One-week financing express | 33 projects received investment, with a total disclosed financing amount of approximately US$537 million (4.8-4.14)

According to incomplete statistics from Odaily, a total of 33 domestic and overseas blockchain financing events were announced from April 8 to April 14, which was a decrease from last week’s data (38 cases). The total amount of financing disclosed was approximately US$537 million, a significant increase from last weeks figure (US$222 million).

Last week, the project that received the most investment was Layer 1 blockchain Monad Labs ($250 million); Bitcoin mining machine manufacturer Auradine followed closely behind ($80 million).

The following are specific financing events (Note: 1. Sorted according to the announced amount; 2. Excludes fund raising and mergers and acquisitions; 3. *Represents companies in the traditional field where some of the business involves blockchain):

Layer 1 blockchain Monad Labs completes $225 million in financing, led by Paradigm

On April 9, Layer 1 blockchain Monad Labs announced the completion of US$225 million in financing, led by Paradigm, with participation from Electric Capital, SevenX Ventures, IOSG Ventures and Greenoaks. The project plans to challenge competitors such as Solana and Sui. It is reported that this transaction is the largest financing in the cryptocurrency field so far in 2024.

On April 10, Bitcoin mining machine manufacturer Auradine announced the completion of an $80 million Series B financing, with participation from StepStone Group, Top Tier Capital Partners, MVP Ventures, Maverick Capital, Celesta Capital, Mayfield Fund and Marathon Digital. It is reported that this round The financing came in the form of a mix of equity and debt, valuing the company at more than $500 million.

On April 12, L1 public chain Berachain announced that its Series B financing has increased to US$100 million, approximately 45% higher than previously reported. This round of financing was jointly led by Brevan Howard Digital’s Abu Dhabi branch and Framework Ventures. , Polychain Capital, Hack VC and Tribe Capital and other institutions participated in the investment.

On April 9, Thesis, the developer of Bitcoin L2 network Mezo, completed a $21 million Series A financing, led by Pantera Capital, with participation from Multicoin, Hack VC, Draper Associates and others.

Singapore’s Web3 smart market maker exchange Ubit completes US$20 million in Series A financing

On April 8, Singapores Web3 smart market maker exchange Ubit completed a $20 million Series A financing. The investor information has not yet been disclosed. It is reported that the new funds will be used to accelerate the development of the exchange ecosystem and promote its technology development, team expansion and Global promotion aims to create a more attractive social trading experience.

On April 10, Bitcoin L2 development company Alpen Labs announced the completion of US$10.6 million in financing, led by Ribbit Capital, with participation from Castle Island Ventures, Robot Ventures and Axiom Capital. Alpen Labs developed the Bitcoin Rollup infrastructure last year to bring smart contract functionality to the Bitcoin network.

DePIN company Uplink completes $10 million in financing, led by Framework Ventures

On April 11, DePIN company Uplink announced the completion of US$10 million in financing, led by Framework Ventures. It is reported that Uplink aims to reduce dependence on traditional centralized telecommunications providers and motivate users and enterprises to participate in and use the network by rewarding tokens.

On April 8, the multi-chain one-click interaction SocialFi project Young Protocol announced on April 1 that it had completed a Pre-Seed round of financing at a valuation of US$8 million. The specific financing amount was not disclosed. Eureka Meta Capital led the investment, and Young Protocol stated that it The community will launch within April.

On April 9, Web3 beauty startup Kiki World announced the completion of a US$7 million seed round of financing, with participation from a16z Crypto, Estee Lauders New Incubation Ventures, OrangeDao and 2 Punks Capital. Kiki World only helps consumers co-create products with the help of Web3 technology, allowing community members to vote on the features they want before the beauty product is produced.

On April 8, blockchain scaling infrastructure provider Lumoz completed a $6 million Pre-Series A round of financing at a $120 million valuation from OKX Ventures, HashKey Capital, KuCoin Ventures, Comma 3 Ventures, Kronos Ventures, Kernel Ventures and Polygon Co-founder Sandeep Nailwal and others participated in the investment.

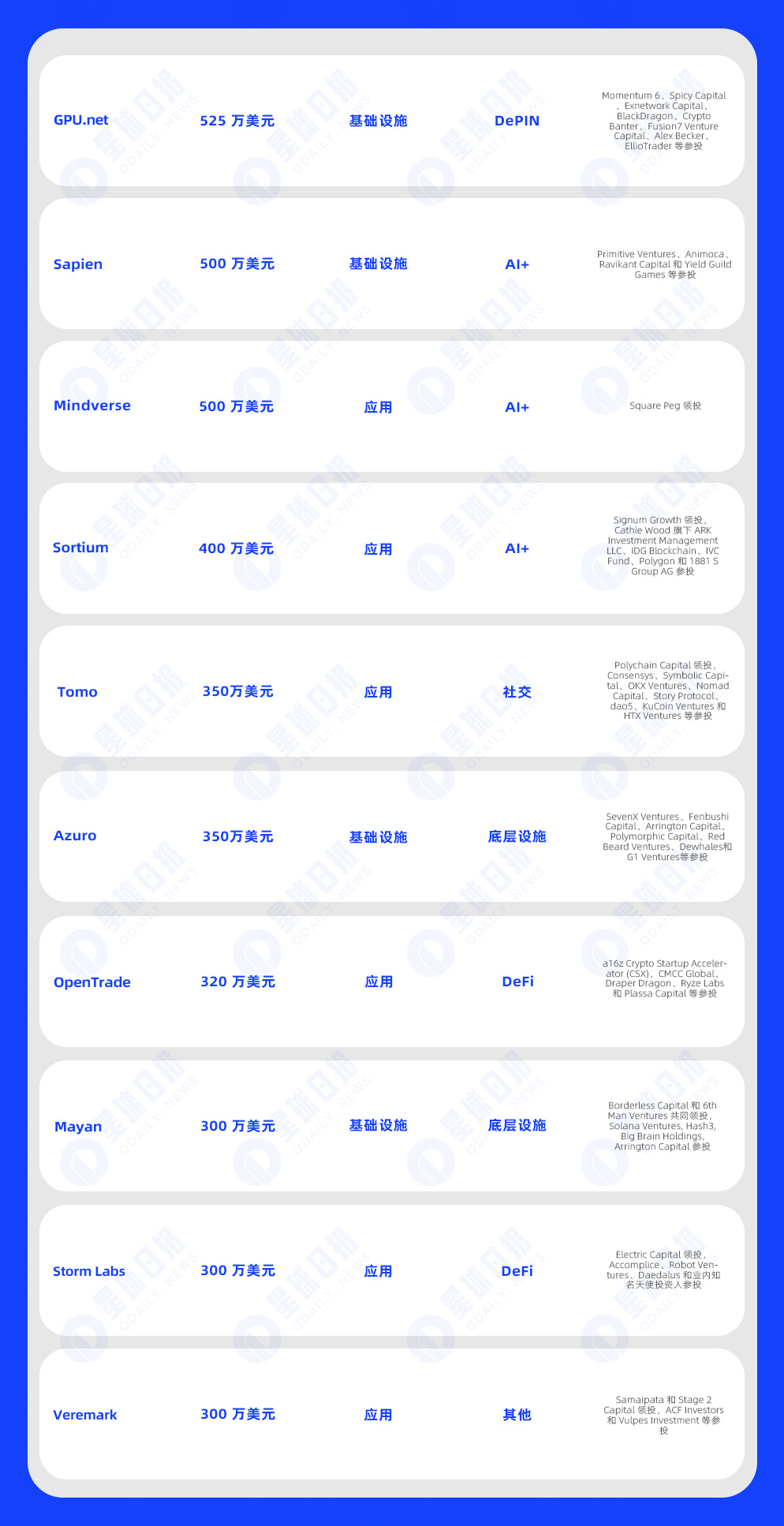

On April 11, decentralized GPU infrastructure company GPU.net announced the completion of a $5.25 million Series A financing, with participation from Momentum 6, Spicy Capital, Exnetwork Capital, BlackDragon, Crypto Banter, Fusion 7 Venture Capital, Alex Becker, ElliotTrader, etc. .

On April 9, blockchain AI data labeling startup Sapien announced the completion of a US$5 million seed round of financing, with participation from Primitive Ventures, Animoca, Ravikant Capital and Yield Guild Games. Sapien will use the funds to enhance its artificial intelligence to Better guidance and assistance with its data labeling will also be used to expand Sapiens blockchain infrastructure to build out its human labeling team.

AI company Mindverse completes US$5 million in seed round financing, led by Square Peg

On April 11, Singapore-based AI company Mindverse completed a US$5 million seed round of financing, led by Square Peg. Mindverse will use the funding from this round to further conduct research and product development to advance its large-scale personalization model.

Web3 game studio Sortium raises over $4 million in funding, led by Signum Growth

On April 11, Sortium, a Web3 game studio focusing on generative AI, announced the completion of more than US$4 million in financing, led by Signum Growth, with participation from Cathie Wood’s ARK Investment Management LLC, IDG Blockchain, IVC Fund, Polygon and 1881 S Group AG. cast. Sortium will use the funding from this round to expand operations and development efforts.

On April 11, Web3 social protocol Tomo announced the completion of a US$3.5 million seed round of financing, led by Polychain Capital, with participation from Consensys, Symbolic Capital, OKX Ventures, Nomad Capital, Story Protocol, dao 5, KuCoin Ventures and HTX Ventures. Tomo No valuation or structure of the round was disclosed.

On April 11, blockchain prediction layer Azuro announced the completion of US$3.5 million in financing, with participation from SevenX Ventures, Fenbushi Capital, Arrington Capital, Polymorphic Capital, Red Beard Ventures, Dewhales and G 1 Ventures. Azuro supports most sports markets and other games, providing a decentralized platform to support the creation of diverse applications, integrations and products.

On April 11, OpenTrade, the Web3 institutional loan and income product platform, announced the completion of a US$3.2 million seed round of financing, with participation from a16z Crypto Startup Accelerator (CSX), CMCC Global, Draper Dragon, Ryze Labs and Plassa Capital. OpenTrade is an on-chain institutional lending and yield product platform built on Circles payments and DeFi infrastructure, allowing regulated asset managers to create on-chain lending products with affordable yields.

On April 11, the cross-chain protocol Mayan announced the completion of a US$3 million seed round of financing, co-led by Borderless Capital and 6th Man Ventures, with participation from Solana Ventures, Hash 3, Big Brain Holdings, and Arrington Capital.

Storm Labs completes $3 million in financing, led by Electric Capital

On April 9, on-chain investment project Storm Labs completed US$3 million in financing, led by Electric Capital, with participation from Accomplice, Robot Ventures, Daedalus and well-known angel investors in the industry. It is reported that Storm Labs will use this round of financing to build Cove, an on-chain portfolio manager, aiming to allow users to build and manage customized DeFi portfolios without manual operations and solve problems such as losses and rebalancing.

Blockchain recruiting firm Veremark raises $3 million, led by Samaipata and Stage 2 Capital

On April 11, Veremark, a London-based blockchain recruitment and recruitment services company, announced the completion of US$3 million (£2.4 million) in financing, led by Samaipata and Stage 2 Capital, with participation from ACF Investors and Vulpes Investment.

On-chain RWA project Zoth raises US$2.5 million, led by Blockchain Founders Fund

On April 10, the on-chain RWA portal project Zoth completed US$2.5 million in financing, led by Blockchain Founders Fund, Borderless Capital, Mindativity Capital, YAP Capital, Momentum 6, Singularity DAO, Aztlan Capital, Outlier Ventures, Decubate, Wormhole Ecosystem Fund, etc. Participate in investment.

On April 13, the decentralized Internet bandwidth sharing network Multisynq announced on the . Multisynq enables individuals to monetize their excess Internet bandwidth by selling it to developers and achieve Internet bandwidth sharing goals.

On April 8, the gamified on-chain trading platform Spotlight announced the completion of US$2 million in financing, with Folius Ventures participating in the investment. Its trading platform Spotlight Market mainly uses gamification methods to attract users to improve the liquidity of on-chain and off-chain assets. In addition, Spotlight It also focuses on discovering and curating high-quality DeFi projects, guiding users to identify promising DeFi opportunities through expert analysis and insights.

On April 13, according to official news, Gull Network, the Manta ecological L3 network, announced the completion of a $1.6 million private placement round. Morningstar Ventures and Ozaru Ventures co-led the investment, and GBV, MH Ventures, Banter Capital, Sky Vision Capital, Asteroid Capital, Andromeda Capital , Momentum 6 and others participated in the investment.

On April 13, decentralized derivatives trading platform Stream Trading completed a $1.5 million seed round of financing at a valuation of $20 million, with Polychain participating.

Web3 game distribution platform GameCene completes US$1.4 million in seed round financing

On April 14, GameCene, a Web3 game distribution platform, announced the completion of a US$1.4 million seed round of financing. The investor information has not yet been disclosed. Its platform mainly helps developers to easily build and distribute blocks by building a full-chain game software development kit (SDK). chain game.

On April 8, the decentralized AI network project Ritual received millions of dollars in additional investment from venture capital firm Polychain Capital. The specific amount has not yet been disclosed. According to previous news, Ritual has completed US$25 million in financing in November 2023, with Archetype leading the investment and Accomplice and Robot Ventures participating.

NuLink completes new round of financing, DWF Labs participates in investment

On April 9, data privacy solution NuLink announced the completion of a new round of financing on the x platform. Web3 investment company DWF Labs participated in the investment and reached a strategic cooperation with it.

On April 9, AI-driven encryption application Sharpe Labs announced the completion of a seed round of financing on the The amount of financing has not yet been disclosed.

HTX Ventures announces strategic investment in Tomo to support SocialFi innovation

On April 11, HTX Ventures recently announced a strategic investment in Tomo, a comprehensive Web3 social application. This investment marks HTX Ventures recognition of Tomos strategic position in the Web3 field, its belief in SocialFis transformative potential, and its commitment to broadening and enhancing the influence and ease of use of Web3 technology.

This week, April 12, modular computing layer Lumoz disclosed that it had completed a new round of financing at a valuation of US$120 million, with participation from OKX Ventures, HashKey Capital, KuCoin Ventures and others. So far, Lumoz has raised a total of US$10 million in financing. The team revealed that the new funds will be used to expand the Lumoz team and further accelerate the platform construction and technological innovation of its Modular Compute Layer and ZK-RaaS. In addition, Lumoz is expected to launch the mainnet in Q3.

On April 13, Black Panther, the artificial intelligence-driven Injective ecological asset management protocol, announced on the Investment, the specific amount has not yet been disclosed. Black Panthers asset management protocol helps users earn returns through smart vaults and automated trading strategies. The protocol utilizes its native token BLACK for governance, staking rewards and incentive programs within the ecosystem.

On April 13, Jigsaw, a DeFi project focusing on dynamic collateral, recently announced the completion of a new round of financing on the X platform, with participation from Tempo, Manifold, Rarestone Ventures, Space Whale Capital, Duplicate Capital, Pastel Alpha, Perridon Ventures, Digits Ventures and DCD Investment, the specific financing amount has not been disclosed yet.