Crypto Market Q2 Outlook: Which Narratives Need to Pay Attention to?

Original author: JAY

Original compilation: Deep Chao TechFlow

We are in a bull market. The retail market is gradually recovering, Bitcoin price is holding steady near its 2021 all-time high, and there are many bullish catalysts ahead. As someone who has been through the entirety of 2023, it’s crazy to see a 7 in front of the Bitcoin price.

As our industry has matured and the market scope has expanded significantly, from modular blockchain infrastructure to Solana meme coins to Bitcoin NFTs (and more), there are now more things to keep up with than ever before .

The goal of this article is to provide an overview of the second quarter of 2024, with the goal of allowing me to consolidate everything I have learned and observed. I want to use this as a starting point for what I think is going to happen in the next 90 days or so. I make no guarantees here that anything is correct. Remember, the market is constantly changing, so updating your prior knowledge based on new information is crucial in this field.

Ive divided this into several parts:

Main assets

Altcoins

NFT

airdrop

narrative

Main assets

Bitcoin

From a higher time frame, the major asset looks impressive. Bitcoin hit its highest ever monthly close yesterday. With the Bitcoin ETF approved, and the halving only weeks away, I dont see why you wouldnt be optimistic about Bitcoin in Q2.

Ethereum

Judging from polymarket prediction markets, rejection is already priced in for most, if not all, Ethereum ETFs. The first deadline is May 23rd, so well be hearing about that.

In addition to regular spot ETFs, several leading ETF issuers have applied for staking as part of the spot ETF itself. I believe this is a natural, logical sequence because traditional finance loves returns, and staking returns are intrinsic to the Ethereum protocol itself. Additionally, given:

The success of spot Bitcoin ETFs

Fink’s ETF History

Coinbase provides a path to regulation in the most respectful, professional manner

The tight correlation between Ethereum futures ETF and spot Ethereum,

Its hard for me to imagine that we wont get a spot ETH ETF at some point this year.

Solana

I published a bullish post on Solana in August 2023, but it’s incredible to see this all happening in real time. At every stage, there are numerous criticisms (which in turn make me even more bullish). Its clear that Solana has established itself as a prime at this point, and I have a pretty good idea that Solanas trajectory will continue over the next quarter.

From being the most accessible on-chain casino to being home to the most innovative RWA and DePIN protocols, I think they have found product market fit. The pace of change among Solana’s core team and ecosystem builders is remarkable.

In Q2, there was a large number of protocols releasing tokens (more on that later). “Come for the meme coins, stay for the dapps” seems to be Solana’s slogan, and it’s clear that every other L1/L2/L3 ecosystem is trying to imitate Solana’s strategy. I think Solana will have another positive quarter in Q2 after spending most of January/February consolidating.

Finally, if/when we see a spot Ethereum ETF approved, I expect this will spark progress on Solana in the traditional finance space. Its clear there is institutional demand for Solana (just look at historical digital asset flows and the Grayscale SOL Trust). Once a spot Ethereum ETF is approved, the market will turn its attention to Sol.

Is anyone paying attention to SOL Futures ETF?

Overall, Im very optimistic, and when the monthly chart looks like this and the overall sentiment remains 50/50, it can only mean one thing: the market is going higher.

Whenever the RSI crosses the 70 mark, Bitcoin goes on a wild run

Beyond that, the main catalysts to watch out for are (if you think Ive missed any other important ones, please let me know!):

Bitcoin Halving Around April 20

Robinhood earnings for April 24

Dogecoin Futures Coinbase Trading for April 29

Expected Coinbase Earnings on May 2

May 23 Spot Ethereum ETF Deadline (and Subsequent ETF Decision)

Altcoins

Relative to the crazy rise in Q4’23, many altcoin pairs fell sharply last quarter. This makes sense considering the following factors:

Institutional focus on Bitcoin (spot ETF approval and upcoming halving)

meme coin madness

I spoke with numerous builders in the space and noted concerns that this would change the incentives for legitimate builders in the space. Why bother working on the infrastructure or protocols that will be at the heart of the future of finance when you can launch a meme coin? I do think that will change at some point.

Ultimately, the crypto market (and markets in general) is an attention game. The goal of any project is to stay relevant and attract attention. While existing meme coins have actually suffered, newer coins like ETHFI, DYM, JUP, etc. have performed reasonably well since their launch. Again, this goes back to the issue of attention.

So what could cause altcoins to rise again? The two main catalysts in my mind are:

Active SEC lawsuit against Coinbase (regarding whether tokens are securities)

Implementation and launch of Uni V3 governance fee switching

I expect both to happen sometime in the second quarter.

During this period, there will be a few altcoins that continue to outperform, just like they have over the past few months. There are too many to list them all.

NFT

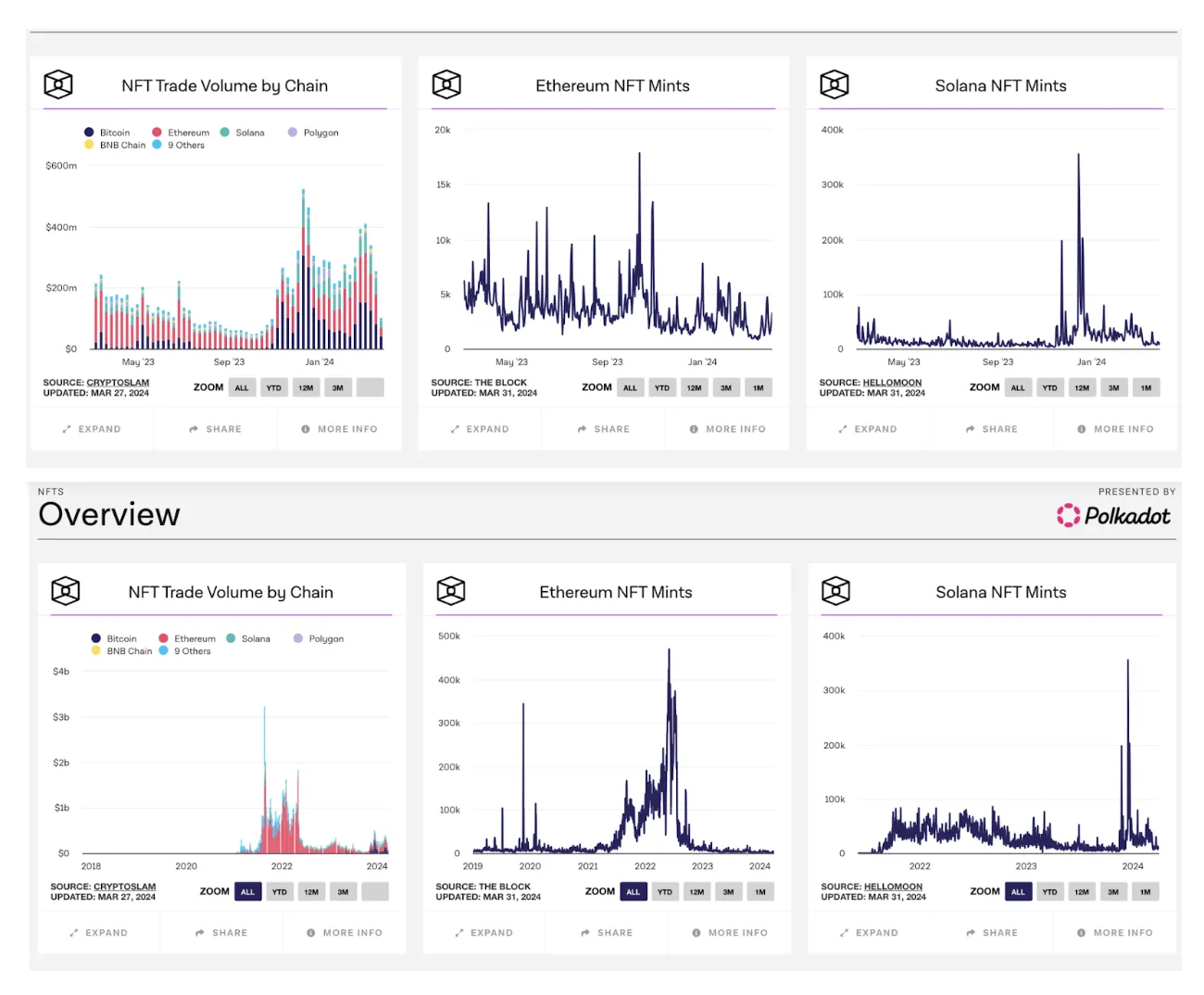

In September 2023, many mainstream media announced the death of NFT. Since then, weve seen some signs of recovery that come and go. Relative to activity in late 2021 and early 2022, we are not yet close to the peak of activity. what is the reason?

In my opinion, there are two reasons:

Meme coins satisfy the desire for gambling/speculation

The market is fed up with an oversupply of NFTs

However, over the past quarter, Bitcoin-related NFTs have shown significant outperformance. I think the market leaders (e.g. puppet, nodemonkes, RSIC) continue to perform well in the second quarter.

To summarize why (which applies not only to NFTs but also to other areas), my observations are:

Several new technologies were introduced in the market, with market leaders clearly identified

Technology becomes more accessible, in this case buying, minting NFTs becomes easier

Copycat projects are created with extremely high expectations (we will be the next cryptopunk/bored ape)

A few of these projects have grown, the vast majority have not

Somewhere between those last two points, supply overwhelms demand and the market begins to decline. To add fuel to the fire, NFTs are less liquid than meme coins and governance tokens. Rising liquidity is a strong factor in the rise, which is why BAYC was able to rise from 5 ETH to 40 ETH. And when participants are eager to exit, this lack of liquidity will become a bug in the decline, that is, during the decline, who will be the incremental buyer, that is, the liquidity to exit?

So where are we today?

Amid the brutal bear market, a few communities persevered. Two of the most prominent are pudgy penguins and mad lads. As a rule of thumb, you will often see industry leaders and original backers using mad lads and pudgy penguins as their avatars PFP. Judging from their price increases in Q4 2023 and Q1 2024, holding on to these two projects means you are either an early holder (and resilient enough not to sell) or Late stage buyer with sufficient wealth.

In either case, builders will want to target these NFT holders in an attempt to bootstrap their own projects and communities. As a result, these communities have been targeted by multiple airdrops.

This continues to happen in Q2, and as more BTC related protocols emerge, we may see the puppets/nodemonkes community start to be targeted.

Airdrops and new tokens

We will see a lot of airdrops in the second quarter. Many projects that have been under construction for the past period of time will undergo airdrops and token releases. Some of the information I observed include:

Liquidity Boot Pool (LBP): Small-scale projects like to use this method to bootstrap liquidity. In effect, LBP is a way for these projects to test demand for their tokens while maintaining an incentive structure that rewards early (and smaller) buyers. For more details,See this tweet, which is a good ELI 5 explanation for LBP.

Points Program: We are all very familiar with this scenario. Some protocols have been running their programs for over a year (the market only has such a long attention span). Whales market and Aevo are platforms where you can hedge/trade your points and pre-launch tokens, but there is some friction. For example, on a whale you have to post collateral and there is asymmetric information about the total number of points and/or how certain protocols will convert. Another method is to utilize liquidity mining credits, Gearbox and Pendle are good protocols for this in terms of ETH.

Staking Dollars: Simply put, stake some governance token and receive some airdrops from a protocol integrated with the staking token protocol. Initially, this came from Celestia and made sense (integrating Celestias protocols saves a lot in terms of data availability charges). If the price of TIA falls, it compromises the security of the network, so protocols that benefit economically from Celestia’s data availability technology should reward TIA stakers, supporting price increases. We have recently seen this approach expand to other projects such as PYTH, JUP, and I expect this trend to continue.

The most anticipated airdrops in the upcoming quarter seem to be:

Confirmed date:

Ethena ($ENA), April 2

Wormhole ($W), April 3

Zeus ($ZEUS), April 4

Solana:

Parcl($PRCL)

Tensor($TNSR)

Kamino ($KMNO) Likely in April

Drift Protocol ($DRIFT) Possibly Sometime in Q2?

Modularity:

Nim network($NIM)

Rivalz Network($RIZ)

Avail

LightLink

Re-pledge:

Renzo

Eigenlayer

Swell

Kelp

AI:

GetGrass

io.net

other:

ZKSync

LayerZero

Hyperliquid

Blast

Im sure theres something else Ive missed, please let me know if theres anything important.

narrative

Bitcoin Halving – BTC Beta

I see more Bitcoin-related protocols being built, many of which dont yet have tokens. This is to be expected given the recent performance of Stacks (STX). We saw a mini version of this in December 2023, anticipating the approval of a spot Bitcoin ETF. Coins like MUBI, BSSB, ORDI, and TRAC saw impressive gains. I think well see something much bigger in the weeks/months before and after the halving.

ETH ETF/Restaking - ETH and Restaking Beta

ETH has taken a serious beating over the past few months, with many calling for ETH to be declared dead (myself included). ETH has performed well in some areas, most recently from the mid-2000s before the run up to $4,000.

It has a number of interesting catalysts ahead, primarily the spot ETH ETF decision and the launch of the Eigenlayer restaking/LRT token. Seeing how well EtherFi’s TGE is progressing (reaching a peak FDV of $8 billion just days after launch), it’s clear there is strong appetite for re-staking. With the launch of Eigen, I expect the ETH situation to transition into a Celestia-like situation, participating and re-staking to qualify for airdrops (utilizing re-staking to earn airdrops).

Additionally, Karak is a protocol to watch as they are building re-hypothecation of universal assets. If Eigen has a very successful start, Karak should do very well as well.

SocialFi

Given the gains in Farcaster and $DEGEN, FriendTech is definitely taking notice of the need here. Just look back to August/September 2023 to see how quickly FriendTech is growing. The release and airdrop of V2 are highly anticipated, considering how high the trading volume for points is. If FT V2 does well, this could be a powerful catalyst with SocialFi projects like Fantasy Top.

Finally, if FriendTech points really are above $10 each, I think theres a good chance Farcaster will issue a token...

Crypto x AI Token

I divide AI tokens into two parts:

Decentralized computing/storage/bandwidth

Machine Learning/Artificial Intelligence/LLM Packaging

With the launch of getGrass and IONet, this should be the catalyst to reignite projects that fall into the first category. The market leader in this space is Render, which performed very well over the past quarter. A strong continuation of NVIDIAs earnings should also reignite interest in the space.

In the latter part, any updates to existing LLM and AI capabilities should be a catalyst. Most existing projects are wrappers, so updates to ChatGPT, Sora, Bard, and other existing models are often positive catalysts. Bittensor is the leading project in this space, so most other projects will be relatively valuable, and the higher Bittensor rises, the better the latter category of projects will perform. To recap, Bittensor had a very strong rally in the first quarter, with TAO rising from around $200 all the way to around $700.

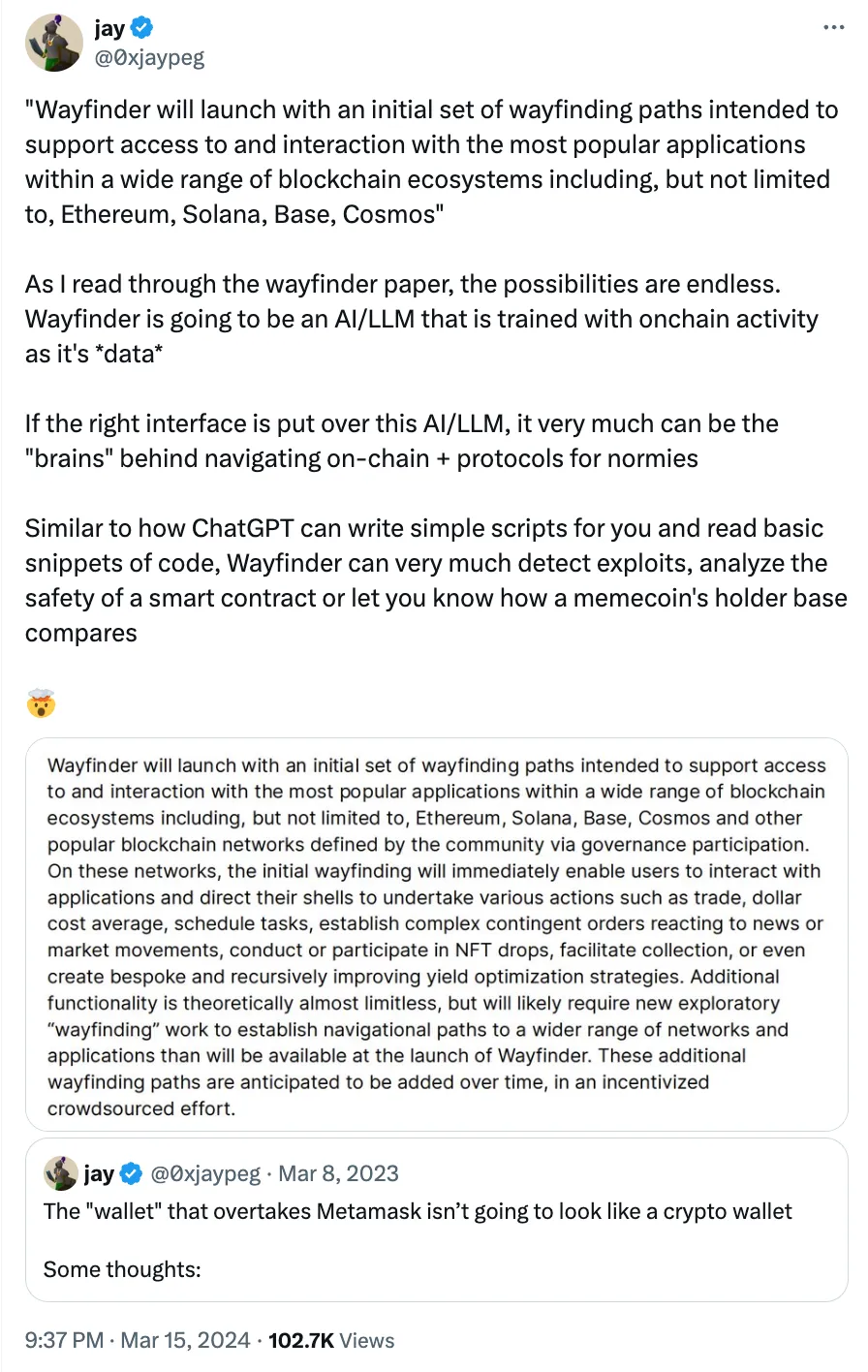

Another positive catalyst is the launch of Wayfinder ($PROMPT), the team behind Parallel TCG and Colony who are building an LLM specifically for navigating all things on the chain. I expect this will reinvigorate the energy around AI/LLM related projects as we learn more and update more about everything they are building.

Disclosure: I am an investor in Parallel/Wayfinder

Modular blockchain

After experiencing a sharp surge in late Q4 2023, Celestia, arguably the market leader in modular blockchain infrastructure, has been in a choppy correction.

Beyond price action, real progress appears to be being made, with applications such as Aevo, Lyra, Conduit, Polygon, and RitualAI starting to use Celestia to provide data. Something similar is happening at Dymension.

As these projects built on this modular blockchain infrastructure continue to see success and airdrop tokens to stakers, it is inevitable that attention will turn to the modular blockchain category. Therefore, I think we will see another round of upward repricing, especially if we get positive new news in the SEC v. Coinbase case: tokens as securities.

Additionally, as the team unlock approaches in late 2024, I expect there will be some level of coordination between infrastructure projects (e.g. DYM/TIA) and integrated dapps to develop a strategy regarding team and investor token unlocks.

Looking longer term (after Q2), I think this modular meta-message will start to become exhausted as these initial market leaders reprice and become successful. My base case for how the end of this cycle plays out is:

Infrastructure project to help dapps/middleware save money → Airdrop → Reprice higher

Follow-up/beta project launches → some projects provide value, but nowhere near as much as market-leading projects

More projects are launched that have no use value and are just building some cool technology with financial backing from investors who missed out on the first two projects.

Other narratives that may appear are: RWA, DEX, DePIN, Blast.