一鱼多吃:Merlin Chain流动性协议速通手册

Original author: Amber, Merlin Chain

As the Bitcoin Layer 2 narrative is fully unfolded, the originally relatively static Bitcoin ecosystem has gradually become more active, and the importance of liquidity has become increasingly prominent. In order to meet the urgent need for a large number of traders to earn interest on Bitcoin while promoting efficient liquidity distribution, many liquidity staking protocols in the Bitcoin ecosystem have emerged in this context. Layer 2 Merlin Chain, the leader of the Bitcoin ecosystem, together with emerging staking protocols such as Solv Protocol, Avalon Finance and StakeStone, introduces the concept of interest-bearing Bitcoin and combines it with the traditional liquidity staking concept to provide investors in the Bitcoin ecosystem with a new Investment experience. This article will introduce the core mechanisms and staking gameplay of Solv Protocol, StakeStone and Avalon Finance, as well as how to cooperate with each other to eat more from one fish driven by the Merlin ecosystem.

Solv Protocol

Project Overview

Solv Protocol is a full-chain basic income protocol proprietary to the Bitcoin ecosystem, which can benchmark against the Ethereum ecological re-pledge protocol Lido. By converting idle basic assets into interest-earning assets while promoting free cross-protocol and cross-ecological combination, we create a more efficient liquidity distribution method.

SovBTC is the first full-chain Bitcoin interest-bearing asset issued by Solv Protocol. It is essentially an ERC-20 token with considerable liquidity, which can be pledged to create safe basic income for users’ wallets that are otherwise idle. Currently, SolvBTC has been listed on Arbitrum, BNB and Merlin Chain.

Currently, Solv Protocol TVL has exceeded US$200 million, with a total number of users exceeding 55,000, and has generated US$7.03 million in revenue for users.

Team and financing

Team background

The Solv team brings together senior professionals from various backgrounds, including experts from traditional financial institutions such as Goldman Sachs and JPMorgan Chase, product managers from Binance and OKX, and other influential celebrities in the cryptocurrency field. In addition to Solv Protocol itself, the team also created the SFT (Semi-Fungible Token) token standard ERC-3525 and attracted more than 100 teams to build new products based on this standard.

Financing situation

Solv Protocol investors include Binance Labs, NOMURA Group, Mirana, Blockchain Capital and other well-known institutions, and raised a total of US$14 million in the last round of financing.

core mechanism

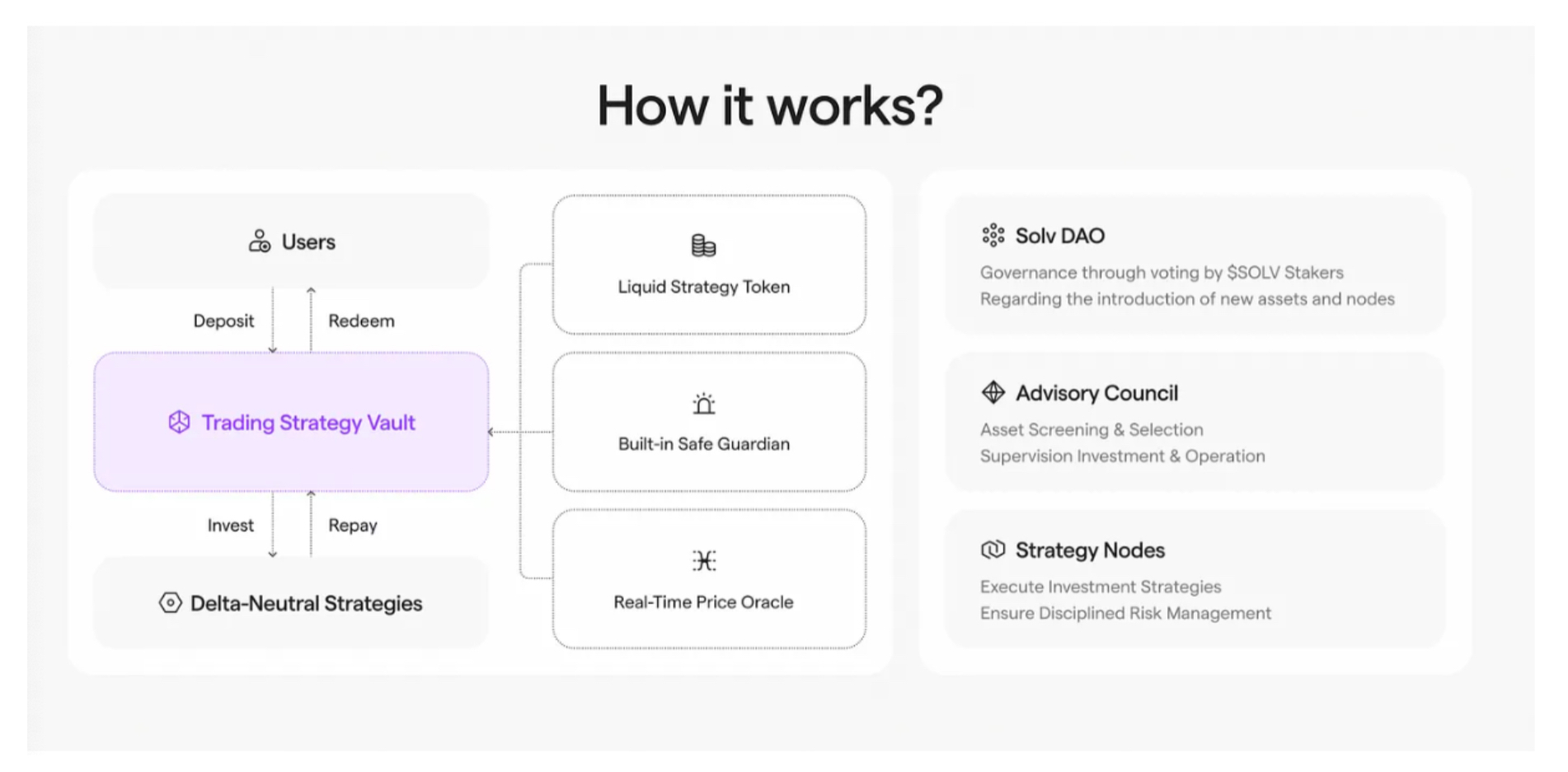

Solv Protocol relies on four core modules of distributed asset management structure, currency selection mechanism with DAO as the core, non-custodial asset operation process, and strictly monitored risk management framework to provide strategy-based solutions for mainstream assets such as BTC, ETH and stablecoins. Native revenue streams.

1. Distributed asset management structure:Solvs structure supports the entire asset life cycle including creation, issuance, redemption and risk control. The asset management framework consists of a trading strategy library, built-in Safe Guardian, price Oracle and liquidity strategy-driven tokens.

Trading strategy Vaults: used to store funds and LP assets and perform asset allocation. Since its core design concept is to eliminate counterparty risks while ensuring the efficiency of liquidity pool operations, Solv pre-defines the types of transactions allowed in the contract to exclude any behavior that may involve the misuse of funds.

Built-in Safe Guardian: Independent operating mechanisms are set up according to different Vault trading strategies, and only wallets within a specified range are allowed to multi-sign. When the user operates through multi-signature, checkTransaction will be called to check whether it complies with the privilege rules.

Price Oracle: Acts as a bridge between Solv and other DeFi protocols. It is mainly used to retrieve and calculate the net asset value, set achievable prices for DeFi protocols, and perform operations such as lending and trading.

Liquidity strategy-driven tokens (vault LP tokens): Liquidity strategy-driven tokens only convert pledged assets into liquid, tradable assets, similar to the ERC-20 standard, to ensure the greatest degree of tradability within the DeFi ecosystem. Combination and practicality. Therefore, vault LP tokens such as SolvUSD and SolvBTC can integrate and interact with other DeFi components (such as money markets, DEXs, LPD-driven stablecoins, etc.)

2. Coin selection mechanism with DAO as the core:The stable risk returns of SolvBTC, SolvETH and SolvUSD require a high-quality underlying portfolio, so Solv chooses to have the decentralized autonomous community Solv DAO perform the asset selection process. Solv DAO currently operates under the supervision of the Advisory Council and will transition to the user-funded SOLV governance model after the end of Solv TGE.

3. Non-custodial asset operation process:Solv provides investors with on-chain asset autonomy and establishes trustless standards through smart contracts to reduce the risk of evildoing. Smart contract upgrades need to be jointly controlled with Solv partners through multi-signature addresses and TimeLock mechanisms.

4. Strictly monitored risk management framework:Solv sets a predefined stop-loss threshold for each strategy. In addition, Solv will later introduce a 24-hour monitoring system to track portfolio delta. Once there is a deviation or a loss, the system will automatically take action.

Code audit

Solv code audits have been performed by well-known security companies such as Quantstamp, Certik, Slowmist, Salus, SecBit, etc., and are publicly availableAudit Report。

How to eat more with SolvBTC

SolvBTC will become the Merlin Chain Liquidity Strategy Token (LST), which users can mint by staking M-BTC 1:1 and will not be redeemable until June. After the lock-up period ends, it can be exchanged back to M-BTC at a ratio of 1:1, and since M-BTC can be exchanged back to BTC at a ratio of 1:1 at any time after the Merlin Seal pledge ends. Therefore, staking in exchange for SolvBTC can essentially achieve currency-based risk-free returns.

SolvBTCs income comes from a combination of multiple neutral trading strategies, including Perp DEX market making income, Funding Rates neutral escape strategy, etc., which ensures stable income while minimizing the impact of market price fluctuations on income.

Since the Merlin ecosystem is still in the early stages of development, the currently pledged BTC will be locked in Vault to avoid the risk of de-anchoring until redemption is opened in June. During the lock-up period, users can obtain Solv points and obtain multi-staking benefits through a series of Merlin Eco DeFi free combinations. The following is a simple SolvBTC exchange process:

SolvBTC:M-BTC = 1: 1

Step 0: Cross-chain Layer 1 BTC to Merlin Chain, and then exchange it for MBTC on MerlinSwap, with a slight discount.

Step 1: Deposit MBTC into Solv and obtain steady income from Merlin POS Staking.

Step 2: In addition, Solv staking will also receive points airdrops, but Solv officials have not yet given specific rules and token airdrop ratios.

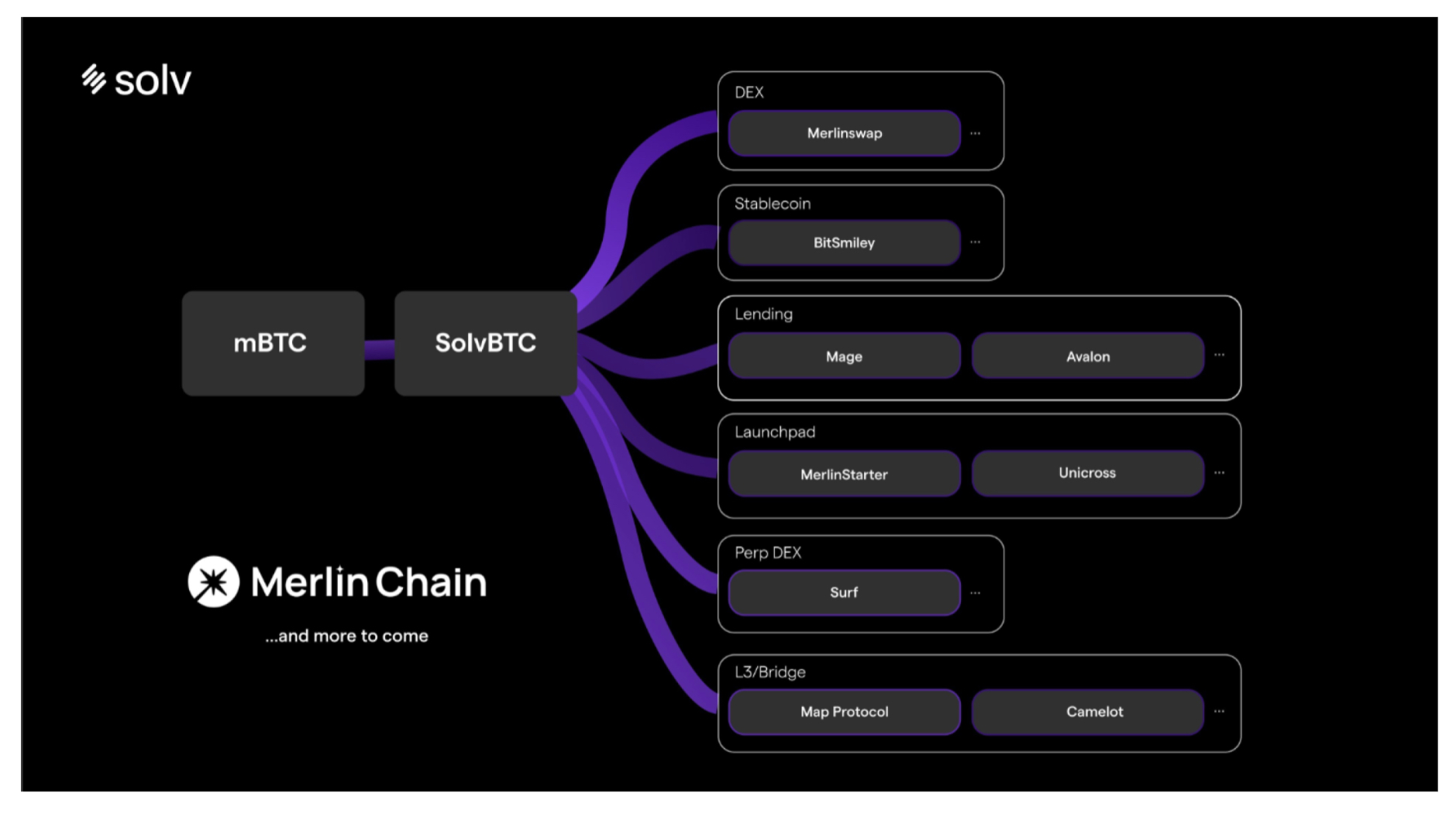

DeFi Protocol Lego Module

Since it is essentially an ERC-20 token, SolvBTC can be used as an important module of Lego bricks and can be combined with other DeFi protocols in any way.

Step 3: The Solv points system is only related to pledge casting, that is, SolvBTC ownership does not affect the pledge points, so users can obtain more benefits through other various DeFi protocols that are connected to Solv.

According to the Merlin Chain application panorama officially released by Solv Protocol, Solv has cooperated with leading DeFi products on Merlin Chain such as MerlinSwap, bitSmiley, Surf Protocol, Mage Finance, AvalonFinance, etc. The guide to eating more for one fish is as follows:

MerlinSwap (DEX): MerlinSwap will list the SolvBTC-M-BTC trading pair for traders to trade freely. MerlinSwap is a DEX launched by the iZUMi Finance team with technical support and official cooperation with MerlinChain. It is committed to leveraging the stability of the Bitcoin ecosystem and the interoperability of Merlin EVM to create a convenient and fast DeFi interactive experience for the Bitcoin ecosystem. As of the end of March, MerlinSwap TVL has exceeded US$100 million, with the highest single-day transaction amount reaching US$70 million. It is currently the largest DEX in the Merlin ecosystem and even the Bitcoin ecosystem.

bitSmiley (StableCoin): pledge SolvBTC to mint bitUSD (stablecoin). bitSmiley is a Bitcoin-native stablecoin protocol that allows users to over-collateralize native BTC on the Bitcoin network to mint the stablecoin bitUSD. In addition, bitSmiley also launched lending and derivatives protocols, aiming to reshape the BTCFi ecosystem. bitSmiley was selected as a high-quality project in the Bitcoin Hackathon organized by ABCDE and OKX Ventures in November last year, and received investment from ABCDE and OKX Ventures at the end of the year.

Surf Protocol (Perp DEX): pledge SolvBTC to open a position. Surf Protocol is a perpetual contract DEX on Bitcoin Layer 2. It was previously selected into the Binance Labs Season 7 MVB Accelerator Program. The Surf Protocol testnet ended on March 26. A total of 30,000 wallet addresses participated in the testnet, and the total transaction amount reached US$250 million. The mainnet will be launched in the near future.

Mage Finance Avalon Finance (Lending Protocol): Mortgage SolvBTC for lending

Mage Finance is the first Bitcoin lending infrastructure built on Merlin Chain.

Avalon is a DeFi platform on Bitcoin Layer 2 and has been launched on Merlin Chain.

MerlinStarter UniCross (LaunchPad): SolvBTC can be used as a future IDO participation certificate

Merlin Starter is Merlin Ecos first Launchpad platform, designed to incubate Merlin Eco native projects and provide asset support for promising projects.

UniCross is a cross-chain BTC inscription casting platform on the Layer 2 network. Allows users to mint Layer 1 BRC-20 tokens on Layer 2, and can choose to pay with multi-chain assets such as BRC-20, BTC and ETH. The stTokens obtained by users can be used for trading on the UniCross market or exchanged for ERC-20 tokens on L2.

Map Protocol Camelot Protocol (Layer 3): Acts as Layer 3 bridging asset

Map Protocol is a peer-to-peer Bitcoin Layer 2 focused on cross-chain interoperability, built on ZK and light clients.

Camelot Protocol is a Bitcoin Layer 3 protocol built based on Merlin Chain and designed specifically for DePIN. It aims to use blockchain technology to achieve decentralization of AI training. Camelot is committed to building a scalable L3 DePIN platform on Merlin Chain, allowing organizations and individuals around the world to contribute computing resources to the shared pool.

In addition, Solv also launched a points system on April 5, allowing users to earn points by minting SolvBTC. The larger the pledge amount, the more points you can get (single wallet operation is recommended), and Solv points can be used to exchange for SOLV token airdrops. The points system will run for three months until the end of the lockdown period in June.

StakeStone

Project Overview

StakeStone is a full-chain liquidity infrastructure dedicated to providing native staking returns and liquidity for Layer 2 networks. StakeStone itself has high scalability, supports various staking pools on multiple chains, and is also compatible with Restaking. In addition, StakeStone has also established a multi-chain liquidity market based on its native LST $STONE, providing token holders with a wider range of application scenarios and income opportunities.

According to official information, StakeStone has already conducted in-depth cooperation with Layer 2 networks such as Merlin Chain, BNB, Manta, and Scroll.

Financing situation

In March this year, Binance Labs and OKX Ventures announced their investments in StakeStone, and the specific amount and other financing were disclosed.

core mechanism

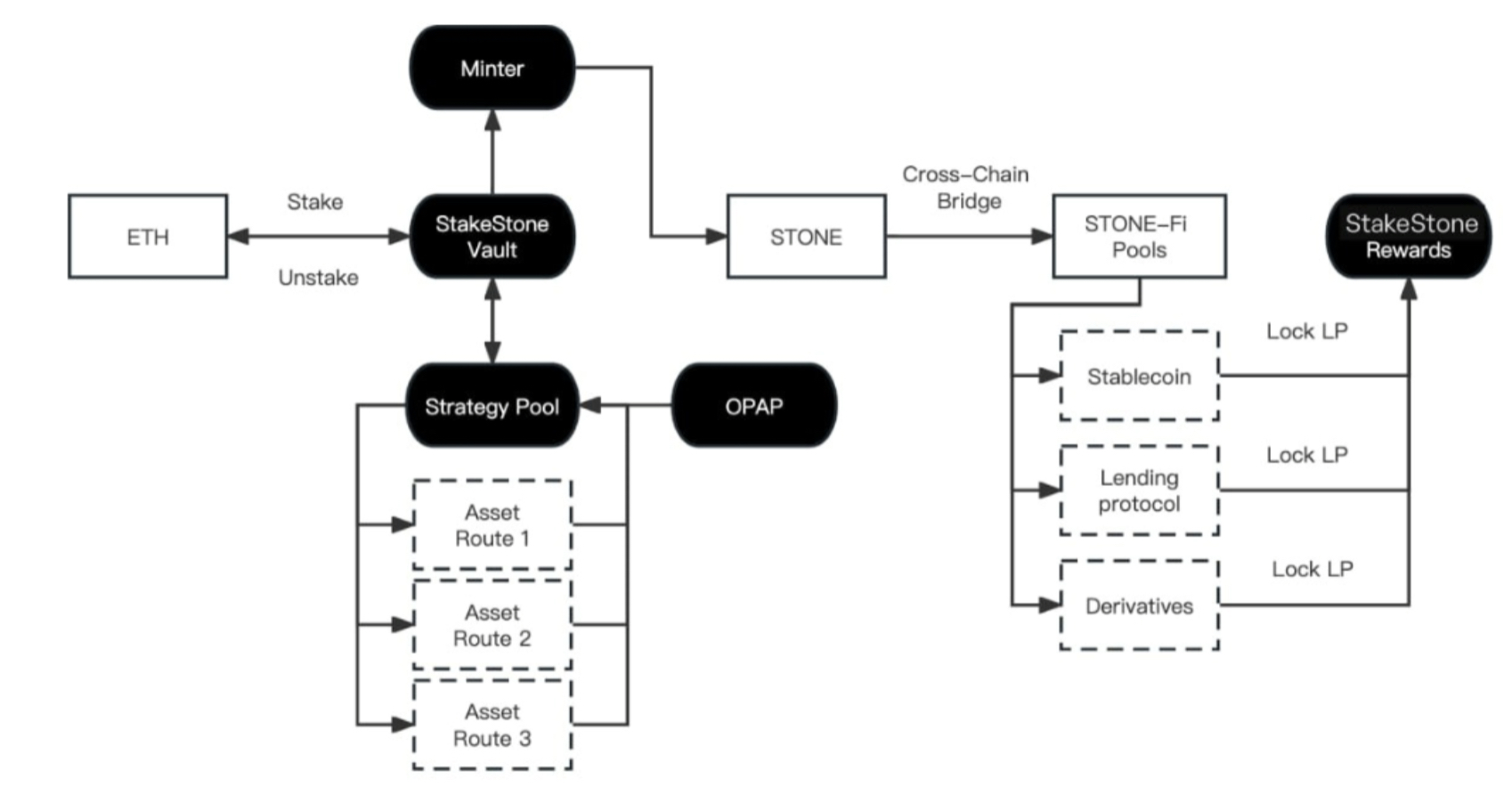

The core mechanism of StakeStone consists of four parts: StakeStone Vault, Minter, strategy pool and OPAP (Optimizing Portfolio and Allocation Proposal)

StakeStone Vault: Acts as a capital buffer pool and is responsible for managing deposits, withdrawals and settlement functions. The ETH pledged into the pool is kept in the contract until a new settlement occurs, and then deployed to the underlying strategy pool.

Minter: Responsible for the casting and destruction of STONE. The existence of Minter allows the minting of STONE and the underlying assets to operate independently, that is, the circulation of STONE tokens can be adjusted, thereby making the tokens more stable.

Strategy pool: The StakeStone strategy pool adopts an OPAP-driven whitelist mechanism and is highly compatible with multiple assets. At the same time, asset risks will also be isolated within single strategy channels to prevent high correlation risks.

OPAP: The first decentralized solution for optimizing the return rate of liquid fixed investments, allowing the investment portfolio and allocation optimization of STONEs underlying assets, thereby optimizing the allocation of interest-earning assets and tracking returns. Any capital changes in StakeStone need to be presented in the form of proposals, and STONE holders will decide whether to implement them through on-chain voting.

StakeStone and BTC Ecology

STONE and mSTONEBTC

STONE is an LSD token issued by StakeStone. It is used to integrate the income of mainstream pledge pools, re-pledging pools and LSD blue chip DeFi strategies. Its value is positively related to the pledge income of the underlying assets and can serve as liquidity on a variety of blockchains.

mSTONEBTC is the first income-generating BTC derivative token based on the BTC Layer 2 PoS mechanism. BTC can use this to enter the StakeStone popular distribution network, thereby further promoting the efficiency of BTC ecological capital allocation. When StakeStone officially completes the integration of Merlin Chain, I believe that a certain proportion of swaps with it can be carried out through m-BTC.

BTC Ecosystem Acceleration Program

Although StakeStone currently relies on staking ETH to obtain STONE, on February 21 this year, StakeStone announced the launch of the BTC ecosystem acceleration plan, intending to expand the scope of staking to the BTC ecosystem. This acceleration program allows users to deposit new ETH mint STONE in Merlin Seal and B^ 2 Buzz and obtain StakeStone points. The program will last until the end of the Merlin Seal and B^ 2 Buzz staking period.

Note: Merlin Seal participants and qualified long-term community members before February 21st can share 0.5% of the total supply of StakeStone tokens as rewards.

Avalon Finance

Project Overview

Avalon Finance is a DeFi platform on Bitcoin Layer 2 that provides users with deposits, lending, leveraged mining and RWA lending services. It is currently online on Merlin Chain. Its key projects include over-collateralized lending, algorithmic stablecoins based on lending, and RWA loans. These products focus on improving capital efficiency and optimizing the income mechanism of less liquid assets through pledged lending.

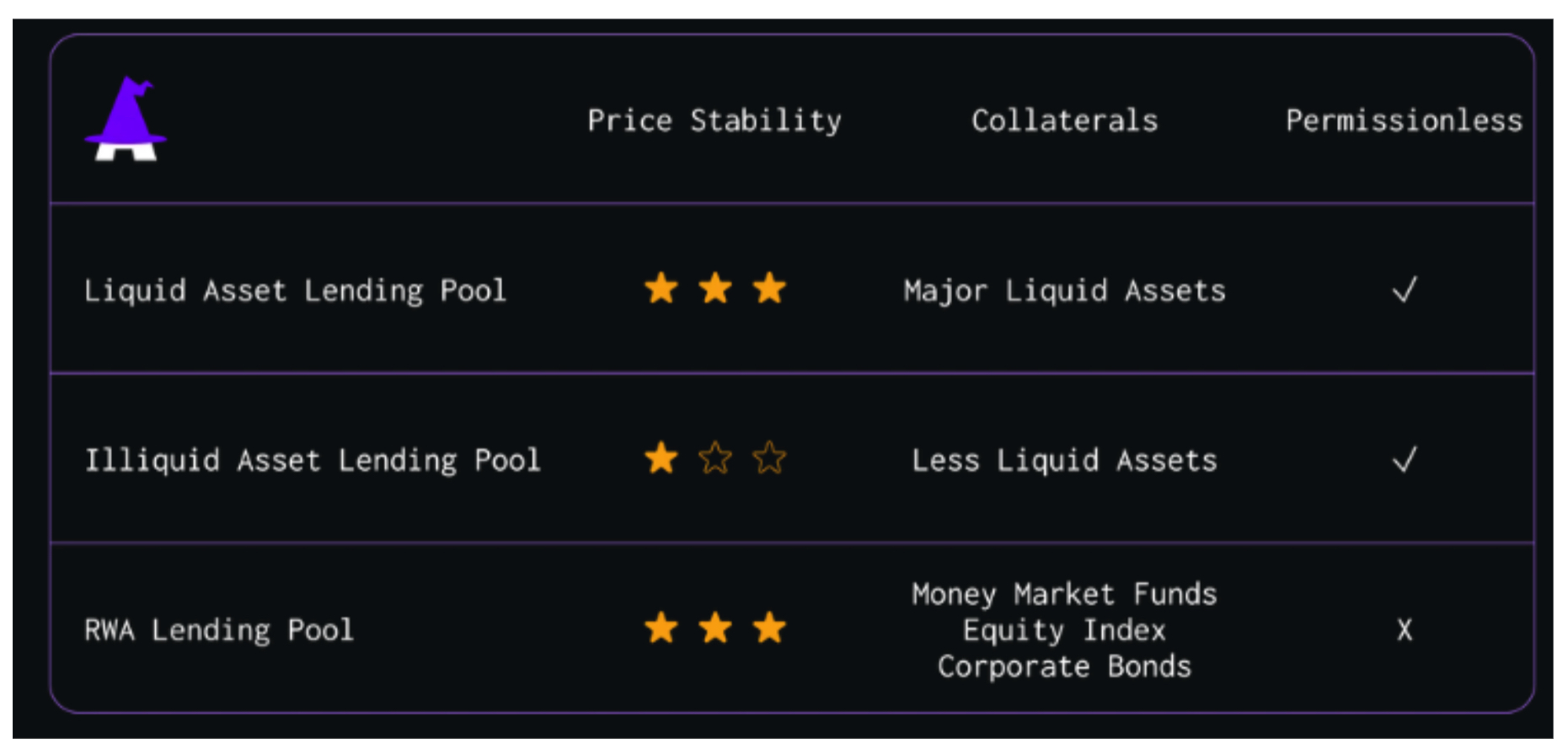

Over-collateralized lending: a basic lending protocol with an isolation pool mechanism that supports multiple assets as collateral (both major assets and less liquid assets are acceptable)

Lending-based algorithmic stablecoin: an over-collateralized algorithmic stablecoin that optimizes capital allocation efficiency through lending protocols

RWA Lending: The pool supports both permissioned and permissionless RWA tokens

Currently, Avalon TVL reaches 51.31 million, and the total number of users exceeds 4,200.

Team and financing

The core team of Avalon is composed of veterans with 10 years of experience in the encryption industry. The founder once served as a Hedge Fund Trader at ExodusPoint, a 15 billion fund, managing an investment portfolio of more than US$300 million.

On March 15 this year, Avalon announced the completion of a US$1.5 million seed round of financing, with participation from SNZ Capital, Summer Capital, Matrixport Ventures and other institutions.

core mechanism

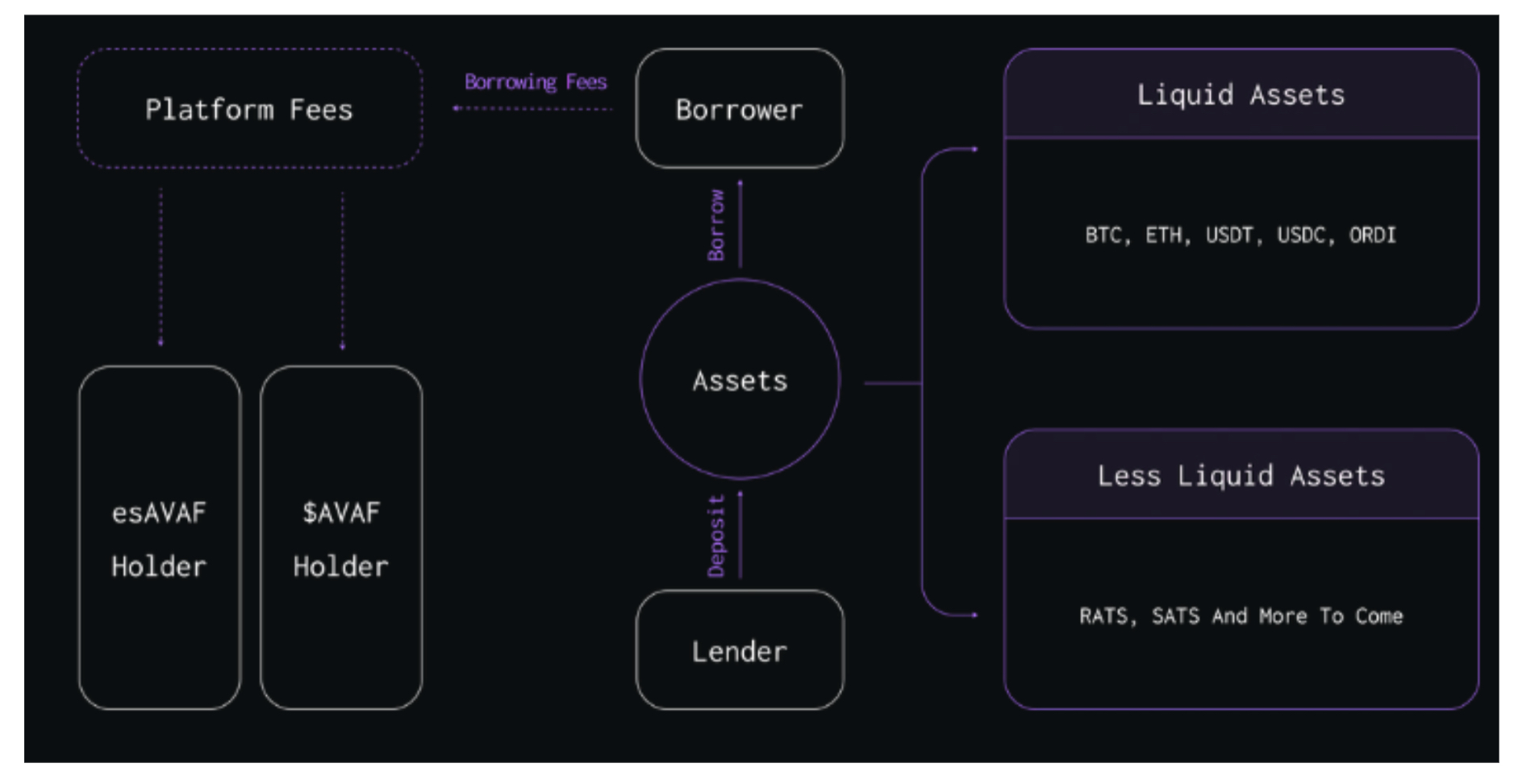

The core mechanism of Avalon Finance includes an isolated pledge pool designed for asset security and an AVAF locking mechanism designed for growth.

Isolated pledge pool mechanism

Since the liquidity of different pledged assets is different, Avalon chooses to invest them in different pledge pools.

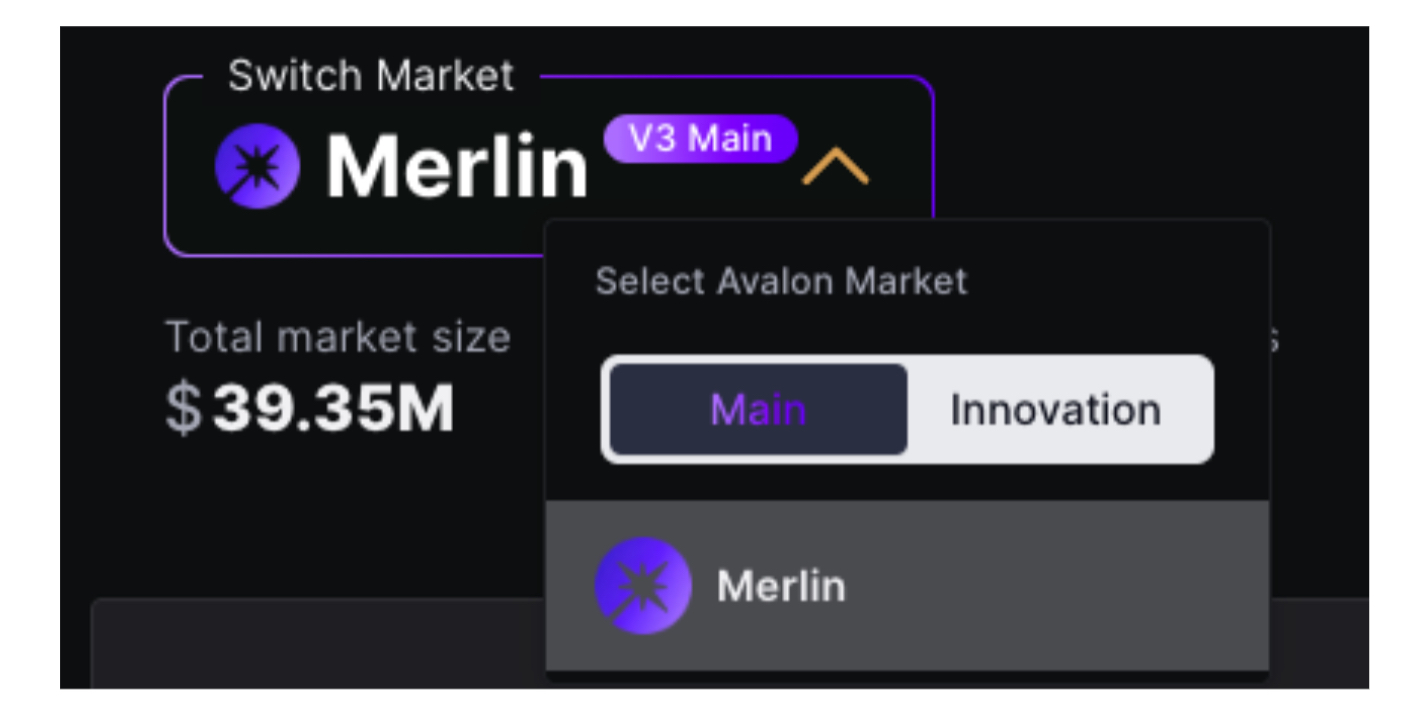

Main pool: used to pledge permissionless assets that are stable in price and not susceptible to manipulation. The current pledgeable assets in the main pool on Merlin Chain include BTC, M-BTC, M-USDT, M-USDC and M-ORDI.

Innovation Pool: Used to pledge unlicensed assets whose prices are unstable and may be subject to potential manipulation. As such token assets mature, they can be migrated to the main pool upon approval by the Avalon DAO. The current innovation pool on Merlin Chain can be used to stake M-BTC, VOYA and HUHU.

RWA Lending Pool: This pool supports both permissioned and permissionless RWA tokens, including money market funds, stock indices, and corporate bonds.

Currently, Avalon has launched the first phase of staking, and the lending function is not available for the time being. The main pool and innovation pool are independently pledged, and assets can be redeemed at any time when liquidity permits. In its second phase, the main pool lending function will be opened, including BTC, ETH, USDT, USDC, etc., and the team will monitor security developments 24 hours a day. In the third stage, innovation pool lending will be launched, independent main pool operation will be started, and Avalon DAO voting will be launched at this stage. In addition, the team also proposed to provide fragmented innovation for NFT and provide an interest-earning channel for small pictures with poor liquidity.

AVAF locking mechanism

AVAF is Avalon Finance’s governance token and is used to incentivize protocol users and liquidity providers. The circulating supply of AVAF will depend on the total number of tokens in the pledge pool that have been used for marketing and relationship maintenance. The maximum supply is expected to be 1 billion. The minting of token supply exceeding the limit is controlled by a 28-day time lock, which will be triggered when and only when the launch of new products requires more liquidity. At the same time, opening the time lock requires a community governance vote.

In addition, liquidity providers will also receive esAVAF as proof of pledge, which has the same utility as AVAF except that it cannot be transferred.

Code audit

The Avalon security audit was performed by Salus and is now publicAudit ReportandContract address。

Avalon LEGO set

At present, Avalon has reached cooperation with other Merlin Eco leading DeFi projects. For example, the cooperation between Avalon and Solv mentioned above means that Avalon supports SolvBTC pledge and lending. Users can first pledge M-BTC on Solv in exchange for Solv pledge pool points, and use The SolvBTC exchanged in equal proportions are then pledged in Avalon to obtain points income.

Staking Tutorial

Deposit link:https://app.avalonfinance.xyz/dashboard/

Step 1: Connect to the wallet (MetaMask is recommended). The default interface is the main pool. If you need to switch to the innovation pool, you need to click the drop-down button next to Merlin Market.

M-BTC can be pledged in both the main pool and the innovation pool, but the points awarded in the main pool are higher. The main purpose of M-BTC in the innovation pool is to use it as a pledge certificate in exchange for other tokens after the third phase of development and lending in the future.

Step 2: Select the currency you want to deposit, click Supply, enter the amount you want to deposit, adjust the gas to 0.05 gwei, and confirm.

After the deposit is completed, the deposit certificate token will automatically pop up, and the page will display the currency and amount that have been deposited.

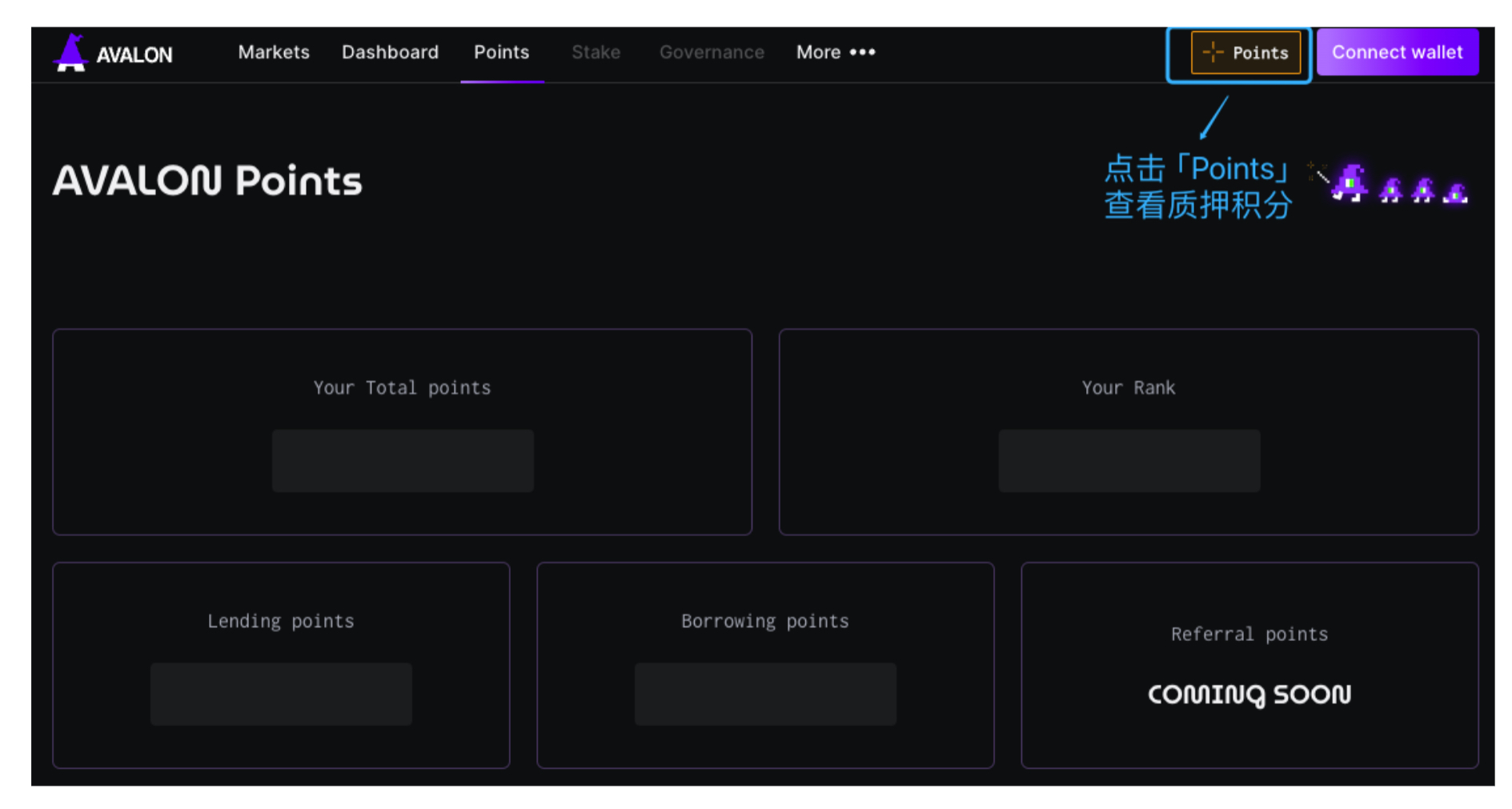

Step 3: Click Points to view the current staking points (after staking, the Avalon points system will be updated every 8 hours)

In addition, click Withdraw next to Supply to redeem it at any time if liquidity permits.

refer to:

https://merlinchain.notion.site/2f4ec0f88d584cb5bab4030ad56c0b60?pvs=74