SignalPlus Macro Analysis (20240417): US economic data is strong and inflation will continue to rebound

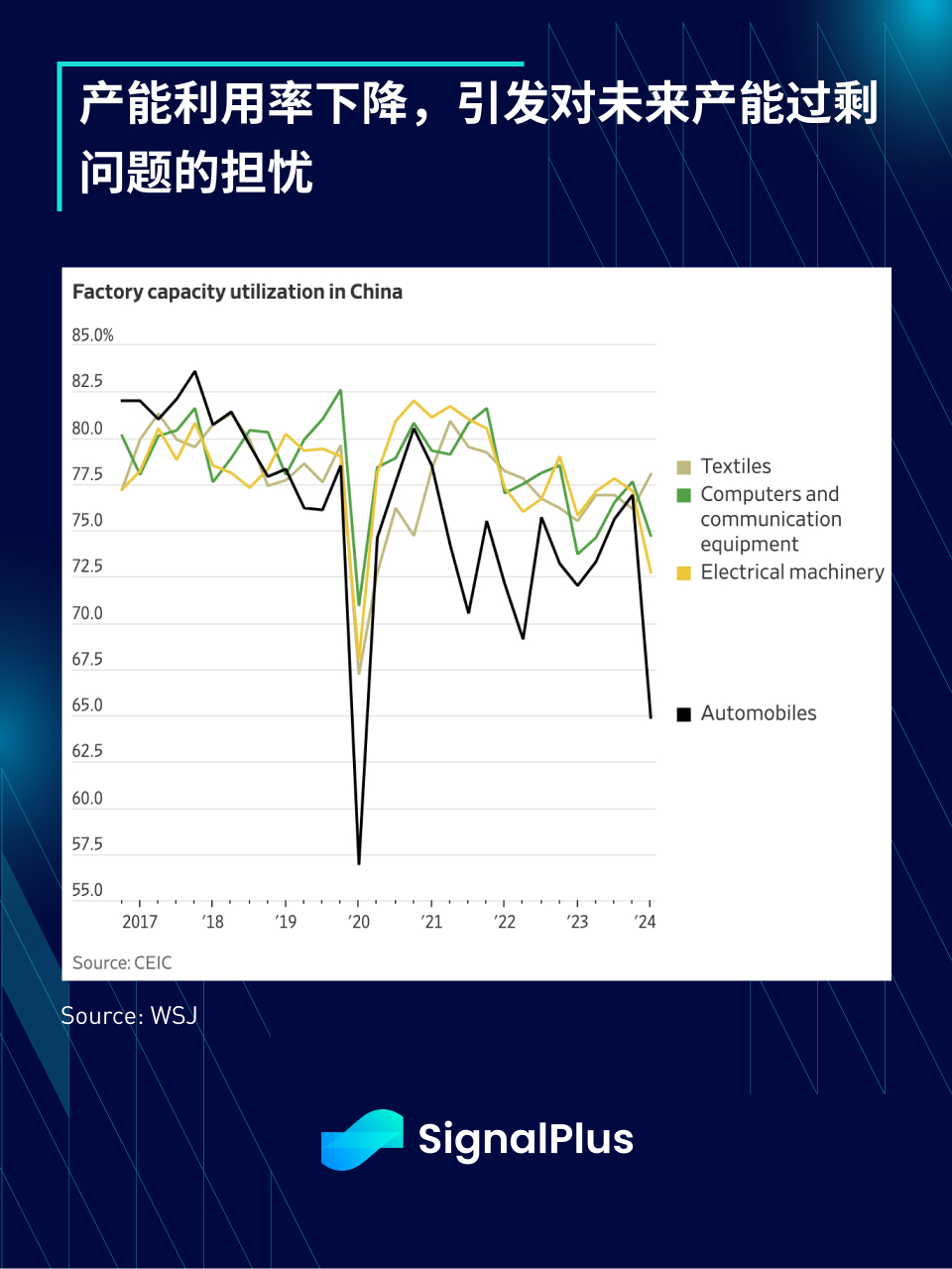

Markets were able to take a breather yesterday, despite intraday volatility in price action and thin order book liquidity keeping profit and loss situations fairly tight. Yesterday’s Chinese economic data got off to a relatively positive start, with second quarter GDP up 5.3% year-on-year, well above consensus expectations of 4.8%, however, optimism quickly faded as investors remained skeptical of fundamental strength, especially given much weaker industrial production and retail sales data, with industrial production up just 4.5% in March, well below expectations of 6.0% and last year’s 7%, while manufacturing capacity utilization plummeted to 73.8%, the lowest level outside of the pandemic since 2015, with the decline in utilization evident even in state-supported sectors such as automobiles, chips, solar panels and other electrical equipment, fueling investor concerns about looming overcapacity.

In the US, recent strong data has led to an upward revision of the Atlanta Fed GDPNow model’s GDP forecast to 2.9%, still well above Wall Street’s forecasts. As inflation concerns mount, the 10-year real yield (adjusted for inflation) has risen back to 2.2%, and the 2/10s real yield curve has steepened to its steepest level since October 2022. Does anyone remember that some macro observers “guaranteed” a recession in 2022-2023 due to an inverted yield curve?

As the reality of stubborn inflation and a strong economy cannot be ignored, the entire Fed, including the Chairman himself, has been forced to walk back their dovish rhetoric, leaving the Fed in an isolated position regarding the future trajectory of policy:

Fed Chairman Powell: "Recent data clearly does not give us greater confidence, but rather suggests that it may take longer than expected to reach that level of confidence"

Fed Vice Chairman Jefferson: If "inflation is more persistent than I currently expect," U.S. interest rates may have to remain higher for longer

Boston Fed's Collins: "It may take longer than previously thought" and "the first quarter CPI data was higher than I hoped"

Richmond Fed's Barkin: Hope to see more "signs of a broader slowdown in inflation, not just commodity inflation"

New York Fed's Williams: "Rate cuts don't seem imminent," suggesting "there are certainly scenarios where we need higher rates, but that's not the baseline scenario I think"

Compared to the narratives of other developed market central banks:

ECB's Lagarde: Unless there are major surprises, the ECB will start cutting interest rates soon; "We are observing the process of slowing inflation, which is progressing in line with our expectations"

BoE's Lombardelli: Rate cuts 'are the way forward'

Bank of Canada's Macklem: "We don't have to follow the Fed's actions, we have to do what Canada needs"

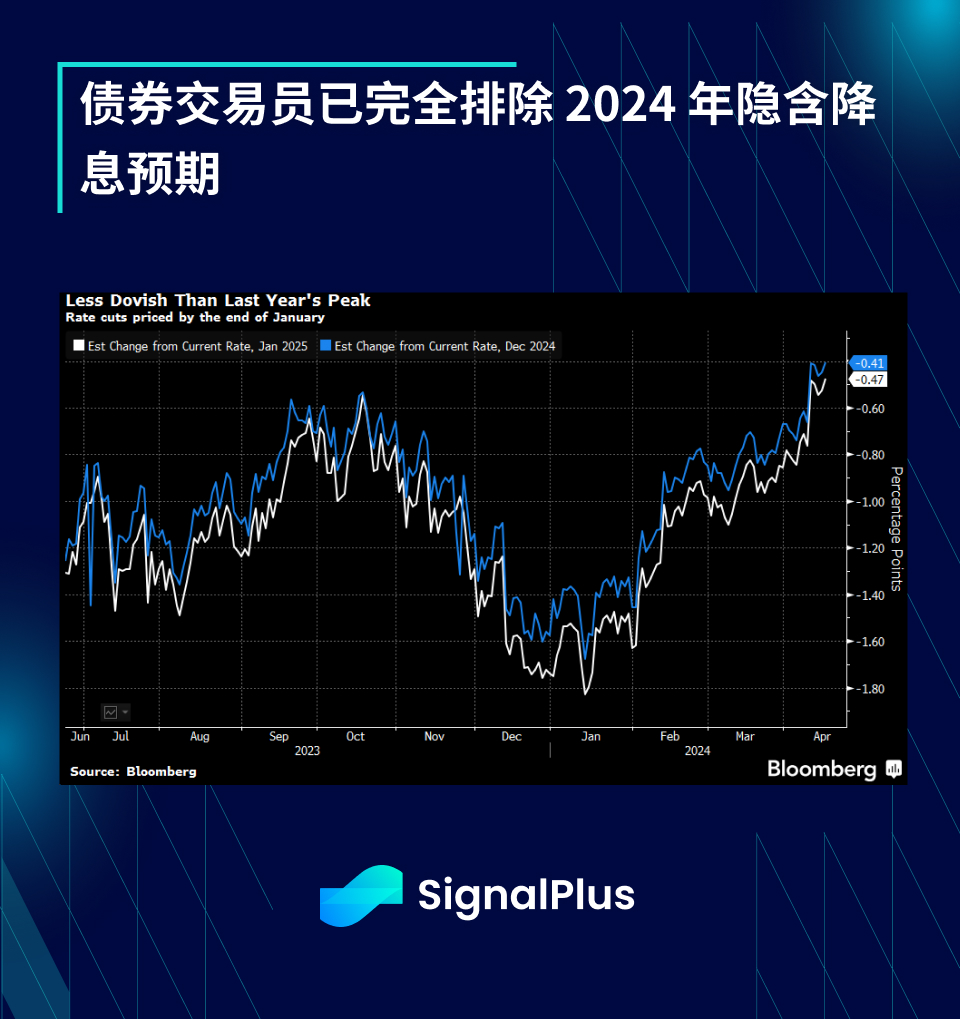

Against the backdrop of the Fed's U-turn, the interest rate market has ruled out most of the expectations for rate cuts in 2024, and the dovish sentiment in the first quarter has completely disappeared, even breaking through the hawkish high point in October last year. In addition, the policy differences between the Fed and other central banks have brought strong buying to the US dollar, with the US dollar above 155 yen and the US dollar above 7.10 yuan against the RMB, and the overall DXY index has returned to its strongest level since 2022.

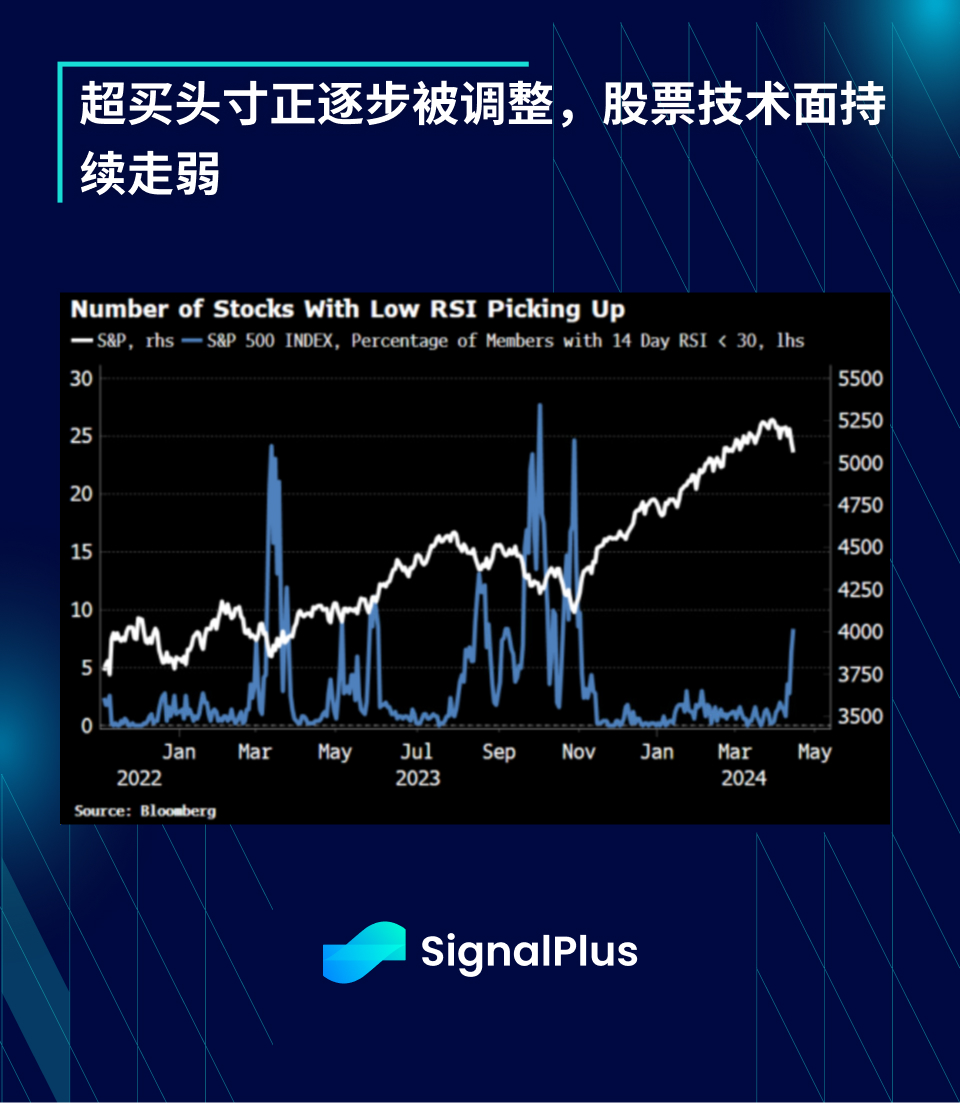

Moreover, the spillover effects of rising real yields are more severe this time around, with stocks finally succumbing to the “higher rates for longer” rate outlook, although this is more due to overbought positions than changes in fundamentals. The negative correlation between U.S. stocks and yields has increased, causing the SPX index to fall 1% for the first time since October. In addition, the stock VIX closed above 19 for the first time since Halloween, and the stock implied correlation has jumped to 23, compared to just 12 at the end of March. Ongoing tensions in the Middle East may keep implied volatility at elevated levels in the short term.

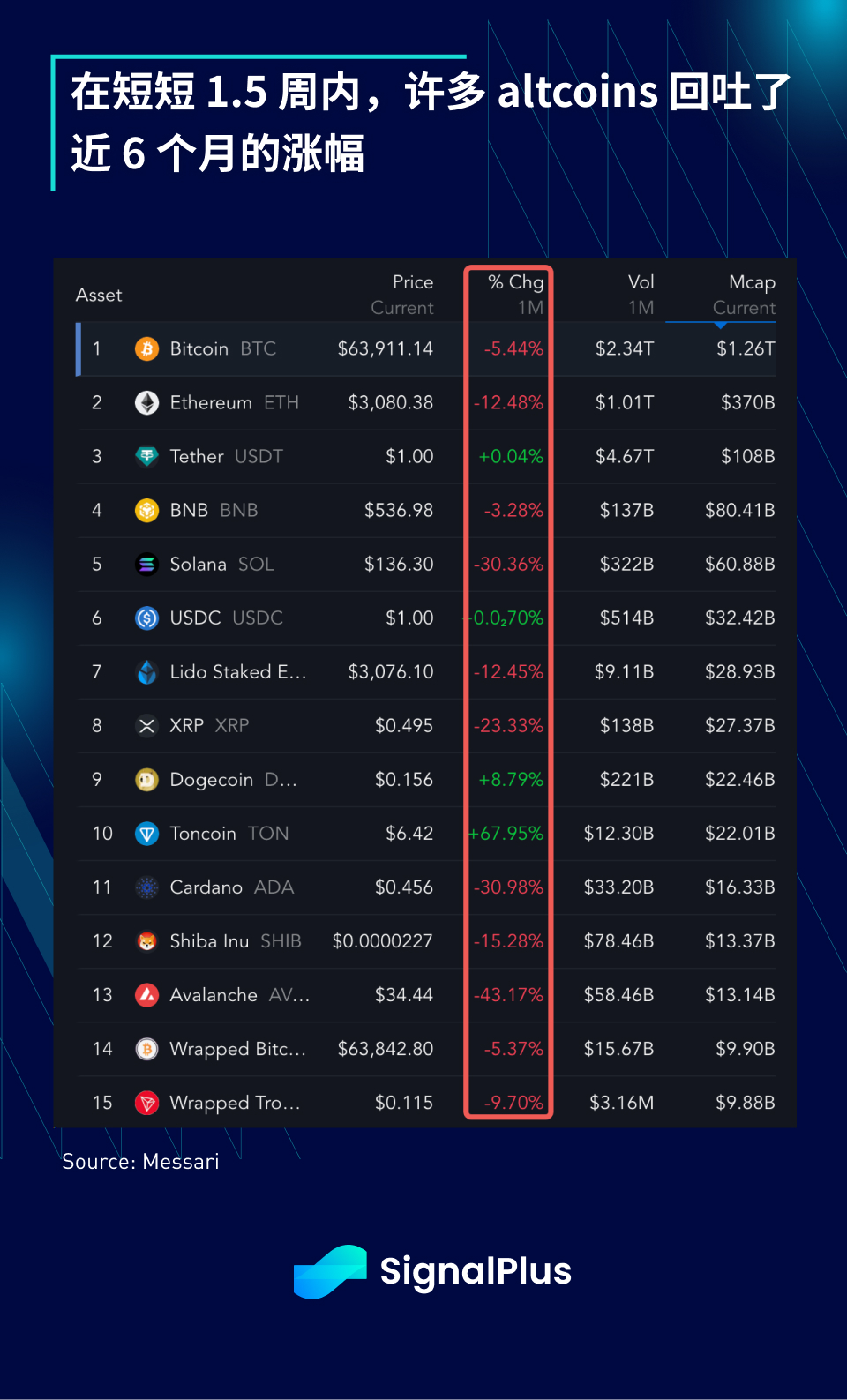

In terms of cryptocurrencies, BTC price has not broken further downwards, hovering at $64,000 as of this writing. However, other tokens have performed much worse than BTC, with the ETH/BTC ratio continuing to fall to a near 4-year low as the likelihood of the SEC approving an ETH ETF in this round becomes increasingly low, while altcoins have lost 30% to 40% of their value in the past month, much higher than BTC's -5%. The market has seen severe losses in the past 1.5 weeks, and it will take quite a while to recover.

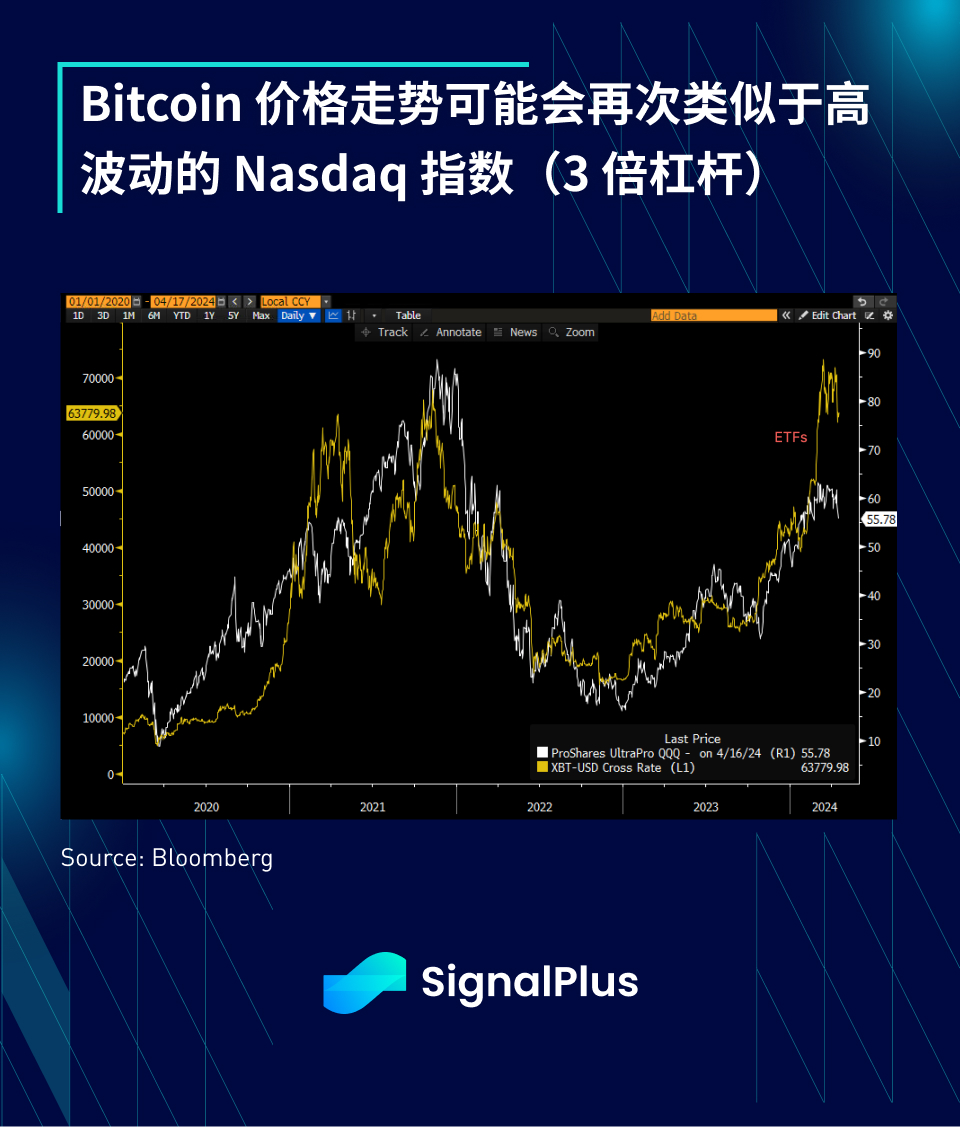

Retail "buy the dip" interest is low and ETF inflows continue to slow, with Blackrock's IBIT being the only ETF to show net inflows since last Friday. As the current FOMO narrative is largely over, ETF inflows are expected to be less significant in the short term, and we expect BTC price action to once again resemble the more volatile Nasdaq index, reverting to the behavior pattern of the past 4 years.

In other words, Bitcoin is no longer like digital gold, but more like a leveraged beta tool. Hopefully, in the upcoming earnings season, similar technology stocks will be able to hold their ground with strong profit results. Good luck to everyone!

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlusCN, or join our WeChat group (add assistant WeChat: SignalPlus 123), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website: https://www.signalplus.com