MIIX Capital: IO.NET Project Research Report

1. Project Status

1.1 Business Overview

io.net is a decentralized GPU network designed to provide computation for ML (machine learning). Computing power is obtained by assembling more than 1 million GPUs from independent data centers, cryptocurrency miners, and projects such as Filecoin or Render.

Its goal is to combine 1 million GPUs into DePIN (decentralized physical infrastructure network) to create an enterprise-level, decentralized distributed computing network. By gathering idle network computing resources around the world (currently mainly GPUs), it will provide artificial intelligence engineers with lower-priced, more accessible, and more flexibly adaptable network computing resource services.

For users, it is equivalent to a decentralized global market for idle GPU resources, where AI engineers or teams can customize and purchase the required GPU computing services according to their needs.

1.2 Team Background

Ahmad Shadid is the founder and CEO and was previously a quantitative systems engineer at WhalesTrader.

Garrison Yang is Chief Strategy Officer and Chief Marketing Officer, and was previously Vice President of Growth and Strategy at Ava Labs.

Tory Green is the Chief Operating Officer, having previously served as Chief Operating Officer at Hum Capital and Director of Corporate Development and Strategy at Fox Mobile Group.

Angela Yi is the Vice President of Business Development. She graduated from Harvard University in the United States and is responsible for planning and executing key strategies such as sales, partnerships and supplier management.

In 2020, when Ahmad Shadid built a GPU computing network for the machine learning quantitative trading company Dark Tick, because the trading strategy was close to high-frequency trading, it required a lot of computing power, and the high GPU service fees of cloud service providers became a problem for them.

The huge demand for computing power and the high costs they faced prompted them to decide to work on decentralized distributed computing resources, which then gained attention at the Austin Solana Hacker House. Therefore, io.net is the team that started from the pain points they faced, proposed solutions, and implemented and expanded their business.

1.3 Products/Technology

Problems faced by market users:

Availability is limited, accessing hardware using cloud services like AWS, GCP, or Azure often takes weeks, and popular GPU models on the market are often not available.

There are very few options, such as GPU hardware, location, security level, latency, etc. Users have almost no choice.

High cost: Getting good quality GPUs is very expensive, costing hundreds of thousands of dollars per month for training and inference.

solution:

By aggregating underutilized GPUs (such as independent data centers, crypto miners, and crypto projects such as Filecoin and Render) and integrating these resources into DePIN, engineers can gain massive computing power in the system. It allows ML teams to build inference and model serving workflows across distributed GPU networks and leverage distributed computing libraries to orchestrate and batch training jobs so that they can be parallelized across many distributed devices using data and model parallelism.

In addition, io.net leverages a distributed computing library with advanced hyperparameter tuning to check for optimal results, optimize scheduling, and simply specify search patterns. It also uses an open source reinforcement learning library that supports production-grade, highly distributed RL (reinforcement learning) workloads with a simple API.

product composition:

IO Cloud aims to deploy and manage decentralized GPU clusters allocated on demand, seamlessly integrates with IO-SDK, and provides a comprehensive solution for expanding artificial intelligence and Python applications. It can provide unlimited computing power while simplifying the deployment and management of GPU/CPU resources.

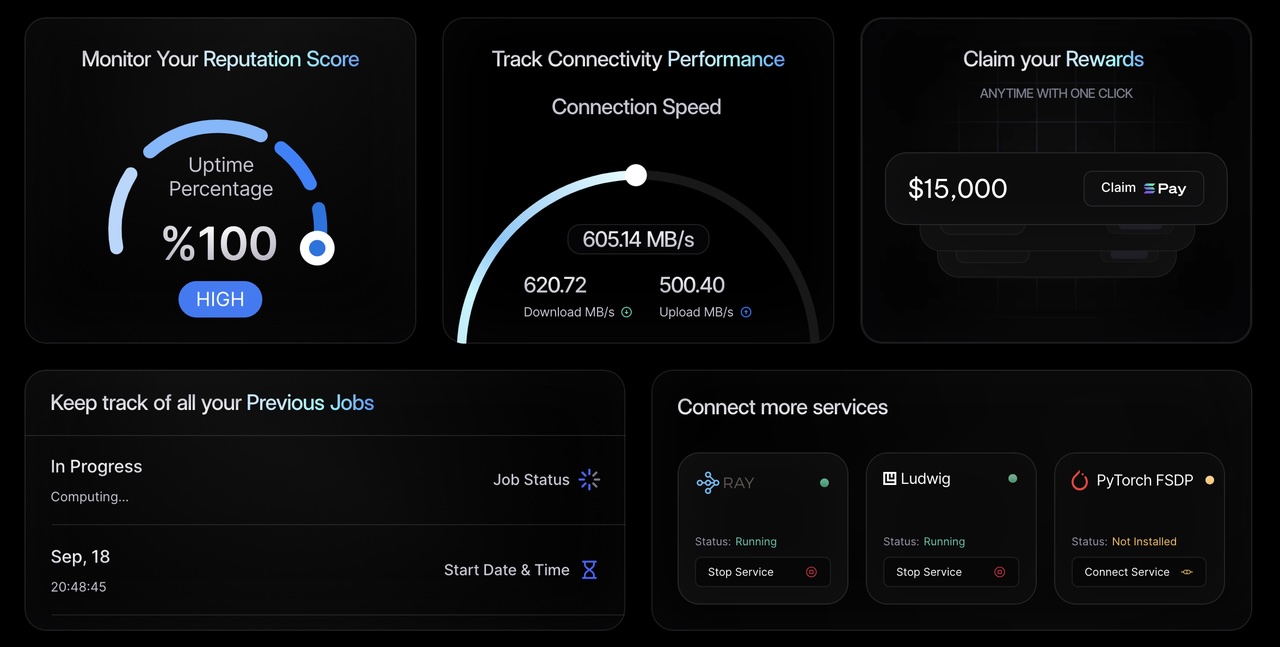

IO Worker , provides users with a comprehensive and user-friendly interface to efficiently manage their GPU node operations through an intuitive web application. The scope of the product includes features related to user account management, computing activity monitoring, real-time data display, temperature and power consumption tracking, installation assistance, wallet management, security measures and profitability calculations.

IO Explorer mainly provides users with comprehensive statistics and visualizations of various aspects of the GPU cloud, allowing users to easily and instantly monitor, analyze and understand the complex details of the io.net network, providing comprehensive visibility into network activity, important statistics, data points and reward transactions.

Features:

Decentralized computing network: io.net adopts a decentralized computing model, distributing computing resources around the world, thereby improving computing efficiency and stability.

Low-cost access: io.net Cloud provides lower access costs than traditional centralized services, making computing resources accessible to more machine learning engineers and researchers.

Distributed cloud cluster: The platform provides a distributed cloud cluster where users can choose appropriate computing resources according to their needs and assign tasks to different nodes for processing.

Support for machine learning tasks: io.net Cloud focuses on providing computing resources for machine learning engineers, enabling them to more easily perform tasks such as model training and data processing.

1.4 Development Roadmap

https://developers.io.net/docs/product-timeline

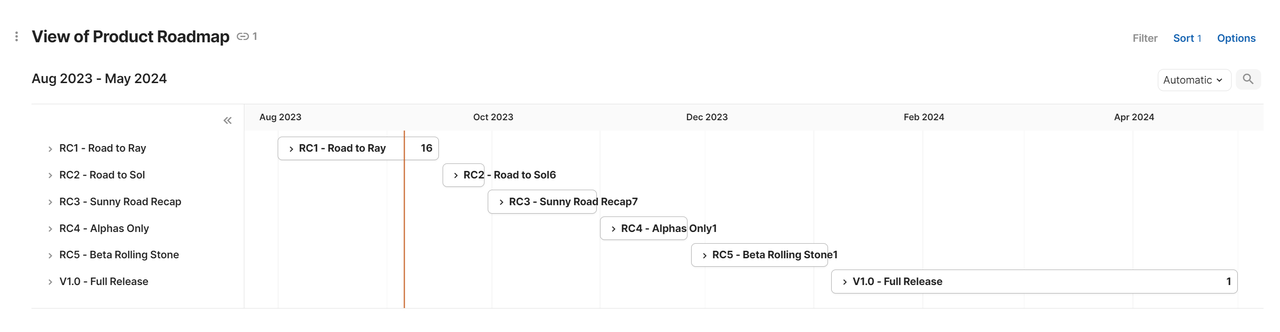

According to the information published in the io.net white paper, the roadmap for the project product is: From January to April 2024, V1.0 will be fully released, dedicated to the decentralization of the io.net ecosystem, enabling it to be self-hosted and self-replicated.

1.5 Financing Information

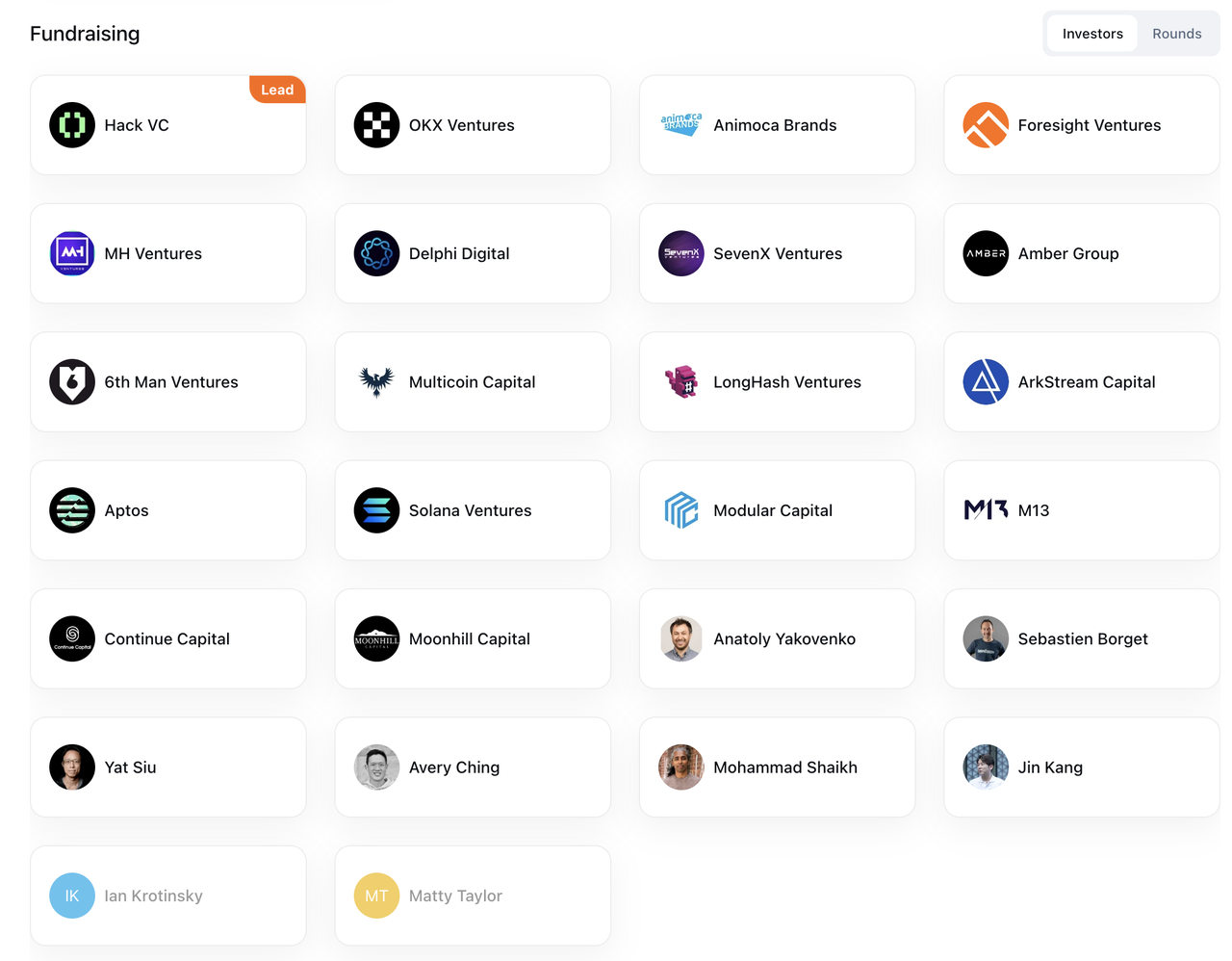

According to public news information, on March 5, 2024, io.net announced the completion of a $30 million Series A financing round, led by Hack VC, with participation from Multicoin Capital, 6th Man Ventures, M13, Delphi Digital, Solana Labs, Aptos Labs, Foresight Ventures, Longhash, SevenX, ArkStream, Animoca Brands, Continue Capital, MH Ventures, Sandbox Games, etc. [1] It is worth noting that after this round of financing, io.net's overall valuation is $1 billion.

2. Market data

2.1 Official Website

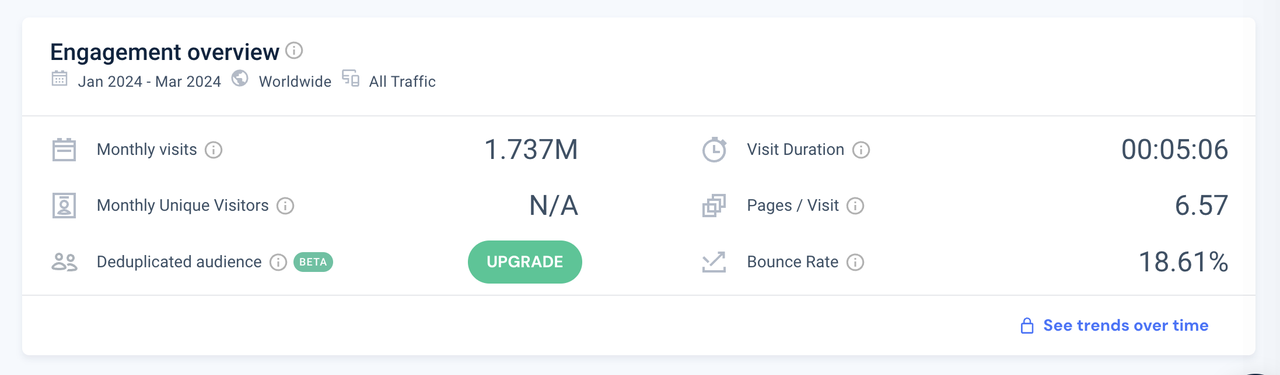

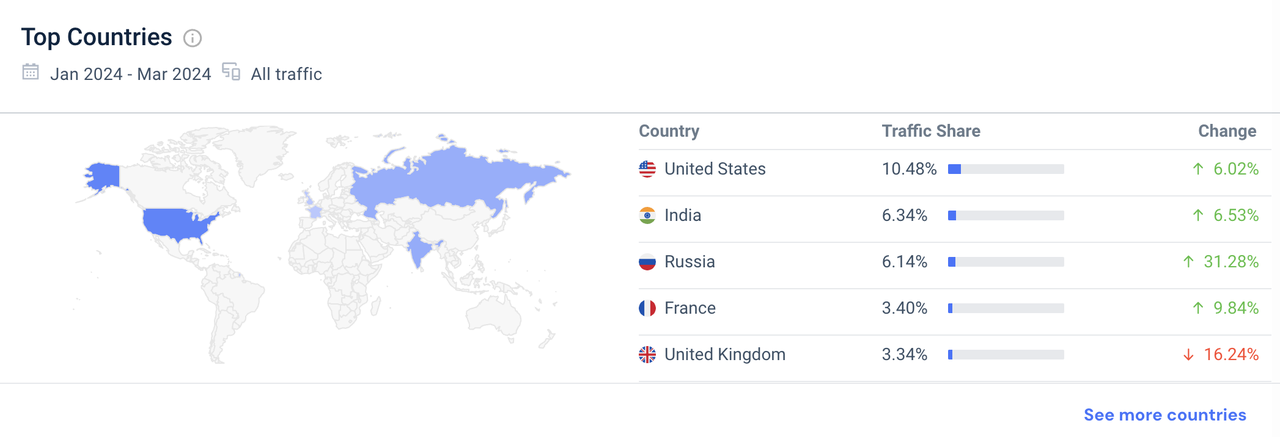

According to the official website data from January 2024 to March 2024, the total visits were 5.212M, the average monthly visits were 1.737M, the bounce rate was 18.61% (low), the user access data in each region was relatively uniform, and direct visits and search visits accounted for more than 80%, which may indicate that the proportion of dirty data in the visiting user data is not high. They have a basic understanding of io.net and are willing to learn more about and interact with the website.

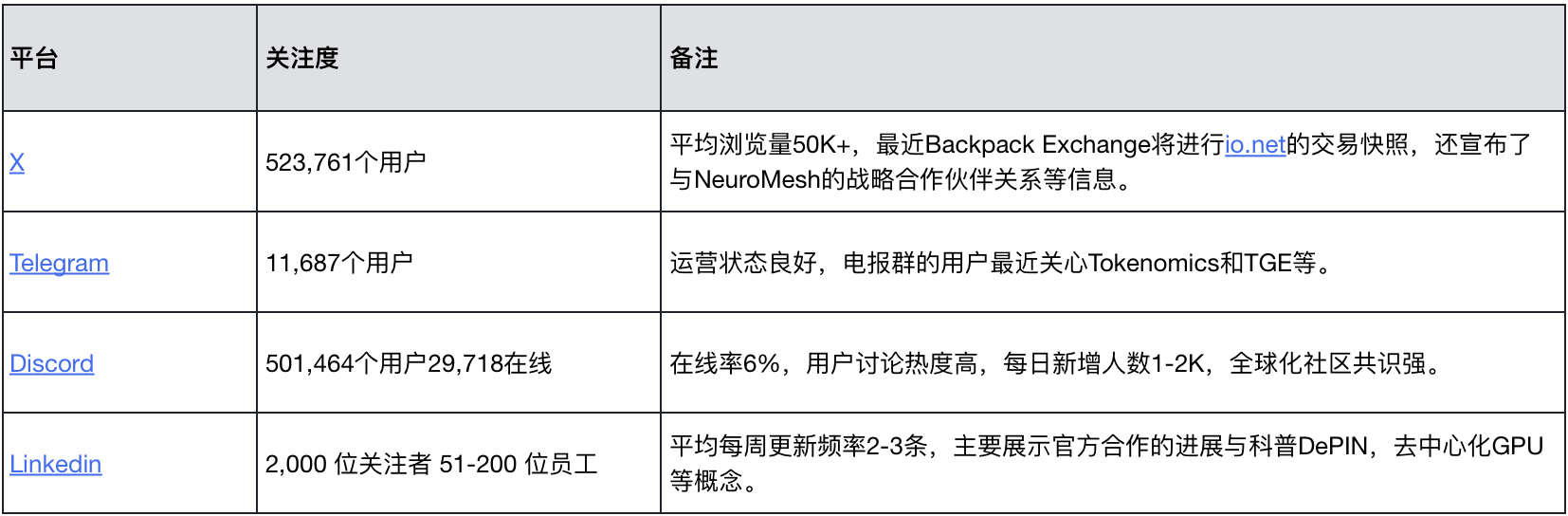

2.2 Social Media Groups

3. Competition Analysis

3.1 Competition Landscape

io.net's core business is related to decentralized AI computing power, and its biggest competitors are traditional cloud service providers such as AWS, Google Cloud, and Microsoft's intelligent cloud business (represented by Azure). According to the "2022-2023 Global Computing Index Assessment Report" jointly compiled by International Data Corporation (IDC), Inspur Information, and Tsinghua University Global Industry Research Institute, the global artificial intelligence computing market size is expected to grow from US$19.5 billion in 2022 to US$34.66 billion in 2026. [2]

Comparing the sales revenues of the world's mainstream cloud computing vendors: In 2023, AWS cloud service sales revenue was US$9.08 billion, Google Cloud sales revenue was US$3.37 billion, and Microsoft Intelligent Cloud business sales revenue was US$9.68 billion. [3] The three companies account for about 66% of the global market share, and the market capitalizations of these three giant companies are all over one trillion US dollars.

https://www.alluxio.io/blog/maximize-gpu-utilization-for-model-training/

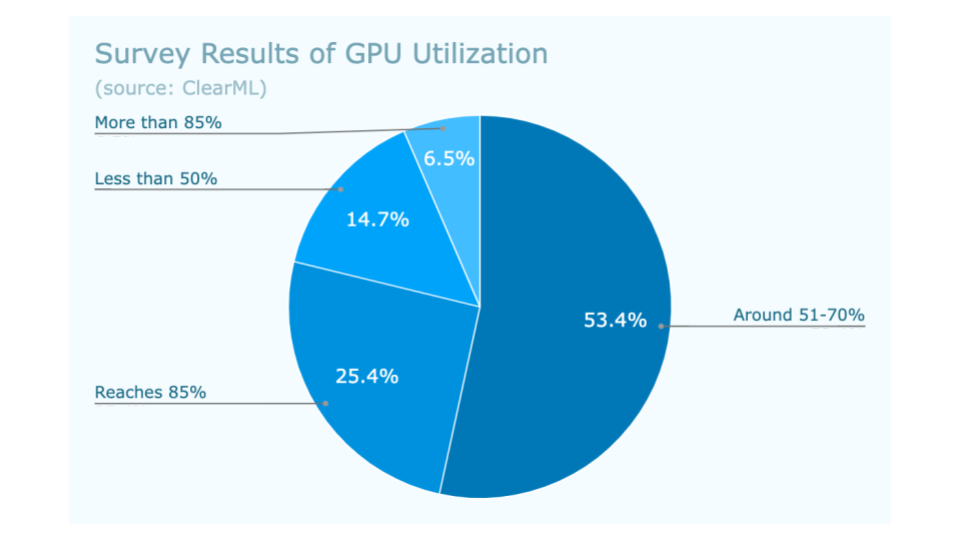

In sharp contrast to the high revenue of cloud service providers, how to improve GPU utilization has become a focus. According to a survey of AI infrastructure, most GPU resources are underestimated - about 53% of people believe that 51-70% of GPU resources are underestimated, 25% believe that the utilization rate reaches 85%, and only 7% believe that the utilization rate exceeds 85%. For io.net, the huge demand for cloud computing and the problem of insufficient effective utilization of GPU resources are market opportunities.

3.2 Advantages Analysis

https://twitter.com/eli5_defi/status/1768261383576289429

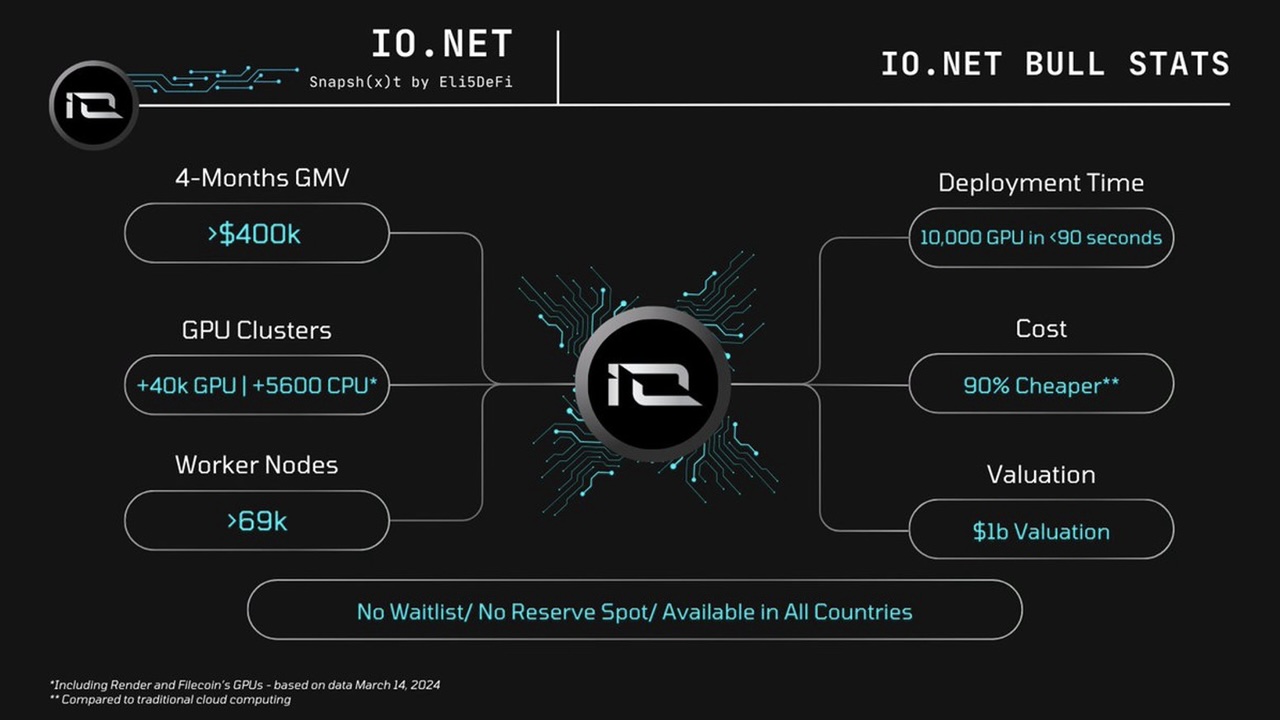

io.net's biggest competitive advantage is reflected in its niche advantage or first-mover advantage. According to official data: io.net currently has a total GPU cluster of more than 40K, a total CPU of more than 5600, and Woker Nodes of more than 69K. It takes less than 90 seconds to deploy 10,000 GPUs, and the price is 90% cheaper than competitors, with a valuation of $1 billion. io.net not only provides customers with a low price of 10% to 20% off the price of centralized cloud service providers and instant online services without permission, but also provides additional startup incentives for computing power providers through the upcoming IO token, helping to achieve the goal of connecting 1 million GPUs.

In addition, compared with other DePIN computing projects, io.net focuses on GPU computing power, and the scale of its GPU network is more than 100 times that of similar projects. io.net is also the first in the blockchain industry to integrate the most advanced ML technology stack (such as Ray clusters, Kubernetes clusters, and giant clusters) into GPU DePIN projects and put them into large-scale practice, which makes it a leader not only in the number of GPUs, but also in the ability of technology application and model training.

As io.net continues to develop, if it can increase its GPU capacity to 500,000 concurrent GPUs across the entire network to compete with centralized cloud service providers, it will be able to provide services similar to Web 2 at a lower cost, and have the opportunity to gradually establish its core position in the field through close cooperation with major DePIN and AI players (including Render Network, Filecoin, Solana, Ritual, etc.), becoming the leader and settlement layer of the decentralized GPU network, bringing vitality to the entire Web 3 xAI ecosystem.

3.3 Risks and Issues

io.net is an emerging computing resource integration and distribution platform that is deeply integrated with Web3. The businesses involved highly overlap with those of traditional cloud service providers, which makes it face positional risks and obstacles in both technology and market.

Technical security risks . As an emerging platform, io.net has not undergone large-scale application testing, nor has it demonstrated the ability to prevent and respond to malicious attacks. In the face of the massive computing resources access, distribution, and management, there is no corresponding experience or practical verification, which is prone to common compatibility, robustness, security, and other issues of technical products. And once a problem occurs, it is likely to be fatal to io.net, because customers care more about their own security and stability and are unwilling to pay for them.

The market expansion is slow . io.net has a high degree of overlap with traditional cloud service providers, which requires it to compete directly with traditional AWS, Google Cloud, Alicloud, and even with second-tier or third-tier service providers. Although io.net has more favorable costs, its service system and market system for Class B customers are just beginning, which is very different from the existing market operation of the Web3 industry. Therefore, at present, its progress in market expansion is not ideal, which may directly affect its project valuation and the market value performance of its tokens.

Latest security incidents

On April 25, Ahmad Shadid, founder and CEO of io.net, tweeted that the io.net metadata API suffered a security incident. Attackers exploited the accessible mapping of user ID to device ID, resulting in unauthorized metadata updates. This vulnerability did not affect GPU access, but it did affect the metadata displayed to users by the front end. io.net does not collect any PII and does not leak sensitive user or device data.

Shadid said that the io.net system design allows for self-healing, constantly updating each device to help recover any metadata that was changed in error. In light of this incident, io.net has accelerated the deployment of OKTA's user-level authentication integration, which will be completed within the next 6 hours. In addition, io.net has launched Auth 0 Token for user verification to prevent unauthorized metadata changes. During the database recovery, users will temporarily be unable to log in. All uptime records are unaffected, and this will not affect the vendor's computing rewards.

4. Token Valuation

4.1 Token Model

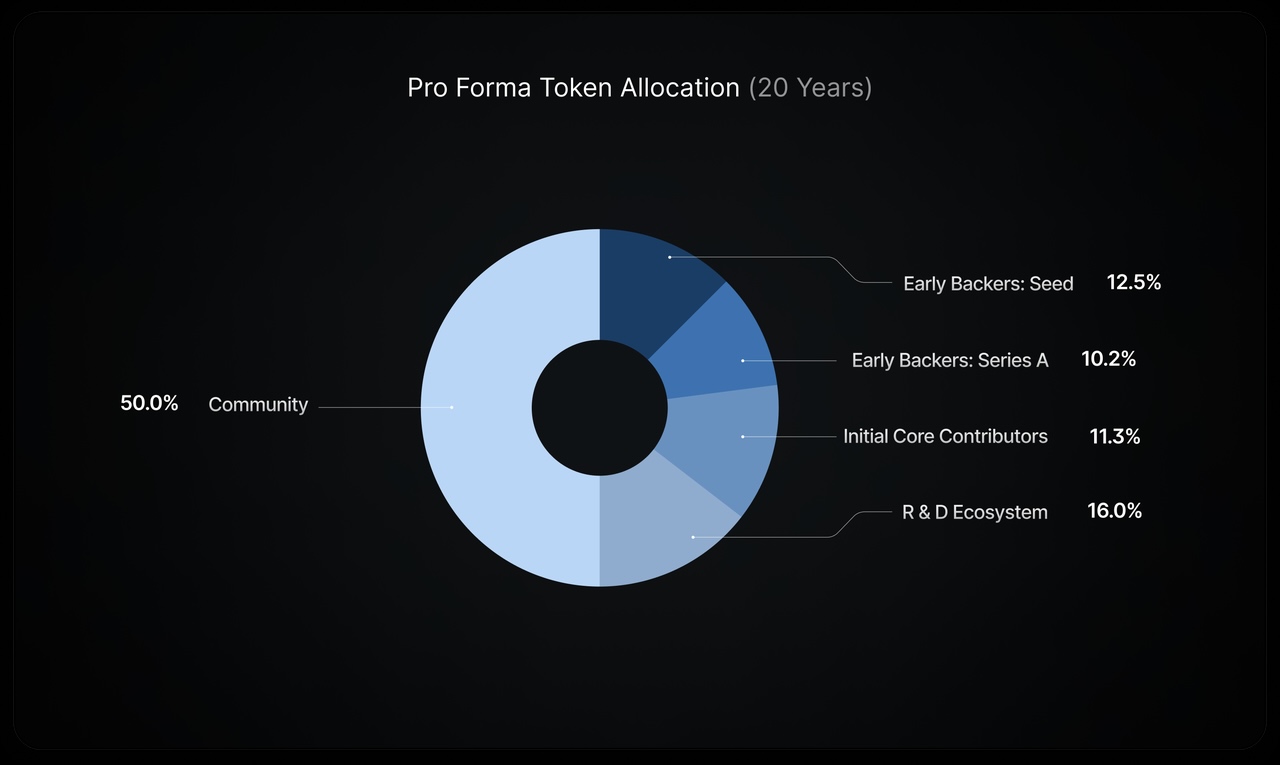

The io.net token economic model will have an initial supply of 500 million IOs at the time of creation, divided into five categories: Seed Investors (12.5%), Series A Investors (10.2%), Core Contributors (11.3%), R&D and Ecosystem (16%), and Community (50%). As IOs are issued to incentivize network growth and adoption, they will grow to a fixed maximum supply of 800 million within 20 years.

The rewards adopt a deflationary model, starting from 8% in the first year, and decreasing by 1.02% per month (about 12% per year) until the IO cap of 800 million is reached. As rewards are distributed, the share of early supporters and core contributors will continue to decrease, and after all rewards are distributed, the community's share will grow to 50%. [4]

The functions of its tokens include allocating incentives to IO Workers, rewarding AI and ML deployment teams for continued use of the network, balancing some demand and supply, pricing IO Worker computing units, and community governance.

In order to avoid payment problems caused by IO coin price fluctuations, io.net has developed a stablecoin IOSD, which is pegged to the US dollar. 1 IOSD is always equal to 1 US dollar. IOSD can only be obtained by destroying IO. In addition, io.net is considering some mechanisms to improve network functionality. For example, IO Workers may be allowed to increase the probability of being rented by pledging native assets. In this case, the more assets they invest, the greater the probability that they will be selected. In addition, AI engineers who pledge native assets can use high-demand GPUs first.

4.2 Token Mechanism

IO tokens are used primarily by two groups: demand and supply. For the demand side, each computing job is priced in USD, and the network will retain payment until the job is completed. Once a node operator configures their share of rewards in USD and tokens, all USD amounts are allocated directly to the node operator, while the share allocated to tokens is used to burn IO coins. All IO coins minted as computing rewards during that period are then distributed to users based on the USD value of their coupon tokens (computing credits).

For the supply side, there are availability rewards and computing rewards. Among them, the computing reward is for jobs submitted to the network. Users can choose the time preference "duration of cluster deployment in hours" and receive cost estimates from the io.net pricing oracle. In terms of availability rewards, the network will randomly submit small test jobs to evaluate which nodes run regularly and can accept jobs from demanders well.

It is worth mentioning that both the supply side and the demand side have a reputation system that accumulates points based on computing performance and network participation to obtain rewards or discounts.

In addition, io.net also sets up ecological growth mechanisms, including staking, invitation rewards, and network fees. IO coin holders can choose to stake their IO tokens to node operators or users. Once pledged, the staker will receive 1-3% of all rewards received by the participant. Users can also invite new network participants to join and share part of the new participants' future income. The network fee is set to charge 5%.

4.3 Valuation Analysis

We are currently unable to obtain accurate revenue data for projects in this track, so we are unable to make an accurate valuation. Here we mainly compare it with Render, a project of io.net that is also an AI+DePIN, for your reference.

https://x.com/ionet/status/1777397552591294797

https://globalcoinresearch.com/2023/04/26/render-network-scaling-rendering-for-the-future/

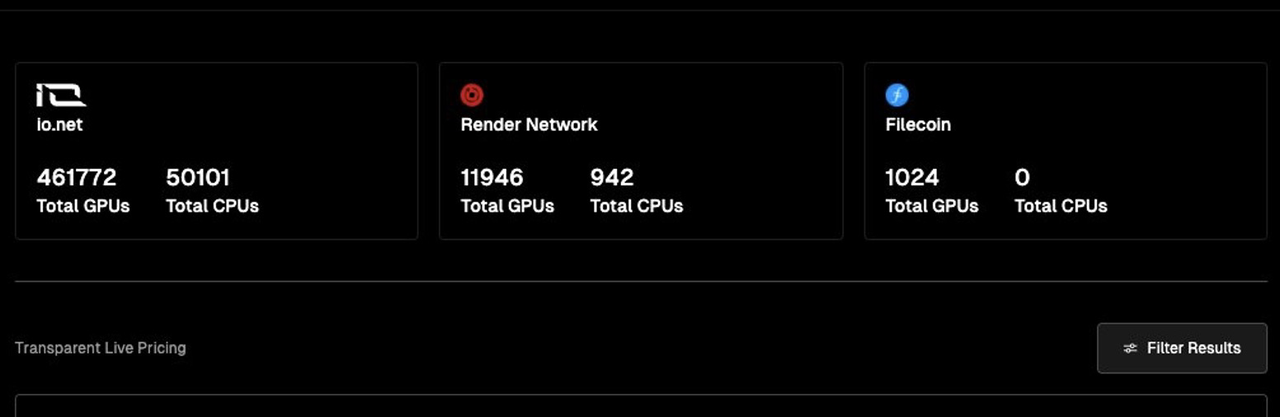

As shown in the figure, Render Network is currently the leading project in the decentralized GPU rendering solution in the AI+Web3 track, with a total GPU resource of 11946 and a current market value of 3 billion US dollars (FDV 5 billion US dollars); while io.net has a total GPU resource of 461772, which is 38 times that of Render, and is currently valued at 1 billion. For the io.net and Render projects, the core key capabilities of both are decentralized GPU computing power. Therefore, from the perspective of GPU supply as the core comparison dimension, io.net's market value after listing is likely to exceed that of render, or at least be comparable.

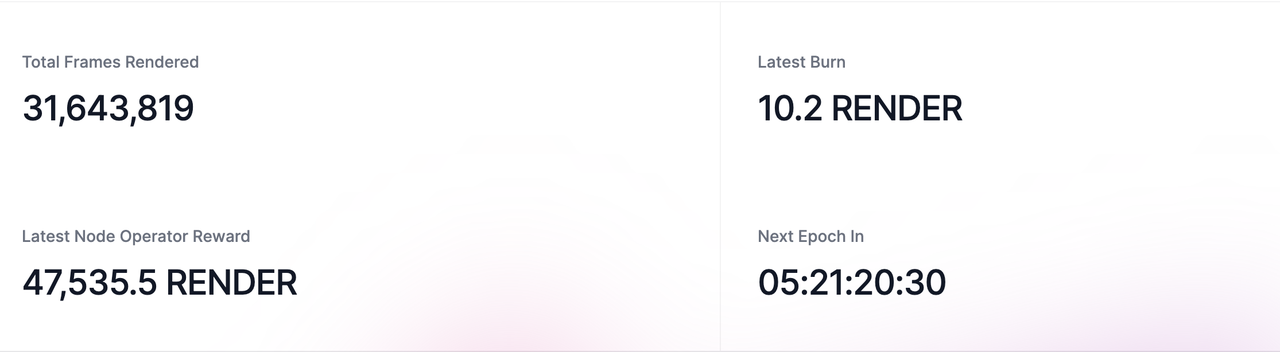

https://stats.renderfoundation.com/

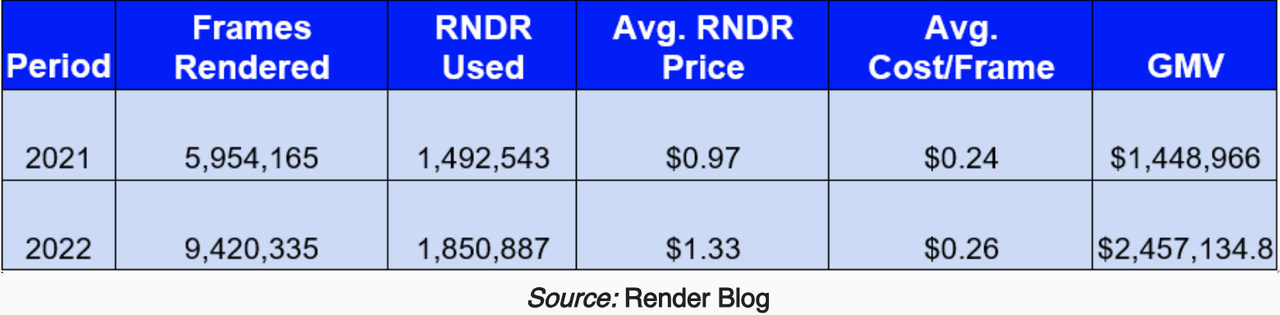

The Frames Rendered of Render Network in 2022 is 9,420,335, and the GMV is 2,457,134 US dollars. Currently, the Frames Rendered of Render Network is 31,643,819, from which it is estimated that the entire GMV is approximately 8,253,751 US dollars.

Compared with io.net's 4-month GMV of 400,000, assuming that io.net grows at an average rate of GM V4 00,000 in 4 months, its 12-month GMV is 1200,000. If io.net wants to reach the current GMV of Render Network, there is still 6.8 times of growth space. Now io.net is valued at 1 billion US dollars. Based on the above analysis, io.net's market value is expected to reach more than 5 billion US dollars in the bull market cycle.

5. Summary

The emergence of io.net fills the gap in the field of decentralized computing and provides users with a novel and promising way of computing. With the continuous development of fields such as artificial intelligence and machine learning, the demand for computing resources is also increasing, so io.net has high market potential and value.

On the other hand, although the market has given io.net a high valuation of $1 billion, its products have not been tested by the market, and there are uncertain risks in terms of technology. Whether it can effectively match its supply and demand relationship is also a key variable that determines whether its subsequent market value can reach a new high. From the current situation, the results of the io.net platform on the supply side have been initially shown, but the demand side has not been fully utilized, resulting in the current platform's overall GPU resources not being fully utilized. How to more effectively mobilize the demand for GPU resources is a challenge that the team has to face.

If io.net can quickly meet market demands and does not encounter or have major risks and technical problems during operations, its overall business attributes of AI+DePIN will start the growth flywheel and become the most eye-catching project product in the Web3 field. This also means that io.net will be a high-quality investment target for the branch. Let us continue to follow up, observe and verify carefully.

References

【1】 https://www.coincarp.com/fundraising/ionet-series-a/

【4】 https://www.chaincatcher.com/article/2120813

All the above opinions are for reference only and are not investment advice. If you disagree, please contact us for correction.

Follow and join the MIIX Captial community to learn more cutting-edge information:

Twitter: https://twitter.com/MIIXCapital_CN ;

Telegram: https://t.me/MIIXCapitalcn ;

Join the MIIX Capital team: hr@miixcapital.com

Recruiting positions: Investment Research Analyst/Operation Manager/Visual Designer