One-week financing express | 26 projects received investment, with a total disclosed financing amount of approximately US$223 million (3.4-3.10)

According to incomplete statistics from Odaily, a total of 26 domestic and overseas blockchain financing incidents were announced from March 4 to March 10, which was a decrease from last week’s data (34 cases). The total amount of financing disclosed was approximately US$223 million, an increase from last weeks figure (US$180 million).

Last week, the project that received the largest amount of investment was the open source cryptography company Zama (USD 73 million); Solana ecological DePIN protocol io.net also followed closely (USD 30 million).

The following are specific financing events (Note: 1. Sorted according to the announced amount; 2. Excludes fund raising and mergers and acquisitions; 3. *Represents companies in the traditional field where some of the business involves blockchain):

Zama raises US$73 million in Series A funding, led by Multicoin Capital and Protocol Labs

On March 7, Zama, an open source cryptography company that helps developers build privacy-preserving applications, announced the completion of a $73 million Series A financing, co-led by Multicoin Capital and Protocol Labs, and founded by Metaplanet, Blockchange Ventures, Vsquared Ventures, Stake Capital and Filecoin People Juan Benet, Solana co-founder Anatoly Yakovenko and Ethereum co-founder and Polkadot co-founder Gavin Wood participated in the investment.

On March 5, according to official news, Solana ecological DePIN protocol io.net announced the completion of $30 million in Series A financing, led by Hack VC, SevenX Ventures, Multicoin Capital, 6th Man Ventures, M 13, Delphi Digital, Solana Labs, Aptos Labs, Foresight Ventures, Longhash, ArkStream Capital, Animoca Brands, Continue Capital, MH Ventures, and OKX, as well as including Solana founder Anatoly Yakovenk, Aptos founders Mo Shaikh and Avery Ching, Animoca Brands’ Yat Siu, and Perlone Capital’s Jin Kang Industry leaders, including The funds raised will be used to build the worlds largest decentralized GPU network and solve the AI computing shortage.

On March 7, Indian social network voting application Hunch announced the completion of US$23 million (approximately 1.9 billion rupees) in financing, led by Alpha Wave and Hashed Emergent. It is reported that Hashed Emergent is a blockchain venture capital focusing on early stages. Hunch can create survey voting projects to vote on topics in finance, games and other fields. Hunch plans to become the preferred platform for voting in the Web2 and Web3 market areas.

Baanx completes US$20 million in Series A financing, with participation from Ledger and others

On March 5, crypto payment company Baanx completed a $20 million Series A round of financing, with participation from Ledger, Tezos, Chiron and British Business Bank.

To date, Baanx has raised more than $30 million in total funding. Funds from this round will be used by Baanx to launch its service in the United States and Latin America this year.

On March 6, according to a research report released by Binance, the decentralized derivatives trading platform Aevo has completed US$16.6 million in three rounds of financing:

-Seed round: 10% of the total amount, valued at US$18.5 million;

-Series A: 4.62% of the total amount, valued at US$130 million;

-A+ round: 3.5% of the total amount, valued at US$250 million.

On March 5, institutional-grade encryption service platform Utila announced the completion of a $11.5 million seed round of financing, with participation from NFX, Wing VC and Framework Ventures. Utila primarily helps institutions and developers securely manage digital assets through its non-custodial, chain-agnostic wallet, which the company claims is currently used by dozens of institutional investors and crypto-native companies, enabling over the past six months. transacted over $3 billion in transactions.

On March 5, decentralized artificial intelligence network Sahara announced the completion of a $6 million seed round of financing, led by Polychain Capital. Samsung Next, Matrix Partners, Motherson Group, dao 5, Geekcartel, Canonical Crypto, Nomad Capital, Dispersion Capital, Alumni Ventures, Tangent Ventures and Coho Deeptech, as well as angel investor Sandeep Nailwal participated in the investment. Sahara is a trustless, permissionless and privacy-centric network that creates customized autonomous knowledge agents for individuals and businesses. By leveraging its decentralized network, users can leverage their intellectual capital to explore monetization opportunities through artificial intelligence. .

On March 4, DePIN+AI project Privasea announced the completion of a US$5 million seed round of financing. Early investment institutions include Binance Labs, MH Ventures, K 300, Gate Labs, 1 NVST, Zephyrus Capital, etc.

It is reported that Privasea has integrated FHEML into the distributed computing power crowdfunding network and combined it with the independently developed DePIN mining machine to form an FHE computing power network that supports all L1 and L2.

This round of financing will be used for FHEML network construction and the promotion of the “Proof of Human” Dapp using FHE technology.

On March 7, Cosmology, the Cosmos ecological development platform, completed a US$5 million seed round of financing, led by Galileo and Lemniscap, with participation from Dispersion, HashKey, Tuesday Capital, Osmosis Foundation, Chorus One and Informal Systems. Cosmosology provides a full-stack development environment, including Tendermint developer tools, Cosmos SDK and Internal Blockchain Communication (IBC) protocol. The project did not disclose the valuation of this round of financing.

Crypto risk analysis firm Agio Ratings has raised approximately $4.6 million in funding

On March 6, crypto risk analysis rating company Agio Ratings announced the completion of two rounds of financing totaling approximately US$4.6 million, namely a US$3.2 million seed round in October 2023 and a US$1.35 million Pre-Seed round in May 2022. Financing. Its seed round of financing was led by Superscrypt, with participation from Portage, MSAD Ventures and others.

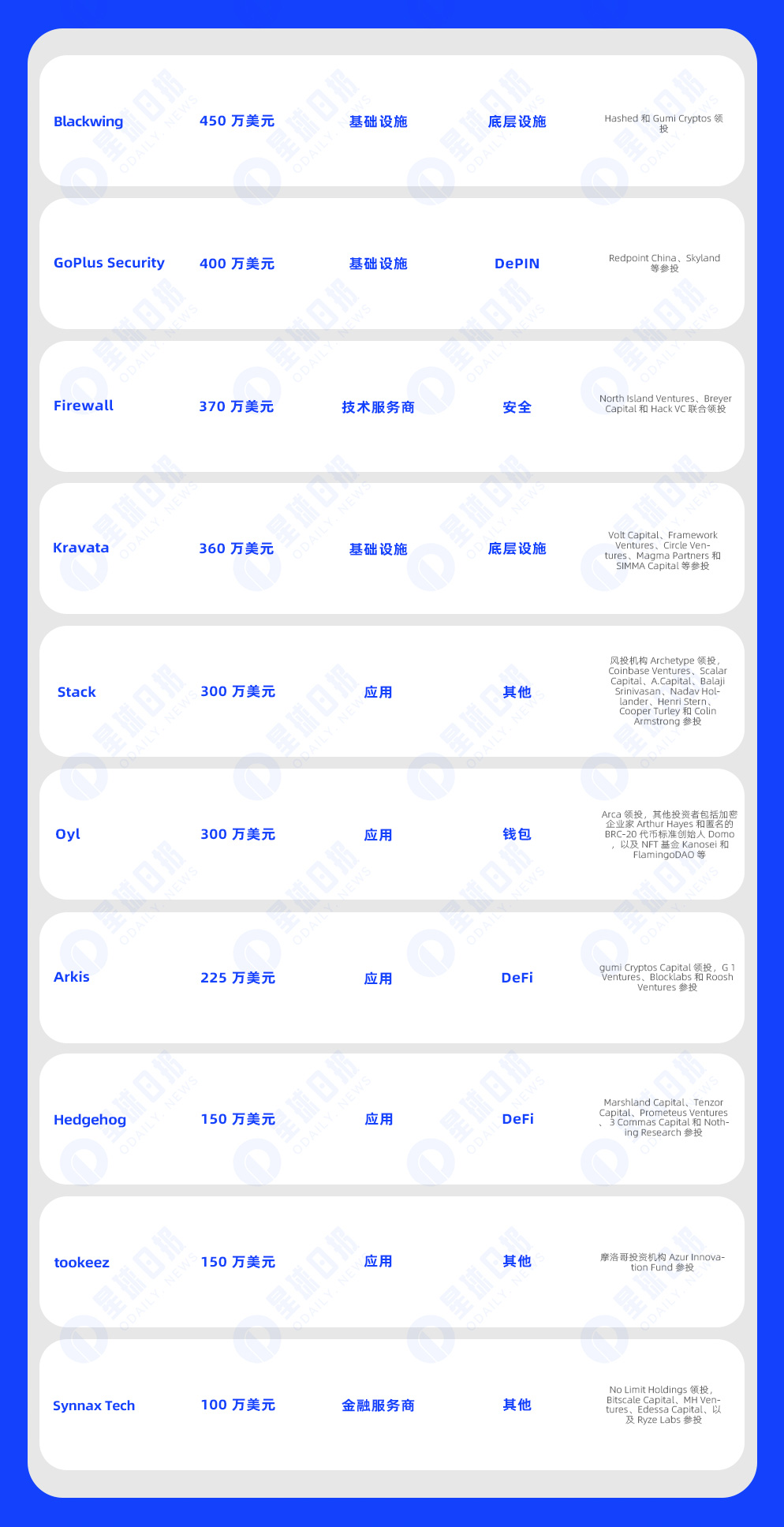

On March 7, the modular blockchain project Blackwing announced the completion of a new round of financing of US$4.5 million, led by Hashed and Gumi Cryptos. The new funds will be used to develop a modular Layer 2 blockchain to support liquidation-free encrypted assets. Leverage trading helps users reduce the risk of forced liquidation.

On March 9, according to official news, GoPlus Security has completed the Private II+ round of financing totaling US$4 million, with participation from Redpoint China, Skyland and others.

GoPlus Security is committed to providing user security network services (User Security Network) for the Web3 ecosystem, continuing to provide decentralized data and computing infrastructure for user security, and accelerating the development of user security industry applications.

On March 7, blockchain security infrastructure company Firewall announced the completion of a $3.7 million Pre-Seed round of financing, jointly led by North Island Ventures, Breyer Capital and Hack VC. Firewall is currently developing firewall solutions for blockchain networks to prevent smart contracts from being exploited, and the new funds will be used to expand the team to support community building and marketing efforts.

On March 8, Kravata, a Web3 application interface service provider from the Alliance Dao accelerator, announced the completion of a US$3.6 million seed round of financing, with participation from Volt Capital, Framework Ventures, Circle Ventures, Magma Partners and SIMMA Capital. Kravata helps users connect to Web3 and get a Web2 experience through application programming interfaces, while integrating the benefits of Web3 into their services without the burden of in-house technology development.

On March 5, Stack, an on-chain points infrastructure development company, completed a US$3 million seed round of financing, led by venture capital institution Archetype, Coinbase Ventures, Scalar Capital, A.Capital, Balaji Srinivasan, Nadav Hollander, Henri Stern, Cooper Turley and Colin Armstrong participated. Stack mainly builds a framework for allocating and tracking points on the chain, including point distribution, rankings, and trustless token exchange services, allowing users to use points to exchange for ERC-20 tokens, ETH or other assets.

On March 8, Bitcoin Ordinals wallet Oyl completed US$3 million in equity financing, led by Arca, a venture capital institution that has previously focused on investing in the Ethereum NFT field. Other investors include crypto entrepreneur Arthur Hayes and anonymous BRC- 20 Token standard founder Domo, as well as NFT funds Kanosei and FlamingoDAO, etc.

It is reported that Oyl will be officially launched in the next few weeks and provide a platform for in-wallet trading of Ordinals.

DeFi prime broker Arkis completes $2.25 million in pre-seed financing, led by gumi Cryptos Capital

On March 5, DeFi prime broker Arkis recently announced the completion of $2.25 million in Pre-Seed financing, led by gumi Cryptos Capital, with participation from G 1 Ventures, Blocklabs and Roosh Ventures.

On March 6, crypto transaction fee hedging protocol Hedgehog announced the completion of a $1.5 million Pre-Seed round of financing, with participation from Marshland Capital, Tenzor Capital, Prometeus Ventures, 3 Commas Capital and Nothing Research. Hedgehog aims to solve the problem of large fluctuations in crypto transaction fees and provide users with tools to deal with price fluctuations in cryptocurrency transaction fees.

Blockchain loyalty program startup tookeez raises $1.5 million

On March 9, blockchain loyalty program startup tookeez announced the completion of a new round of financing of US$1.5 million, with Moroccan investment institution Azur Innovation Fund participating. The company has not yet disclosed the valuation information of this round of financing.

On March 7, Synnax Tech, a digital asset credit rating project based on artificial intelligence, announced the completion of a $1 million Pre-Seed round of financing on the . Synnax hopes to build an AI-driven credit rating standard for the digital asset industry and use decentralized networks to solve core issues such as opaque data in the current digital asset rating market.

KuCoin Ventures strategically invests in Bitcoin DeFi ecological project bitSmiley

On March 4, KuCoin Ventures announced its strategic investment in the Bitcoin DeFi ecological project bitSmiley on the X platform.

Mirror L2 completes first round of financing with participation from UTXO, Conflux and IMO Ventures

On March 4, Mirror L2 announced the completion of its first round of financing from UTXO (Bitcoin magazine’s investment arm), Conflux and IMO Ventures. Mirror L2 (Mirror L2.com) is a decentralized Proof of Stake (POS) BTC L2 network that is compatible with EVM and utilizes BTC as GAS.

On March 7, Web3 social platform Beoble announced the completion of a strategic round of financing, with Animoca Brands participating, but the specific financing amount has not yet been disclosed. Beble will provide its chat capabilities to Animoca Brands-related companies and projects to enhance community engagement and interactivity across the Web3 ecosystem.

On March 7, Bison Labs announced the completion of a Pre-Seed round of financing, aiming to create a second-layer Bitcoin network with Trustless and on-chain sovereign Rollup solutions. This round of financing was led by Portal Ventures, with participation from UTXO Fund, Domo (creator of BRC-20), Magic Eden’s chief product officer Linus Chuang, Waterdrip Capital, Bitcoin Startup Labs, Satoshi Lab and other strategic investors.

On March 10, Onramp Money, a provider of cryptographic deposit and withdrawal solutions, announced the completion of a strategic seed round of financing. The specific amount has not yet been disclosed. FunFair Ventures, a venture capital institution of FunFair Technologies Group, participated in the investment and reached a strategic partnership with it.

On March 4, Web3 fan collaboration platform Hypercomic announced the completion of Series A financing, led by Logan Ventures. It is reported that the company’s valuation in this round of financing is close to 11 billion won (approximately US$8.26 million), but the specific financing amount has not been disclosed. The new funds will be used to expand Korean IP globally.