With the ETH ETF boom, here are some DeFi 1.0 projects worth watching

Original author: Crypto, Distilled

Original translation: TechFlow

Recent news about $ETH ETFs has sparked huge attention on $ETH beta. However, where are the best opportunities in the context of high-demand, high-volume tokens?

This may be the point, as DeFi 1.0, despite being rich with truly valuable projects, is overshadowed by risky speculative projects and popular but substance-less memes.

Here are the key takeaways:

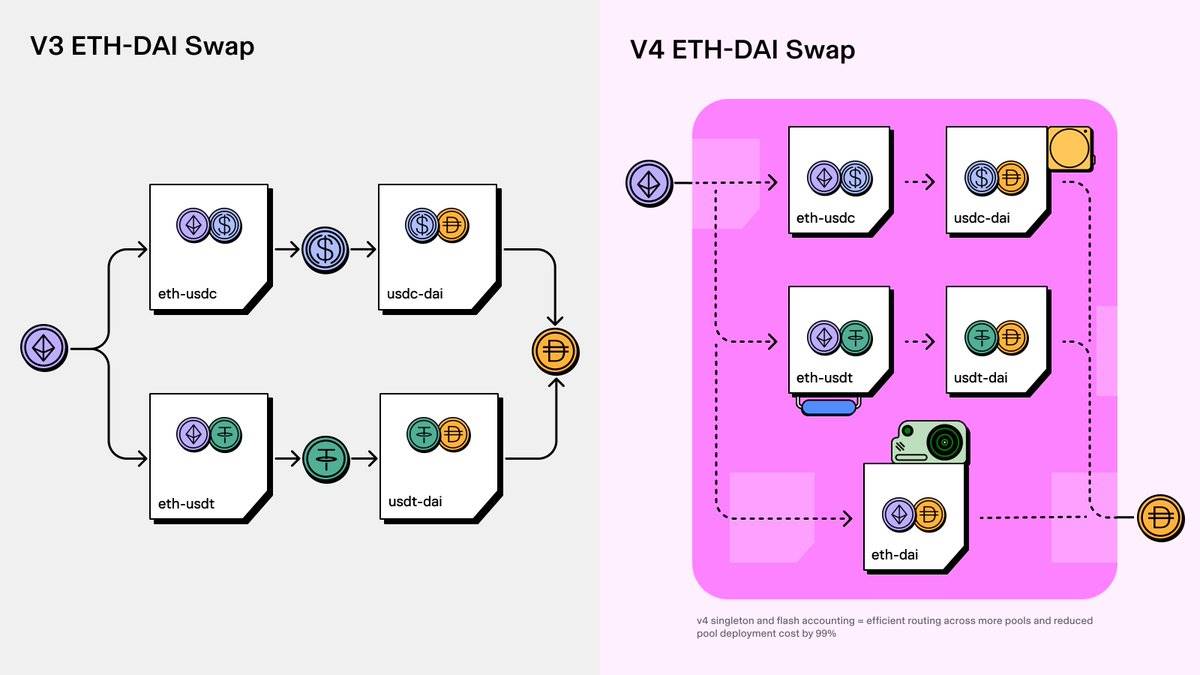

1. $UNI DEX

L2 transaction volume surged 650% in two years.

Uniswap V4 is scheduled to be launched in Q3.

The DAO proposed activating a $3.3 B “fee switch” in February.

Received notice from Wells in April

$UNI responded by claiming that 65% of its volume consists of explicitly non-securities.

2. $AAVE - Money Market

The third largest DeFi protocol with a TVL of over $10 B.

Approval to deploy Aave V3 on Solana was obtained in the first quarter.

Aave V4, a unified cross-chain liquidity solution, was released on May 1; prototyping began in Q4.

Aave’s TVL has almost doubled year-to-date.

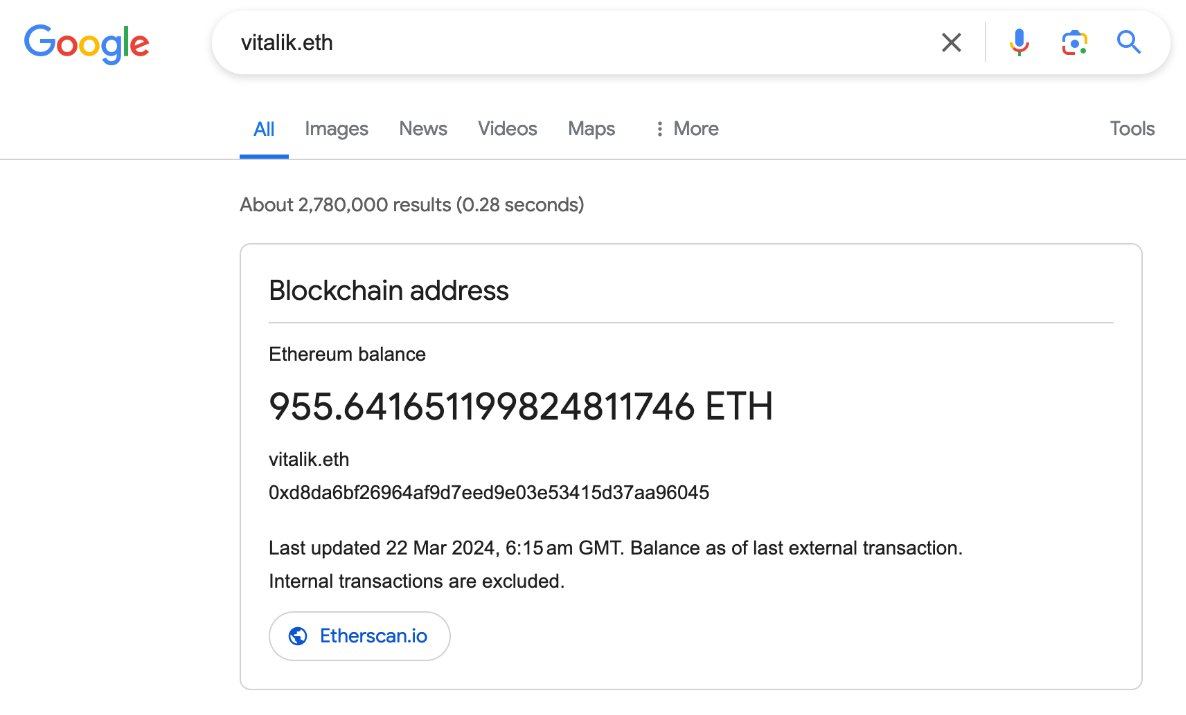

3. $ENS – Domain Name Service

In February, ENS partnered with GoDaddy to simplify linking wallets to web pages.

In March, Google integrated wallet balances with $ETH Name Service (ENS) domains.

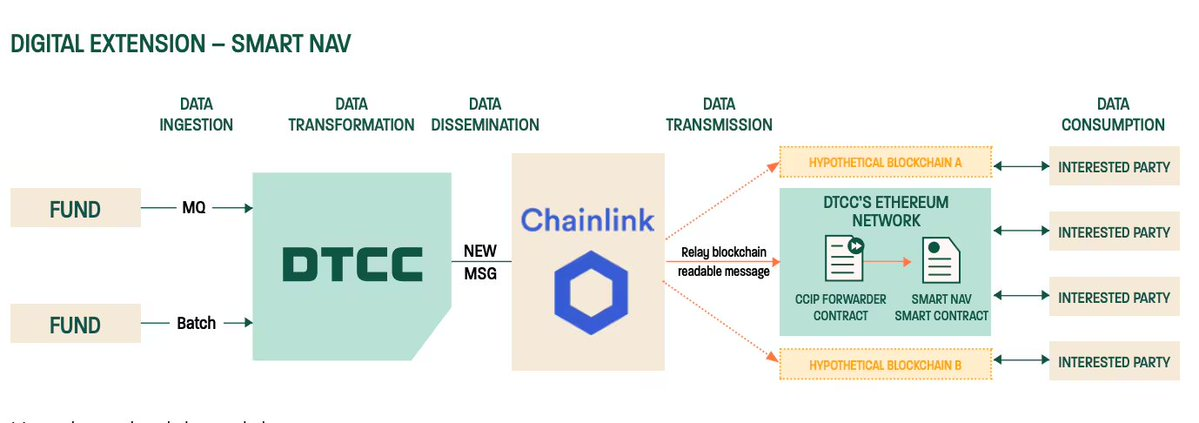

4. $LINK Oracle

In April, $LINK launched the cross-chain bridge application "Transporter" to improve the security of token transfer

In May, DTCC $LINK completed a pilot to accelerate fund tokenization across multiple blockchains

Participants include Franklin Templeton, Invesco, JPMorgan Chase, State Street and others.

5. $MKR - The DAO behind $DAI

May: $MKR unveils their “end game” strategy.

Two new stablecoins were launched: NewStable and PureDAI to surpass $DAI .

NewStable focuses on practicality and scalability, and is supported by RWA.

PureDAI aims to be decentralized and is backed by assets such as ETH

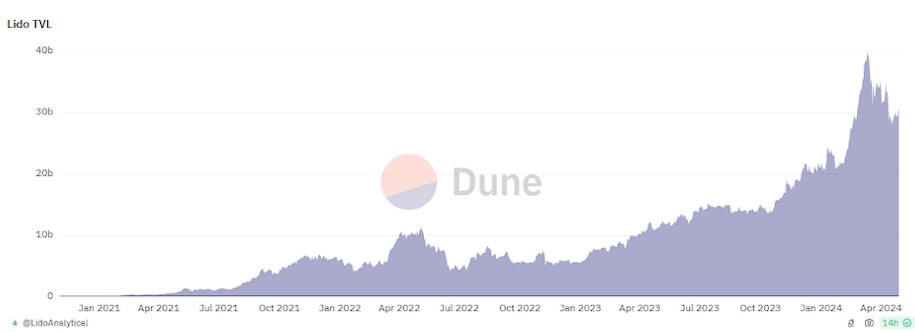

6. $LDO dominates liquidity staking

In February, $LDO TVL exceeded $30B.

By April, $LDO reached 1M+ validators.

As the leading liquidity staking protocol, $LDO manages 25%+ of all staked ETH.

Tailwind: $ETH staking is growing 20 times faster than $ETH issuance.

Final Thoughts

As the backbone of the $ETH ecosystem, DeFi 1.0 may be ready to re-price.

The market landscape is dynamic; please exercise caution and caution as ETFs evolve.

As always, not financial advice