RWA Weekly Report | Visa invests another 2 million euros in stablecoins; Stripe launches stablecoin accounts in more than 100 countries (5.8-5.13)

Original | Odaily Planet Daily ( @OdailyChina )

Author | Ethan ( @ethanzhang_web3 )

RWA Sector Market Performance

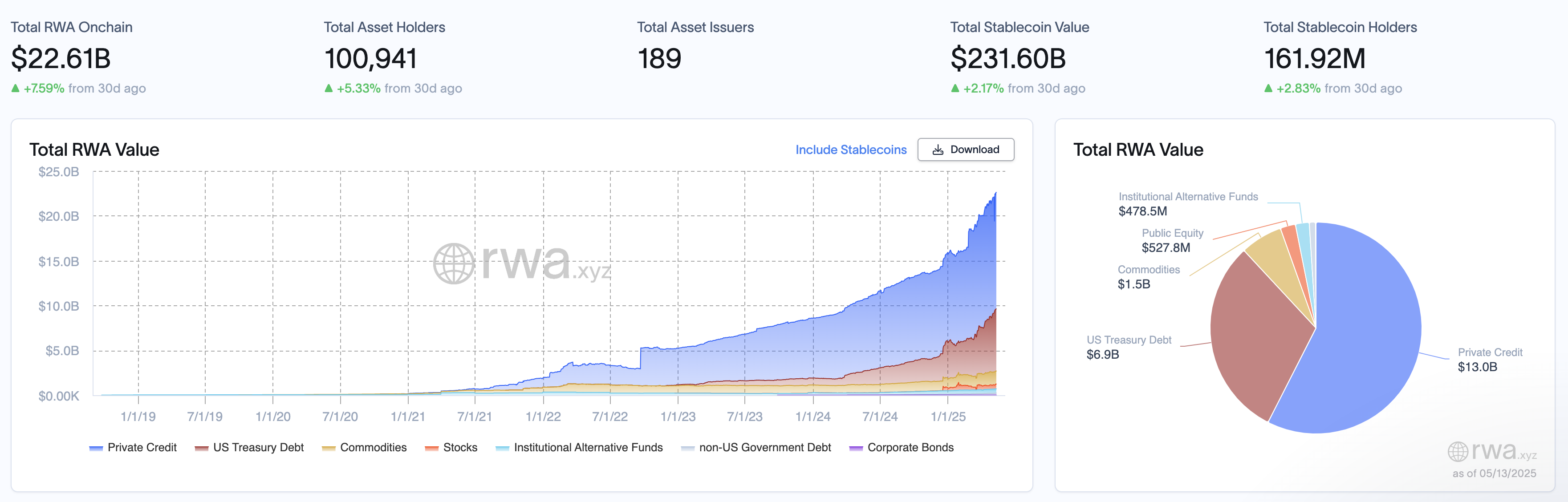

According to RWA.xyz data, as of May 13, 2025, the total value of RWA on the chain reached 22.38 billion US dollars, an increase of 7.59% from 30 days ago. The total number of on-chain asset holders is 100,941 , an increase of 5.33 % from 30 days ago , and the number of asset issuances is 189. The total value of stablecoins is 231.6 billion US dollars, an increase of 2.17% from 30 days ago, and the number of stablecoin holders is 161.92 million, an increase of 2.83% from 30 days ago.

From the historical trend, the total value of RWA chain has shown significant growth since 2019, especially after 2023, and reached a peak in early 2025, showing the rapid popularization of tokenized assets. In the distribution of asset categories, private credit dominates, with a value of US$13 billion, accounting for 58.09% of the total value; US Treasury Debt is worth US$6.8 billion, accounting for 30.38%; Commodities is US$1.5 billion, accounting for 6.7%; International Alternative Funds is US$478.5 million, accounting for 2.14%. Stocks, non-US Government Debt and Corporate Bonds account for a relatively small proportion.

Compared with last week's data , the distribution of asset classes this week has changed slightly compared with last week, but some trends can still be observed. The value of Private Credit increased slightly to US$13 billion, and its share increased from 57.64% to 58.09%, further consolidating its dominant position. The value and share of US Treasury Debt (US$6.8 billion, 30.38%) remained unchanged. The value of Commodities and International Alternative Funds increased slightly, but the share did not change much (6.7% and 2.14%). Stocks, non-US government debt and corporate bonds still accounted for a small proportion, and investors had low interest in allocating these assets.

Summary: Private credit continues to attract capital inflows, reflecting investors' preference for high-yield, alternative assets, while the stability of U.S. Treasuries makes them the first choice for safe-haven assets. Investors may consider looking for opportunities in the private credit sector while paying attention to the role of U.S. Treasuries as a portfolio stabilizer, but they should be wary of potential downturns in the stock and corporate bond markets.

Review of key events last week

US Senate rejects stablecoin bill, Trump's concerns intensify

According to reports, on May 8, the U.S. Senate rejected the procedural vote of the Stablecoin Regulation Act (GENIUS Act) by 48 votes to 49, failing to reach the 60-vote threshold for advancement, delaying the debate process. Two Republican senators, Josh Hawley and Rand Paul, voted against it with all Democrats, and Majority Leader John Thune also changed his vote to against it so that it could be re-introduced in the future. The Democrats opposed it due to concerns about the relationship between the Trump family and the crypto business and the bill's incomplete anti-money laundering provisions. Senators Ruben Gallego and Mark Warner called for an extension to improve the text. Republicans accused the Democrats of lacking the willingness to cooperate, saying that this move could stifle the U.S. crypto industry.

Superstate launches “Opening Bell” to support on-chain issuance and trading of SEC-registered stocks

Superstate announced the launch of the "Opening Bell" platform, which supports the direct issuance and trading of SEC-registered stocks on the chain. The project will be deployed first on the Solana chain to achieve the native integration of traditional equity and blockchain infrastructure. Superstate has recently joined forces with several institutions to submit a framework proposal to the SEC.

Stripe launches stablecoin accounts in over 100 countries

According to the announcement on May 7, the global payment platform Stripe launched stablecoin accounts in 101 countries, supporting users to send, receive and hold USD stablecoin balances, similar to traditional bank accounts. The service supports Circle's USDC and the USDB stablecoin issued by the Bridge platform acquired by Stripe in October 2024, covering Argentina, Chile, Turkey and other countries. The current total market value of stablecoins has exceeded US$231 billion, especially in developing economies with high inflation and lack of financial infrastructure, the demand for stablecoins as a store of value and medium of exchange continues to grow.

Visa invested in the stablecoin payment infrastructure platform BVNK through its venture capital arm Visa Ventures. This is Visa's first direct investment in a startup in this field, and is seen as a strong validation of the potential of stablecoins as a global payment infrastructure. BVNK currently processes $12 billion in annual transactions, and its clients include Deel, dLocal and other companies.

Earlier news said that stablecoin infrastructure company BVNK completed a US$50 million Series B financing round, led by Haun Ventures.

BioSig and Streamex merge to create Nasdaq-listed RWA company

BioSig Technologies has reportedly signed a letter of intent to merge with Streamex Exchange Corp., intending to list an RWA company on Nasdaq in an all-stock transaction. Streamex provides Solana-based commodity market tokenization infrastructure, with the goal of chaining the $2.1 trillion mining industry and the $142 trillion global commodity market. After the merger, Streamex shareholders will hold approximately 19.9% of the company's common stock, which will increase to 75% after conversion of preferred shares. BioSig CEO Anthony Amato said the move will enhance growth potential, and Streamex co-founders Henry McPhie and Morgan Lekstrom called it an evolution of traditional finance.

Hot Projects Latest News

Plume Network

Official website: https://plumenetwork.xyz/

Introduction: Plume Network is a modular Layer 1 blockchain platform focused on the tokenization of real-world assets (RWA). It aims to transform traditional assets (such as real estate, art, equity, etc.) into digital assets through blockchain technology, lowering the investment threshold and improving asset liquidity. Plume provides a customizable framework that supports developers to build RWA-related decentralized applications (dApps) and integrate DeFi and traditional finance through its ecosystem. Plume Network emphasizes compliance and security, and is committed to providing solutions that bridge traditional finance and the crypto economy for institutional and retail investors.

Latest developments: On May 9, it was announced that it would cooperate with Lorenzo Protocol ( @LorenzoProtocol ) to introduce its financial abstraction layer into the Plume ecosystem, reducing the friction cost of RWA staking and sustainable returns for native BTC and other CeFi products . On the same day, it was announced that it would integrate with Hyperliquid, and the PLUME token would be listed on Hyperbridge.

On May 12, the first step of its mainnet journey was announced: Plume Alpha, marking the initial stage of mainnet deployment. Plume's goal is to make the on-chain RWA experience as seamless as native crypto assets, and users can stake, exchange, lend, borrow, and speculate on RWA on Plume. This stage lays the foundation for the unlocking of subsequent features such as asset tokenization and governance.

R2 Yield ( R2 )

Official website: https://www.r2.money/

Introduction: R2 Yield is a stablecoin yield protocol that integrates physical assets (RWA), traditional finance (TradFi) and decentralized finance (DeFi), aiming to provide users with stable income opportunities through blockchain technology. Its core product, R2 USD, is a stablecoin backed by physical assets, including on-chain tokenized U.S. Treasuries, money market strategies, and real estate rental income. This design allows R2 USD to have both stability and yield generation capabilities, breaking the limitation of traditional stablecoins (such as USDT and USDC) that do not directly generate income for users. The mainnet is expected to be officially launched in the second to third quarter of 2025.

Latest developments: On May 8, the testnet’s points dashboard was updated, allowing users to view points earned through tasks such as minting, staking, and providing liquidity. On May 9 , it was announced that the number of testnet addresses has exceeded 200,000, and the cumulative number of transactions has exceeded 10,000,000.

Since the testnet was launched , R2 has completed deployment on multiple test networks including Plume, ETH Sepolia, Arbitrum Sepolia, etc., attracting more than 90,000 users to participate in just one week.

Related articles

RWA Weekly Report Last Week: Sorting out the latest industry insights and market data.

《 Reprint Interpretation丨 RWA Tokenization: Key Trends and Market Outlook for 2025 》

At the critical stage when the crypto market is shifting from "concept" to "real industry", Real World Asset (RWA) Tokenization is undoubtedly the core trend connecting the on-chain and off-chain asset worlds. The content of this report is both in-depth and practical. From JP Morgan's ABS pilot, to Franklin Templeton's on-chain money fund, to the $30 billion real estate asset on-chain, accurate cases and data will help us clarify the RWA market trend.