Weekly Editor's Picks (0628-0704)

"Weekly Editor's Picks" is a "functional" column of Odaily Planet Daily. In addition to covering a large amount of real-time information every week, Planet Daily also publishes a lot of high-quality in-depth analysis content, but they may be hidden in the information flow and hot news, and pass you by.

Therefore, every Saturday, our editorial department will select some high-quality articles that are worth spending time reading and collecting from the content published in the past 7 days, and bring new inspiration to you in the crypto world from the perspectives of data analysis, industry judgment, and opinion output.

Now, come and read with us:

Investment and Entrepreneurship

The "on-chain synthetic asset mechanism" was popular in the last era, but price anchoring ≠ asset ownership. The U.S. stocks minted and traded under the synthetic asset model do not represent actual ownership of the stock in reality. It is just a "bet" on the price. Once the oracle fails or the mortgaged assets collapse (Mirror collapsed due to the collapse of UST), the entire system will face the risk of liquidation imbalance, price de-anchoring, and collapse of user confidence.

At the same time, a long-term factor that is easily overlooked is that U.S. stock tokens under the synthetic asset model are destined to be a niche market in Crypto - funds only circulate within the closed loop on the chain, without the participation of institutions or securities firms, which means that it will always remain at the "shadow asset" level. It can neither be integrated into the traditional financial system and establish real asset access and funding channels, nor will anyone be willing to launch derivative products based on this, making it difficult to leverage the structural inflow of incremental funds.

This time, the tokenization of U.S. stocks has changed its gameplay. From a micro perspective, this means that global users can buy and sell U.S. stocks more freely, but from a macro perspective, this is actually the U.S. dollar and the U.S. capital market, using Crypto, a low-cost, highly flexible, 7 × 24 pipeline, to attract global incremental funds - after all, under this structure, users can only go long, not short, and there is no leverage and non-linear income structure (at least so far).

A series of "new/old" narratives around Crypto are being designed as a set of distributed financial infrastructure, and are specifically designed for US financial services: US debt stablecoins → world currency liquidity pool; US stock tokenization → Nasdaq's traffic entrance; on-chain trading infrastructure → global transit station for US brokerages. This may be a flexible way to siphon global funds.

This may be the real turning point for DeFi.

Investors who buy MSTR stock are not only buying Bitcoin, but also buying "the ability to continue to increase Bitcoin in the future."

This model relies on a self-reinforcing cycle: the stock price premium supports fundraising capabilities → fundraising is used to increase Bitcoin holdings → Bitcoin holdings strengthen the company's narrative → narrative value maintains the stock price premium. If the premium disappears, the cycle will be broken: financing costs rise, Bitcoin holdings slow down, and narrative value weakens.

Currently, Bitcoin Reserve still enjoys the advantages of capital market access and investor enthusiasm, but its future development will depend on financial discipline, transparency, and the ability to "increase the amount of Bitcoin held per share" (rather than simply piling up the total amount of Bitcoin). The "option value" that makes these stocks attractive in a bull market may quickly turn into a burden in a bear market.

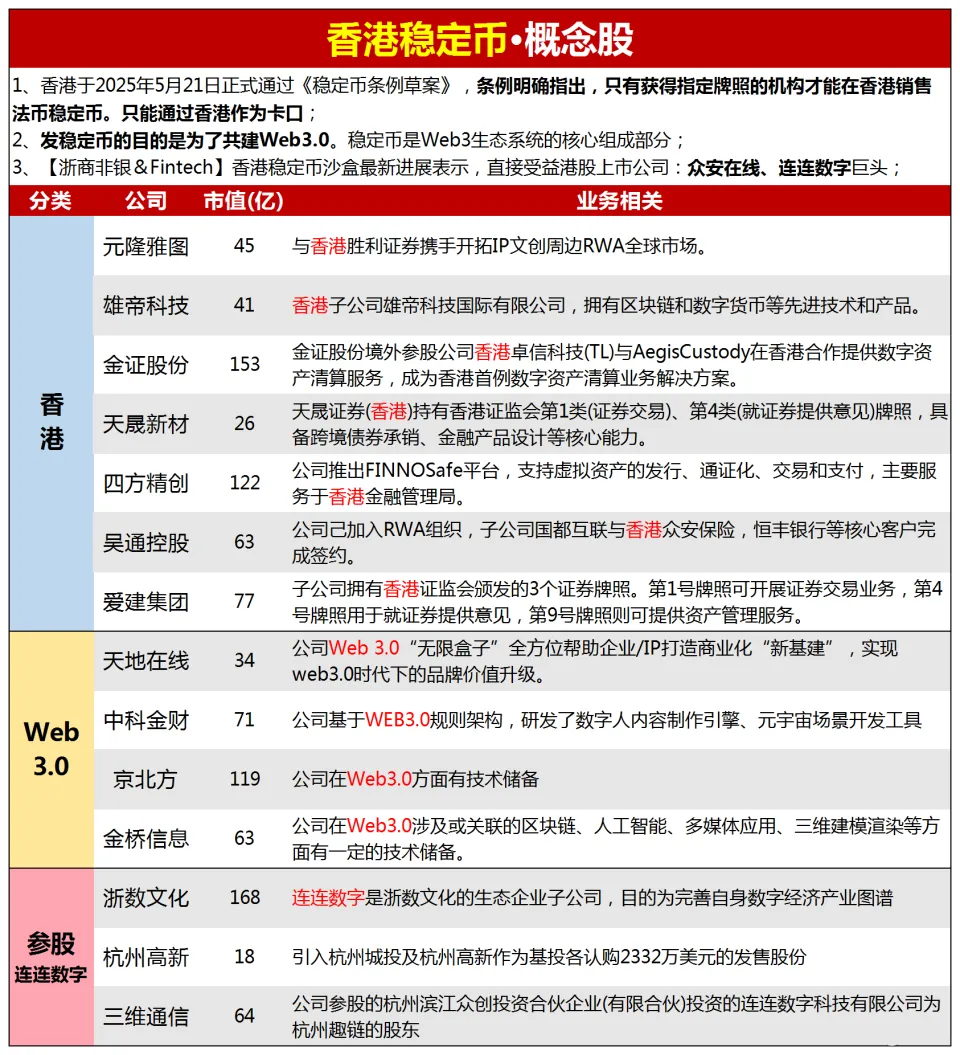

A closer look at the arrival of this crypto Hong Kong stock alt season shows that it has experienced three stages of emotional rises, namely, from the initial "Circle concept stocks", to the later "stable currency concept stocks", and finally "brokerage crypto concept stocks". However, Hong Kong stock gold rush also faces problems such as the steep increase in the threshold for new listings, and the rigid restrictions on funds and trading volume.

VC Reflection: Betting on "Founder-Investor Fit" is not as good as betting on "Product-Market Fit"

95% of VCs surveyed consider founders or founding teams to be the most important factor in their investment decisions, which makes sense from a risk management perspective. But this creates a systematic bias: favoring founders who are good at communicating with investors over founders who are good at communicating with customers. The so-called "product-market fit " is often just " founder-investor fit " with some revenue numbers attached , which only exists in the conference room.

True product-market fit is reflected in user behavior: people who use your product without prompting, who get frustrated when it breaks, who actively recommend your product, and who are willing to pay more and more for it over time.

The most successful founders know how to create true product-market fit while maintaining the ability to communicate that fit to investors in a way that they can understand and get excited about. This often means translating customer insights into investor language: showing how user behavior translates into revenue metrics, how product decisions create competitive advantage, and how market understanding drives strategic positioning.

The new regulatory environment provides entrepreneurs with an opportunity to redefine the proper relationship between tokens and equity: tokens should capture on-chain value, while equity corresponds to off-chain value. Entrepreneurs need to abandon the idea of tokenized governance as a shortcut to regulatory compliance. Instead, governance mechanisms should be enabled only when necessary and should be kept minimal and orderly. Entrepreneurs can also ensure that governance mechanisms operate effectively through customized legal structures and on-chain tools. In addition, token holders’ ownership of on-chain infrastructure needs to be maximized.

To address regulatory risks, tokens must be clearly distinguished from securities.

The "single asset" model (anchoring all value on the chain and attributing it to the token) has two core advantages: one is the incentive mechanism that aligns enterprises and token holders, and the other is that it allows entrepreneurs to focus on improving the competitiveness of the protocol. With minimalist design logic, leading projects such as Morpho have taken the lead in practicing this model.

Dialogue with Robinhood Co-founder: Why do we want to build our own chain?

Robinhood is moving away from its positioning as a single trading tool and toward an "operating system" layout centered on the user's entire life cycle. From private equity tokenization, integration of CFTC-compliant prediction markets, the launch of Cortex and Strategies covering AI strategy advisors and option strategy construction, to the launch of "cash express"-style Robinhood Banking and a unified multi-chain wallet architecture, the pace of its financial expansion far exceeds the outside world's traditional imagination of a FinTech company.

Also recommended: " 10 Questions for xStocks: What are we trading when trading US stock tokens? " " Dialogue with Tether CEO: Unveiling the "Four Stability" Vision and 14 Billion Investment Map ".

policy

Crypto wins again? An in-depth analysis of Trump’s “Big and Beautiful Bill”

On paper, the now-well-known provisions of the Big, American Act could weaken the power of federal courts, severely damage the health care system, increase the debt burden, intensify immigration enforcement, restrict foreign investment, increase air pollution, and increase the defense budget. Although the impact is wide-ranging, it has nothing to do with encryption.

This may not be the case. The passage of the Big, Big, Beautiful Act (OBBBA) is likely to have a profound impact on the cryptocurrency and financial industries. The tax cuts and fiscal stimulus measures in the bill create a more relaxed macroeconomic environment for crypto assets. The favorable capital gains tax policy encourages investors to hold digital assets for the long term, which not only injects long-term funds into the cryptocurrency market, but also further consolidates the United States' position as the global cryptocurrency center.

Crypto Regulatory World Map: Policies and Evolution Trends in 20+ Jurisdictions Around the World

Airdrop Opportunities and Interaction Guide

This week's featured interactive projects: vooi trading experience, Elympics and Surf earn points

Ethereum and Scaling

Trend Research: The storm is coming, and the market will promote ETH to achieve value discovery

Stablecoin is the most important underlying foundation for the integration of traditional finance into the chain. It makes currency programmable and decentralized, and is the basis for the circulation and settlement of all on-chain financial assets.

The rapid development of RWA this time is due to the fact that institutional compliance is constantly exploring new ways of integration and promoting the legislation of the Digital Asset Market Structure Act. When the legislation of the stablecoin and market structure bill is completed, a large number of assets will be quickly pushed onto the chain, and transactions, income, settlement and other links will be run on the native blockchain, with stablecoins as the basic currency unit and value carrier.

After a large number of assets are on-chain, DeFi will begin to play a role, integrating the newly on-chain assets with the increasingly mature DeFi protocols to achieve efficiency, automation, and compliance.

The process of accelerating ETH repricing is happening: surging demand, accelerated demand for native crypto income, strategic hoarding of ETH, and ETH as an institutional fund asset. The rise of ETH is not driven by the purchase or publicity of one or two institutions, but is the common choice of mainstream institutions when changing their layout, and the critical point of trend change is coming soon.

Multi-ecology

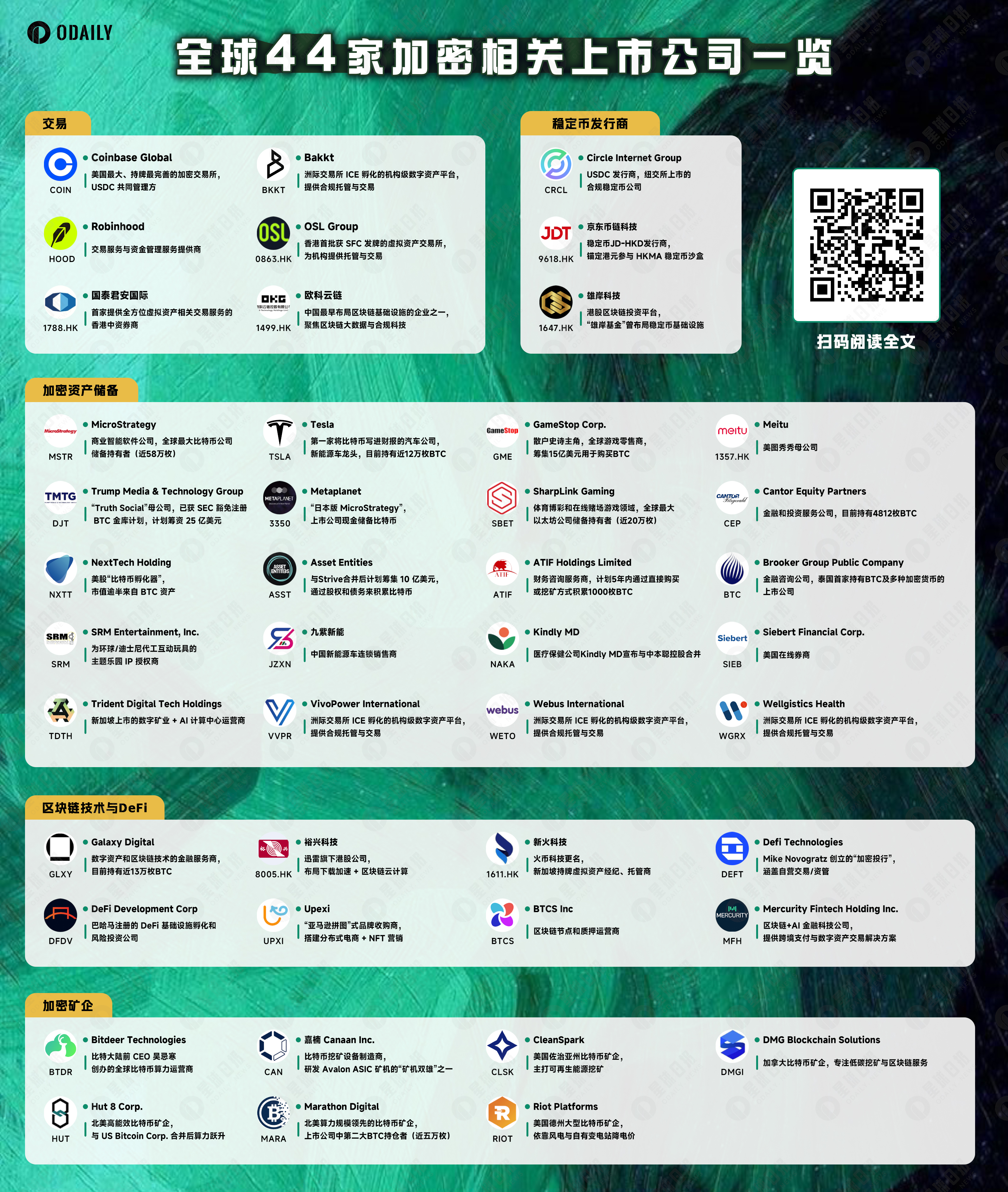

SOL ETF approved. Who is playing the role of Solana version of MicroStrategy in the US stock market?

The Solana spot staking ETF launched by REX-Osprey has been approved.

This year, a number of U.S.-listed companies have announced that they will incorporate Solana into their financial strategies, and even use SOL tokens as core reserves on their balance sheets, including: DeFi Development Corporation (trading code: DFDV), SOL Strategies Inc. (Canadian Stock Exchange code: HODL, U.S. OTC code: CYFRF), Classover Holdings, Inc. (NASDAQ code: KIDZ), and Upexi, Inc. (NASDAQ code: UPXI).

The ecological hotspots that rose following the good news mainly fell on the DEX and staking tracks, such as Raydium (RAY), Jupiter (JUP), and Jito (JITO).

CeFi & DeFi

Web3 & AI

Safety

Watch out for red flags: coordinated false alerts to create confusion and urgency, mixing short codes with regular phone numbers, requests to operate through unofficial or unfamiliar domain names, unsolicited calls and follow-up communications, unsolicited warnings of urgency and consequences, requests to bypass official channels, unverified case numbers or support tickets, a mix of real and fake information, use of real company names in alternative suggestions, and overzealousness without verification.

Proactive protection measures and recommendations include: Enable transaction-level verification on the exchange, Always contact the service provider through legitimate, verified channels, Exchange customer service will never ask you to move, access or protect funds, Consider using a multi-signature wallet or cold storage solution, Bookmark official websites and avoid clicking on links from unsolicited messages, Use a password manager to identify suspicious websites and maintain strong passwords, Regularly review connected apps, API keys, and third-party integrations, Enable real-time account alerts where available, Report all suspicious activity to the service provider’s official support team.

Also recommended: " Beosin Important | Analysis of Web3 Blockchain Security Situation in the First Half of 2025 ".

Hot Topics of the Week

In the past week, the U.S. House of Representatives voted to pass the "Big and Beautiful" bill ; Robinhood plans to launch a Layer 2 blockchain and provide "stock token" business in the European Union ( detailed explanation ); Viewpoint: If Robinhood succeeds, it will eliminate 90% of financial intermediaries ; OpenAI angrily denounced Robinhood for unauthorized tokenization of stocks ( interpretation ); Several technology billionaires, including PayPal co-founder and Silicon Valley venture capitalist Peter Thiel, are jointly launching a new bank called Erebor, aiming to fill the banking service gap for the cryptocurrency industry after the collapse of Silicon Valley Bank ( introduction ); Circle applied for a U.S. national bank license and plans to independently manage USDC reserves ( detailed explanation ); Ripple gave up its cross-appeal to the SEC and accepted a $125 million fine, and the long-term legal battle may be coming to an end; Nate Geraci: The end of Ripple's dispute with the SEC has cleared the way for the spot XRP ETF ; Ripple applied for a U.S. banking license after Circle and plans to provide more encryption services; L1 public chain Stablecoin supported by USDT Official release ( interpretation ); Hong Kong Stock Exchange implements new stock settlement fee structure ;

In addition, in terms of opinions and voices, Trump: If I had known that the US president was a "high-risk job", I might not have run for election; Musk: 80% of people think that a new political party should be created ; Trump: Musk knew long before he strongly supported my presidential campaign that I strongly opposed the electric vehicle mandate ; Cathie Wood: Bitcoin holders may transfer BTC to Coinbase for mortgage loans to buy houses ; The Wall Street Journal: Bhutan is betting on Bitcoin mining ; TD Cowen: Maintain Strategy's "buy" rating ; Analyst: Bitcoin bull market may end in October ; China Asset Management Hong Kong: It is predicted that legal currency will become stable currency in the future, and there are only a few universal stable currencies in the world ; JD.com: JD.com Coin Chain Technology has not yet started issuing stable currency ; Vitalik: Zero-knowledge proof of identity is still risky ; FTX creditor representative Sunil: Creditors in 49 jurisdictions, including China, may lose their right to claim ( interpretation );

In terms of institutions, large companies and leading projects, Trump Phone T 1 deleted the words "Made in the USA" and changed it to "American Proud Design" ; Cel AI, a British listed company , has raised 10 million pounds to purchase Bitcoin ; the Ethereum Community Foundation (ECF) was established; Leading Pharmaceutical Biotechnology plans to acquire all the shares of Conflux to expand the field of blockchain technology; Hong Kong-listed company Yisou Technology plans to explore RWA token products , stimulating a nearly 70% increase in its stock price; Jupiter launched its own Launchpad platform Jupiter Studio ; Fragmetric has opened airdrop applications;

According to the data, the Trump family has recently made a profit of $620 million from crypto projects; 27% of South Koreans aged 20-50 hold crypto assets, and 70% plan to continue to increase their investment; Bitcoin volatility has dropped to its lowest level since 2023 , and has only occurred 7 times in history; Analysis: Ethereum, ZKsync Era and Aptos rank among the top three RWA asset public chains; On June 27, Binance Alpha's trading volume of $487 million has dropped 70% from its high point ;

In terms of security, Resupply incident review : hackers are at large, users are forced to fill the hole, and the security incident has evolved into a racial discrimination scandal; SlowMist founder: Resupply protocol chain calls out to hackers , hoping to communicate through Blockscan; SlowMist CISO: Security company Koi disclosed that more than 40 fake crypto wallet extensions appeared in the official Firefox browser plug-in store; Backpack suddenly malfunctioned ; ZachXBT: USDC has become the main payment tool for North Korean IT practitioners , and Circle has not frozen related activities... Well, it's another week of ups and downs.

Attached is a portal to the “Weekly Editor’s Picks” series.

See you next time~