SignalPlus Macro Analysis (20240404): BTC ETF inflows increased significantly

The economic data released by the United States yesterday were mixed. The ADP employment data in the morning was stronger than expected. The number of employed people increased by 184,000. The previous value was also revised upward by 15,000. The wage growth of those who changed jobs was particularly outstanding, with an annual increase of more than 10%. Attached Comments noted that construction, financial services and manufacturing saw the largest wage increases.

On the other hand, the US ISM services index fell 1.2 points to 51.4 in March, and prices paid fell sharply (-5.2 points), reaching the lowest level since March 2020. The remaining components were mixed, but weakness in the prices paid and employment components temporarily prevented bond yields from rising any further.

Atlanta Fed President Bostic reiterated his hawkish stance, insisting on only one rate cut in the fourth quarter, but he also said it depends on whether his economic views come true, but he has not yet received any information about a weakening job market. .

Powell, on the other hand, struck a more dovish tone, insisting that the process of slowing inflation will continue despite strong economic growth and suggesting that interest rates are currently at restrictive levels and need to be lowered. In addition, his QA was also full of dovish details, such as Productivity improvements may exceed output, Significant population growth may help reduce inflation, regarding capacity pressure, There may be more growth on the supply side that can be achieved, etc. .

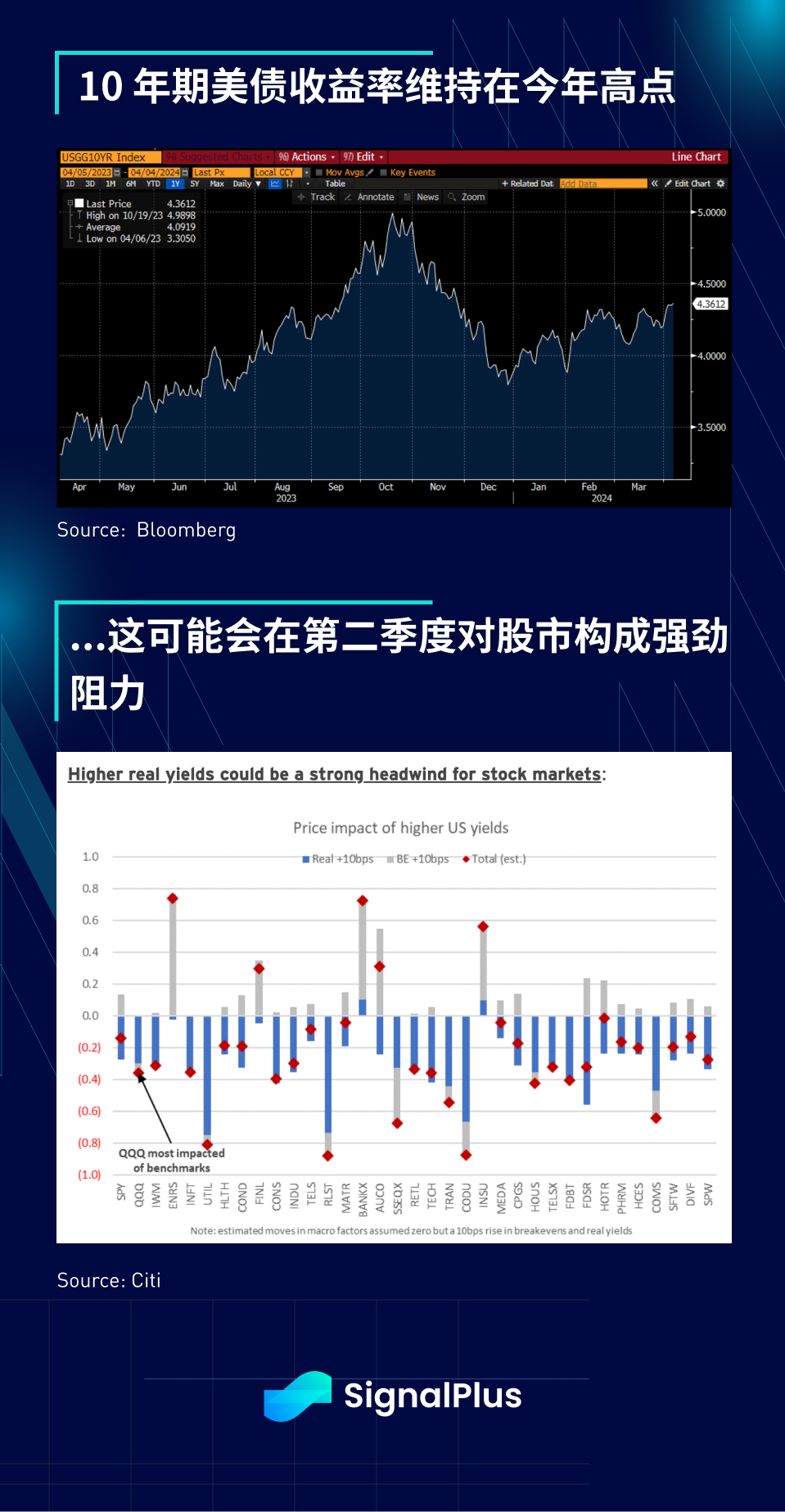

The 10-year U.S. Treasury yield remains at this years high, but there hasnt been much concern yet, though that could prove to be a headwind for stocks in the second quarter.

Fridays non-farm payrolls data is expected to remain strong with a slight slowdown, but the wide divergence between agency surveys (strong) and household employment data (weaker) will remain a major source of uncertainty. Considering the recent decline in fixed income, the market may be hawkish when the data is released, and if the non-farm payrolls data is weak, the probability of a rate cut in June may rise back to above 75%.

On the cryptocurrency front, ETF inflows were significantly stronger yesterday, with Fidelity and Blackrock both seeing large inflows, offsetting unexpected outflows from ARK the day before, bringing total net inflows to $220 million, including $75 million from Grayscale, ETFs The inflow of funds helped keep the price of BTC stable at around $65,500.

You can search for SignalPlus in the Plugin Store of ChatGPT 4.0 to get real-time encryption information. If you want to receive our updates immediately, please follow our Twitter account @SignalPlus_Web3, or join our WeChat group (add assistant WeChat: xdengalin), Telegram group and Discord community to communicate and interact with more friends.

SignalPlus Official Website:https://www.signalplus.com