Detailed explanation of HTX Liquid Restaking: the industry's first CeFi+DeFi restaking solution

Restaking is undoubtedly one of the hottest tracks in the current cryptocurrency market.

Based on EigenLayer's "shared security" narrative, supplemented by the liquidity re-staking support of ecological projects such as ether.fi, Renzo, and Puffer, the re-staking market has accumulated value from zero to tens of billions of US dollars in the past year. The entire re-staking track has created and is expected to continue to create a large number of new wealth opportunities.

Restaking “Player One” — Justin Sun

To the surprise of many people, although many analysts regard re-staking as an innovation that is like a "life-saving straw" for Ethereum and believe that this is the most important narrative in the current Ethereum ecosystem, in fact, the "smart money" who is most deeply involved in re-staking is a person with a very delicate relationship with Ethereum - Justin Sun.

Although Justin Sun has not made many comments on re-staking personally, it can be seen from the public information on the chain that Justin Sun had personally entered the game long before the re-staking narrative emerged. As of now, he has invested hundreds of thousands of ETH to actively participate in major projects in the re-staking track, which is enough to demonstrate his interest and support for this innovation.

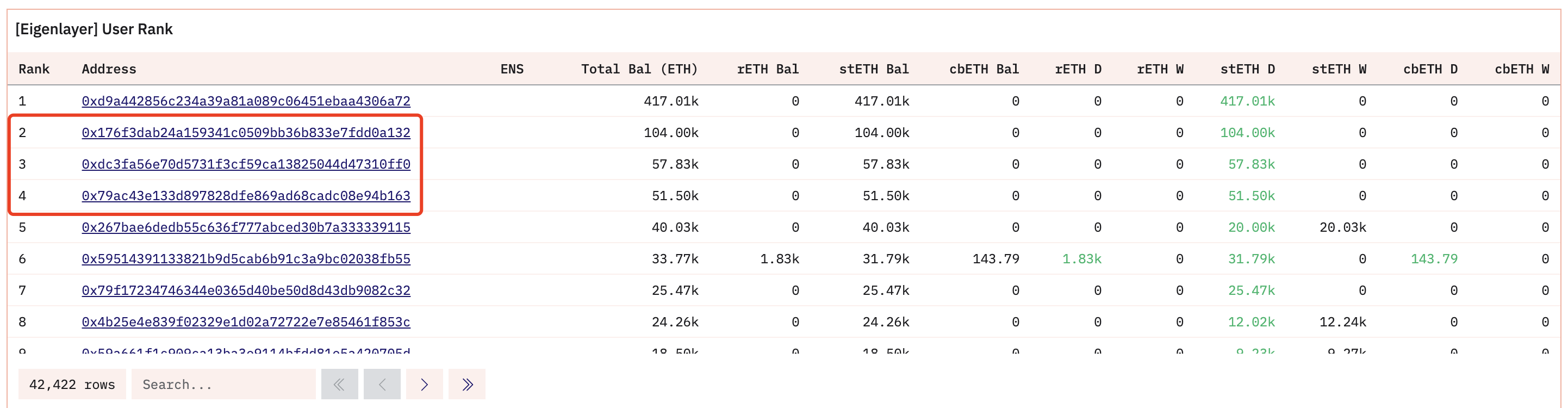

Dune data shows that in the real-time deposit amount ranking of EigenLayer, the three addresses 0x176 , 0xdC3 , and 0x79ac currently occupy the 2nd, 3rd, and 4th places respectively, and these three addresses are all owned by Justin Sun. On February 8, Justin Sun unpacked 109,327 wstETH into stETH, and then transferred them to two new addresses, 0xdC3 and 0x79ac , and deposited them in EigenLayer; On February 9, Justin Sun again pledged 58,000 stETH to Puffer through the 0x176 address, and deposited 104,001 stETH to EigenLayer.

As of the time of writing, the three verifiable Justin Sun addresses mentioned above have deposited a total of more than 200,000 ETH into EigenLayer.

In the liquidity re-staking market, Sun Yuchen's participation is more intuitive. Ether.fi, the current TVL-ranked liquidity re-staking protocol, officially launched and airdropped its governance token ETHFI in mid-March, and Sun Yuchen was the user who received the largest amount of airdrops at the time. His huge deposit also indirectly benefited the community - the rule of ether.fi is that for every 50,000 ETH increase in the total amount of protocol pledges, the total airdrop amount will increase by 0.125% of the supply share, so Sun Yuchen's huge deposit behavior did not reduce the airdrop share of others, but increased the total amount of airdrops.

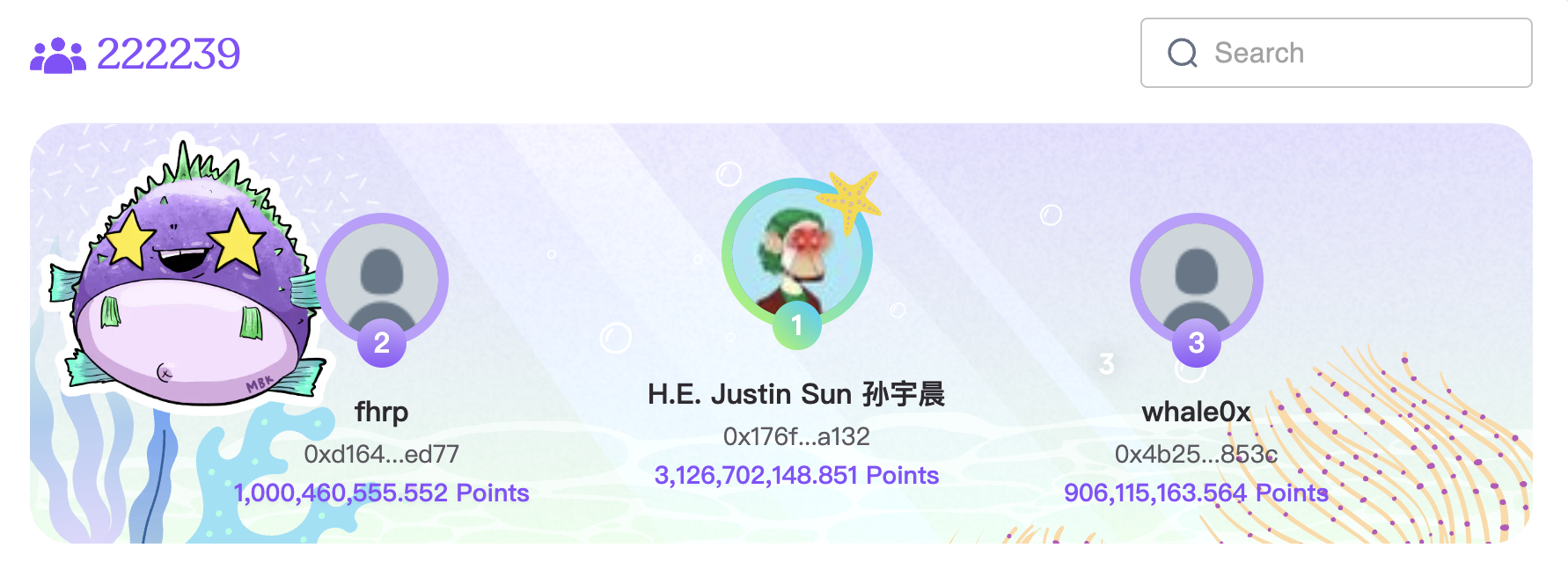

In the real-time score ranking of Puffer, another popular liquidity re-staking protocol that has not yet issued a token, Justin Sun not only ranked first, but also left the other users behind him several times behind.

HTX Liquid Restaking: The first restaking solution integrating CeFi + DeFi

Perhaps because he has personally participated in the re-staking game for a long time and in depth, Justin Sun has a clearer perception of the user pain points of the current liquidity re-staking services on the market, and these valuable perceptions and experiences are ultimately reflected in HTX's own liquidity re-staking services.

On February 29, HTX officially launched the liquidity restaking service HTX Liquid Restaking on the site. This is also the industry's first comprehensive restaking solution that combines the advantages of CeFi and DeFi, allowing users to use the HTX site balance to participate in high-quality restaking projects on major chains with one click.

In HTX's view, the current mainstream on-chain re-staking solutions have the following major pain points: the operations are too complicated, and ordinary users are often confused when faced with re-staking, liquidity re-staking, and various derivative tokens; the fees are too high. Although the on-chain gas has dropped recently, multiple authorization and staking operations often still require tens of dollars; it is difficult to balance risks and benefits. When faced with multiple so-called "opportunities", users do not know how to evaluate the benefits and risks of specific projects.

In response to this, HTX Liquid Restaking has provided the following solutions:

In order to solve the problem of too complicated operations, HTX Liquid Restaking allows users to directly use the balance in the HTX website to "participate with one click". The balance range includes not only the BTC, ETH, USDT, HTX, and TRX balances in the spot account, but also the net equity of the contract account. Users only need to sign up to participate in the HTX application, and they can directly "wait" for the income. When they want to exit, they can also "exit with one click". HTX will use its own liquidity to help users redeem in time.

Regarding the issue of excessively high fees, since HTX Liquid Restaking will process users' re-staked funds in batches, the overall gas consumption will be relatively low, and users can receive all rewards for free without paying any gas.

In order to solve the problem of difficulty in balancing risks and benefits, HTX Liquid Restaking will use its professional technical capabilities to strictly screen staking projects in terms of contract security audit, code audit, team composition, on-chain participation, etc., to help users deploy multiple high-quality projects such as EigenLayer and Puffer while minimizing risks and maximize benefits. However, contract loopholes, hacking incidents, suspension, termination of business, and bankruptcy of third-party platforms on the chain can never be 100% avoided, and HTX will not bear the responsibility for external risks.

It is worth mentioning that in addition to the original $50 million staking quota reward pool, HTX added a $50 million staking quota reward pool at the end of March, with a total of $100 million staking quota reward pool, specifically including 500 BTC, 5,000 ETH, 50,000,000 USDT, 250,000,000 TRX, and 3,000,000,000,000 HTX.

Acceleration mechanism: How to achieve big results with small efforts?

In order to achieve efficiency grading within the user group and provide higher income incentives to loyal users, HTX Liquid Restaking has also designed detailed acceleration gameplay. Users with smaller funds can try to use the acceleration rules to "gain big with small" by improving the efficiency of fund utilization.

In summary, HTX Liquid Restaking allows users to accelerate efficiency in three ways.

The first is to accelerate efficiency through HTX on-site fees, which include the net fees generated by users through all trading pairs such as spot, leverage, and contracts. With a daily fee of $1,200 as the threshold, HTX Liquid Restaking users can get up to 8% efficiency acceleration.

The second is to obtain efficiency acceleration by holding HTX tokens. HTX Liquid Restaking will take a real-time snapshot of the HTX balance held by users in their spot accounts and coin-earning accounts. Depending on the size of their holdings, users can obtain efficiency acceleration of 3% and 6%.

The third is to achieve efficiency acceleration by joining or creating a team through collective efforts. In the same team, all team members can obtain acceleration value, and the specific acceleration value is determined by the team level. The higher the total pledge scale of the team (the total amount of participation of all team members), the higher the team level will be. Each team has a maximum of 2,000 members, and the captain can also get an additional 20% acceleration.

The acceleration value will affect the user's HTX Liquid Restaking points accumulation efficiency and can be applied to all currencies that have enabled liquidity restaking services. These points will ultimately determine the user's weight in the prize pool.

Unlocking the next phase of re-staking

Looking back at the development trend of the re-staking track, although this narrative has shown strong financial appeal, as the TVL of the entire track has rapidly grown to tens of billions of dollars, the growth rate has slowed down to a certain extent. The main reason is that the available liquidity on the chain is gradually decreasing. If you want to achieve further expansion in terms of fund scale, you must leverage the massive funds "sleeping" under the chain.

Based on this development trend, the emergence of HTX Liquid Restaking can not only solve market pain points in a timely manner and help more users participate in the innovation of restaking; in turn, it can also help the restaking industry to further expand its scale, improve the security of active verification services by increasing the total amount of funds, and promote the further development of the industry.

HTX itself is also expected to keep pace with the times of re-staking, capturing value while steadily promoting its own services.