Financing Express of the Week | 33 projects received investment, with a total disclosed financing amount of approximately US$126 million (April 15-April 21)

According to incomplete statistics from Odaily Planet Daily, there were 33 blockchain financing events announced at home and abroad from April 15 to April 21, which was unchanged from last week's data (33). The total amount of financing disclosed was approximately US$126 million, a significant decrease from last week's data (US$537 million).

Last week, the project that received the most investment was the liquidity staking agreement Puffer Finance ($18 million); the on-chain financial platform Centrifuge followed closely behind ($15 million).

The following are specific financing events (Note: 1. Sort by the amount of money announced; 2. Excludes fund raising and M&A events; 3. * indicates a "traditional" company whose business involves blockchain):

On April 16, Puffer Finance completed an $18 million Series A financing round led by Brevan Howard Digital and Electric Capital, with participation from Coinbase Ventures, Kraken Ventures, Lemniscap, Franklin Templeton, Avon Ventures (affiliated with Fidelity Investments), Mechanism, Lightspeed Faction, Consensys, Animoca, GSR and several angel investors.

Centrifuge Completes $15 Million Series A Funding, Led by ParaFi Capital and Greenfield

On April 17, the on-chain financial platform Centrifuge announced the successful completion of a US$15 million Series A financing round, which will be used to accelerate the widespread application of institutional DeFi.

This round of financing was jointly led by ParaFi Capital and Greenfield, with participation from IOSG Ventures, Circle Ventures, Arrington Capital, The Spartan Group, Wintermute Ventures, etc. The new funds will be mainly used for product development, building on-chain practicality, ecosystem growth, and talent recruitment.

On April 16, Avalanche-based real estate equity mortgage lender and tokenization platform Homium completed a $10 million Series A financing round, led by Sorenson Impact Group and Avalanche Blizzard Fund.

Crypto game studio Avalon completes $10 million financing, led by Bitkraft and others

On April 15, crypto game studio Avalon announced that it had completed a $10 million financing round, led by Bitkraft and Hashed, with participation from Coinbase Ventures, Spartan Capital, LiquidX and Momentum 6. It is reported that the studio plans to release a massively multiplayer online game.

On April 20, the Bitcoin cross-chain infrastructure TeleportDAO officially announced that it had raised $9 million through CoinList public sales and financing, with participation from OIG Capital, DefinanceX, Oak Grove Ventures, Candaq Ventures, TON, Across, bitSmiley and others.

On April 19, enterprise-level loyalty platform Superlogic announced the completion of a US$7.6 million strategic round of financing, with participation from Amex Ventures, Sangha Capital, 10 SQ Capital, Nima Capital, Actai Unicorn Fund, Chainlink Capital and others. As of now, the total financing amount has reached US$15 million. Its early investors also include Warner Music Group, Mirabaud, Galaxy Interactive and Liquid 2 Ventures.

On April 18, Thruster, a DEX project in the Blast ecosystem, completed a $7.5 million seed round of financing with a valuation of $70 million. Pantera Capital led the investment, with participation from OKX Ventures, Mirana Ventures, ParaFi Capital, Manifold Ventures and Arche Fund (formerly Coin 98 Ventures).

Decentralized exchange CVEX completes $7 million financing, led by Fabric Ventures and others

On April 16, the decentralized exchange CVEX announced that it had completed a $7 million financing round, led by abric Ventures and Kyber Capital Crypto Fund, with participation from AMDAX, Wave Digital, Funfair Ventures, Seier Capital Family Office, Five T Group and Saxon. It is reported that CVEX expects to launch its mainnet this summer.

Stablecoin issuer Usual Labs completes $7 million financing, led by IOSG and Kraken Ventures

On April 17, stablecoin issuer Usual Labs announced the completion of a $7 million financing, led by IOSG and Kraken Ventures, with participation from GSR, Mantle, Starkware, Flowdesk, Avid 3, Bing Ventures, Breed, Hypersphere, etc. Usual Labs intends to use this latest funding to support the launch of the stablecoin USD 0 on the Ethereum mainnet in the second quarter of this year.

Account abstraction app Plena raises $5 million in funding from Normie Ventures and others

On April 16, the account abstraction application Plena announced the completion of a $5 million financing, with participation from Big Brain Holdings, DeWhale, GBV, WebWise, Galxe, Normie Ventures, FounderHeads, etc. In addition, Plena also announced that it will cooperate with DAO Maker, Chain GPT, Decubate, AI Tech and Viction Chain by Coin 98 to carry out the largest airdrop event, distributing 2% of its total supply before listing.

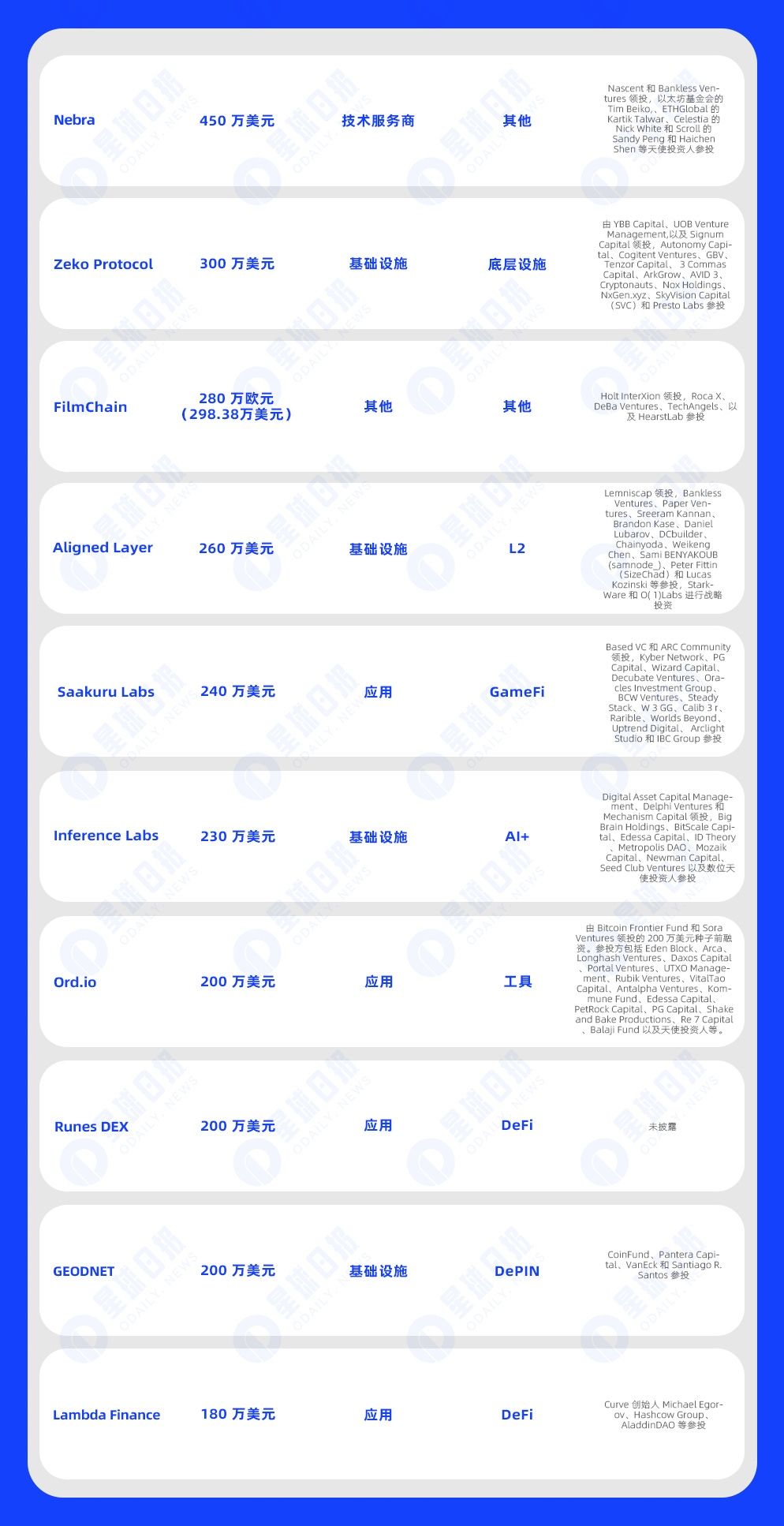

Blockchain research institute Nebra raises $4.5 million, led by Nascent and Bankless Ventures

On April 17, blockchain and zero-knowledge proof research organization Nebra announced the completion of a $4.5 million financing round, led by Nascent and Bankless Ventures, with participation from angel investors including Tim Beiko of the Ethereum Foundation, Kartik Talwar of ETHGlobal, Nick White of Celestia, and Sandy Peng and Haichen Shen of Scroll.

Web3 startup Zeko Labs completes $3 million pre-seed financing led by YBB Capital and others

On April 18, Zeko Labs, the company behind the cross-chain zero-knowledge scaling protocol Zeko Protocol, completed a $3 million pre-seed financing led by YBB Capital, UOB Venture Management, and Signum Capital, with participation from Autonomy Capital, Cogitent Ventures, GBV, Tenzor Capital, 3 Commas Capital, ArkGrow, AVID 3, Cryptonauts, Nox Holdings, NxGen.xyz, SkyVision Capital (SVC), and Presto Labs.

On April 19, FilmChain, a film and television payment platform based on the Ethereum blockchain, announced the completion of a 2.8 million euro financing round, led by Holt InterXion, with participation from Roca X, DeBa Ventures, TechAngels, and HearstLab. FilmChain uses blockchain to improve transaction transparency and auditability, and uses blockchain to track ownership in payment architectures, injecting trust and responsibility into payment transactions in the film, television, and gaming industries.

On April 15, Aligned Layer, a decentralized ZK Proof verification layer of Ethereum powered by Eigen Layer, completed a $2.6 million seed round of financing, led by Lemniscap, with participation from Bankless Ventures, Paper Ventures, Sreeram Kannan, Brandon Kase, Daniel Lubarov, DCbuilder, Chainyoda, Weikeng Chen, Sami BENYAKOUB (samnode_), Peter Fittin (SizeChad) and Lucas Kozinski, and strategic investments from StarkWare and O(1)Labs.

GameFi project Saakuru Labs completes $2.4 million in financing, led by Based VC and ARC Community

On April 16, GameFi project Saakuru Labs announced the completion of US$2.4 million in financing, led by Based VC and ARC Community, with participation from Kyber Network, PG Capital, Wizard Capital, Decubate Ventures, Oracles Investment Group, BCW Ventures, Steady Stack, W 3 GG, Calib 3 r, Rarible, Worlds Beyond, Uptrend Digital, Arclight Studio and IBC Group. The new funds will be used to promote the adoption of the Saakuru protocol to provide more support in the GameFi field and ecosystem.

On April 15, Web3 AI startup Inference Labs announced the completion of a $2.3 million Pre-Seed round of financing, led by Digital Asset Capital Management, Delphi Ventures and Mechanism Capital, with participation from Big Brain Holdings, BitScale Capital, Edessa Capital, ID Theory, Metropolis DAO, Mozaik Capital, Newman Capital, Seed Club Ventures and several angel investors.

Bitcoin Ordinals Browser Ord.io Completes $2 Million Pre-Seed Funding

On April 17, Bitcoin Ordinals browser Ord.io announced the completion of a $2 million pre-seed financing led by Bitcoin Frontier Fund and Sora Ventures. Investors include Eden Block, Arca, Longhash Ventures, Daxos Capital, Portal Ventures, UTXO Management, Rubik Ventures, VitalTao Capital, Antalpha Ventures, Kommune Fund, Edessa Capital, PetRock Capital, PG Capital, Shake and Bake Productions, Re 7 Capital, Balaji Fund and angel investors.

Runes DEX Completes $2 Million Seed Round

On April 18, Runes DEX announced the completion of a $2 million seed round of financing, which will be used to expand Runes DEX's technical infrastructure and enhance its user interface. The investment institution has not yet been disclosed. Runes DEX is an AMM platform of the Bitcoin network Runes, dedicated to becoming the link where the future of Bitcoin meets the vitality of digital culture.

On April 17, the GEODNET Foundation announced the completion of a strategic financing of more than US$2 million, with participation from CoinFund, Pantera Capital, VanEck and Santiago R. Santos.

The DePIN project GEODNET is a blockchain-based global navigation network, and its real-time kinematic (RTK) network currently has more than 5,000 GPS/GNSS reference stations registered.

Bitcoin Ecosystem Stablecoin Project Lambda Finance Completes $1.8 Million Angel Round Financing

On April 18, Lambda Finance, a Bitcoin ecosystem stablecoin project, announced the completion of a $1.8 million angel round of financing, with participation from Curve founder Michael Egorov, Hashcow Group, AladdinDAO and others.

NFT social platform Only 1 completes $1.3 million in strategic financing, led by Newman Group

On April 21, Only 1, the NFT social platform of the Solana ecosystem, announced the completion of a strategic financing of US$1.3 million, led by Newman Group, with participation from Folius Ventures, Modular Capital, PetRock Capital, etc. As of now, Only 1 has raised a total of US$4.8 million.

On April 16, RWA project RWA Inc. announced on the X platform that it had completed a $1.175 million private placement financing, with participation from Castrum Capital, Maven Capital, Unreal Capital, Decubate.com, SkyGardians Capital, Undefined Capital, DuckDAO, etc., as a supplement to the more than $9 million in financing promised in previous rounds.

Hedera Ecosystem Web3 Game Platform Circle of Games Completes $1 Million in Equity Financing

On April 18, Web3 gaming platform Circle of Games (COG) announced the completion of a $1 million equity financing, with participation from The Hashgraph Association and Nazara Technologies FZ LLC.

Circle of Games is built on the Hedera blockchain, with the vision of creating a Web3 casual gaming platform that leverages blockchain to provide rewards.

On April 20, the rune analysis infrastructure protocol SatScreener announced on the X platform that it had completed a $500,000 Pre-Seed round of financing, led by Sora Ventures, with participation from Bitcoin Frontier Fund, UTXO Management, Moonwalker Capital, and others.

HTX Ventures announces strategic investment in COREx

On April 15, HTX Ventures recently announced a strategic investment in COREx. This investment emphasizes the strategic value of COREx in the evolving Web3 framework, aiming to revolutionize its field and open a new chapter in the DeFi space.

On April 16, Solana on-chain AI model training platform NavyAI announced on X platform that it has completed its seed round of financing, with participation from X Ventures, AlfaDAO, and Moni. The specific amount and valuation have not been disclosed. NavyAI is a blockchain layer dedicated to AI model training and self-learning, providing cost-effective solutions to reduce AI bias. Through decentralized GPU resources, users can access and train virtual AI models to improve artificial intelligence accessibility and fair innovation.

Camelot Protocol completes angel round of financing to advance its DePIN product development

On April 16, Camelot Protocol announced the completion of its angel round of financing, with participation from DWF Labs, Titanomachy Societe Anonyme, Web3 Research, Defi Lab Ventures and several other well-known individual investors in the industry. The specific amount was not disclosed.

Merlin Chain Completes New Round of Financing, Spartan Group and Hailstone Labs Lead the Investment

On April 17, Merlin Chain announced the completion of a new round of financing, led by Spartan Group and Hailstone Labs, with participation from more than a dozen institutions including Amber Group, Presto Labs, IOBC Ventures, Sandeep (Polygon CEO), UTXO Management (a fund under Bitcoin Magazine), and Primitive Ventures. The specific amount has not yet been disclosed. It is reported that Merlin Chain has facilitated more than 9 million transactions and hosted more than 70 real-time projects, with a total locked value (TVL) of more than 4 billion US dollars.

On April 18, London-based enterprise-level Web3 solution service provider Gate 2Chain announced the completion of a new round of financing, led by Ayre Ventures. The specific amount and valuation data have not been disclosed. The company intends to use the new financing to expand its business and development.

MerlinStarter Completes Seed Round Financing, Amber Group and Others Participate

On April 18, Merlin Ecosystem Launchpad MerlinStarter announced the completion of its seed round of financing on the X platform, with participation from Amber Group, Arkstream Capital, MoonHill Capital, Cogitent Ventures, Mapleblock, CGV, Basics Capital, Waterdrip and Sidedoor Ventures.

On April 19, Skynet Trading, a trading, software, consulting and investment service provider focusing on the digital asset market, announced the completion of a new round of financing, with Seier Capital and Edessa Capital participating. The specific amount and valuation data have not been disclosed. Skynet Trading is an algorithmic trading and investment company focusing on the digital asset market, aiming to use advanced algorithms and market insights to optimize trading strategies and maximize returns for customers in the fast-paced digital asset world.

Coinbase Ventures Joins Bitcoin L2 Network BOB $10 Million Seed Round

On April 15, Bitcoin L2 network BOB (Build on Bitcoin) announced on the X platform that Coinbase Ventures joined its $10 million seed round of financing. The cooperation is to accelerate its development and launch a hybrid L2 network that combines the advantages of Bitcoin and Ethereum.

Earlier in late March, BOB announced the completion of a $10 million seed round of financing, led by Castle Island Ventures, with participation from Mechanism Ventures, Bankless Ventures, CMS Ventures and UTXO Management, as well as some angel investors. BOB is a hybrid layer 2 network that sits on top of the Bitcoin blockchain but is compatible with Ethereum.

Perpetual DEX Aark announces completion of $6 million in financing

On April 17, the perpetual DEX Aark announced the completion of its seed round of financing, with HashKey Capital, Arrington Capital, Cypher Capital, Morningstar Ventures, IVC and Metavest participating. Prior to this, it conducted a Pre-Seed round of financing in the second quarter of 2023, led by Delphi Digital, with participation from OKX Ventures and Big Brain Holdings. The financing amount has reached US$6 million.