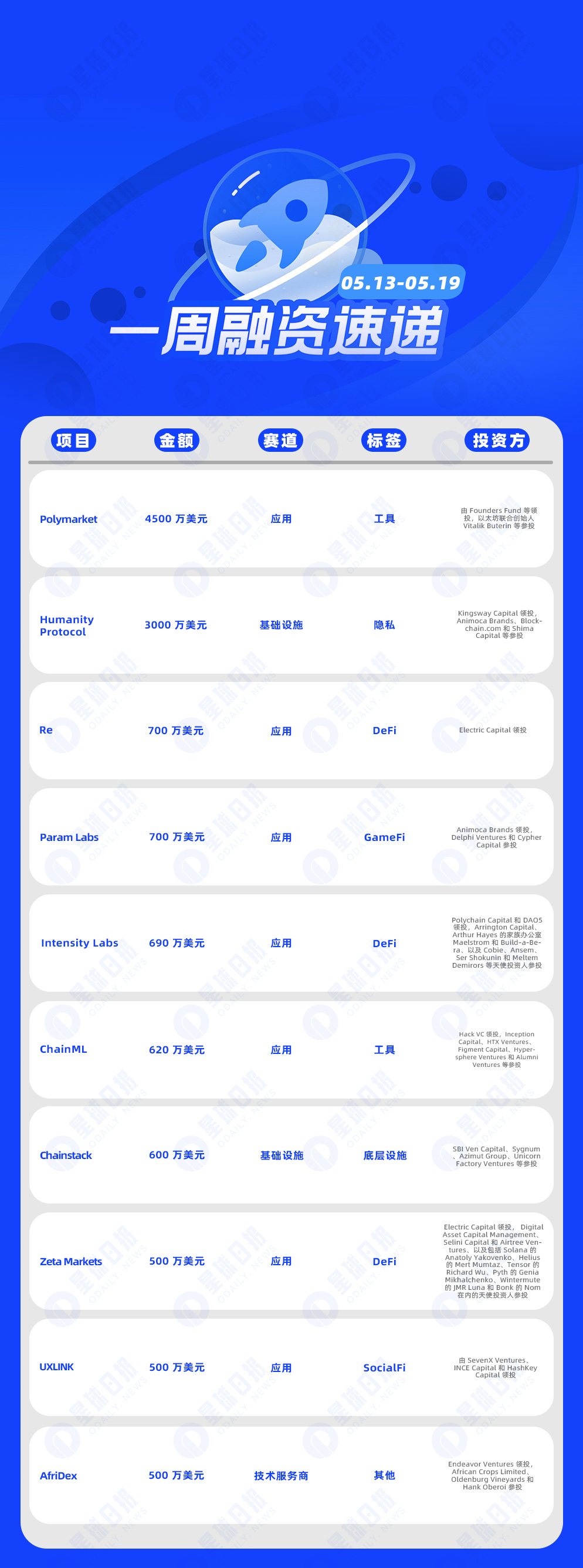

Financing Express of the Week | 26 projects received investment, with a total disclosed financing amount of approximately US$151 million (May 13-May 19)

According to incomplete statistics from Odaily Planet Daily, there were 26 blockchain financing events announced at home and abroad from May 13 to May 19, which was a decrease from last week's data (35). The total amount of financing disclosed was approximately US$151 million, which was unchanged from last week's data (US$151 million).

Last week, the project that received the most investment was the crypto prediction market Polymarket ($45 million); the DID infrastructure Humanity Protocol followed closely behind ($30 million).

The following are specific financing events (Note: 1. Sort by the amount of money announced; 2. Excludes fund raising and M&A events; 3. * indicates a "traditional" company whose business involves blockchain):

On May 14, the crypto prediction market Polymarket has completed two rounds of financing totaling $70 million. The latest round of financing was led by Founders Fund and others, and Ethereum co-founder Vitalik Buterin and others participated. A Polymarket spokesperson said that Founders Fund led the $45 million Series B financing. General Catalyst earlier helped the company raise $25 million in Series A financing.

On May 15, Humanity Protocol announced that it had completed a new round of financing of US$30 million at a valuation of US$1 billion, led by Kingsway Capital, with participation from Animoca Brands, Blockchain.com and Shima Capital. Founder Terence Kwok said the company also raised about US$1.5 million from influential crypto figures among "KOLs".

On May 14, the tokenized reinsurance RWA platform Re completed a new round of financing of US$7 million, led by Electric Capital. It is reported that the project had completed a US$14 million seed round of financing at the end of 2022. Re's goal is to support US$200 million in premiums by the end of this year.

Web3 gaming platform Param Labs completes $7 million financing, led by Animoca Brands

On May 16, Web3 gaming platform Param Labs announced the completion of a $7 million financing led by Animoca Brands, with participation from Delphi Ventures and Cypher Capital. Param Labs aims to build a gaming ecosystem governed by its native PARAM token, which will be launched soon.

On May 16, Intensity Labs, the developer of the intent-centric DeFi protocol Shogun, announced the completion of a $6.9 million seed round of financing with a valuation of $69 million. Polychain Capital and DAO 5 led the investment, with participation from Arrington Capital, Arthur Hayes' family office Maelstrom and Build-a-Bera, as well as angel investors such as Cobie, Ansem, Ser Shokunin and Meltem Demirors.

Web3 AI platform ChainML completes $6.2 million seed round extension financing, led by Hack VC

On May 14, Web3 AI platform ChainML announced the completion of a $6.2 million seed round of extended financing, led by Hack VC, with participation from Inception Capital, HTX Ventures, Figment Capital, Hypersphere Ventures and Alumni Ventures. The platform also announced the launch of its proxy base layer Theoriq.

On May 16, Web3 infrastructure company Chainstack completed a $6 million financing round, with SBI Ven Capital, Sygnum, Azimut Group, Unicorn Factory Ventures and others participating in the investment.

It is reported that Chainstack provides tools and services that allow developers to create, deploy and scale blockchain applications without having to manage the underlying infrastructure.

Solana on-chain DEX Zeta Markets completes $5 million financing, led by Electric Capital

On May 14, Solana DEX Zeta Markets announced the completion of a new round of US$5 million in financing, led by Electric Capital, with participation from Digital Asset Capital Management, Selini Capital and Airtree Ventures, as well as angel investors including Solana’s Anatoly Yakovenko, Helius’ Mert Mumtaz, Tensor’s Richard Wu, Pyth’s Genia Mikhalchenko, Wintermute’s JMR Luna and Bonk’s Nom.

On May 13, according to official news, less than 3 months after the last round of financing, the social infrastructure project UXLINK announced that it had received a new round of financing led by SevenX Ventures, INCE Capital and HashKey Capital, and introduced multiple investors. This round of financing totaled more than 5 million US dollars, and UXLINK's total financing to date exceeded 15 million US dollars, covering many first-line institutions and well-known individuals from Europe, America, Asia and the Middle East.

On May 14, AfriDex, a blockchain software-as-a-service solution headquartered in London, UK, announced the completion of a $5 million Pre-Seed round of financing, led by Endeavor Ventures, with participation from African Crops Limited, Oldenburg Vineyards and Hank Oberoi.

Zest Protocol Completes $3.5 Million Seed Round Led by Tim Draper

On May 13, Bitcoin lending protocol Zest Protocol completed a $3.5 million seed round of financing, led by Tim Draper, with participation from Binance Labs, Flow Traders, Trust Machines, etc. It is reported that the protocol uses the Nakamoto upgrade of Bitcoin's layer 2 stack and the bridge asset sBTC (pegged to Bitcoin 1: 1) to create a lending service that is completely native to the Bitcoin network.

Egypt's RWA fintech startup Mnzl completes $3.5 million seed round led by 500 Globa

On May 16, Egypt's RWA fintech startup Mnzl announced the completion of a $3.5 million seed round of financing, led by P1 Ventures, Localglobe and Ingressive Capital, with participation from 500 Global, Flat 6 Labs, First Circle Capital, Enza Capital, Beenok and a group of unnamed angel investors. Mnzl allows users to convert illiquid assets such as cars and real estate into liquid assets and upload assets to digital wallets for management.

Blockchain game CROSS THE AGES completes $3.5 million equity financing, led by Animoca Brands

On May 15, CROSS THE AGES (CTA), a multimedia game ecosystem based on science fiction fantasy IP, announced the completion of a $3.5 million equity financing led by Animoca Brands. With additional investments from Sebastien Borget of The Sandbox and Nicolas Jeuffrain of Tenergie, this round of financing has risen to $15 million. As of now, the total financing, including community financing, is $23.5 million.

Web3 football fantasy game FANTAGOAL completes $3 million financing, led by IDG capital

On May 17, the Web3 football fantasy game FANTAGOAL completed a $3 million round of financing with a valuation of $25 million. The round was led by IDG Capital, with participation from KuCoin Ventures, Chain Capital, and OptaJoe. Previously, FANTAGOAL also received a total of $400,000 in sponsorship from Sportsbet and whale.io.

On May 15, Raven, a crypto proprietary trading company co-founded by three former Wintermute employees, announced the completion of a $2.7 million seed round of financing, led by Hack VC, with participation from Wintermute Ventures and several undisclosed angel investors.

ZK project Hylé completes $2.6 million financing, led by Framework Ventures

On May 14, the ZK project Hylé announced the completion of a $2.6 million financing led by Framework Ventures, with participation from Cherry Crypto, Fabric Ventures, First Capital, and Heartcore Capital. Hylé built the Hylé network, which uses zero-knowledge proof (ZKP) to achieve scalability and privacy.

Web3 productivity app Focus Tree completes $2 million seed round led by Sfermion

On May 18, Web3 productivity application Focus Tree published a post on the X platform stating that it had completed a $2 million seed round of financing.

Sfermion led the investment, with participation from institutions and individuals including VoltCapital, PsalionVC, Foresight Ventures, StarkWare, Typhon Ventures, Sebastien Borget, GiulioX, Ramzi Laieb, Th 0 rgal, Chen Zituo, Christophe Lassuyt, Benjamin Flores, Elias, Tazartes, and Mentor Reka.

On May 15, Web3 social application Gamic announced that it had completed a financing of US$1.8 million. Polygon Ventures, Gate.io, Mapleblock, Mulana, Double Peak Group, Momentum 6, D Web3 Capital, LD Capital, Polygon co-founder Sandeep Nailwal, Krypto's Fund, Onega Ventures, Xend Finance co-founder Ugo Aronu, bitsCrunch founder Vijay Pravin and others participated in the investment.

On May 15, Spark, an on-chain order book development project based on Fuel Network, announced the completion of a $1.5 million Pre-Seed round of financing, with participation from P2 Ventures, Curiosity Capital, Unicorn Ventures, and Fuel Network. Spark can be seen as a DeFi super application on the Fuel network, integrating a series of financial services such as perpetual contracts, order books, and lending functions. It also introduces a multi-collateral full-position margin system, supports diversified asset deposits and complex risk management liquidation protocols, and uses order books and tools to facilitate non-custodial interactions.

Anime game metaverse Sekuya completes $1.6 million in financing, led by SingularityDAO

On May 17, the anime game metaverse Sekuya announced the completion of a US$1.6 million financing round, led by SingularityDAO, with participation from OIG Capital, GAINS Associates, NewTribe Capital, SEED THRIFT VENTURES, Bigger Than Race VC, and angel investors Casiraghi Mario A., SingularityNET, R 1 n, and W 3 GG.

On May 14, Anomaly, an AI-powered zero-gas Layer 3 network developer focused on games and Telegram users, raised $1.45 million in an oversubscribed Pre-Seed round of funding, with participation from Decasonic, Shima Capital, BreakOrbit, and Round 13 Capital.

On May 16, the decentralized trading platform Multipool announced the completion of a new round of financing of US$600,000, led by NxGen. The project has planned to launch Fjord Foundry LBP from May 21 to 23. Multipool currently focuses on cryptocurrencies related to real-world assets, aiming to provide traders with a fair and equal trading environment with compliance and innovative functions.

On May 13, the metaverse project Baby Shark Universe announced that it had completed its seed round of financing with a valuation of US$34 million. Animoca Brands, CREDIT SCEND, Sui Foundation, Comma 3 Ventures, Creditcoin, GM Ventures, Neuler, Notch Ventures, X+ and Planetarium participated in the investment. The specific amount has not been disclosed yet. The new funds will be used for development and marketing in the global market.

TON Ecosystem Decentralized AMM STON.fi Completes New Round of Financing, CoinFund Participates

On May 15, TON ecosystem decentralized automated market maker STON.fi announced the completion of a new round of financing, with CoinFund participating in the investment. The specific amount of financing and valuation data have not been disclosed yet. The new funds will be used to further strengthen its operations, thereby expanding financial services to Telegram users, allowing users to trade encrypted assets across multiple blockchains without bridging or packaging.

NFT perpetual contract trading platform nftperp completes angel round financing

On May 16, the NFT perpetual contract trading platform nftperp announced the completion of a new angel round of financing. Angel investors including Zeneca, Dingaling, Sergito, @BaoLeKV, @BlurCrypto, @Bribe and others participated in the investment. The specific amount and valuation information have not been disclosed yet.

Telegram-based iGaming platform Boxbet completes strategic round of financing

On May 19, the Telegram-based iGaming platform Boxbet announced that it had completed a strategic round of financing, but the specific amount has not been disclosed. Boxbet stated that investors include a crypto fund that supports Solana and a global leading iGaming operator. The names of these investors will be made public in the next few weeks.