A brief discussion on crypto in April: Meme, CEX "volume king" and new logic of market effect

Every April in the crypto market is full of confusion and distress, and so is 2025. From the tariff cloud at the beginning of the month to Trump's brief relaxation, the crypto market has become a battlefield for testing political compliance. Combined with the Fed's dovish expectations and multiple external factors, the market rebounded rapidly, among which AI narratives and Meme narratives rebounded most significantly. At the same time, benefiting from CZ's typical celebrity effect and Binance Alpha's aggressive airdrop effect, Meme has become a key indicator of short-term market sentiment and liquidity trends.

This article will review and analyze the market situation in April: the overall data performance of the cryptocurrency market and the rise and fall of newly issued Meme tokens, and then analyze the capital flow and narrative evolution path of the Meme market in April. Finally, it will look forward to the trends and key events in May, in order to reveal the panoramic picture of the monthly trend of the Meme market in April and provide a reference thinking framework for the market situation in May.

Market mild recovery: Affected by macro constraints, funds are pouring into AI and Meme

In April, the pace of inflation in the United States slowed down, and the Federal Reserve released a signal that "balance sheet reduction (QT) may end within the year". The market still has differences on the timetable for interest rate cuts, and the overall risk appetite is cautious. Under macro uncertainty, stablecoins continue to "serve as a safe haven". Benefiting from the inflow of incremental US dollar stablecoins, Bitcoin took the lead in rebounding from the first line of $82,000 to the range of $90,000-95,000, with a monthly increase of more than 20%.

Throughout April, Meme and AI sectors became the core incremental engines of the market. In comparison, most mainstream and long-tail tokens performed mediocrely: in Coingecko's 30-day gain list, only VIRTUAL, FARTCOIN, and TAO tokens had a monthly gain of more than 100%, and the remaining Top 100 assets only recorded a single-digit gain on average.

The battle for liquidity escalates: Competition among exchanges intensifies

In April, the competition for liquidity intensified, and major trading platforms launched a more intense competition for market traffic. Binance Alpha tied users to the trading interface through the "points + airdrop" mechanism, and the Web3 wallet TGE event attracted a lot of attention. Gate.io seized early traffic with the combination of "Innovation Zone + MemeBox", and the OKX DEX aggregator, which had undergone 49 days of technical upgrades, was re-launched and re-joined the battle for market share.

Among them, although LBank has not launched DEX products, it has maintained the rhythm of "48-hour rapid listing" by virtue of its advantages of "fastest coin listing and first in Meme liquidity", and its market share has remained No. 1 in the CEX of high-quality Meme assets, continuously locking in the maximum benefits of popular Memes.

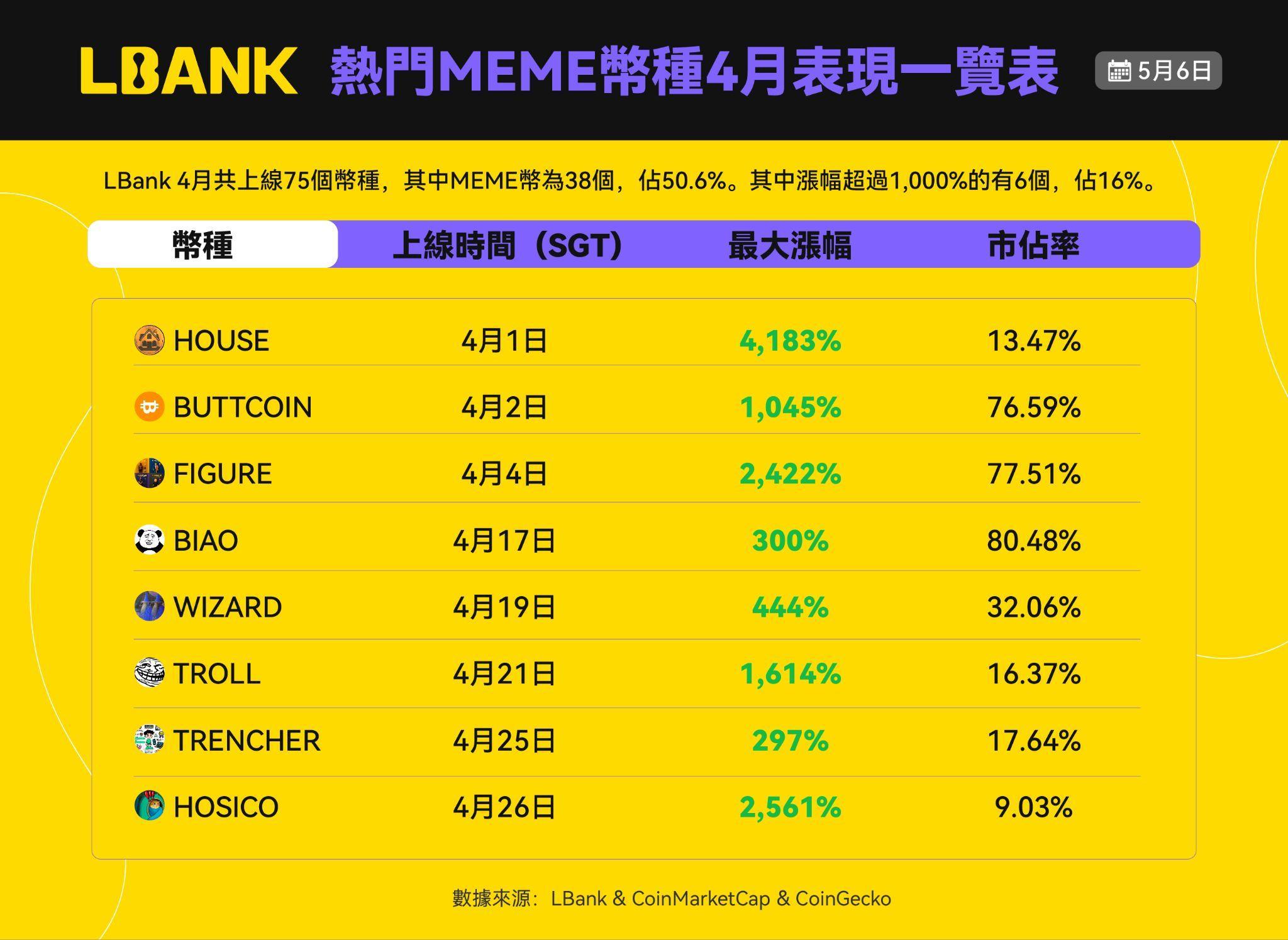

LBank has an eye-catching performance in the Meme track with its two major advantages of "extremely fast listing + deep liquidity":

The average increase of the top five meme coins listed in April was 3,166%, far exceeding other mainstream CEXs.

CoinGecko shows that LBank ranks at the forefront of the global trading share of many popular meme coins. It was launched before the surge of meme coins such as RFC, HOUSE, TROLL, and HOSICO, and maintains a leading position in market share.

Among them, BIAO, FIGUR and EBUTTCOIN all have a market share of over 70%, reflecting that the aggregation effect of LBank's first launch of Meme has formed a first-mover barrier.

Binance Alpha has launched a new points system, which has injected new vitality into the BNB chain Meme ecosystem by locking in early liquidity. The dynamic adjustment of the points threshold and airdrop rewards has also significantly intensified the high-frequency gaming atmosphere in the market. In April, Binance Alpha launched early Meme coins such as SPX, MOG, POPCAT and CULT. In early May, it followed the hot spots and launched BOOP, Jager and DONKEY, driving the price of coins to soar briefly. Although Alpha, as a test field for Binance spot listing, has tried to reverse the previous listing dilemma caused by VC coins, the speed of listing is still relatively slow. The highest prices of many Meme coins are often fixed at the moment of announcement, but the rise is weak and stalled after the actual opening.

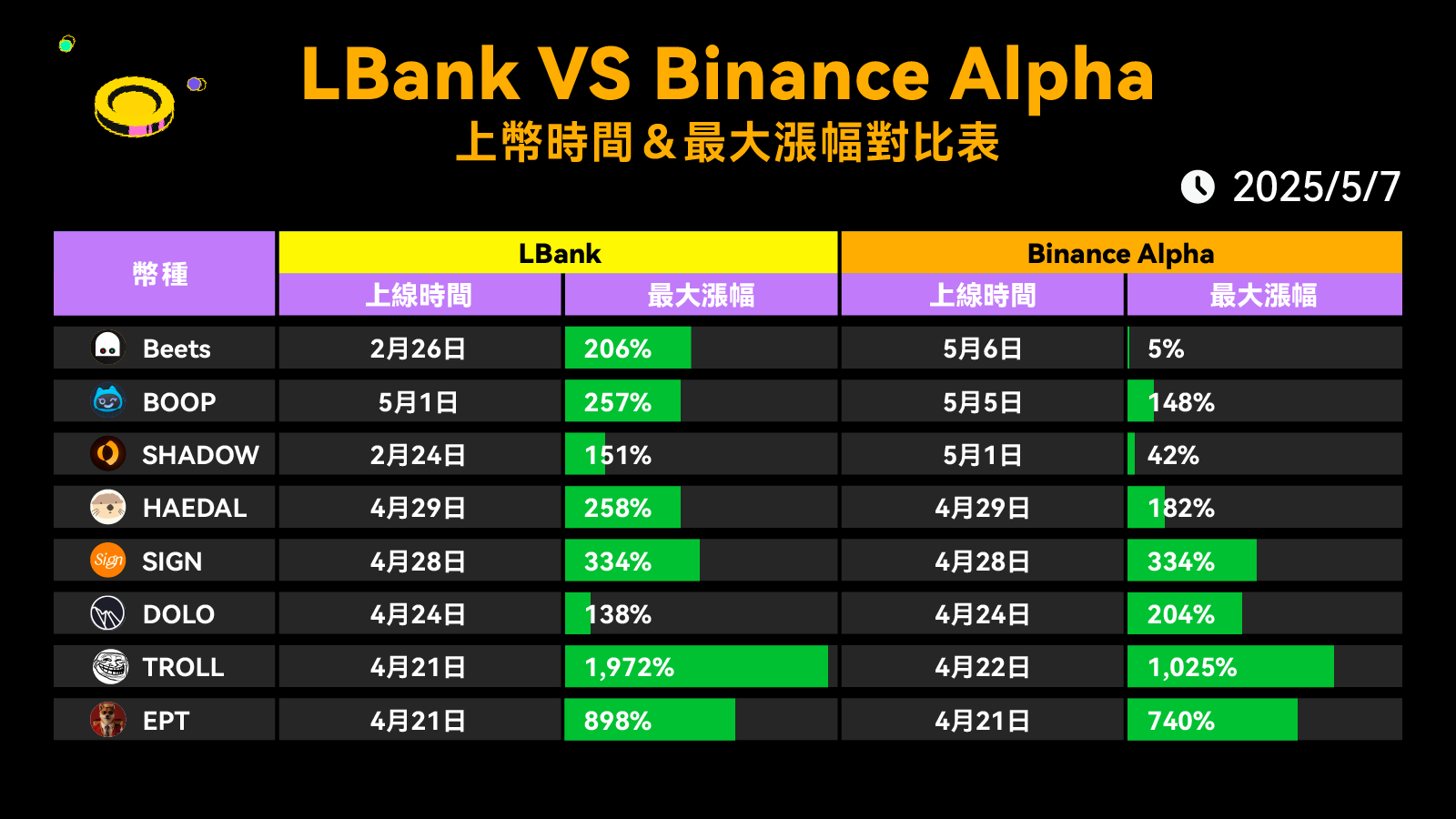

It is worth mentioning that LBank launched these potential Meme tokens at the beginning of the popularity, successfully capturing the biggest increase for LBank users. For new coin hunters who pursue high elasticity, time difference is profit. Actual tests in April showed that the average increase of the eight Meme coins launched by LBank reached 527%, while Binance Alpha increased by 335%, a difference of 192%, which is equivalent to taking about 57% more profit space in the same wave of market.

For example, Beets was launched on LBank on February 26, and its price rose by as much as 206%; while Binance Alpha was launched on May 6, and its price rose by only 5%. The 70-day information gap directly magnified the profit space by 201%. TROLL was launched on LBank on April 21, and it soared by 1,972% in one day; although Binance Alpha followed up the next day, the main upward wave had already passed, and only 1,025% remained, earning 947% more 24 hours in advance.

At the same time, we noticed that the Meme launch platform also rolled out a new dimension. ElizaLabs released auto.fun, replicating the "zero code release" experience of pump.fun, but superimposed the AI agent deployment function, allowing anyone to launch an "AIMeme" in three minutes. At the same time, Virtuals Protocol launched GenesisLaunch: as long as you hold VIRTUAL and earn points, you can subscribe to AIAgent theme new coins according to weight, making "fair first release" a community operation tool. The two-way increase in liquidity competition and Launchpad competition has made the "liquidity-topic-income" flywheel turn faster, and also made high-frequency trading the main theme of the market in April.

Attention is waning: The power game of celebrity calls is decreasing marginally

In the past two years, "rich people changing their names and founders shouting orders" has almost been the killer move for the Meme coin market; but in April, the market's sensitivity to celebrity endorsements is declining significantly. Musk changed the nickname of his X account to "GorklonRust", which caused the GORK token to surge by nearly 100% in 24 hours, but after a brief stay at the high point of $0.083, it quickly fell back to around $0.06, and the intraday increase of less than 20% was swallowed up. A similar situation also occurred in the CZ-related DONKEY token: after the coin was listed on BinanceAlpha on May 5 and surged on the same day, it retreated more than 45% within 72 hours. Zerebro Lianchuang wanted to replicate the celebrity effect through "suicide live broadcast + legacy coin", but after 48 hours of backlash from public opinion, the market value was reduced from $30 million to $2 million, and it eventually became a "leek-cutting script."

This shows that celebrity tweets can still cause prices to drop or rise instantly, but their validity period is being compressed from "a few days" to "a few hours", and then they enter the inertial "sell at the top" cycle. The reason is that the market has become tired of "personalized narratives", and the effect of creating FOMO simply through dramatic plots has significantly decreased.

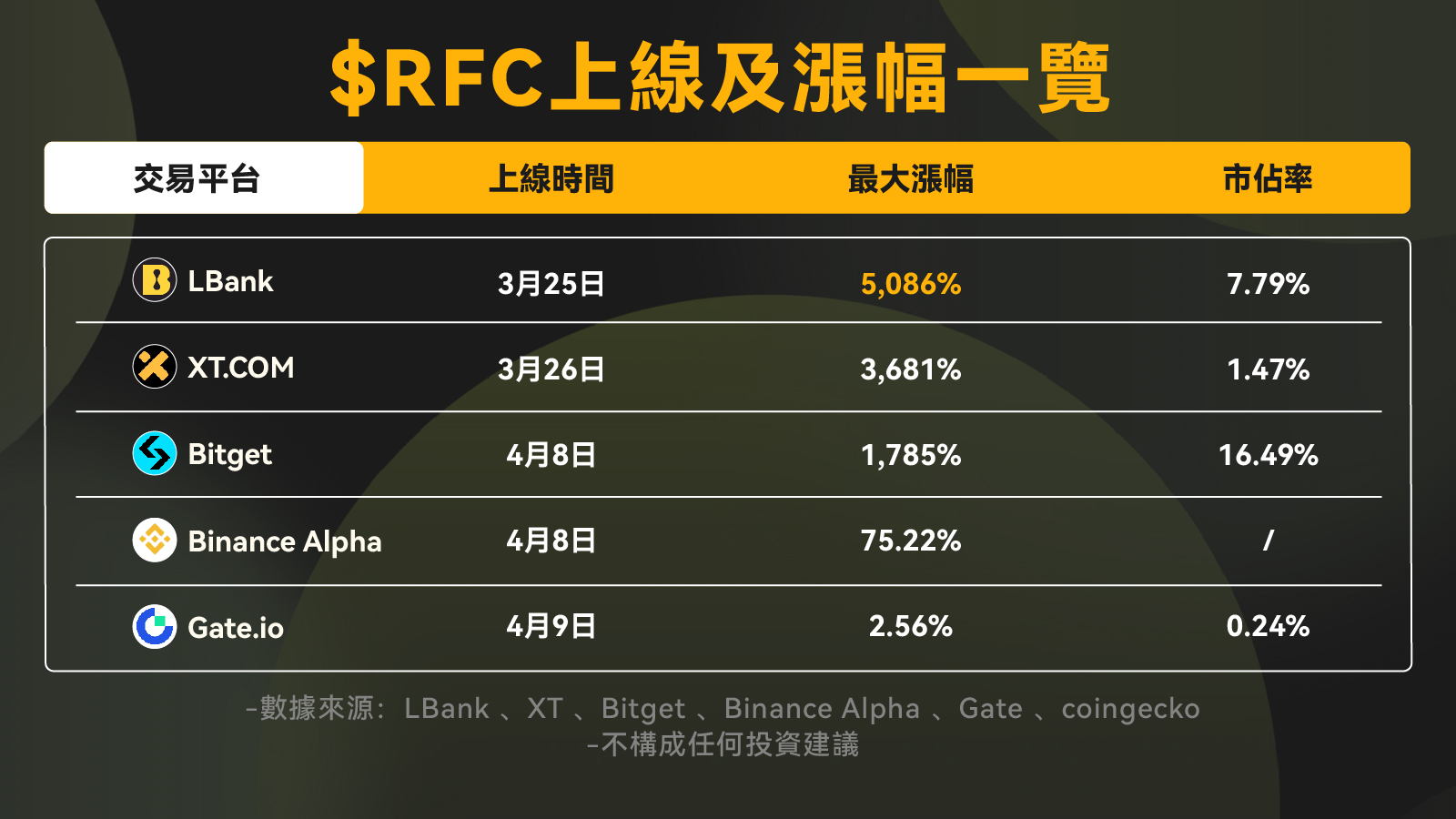

As the "celebrity halo" fades faster, it is particularly important to launch assets before the steepest interval of the sentiment curve. LBank's speed advantage is therefore amplified: when popular meme coins such as RFC and FIGURE first became popular on social media, LBank completed the review and launched them online as soon as possible, helping users grab the first wave of 5,086% and 2,422% pull-up intervals; when spot liquidity began to withdraw, LBank quickly launched perpetual contracts, giving long and short parties a new game field, while providing hedging outlets for early holders. In other words, in the environment of diminishing celebrity effect, the first-step listing rhythm + timely supplement of derivatives allow LBank users to not only eat the "first bite of meat" of emotions, but also have tools to safely pocket or reverse layout when the heat dissipates.

New blood emerges in meme: abstraction and meme play return to the original intention of meme

The total market value of the Meme track is currently hovering around $56 billion, a slight rebound from the low point in March, and is in the "mid-term consolidation" range. CoinGecko data shows that the top Meme assets (DOGE, SHIB) are firmly in the 10 billion market value club, and mid-level newcomers such as RFC and HOUSE are mostly distributed in the $10M-$100M range, still in the "price discovery + community diffusion" stage; a large number of <$10M micro-cap tokens account for more than 70% of the Meme asset pool, with extremely high volatility and elimination rates.

At the same time, we noticed that since April, a group of new coins with more "abstract narratives" and irony are pulling the focus of the topic back from pure hype to the origin of Meme: using humor, ridicule and community co-creation to express complaints about reality. The most representative of them are the three "new bloods" RFC, TROLL and HOUSE.

RFC: RetardFinderCoin originated from the popular account @IfindRetards on the X platform. The account became popular with a sentence satirizing absurd remarks, and was "liked/replied" by Musk many times. According to official statistics, Musk interacted with him 22 times in just one month, and his fans soared to 700,000. On April 6, Musk retweeted "Investigating", which triggered the market value of RFC to rise from 10 million US dollars to 30 million US dollars in two days. LBank, as the first trading platform to launch RFC on the entire network, successfully captured a 5,086% increase. ! At present, RFC is still hovering in the thousandth place with a market value of about 10.7 million US dollars; although it has fallen by more than 60% from the high point, it has not returned to zero. The community still maintains thousands of "report stupid tweets" every day, forming a highly sticky cultural cycle.

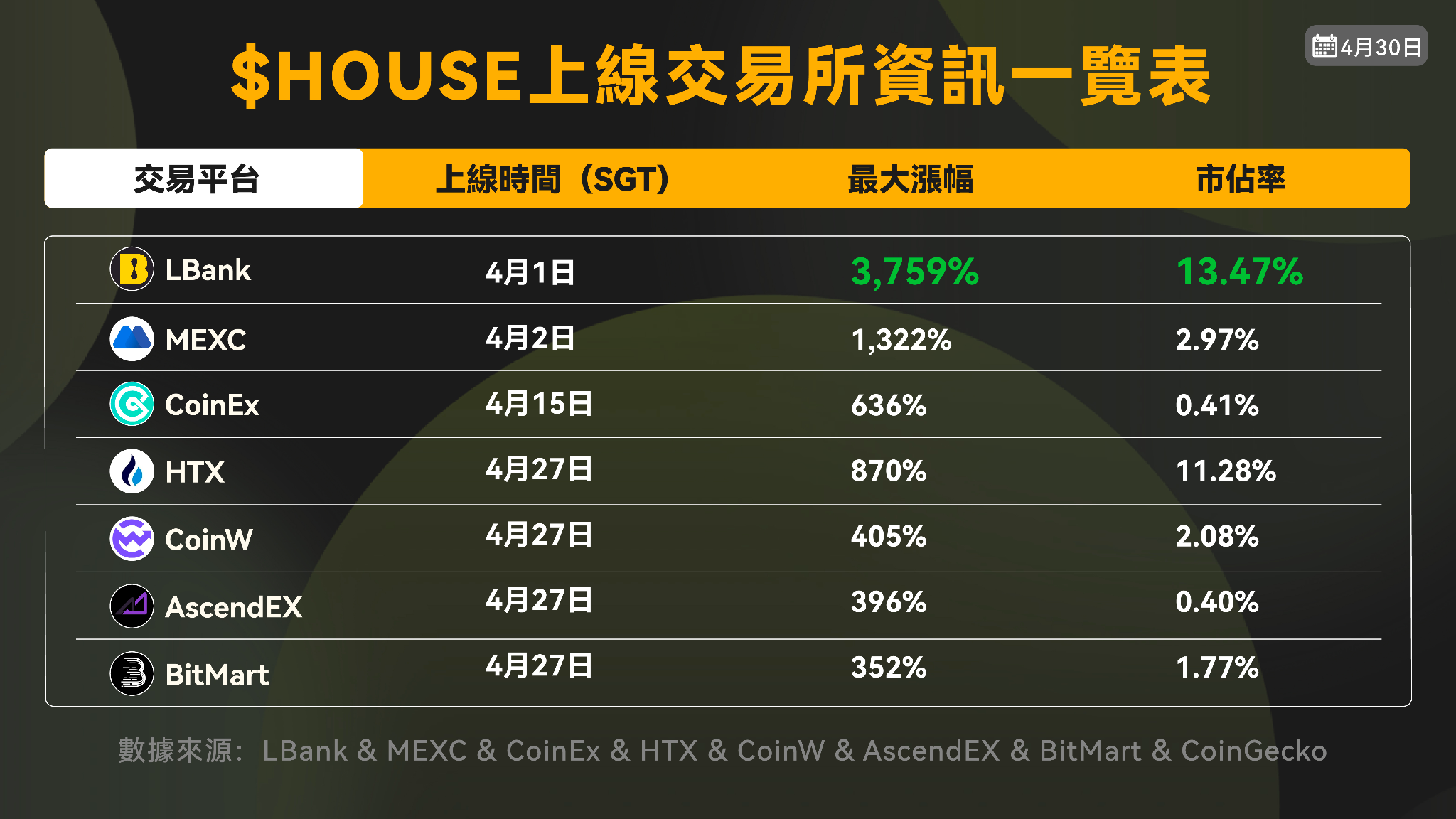

HOUSE: "Since you can't afford a house, why not buy Housecoin" - HOUSE transforms the frustration of young people around the world about high housing prices into absurd jokes. On April 1, LBank launched HOUSE for the first time, with a maximum increase of 3,759% and a market share of 13.47%. Its market value exceeded the $100 million mark for the first time at the end of April; even after a 40% retracement from ATH, it is still trading sideways in the range of about $53 million to $63 million. Compared with traditional "one-day tours", HOUSE has successfully transformed FOMO traffic into a long-term coin holding community by continuously outputting housing price jokes and "building a building on the spot" emoticons. The experiment of "breaking away from the fast pass" is regarded by many analysts as a replicable paradigm in the Meme track.

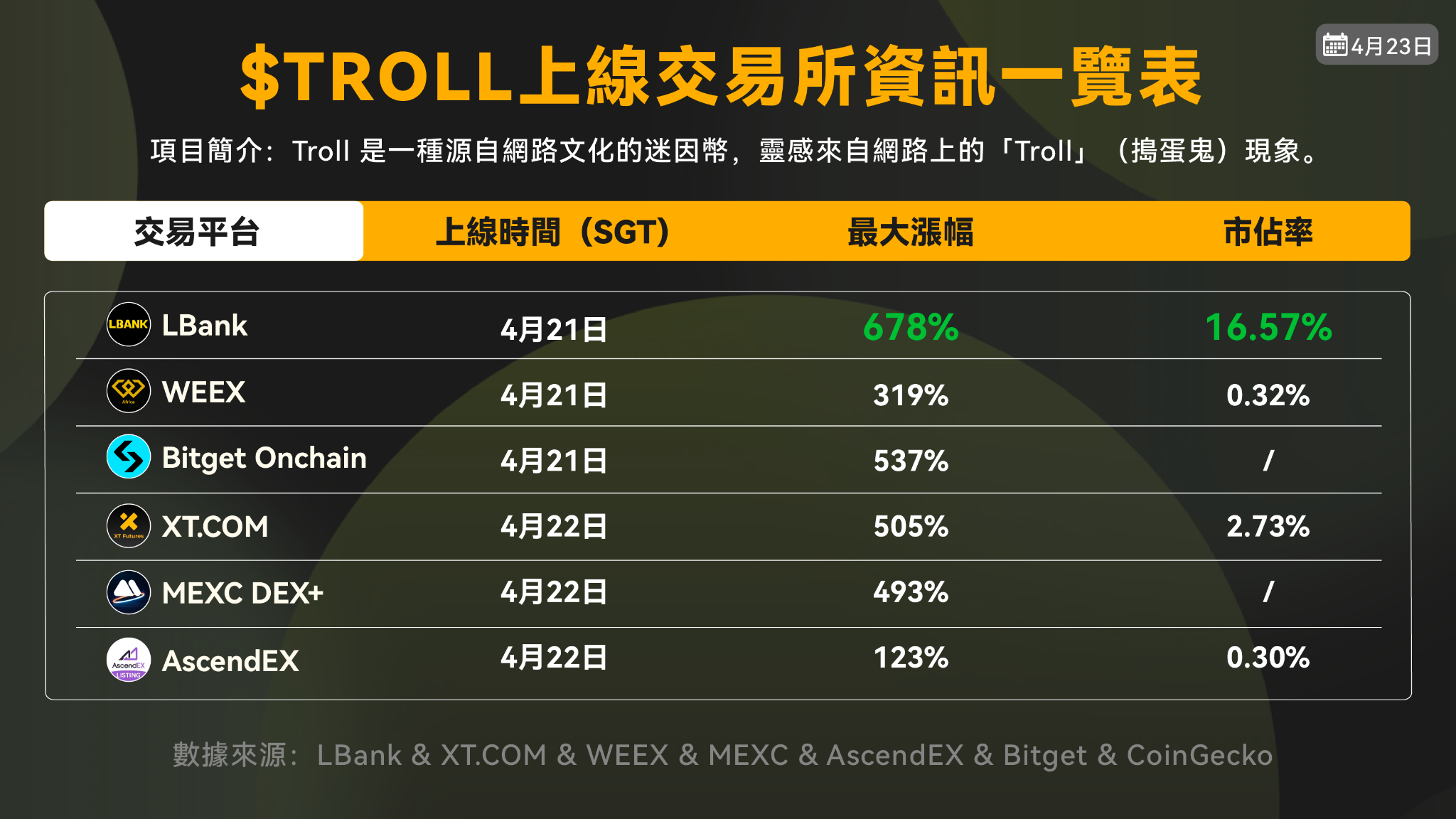

TROLL: TROLL is based on the classic emoticon Trollface created by Carlos Ramirez (nickname Whynne) in 2008, which is a symbol of the anti-authority and spoof spirit of the early Internet. The coin was initially unknown, but suddenly broke out on April 20, with a single-day market value soaring 59,944%, reaching a high of $27.37 million. On April 21, LBank keenly captured the potential of TROLL and went online first, successfully locking in the maximum increase of 678% and a market share of 16.57%. DEXScreener data shows that the current market value of TROLL is still fluctuating around $16 million. The project team cooperated with old painters to launch the "Original Manuscript NFT" and community comic competitions, allowing the classic meme culture to be re-created and amplified in a cycle, significantly extending the half-life of popularity.

RFC, HOUSE, and TROLL each hit the triple irony of contemporary youth towards authority, reality, and Internet history. The rise of these Meme tokens also reminds us that when Meme re-embraces abstract and meme culture and resonates with real community sentiment, rapid birth and death is not an inevitable fate, and it also allows funds to shift from pure profit-seeking to resonance with stories and culture.

Outlook for May: Trend Continuation and Key Focus

In general, in April, under the joint effect of the three engines of "Bitcoin stabilization - social narrative ignition - exchange liquidity competition", the Meme coin market boom continued to ferment, and this trend is expected to continue until May.

At the macro level, the United States and China resumed tariff negotiations, and market risk aversion eased; New Hampshire became the first state in the United States to pass "Strategic Bitcoin Reserve" legislation, which will open a new chapter in the participation of public funds in digital assets.

In terms of technology and narrative, Ethereum is about to usher in the Pectra upgrade, which aims to solve the challenges of scalability, security and user experience within the Ethereum ecosystem; the trend of combining AI and MEME is expected to continue to deepen, and more Memecoins with AI elements may appear; at the same time, the RWA narrative is also beginning to emerge and is expected to become a new market hotspot in May.

In terms of social hot spots, the “TRUMP Dinner” on May 22 will once again test the chemical reaction between politicians and tokenized narratives; and Trump’s Truth Social platform’s plan to issue new coins is more likely to become the next wave of emotional catalysts.

Looking back at April, Meme and AI narratives ignited the market under the resonance of Bitcoin stabilization, celebrity effect and liquidity competition. LBank's "fast listing" rhythm and BNB chain's Alpha accelerator pushed the capital game to a climax. Looking forward to May, macro-favorable conditions, Ethereum upgrades, AI Meme and RWA narratives are still extending. What really determines the return is not only the speed of stepping on the wave, but also the awe of the retracement. Staying curious, persisting in research, and controlling positions may be the most worthwhile strategy to stick to before the next round of market.