Crypto game investment review: out of the bear market, the primary market is cautiously optimistic

Original author: Zen

In the first quarter just past, as the price of cryptocurrencies rose, the primary market gradually recovered. According to PitchBook statistics, a total of US$2.52 billion was raised in the cryptocurrency and blockchain fields in the first quarter of 2024, a month-on-month increase of 25%. The investment mainly involved L1/L2, DeFi, AI, DePIN and Web3 games. However, according to the blockchain game report for the first quarter of 2024 jointly released by DappRadar and BGA, related investment in the vertical field of Web3 games is actually on a downward trend. This trend is a correction after the investment boom in the metaverse and games during the epidemic, not only Web3 games, but also the traditional game industry.

Primary market in the early stage of bull market: cautious and optimistic

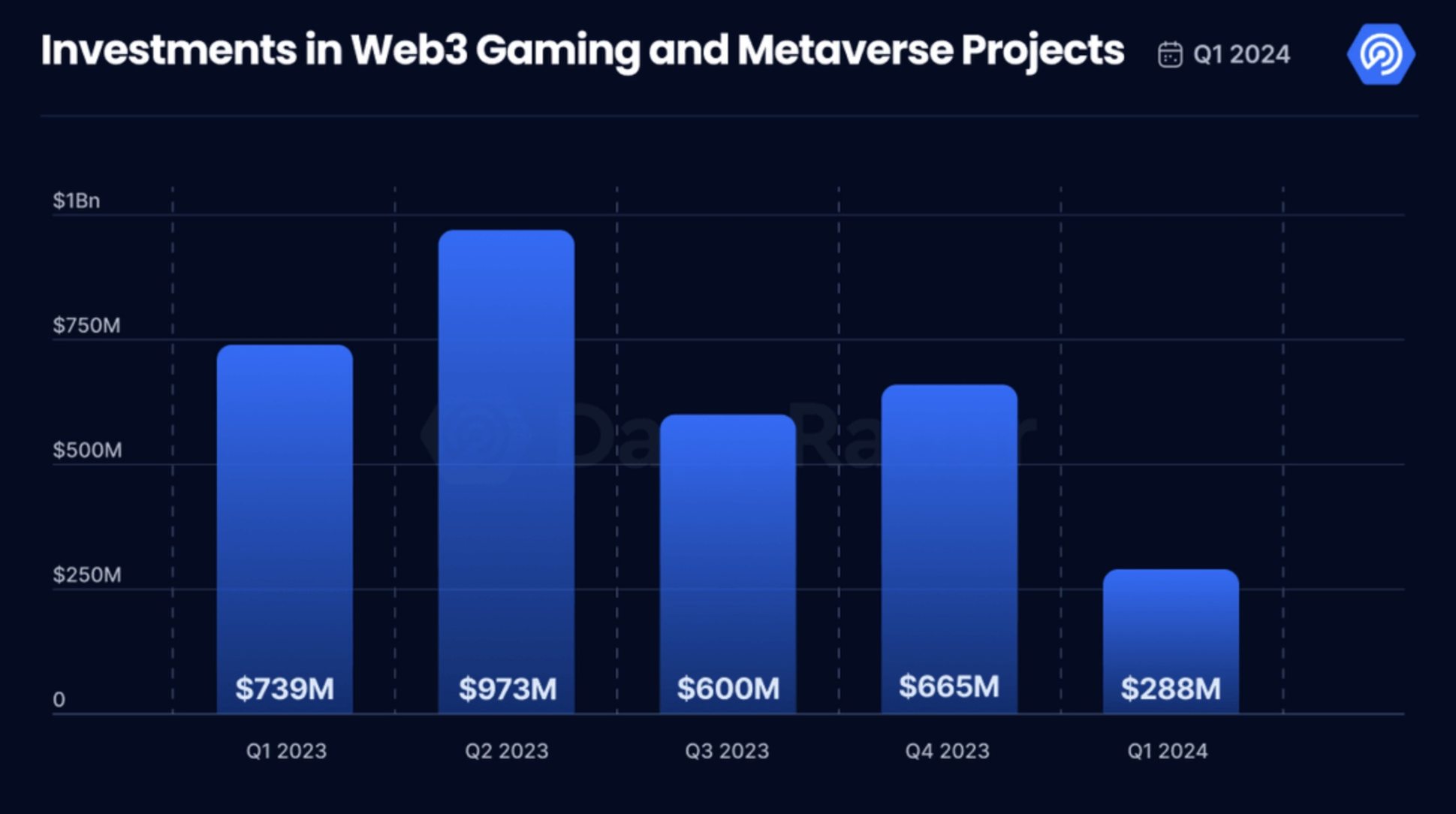

The first quarter blockchain game report pointed out that the investment prospects in the Web3 and blockchain game fields are cautious and optimistic. The blockchain game industry received $288 million in financing in the quarter, a significant decline from previous quarters. Its analysis said that this cautious attitude can be attributed to the challenging year in the past, and many companies are waiting for the results of early investments. In addition, the focus of these investments is mainly on Web3 games and infrastructure, indicating that the industry is in a period of infrastructure construction aimed at enriching the Web3 game ecosystem.

Considering that Bitkraft Ventures announced the launch of a $275 million gaming fund in early April, and according to the PANews column "Financing Weekly Report", the blockchain gaming sector raised nearly $40 million in the first week of this month, overall, the performance of the Web3 gaming industry in the primary market since the beginning of the year has basically remained at the same level as in the second half of last year, and has shown an explosive trend in the past month.

In March, the NFT card game Parallel and AAA game developer Gunzilla Games had impressive large-scale financing. Parallel completed a new round of financing of US$35 million at the end of the month, with participation from Solana Ventures, Amber Group and others. In the previous round, Parallel raised US$50 million from Paradigm at a valuation of US$500 million in October 2021; the studio's current strategy focuses on expanding the player base, including the implementation of the Parallel Ambassador Program and leveraging influential partnerships. It is worth mentioning that several well-known Hearthstone game anchors, represented by Thijs, recently endorsed Parallel, sparking conflicts between the communities. Crypto media Decrypt commented: "A lot of the hatred about the traditional gaming community seems to be due to crypto games trying to compete with their favorite 'Web2' games and the suspicion that follows."

Gunzilla Games also raised $30 million in a round of financing led by Avalanche Blizzard Fund and CoinFund at the end of the month. It had completed a $46 million financing in August 2022, led by Republic Capital, and participated by Griffin Gaming Partners, Animoca Brands, Jump Crypto, CoinFund, Shima Capital, etc. In addition, Gunzilla raised $25 million when it was founded in 2020, and the studio's total financing amount has exceeded $100 million. Gunzilla Games is about to launch the battle royale game Off the Grid. This free third-person shooter game will be released on Sony PlayStation, Microsoft Xbox and PC platforms.

These investments underscore the strategic shift toward creating immersive, player-centric experiences in the blockchain gaming world. As the industry continues to go through a post-challenging recovery phase, building and enhancing Web3 games and infrastructure remains a top priority, laying the foundation for future growth and innovation.

However, in the gaming industry, project bankruptcies and failures are very common. According to a survey of more than 500 mobile game developers by game service company SuperScale, 83% of mobile game projects will die within three years, nearly half of the projects (47%) have died within 12 months of launch, and 17% of games even have a life cycle of less than 6 months. The same is true for Web3 games, which are currently a niche market. According to Coingecko statistics, 2,127 of the 2,817 Web3 games launched between 2018 and 2023 have failed, accounting for 75.5%.

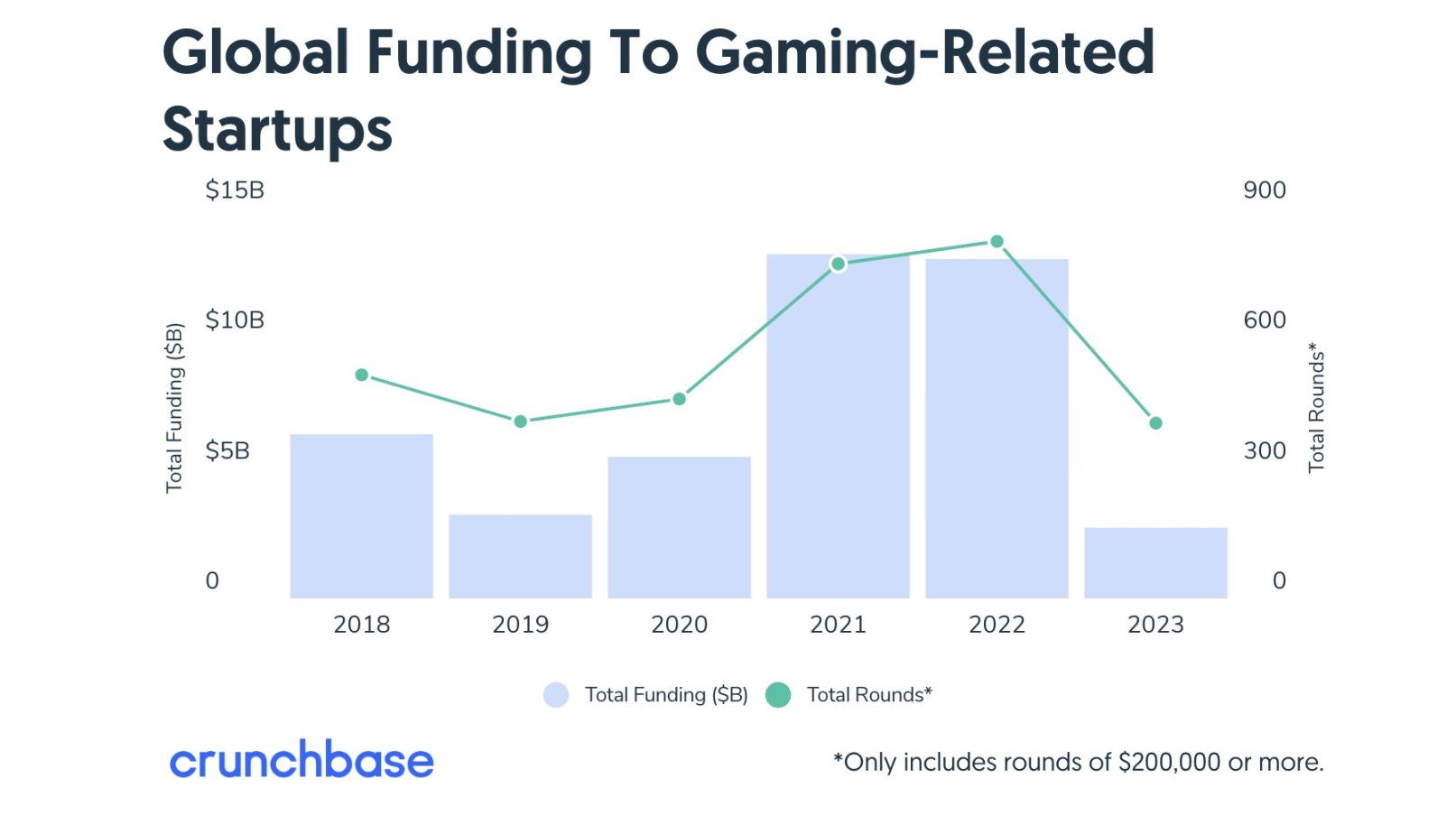

Investment correction after the epidemic, the game industry investment and financing market entered a low period

In 2023, the investment and financing market of the entire gaming industry was very sluggish. According to Crunchbase data, the investment in the market from seed stage to growth stage has hit the lowest point in many years. Last year, no digital game company received hundreds of millions of dollars in late-stage venture capital, large-scale financing before IPO disappeared, and early-stage financing continued to be tepid. According to Crunchbase's statistics on global gaming market investment in the past six years, the total amount of funds raised by the industry in 2023 decreased by 79% year-on-year. By country and region, the decline in investment in the US market was as high as 86%.

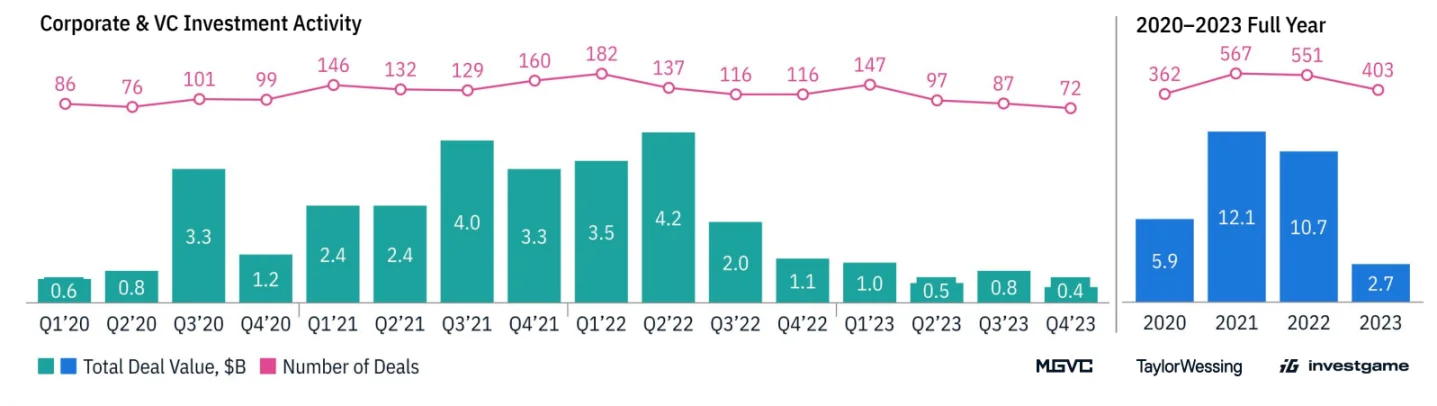

In terms of specific amounts, according to statistics from Investgame, a game investment data analysis company, venture capital and private investment totaled US$2.7 billion in 2023, involving 403 financing events. Compared with the annual financing total of US$10.7 billion in 2022, it has dropped by 75%. It is worth noting that the number of financing events has not decreased that much, "only 21% less than" 551. This has reduced the average financing size by two-thirds year-on-year, from US$19.4 million in 2022 to US$6.7 million in 2023. InvestGame described this sluggish market as a correction to the inflated financing activities during the COVID-19 pandemic. The industry's financing volume remains higher than pre-COVID-19 levels, but the number of late-stage financings is small, so the total amount of funds cannot be increased.

Joanna Glasner, a business and technology columnist for Crunchbase News, believes that the coldness of the primary market may be caused by changes in consumer habits. During the worst period of the global COVID-19 pandemic, home consumers spent more time and money on video games, but now consumption is increasingly turning to activities outside the home. She said that the decline in adjacent categories such as Web3 and Metaverse has also affected the gaming sector. It was very popular for startups to integrate plug-in products such as NFTs in games or metaverse games in 2021 and 2022, but it is not as popular now.

Josh Chapman, co-founder and managing partner of gaming venture capital firm Konvoy Ventures, believes that the gaming boom triggered by the pandemic has attracted increased activity from tourist investors, and predicts that the industry will return to normal growth in 2024. Chapman also said that the decline of the Web3 gaming industry in 2023 is also the reason for the overall decline in transaction volume. "A lot of Web3 and cryptographic technologies in games disappeared last year, and the lack of Web3 gaming companies entering the market has led to an overall decline in transaction flow. This is a sub-industry of the gaming industry, and other industries have maintained a fairly strong momentum."

It is worth mentioning that Konvoy Ventures announced the launch of a new fund of US$150 million in July 2022, and said that part of the funds would be invested in blockchain and crypto-related games. Prior to this, Konvoy Ventures had invested in Axie Infinity developer Sky Mavis, NFT sports game Genopets, and NFT pet game Ready Player Me. As Web3 games entered the bear market along with the crypto industry, star projects such as Axie Infinity inevitably hit the bottom, and Konvoy Ventures did not seem to inject more funds into the field.

Web3 game investment and financing "back to the pre-liberation era"

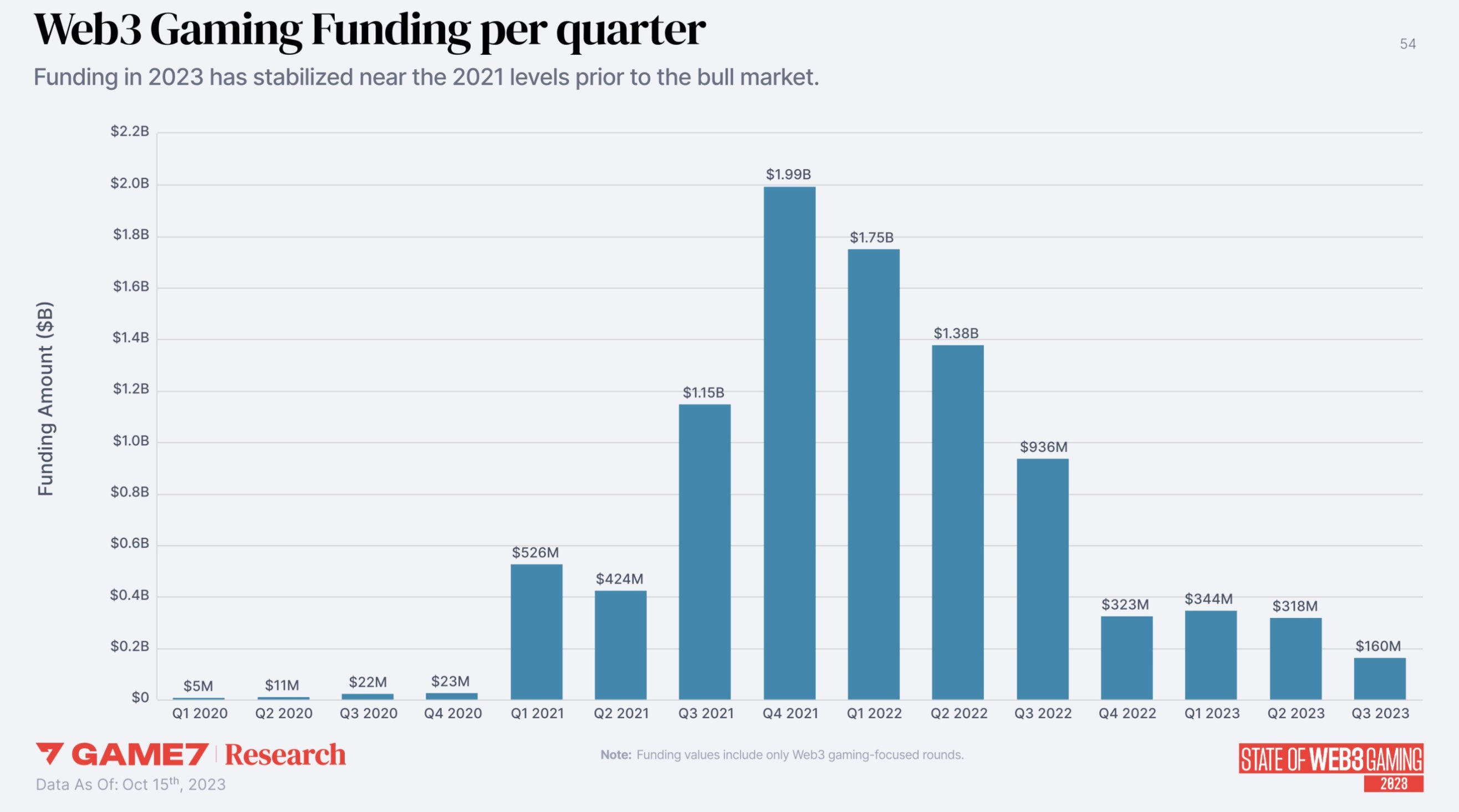

Against the backdrop of a weak overall gaming market and a cold winter in the crypto market, investment and financing in the Web3 gaming sector also showed a significant downturn in 2023. According to statistics from Game 7, a decentralized organization focused on blockchain games, the Web3 gaming industry continued to decline in the first three quarters of 2023, from $344 million in the first quarter to $160 million in the third quarter. The scale of financing in a single quarter was halved and has stabilized at a level lower than the eve of the 2021 bull market.

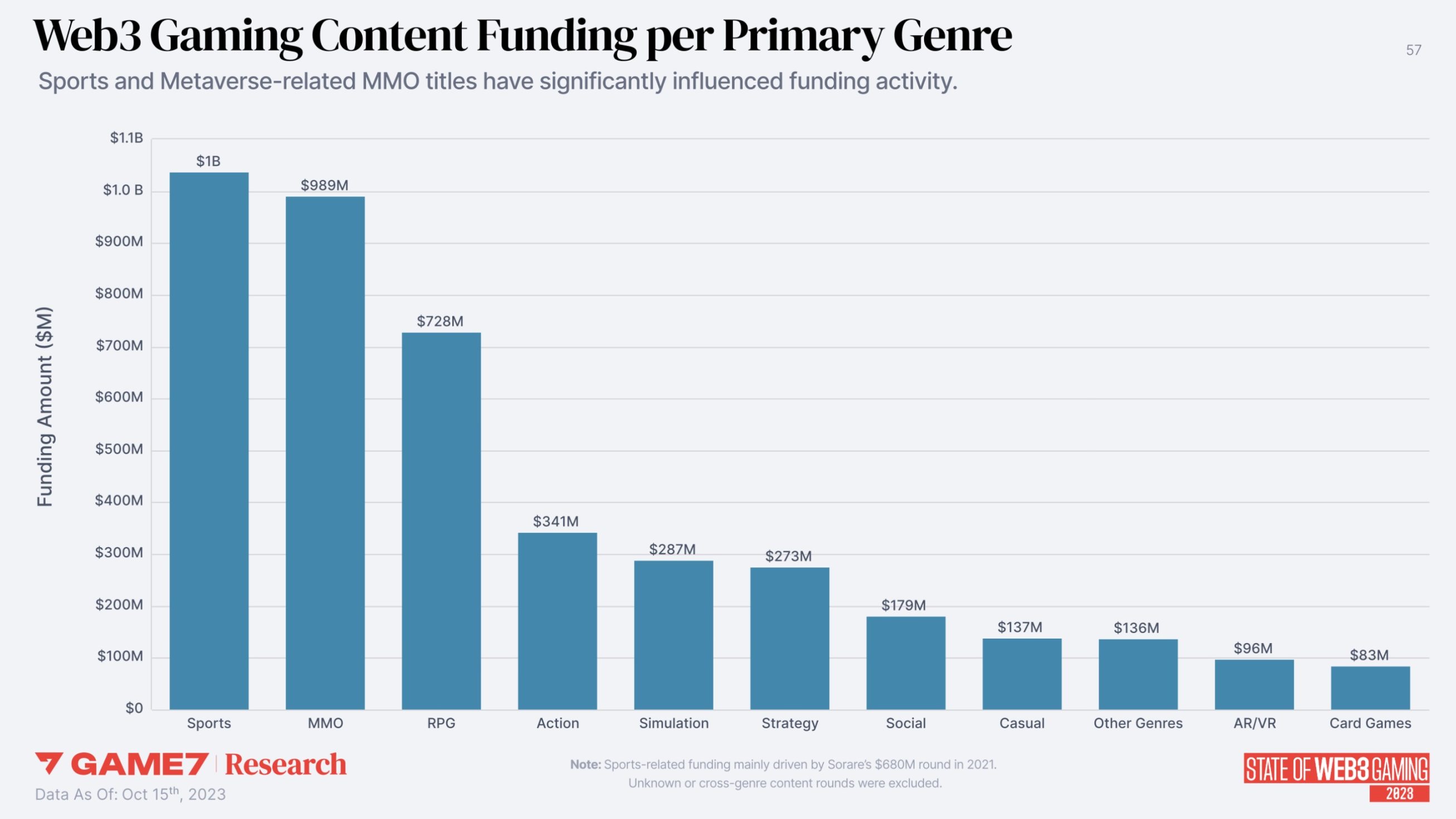

In addition, after Game 7 classified the game types, it was found that in recent years, sports, MMO (massively multiplayer online games), and RPG (role-playing games) blockchain games have raised the most funds, ranking in the top three, far ahead of other categories. It should be pointed out that the football game Sorare completed a $680 million Series B financing in 2021 with a valuation of $4.3 billion, accounting for nearly 70% of the total funds in the same category. In addition, action, business, and strategy games have also received some attention from the market.

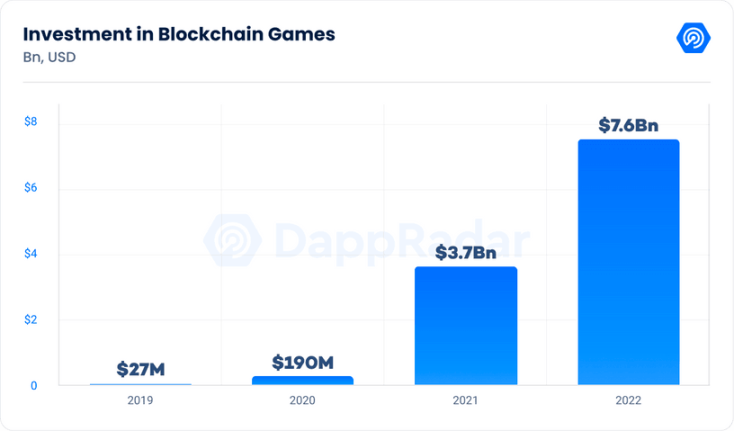

Although there are some discrepancies in the data, the report jointly released by DappRadar and the Blockchain Game Alliance (BGA) also shows the downturn in the primary market last year. The report also counts the funds raised by VCs that focus on the gaming sector and intend to invest in Web3 games. According to its statistics, a total of US$2.9 billion will flow into the Web3 game and metaverse industry in 2023, a decrease of 61% compared with the US$7.6 billion investment in 2022, and lower than the US$3.7 billion in 2021.

The report points out that among the funds flowing into the Web3 game and metaverse industries, game infrastructure, games and metaverse, and game investment companies are basically in a three-way competition. This distribution shows a strong focus on the core aspects of blockchain game and metaverse development, especially in terms of game experience and supporting infrastructure. It interprets this as a positive signal for the industry and believes that it shows that the industry is focusing on providing top games. This strategy of quality over quantity aims to improve the standards and public awareness of blockchain games to promote wider adoption and long-term market success.