Binance survey shows that users have mature security awareness, more than 80% of Asian users have enabled 2FA, and more than 73% review addresses before transferring money

According to a large-scale user survey conducted by Binance, more than 80% of respondents have enabled two-factor authentication (2FA), and 84% of respondents expressed trust in protection mechanisms such as the Binance Investor Protection Fund (SAFU), showing that users' security awareness has significantly improved and their confidence in the protection system led by the exchange has gradually increased.

The survey, titled "Asia Crypto Security Survey," collected 29,847 valid responses from users in Southeast Asia, South Asia, and East Asia, and is one of the most comprehensive regional insights to date. The survey provides insights into how users in the region view and practice security measures, and how exchanges and the industry can further support users through tools, education, and proactive protection mechanisms.

From "awareness" to "action": security habits are changing

Survey data shows that 47.2% of respondents are high-frequency traders who use cryptocurrency exchanges multiple times a day. It is worth noting that nearly 30% of respondents entered the crypto market in the past six months, reflecting the rapid growth of the Asian market.

Despite the rapid expansion of the number of users, the survey also revealed an obvious difference in security behavior: although most users have basic protection awareness, the adoption of advanced protection mechanisms is still relatively insufficient:

● 80.5% of respondents have enabled 2FA, indicating that users have a good understanding of basic security measures.

● Only 17.6% of respondents enable the address whitelist mechanism, and 21.5% of respondents use anti-phishing verification codes.

● In addition, 34.4% of respondents store their private keys on connected devices, with the proportion rising to 42% in Southeast Asia. These behaviors highlight the importance of ongoing education and practical tools in simplifying security protection processes.

● It is gratifying that 73.3% of users will review the payment address before transferring money, showing that users attach great importance to risk management in their daily operations.

Overall, the survey shows that ongoing education is critical to driving user confidence in taking higher levels of security measures.

Users are more proactive and their trust in exchanges is increasing

The survey pointed out that although 40.7% of respondents had encountered crypto-related scams, most of them showed higher resilience:

● More than half of the respondents (53.4%) said that if they encountered fraud, they would immediately contact the exchange to freeze their assets, demonstrating basic preparedness and trust in the platform's ability to respond.

● In addition, 84% of respondents said they trust protection mechanisms such as the Binance Investor Protection Fund (SAFU).

Although common fraud methods such as phishing links (69.5%), false insider information (54.9%) and fake airdrops (52%) are still appearing, the survey results show that more and more users are able to identify potential risk signals, are more rational and proactive, and are willing to use the security mechanisms provided by the platform.

From passive to active: Users have higher expectations for exchange security

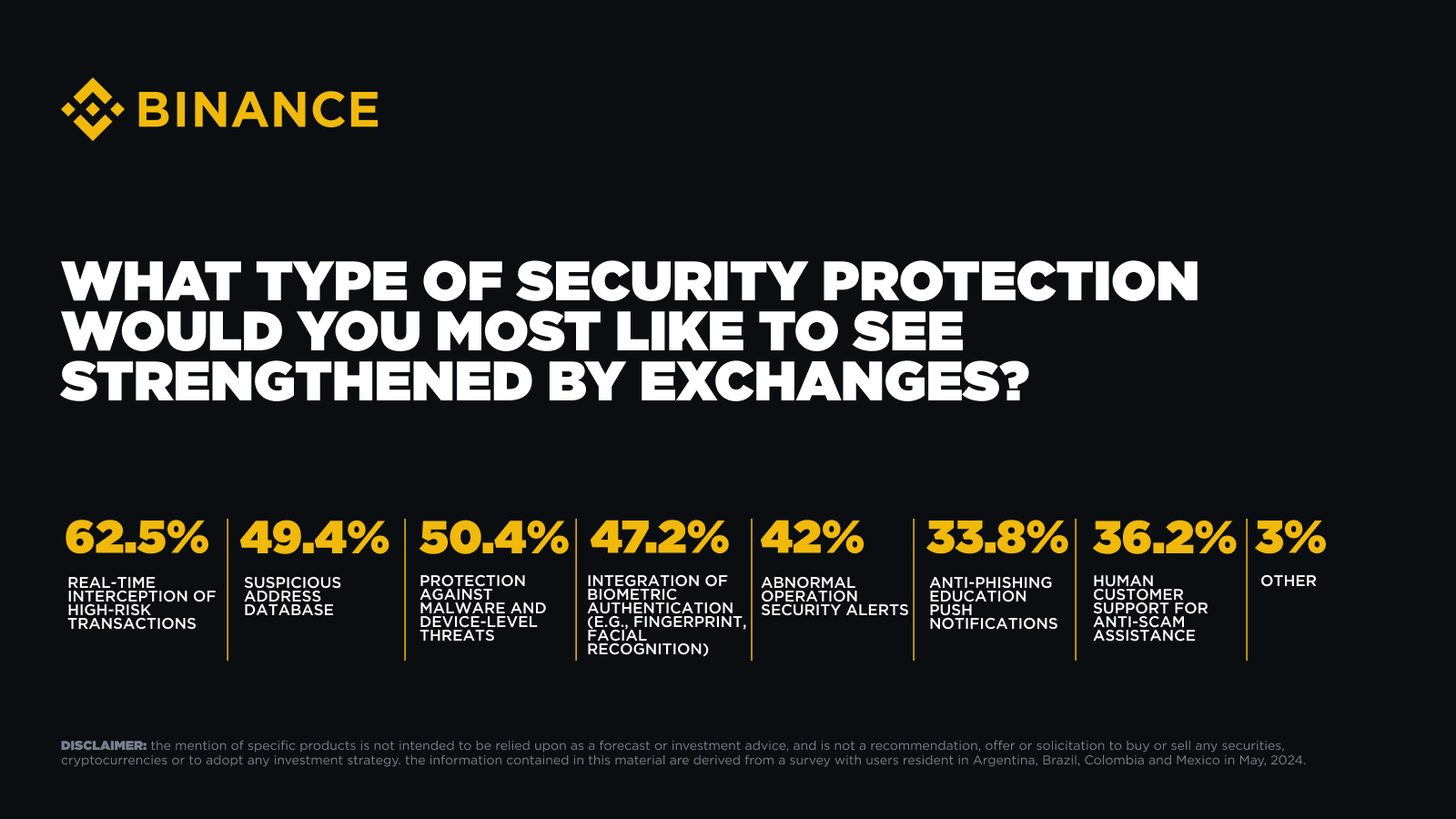

The survey results show that users' expectations have clearly shifted from passive protection to real-time, intelligent threat management. Users increasingly expect exchanges to proactively identify, prevent and mitigate potential threats and respond in a timely manner before losses occur.

● 62.5% of respondents listed “real-time threat interception” as their top security need, indicating a strong demand for automated defense and early warning systems.

● 50.4% of respondents hope that exchanges will have device-level threat detection capabilities, such as identifying malware and prompting that the device has been hacked.

● Nearly half of the respondents support the establishment of a suspicious address database and the introduction of biometric authentication to strengthen identity protection.

This trend reflects a shift in user mentality: exchanges are no longer just platforms for trading assets, and users expect industry leaders like Binance to set new standards, especially in building smart and intuitive security systems.

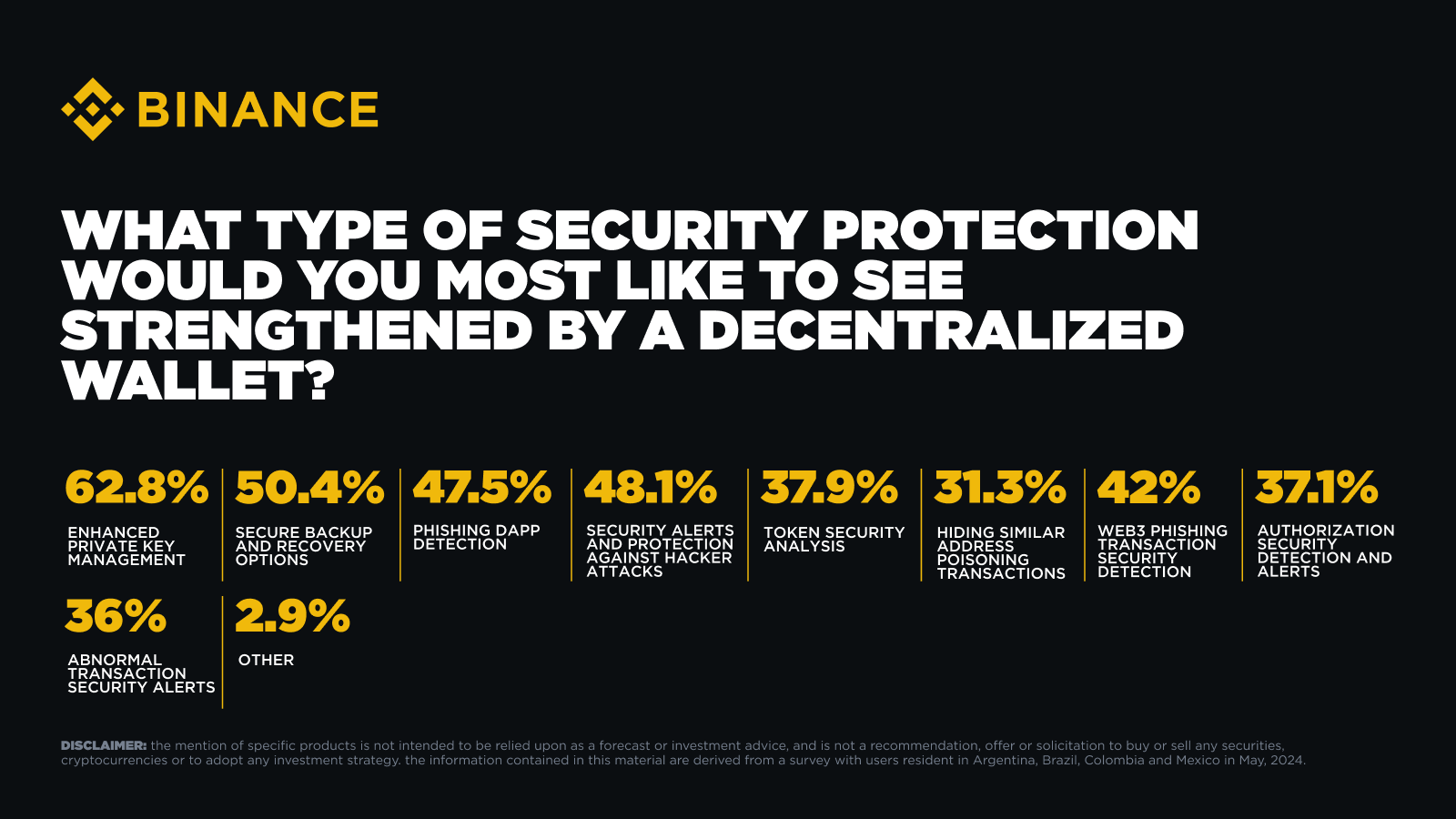

Users attach the most importance to private key protection. Binance uses MPC technology to enhance wallet security

In terms of decentralized wallets, users value the features of stronger control and intelligent threat detection the most. The survey shows that wallets are not only a tool for storing assets, but also a key line of defense to ensure asset security:

● 62.8% of respondents ranked enhanced private key protection as their most desired wallet feature - highlighting the strong demand among users for intuitive and secure self-custody tools.

● 50.4% of respondents hope that wallets provide more complete backup and recovery options to enhance their sense of security and control over their assets.

● More than 40% of respondents support the integration of proactive fraud detection tools, such as phishing alerts, suspicious transaction monitoring, and hacker protection features.

Binance meets these user needs through the Binance Wallet , which plays an important role in the field of decentralization. It uses MPC (multi-party computation) technology to eliminate the need for mnemonics and splits the private key into three encryption keys for separate management to enhance security.

Simple, localized education is key to closing the safety gap

Education remains the cornerstone of user security protection. The survey shows that users want more practical and accessible learning resources:

● 55.8% of respondents believe that existing textbooks are “too technical and difficult to understand”

● 39.7% prefer to see localized real-world case studies to improve their actual cognitive abilities

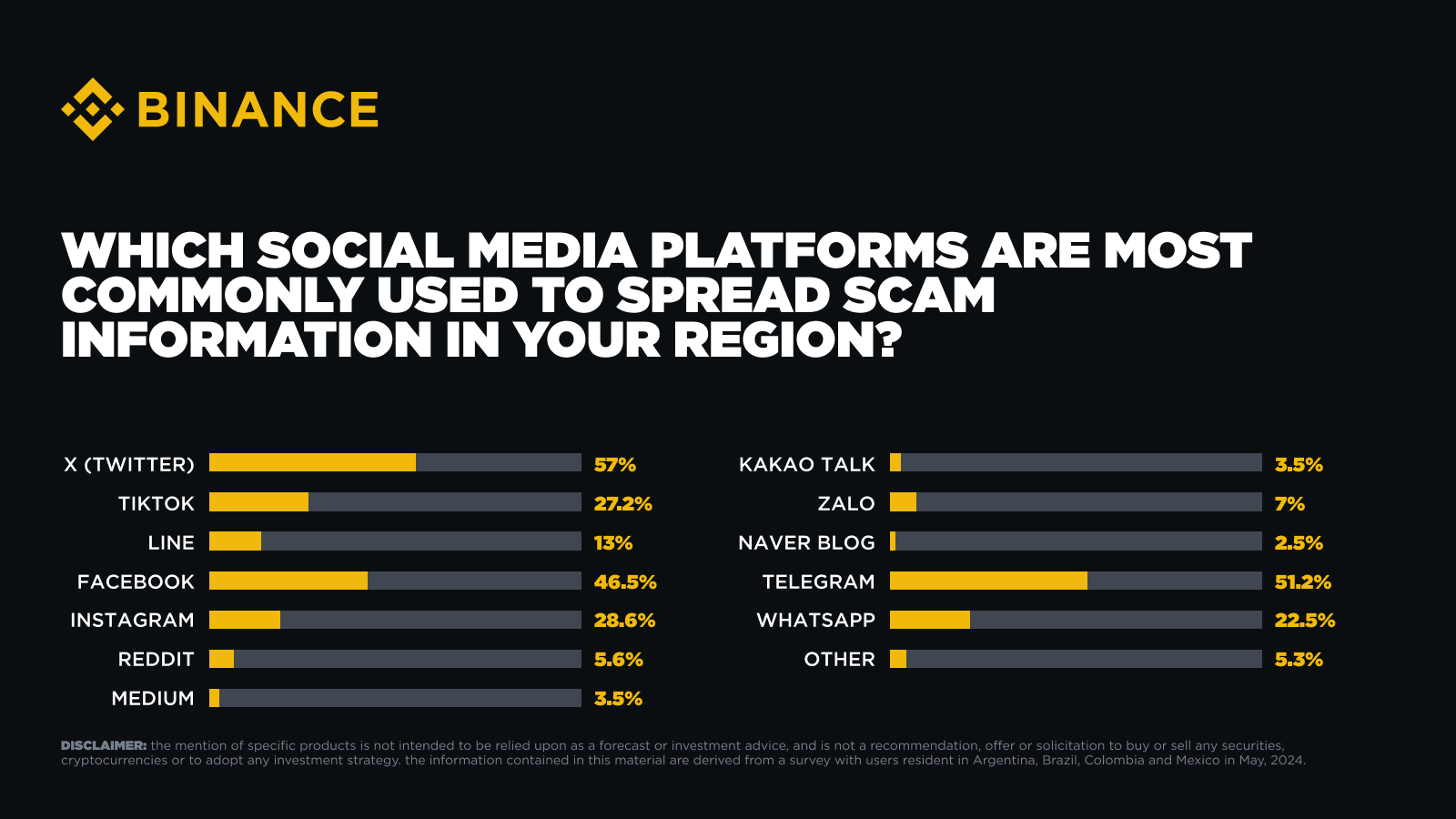

In order to promote anti-fraud education, it is also very important to effectively understand the channels through which users are most exposed to misleading or fraudulent information. In the Asia-Pacific region, common fraudulent information is concentrated on X (formerly Twitter, accounting for 57%) and Telegram (51.2%). However, there are slight differences in channels in different markets - the most important platform in Southeast Asia is Facebook (61.1%), while in India, WhatsApp is the key channel (42.5%).

61.3% of respondents expressed their willingness to participate in "anti-fraud simulation tests" led by exchanges to improve security awareness, especially when these tests are combined with rewards or game mechanisms, showing that users are not only willing to learn, but also eager to learn.

The Binance Security team regularly publishes easy-to-understand articles that break down complex topics such as smishing and phishing , helping users fill in the knowledge gap while retaining all the key details. Welcome to check out Binance's security column series to start an insightful learning journey and help you identify potential risks!

Binance: Comprehensively Strengthen Security Protection

According to Chainalysis' 2025 Crypto Crime Report , wallet addresses used for illegal activities received a total of approximately $40.9 billion in crypto assets in 2024. Although this figure may rise further as more illegal addresses are identified, the proportion of illegal transactions in overall on-chain activity has dropped significantly, from 0.61% in 2023 to 0.14%, indicating that the proactive security measures generally adopted by the industry are working.

Binance continues to lead in security and has increased its investment in platform security and compliance, investing hundreds of millions of dollars in strengthening platform protection and building industry resilience.

Jimmy Su, Binance’s chief security officer, said: “In 2024 alone, we successfully prevented more than $4.2 billion in potential user losses, assisted in the recovery of $88 million in stolen or lost assets, and protected more than 2.8 million users from malicious attacks.”

“As the industry continues to evolve, the methods of attackers are also evolving. We are investing heavily in localized, practical and easy-to-understand anti-fraud education to meet user needs; at the same time, we are accelerating the deployment of real-time risk detection systems and working closely with regulators and law enforcement agencies across Asia to better protect user assets.”