After selling Anthropic for $900 million, can FTX achieve full compensation?

Original - Odaily

Author - Azuma

On the evening of March 25th, Beijing time,WSJReports indicate that FTX has reached a deal worth a total of US$884 million with more than two dozen buyers to sell its shares in artificial intelligence startup Anthropic, which accounts for about two-thirds of its holdings.

According to court documents disclosed subsequently, FTX plans to sell 29.5 million Anthropic shares to 24 buyers, the most important of which is ATIC Third International Investment, headquartered in Abu Dhabi, which plans to spend $500 million to purchase 16.6 million shares. In addition, Jane Street also plans to pay US$100 million to buy 3.3 million shares, and Fidelitys funds plan to use US$50 million to buy 1.5 million shares.

The transaction is still subject to final court approval, but given that Judge John Dorsey of the Delaware Bankruptcy Court in late February approved FTX to advance the sale, it is expected that the court will not be an obstacle to the final landing of the transaction.

The unintentional investment in 2022 has become a life-saving straw for creditors

With the rise of the concept of artificial intelligence, Anthropics valuation has grown significantly in the past two years. Considering that FTX has invested US$500 million as a lead investor in Anthropics Series B financing, the value of this equity investment has increased. Expectation is also regarded by many FTX creditors as the best hope for getting back their principal.

About Anthropic, an artificial intelligence company founded by former OpenAI employees, developed Claude, an artificial intelligence chat application similar to ChatGPT, and is now widely regarded as one of OpenAIs biggest competitors.

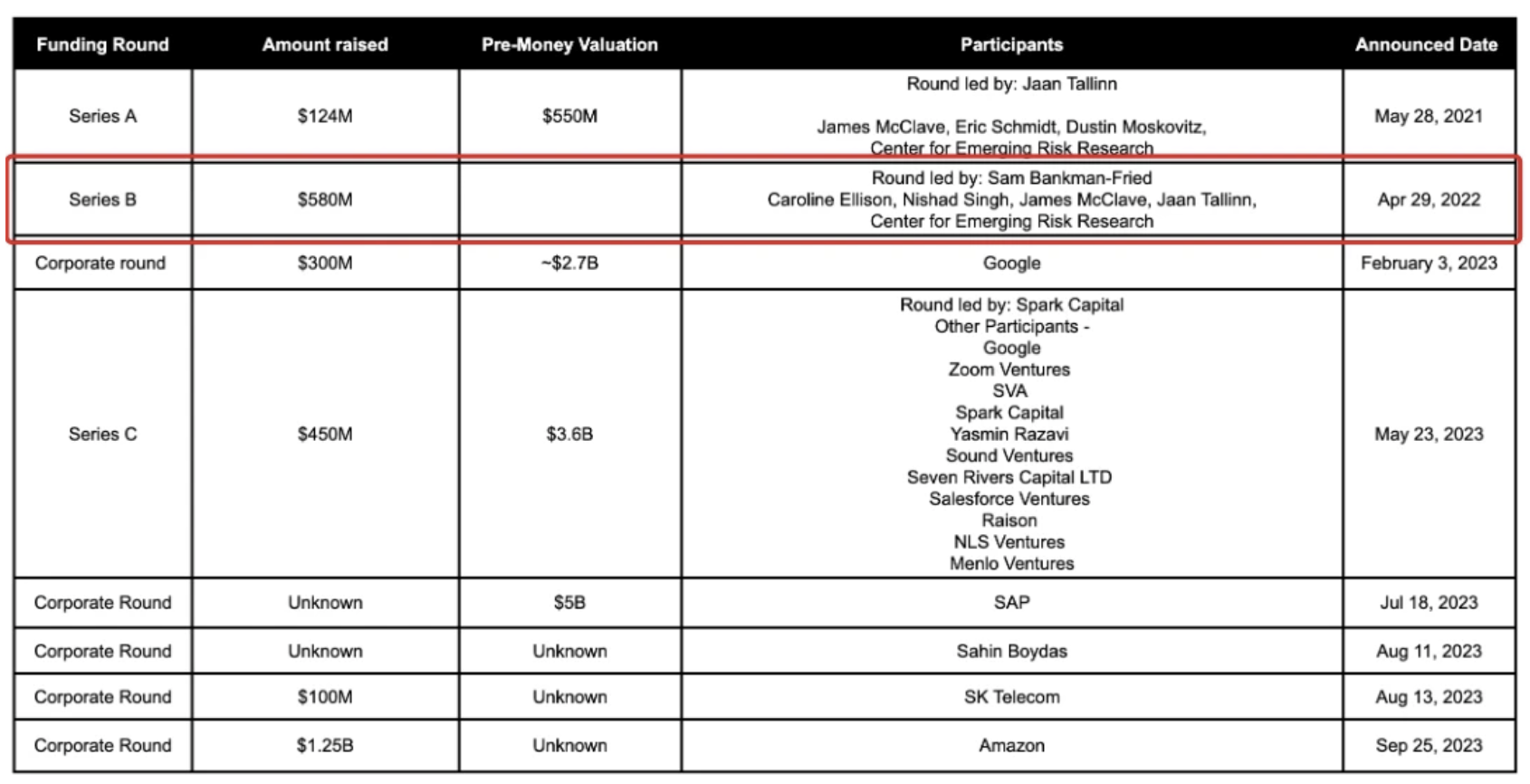

Since its founding, Anthropic has received billions of dollars in venture funding through multiple rounds of funding.

In April 2022, Anthropic completed a US$580 million Series B round, of which FTX invested a total of US$500 million, including SBF himself leading the investment, as well as senior executives such as FTX co-chief engineer Nishad Singh and former Alameda CEO Caroline Ellison. Participate in investment.

For a long time, there was no credible disclosure about the valuation of Series B financing, so the market had not been able to know the specific transaction price and shareholding ratio of FTX. However, in February this year, FTX disclosed it when promoting the sale of Anthropics equity. Get the exact data——The shareholding ratio is approximately 7.84%.

At the end of last year, includingThe InformationMany media outlets, includingAnthropic plans to raise US$75,000 at a valuation of more than US$18 billion. At this price, the approximately 7.84% stake held by FTX is valued at more than US$1.4 billion. This data is basically consistent with the sale price that FTX is currently advancing. .

Back to the debt issue of FTX itself.

When FTX filed for bankruptcy, its asset gap was approximately US$9 billion, and in May 2023, FTX submitted information stating that approximately US$7 billion in liquidity has been recovered to date. Although we do not know the specific way in which FTX positions are held and accounted for (both gaps and liquidity are subject to change due to fluctuations in asset values),But if we calculate the static data using a carrying a boat to find a sword approach, Anthropics equity value can already fill most of the remaining holes.. In addition, considering the overall upward trend of the cryptocurrency market, judging from some on-chain data that have been marked as FTX-related addresses, FTX has been holding a large number of non-stable currency assets, and the value of these assets will also increase as the market rises. increase.

The estimated loss ratio is gradually rising, with an increase comparable to that of Solana

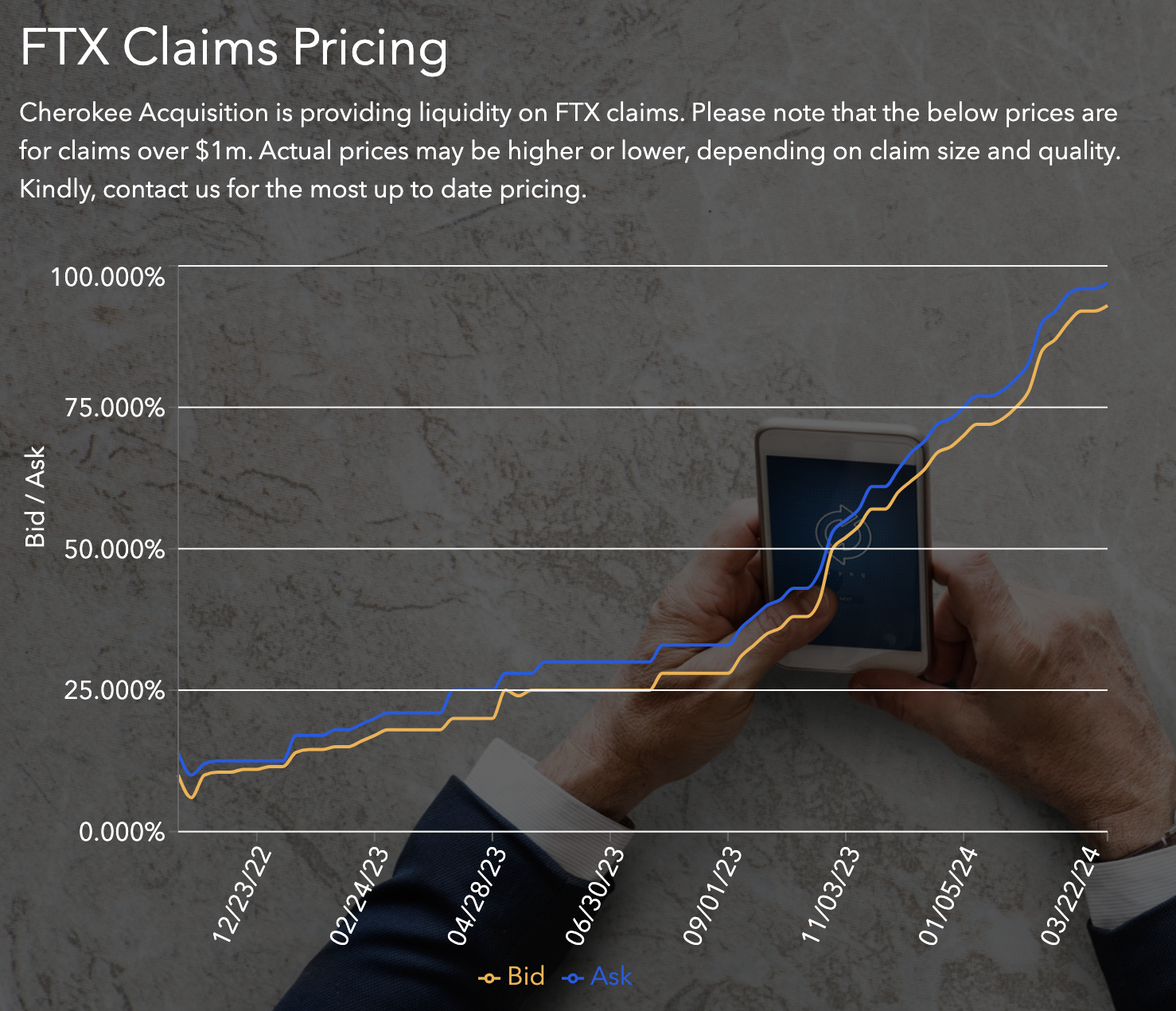

According to data compiled by Cherokee Acquisition, an investment bank that specializes in bankruptcy claims and provides liquidity on FTX claims,As of March 22, the estimated loss ratio (the face value valuation of the claims) of FTX claims has risen to between 93% (Bid) and 97% (Ask).

It is worth mentioning that Cherokee Acquisition’s data is updated weekly,Given that FTX has made definite progress in selling Anthropic shares, its debt valuation is expected to continue to rise when the next update of data (March 29).

Looking back at the growth trend of FTX debt face value valuation over the past year or so,From November 18, 2022, when Bids quotation was only 6%, until today, the face value valuation of the debt has increased by more than 15 times. This growth rate is comparable to SBFs former favorite Solana (SOL).

Judging from the debt trading sentiment, the current market is quite optimistic that FTX will eventually complete nearly full debt compensation. This may be the best outcome for every user who was damaged by the FTX incident. Bar.

At the end of the article, let’s talk about an episode.

In June 2023, FTX also almost sold away Anthropic.

People familiar with the matter have revealed that Perella Weinberg, the investment bank responsible for handling the FTX bankruptcy case, has been considering selling FTX’s stake in Anthropic. At that time, Anthropic’s just-completed Series C financing was valued at “only” $4.1 billion... However, in terms of potential After months of research among the bidders, Perella Weinberg ultimately chose HODL.

Todays market trends have verified the correctness of this decision.