At the crossroads of the market, what is the basis for the various "experts" to be bullish or bearish?

Original | Odaily Planet Daily

Author | Azuma

There are only a few days left before Bitcoin's fourth halving, but the predictions of the leading "order masters" for the market outlook show a completely different direction.

Doujinshi generally believe that the darkest moment has passed; neither the higher-than-expected CPI nor the shelving of interest rate cuts can interrupt Bitcoin's rising trend; the main reason for the adjustment in the past few days is that liquidity was temporarily drained due to the arrival of tax filing day; and The Air Force believes that unexpected and persistent inflation has put risk assets on the verge of a sharp correction...

Below, we will take stock of the seed players on both the long and short sides and their main remarks, hoping to help everyone make correct operations in the market outlook.

The four kings of bulls: GCR, Arthur Hayes, Chris Burniske, Matt Hougan

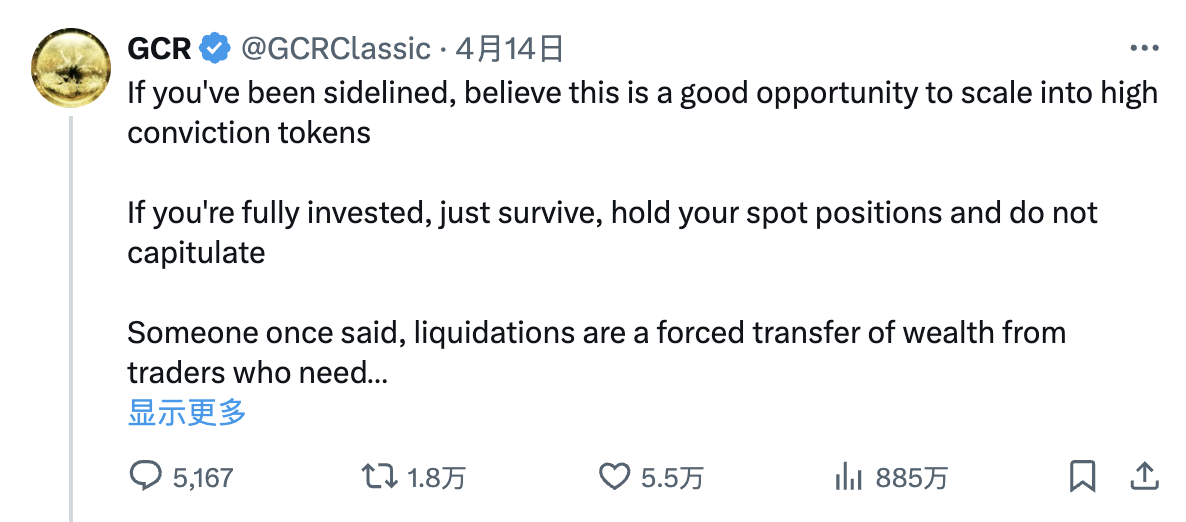

GCR: Hold on to the spot and don’t surrender!

After the plunge in the early morning of April 14, the legendary trader GCR (who had shorted DOGE, SHIBA, and LUNA at the top), who had not published trading remarks on social media for a long time, publicly called for long. This news has now been read by nearly 9 million people on X , and the number of likes reached 55,000.

GCR said: “If your position is insufficient, this will be a good opportunity for you to expand your position on the token with stronger consensus. If you are already full, then stick to it and stick to your spot position. Don't surrender. Someone once said that the essence of liquidation is a forced transfer of wealth from traders who need leverage to wealthy spot holders. I have retired from social media, but I don't want to see the future still so bright for my brothers. Next was eliminated.”

Arthur Hayes: The bottom has been reached, start charging!

Arthur Hayes, co-founder of BitMEX, has long become one of the most popular “order leaders” in the market. Earlier this month, Arthur predicted that from April 15 to May 1, the U.S. annual tax filing period (April 15 is the tax deadline) will drain market liquidity. In addition, the Federal Reserve continues to shrink its balance sheet, and Bitcoin is expected to The halving event on April 20 may bring short-term oversold conditions, and the market may experience extreme weakness. However, starting from May 1, as the Federal Reserve slows down its balance sheet reduction and the U.S. Treasury Department uses funds to stimulate the market, a new round of crypto bull market is expected to begin.

With the sharp decline in the past few days, Arthur also turned his gun and began to shout long.

On April 15, Arthur posted on the X platform and shouted: " The bottom has arrived, start charging! "

On April 16, Arthur said again: “ Until the weekend before the U.S. tax filing deadline on April 15, the trends of Bitcoin and gold remained in sync. Also during this weekend, the situation in Israel and Iran escalated, and the price of Bitcoin The market fell sharply, and gold was closed. On Monday, there was no volatility after the market opened, and Bitcoin’s general trend still works. People just need to pay their taxes. ”

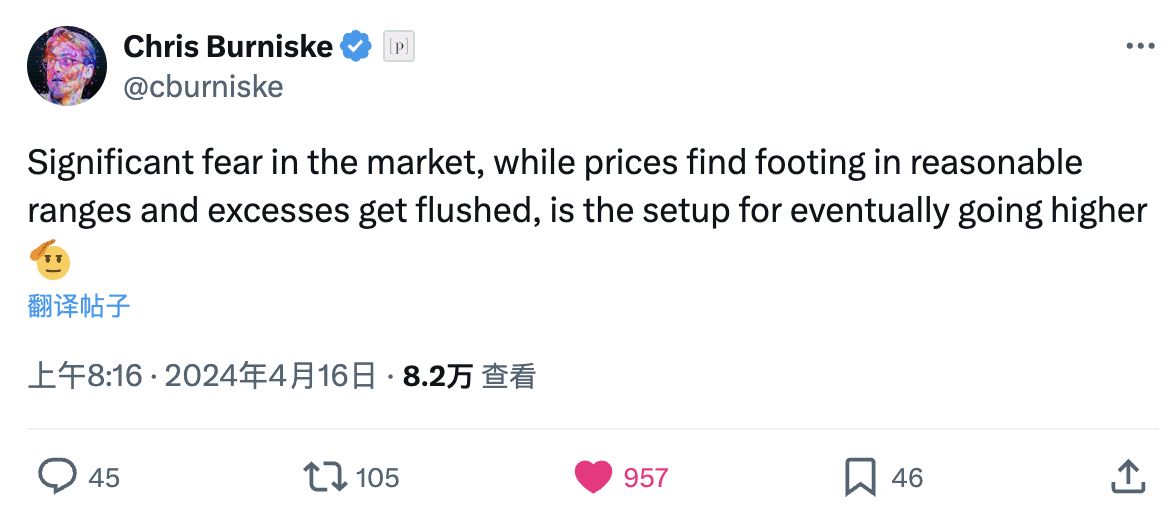

Chris Burniske: How dare you clear your positions before the halving? ? ?

Chris Burniske, the former head of encryption at ARK Invest and now a partner at Placeholder VC, had previously accurately predicted that the market would see a significant correction after the ETF was approved.

After this round of declines, Burniske also called out many times.

Earlier this morning, Burniske wrote: " There is significant panic in the market, but prices have gained a firm foothold within a reasonable range and excessive fluctuations have been eliminated. This will be the basis for the final rise in prices. "

Afterwards, Burniske also forwarded a post about "You are actually clearing out stocks 4 days before the halving", accompanied by pictures of whales swallowing, or implying that giant whales are eating chips at low prices due to panic selling by retail investors.

Matt Hougan: Mere interest rates are nothing to worry about!

Bitwise Chief Investment Officer Matt Hougan (the one on the left in the picture below) has always been a representative of Bitcoin’s “dead bulls” active in the social media field.

When Bitcoin fell last week due to higher-than-expected CPI and a delay in interest rate cuts, Hougan said, “I don’t think higher-than-expected CPI will interrupt Bitcoin’s rising trend. Whether the Federal Reserve will cut interest rates in June is not related to the price of Bitcoin.” The long-term drivers are just marginal factors, and ETF flows and growing deficit concerns are more important, and these data are bullish for Bitcoin. ”

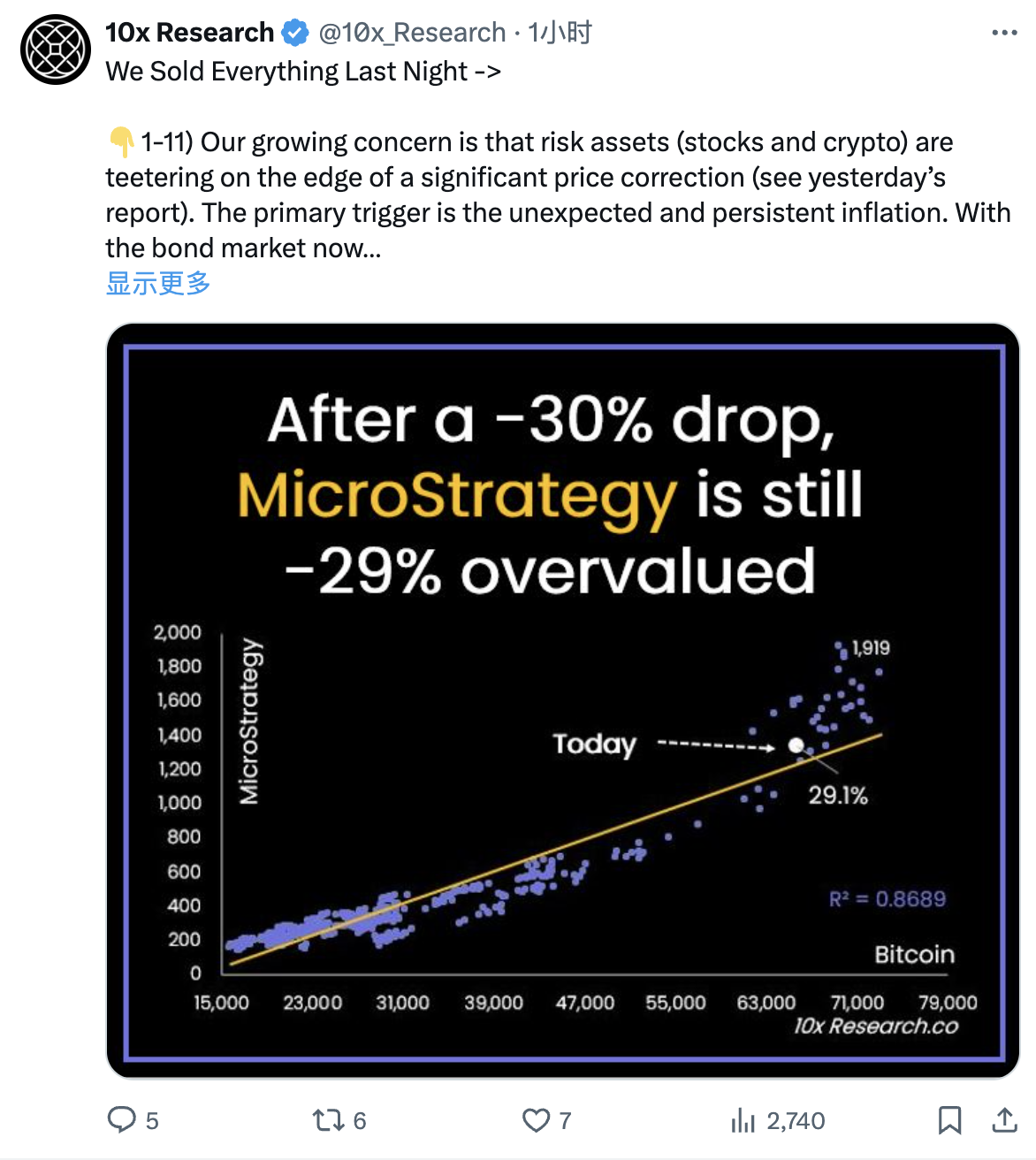

Long shot: 10x Research

Compared with many military forces, the Air Force has relatively few well-known players who respond to everything. Originally, Arthur, who was bearish in April, would be the best representative. However, as Arthur turned bullish, the Air Force was in urgent need of a new banner.

This morning, 10x Research, a well-known institution that was still calling for 80,000 orders last week, suddenly stated that it had "cleared all its positions last night." This development also triggered extensive discussions on social media.

When explaining the logic behind liquidation, 10x Research said the main reasons were:

1. We are increasingly concerned that risk assets (equities and cryptocurrencies) are both in critical condition and may experience significant price corrections. The main trigger is unexpectedly persistent inflation, with current bond market forecasts pointing to fewer than three rate cuts and with the 10-year Treasury yield above 4.50%, we may have reached the point where risk assets An important turning point.

2. It must be understood that trading is an uninterrupted game full of opportunities. The key to trading is to continually analyze the market and spot opportunities when the times are favorable . Sometimes we will advocate strategies that increase risk (to gain more returns), while at other times preserving capital is the priority, allowing you to trade at a higher risk level. Take advantage of opportunities when they are low.

3. ...(The 10x Research report does have a third item, but the minimum membership fee requirement to read the report is $340 a year. I chose to use the $340 to hunt for the bottom.)

risk warning

Finally, it should be emphasized that the above content is only a summary of the market forecasts of some KOLs who have high attention to the current market. The predictions and reasons of each major KOL in the article are their personal opinions and do not represent the opinions of Odaily Planet Daily.

Investment risks are extremely high, please do not trust others' orders and be sure to DYOR before operating.