Taking stock of the Arbitrum Long-Term Incentive Pilot Program (LTIPP) project, what are the returns?

Original author: Stephen , founder of DeFi Dojo

Original translation: Felix, PANews

The Arbitrum Foundation previously launched the Long-Term Incentive Pilot Program (LTIPP), which aims to drive greater network participation by enabling the ArbitrumDAO to direct protocol funds as liquidity incentives to collaborative projects based on Arbitrum. Granted LTIPP grants will be redistributed to the Arbitrum community through the recipient's protocol as liquidity incentives. This incentivizes Arbitrum users to try emerging use cases while generating greater network activity.

The total amount of grants for the program is about 30 million US dollars, and most projects will be funded until September. Stephen, founder of DeFi Dojo, took stock of the revenue of each project.

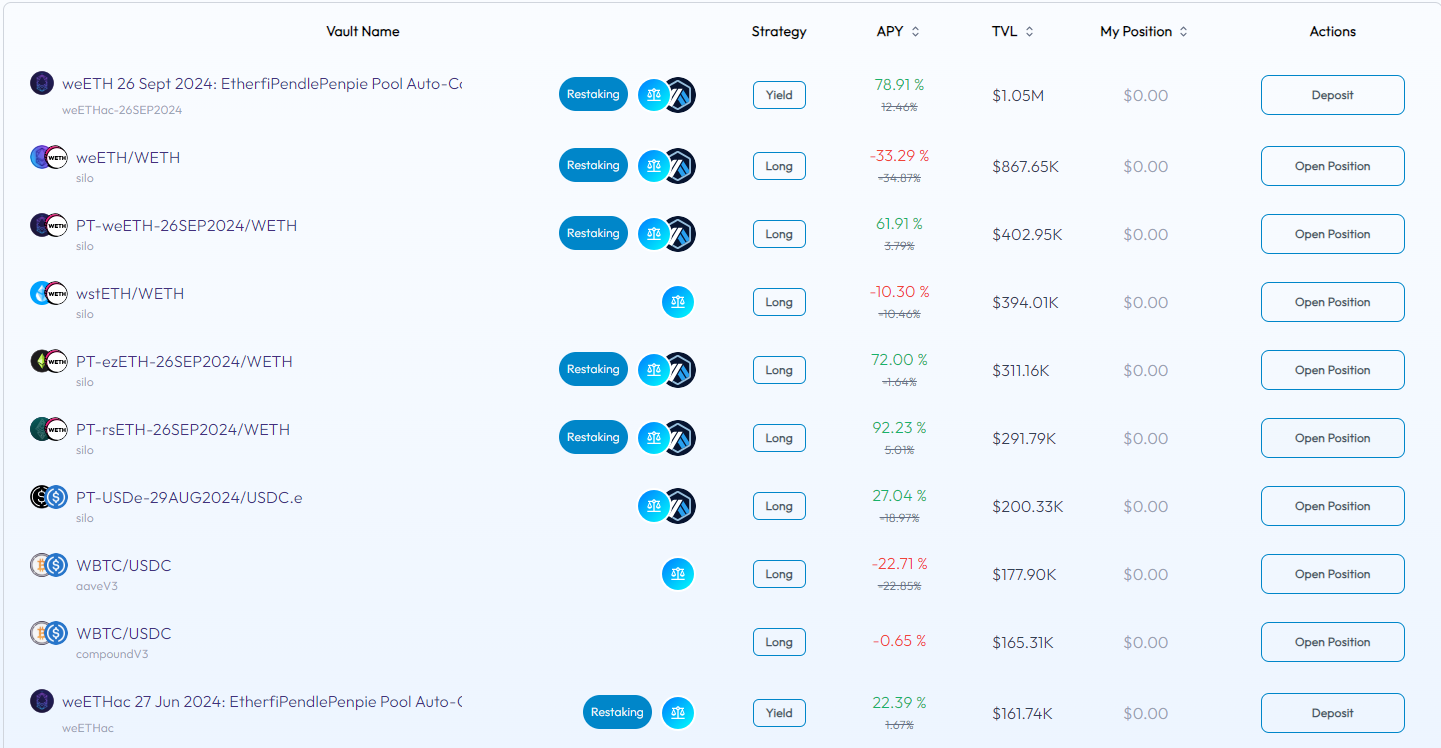

Factor

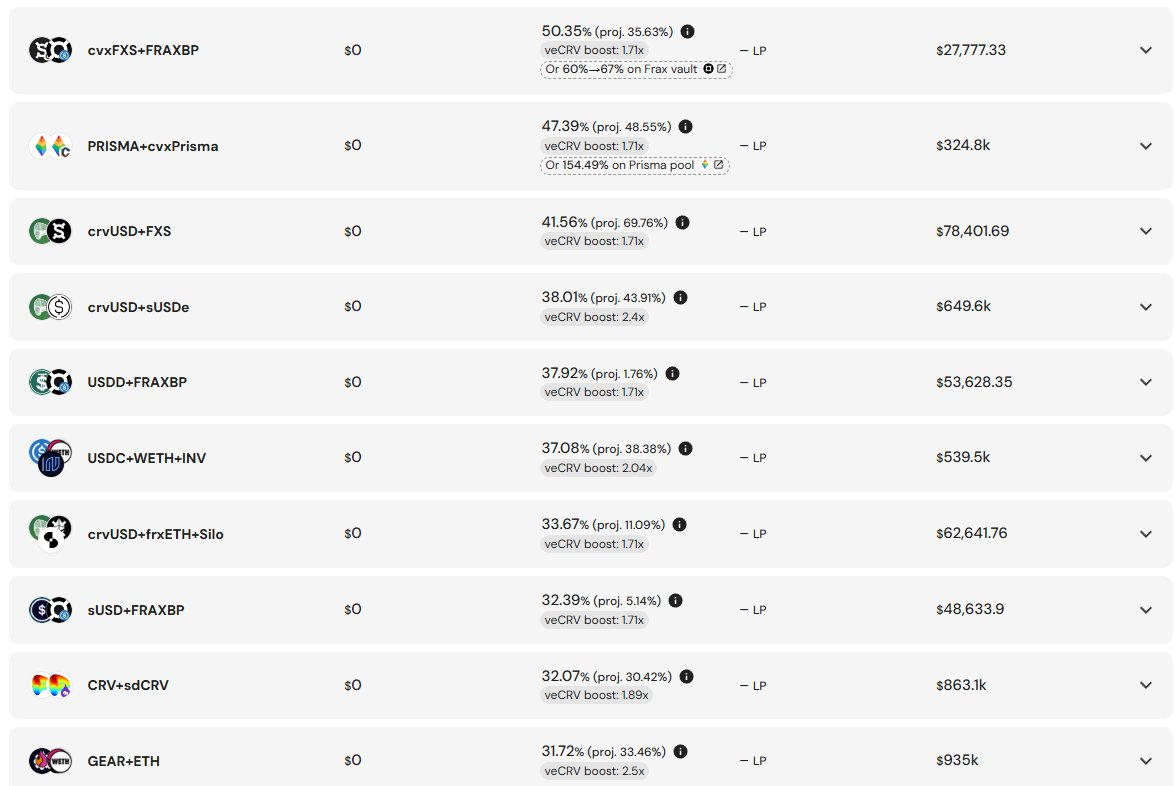

Most of the incentivized strategies are either LRT Silo Labs leveraged strategies or LRTPenpie LP strategies.

Yields range from 22% to 93%, but Factor’s TVL is relatively low, so be aware of dilution and security risks.

Return: 22% -93%

TVL in Vault: <$2 million

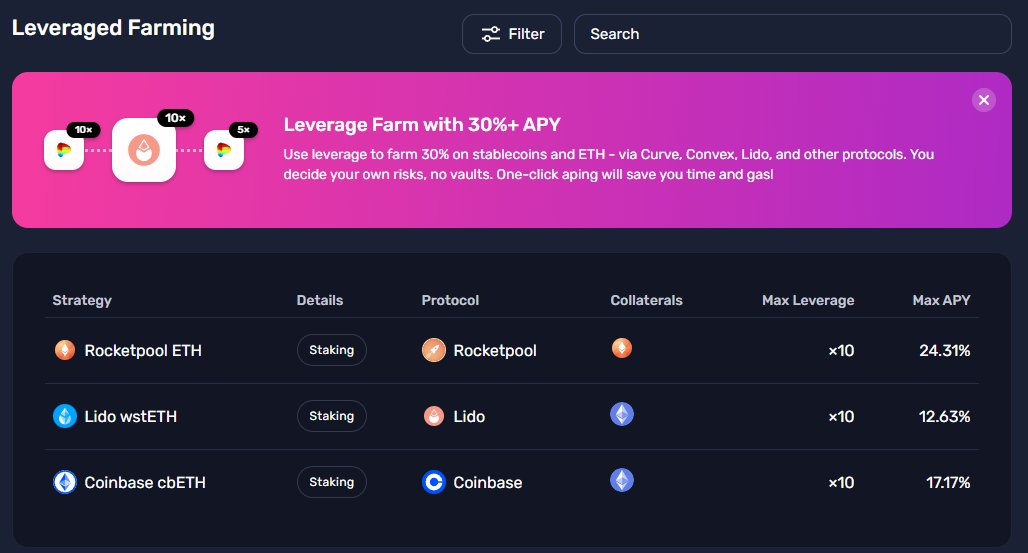

Gearbox

Gearbox launched the lending campaign first, but will soon launch incentivized trading and incentivized Renzo leverage. In their new STIMMIES campaign, you can not only get ARB rewards, but also GEAR rewards. Current lending yields:

USDC: 15%

ETH: 14%

It is worth looking forward to the subsidy for ezETH leverage, but you will have to wait a week to see the full details. You can also leverage LSTs such as rETH, wstETH and cbETH to benefit from the low borrowing rates subsidized by LTIPP.

Trading on PURE will also feature STIMMIES.

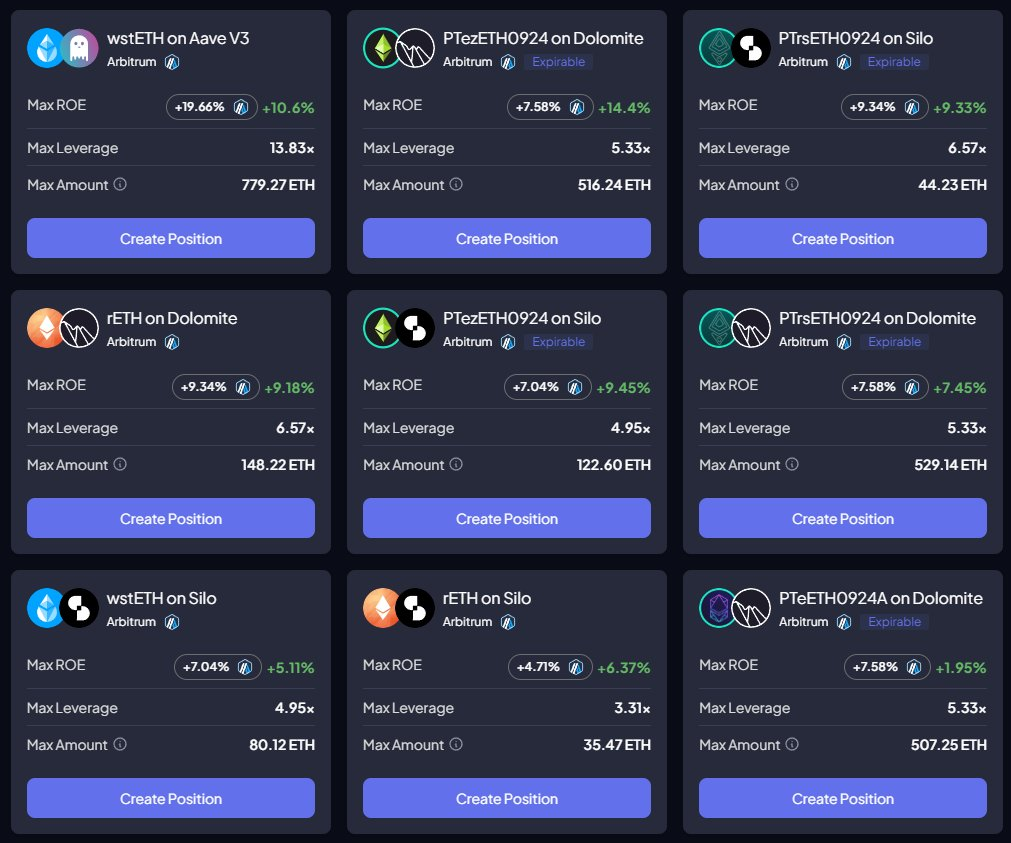

Contango

DeFi protocol Contango has a lot of ARB flowing into leveraged ETH positions. In contrast, these can handle large amounts of ETH. Yields range from 20-30%, and some strategies can in principle handle more than $2 million.

Using Contango will also generate some points, which will be used for the TGE airdrop in about a month.

Related reading: 9 hot events and airdrop opportunities you need to pay attention to this week

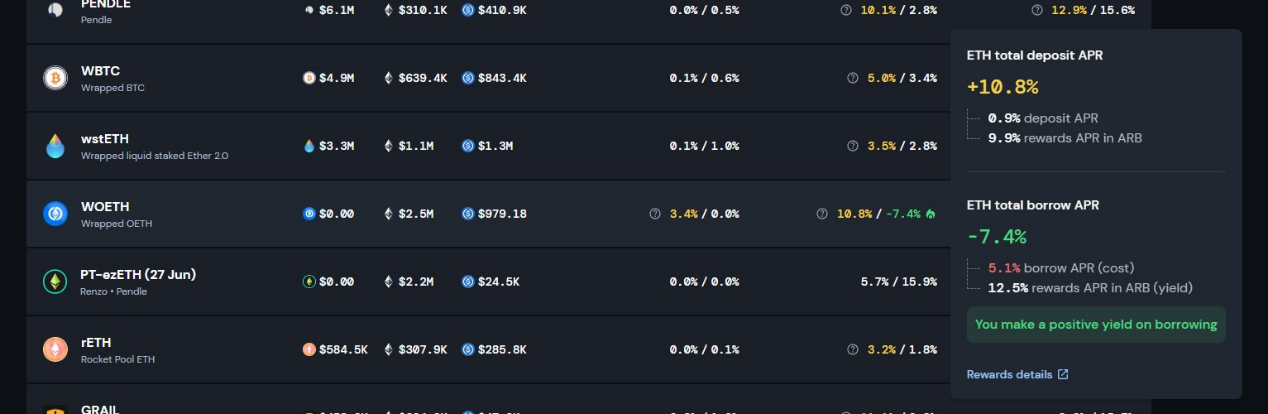

Silo Labs

While both Factor and Contango aggregate Silo opportunities, there are other opportunities that should be noted.

WOETH collateral currently has a lending rate of -7.4% on ETH.

This means that you can get paid to borrow ETH.

At maximum leverage, this equates to an annual interest rate of 63%, although almost all is paid in ARB.

Please note that you can continue to increase your collateral by selling ARB to get more WOETH.

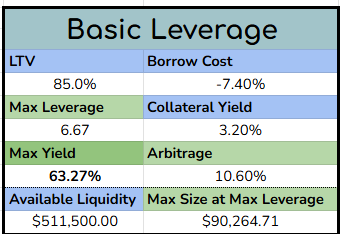

Merkl

Merkl has a lot of LTIPP incentives because big projects like Lido, PancakeSwap, and Camelot use Merkl as an incentive layer for LTIPP activity.

However, having so many options can be overwhelming.

The author tends to like stablecoin pairs and ETH pairs (and occasionally ETH/BTC if yields > 30%).

ETH yield

WETH/ETHx: 45%

wstETH/ETHx: 37%

ezETH/WETH: 21%

uniETH/ETH: 46%

Stablecoin yields:

fUSDC/USDC: 52%

USDe/USDT: 43%

grai / usdc: 40%

USDC / USDC: 25%

Note: These are average APRs; many of these have lower liquidity, so be extra careful about dilution.

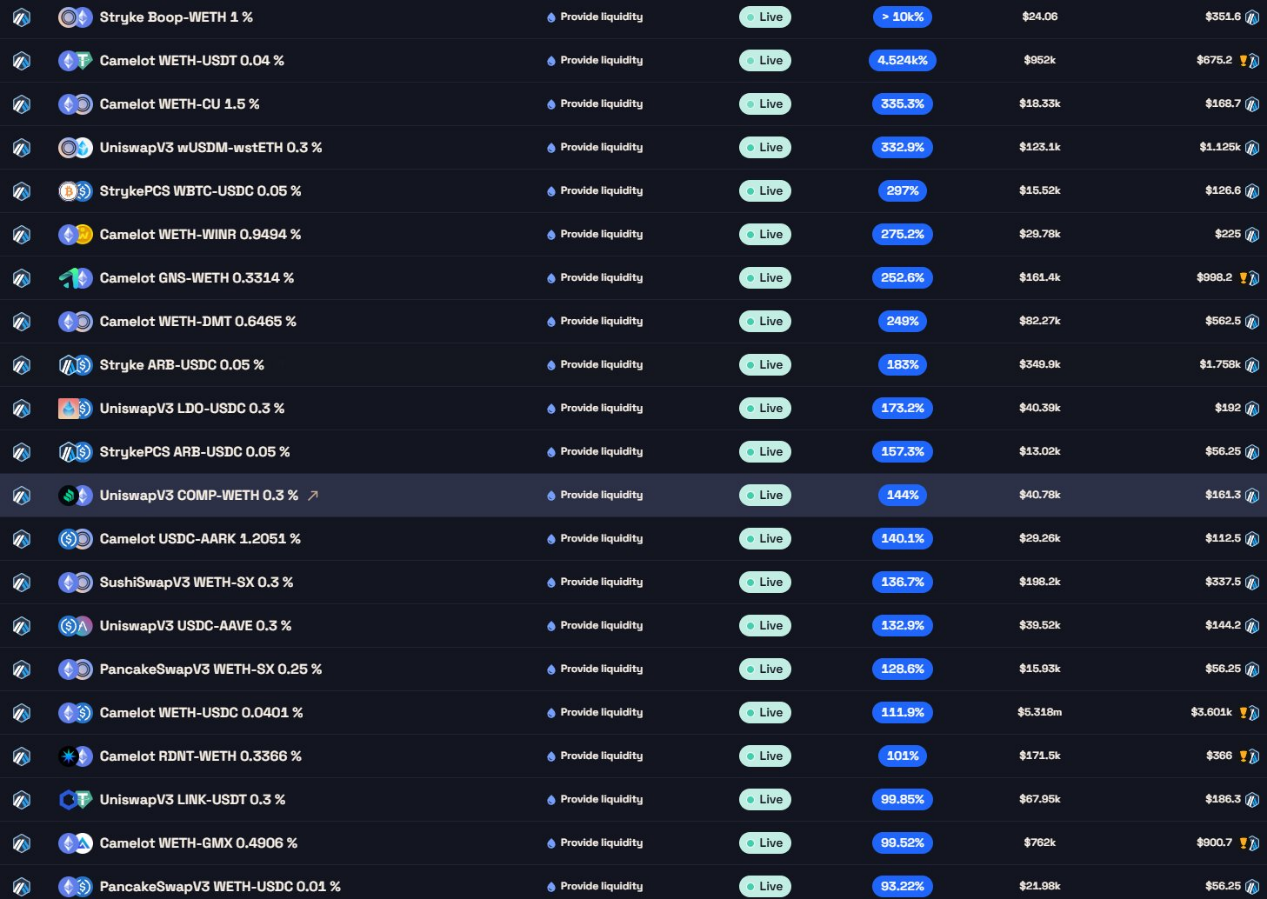

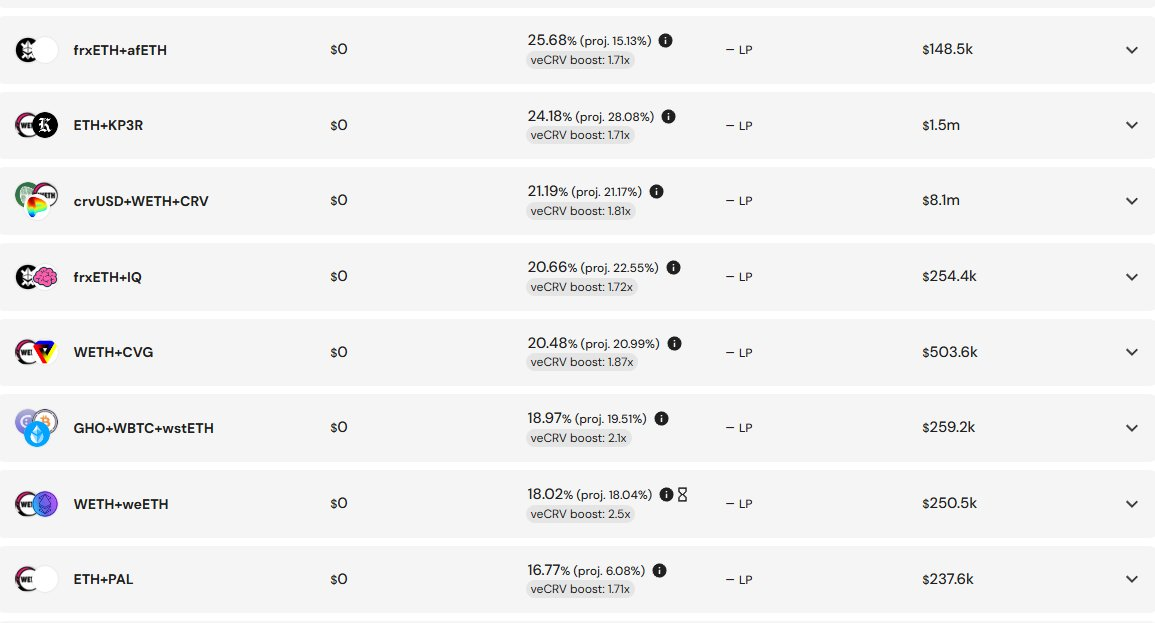

Curve and Convex

Curve and Convex use ARB rewards to subsidize some interesting pools. Similarly, the author likes ETH, BTC or stablecoin pools.

Stablecoin pool:

crvUSD/sUSDe: 41%

usdd/fraxbp: 38%

sUSD/FRAXBP: 32%

ETH and BTC pools:

2B TC-nq: 27%

WETH/weETH: 18%

frxETh/afETH: 26%

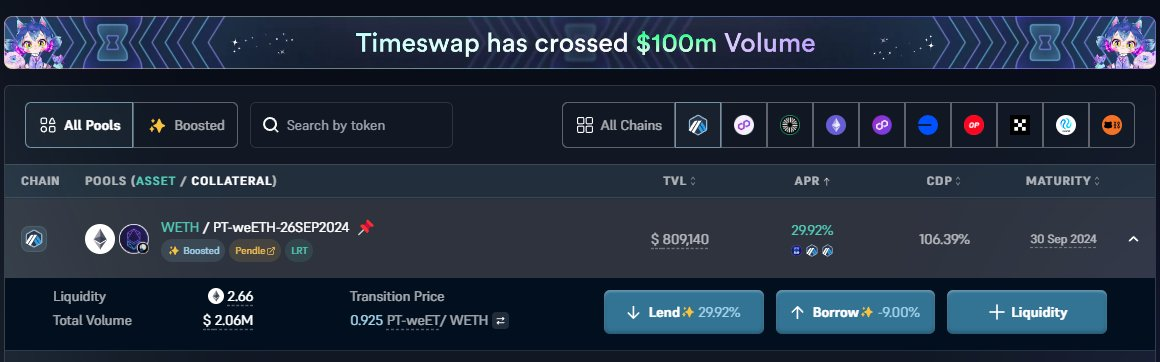

Timeswap

The lending protocol Timeswap has an interesting Pendle market where you can earn ARB rewards through lending.

Here, you can earn 30% by lending PT-weETH, and 9% by borrowing WETH with collateral.

Note: Since this is an emerging market, there is interest rate liquidity available for lending.

Related reading: Detailed explanation of Timeswap: stripping away the time value of tokens and creating a new paradigm for lending protocols

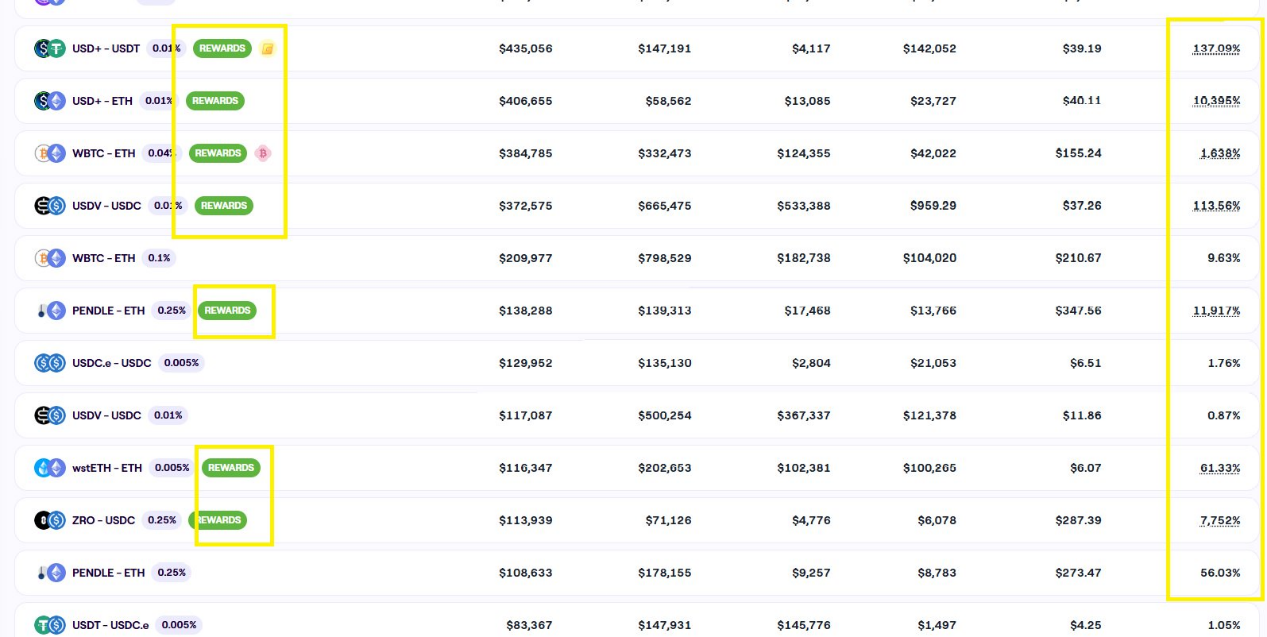

Trader Joe

Trader Joe’s also has some interesting farms running LTIPP right now.

There are some crazy APRs here, but it’s important to note that the APRs advertised on Trader Joe’s assume single Bin (Tick) liquidity.

This means that any reasonable liquidity will receive a lower APR. You can quickly calculate the average APR of the pool. For example (WBTC/ETH):

Claimed APR: 2065%

TVL: $331K

24-hour volume: $441,000

Fees: 0.04%

Reward: 214 ARB/day ($173)

therefore:

Average Fee APR: 19.45%

ARB Incentive Average APR: 19.08%

Total average APR: 38.53%

A big difference from the advertised single tick APR.

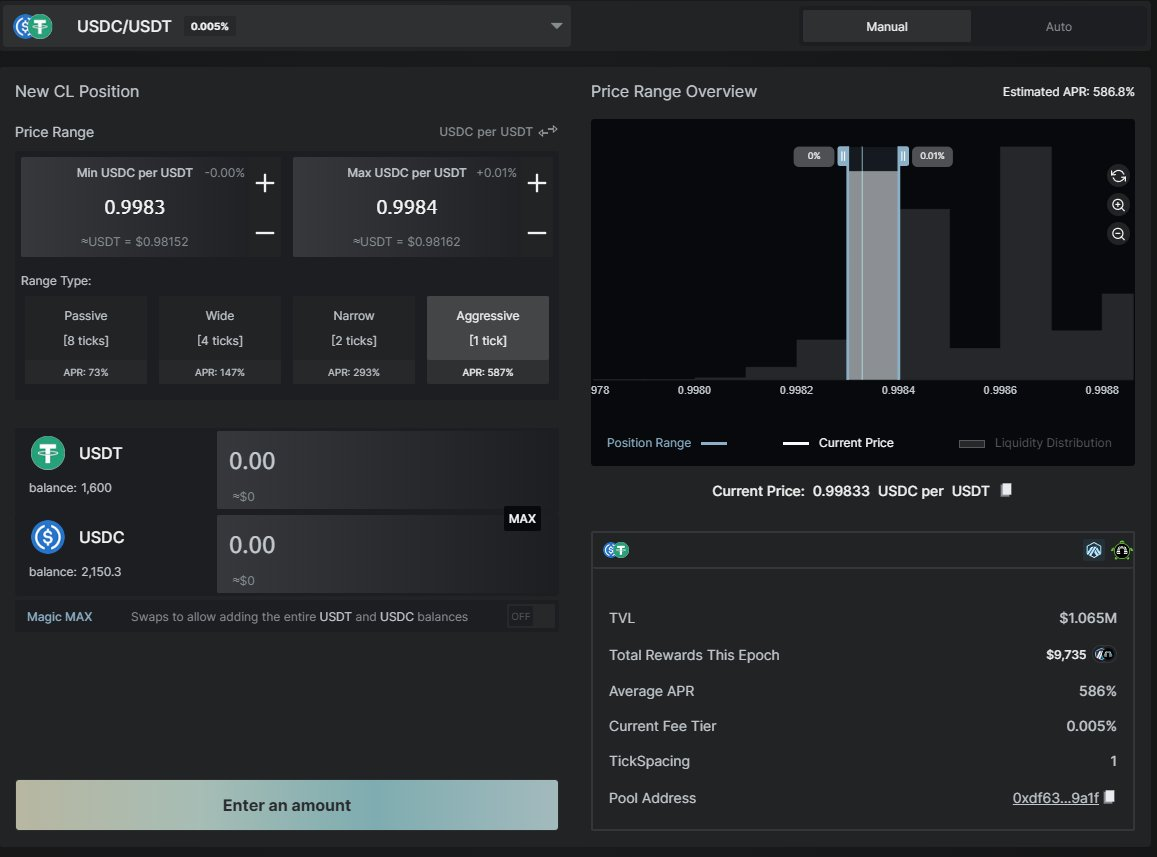

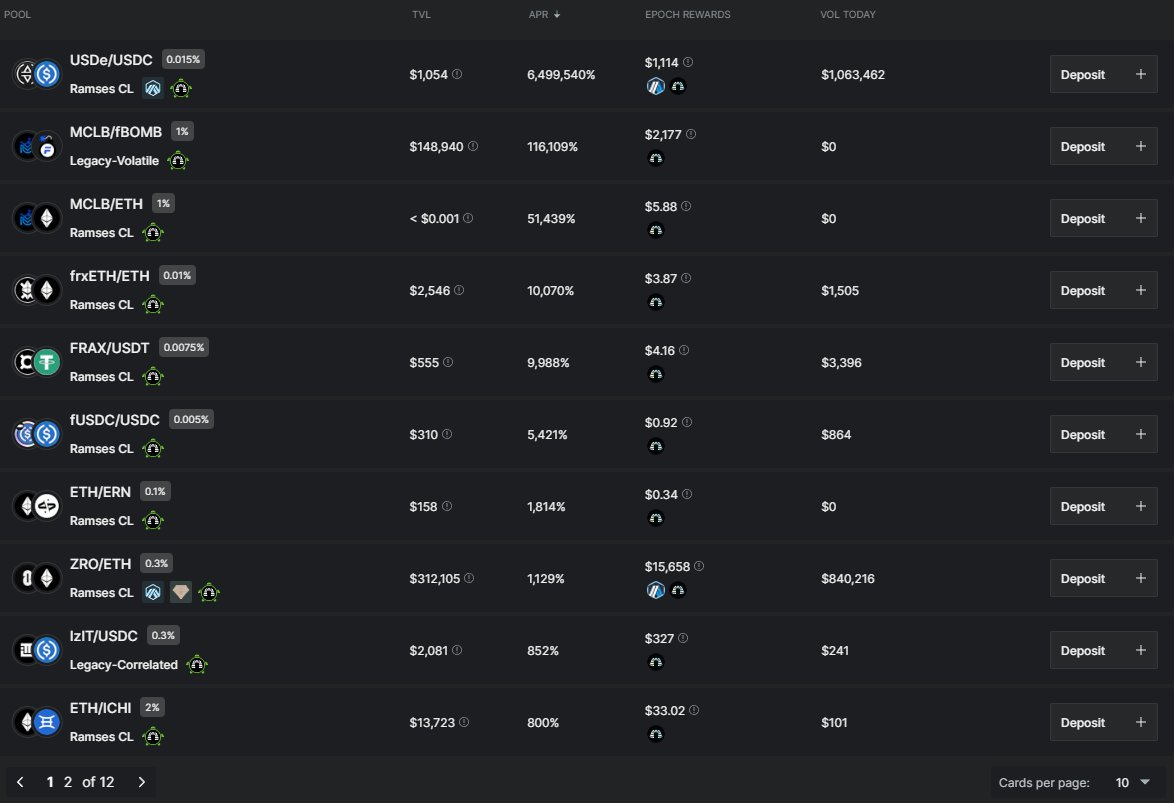

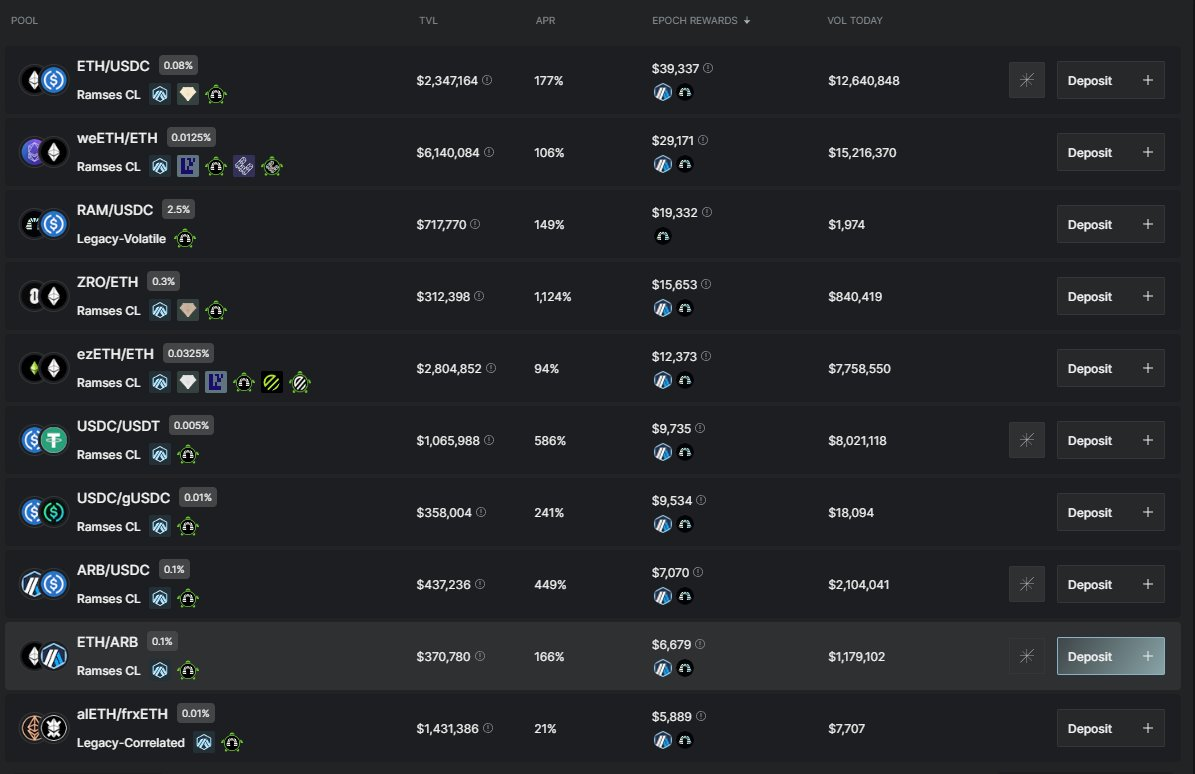

RAMSES

Ramses, much like Trader Joes, like to advertise APRs for single-tick liquidity.

These are very unrealistic for ordinary miners, but at least we can know where the incentives are going.

The author likes to click on the “EPOCH REWARDS” sort to see where all the ARB incentives are.

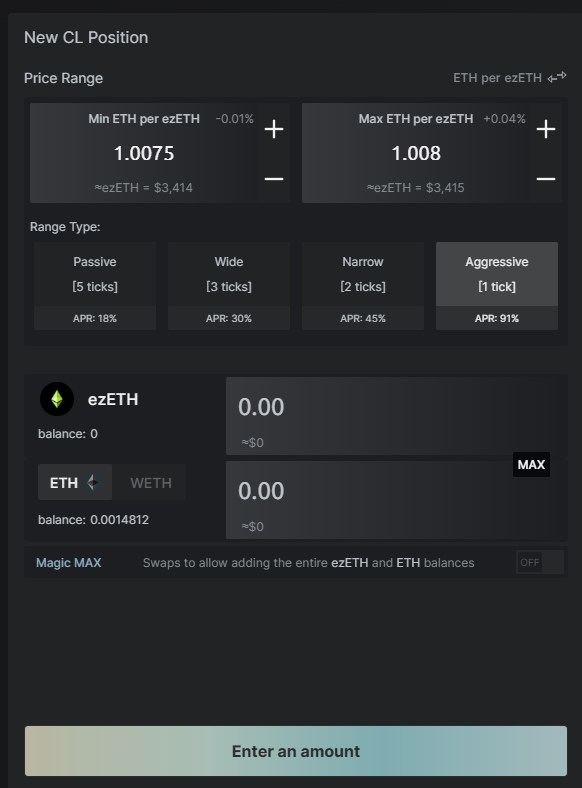

Then if you look at a token pair like Renzo’s ezETH/ETH, you can get a better idea of what a realistic reasonable rate of return is.

With 5 ticks of liquidity, you can get an APR of 18% (as shown below).

For stablecoin miners, what may attract them is USDC/USDT, for which miners can set 8 ticks as a range and obtain 73% APR.