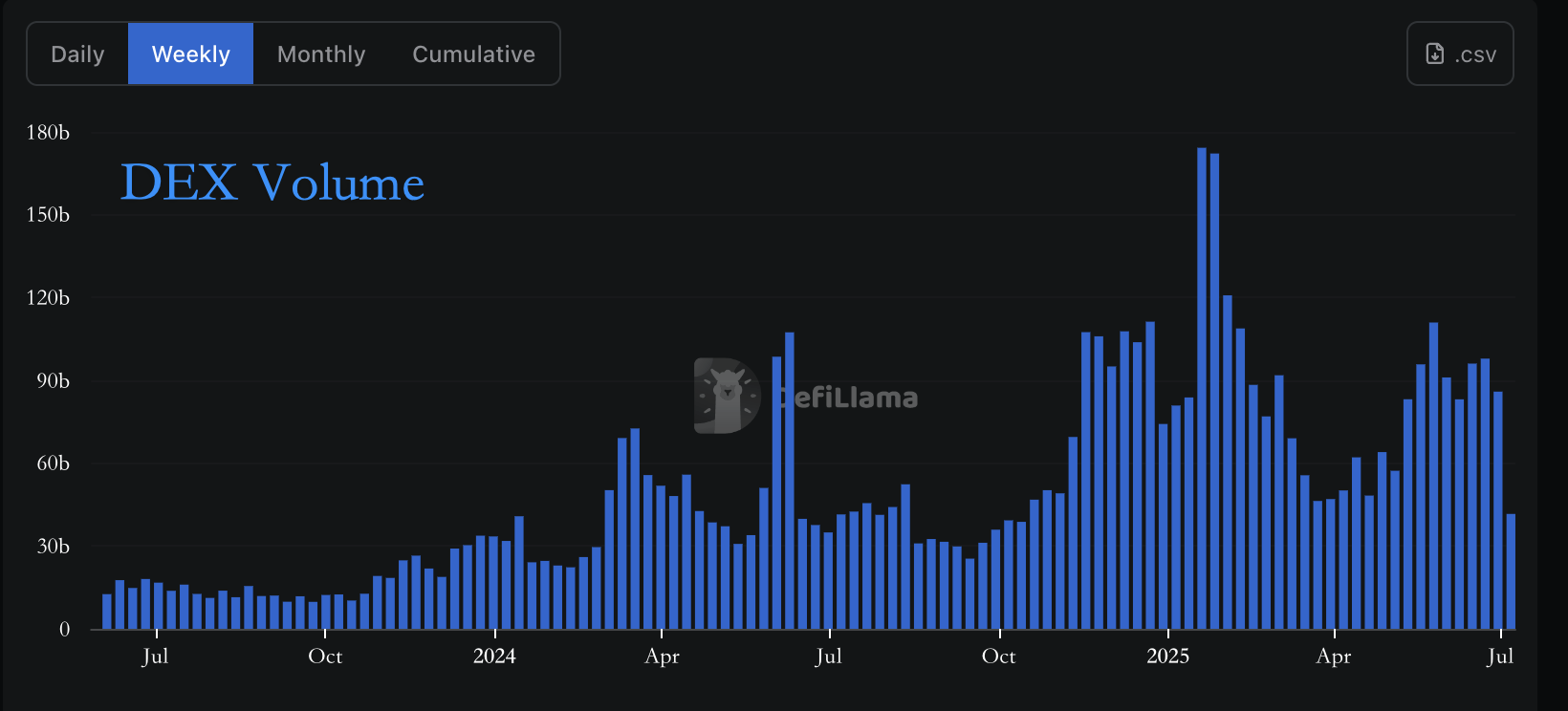

Another phenomenon worthy of attention within the market is the shift in trading patterns. In the past, CEX trading volumes were often dominated by retail-driven short-term speculation and leveraged trading, but data from June 2025 showed that the proportion of leveraged trading has declined, while the dominance of spot trading has further highlighted. This may be related to the trading strategies of institutional investors, who prefer long-term holding rather than high-frequency trading. In addition, the trading volume of decentralized exchanges (DEXs) did not see significant growth in June, indicating that liquidity in the entire market is shrinking. This liquidity contraction may further suppress the trading activity of altcoins, as the price discovery and market depth of altcoins are highly dependent on an active trading ecosystem.

Differentiation between institutions and retail investors

Comments from Presto Research analyst Min Jung provide important insights into market dynamics. She noted: “While Bitcoin remains stable and not far from its all-time high, the altcoin market is struggling, with most altcoins, including ETH, still down nearly 40% from their peak. This suggests that the market is primarily driven by institutional investors buying Bitcoin, while retail participation, which typically favors altcoins, remains relatively subdued.” This analysis accurately captures the core feature of the current market: the divergence between institutional and retail investors in investment preferences and market participation.

The continued deployment of institutional investors in the Bitcoin market is a key factor in driving market stability. The continued inflow of Bitcoin spot ETFs, the increase in corporate adoption, and the improvement of institutional custody solutions have all provided solid financial support for Bitcoin. This institutional-driven market logic has made Bitcoin a "stable anchor" in the market, while altcoins have performed poorly due to the lack of similar support. In contrast, the low participation of retail investors has made the altcoin market lack the necessary momentum. The wait-and-see sentiment of retail investors may be due to multiple factors, including previous investment losses, the lack of market hotspots, and unfamiliarity with complex investment tools. This differentiation not only reflects the different motivations of market participants, but also indicates that the cryptocurrency market may be entering a more mature stage, with the long-term strategies of institutional investors gradually replacing the short-term speculation of retail investors.

Implications for future markets

The decline in CEX spot trading volume in June and the differentiation within the market provide several insights into future market trends. First, Bitcoin's dominance may continue to consolidate in the short term. The continued entry of institutional investors and Bitcoin's safe-haven properties make it more attractive in an uncertain market environment. However, this may further compress the market space for altcoins unless the latter can find new growth points. For example, further upgrades to Ethereum (such as the implementation of sharding technology) or the outbreak of emerging application scenarios (such as Web3 or the metaverse) may inject new vitality into the altcoin market.

Secondly, the recovery of retail participation will be key to the recovery of the altcoin market. Lowering the investment threshold, simplifying the user experience, and providing more extensive educational resources may help attract retail investors to re-enter the market. In addition, new market narratives or technological breakthroughs may rekindle retail enthusiasm. For example, the craze of DeFi and NFT in the past has driven the rapid rise of altcoin prices, and similar new hot spots may reshape the market landscape in the future.

Finally, the recovery of market liquidity will be key to future development. Whether it is CEX or DEX, the growth of trading volume requires a wider range of participants and a healthier ecosystem. The current market liquidity contraction may be a short-term phenomenon, but if it continues, it may have long-term effects on price discovery and market depth. Investors need to pay close attention to on-chain data, trading volume trends, and behavioral changes of institutions and retail investors to grasp the direction of the market.

The sharp drop in CEX spot trading volume in June 2025 reflects profound changes within the cryptocurrency market. Bitcoin's stability is in stark contrast to the downturn in altcoins, and the divergence between institutional investors and retail investors has further exacerbated this trend. Institutional-driven Bitcoin trading has provided support for the market, but low retail participation has put the altcoin market in trouble. In the future, the development of the market will depend on technological innovation, the recovery of retail participation, and the restoration of overall liquidity. For investors, understanding these dynamics and adjusting strategies according to market signals will be the key to seizing opportunities.

**Disclaimer**: This article is only a market analysis and does not constitute investment advice. The cryptocurrency market is highly volatile and risky, and CoinRank recommends that investors make decisions carefully based on sufficient research.